Professional Documents

Culture Documents

Nota Detalle Registros LSD

Nota Detalle Registros LSD

Uploaded by

Clara SackOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nota Detalle Registros LSD

Nota Detalle Registros LSD

Uploaded by

Clara SackCopyright:

Available Formats

2021-07-08 2197671

2197671 - [AR] RG 3781/2015 - Libro de Sueldos Digital

Version 11 Type SAP Note

Language Inglés Master Language Inglés

Priority Correction with high priority Category Legal change

Release Status Released for Customer Released On 09.10.2015

Component PY-AR ( Argentina )

Please find the original document at https://launchpad.support.sap.com/#/notes/ 2197671

Symptom

As described in the Announcement Note 2192719, the new law RG 3781/2015 published by AFIP on June

26, 2015, introduced a new legal report.

This note provides you with the relevant system changes to address this legal report, called in the SAP

standard as Libro de Sueldos Digital (F931).

For more information, see also http://www.infoleg.gob.ar/infolegInternet/anexos/245000-

249999/248688/norma.htm. The website accessible through this hyperlink is an external website, which is not

part of SAP's offering. By clicking the hyperlink YOU AGREE that unless expressly stated otherwise in your

agreements with SAP: (i) the content of the linked to website and any further external website is not content

provided by or on behalf of SAP, nor is it otherwise under SAP's control; (ii) the fact that SAP provides links

to external websites does not imply that SAP agrees or disagrees with the contents and information provided

on such websites; (III) SAP DOES NOT GIVE ANY REPRESENTATION REGARDING THE QUALITY,

SAFETY, SUITABILITY, ACCURACY OR RELIABILITY OF ANY EXTERNAL WEBSITE OR ANY OF

INFORMATION, CONTENT AND MATERIALS PROVIDED THEREON; (IV) YOU VISIT THOSE EXTERNAL

WEBSITES ENTIRELY AT YOUR OWN RISK SAP SHALL NOT BE DIRECTLY OR INDIRECTLY

RESPONSIBLE OR LIABLE FOR ANY DAMAGE OR LOSS CAUSED OR ALLEGED TO BE CAUSED BY

OR IN CONNECTION WITH YOUR USE OF OR RELIANCE ON ANY CONTENT, GOODS OR SERVICES

AVAILABLE ON OR THROUGH ANY SUCH LINKED WEBSITE.

Other Terms

&LIBRODIGITAL; Libro de Sueldos Digital; F931

Reason and Prerequisites

You have applied the following SAP Notes:

• 2210757 (creates the necessary data dictionary (DDIC) objects in your system

• 2205044 (pre-requisite note)

• 2210707 (pre-requisite note)

The following Support Package level is also the minimum prerequisite:

Release Support Package

6.00 HR SP A6

6.04 HR SP 72

© 2021 SAP SE or an SAP affiliate company. All rights reserved 1 of 9

2021-07-08 2197671

(For more information, click on "R/3 HR Support Package Schedule" in www.service.sap.com/ocs-schedules)

Solution

The new report called Libro de Sueldos Digital (report RPC_PAYAR_F931, transaction PC00_M29_F931)

was created. According to law RG 3781/2015, this report has to generate a text file with the following format:

• Record 01: Datos referenciales del envío (liquidación de SyJ y datos para DJ F931).

• Record 02: Datos referenciales de la liquidación de sueldos y jornales del trabajador.

• Record 03: Detalle de los conceptos de sueldo liquidados al trabajador.

• Record 04: Datos del trabajador para el cálculo de la dj F931.

• Record 05: Datos del trabajador de la empresa de servicios eventuales.

For details on how the fields of each record are filled in the standard system, as well as a description of the

necessary customizing steps, refer to the Setup and Configuration section below.

Setup and Configuration

To fill the information related to amounts that are processed and store it in employees’ cluster (payroll

results), the new report will consider the wage types customized in the new subapplication Libro de Sueldo

Digital (F931) and the corresponding cumulation groups. This subapplication has the following cumulation

groups:

Group Description Record Field

AADS Porcentaje de aporte adicional para 04 Porcentaje de aporte adicional de seguridad

Seguridad Social social

AAOS Aporte adicional Obra Social 04 Aporte adicional de obra social

ADHE Adherentes a la Obra Social 04 Cantidad de adherentes de obra social

DAOF Base para el cálculo diferencial de 04 Base para el cálculo diferencial de aporte de

aporte de obra social y FSR obra social y FSR

DCOF Base para el cálculo diferencial de 04 Base para el cálculo diferencial de

contribuciones de obra social y FSR contribuciones de obra social y FSR

DLRT Base para el cálculo diferencial Ley de 04 Base para el cálculo diferencial Ley de Riesgos

Riesgos del Trabajo del Trabajo

HORA Cantidad de horas trabajadas 04 Cantidad de horas trabajadas

IAOS Importe adicional para Obra Social 04 Contribución adicional de obra social

MATR Remuneración maternidad para 04 Remuneración maternidad para ANSeS

ANSeS

PRDT Porcentaje Tarea Diferencial 04 Porcentaje de contribución por tarea diferencial

RIM1 Base imponible 1 04 Base imponible 1

RIM2 Base imponible 2 04 Base imponible 2

RIM3 Base imponible 3 04 Base imponible 3

RIM4 Base imponible 4 04 Base imponible 4

RIM5 Base imponible 5 04 Base imponible 5

RIM6 Base imponible 6 04 Base imponible 6

RIM7 Base imponible 7 04 Base imponible 7

RIM8 Base imponible 8 04 Base imponible 8

RIM9 Base imponible 9 04 Base imponible 9

RTOT Remuneración total del empleado 04 Remuneración bruta

(suma bruta liquidada)

SVCO Seguro Vida Colectivo Obligatorio 04 *Marca de cobertura de SCVO

PDAY Cantidad de días liquidados 02 Cantidad de días liquidados

© 2021 SAP SE or an SAP affiliate company. All rights reserved 2 of 9

2021-07-08 2197671

*For cumulation SVCO, if any wage type is customized in this group and is found in the employees' cluster

with an amount different from zero, the indicator of "Marca de cobertura de SCVO" is set to true, otherwise it

is set to false.

All cumulations above are available in table view "Asignación CC-nóminas a CC-nóm.acumulación

(tab.clientes)" (V_T596J) for sub-application F931.

You must assign the corresponding wage types to the corresponding cumulations for the record fields to be

filled correctly. SAP delivers a model customizing in view "Asignación claves concepto nómina a CC-nómina

acumulación" (V_T596I), however it is overwritten in case you create your own customizing in view V_T596J

(customer table).

Below you can find details on how each field of each record is filled during the processing of this new report.

Record 01

1. Identificación del tipo de registro: fixed value "01"

2. CUIT del empleador: field "Clave Única de Identificación Tributaria" (CUITC) from table "Datos del

empleador según fecha informe Censo ANSES" (T7AR80) according to the selection criteria

(Company code)

3. Identificación del envío: fixed value "SJ"

4. Período: period entered on the selection screen of the report

5. Tipo de liquidación: legal value "M" (mensual), "Q" (quincenal) and "S" (semanal) according to the

customizing of tables "Áreas de nómina" (T549A) and "Parámetro período" (T549R)

6. Número de liquidación: field Nº de la liquidación from the selection screen of the report

7. Días base: value of constant "Cant. Días Tope diario aportes" (SESTD) customized in table view

"Constantes de nómina" (V_T511K)

8. Cantidad de trabajadores informados en registros '04': counting of records of type "04"

Record 02

1. Identificación del tipo de registro: fixed value "01"

2. CUIL del trabajador: field "Número de identificación personal" (PERID) from "Datos personales" (0002)

infotype

3. Legajo del trabajador: field "Nº personal" (PERNR) from "Asignación organizativa" (0001) infotype

4. Dependencia de revista del trabajador: field "Identificación de la categoría de convenio" (IDCON) from

table "Identificación de la categoria de convenio" (T7AR65) according to the selection criteria

5. CBU de acreditación del pago: When constant "" (MOCBU) is set to "0" in V_T511K, it is filled with

fields "Referencia para el banco/cuenta" (BKREF) and "Nº cuenta bancaria" (BANKN), otherwise field

(ZWECK) is used. All fields are from cluster table "Transferencias" (BT) and according to the selection

criteria and payment type set in "Relación bancaria" (0009) infotype

6. Cantidad de días liquidados: field "Cantidad" (ANZHL) of wage type(s) customized in view V_T596I/J

for subapplication F931 and cumulation PDAY

7. Fecha de pago: field "Fecha de pago de un resultado de nómina" (PAYDT) from cluster table

"Información status de nómina" (VERSC)

8. Fecha de rúbrica: field "Fecha de la ejecución de la nómina" (RUNDT) from cluster table "Información

status de nómina" (VERSC)

9. Forma de pago: field "Vía de pago" (ZLSCH) from cluster table "Transferencias" (BT) according to the

information set in "Relación bancaria" (0009) infotype.

Record 03

1. Identificación del tipo de registro: fixed value "03"

2. CUIL del trabajador: field "Número de identificación personal" (PERID) from "Datos personales" (0002)

© 2021 SAP SE or an SAP affiliate company. All rights reserved 3 of 9

2021-07-08 2197671

infotype

3. Código de concepto liquidado por el empleador: wage types customized in table view "Clases de

tratamiento, acumulaciones y clases de evaluación" (V_512W_D) with values 01 ("Remuneraciones"

(con aportes)), 02 ("Haberes sin aportes") and 03 ("Retenciones") in evaluation class 11 ("Asignación

CC-nóminas para Libro Ley")

4. Cantidad: fields "Cantidad" (ANZHL) or "Importe por unidad" (BETPE) from wage type stored in cluster

table Tabla de resultados (RT)

5. Unidades: legal values bellow according to the customizing of the corresponding wage type in table

view "Propiedades de CC-nóminas" (V_T511):

• H: value "Horas" (001) in field "Unidad de tiempo/medida" (ZEINH) of table T511

• D: value "Días" (010) in field "Unidad de tiempo/medida" (ZEINH) of table T511

• M: value "Meses" (012) in field "Unidad de tiempo/medida" (ZEINH) of table T511

• A: value "Años" (013) in field "Unidad de tiempo/medida" (ZEINH) of table T511

• %: value "Porcentaje" (030) in field "Unidad de tiempo/medida" (ZEINH) of table T511

• $: value "Grd.rend." (022) in field "Unidad de tiempo/medida" (ZEINH) of table T511

6. Importe: field "Importe" (BETRG) from wage type stored in cluster table "Tabla de resultados" (RT)

7. Indicador Débito/Crédito: legal value "C" if wage type is customized with value 01 or 02 in evaluation

class 11, and D if wage type is customized with value 03 in evaluation class 11

8. Período de ajuste retroactive: for period of payroll result in case the wage type is based on a

retroactive accounting, and blank if it is not related to a retroactive accounting

Record 04

1. Identificación del tipo de registro: fixed value "04"

2. CUIL del trabajador: field "Número de identificación personal" (PERID) from "Datos personales" (0002)

infotype

3. Marca de cónyuge: filled as true, if any spouse is found in "Familia/pers.refer." (0021) infotype, and

false, otherwise

4. Cantidad de hijos: filled with the number of children found in "Familia/pers.refer." (0021) infotype

5. Marca de trabajador en CCT: filled according to the return value of feature "Determinación de la

situacion de convenio del empleado" (ARCNV) and the selection criteria

6. Marca de cobertura de SCVO: filled with true if any wage customized in group "SCVO" (V_T596I/J) is

found in employees' cluster, and false otherwise

7. Marca de corresponde reducción: fixed value "0"

8. Código de tipo de empleador asociado al trabajador: field "Tipo empresa" from the selection screen of

the report

9. Código de tipo de operación: fixed value "0"

10. Código de situación de revista: filled according the the current situation of the employee, consideraing

actions (0000 infotype) and absences (2001 infotype)

11. Código de condición: filled according to field "Agrupación de áreas de personal para Seguridad Social"

(GESES) of cluster table "Datos maestros de Seguridad Social" (ARSES)

12. Código de actividad: filled according to field "Agrupación de áreas de personal para Seguridad Social"

(GESES) of cluster table "Datos maestros de Seguridad Social" (ARSES)

13. Código de modalidad de contratación: field "Código de modalidad de contratación para SIJP" (TCSIJ)

from table "Asignación de modalidad de contratación a tipo contrato AR" (T7AR23) according to the

selection criteria

14. Código de siniestrado: filled according to the absence situation related to ART

15. Código de localidad: field "Códigos de zona de disminución de contribuciones a la DGI" (COZON) from

table Divis./Subdiv.personal: "Datos de Seg.Social y asign.fliare" (T7AR4P) according to the selection

criteria

16. Situación de revista 1: filled according to the current situation of the employee, consideraing actions

© 2021 SAP SE or an SAP affiliate company. All rights reserved 4 of 9

2021-07-08 2197671

(0000 infotype) and absences (2001 infotype)

17. Día de inicio situación de revista 1: start day of the current situation

18. Situación de revista 2: filled according to the current situation of the employee, consideraing actions

(0000 infotype) and absences (2001 infotype)

19. Día de inicio situación de revista 2: start day of the current situation

20. Situación de revista 3: filled according to the current situation of the employee, consideraing actions

(0000 infotype) and absences (2001 infotype)

21. Día de inicio situación de revista 3: start day of the current situation

22. Cantidad de días trabajados: filled with number of days of the current period minus days of absences

of "Absentismos" (2001) infotype customized in table "Información adicional para ausentismos"

(T7AR45)

23. Cantidad de horas trabajadas: filled with the number of wage types customized in cumulation "HORA",

and subapplication "F931" in table view V_T596I/J

24. Porcentaje de aporte adicional de seguridad social: filled with the rate of wage types customized in

cumulation AADS, and subapplication F931 in table view V_T596I/J

25. Porcentaje de contribución por tarea diferencial: filled with the rate of wage types customized in

cumulation PRDT, and subapplication F931 in table view V_T596I/J

26. Código de obra social del trabajador: field "Obra Social" (OBRAS) from "Seguridad Social" (0392)

infotype

27. Cantidad de adherentes de obra social: filled with the amount of wage types customized in cumulation

PRDT, and subapplication F931 in table view V_T596I/J

28. Aporte adicional de obra social: filled with the amount of wage types customized in cumulation AAOS,

and subapplication F931 in table view V_T596I/J

29. Contribución adicional de obra social: filled with the amount of wage types customized in cumulation

IAOS, and subapplication F931 in table view V_T596I/J

30. Base para el cálculo diferencial de aporte de obra social y FSR: filled with the amount of wage types

customized in cumulation DAOF, and subapplication F931 in table view V_T596I/J

31. Base para el cálculo diferencial de contribuciones de obra social y FSR: filled with the amount of wage

types customized in cumulation DCOF, and subapplication F931 in table view V_T596I/J

32. Base para el cálculo diferencial Ley de Riesgos del Trabajo: filled with the amount of wage types

customized in cumulation DLRT, and subapplication F931 in table view V_T596I/J

33. Remuneración maternidad para ANSES: filled with the amount of wage types customized in cumulation

MATR, and subapplication F931 in table view V_T596I/J

34. Remuneración bruta: filled with the amount of wage types customized in cumulation RTOT, and

subapplication F931 in table view V_T596I/J

35. Base imponible 1: filled with the amount of wage types customized in cumulation RIM1, and

subapplication F931 in table view V_T596I/J

36. Base imponible 2: filled with the amount of wage types customized in cumulation RIM2, and

subapplication F931 in table view V_T596I/J

37. Base imponible 3: filled with the amount of wage types customized in cumulation RIM3, and

subapplication F931 in table view V_T596I/J

38. Base imponible 4: filled with the amount of wage types customized in cumulation RIM4, and

subapplication F931 in table view V_T596I/J

39. Base imponible 5: filled with the amount of wage types customized in cumulation RIM5, and

subapplication F931 in table view V_T596I/J

40. Base imponible 6: filled with the amount of wage types customized in cumulation RIM6, and

subapplication F931 in table view V_T596I/J

41. Base imponible 7: filled with the amount of wage types customized in cumulation RIM7, and

subapplication F931 in table view V_T596I/J

42. Base imponible 8: filled with the amount of wage types customized in cumulation RIM8, and

subapplication F931 in table view V_T596I/J

43. Base imponible 9: filled with the amount of wage types customized in cumulation RIM9, and

© 2021 SAP SE or an SAP affiliate company. All rights reserved 5 of 9

2021-07-08 2197671

subapplication F931 in table view V_T596I/J

Record 05

1. Identificación del tipo de registro: fixed value "05"

2. CUIL del trabajador: field "Número de identificación personal" (PERID) from "Datos personales" (0002)

infotype

3. Categoría professional: filled with blanks

4. Puesto desempeñado: filled with blanks

5. Fecha de ingreso: filled with hiring date of the employee

6. Fecha de egreso: filled with firing date of the employee

7. Remuneración: filled with the amount of wage types customized in cumulation INCB, and

subapplication ARTE in table view V_T596I/J

8. CUIT del empleador: field "Clave Única de Identificación Tributaria" (CUITC) from table "Datos del

empleador según fecha informe Censo ANSES" (T7AR80) according to field "Número de

identificación" (ICNUM) from "ID personal" (0185) infotype and subty 41 ("CUIT/CUIL Trabajador

Eventual")

Installation Instructions

As general rule, SAP recommends that you install a solution by applying a Support Package. However, if you

need to install the solution earlier, proceed as follows:

1. Apply the manual pre-implementation steps

2. Apply SAP note 2210757 (creation of DDIC objects)

3. Use Note Assistant (SNOTE) to implement the correction instructions

4. Apply the manual post-implementations steps.

You can find more information about the Note Assistant in SAP Service Marketplace, under

service.sap.com/note-assistant.

Note that documentation, transactions and Customizing activities are only delivered via Support Package.

However you can find attached a documentation of the new report that will be available also via Support

Package.

Manual Activities

------------------------------------------------------------------------

|Manual Pre-Implement. |

------------------------------------------------------------------------

|VALID FOR |

|Software Component SAP_HRCAR |

| Release 600 Until SAPK-600C6INSAPHRCAR |

| Release 604 Until SAPK-60492INSAPHRCAR |

| Release 608 Until SAPK-60820INSAPHRCAR |

------------------------------------------------------------------------

Perform the manual pre-implementation steps described in the attached document

"Manual_pre_implem_note_2197671.pdf".

------------------------------------------------------------------------

|Manual Post-Implement. |

------------------------------------------------------------------------

© 2021 SAP SE or an SAP affiliate company. All rights reserved 6 of 9

2021-07-08 2197671

|VALID FOR |

|Software Component SAP_HRCAR |

| Release 600 Until SAPK-600C6INSAPHRCAR |

| Release 604 Until SAPK-60492INSAPHRCAR |

| Release 608 Until SAPK-60820INSAPHRCAR |

------------------------------------------------------------------------

Perform the manual post-implementation steps described in the attached document

"Manual_post_implem_note_2197671.pdf".

Software Components

Software Component Release

SAP_HRCAR 600 - 600

SAP_HRCAR 604 - 604

SAP_HRCAR 608 - 608

Correction Instructions

Software Component From To Version Changed on ID

SAP_HRCAR 600 600 2 09.10.2015 21:16:19 0001606638

SAP_HRCAR 604 604 2 09.10.2015 21:20:49 0001606636

SAP_HRCAR 604 604 2 09.10.2015 21:18:49 0001606635

SAP_HRCAR 600 600 2 09.10.2015 21:13:14 0001606637

SAP_HRCAR 608 608 3 09.10.2015 21:23:08 0001606634

Prerequisites

Software SAP

From To Title Component

Component Note/KBA

HARCDGI1 - SICORE file's lacks final

SAP_HRCAR 600 600 1226464 PY-AR

spaces

SAP_HRCAR 600 600 1329055 SICOSS V32 PY-AR

SAP_HRCAR 600 600 1433325 SICOSS V33 PY-AR

© 2021 SAP SE or an SAP affiliate company. All rights reserved 7 of 9

2021-07-08 2197671

SICOSS V34 (part 2) - New field in temse

SAP_HRCAR 600 600 1504031 PY-AR

layout

SAP_HRCAR 600 600 1520037 SICOSS V34.1 PY-AR

SAP_HRCAR 600 600 1684242 [AR] New Report for ART Calculation PY-AR

SAP_HRCAR 600 600 2205044 [HR-AR] HCM objects framework PY-AR

SAP_HRCAR 600 600 2210707 [HR-AR] New Generic Log Framework PY-AR

SAP_HRCAR 604 604 1329055 SICOSS V32 PY-AR

SAP_HRCAR 604 604 1433325 SICOSS V33 PY-AR

SICOSS V34 (part 2) - New field in temse

SAP_HRCAR 604 604 1504031 PY-AR

layout

SAP_HRCAR 604 604 1520037 SICOSS V34.1 PY-AR

SAP_HRCAR 604 604 1684242 [AR] New Report for ART Calculation PY-AR

SAP_HRCAR 604 604 2205044 [HR-AR] HCM objects framework PY-AR

SAP_HRCAR 604 604 2210707 [HR-AR] New Generic Log Framework PY-AR

SAP_HRCAR 604 608 1684242 [AR] New Report for ART Calculation PY-AR

[AR] RG 3781/2015 - Libro de Sueldos

SAP_HRCAR 608 608 2197671 PY-AR

Digital

SAP_HRCAR 608 608 2205044 [HR-AR] HCM objects framework PY-AR

SAP_HRCAR 608 608 2210707 [HR-AR] New Generic Log Framework PY-AR

Support Package

Software Component Release Support Package

SAP_HRCAR 600 SAPK-600C7INSAPHRCAR

SAP_HRCAR 604 SAPK-60493INSAPHRCAR

SAP_HRCAR 608 SAPK-60821INSAPHRCAR

This document refers to

SAP Note/KBA Title

© 2021 SAP SE or an SAP affiliate company. All rights reserved 8 of 9

2021-07-08 2197671

2210757 [AR] RG 3781/2015 - Libro de Sueldos Digital: UDO report for SAP Note 2197671

2192719 LC AR: RG 3781/2015 - Libro de Sueldos Digital

This document is referenced by

SAP Note/KBA Title

2841959 [AR] Working Days Calculation Framework

2699306 [AR] Documentation updates (wage types, feature 29DES, BAdI HR_PAYAR_F931_BADI)

2192719 LC AR: RG 3781/2015 - Libro de Sueldos Digital

2227013 [AR] Documentation RG 3781/2015 - Libro de Sueldos Digital

2210757 [AR] RG 3781/2015 - Libro de Sueldos Digital: UDO report for SAP Note 2197671

Attachments

File Name File Size Mime Type

Documentation_SAP_Note_2197671.pd

626 application/pdf

f

Manual_pre_implem_note_2197671.pd

425 application/pdf

f

Manual_post_implem_note_2197671.p

330 application/pdf

df

Terms of use | Copyright | Trademark | Legal Disclosure | Privacy

© 2021 SAP SE or an SAP affiliate company. All rights reserved 9 of 9

You might also like

- Analysis Information For Cross-Company Transactions (Delivery)Document7 pagesAnalysis Information For Cross-Company Transactions (Delivery)ambar10No ratings yet

- Ebook BRZ SAP LocalizationDocument62 pagesEbook BRZ SAP LocalizationSergio Monteiro Barros100% (3)

- SAP SD Tax ConfigurationDocument13 pagesSAP SD Tax Configurationcrm4key100% (2)

- Finsas: Financial Statement Analysis SpreadsheetDocument25 pagesFinsas: Financial Statement Analysis SpreadsheetMashaal FNo ratings yet

- 2014-10electronic Accounting Mexico enDocument19 pages2014-10electronic Accounting Mexico envenkatemani100% (2)

- Cutover Strategy Document For ARASCO V1.0Document12 pagesCutover Strategy Document For ARASCO V1.0Anonymous hCDnyHWjTNo ratings yet

- THE BIBLE: WORD OF GOD OR WORD OF MAN? by A.S.K. JoommalDocument103 pagesTHE BIBLE: WORD OF GOD OR WORD OF MAN? by A.S.K. JoommalЖаяам Дмэя100% (8)

- Pub The-Snouters PDFDocument90 pagesPub The-Snouters PDFJeremy VargasNo ratings yet

- Interview QuestionsDocument160 pagesInterview QuestionsreddynagiNo ratings yet

- E - 20201002 - RFUMSV50 Legal Change Spain (Non-Deductible+date Check For Old Unpaid Invoices)Document22 pagesE - 20201002 - RFUMSV50 Legal Change Spain (Non-Deductible+date Check For Old Unpaid Invoices)RangabashyamNo ratings yet

- 04 1 TRM PSCD DocumentsDocument4 pages04 1 TRM PSCD DocumentsBatboy BatkoNo ratings yet

- Header Data: SymptomDocument2 pagesHeader Data: Symptomherve.searchNo ratings yet

- Release Info Note Automatic Account Determ S4 Hana 1908Document5 pagesRelease Info Note Automatic Account Determ S4 Hana 1908RodrigoPepelascovNo ratings yet

- SAP Note - 1469906 - E - 20230615Document2 pagesSAP Note - 1469906 - E - 20230615Ruben MenesesNo ratings yet

- SD Tax ConfigDocument13 pagesSD Tax ConfigRahul DholeNo ratings yet

- Cash Discount in MIRODocument13 pagesCash Discount in MIROBalanathan VirupasanNo ratings yet

- Aei Rg2485 SetupDocument9 pagesAei Rg2485 Setupvikas_anne_1No ratings yet

- Brazil Tax Help-2Document26 pagesBrazil Tax Help-2RuchaNo ratings yet

- 11.1.2022 Payroll SlidesDocument19 pages11.1.2022 Payroll SlideskumarkomNo ratings yet

- Note2958296 TCSJV ProcessDocument5 pagesNote2958296 TCSJV Processvishnu900890No ratings yet

- Sap NotesDocument38 pagesSap NotesJyotirmay SahuNo ratings yet

- Transaction Codes Finance SAPDocument11 pagesTransaction Codes Finance SAPKarolina ReyNo ratings yet

- SAP FI Range NumbersDocument6 pagesSAP FI Range NumbersDavid JaimesNo ratings yet

- Configuration Guide Pre-Numbered Invoicing in SAPDocument14 pagesConfiguration Guide Pre-Numbered Invoicing in SAPGustavoGDANo ratings yet

- Bpcnw10 Ifrs Overw Sp5Document41 pagesBpcnw10 Ifrs Overw Sp5YudhaPKusumahNo ratings yet

- Argentina Withholding Tax Report (RPFIWTAR SIRE SICORE) User GuideDocument16 pagesArgentina Withholding Tax Report (RPFIWTAR SIRE SICORE) User GuideFede00070% (1)

- Sap Fico Blueprint-1Document32 pagesSap Fico Blueprint-1Deepak AggarwalNo ratings yet

- SAP Financials Accounts ReceivablesDocument17 pagesSAP Financials Accounts ReceivablesAyubPinjarNo ratings yet

- GU - SAP S4 HANA - 872449 - Tax Determination in Sales and DistributionDocument14 pagesGU - SAP S4 HANA - 872449 - Tax Determination in Sales and DistributionPaper ArtNo ratings yet

- SLA Part 3 - Journal Line Definition PDFDocument7 pagesSLA Part 3 - Journal Line Definition PDFsoireeNo ratings yet

- Withholding For The Sale of Services PDFDocument22 pagesWithholding For The Sale of Services PDFdgdssgdNo ratings yet

- Sap Subject Project MaterialDocument233 pagesSap Subject Project MaterialpavanNo ratings yet

- SAP and Finance - Asset AccountingDocument6 pagesSAP and Finance - Asset Accountingpawanjames7896No ratings yet

- Q. 01 Explain The Client Concept of SAP?Document35 pagesQ. 01 Explain The Client Concept of SAP?Nithin JosephNo ratings yet

- BEN: FAQ About Affordable Care Act (ACA) - Information Reporting For Employer Sponsored Coverage and Minimum Essential CoverageDocument10 pagesBEN: FAQ About Affordable Care Act (ACA) - Information Reporting For Employer Sponsored Coverage and Minimum Essential CoveragearbindokiluNo ratings yet

- Accounting Exercise PDFDocument61 pagesAccounting Exercise PDFAbdelhamid HarakatNo ratings yet

- Dokumentasi 3 - Config Submodule General Ledger AccountingDocument182 pagesDokumentasi 3 - Config Submodule General Ledger AccountingPuspaOktavianiNo ratings yet

- SAP New General Ledger ConfigurationDocument51 pagesSAP New General Ledger ConfigurationParas GourNo ratings yet

- SAP SD Interview Questions & Answers With ExplanationsDocument116 pagesSAP SD Interview Questions & Answers With ExplanationsGiri DharNo ratings yet

- Warranty ClaimbsDocument44 pagesWarranty ClaimbsJuan Salvador Meza Cruz50% (2)

- System Documentation For Legal Change 2014/2015 On VAT Rate: Post Tax Adjustment SAP Note 1927497Document5 pagesSystem Documentation For Legal Change 2014/2015 On VAT Rate: Post Tax Adjustment SAP Note 1927497Anonymous 1cTyiSF84No ratings yet

- FicaDocument41 pagesFicaSai ParekhNo ratings yet

- General Ledger Breakup of Account PayablesDocument11 pagesGeneral Ledger Breakup of Account PayablesAnand SharmaNo ratings yet

- SD - Tax Determination in Sales and DistributionDocument15 pagesSD - Tax Determination in Sales and DistributionNarendra BodhisatvaNo ratings yet

- Bpcnw100 Ifrs Sp4 OverviewDocument44 pagesBpcnw100 Ifrs Sp4 OverviewVinutaNo ratings yet

- PracticeDocument16 pagesPracticepradeepkumarmannepuliNo ratings yet

- Release Notes: MYOB Premier Plus v12.2 MYOB Premier v12.2 MYOB Accounting v18.2Document14 pagesRelease Notes: MYOB Premier Plus v12.2 MYOB Premier v12.2 MYOB Accounting v18.2Jatua MuntheNo ratings yet

- SD QuestionsDocument227 pagesSD QuestionschaurasiaNo ratings yet

- SAP FIGL Configuration SAP RDocument19 pagesSAP FIGL Configuration SAP RNeelesh KumarNo ratings yet

- HMRC Rti With Sap Payroll UkDocument7 pagesHMRC Rti With Sap Payroll UkkpvishwasNo ratings yet

- InterCompany Matching Application in BPCDocument36 pagesInterCompany Matching Application in BPCsapd65No ratings yet

- Introducing A New VAT System: Everything You Always Wanted To Know About VAT in SAP But Were Not Aware To AskDocument7 pagesIntroducing A New VAT System: Everything You Always Wanted To Know About VAT in SAP But Were Not Aware To Askchandra_kumarbrNo ratings yet

- Balance Sheet Cash Flow Planning Final TechwaveDocument7 pagesBalance Sheet Cash Flow Planning Final TechwaveCatherine WreyfordNo ratings yet

- Sap FicoDocument43 pagesSap FicoDhiraj PawarNo ratings yet

- Whats Is The Line ItemDocument54 pagesWhats Is The Line Itemcrazybobby007No ratings yet

- R12 Functional HighlightsDocument18 pagesR12 Functional HighlightsKamal100% (1)

- FICA1Document8 pagesFICA1alexisNo ratings yet

- Flight Training Revenues World Summary: Market Values & Financials by CountryFrom EverandFlight Training Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Manifold Business Forms World Summary: Market Sector Values & Financials by CountryFrom EverandManifold Business Forms World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Antifreeze for Internal Combustion Engines World Summary: Market Values & Financials by CountryFrom EverandAntifreeze for Internal Combustion Engines World Summary: Market Values & Financials by CountryNo ratings yet

- Crushing, Pulverizing & Screening Machinery World Summary: Market Sector Values & Financials by CountryFrom EverandCrushing, Pulverizing & Screening Machinery World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Data Processing Service Revenues World Summary: Market Values & Financials by CountryFrom EverandData Processing Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- S4HANA Business Partner ConversionDocument2 pagesS4HANA Business Partner ConversionClara SackNo ratings yet

- Manual Pre Implem Note 3383275Document4 pagesManual Pre Implem Note 3383275Clara SackNo ratings yet

- 03 S4HANA Product Overview TechnicalDocument90 pages03 S4HANA Product Overview TechnicalClara SackNo ratings yet

- Manual Activity Note 3382125Document5 pagesManual Activity Note 3382125Clara SackNo ratings yet

- Manual Instructions For SAP Note 3380514Document4 pagesManual Instructions For SAP Note 3380514Clara SackNo ratings yet

- Payroll Argentina Troubleshooting Guide - General Resolution 5417/2023Document3 pagesPayroll Argentina Troubleshooting Guide - General Resolution 5417/2023Clara SackNo ratings yet

- Otitis Media Supuratif KronisDocument29 pagesOtitis Media Supuratif KronisKhairan IrmansyahNo ratings yet

- 2011 Corrigan - Nutrition in Stroke PatientsDocument11 pages2011 Corrigan - Nutrition in Stroke PatientsAmy100% (1)

- Kajian Tindakan PPGBDocument18 pagesKajian Tindakan PPGBAtiqah NoriNo ratings yet

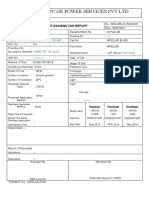

- NTPC Ge Power Services PVT LTD: Liquid Penetrant Examination ReportDocument2 pagesNTPC Ge Power Services PVT LTD: Liquid Penetrant Examination ReportBalkishan DyavanapellyNo ratings yet

- Chap.1 Bda 10602Document32 pagesChap.1 Bda 10602Firzana AmiraNo ratings yet

- Khedive IsmailDocument3 pagesKhedive IsmailAbimbola OyarinuNo ratings yet

- A Study On The Organisational Behaviour of Aviation IndustryDocument8 pagesA Study On The Organisational Behaviour of Aviation IndustryRoshan BhosaleNo ratings yet

- What Exactly Is ShivlingDocument1 pageWhat Exactly Is ShivlingApoorva BhattNo ratings yet

- Reo Speedwagon - in My Dreams - Guitar ChordsDocument1 pageReo Speedwagon - in My Dreams - Guitar ChordsArch Dela CruzNo ratings yet

- Amax 2000Document30 pagesAmax 2000Popa OachimNo ratings yet

- Primemotiontraining Beeptest GuideDocument6 pagesPrimemotiontraining Beeptest GuideCristian NechitaNo ratings yet

- Buku Panduan Bengkel 2 - Sesi 20182019Document55 pagesBuku Panduan Bengkel 2 - Sesi 20182019Cheng Ching HaoNo ratings yet

- Edinburgh Castle Power PointDocument12 pagesEdinburgh Castle Power Pointlaurcahs100% (3)

- GCP Command LibrariesDocument2 pagesGCP Command LibrariesIdris AdeniranNo ratings yet

- Training Loans Are Available For WSH Professional Courses!: Only 6% Per ANNUMDocument2 pagesTraining Loans Are Available For WSH Professional Courses!: Only 6% Per ANNUMGlenden KhewNo ratings yet

- Action Plan in Reading 2018-2019Document2 pagesAction Plan in Reading 2018-2019Es Jey NanolaNo ratings yet

- Review Text of Indonesian MovieDocument8 pagesReview Text of Indonesian Movieadel fashaNo ratings yet

- Bride For SaleDocument3 pagesBride For SalePrince SamsonNo ratings yet

- Owen Hatherley - Silo DreamsDocument16 pagesOwen Hatherley - Silo DreamsLuiza NadaluttiNo ratings yet

- CDADocument3 pagesCDADanish YaseenNo ratings yet

- The Global Islamic Media Front General CommandDocument6 pagesThe Global Islamic Media Front General CommandabuumareulNo ratings yet

- Aspire Budget 2.8 PDFDocument274 pagesAspire Budget 2.8 PDFLucas DinizNo ratings yet

- Business Plan Group 4Document13 pagesBusiness Plan Group 4Jennilyn EstilliosoNo ratings yet

- Satheeshkumar Dhrithiya (NJC) - 2021-Is1-PA8.1 Tea Bag Activity - HBL (ST)Document6 pagesSatheeshkumar Dhrithiya (NJC) - 2021-Is1-PA8.1 Tea Bag Activity - HBL (ST)weiliNo ratings yet

- Chapter 2: Goals and Motivations: Career/Life Planning and Personal ExplorationDocument10 pagesChapter 2: Goals and Motivations: Career/Life Planning and Personal ExplorationSendriniNo ratings yet

- Official Taboo For Print PDFDocument2 pagesOfficial Taboo For Print PDFSrdjan MaksimovicNo ratings yet

- Igo Primo Exe DownloadDocument4 pagesIgo Primo Exe DownloadMark V BeekNo ratings yet

- A Study On Consumer Preference For Branded ShoesDocument126 pagesA Study On Consumer Preference For Branded ShoesJyotsna Agarwal60% (5)