Professional Documents

Culture Documents

FINE3025 Exercise 2

FINE3025 Exercise 2

Uploaded by

低調用戶929Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FINE3025 Exercise 2

FINE3025 Exercise 2

Uploaded by

低調用戶929Copyright:

Available Formats

FINE3025, Sem 1, 2023-24, Dr.

Yang Duan

FIN3025 Entrepreneurial Finance (Section 1/2)

Exercise 2 (Lecture 5 Managing Cash Flow)

1. (25 pts) The Itsar Products Company has made the following monthly estimates of

cash receipts and cash disbursements when preparing cash budgets for the next 12

months. Itsar Products has beginning cash on hand of $10,000 and wants to

maintain this minimum cash level (i.e., minimum cash desired is $10,000)

throughout the next year.

MONTH CASH CASH

RECEIPTS DISBURSEMENTS

($ in ($ in thousands)

thousands)

Jan 100 110

Feb 100 110

Mar 80 110

Apr 110 120

May 120 180

Jun 150 180

July 200 180

Aug 250 180

Sep 250 150

Oct 200 110

Nov 140 100

Dec 100 100

A. Determine whether Itsar Products will have a cash need (a need for borrowing)

during the next year. If Itsar Products has a cash need, indicate the month

when the need will begin. (15 pts)

B. Determine whether the cash need (if any) can be repaid within the next year

(assuming no financing costs). Indicate the month when the cash need will be

repaid (if any). (10 pts)

2. (25 pts) Rework Problem 1 assuming minimum cash-on-hand requirements are

$10,000 a month through April, increase to $15,000 in May and June, increase

further to $20,000 in July and August, and return to the $10,000 per month level

beginning in September.

FINE3025, Sem 1, 2023-24, Dr. Yang Duan

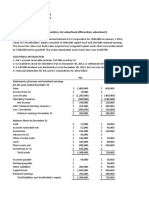

3. (50 pts) The PDA Products Company was started in 2013. A difficult operating

year, 2014, was followed by a profitable 2015. However, the founders are still

concerned about the venture’s liquidity position and the amount of cash being

used to operate the firm.

2014 2015

Income statement

(in thousands) (in thousands)

Net sales $900 $1,500

COGS 540 900

Gross profit 360 600

Marketing 90 150

General and administrative 200 200

Research and development 50 50

Depreciation 40 40

EBIT -20 160

Interest 45 60

Earnings before taxes -65 100

Income taxes 0 25

Net income (loss) ($65) $75

Dec 31, 2014 Dec 31, 2015

Balance sheet

(in thousands) (in thousands)

Cash $50 $20

Accounts receivable 100 180

Prepaid expenses 100 100

Inventories 400 500

Total current assets 650 800

Net fixed assets 350 400

Total assets $1,000 $1,200

Accounts payable $130 $160

Accrued wages 50 70

Bank loan 90 100

Total current liabilities 270 330

Long-term debt 300 400

Common stock 350 350

Retained earnings 80 120

FINE3025, Sem 1, 2023-24, Dr. Yang Duan

Total liabilities and equity $1,000 $1,200

A. Determine the firm’s cash build and cash burn for 2015. Did PDA have a net

cash build or a net cash burn for 2015? (30 pts)

B. Calculate the length of PDC’s cash conversion cycle for 2015. (20 pts)

You might also like

- Finance Problem Set 1Document4 pagesFinance Problem Set 1Hamid Yaghoubi0% (1)

- Ashton Tate Limited ANSWERDocument4 pagesAshton Tate Limited ANSWERJoseph HallNo ratings yet

- Konsolidasi Pub CorpDocument3 pagesKonsolidasi Pub CorpadibaNo ratings yet

- Assignment 1 Preparing Financial StatementsDocument3 pagesAssignment 1 Preparing Financial Statements吴静怡0% (1)

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Assignment 1 MENG 6502Document6 pagesAssignment 1 MENG 6502russ jhingoorieNo ratings yet

- P4-12 AnswerDocument5 pagesP4-12 AnswerPutri Apriliana100% (1)

- Practice Question Bells LTD LTDDocument2 pagesPractice Question Bells LTD LTDShaikh Hafizur RahmanNo ratings yet

- Sample Nonprofit Budget TemplateDocument15 pagesSample Nonprofit Budget TemplateMandy NormanNo ratings yet

- Blaine Kitchenware Case Study SolutionDocument5 pagesBlaine Kitchenware Case Study SolutionFarhanie Nordin67% (3)

- Enron Case Study SolutionDocument3 pagesEnron Case Study SolutionSky Heartt100% (2)

- Accounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusDocument18 pagesAccounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusAung Zaw HtweNo ratings yet

- Tugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Document6 pagesTugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Iche IcheNo ratings yet

- Notes Before UTSDocument20 pagesNotes Before UTSdevina utamiNo ratings yet

- Tugas Minggu 7 Akl Nama: Hidayani Puteri NIM: 20043136Document8 pagesTugas Minggu 7 Akl Nama: Hidayani Puteri NIM: 20043136Hidayani Puteri100% (1)

- Tugas Akuntansi Lanjutan II: Fakultas Ekonomika Dan BisnisDocument6 pagesTugas Akuntansi Lanjutan II: Fakultas Ekonomika Dan Bisniskurniawan rosidNo ratings yet

- CMA SS August 2018Document12 pagesCMA SS August 2018Goremushandu MungarevaniNo ratings yet

- An Introduction To Consolidated Financial StatementDocument27 pagesAn Introduction To Consolidated Financial StatementKelvin Febriansyah PratamaNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument4 pagesSolutions To End-Of-Chapter ProblemsRab RakhaNo ratings yet

- IAS 28 AssociatesDocument7 pagesIAS 28 AssociatesRumbidzai Mapanzure100% (1)

- Ratio AnlysDocument5 pagesRatio AnlysVi PhuongNo ratings yet

- IIMK - FA - SectionB - Assignment 4Document4 pagesIIMK - FA - SectionB - Assignment 4Jay PatelNo ratings yet

- Common Size Statement, Comparative Balance SheetDocument5 pagesCommon Size Statement, Comparative Balance SheetshubhcplNo ratings yet

- Modeling ExerciseDocument10 pagesModeling Exercisekiasha3496No ratings yet

- Summary Personal CashflowDocument8 pagesSummary Personal Cashflowpattydigal05No ratings yet

- Introduction To Financial Accounting: To: Prof. Syed Azeem AhmadDocument8 pagesIntroduction To Financial Accounting: To: Prof. Syed Azeem AhmadjawadNo ratings yet

- 2007ARDocument24 pages2007ARceojiNo ratings yet

- BBA Program Spring 2022 ACT301: Intermediate Accounting Assignment 2Document2 pagesBBA Program Spring 2022 ACT301: Intermediate Accounting Assignment 2মাহিদ হাসানNo ratings yet

- Home Control Work - Variant 10 - Le Duc Tuan Minh - IFF18-3kDocument15 pagesHome Control Work - Variant 10 - Le Duc Tuan Minh - IFF18-3kMinh LêNo ratings yet

- Ratio Analysis Problems-1Document10 pagesRatio Analysis Problems-1Aditya DalviNo ratings yet

- Chapter 4 SolvedDocument4 pagesChapter 4 SolvedAsad BabbarNo ratings yet

- PA T322WSB 5 - Group Assignment (Solution)Document8 pagesPA T322WSB 5 - Group Assignment (Solution)Hoang Khanh Linh NguyenNo ratings yet

- Book Value of Stu (100%) : Pop Corporation and SubsidiaryDocument4 pagesBook Value of Stu (100%) : Pop Corporation and SubsidiaryKimberlyNo ratings yet

- FSA Financial Mechanism ExcelDocument11 pagesFSA Financial Mechanism ExcelDaniela AriasNo ratings yet

- Tugas AklDocument5 pagesTugas AklJessica HutabaratNo ratings yet

- Pert 4 ExcelDocument8 pagesPert 4 ExcelSagita RajagukgukNo ratings yet

- Consolidation WorksheetDocument1 pageConsolidation WorksheetJean Kathyrine ChiongNo ratings yet

- Sweet Potato Chips Financial StatementDocument3 pagesSweet Potato Chips Financial StatementMac John Teves PobleteNo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsTabish HyderNo ratings yet

- Extra Session 2 (30 Sept 2022) Spreadsheet (CH 3)Document2 pagesExtra Session 2 (30 Sept 2022) Spreadsheet (CH 3)georgius gabrielNo ratings yet

- Enterpreneurship Finance Exercises 4-6Document6 pagesEnterpreneurship Finance Exercises 4-6Trang TranNo ratings yet

- Opening of Business End of Year 2Document10 pagesOpening of Business End of Year 2Mhd RahmanNo ratings yet

- AFR Pilot PaperDocument7 pagesAFR Pilot PaperPa HabbakukNo ratings yet

- WorkshitDocument12 pagesWorkshitLukman ArimartaNo ratings yet

- Solution Key To Problem Set 2Document6 pagesSolution Key To Problem Set 2Ayush RaiNo ratings yet

- Financial BP OriDocument32 pagesFinancial BP OriKhairul AnuarNo ratings yet

- List of Important Questions With Answers For Nov 2022 (R)Document108 pagesList of Important Questions With Answers For Nov 2022 (R)manuacreddyNo ratings yet

- DW CorpDocument20 pagesDW CorpAlejo valenzuelaNo ratings yet

- ABC Income Statement (Millons) 2018: Short Term InvestmentsDocument20 pagesABC Income Statement (Millons) 2018: Short Term InvestmentsAlejo valenzuelaNo ratings yet

- Partnership LiquidationDocument8 pagesPartnership LiquidationJhane XiNo ratings yet

- Module 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument48 pagesThis Paper Is Not To Be Removed From The Examination Hallsduong duongNo ratings yet

- Michael Hermawan Yuwono MGMT6346 Ba10 UtpDocument36 pagesMichael Hermawan Yuwono MGMT6346 Ba10 UtpchristianNo ratings yet

- Non Profit Budget Template 11Document15 pagesNon Profit Budget Template 11Project Management Office JTCLNo ratings yet

- Question 1 - Pretend CorporationDocument6 pagesQuestion 1 - Pretend Corporationyusuf pashaNo ratings yet

- Cash Flow ForecastDocument2 pagesCash Flow Forecastsusanazheng123No ratings yet

- Wan Aidi Pra Uts Adv. AccDocument10 pagesWan Aidi Pra Uts Adv. AccWan Aidi AbdurrahmanNo ratings yet

- Income Statement (INR 2013 2014 Balance Sheet (INR MN) 2013: For The Period Ending 31st December As On 31st December.Document3 pagesIncome Statement (INR 2013 2014 Balance Sheet (INR MN) 2013: For The Period Ending 31st December As On 31st December.Sathyanarayana GNo ratings yet

- Kertas Kerja Konsolidasi InventoryDocument3 pagesKertas Kerja Konsolidasi InventoryArriNo ratings yet

- Cash Flow Statement Template Someka V1FDocument5 pagesCash Flow Statement Template Someka V1Fmichael odiemboNo ratings yet

- Financial Planing & ForecastingDocument31 pagesFinancial Planing & ForecastingRetno Yuniarsih Marekhan IINo ratings yet

- What's Cooking: Digital Transformation of the Agrifood SystemFrom EverandWhat's Cooking: Digital Transformation of the Agrifood SystemNo ratings yet

- SPM Example 3Document8 pagesSPM Example 3inderNo ratings yet

- DipIFR 2009 Dec QDocument19 pagesDipIFR 2009 Dec QSaed AliNo ratings yet

- Asset Care Maturity ScoresheetDocument93 pagesAsset Care Maturity Scoresheetmobility.atomNo ratings yet

- TB 07Document52 pagesTB 07Andrea Banayat MailumNo ratings yet

- A Macrae Marketing AuditDocument2 pagesA Macrae Marketing AuditAriel MacraeNo ratings yet

- Lecture - 01. PURE COMPETITION: Handout - 1Document11 pagesLecture - 01. PURE COMPETITION: Handout - 1sofia100% (1)

- Dendrite InternationalDocument9 pagesDendrite InternationalSaurabh Srivastava0% (1)

- Uchumi Case StudyDocument22 pagesUchumi Case StudywarrenmachiniNo ratings yet

- Problem MDocument3 pagesProblem Mheny2517100% (1)

- Accounting NSC P1 MG Sept 2022 Eng GautengDocument13 pagesAccounting NSC P1 MG Sept 2022 Eng GautengSweetness MakaLuthando LeocardiaNo ratings yet

- Acct Statement XX6194 28072023Document4 pagesAcct Statement XX6194 28072023Mohammad Sharafat KhanNo ratings yet

- Chapter 1 and 2 Additional ProblemsDocument3 pagesChapter 1 and 2 Additional ProblemsChristlyn Joy BaralNo ratings yet

- Mba Faaunit - IIDocument15 pagesMba Faaunit - IINaresh GuduruNo ratings yet

- CH 01 Hull FundamentalsDocument37 pagesCH 01 Hull FundamentalsMyroslav PidkuykoNo ratings yet

- Assignment # 1 Feb 2023Document5 pagesAssignment # 1 Feb 2023GIAN ALEXANDER CARTAGENANo ratings yet

- Marketing For Hospitality and Tourism 7th Edition Kotler Test BankDocument7 pagesMarketing For Hospitality and Tourism 7th Edition Kotler Test Bankkaylayoungfpkgwdbjcz100% (29)

- Chapter 8. Services Marketing - Introduction To Tourism and Hospitality in BCDocument30 pagesChapter 8. Services Marketing - Introduction To Tourism and Hospitality in BCkelkararNo ratings yet

- 1 Sitxfin004 Wa V92020Document8 pages1 Sitxfin004 Wa V92020Kamal Saini100% (1)

- Liaison Officer Bookeeper Signature Over Printed Name/Date SignedDocument51 pagesLiaison Officer Bookeeper Signature Over Printed Name/Date SignedArmando LlidoNo ratings yet

- BMAN71171 Portfolio Investment Lecture 2a: Intuition On Portfolio Selection Chris Godfrey (Christopher - Godfrey@manchester - Ac.uk)Document27 pagesBMAN71171 Portfolio Investment Lecture 2a: Intuition On Portfolio Selection Chris Godfrey (Christopher - Godfrey@manchester - Ac.uk)Nazmul H. PalashNo ratings yet

- Sales Executive Business Development in Boston MA Resume Martin LairdDocument2 pagesSales Executive Business Development in Boston MA Resume Martin LairdMartinLairdNo ratings yet

- Asmamaw Module Edit 11 FontDocument155 pagesAsmamaw Module Edit 11 FontEdlamu AlemieNo ratings yet

- 1034 Income Statement Exercise KEYDocument4 pages1034 Income Statement Exercise KEYMaria Charise TongolNo ratings yet

- Emerging Modes of Business Class 11 Notes CBSE Business Studies Chapter 5Document5 pagesEmerging Modes of Business Class 11 Notes CBSE Business Studies Chapter 5Binoy TrevadiaNo ratings yet

- Tiger Analytics: Data Is The New OilDocument10 pagesTiger Analytics: Data Is The New OilAjinkya GaunsNo ratings yet

- TB 1Document12 pagesTB 1Marwa AbdelazizNo ratings yet

- ACCOUNTING Chap.4. Adjusting The AccountsDocument6 pagesACCOUNTING Chap.4. Adjusting The AccountsKyla NavaretteNo ratings yet

- MKTG2 - Mod 1Document2 pagesMKTG2 - Mod 1ShanseaaNo ratings yet