Professional Documents

Culture Documents

Sas12 Fin081

Sas12 Fin081

Uploaded by

Mary Lyn DatuinCopyright:

Available Formats

You might also like

- Wendy Yvana Intro To Finance Unit 6Document11 pagesWendy Yvana Intro To Finance Unit 6pse100% (1)

- Topics of Project Report For BBA Sem - 6Document3 pagesTopics of Project Report For BBA Sem - 6Jadeja Satyajeetsinh100% (1)

- Mini Case: Bunyan Lumber, LLC: Disusun OlehDocument5 pagesMini Case: Bunyan Lumber, LLC: Disusun OlehricaNo ratings yet

- Notes in Short Term FinancingDocument3 pagesNotes in Short Term FinancingLiana Monica LopezNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRavi ParmarNo ratings yet

- Types of Borrowers-Lending ProcessDocument39 pagesTypes of Borrowers-Lending ProcessEr Yogendra100% (2)

- ACCT 212 Individual Learning Project Study GuidesDocument8 pagesACCT 212 Individual Learning Project Study GuidesJohn LibertyNo ratings yet

- Sas - Day 23 - Fin 004Document8 pagesSas - Day 23 - Fin 004Hazal DereNo ratings yet

- FINMNN1 Chapter 4 Short Term Financial PlanningDocument16 pagesFINMNN1 Chapter 4 Short Term Financial Planningkissmoon732No ratings yet

- BUSINESS FINANCE Week 3Document5 pagesBUSINESS FINANCE Week 3Ace San GabrielNo ratings yet

- SAS #7-FIN 012.docxDocument8 pagesSAS #7-FIN 012.docxconandetic123No ratings yet

- SAS #2-FIN 012.docxDocument6 pagesSAS #2-FIN 012.docxconandetic123No ratings yet

- Smart Task 2 SubmissionDocument5 pagesSmart Task 2 SubmissionPrateek JoshiNo ratings yet

- Manage Overdue Coustmer AccountDocument19 pagesManage Overdue Coustmer AccountNigussie BerhanuNo ratings yet

- FM - Working Capital ManagementDocument20 pagesFM - Working Capital Managementaadi cr7No ratings yet

- Banking and Financial Institutions Module5Document14 pagesBanking and Financial Institutions Module5bad genius100% (1)

- Pratibha Singh - VCE Task1Document5 pagesPratibha Singh - VCE Task1Pratibha SinghNo ratings yet

- Short Term Financing Less Than One YearDocument6 pagesShort Term Financing Less Than One YearPaul Anthony AspuriaNo ratings yet

- Term Paper Topics For Investment ManagementDocument8 pagesTerm Paper Topics For Investment Managementaflskkcez100% (1)

- Chapter 8 - Short Term FinancingDocument45 pagesChapter 8 - Short Term FinancingCindy Jane Omillio100% (1)

- SAS #3-FIN012.docxDocument7 pagesSAS #3-FIN012.docxconandetic123No ratings yet

- Senior High School: First Semester S.Y. 2020-2021Document13 pagesSenior High School: First Semester S.Y. 2020-2021sheilame nudaloNo ratings yet

- VCE Summer Internship Program 2021: Name Email-ID Smart Task No. Project TopicDocument3 pagesVCE Summer Internship Program 2021: Name Email-ID Smart Task No. Project TopicShazmeenNo ratings yet

- University of Makati: Short-Term Financing Prof. Marlo D. GileDocument4 pagesUniversity of Makati: Short-Term Financing Prof. Marlo D. GileArt2826No ratings yet

- VCE Summer Internship Program 2021: Smart Task Submission FormatDocument7 pagesVCE Summer Internship Program 2021: Smart Task Submission FormatNiharika MathurNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument4 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRavi ParmarNo ratings yet

- MFS AssignmentDocument37 pagesMFS AssignmentMoh'ed A. KhalafNo ratings yet

- VCE Summer Internship Program 2021: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2021: Smart Task Submission FormatKetan PandeyNo ratings yet

- Bba Banking Fin1Document10 pagesBba Banking Fin1kotit35No ratings yet

- AdvancesprocessmDocument98 pagesAdvancesprocessmAmol DahiphaleNo ratings yet

- Week 5 Business LoansDocument34 pagesWeek 5 Business Loans23-08439No ratings yet

- FIN 072 - SAS - Day 23Document8 pagesFIN 072 - SAS - Day 23rago.cachero.auNo ratings yet

- Summer Training Handbo Ok: Lokesh JasraiDocument32 pagesSummer Training Handbo Ok: Lokesh JasraiJuiÇý ßitëNo ratings yet

- Effects of Credit Policy On Profitability of Manufacturing Firms in KenyaDocument7 pagesEffects of Credit Policy On Profitability of Manufacturing Firms in KenyaSahul RanaNo ratings yet

- Working Capital FinancingDocument11 pagesWorking Capital FinancingShaRiq KhAnNo ratings yet

- Features of Credit CardDocument11 pagesFeatures of Credit CardBipin ThakorNo ratings yet

- Chapter 17 - FINANCEDocument4 pagesChapter 17 - FINANCEHamieWave TVNo ratings yet

- Thesis-1 13Document29 pagesThesis-1 13Beige TanNo ratings yet

- Business Finance Q3 Module 4Document28 pagesBusiness Finance Q3 Module 4yanadelossantos042No ratings yet

- Business Finance Q3 Module 4 3Document28 pagesBusiness Finance Q3 Module 4 3krystelairaa14No ratings yet

- Master of Business Administration-MBA Semester 2 MB0045 - Financial Management - 4 Credits (Book ID: B1134) Assignment Set - 2 (60 Marks)Document13 pagesMaster of Business Administration-MBA Semester 2 MB0045 - Financial Management - 4 Credits (Book ID: B1134) Assignment Set - 2 (60 Marks)Maulik Parekh100% (1)

- Global College: Learning GuideDocument16 pagesGlobal College: Learning Guideembiale ayaluNo ratings yet

- Financial ManagementDocument44 pagesFinancial ManagementNitish SinhaNo ratings yet

- Subject Code - MB0045: MB0045 - Financial Management - 4 CreditsDocument9 pagesSubject Code - MB0045: MB0045 - Financial Management - 4 CreditsJared HuffmanNo ratings yet

- Corporate FinanceDocument20 pagesCorporate FinanceMrs. Seema NazneenNo ratings yet

- Manage Overdue Customer AccountsDocument15 pagesManage Overdue Customer Accountsmulehabesha.mhNo ratings yet

- Short-Term Commercial Paper Interest RatesDocument4 pagesShort-Term Commercial Paper Interest Ratesc5e83cmh100% (1)

- Part I: Review Credit Products and Services of 05 Commercial Banks 1.1. Overview of Banking Networks in VietnamDocument15 pagesPart I: Review Credit Products and Services of 05 Commercial Banks 1.1. Overview of Banking Networks in VietnamTrịnh Đẹp TraiNo ratings yet

- Coursework FinanceDocument7 pagesCoursework Financexokcccifg100% (2)

- Unit 4 Receivables - ManagementDocument27 pagesUnit 4 Receivables - ManagementrehaarocksNo ratings yet

- Credit Risk Management Master ThesisDocument5 pagesCredit Risk Management Master ThesisPapersHelpEvansville100% (2)

- Credit Managers. Lesson 3Document40 pagesCredit Managers. Lesson 3Joseph PoNo ratings yet

- Dissertation On Merchant Banking in IndiaDocument5 pagesDissertation On Merchant Banking in IndiaBuyingCollegePapersOnlineUK100% (1)

- PERSONAL FINANCE Lesson Two Money ManagementDocument6 pagesPERSONAL FINANCE Lesson Two Money ManagementJohn Greg MenianoNo ratings yet

- Tutorial 2 AnswersDocument7 pagesTutorial 2 Answerskung siew houngNo ratings yet

- Ms 41Document12 pagesMs 41kvrajan6No ratings yet

- Business Finance - 12 - Third - Week 4Document10 pagesBusiness Finance - 12 - Third - Week 4AngelicaHermoParasNo ratings yet

- Fabm 2: Quarter 3 - Module 6 Computing and Interpreting Financial RatiosDocument23 pagesFabm 2: Quarter 3 - Module 6 Computing and Interpreting Financial RatiosMaria Nikka GarciaNo ratings yet

- Name Email Smart Task No. Project Topic: Mohd Mujeeb 3 Project Finance-Modelling and AnalysisDocument3 pagesName Email Smart Task No. Project Topic: Mohd Mujeeb 3 Project Finance-Modelling and Analysismohd mujeebNo ratings yet

- 1nh21ba076 230712 112345Document64 pages1nh21ba076 230712 112345akshaya kasi rajanNo ratings yet

- Chapter 6-8 - Sources of Finance & Short Term FinanceDocument8 pagesChapter 6-8 - Sources of Finance & Short Term FinanceTAN YUN YUNNo ratings yet

- Business Enterprise Module 2 - Fourth QuarterDocument3 pagesBusiness Enterprise Module 2 - Fourth QuarterBernadette Hernandez PatulayNo ratings yet

- Unlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditFrom EverandUnlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditNo ratings yet

- Group 1Document28 pagesGroup 1Mary Lyn DatuinNo ratings yet

- BAM 241 Bus Law Reg CFE 2S2324Document3 pagesBAM 241 Bus Law Reg CFE 2S2324Mary Lyn DatuinNo ratings yet

- San Pablo Water District Laguna Executive Summary 2019Document13 pagesSan Pablo Water District Laguna Executive Summary 2019Mary Lyn DatuinNo ratings yet

- ScriptDocument1 pageScriptMary Lyn DatuinNo ratings yet

- Slide 3 - Practice Exercise - Property RelationsDocument35 pagesSlide 3 - Practice Exercise - Property RelationsMary Lyn DatuinNo ratings yet

- Gen008 P1 ExamDocument11 pagesGen008 P1 ExamMary Lyn DatuinNo ratings yet

- Elements of DanceDocument16 pagesElements of DanceMary Lyn DatuinNo ratings yet

- Cash and Cash Equivalents: Purchased Three Months Before MaturityDocument8 pagesCash and Cash Equivalents: Purchased Three Months Before MaturityMary Lyn DatuinNo ratings yet

- Bank Recon SeatworkDocument4 pagesBank Recon SeatworkMary Lyn DatuinNo ratings yet

- Cta 00 CV 00071 D 1955aug11 AssDocument16 pagesCta 00 CV 00071 D 1955aug11 AssMary Lyn DatuinNo ratings yet

- Sas13 Fin081Document8 pagesSas13 Fin081Mary Lyn DatuinNo ratings yet

- FIN081 P3 Quiz2 Short-Term-Financing AnswerDocument4 pagesFIN081 P3 Quiz2 Short-Term-Financing AnswerMary Lyn DatuinNo ratings yet

- BAM 026 Group 2 Comprehensive PaperDocument8 pagesBAM 026 Group 2 Comprehensive PaperMary Lyn DatuinNo ratings yet

- Ped-032 Sas Lesson-3Document8 pagesPed-032 Sas Lesson-3Mary Lyn DatuinNo ratings yet

- Receivable MNGMNTDocument17 pagesReceivable MNGMNTMary Lyn DatuinNo ratings yet

- Ratio Analysis - Practice ExerciseDocument4 pagesRatio Analysis - Practice ExerciseMary Lyn DatuinNo ratings yet

- Examples WACC Project RiskDocument4 pagesExamples WACC Project Risk979044775No ratings yet

- Ac1101 Final Exam QuestionnaireDocument11 pagesAc1101 Final Exam QuestionnaireAngel ObligacionNo ratings yet

- Asii LK TW Ii 2016Document122 pagesAsii LK TW Ii 2016Ndtriyansyah SampitNo ratings yet

- Topic 9 Foreign Exchange Exposure and Currency HedgingDocument32 pagesTopic 9 Foreign Exchange Exposure and Currency HedgingAdam Mo AliNo ratings yet

- Dow Theory The Key To Stock MarketDocument7 pagesDow Theory The Key To Stock MarketPiyush KumarNo ratings yet

- PTTCDN D02 Team-05 Hoa-Sen-GroupDocument61 pagesPTTCDN D02 Team-05 Hoa-Sen-GroupHợp NguyễnNo ratings yet

- Hedge Funds StrategiesDocument13 pagesHedge Funds StrategiesJoel FernandesNo ratings yet

- Introducing "Varsity": CategoriesDocument25 pagesIntroducing "Varsity": CategoriesrohaNo ratings yet

- Valuation of StocksDocument47 pagesValuation of Stocksojasd1100% (1)

- RatingsDocument6 pagesRatingssheinaNo ratings yet

- Crude Trading PlanDocument19 pagesCrude Trading PlanGopagani DharshanNo ratings yet

- 2 Statement of Financial PositionDocument7 pages2 Statement of Financial Positionreagan blaireNo ratings yet

- BPS InvestmentsDocument22 pagesBPS InvestmentsSheena CalderonNo ratings yet

- Partnership FormationDocument39 pagesPartnership FormationLe Ann Rhine MayantongNo ratings yet

- Ias 2 - Inventories Case Studies 1 - 13: C K / C FV D - BZVC RCV KdeuzvcDocument14 pagesIas 2 - Inventories Case Studies 1 - 13: C K / C FV D - BZVC RCV KdeuzvcHernan EleNo ratings yet

- Accounts Test 100 Marks PDFDocument9 pagesAccounts Test 100 Marks PDFAruna RajappaNo ratings yet

- Ichimoku Indicator StrategyDocument10 pagesIchimoku Indicator StrategyTanto Argianto75% (4)

- Private Equity Real Estate: NorthfieldDocument26 pagesPrivate Equity Real Estate: NorthfieldchrisjohnlopezNo ratings yet

- Edrolo VCE Business Management Units 12 - Full Textbook PDFDocument601 pagesEdrolo VCE Business Management Units 12 - Full Textbook PDFLeona JobinNo ratings yet

- Another Stupid Letter From Larry FinkDocument2 pagesAnother Stupid Letter From Larry FinkCODEPINKNo ratings yet

- Mckinsey Appraisal - AppraisalDocument8 pagesMckinsey Appraisal - Appraisalalex.nogueira396No ratings yet

- Curvature Trading Part ThreeDocument4 pagesCurvature Trading Part ThreesteveNo ratings yet

- Trading Strategies Chap10Document4 pagesTrading Strategies Chap10SolisterADVNo ratings yet

- AFM Test 1Document3 pagesAFM Test 1Syeda IsmailNo ratings yet

- MortgageDocument88 pagesMortgagejhanu jhanuNo ratings yet

- Made By: Sagar Phul Shruti Kashyap Deepshikha Yadav Lincy Kurian Tingle ThomasDocument35 pagesMade By: Sagar Phul Shruti Kashyap Deepshikha Yadav Lincy Kurian Tingle ThomasDeepshikha YadavNo ratings yet

- Final Exam Paper POA 1st YearDocument2 pagesFinal Exam Paper POA 1st YearMustafa AhmedNo ratings yet

Sas12 Fin081

Sas12 Fin081

Uploaded by

Mary Lyn DatuinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sas12 Fin081

Sas12 Fin081

Uploaded by

Mary Lyn DatuinCopyright:

Available Formats

Course Code: Financial Management

Student Activity Sheet Module #12

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

Lesson title: WORKING CAPITAL AND CASH MANAGEMENT Materials:

(CONT.) SAS

Lesson Objectives: References:

At the end of this module, I should be able to: Brigham, E. and Houston, J.

1. describe how the costs of trade credit, bank loans and (2013). Fundamentals of Financial

commercial paper are determined and how that information Management. Pasig City: Cengage

impacts decisions for financing working capital Learning Asia Pte. Ltd.

2. explain how companies use security to lower their costs of

short-term credit

Productivity Tip: Schedule doing practice drills similar to the ones in this module two more times this week.

Spacing your practice time will help you master the process!

A. LESSON PREVIEW/REVIEW

1) Introduction

In the two immediately preceding modules, we learned about the concept of working capital, its

components, effect on a firm’s profitability, credit policies companies set and the cash

conversion cycle. In this module, we will determine the cost of trade credit, bank loans and

commercial paper, and the ways a company uses security to lower their costs of short-term

credit.

2) Activity 1: What I Know Chart, part 1 (3 mins)

Try answering the questions below by writing your ideas under the first column What I Know. It’s

okay if you write key words or phrases that you think are related to the questions.

What I Know Questions: What I Learned (Activity 4)

What is a trade credit?

What is a promissory note?

This document is the property of PHINMA EDUCATION

Page 1 | 8

Course Code: Financial Management

Student Activity Sheet Module #12

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

B. MAIN LESSON

1) Activity 2: Content Notes

TRADE CREDIT

Trade credit is debt arising from credit sales and recorded as an account receivable by the seller and

as an account payable by the buyer.

There are two types of trade credit:

1. Free trade credit - the trade credit that is obtained without a cost, and it consists of all trade credit

that is available without giving up discounts. Given the credit term 2/10, net 30, the first 10 days of

purchases are free.

2. Costly trade credit - any trade credit over and above the free trade credit. Given the credit term

2/10, net 30, the period in excess of 10 days is not free because it would mean giving up the

discount.

Calculating the Nominal Annual Cost of Trade Credit

Suppose a company buys 20 microchips each day with a list price of P100 per chip on terms of 2/10,

net 30. Under those terms, the “true” price of the chips is P98 [computed as: 100 – (2% x P100) =

P98] because the chips can be purchased for only P98 by paying within 10 days. Thus, the P2 is

effectively a finance charge for paying beyond 10 days.

Suppose the said company operates 365 days in a year and buys 20 chips per day. If it takes the

discount, the total amount of purchase is P715,400 per year. If it does not take the discount, the total

cost of the chips will be P730,000. The difference of P14,600 is the annual cost of the trade credit.

To compute the Nominal Annual Cost of Trade Credit (NACTC), the following equation is used:

𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 (%) 365

𝑁𝐴𝐶𝑇𝐶 = 100−𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 (%) 𝑥 𝐷𝑎𝑦𝑠 𝑐𝑟𝑒𝑑𝑖𝑡 𝑖𝑠 𝑜𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔−𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑝𝑒𝑟𝑖𝑜𝑑

Suppose the company decides to delay payment until the 30th day, the NACTC is computed as

follows:

2 365 2 365

𝑁𝐴𝐶𝑇𝐶 = 100−2 𝑥 30−10 = 98 𝑥 20 = 37. 24%

Nominal Annual Cost of Trade Credit vs. Effective Annual Cost of Trade Credit or Effective

Annual Rate (EAR)

This document is the property of PHINMA EDUCATION

Page 2 | 8

Course Code: Financial Management

Student Activity Sheet Module #12

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

The nominal annual cost formula does not take account of compounding; and in effective annual

interest terms, the cost of trade credit is even higher.

The discount is equivalent to interest; and with terms of 2/10, net 30, the company gains the use of

funds for 30 – 10 = 20 days. So there are 365/20 = 18.25 “interest periods” per year.

The first term in the NACTC equation, (Discount %)/(100 – Discount %) = 0.02/0.98 = 0.0204, is the

periodic interest rate. That rate is paid 18.25 times each year, so the effective annual cost of trade

credit is 44.6%:

18.25

𝐸𝐴𝑅 = (1. 0204) − 1. 0 = 1. 4459 − 1 = 44. 6%

BANK LOANS

Bank loans are an important source of short-term financing for business organizations, evidenced by

promissory notes. A promissory note is a document specifying the terms and conditions of a loan,

including the amount, interest rate, and repayment schedule. Here are some of the key features of

most promissory notes:

1. Amount

2. Maturity

3. Interest rate

4. Frequency of principal and interest payments

5. Collateral or security for loans

Cost of Bank Loans

The costs of bank loans vary for different types of borrowers at any given point in time and for all

borrowers over time. Interest rates are higher for riskier borrowers, and rates are higher on smaller

loans because of the fixed costs involved in making and servicing loans. If a firm can qualify as a

“prime credit” because of its size and financial strength, it can borrow at the prime rate, which at one

time was the lowest rate banks charged.

Calculating the Effective Interest Rate on Bank Loans

Assuming the company has a loan of P10,000 at the prime rate of 5.25% with a 360-day year. If

interest is paid once a year, the nominal rate also will be the effective rate. However, if interest must

be paid monthly, the effective rate will be (1 + 0.0525/12)12 – 1 = 5.3782%.

This document is the property of PHINMA EDUCATION

Page 3 | 8

Course Code: Financial Management

Student Activity Sheet Module #12

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

Commercial Paper

Commercial paper is a promissory note issued by a large, strong firm—most often a financial

institution—that wants to borrow on a short-term basis. Commercial paper is sold primarily to other

business firms, insurance companies, pension funds, money market mutual funds, and banks and is

generally unsecured; but “asset-backed paper” secured by credit card debt and other small,

short-term loans has also been issued.

Secured Loans

Companies may find that they can borrow only if they put up collateral to protect the lender or that

securing the loan enables them to borrow at a lower rate. A secured loan is a loan backed by

collateral, such as movable or immovable properties of the borrower. Land, buildings, and equipment

are good forms of collateral; but they are generally used to secure long-term loans rather than

short-term working capital loans. Therefore, most secured short-term business loans use accounts

receivable and inventories as collateral.

2) Activity 3: Skill-building Activities

Let’s practice! After completing each exercise, you may refer to the Key to Corrections for

feedback. Try to complete each exercise before looking at the feedback.

Exercise 1: Lamar Lumber buys P8 million of materials (net of discounts) on terms of 3/5, net

60; and it currently pays after 5 days and takes discounts. Lamar plans to expand, which will

require additional financing. If Lamar decides to forgo discounts, how much additional credit

could it get and what would be the nominal and effective cost of that credit? If the company

could get the funds from a bank at a rate of 10%, interest paid monthly, based on a 365-day

year, what would be the effective cost of the bank loan? Should Lamar use bank debt or

additional trade credit? Explain.

This document is the property of PHINMA EDUCATION

Page 4 | 8

Course Code: Financial Management

Student Activity Sheet Module #12

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

Exercise 2: Why is some trade credit called free while other credit is called costly? If a firm buys

on terms of 2/10, net 30, pays at the end of the 30th day, and typically shows P300,000 of

accounts payable on its balance sheet, would the entire P300,000 be free credit, would it be

costly credit, or would some be free and some costly? Explain your answer. No calculations are

necessary.

3) Activity 4: What I Know Chart, part 2

It’s time to answer the questions in the What I Know chart in Activity 1. Log in your answers in

the table.

4) Activity 5: Check for Understanding

Encircle the letter of the correct answer.

23. Suppose the credit terms offered to your firm by your suppliers are 2/10, net 30 days. Out of

convenience, your firm is not taking discounts, but is paying after 20 days, instead of waiting

until Day 30. You point out that the nominal cost of not taking the discount and paying on Day 30

is approximately 37 percent. But since your firm is not taking discounts and is paying on Day

20, what is the effective annual cost of your firm’s current practice, using a 365-day year?

a. 36.7%

b. 105.4%

c. 73.4%

d. 43.6%

e. 109.0%

24. Hayes Hypermarket purchases $4,562,500 in goods over a 1-year period from its sole

supplier. The supplier offers trade credit under the following terms: 2/15, net 50 days. If Hayes

chooses to pay on time but not to take the discount, what is the average level of the company’s

accounts payable, and what is the effective annual cost of its trade credit? (Assume a 365-day

year.)

This document is the property of PHINMA EDUCATION

Page 5 | 8

Course Code: Financial Management

Student Activity Sheet Module #12

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

a. $208,333; 17.81%

b. $416,667; 17.54%

c. $416,667; 27.43%

d. $625,000; 17.54%

e. $625,000; 23.45%

(The following data apply to the next two problems.)

You have just taken out a loan for $75,000. The stated (simple) interest rate on this loan is 10

percent, and the bank requires you to maintain a compensating balance equal to 15 percent of

the initial face amount of the loan. You currently have $20,000 in your checking account, and

you plan to maintain this balance. The loan is an add-on installment loan that you will repay in

12 equal monthly installments, beginning at the end of the first month.

3. How large are your monthly payments?

a. $6,250

b. $7,000

c. $7,500

d. $5,250

e. $6,875

4. What is the nominal annual add-on interest rate on this loan?

a. 10.00%

b. 16.47%

c. 18.83%

d. 20.00%

e. 24.00%

C. LESSON WRAP-UP

1) Activity 6: Thinking about Learning

Congratulations for finishing this module! Shade the number of the module that you finished.

This document is the property of PHINMA EDUCATION

Page 6 | 8

Course Code: Financial Management

Student Activity Sheet Module #12

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

Did you have challenges learning the concepts in this module? If none, which parts of the module

helped you learn the concepts?

__________________________________________________________________________________

___________________________

Some question/s I want to ask my teacher about this module is/are:

______________________________________

__________________________________________________________________________________

___________________________

KEY TO CORRECTIONS

Answers to Skill-Building Exercises

Exercise 1:

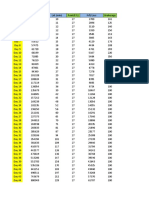

Purchases = P8,000,000; terms = 3/5 net 60; currently pays on Day 5 and takes discounts.

Forgoes discounts; additional credit = ?

P8,000,000/365 x 55 days = P1,205,479.45.

Nominal cost of trade credit = = 3.09% x 6.6364 = 20.52%.

Effective cost of trade credit = (1 + 3/97)365/55 – 1 = 1.2240 – 1 = 22.40%.

Bank loan: 10%, interest paid monthly

EAR = (1 + 0.10/12)12 – 1 = 1.1047 – 1 = 10.47%.

Because the effective cost of the bank loan is less than half the effective cost of the trade credit,

the bank loan should be used.

Exercise 2:

Trade credit is the debt arising from credit sales and recorded as an account receivable by the

seller and as an account payable by the buyer. Free trade credit is the credit received during

This document is the property of PHINMA EDUCATION

Page 7 | 8

Course Code: Financial Management

Student Activity Sheet Module #12

Name: _________________________________________________________ Class number: ____

Section: ____________ Schedule: __________________________________ Date: ___________

the discount period, while the costly trade credit is the credit taken in excess of free trade credit,

whose cost is equal to the discount lost. With credit terms of 2/10, net 30 and the firm pays on

the 30th day, then some of the trade credit would be free and some would be costly. With an

accounts payable balance of P300,000, then the free trade credit would be P100,000 and the

costly trade credit would be P200,000. The free trade credit represents the 10 days of

purchases that would qualify for the discount, while the costly trade credit represents the

additional 20 days of purchases that do not qualify for the discount.

4) Activity 5: Check for Understanding

. EAR cost of trade credit Answer: e

Calculate the nominal percentage, which is the nominal annual cost:

Nominal cost = × = 0.0204 x 36.5 = 0.7449 ≈ 74.5%.

Calculate the effective annual rate (EAR):

Numerical solution:

EAR = (1.0204)36.5 - 1.0 = 2.0905 - 1.0 = 109.05% ≈ 109%.

2. EAR cost of trade credit Answer: e

The company pays every 50 days or 365/50 = 7.3 times per year. Thus, the average accounts

payable are $4,562,500/7.3 = $625,000. The effective cost of trade credit can be found as

follows:

EAR = (1 + 2/98)365/35 - 1 = 1.2345 - 1 = 0.2345 = 23.45%.

3. Add-on loan payments Answer: e

The monthly payments would be:

Monthly payment = = $6,875.

4. Nominal add-on interest rate Answer: d

Approximate rate = = 20%.

This document is the property of PHINMA EDUCATION

Page 8 | 8

You might also like

- Wendy Yvana Intro To Finance Unit 6Document11 pagesWendy Yvana Intro To Finance Unit 6pse100% (1)

- Topics of Project Report For BBA Sem - 6Document3 pagesTopics of Project Report For BBA Sem - 6Jadeja Satyajeetsinh100% (1)

- Mini Case: Bunyan Lumber, LLC: Disusun OlehDocument5 pagesMini Case: Bunyan Lumber, LLC: Disusun OlehricaNo ratings yet

- Notes in Short Term FinancingDocument3 pagesNotes in Short Term FinancingLiana Monica LopezNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRavi ParmarNo ratings yet

- Types of Borrowers-Lending ProcessDocument39 pagesTypes of Borrowers-Lending ProcessEr Yogendra100% (2)

- ACCT 212 Individual Learning Project Study GuidesDocument8 pagesACCT 212 Individual Learning Project Study GuidesJohn LibertyNo ratings yet

- Sas - Day 23 - Fin 004Document8 pagesSas - Day 23 - Fin 004Hazal DereNo ratings yet

- FINMNN1 Chapter 4 Short Term Financial PlanningDocument16 pagesFINMNN1 Chapter 4 Short Term Financial Planningkissmoon732No ratings yet

- BUSINESS FINANCE Week 3Document5 pagesBUSINESS FINANCE Week 3Ace San GabrielNo ratings yet

- SAS #7-FIN 012.docxDocument8 pagesSAS #7-FIN 012.docxconandetic123No ratings yet

- SAS #2-FIN 012.docxDocument6 pagesSAS #2-FIN 012.docxconandetic123No ratings yet

- Smart Task 2 SubmissionDocument5 pagesSmart Task 2 SubmissionPrateek JoshiNo ratings yet

- Manage Overdue Coustmer AccountDocument19 pagesManage Overdue Coustmer AccountNigussie BerhanuNo ratings yet

- FM - Working Capital ManagementDocument20 pagesFM - Working Capital Managementaadi cr7No ratings yet

- Banking and Financial Institutions Module5Document14 pagesBanking and Financial Institutions Module5bad genius100% (1)

- Pratibha Singh - VCE Task1Document5 pagesPratibha Singh - VCE Task1Pratibha SinghNo ratings yet

- Short Term Financing Less Than One YearDocument6 pagesShort Term Financing Less Than One YearPaul Anthony AspuriaNo ratings yet

- Term Paper Topics For Investment ManagementDocument8 pagesTerm Paper Topics For Investment Managementaflskkcez100% (1)

- Chapter 8 - Short Term FinancingDocument45 pagesChapter 8 - Short Term FinancingCindy Jane Omillio100% (1)

- SAS #3-FIN012.docxDocument7 pagesSAS #3-FIN012.docxconandetic123No ratings yet

- Senior High School: First Semester S.Y. 2020-2021Document13 pagesSenior High School: First Semester S.Y. 2020-2021sheilame nudaloNo ratings yet

- VCE Summer Internship Program 2021: Name Email-ID Smart Task No. Project TopicDocument3 pagesVCE Summer Internship Program 2021: Name Email-ID Smart Task No. Project TopicShazmeenNo ratings yet

- University of Makati: Short-Term Financing Prof. Marlo D. GileDocument4 pagesUniversity of Makati: Short-Term Financing Prof. Marlo D. GileArt2826No ratings yet

- VCE Summer Internship Program 2021: Smart Task Submission FormatDocument7 pagesVCE Summer Internship Program 2021: Smart Task Submission FormatNiharika MathurNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument4 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRavi ParmarNo ratings yet

- MFS AssignmentDocument37 pagesMFS AssignmentMoh'ed A. KhalafNo ratings yet

- VCE Summer Internship Program 2021: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2021: Smart Task Submission FormatKetan PandeyNo ratings yet

- Bba Banking Fin1Document10 pagesBba Banking Fin1kotit35No ratings yet

- AdvancesprocessmDocument98 pagesAdvancesprocessmAmol DahiphaleNo ratings yet

- Week 5 Business LoansDocument34 pagesWeek 5 Business Loans23-08439No ratings yet

- FIN 072 - SAS - Day 23Document8 pagesFIN 072 - SAS - Day 23rago.cachero.auNo ratings yet

- Summer Training Handbo Ok: Lokesh JasraiDocument32 pagesSummer Training Handbo Ok: Lokesh JasraiJuiÇý ßitëNo ratings yet

- Effects of Credit Policy On Profitability of Manufacturing Firms in KenyaDocument7 pagesEffects of Credit Policy On Profitability of Manufacturing Firms in KenyaSahul RanaNo ratings yet

- Working Capital FinancingDocument11 pagesWorking Capital FinancingShaRiq KhAnNo ratings yet

- Features of Credit CardDocument11 pagesFeatures of Credit CardBipin ThakorNo ratings yet

- Chapter 17 - FINANCEDocument4 pagesChapter 17 - FINANCEHamieWave TVNo ratings yet

- Thesis-1 13Document29 pagesThesis-1 13Beige TanNo ratings yet

- Business Finance Q3 Module 4Document28 pagesBusiness Finance Q3 Module 4yanadelossantos042No ratings yet

- Business Finance Q3 Module 4 3Document28 pagesBusiness Finance Q3 Module 4 3krystelairaa14No ratings yet

- Master of Business Administration-MBA Semester 2 MB0045 - Financial Management - 4 Credits (Book ID: B1134) Assignment Set - 2 (60 Marks)Document13 pagesMaster of Business Administration-MBA Semester 2 MB0045 - Financial Management - 4 Credits (Book ID: B1134) Assignment Set - 2 (60 Marks)Maulik Parekh100% (1)

- Global College: Learning GuideDocument16 pagesGlobal College: Learning Guideembiale ayaluNo ratings yet

- Financial ManagementDocument44 pagesFinancial ManagementNitish SinhaNo ratings yet

- Subject Code - MB0045: MB0045 - Financial Management - 4 CreditsDocument9 pagesSubject Code - MB0045: MB0045 - Financial Management - 4 CreditsJared HuffmanNo ratings yet

- Corporate FinanceDocument20 pagesCorporate FinanceMrs. Seema NazneenNo ratings yet

- Manage Overdue Customer AccountsDocument15 pagesManage Overdue Customer Accountsmulehabesha.mhNo ratings yet

- Short-Term Commercial Paper Interest RatesDocument4 pagesShort-Term Commercial Paper Interest Ratesc5e83cmh100% (1)

- Part I: Review Credit Products and Services of 05 Commercial Banks 1.1. Overview of Banking Networks in VietnamDocument15 pagesPart I: Review Credit Products and Services of 05 Commercial Banks 1.1. Overview of Banking Networks in VietnamTrịnh Đẹp TraiNo ratings yet

- Coursework FinanceDocument7 pagesCoursework Financexokcccifg100% (2)

- Unit 4 Receivables - ManagementDocument27 pagesUnit 4 Receivables - ManagementrehaarocksNo ratings yet

- Credit Risk Management Master ThesisDocument5 pagesCredit Risk Management Master ThesisPapersHelpEvansville100% (2)

- Credit Managers. Lesson 3Document40 pagesCredit Managers. Lesson 3Joseph PoNo ratings yet

- Dissertation On Merchant Banking in IndiaDocument5 pagesDissertation On Merchant Banking in IndiaBuyingCollegePapersOnlineUK100% (1)

- PERSONAL FINANCE Lesson Two Money ManagementDocument6 pagesPERSONAL FINANCE Lesson Two Money ManagementJohn Greg MenianoNo ratings yet

- Tutorial 2 AnswersDocument7 pagesTutorial 2 Answerskung siew houngNo ratings yet

- Ms 41Document12 pagesMs 41kvrajan6No ratings yet

- Business Finance - 12 - Third - Week 4Document10 pagesBusiness Finance - 12 - Third - Week 4AngelicaHermoParasNo ratings yet

- Fabm 2: Quarter 3 - Module 6 Computing and Interpreting Financial RatiosDocument23 pagesFabm 2: Quarter 3 - Module 6 Computing and Interpreting Financial RatiosMaria Nikka GarciaNo ratings yet

- Name Email Smart Task No. Project Topic: Mohd Mujeeb 3 Project Finance-Modelling and AnalysisDocument3 pagesName Email Smart Task No. Project Topic: Mohd Mujeeb 3 Project Finance-Modelling and Analysismohd mujeebNo ratings yet

- 1nh21ba076 230712 112345Document64 pages1nh21ba076 230712 112345akshaya kasi rajanNo ratings yet

- Chapter 6-8 - Sources of Finance & Short Term FinanceDocument8 pagesChapter 6-8 - Sources of Finance & Short Term FinanceTAN YUN YUNNo ratings yet

- Business Enterprise Module 2 - Fourth QuarterDocument3 pagesBusiness Enterprise Module 2 - Fourth QuarterBernadette Hernandez PatulayNo ratings yet

- Unlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditFrom EverandUnlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditNo ratings yet

- Group 1Document28 pagesGroup 1Mary Lyn DatuinNo ratings yet

- BAM 241 Bus Law Reg CFE 2S2324Document3 pagesBAM 241 Bus Law Reg CFE 2S2324Mary Lyn DatuinNo ratings yet

- San Pablo Water District Laguna Executive Summary 2019Document13 pagesSan Pablo Water District Laguna Executive Summary 2019Mary Lyn DatuinNo ratings yet

- ScriptDocument1 pageScriptMary Lyn DatuinNo ratings yet

- Slide 3 - Practice Exercise - Property RelationsDocument35 pagesSlide 3 - Practice Exercise - Property RelationsMary Lyn DatuinNo ratings yet

- Gen008 P1 ExamDocument11 pagesGen008 P1 ExamMary Lyn DatuinNo ratings yet

- Elements of DanceDocument16 pagesElements of DanceMary Lyn DatuinNo ratings yet

- Cash and Cash Equivalents: Purchased Three Months Before MaturityDocument8 pagesCash and Cash Equivalents: Purchased Three Months Before MaturityMary Lyn DatuinNo ratings yet

- Bank Recon SeatworkDocument4 pagesBank Recon SeatworkMary Lyn DatuinNo ratings yet

- Cta 00 CV 00071 D 1955aug11 AssDocument16 pagesCta 00 CV 00071 D 1955aug11 AssMary Lyn DatuinNo ratings yet

- Sas13 Fin081Document8 pagesSas13 Fin081Mary Lyn DatuinNo ratings yet

- FIN081 P3 Quiz2 Short-Term-Financing AnswerDocument4 pagesFIN081 P3 Quiz2 Short-Term-Financing AnswerMary Lyn DatuinNo ratings yet

- BAM 026 Group 2 Comprehensive PaperDocument8 pagesBAM 026 Group 2 Comprehensive PaperMary Lyn DatuinNo ratings yet

- Ped-032 Sas Lesson-3Document8 pagesPed-032 Sas Lesson-3Mary Lyn DatuinNo ratings yet

- Receivable MNGMNTDocument17 pagesReceivable MNGMNTMary Lyn DatuinNo ratings yet

- Ratio Analysis - Practice ExerciseDocument4 pagesRatio Analysis - Practice ExerciseMary Lyn DatuinNo ratings yet

- Examples WACC Project RiskDocument4 pagesExamples WACC Project Risk979044775No ratings yet

- Ac1101 Final Exam QuestionnaireDocument11 pagesAc1101 Final Exam QuestionnaireAngel ObligacionNo ratings yet

- Asii LK TW Ii 2016Document122 pagesAsii LK TW Ii 2016Ndtriyansyah SampitNo ratings yet

- Topic 9 Foreign Exchange Exposure and Currency HedgingDocument32 pagesTopic 9 Foreign Exchange Exposure and Currency HedgingAdam Mo AliNo ratings yet

- Dow Theory The Key To Stock MarketDocument7 pagesDow Theory The Key To Stock MarketPiyush KumarNo ratings yet

- PTTCDN D02 Team-05 Hoa-Sen-GroupDocument61 pagesPTTCDN D02 Team-05 Hoa-Sen-GroupHợp NguyễnNo ratings yet

- Hedge Funds StrategiesDocument13 pagesHedge Funds StrategiesJoel FernandesNo ratings yet

- Introducing "Varsity": CategoriesDocument25 pagesIntroducing "Varsity": CategoriesrohaNo ratings yet

- Valuation of StocksDocument47 pagesValuation of Stocksojasd1100% (1)

- RatingsDocument6 pagesRatingssheinaNo ratings yet

- Crude Trading PlanDocument19 pagesCrude Trading PlanGopagani DharshanNo ratings yet

- 2 Statement of Financial PositionDocument7 pages2 Statement of Financial Positionreagan blaireNo ratings yet

- BPS InvestmentsDocument22 pagesBPS InvestmentsSheena CalderonNo ratings yet

- Partnership FormationDocument39 pagesPartnership FormationLe Ann Rhine MayantongNo ratings yet

- Ias 2 - Inventories Case Studies 1 - 13: C K / C FV D - BZVC RCV KdeuzvcDocument14 pagesIas 2 - Inventories Case Studies 1 - 13: C K / C FV D - BZVC RCV KdeuzvcHernan EleNo ratings yet

- Accounts Test 100 Marks PDFDocument9 pagesAccounts Test 100 Marks PDFAruna RajappaNo ratings yet

- Ichimoku Indicator StrategyDocument10 pagesIchimoku Indicator StrategyTanto Argianto75% (4)

- Private Equity Real Estate: NorthfieldDocument26 pagesPrivate Equity Real Estate: NorthfieldchrisjohnlopezNo ratings yet

- Edrolo VCE Business Management Units 12 - Full Textbook PDFDocument601 pagesEdrolo VCE Business Management Units 12 - Full Textbook PDFLeona JobinNo ratings yet

- Another Stupid Letter From Larry FinkDocument2 pagesAnother Stupid Letter From Larry FinkCODEPINKNo ratings yet

- Mckinsey Appraisal - AppraisalDocument8 pagesMckinsey Appraisal - Appraisalalex.nogueira396No ratings yet

- Curvature Trading Part ThreeDocument4 pagesCurvature Trading Part ThreesteveNo ratings yet

- Trading Strategies Chap10Document4 pagesTrading Strategies Chap10SolisterADVNo ratings yet

- AFM Test 1Document3 pagesAFM Test 1Syeda IsmailNo ratings yet

- MortgageDocument88 pagesMortgagejhanu jhanuNo ratings yet

- Made By: Sagar Phul Shruti Kashyap Deepshikha Yadav Lincy Kurian Tingle ThomasDocument35 pagesMade By: Sagar Phul Shruti Kashyap Deepshikha Yadav Lincy Kurian Tingle ThomasDeepshikha YadavNo ratings yet

- Final Exam Paper POA 1st YearDocument2 pagesFinal Exam Paper POA 1st YearMustafa AhmedNo ratings yet