Professional Documents

Culture Documents

Adv Acc - Banking

Adv Acc - Banking

Uploaded by

rshyams165Copyright:

Available Formats

You might also like

- Receivables (Part 1) With AnswersDocument7 pagesReceivables (Part 1) With AnswersUzziehllah Ratuita83% (6)

- Case Study No.4Document1 pageCase Study No.4sasiganthNo ratings yet

- Quizzes - Chapter 4 - Types of Major Accounts.Document4 pagesQuizzes - Chapter 4 - Types of Major Accounts.Amie Jane Miranda100% (3)

- Mark Elliot Zuckerberg: 5.02 - A Private Enterprise SystemDocument3 pagesMark Elliot Zuckerberg: 5.02 - A Private Enterprise Systemapi-535858416No ratings yet

- Audit of Receivable PDFDocument7 pagesAudit of Receivable PDFRyan Prado Andaya100% (1)

- Prudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesDocument47 pagesPrudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesRAJESH MAHTO 2058No ratings yet

- Irrecoverable Debts & Provision For Irrecoverables DebtsDocument5 pagesIrrecoverable Debts & Provision For Irrecoverables DebtsYomi AmvNo ratings yet

- C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C CDocument19 pagesC C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C CKapil PardeshiNo ratings yet

- Chapter 2 Cash and Cash EquivalentsDocument3 pagesChapter 2 Cash and Cash EquivalentsMisiah Paradillo Jangao100% (1)

- Income Recognition and Asset ClassificationDocument21 pagesIncome Recognition and Asset Classificationsagar7No ratings yet

- Audit of AdvancesDocument29 pagesAudit of AdvancesHemanshu SolankiNo ratings yet

- Term Paper Banking and InsuranceDocument27 pagesTerm Paper Banking and InsuranceneenajoshiNo ratings yet

- NPA NotesDocument33 pagesNPA NotesAdv Sheetal SaylekarNo ratings yet

- Prudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesDocument21 pagesPrudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesSubrahmanya ShastryNo ratings yet

- Financial Statements of Banking CompaniesDocument20 pagesFinancial Statements of Banking CompaniesBashu GuragainNo ratings yet

- Libby Chapter 6 Study NotesDocument6 pagesLibby Chapter 6 Study NoteshatanoloveNo ratings yet

- Performance Evaluation of Banks - IIM Indore Session 3,4,5Document99 pagesPerformance Evaluation of Banks - IIM Indore Session 3,4,5LEO BABU PGP 2021-23 BatchNo ratings yet

- Final Accounts - That's It BatchDocument16 pagesFinal Accounts - That's It BatchKunika PimparkarNo ratings yet

- Non Performing AssetsDocument12 pagesNon Performing AssetsVikram SinghNo ratings yet

- 66649bos53803 Cp8u4 PDFDocument30 pages66649bos53803 Cp8u4 PDFpratham.mishra1809No ratings yet

- Emperical ProjectDocument11 pagesEmperical ProjectSajal ChakarvartyNo ratings yet

- NPA Management by Indian Banks-LATEST: Dr. Deepak Tandon IMI New DelhiDocument40 pagesNPA Management by Indian Banks-LATEST: Dr. Deepak Tandon IMI New Delhidev mhaispurkarNo ratings yet

- Chapter 4 Accounts Receivable Learning Objectives: Receivables."Document4 pagesChapter 4 Accounts Receivable Learning Objectives: Receivables."Misiah Paradillo JangaoNo ratings yet

- Basic Banking CRM-CBSDocument60 pagesBasic Banking CRM-CBSAkshayNo ratings yet

- Understanding NPA, SMA and NPA ProvisioningDocument8 pagesUnderstanding NPA, SMA and NPA ProvisioningabhinavNo ratings yet

- Income Recognition & Asset Classification CA Pankaj TiwariDocument42 pagesIncome Recognition & Asset Classification CA Pankaj TiwariRakesh RajpurohitNo ratings yet

- Audit of Accounts ReceivablesDocument5 pagesAudit of Accounts ReceivablesIzza Mae Rivera KarimNo ratings yet

- 6 Gleim FarDocument15 pages6 Gleim Farsendbad_m32450No ratings yet

- A Study On Npa of Public Sector Banks in India: Sulagna Das, AbhijitduttaDocument9 pagesA Study On Npa of Public Sector Banks in India: Sulagna Das, AbhijitduttaSunil Kumar PalikelaNo ratings yet

- Audit of ArDocument8 pagesAudit of ArRizzel SubaNo ratings yet

- Intermediate Accounting, Part 1Document7 pagesIntermediate Accounting, Part 1dfsdfdsfNo ratings yet

- Factors For Rise in NpasDocument10 pagesFactors For Rise in NpasRakesh KushwahNo ratings yet

- Skip To Main ContentDocument28 pagesSkip To Main Contentshreeya salunkeNo ratings yet

- ACC 01 - Completion of The Accounting Cycle For Merchandising - Notes 7Document18 pagesACC 01 - Completion of The Accounting Cycle For Merchandising - Notes 7Hans MosquedaNo ratings yet

- Mob NpaDocument44 pagesMob NpaParthNo ratings yet

- ReceivablesDocument6 pagesReceivablessafe.skies00No ratings yet

- Acc05 Take Home Quiz Cash and ReceivablesDocument12 pagesAcc05 Take Home Quiz Cash and ReceivablesJullia BelgicaNo ratings yet

- Understanding The SelfDocument9 pagesUnderstanding The SelfNatalie SerranoNo ratings yet

- Chapter 21Document10 pagesChapter 21soniadhingra1805No ratings yet

- "The Impact of NPA On The Net Profit of SBI and Axis BankDocument9 pages"The Impact of NPA On The Net Profit of SBI and Axis BankJayesh SonawaneNo ratings yet

- Consumer EducationDocument3 pagesConsumer EducationteconsvillagemapNo ratings yet

- Report On Non Performing Assets of BankDocument53 pagesReport On Non Performing Assets of Bankhemali chovatiya75% (4)

- Income Recognition and Asset Classification Norms (IRAC) : - by CA KVS ShyamsunderDocument10 pagesIncome Recognition and Asset Classification Norms (IRAC) : - by CA KVS ShyamsunderMukesh SinghNo ratings yet

- UntitledDocument22 pagesUntitledAayush TareNo ratings yet

- Company A:c-Banking CompaniesDocument30 pagesCompany A:c-Banking CompaniessarahhussainNo ratings yet

- 08 - Receivables PDFDocument2 pages08 - Receivables PDFJamie ToriagaNo ratings yet

- Branch Audit Planning & ExecutionDocument32 pagesBranch Audit Planning & Executionkumarbk3No ratings yet

- Rbi Instructions On Prudential Norms On Income Recognition Asset Classification and ProvisioningDocument7 pagesRbi Instructions On Prudential Norms On Income Recognition Asset Classification and ProvisioningSanjenbam SumitNo ratings yet

- Non Performing AssetsDocument13 pagesNon Performing AssetsVinayaka McNo ratings yet

- Chapter 9Document8 pagesChapter 9Jagadeesh ind7No ratings yet

- Piecemeal RealizationDocument6 pagesPiecemeal RealizationSethwilsonNo ratings yet

- Sayali ProjectDocument63 pagesSayali ProjecthemangiNo ratings yet

- Chapter 9 - NPA PDFDocument98 pagesChapter 9 - NPA PDFSuraj ChauhanNo ratings yet

- Chapter 8 Lecture NoteDocument37 pagesChapter 8 Lecture Note김가온No ratings yet

- FARAP 4702 ReceivablesDocument8 pagesFARAP 4702 Receivablesliberace cabreraNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Credit Repair 101: A Comprehensive Guide to Restoring Your Personal CreditFrom EverandCredit Repair 101: A Comprehensive Guide to Restoring Your Personal CreditNo ratings yet

- School Assignment On Agricultural Practices in IndiaDocument2 pagesSchool Assignment On Agricultural Practices in IndiaUma Ganesan100% (1)

- CIMA F2 Notes 2018 PDFDocument154 pagesCIMA F2 Notes 2018 PDFsolstice567567No ratings yet

- Mea Assignment WordDocument23 pagesMea Assignment WordNabila Afrin RiyaNo ratings yet

- Shut Down PriceDocument14 pagesShut Down PriceNoor NabiNo ratings yet

- DSP App - Dspfinance - Com - A Document Received As Part of A Job Scam, Likely A Cheque Fraud NetworkDocument3 pagesDSP App - Dspfinance - Com - A Document Received As Part of A Job Scam, Likely A Cheque Fraud NetworkJames BarlowNo ratings yet

- Macroeconomics 6th Edition Williamson Solutions ManualDocument36 pagesMacroeconomics 6th Edition Williamson Solutions Manualstirrupsillon.d8yxo100% (42)

- Bus 2101 - Chapter 2Document24 pagesBus 2101 - Chapter 2HarshaBorresAlamoNo ratings yet

- Introduction To Goods and Services Tax (GST)Document6 pagesIntroduction To Goods and Services Tax (GST)Tax NatureNo ratings yet

- 142 Mcqs Good - Financial ManagementDocument26 pages142 Mcqs Good - Financial ManagementMuhammad Arslan Usman71% (7)

- I To B Ok AssignmentDocument4 pagesI To B Ok AssignmentHashim MalikNo ratings yet

- Sample 1 Bakery Business PlanDocument18 pagesSample 1 Bakery Business PlanJohn Leric Dela MercedNo ratings yet

- The Role of Purchasing in The OrganisationDocument20 pagesThe Role of Purchasing in The OrganisationThomo MolwaneNo ratings yet

- Project Justification: Increase OEEDocument21 pagesProject Justification: Increase OEEKaran Singh RaiNo ratings yet

- JohnsonDocument12 pagesJohnsonJannah Victoria AmoraNo ratings yet

- Sikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Document11 pagesSikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Alaji Bah CireNo ratings yet

- Modern Auditing and Assurance Services 6th Edition Leung Solutions ManualDocument6 pagesModern Auditing and Assurance Services 6th Edition Leung Solutions ManualSonam ChophelNo ratings yet

- QUESTIONNAIREDocument5 pagesQUESTIONNAIREMuneebVpMuniCholayilNo ratings yet

- BSP Circular 1107Document7 pagesBSP Circular 1107Maya Julieta Catacutan-EstabilloNo ratings yet

- GIN - 05820402 - Priyadarshan Hasigala Narayanaswamy - STA - Passport and US VisaDocument5 pagesGIN - 05820402 - Priyadarshan Hasigala Narayanaswamy - STA - Passport and US VisaALexNo ratings yet

- Chapter 7 Strategy Formulation: Corporate Strategy: Strategic Management & Business Policy, 13e (Wheelen/Hunger)Document22 pagesChapter 7 Strategy Formulation: Corporate Strategy: Strategic Management & Business Policy, 13e (Wheelen/Hunger)Anonymous 7CxwuBUJz3No ratings yet

- Principles of Business For CSEC®: 2nd EditionDocument3 pagesPrinciples of Business For CSEC®: 2nd Editionyuvita prasadNo ratings yet

- Analyzing Farming Systems DeterminantsDocument12 pagesAnalyzing Farming Systems Determinantsadmirechawaz100% (1)

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- Eco162 Report - Mba1112gDocument19 pagesEco162 Report - Mba1112gNUR WIRDANI ALANINo ratings yet

- #1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldDocument5 pages#1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldMarie Frances SaysonNo ratings yet

- Cost of Capital NotesDocument6 pagesCost of Capital NotesAmy100% (1)

- Taxation of Business Entities 2017 8th Edition Spilker Solutions ManualDocument11 pagesTaxation of Business Entities 2017 8th Edition Spilker Solutions Manualotisviviany9zoNo ratings yet

Adv Acc - Banking

Adv Acc - Banking

Uploaded by

rshyams165Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adv Acc - Banking

Adv Acc - Banking

Uploaded by

rshyams165Copyright:

Available Formats

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

BANKING COMPANIES

NPA CLASSIFICATION

Asset When it is treated as NPA?

Term Loan If interest and/or installment of principal remains

overdue for a period of more than 90 days

Cash credits and The account remains out of order for a period of more

Overdrafts than 90 days

Bills purchased and If they remain overdue and unpaid for a period of

discounted more than 90 days

Agricultural advances If interest and/or installment of principal overdue for

for short duration crops two harvest seasons

Agricultural advances If interest and/or installment of principal remains

for long duration crops overdue for one crop season

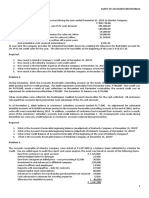

Q. 1 CLASSIFICATION OF NPA

On 31st March, 2018 Maya Bank Ltd. finds that:

(1) On a term loan of Rs.2 crores, interest for the last three quarters is in arrears

beyond the due date.

(2) The amount of Rs.10 lakhs of a discounted bill were due on 31st January, 2018

but the same has not been received.

(3) On a term loan of Rs.1 crore, interest for the last one month is past due.

Which of the above advances, will be treated as non-performing assets (NPA) as on 31st

March, 2018?

INCOME RECOGNITION FOR PERFORMING AND NON-PERFORMING ASSETS

Term Meaning Income

Recognition

Performing Assets Performing assets are such assets Accrual Basis

which generates adequate income

for the bank

Non-Performing Non-Performing assets are such Cash Basis

Assets assets which ceases to generate

adequate income for the bank

[popularly called as NPA]

• Therefore, bankers follow hybrid system for income recognition

CA_STUDENTS’ STUDY CIRCLE 91

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Q. 2 Given below the interest on advances of a commercial bank (Rs. in lakhs)

Performing assets NPA

Interest Interest Interest Interest

earned received earned received

Term Loans 120 80 75 5

Cash credits and overdrafts 750 620 150 12

Bills purchased and 150 150 100 20

discounted

Find out the income to be recognised for the year ended 31st Mar, 2018.

PARTIAL RECOVERIES OF NPA

Interest partly realized in NPAs can be taken to income. If financial position of the

customer is good and will be in a position to return the money, then journal entry will be

Party’s Loan a/c Dr.

To Interest a/c

If there is any doubt regarding customer’s ability to pay, the debt becomes doubtful and

the interest accrued on doubtful debts at the end of the accounting year should not be

credited to Interest Account because it remains unrealized and would artificially inflate the

profit of the bank company. In such cases, the following entry is to be passed:

Party’s Loan a/c Dr.

To Interest Suspense a/c

If some portion of the loan is repaid by the customer, then entry will be:

Bank a/c Dr.

To Party’s Loan a/c

Interest Suspense a/c Dr.

To Interest a/c [to the extent of recovery]

To Party’s Loan a/c [unrecovered amount]

(Interest suspense transferred to interest to the

extent of collection and balance transferred to his

loan a/c)

Bad Debts a/c Dr.

To Party’s Loan a/c

(Amount irrecoverable is written off as bad debts)

CA_STUDENTS’ STUDY CIRCLE 92

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Q. 3 On 31.3.18, there is an unsecured loan of Rs.8,00,000 to Shri Pankaj in the loan ledger

of a Sona Bank Ltd. It is found on enquiry that the financial position of the borrower is bad

and doubtful. Interest on the said loan has accrued Rs.80,000 and is yet to be recorded.

During 2018-19, the bank is able to realize only 80 paise in a rupee on account of customer’s

bankruptcy. Show how the transactions would be recorded in the books of bank.

REBATE ON BILLS DISCOUNTED

• When a bank discounts a bill of exchange, full amount of discount earned is credited

to “Discount Account”

At the end of the year

All the Bills All the Bills discounted

discounted, matures do not matures

Entire discount will be Unexpired portion should be

transferred to P & L a/c transferred to “Rebate on Bills

discounted” & balance should be

transferred to p & l a/c

• Rebate on Bills discounted will be shown in liabilities side of balance sheet

• At the beginning of next period, the “Rebate on Bills Discounted” a/c is closed off by

transferring it to “Discount a/c”

1 Reversal of Rebate on bills discounted at the beginning of the year

Rebate on bills discounted a/c dr.

To Discount a/c

2 For bills purchased and discounted during the year

Bills purchased and discounted a/c dr.

To clients a/c

To Discount a/c

3 At the end of the year

A If all the bills are matured

Discount a/c dr

To P & l a/c

B If all the bills are not matured

For expired portion

Discount a/c dr

To P & l a/c

For unexpired portion

Discount a/c dr.

To Rebate on bills discounted

CA_STUDENTS’ STUDY CIRCLE 93

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Q. 4 On 31st Mar, 2018, Uncertain Bank Ltd. had a balance of Rs. 9 Crores in “rebate on bills

discounted” account. During the year ended 31st Mar, 2019, Uncertain Bank Ltd. discounted

Bills of exchange of Rs. 4000 crores charging interest at 18% per annum the average period

of discount being for 73 days. Of these, bills of exchange of Rs. 600 crores were due for

realisation from the acceptors/customers after 31st Mar, 2019, the average period outstanding

after 31st Mar, 2019, being 36.5 days. Uncertain Bank Ltd. asks you to pass journal entries

and show the ledger accounts pertaining to:

(a) Discounting of bills of exchange and

(b) Rebate on bills discounted.

Q. 5 The following is an extract from Trial Balance of overseas Bank Ltd. as on 31.3.2019

Rs. Rs.

Bills discounted 12,64,000

Rebate on bills discounted not due on 31st Mar 2018 22160

Discount received 105708

An analysis of the bills discounted is as follows:

Amount Due date 2019 Rate of Discount

(i) Rs. 1,40,000 June 5 14%

(ii) Rs. 4,36,000 June 12 14%

(iii) Rs. 2,82,000 June 25 14%

(iv) Rs. 4,06,000 July 6 16%

Calculate Rebate on Bills Discounted as on 31-3-2019 and show necessary journal entries.

BILLS FOR COLLECTION

The bank may accept bills receivable of customers for collection on their behalf. These bills

are recorded in a special book known as “Bills for Collection Register”. Unless these bills are

collected no entry is required. On the collection of bill, cash will be debited with the amount

received and customer’s account will be credited by the amount after deducting commission,

and commission charged will be credited to Commission account. Bills held by the bank for

collection are shown as information below the Balance Sheet as per new format.

CA_STUDENTS’ STUDY CIRCLE 94

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Q. 6 From the following information prepare “Bills for collection (Asset) a/c and Bills for

Collection (Liability) a/c.

On 1.4.18, Bills for Collection were 5100

During the 2018-19 bills received for collection amounted to 7500

Bill collected during the year 2018-19 9847

Bills dishonoured and returned during the year 2710

PROVISIONING FOR VARIOUS TYPES OF ASSETS

S.N. Category of Advances Rate (%)

1 Standard Advances

a. Direct advances to agricultural and 0.25

SME

b. Advances to Commercial Real 1.00

Estate (CRE) Sector

c. All other loans and advances not 0.40

included in (a) and (b) above

2 Sub-Standard Advances

a. Secured Exposures 15

b. Unsecured Exposures 25

c. Unsecured Exposures in respect of 20

Infrastructure loan accounts where

certain safeguards such as escrow

accounts are available

3 Doubtful Advances

a. Unsecured Portion 100

b. Secured Portion

i. Doubtful upto 1 year 25

ii. Doubtful > 1 year and upto 3 40

years

iii. Doubtful > 3 years 100

4 Loss Advances 100

CA_STUDENTS’ STUDY CIRCLE 95

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Q. 7 From the following information, find out the amount of provisions to be shown in the

Profit and Loss Account of a commercial bank.

Assets Rs. in lakhs

Standard 5000

Sub-standard 4000

Doubtful : for one year 800

For three years 600

For more than three years 200

Loss Assets 1000

DICGC/ECGC GURANTEE

• DICGC – Deposit Insurance & Credit Guarantee Corporation

• ECGC – Export Credit Guarantee Corporation

• If the advances are guaranteed by ECGC/DICGC coverage, the provision is required

to be made only for the balance in excess of amount guaranteed

• In case, the bank also holds a security in respect of an advance guaranteed by

ECGC/DICGC, the realisable value of the security should be deducted from the

outstanding balance before the ECGC/DICGC guarantee is off-set.

• In addition, 25%/40%/100% of the secured portion should be provided for, depending

upon the period for which the advance has been considered as a doubtful asset, as

follows:

Period for which the advance has been considered as doubtful % of provision on

secured portion

Upto 1 year 25

More than 1 year and upto 3 years 40

More than 3 years 100

Format for ascertaining provision:

Step: 1 Ascertaining Unsecured Portion

A Amount outstanding Xxxx

B Less: Realisable value of securities Xxxx

C Gross Unsecured portion [A – B] Xxxx

D Less: ECGC/DICGC coverage [Gross unsecured portion x prescribed Xxxx

coverage]

E Net Unsecured Portion Xxxx

Step: 2 Ascertaining Total Provision to be made:

A Provision for Unsecured Portion [@ 100% of net unsecured portion] Xxxx

B Provision for Secured portion 25%/40%/100% (depends upon the period for Xxxx

which advance has been considered as a doubtful asset)

C Total Provision to be made [A+B] Xxxx

CA_STUDENTS’ STUDY CIRCLE 96

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Q. 8 Gajana Bank Ltd. had extended the following credit lines to a Small Scale Industry,

which had not paid any interest since March 2014

Term Loan Export Credit

Balance Outstanding on 31.03.2018 Rs. 35 lakhs Rs. 30 lakhs

DICGC/ECGC cover 40% 50%

Securities held Rs. 15 lakhs Rs. 10 lakhs

Realisable value of Securities Rs. 10 lakhs Rs. 8 lakhs

Compute necessary provisions to be made for the year ended 31st Mar, 2018.

ACCEPTANCE, ENDORSEMENTS AND OTHER OBLIGATION

A bank is frequently called upon to accept or endorse a bill of exchange on behalf of its

customer. For greater security, the drawer of the bill wants acceptance of the drawee bank.

The bank incurs a liability by accepting bills on behalf of its customers. On maturity of the bill,

the bank pays and collects the amount from its customer. Generally, the bank requires the

customer to deposit the security equal to the sum of the bill accepted. The bill accepted

register is used for recording particulars of bills accepted and/or endorsed and securities

provided.

At the end of the accounting period, if there are any outstanding bills, it is shown as

“contingent liability” as per the new format. As per the new format, Acceptances,

Endorsements and other obligation are off Balance Sheet items. In the general ledger, no

account is maintained for this. The details are maintained on the memorandum basis. A

Record of the particulars of bills accepted as well as securities collected from the customer

is kept in the Bills Accepted Register. A bank may not treat this book as part of system of its

accounts. In such a case, no further record of the transactions is kept until the bill matures

for payment. If the bill, at the end of its term, has to be retired by the bank and the amount

cannot be collected from the customer on demand, the bank reimburses itself by disposing

of the security deposited by the customer.

Q. 9 From the following details prepare “Acceptance, Endorsements and other Obligation

A/c” as would appear in the general ledger. On 1.4.2018 Acceptances not yet satisfied stood

at Rs. 22,30,000. Out of which Rs. 20 lacs were subsequently paid off by clients and bank had

to honour the rest. A scrutiny of Acceptance Register revealed the following:

Client Acceptances/Guarantees Remarks

A Rs. 10,00,000 Bank honored on

10.6.18

B Rs. 12,00,000 Party paid off on 30.9.18

C Rs. 5,00,000 Party failed to pay and

bank had to honour on

30.11.18

CA_STUDENTS’ STUDY CIRCLE 97

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

D Rs. 8,00,000 Not satisfied upto

31.3.19

E Rs. 5,00,000 -do-

F Rs. 2,70,000 -do-

Total Rs. 42,70,000

PREPARATION OF FINANCIAL STATEMENTS

Profit and Loss Account for the year ended 31st March

Schedule No. Amount

I Income:

Interest earned 13

Other Income 14

Total

II Expenditure:

Interest expended 15

Operating expenses 16

Provisions and Contingencies

Total

III Profit/Loss:

Net Profit/Loss (-) for the year

Profit/Loss (-) brought forward

Total

IV Appropriations:

Transfer to statutory reserves

Transfer to other reserves

Transfer to proposed dividend

Balance carried over to balance sheet

Total

Schedule 13 – Interest Earned

Interest on advances/Discount on Bills Xxxx

Income on Investments Xxxx

Interest on Balances with RBI and other inter-bank funds Xxxx

Note:

When there is opening and/or closing rebate on bills discounted, adjust the discount during

the year for the same.

CA_STUDENTS’ STUDY CIRCLE 98

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Schedule 14 – Other Income

Brokerage/Commission/Dividend/Exchange Xxxx

Profit/Loss on revaluation/sale/exchange Xxxx

transactions

Miscellaneous Xxxx

Schedule 15 – Interest Expended

Interest on deposits Xxxx

Interest on RBI and other inter-bank borrowings Xxxx

Note: It is opposite to Schedule 13

Schedule 16 – Operating Expenditure

Salary Xxxx

Rent Xxxx

Insurance Xxxx

Advertisement etc. Xxxx

Provisions and Contingencies

Provisions for bad & doubtful debts Xxxx

Provision for taxation Xxxx

Q. 10 From the following information, prepare Profit and Loss Account of Indian Bank Ltd.,

for the year ended 31.12.2018.

Rs. In (000’s)

Interest on Fixed Deposits 430

Interest on loans 650

Discount on bill discounted 415

Interest on overdrafts 210

Interest on cash credit 410

Interest on savings bank deposits 125

Salaries and allowances 140

Rent, taxes, insurance and lighting 40

Locker rent 7

Repairs to bank property 2

Commission, exchange and brokerage 24

Director’s fees and allowances 25

Provident fund contribution 12

Local committee fees and allowances 10

Audit fees 12

CA_STUDENTS’ STUDY CIRCLE 99

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Printing and Stationery 4

Loss on sale of Government Securities 5

Loss on sale of furniture 2

Postage charges 2

Depreciation 10

Advertisement 4

Legal Charges 3

Additional information:

a. Rebate on bills discounted on 31.12.2017 Rs.19,000

b. Rebate on bills discounted on 31.12.2018 Rs.26,000

c. Bad debts to be written off Rs.40,000

d. Provide for taxation Rs.50,000

Q. 11 Some of the items in the Trial Balance of Modern Bank Ltd. as on December 31,

2018 were as follows:

Loans and advances 71,50,000

Current accounts [including overdraft of Rs.15,00,000] 66,00,000

Bills discounted and purchased 19,20,000

Interest on fixed deposits 1,55,000

Interest on loans 2,25,000

Discount [subject to unexpired discounts Rs.30,000] 2,01,000

Interest on cash credits 1,05,000

Commission earned 46,500

Loss on sale of investments 34,000

Salaries and allowances 82,000

Printing and Stationery 4,500

Interest on savings bank deposits 75,000

Auditor’s Fees 5,000

Director’s Fees 2,500

Interest on Overdrafts 95,000

Provision for bad debts, January 1, 2018 42,000

Bad debts 21,000

Provision for income tax, January 1, 2018 66,000

Income tax paid for 2018 54,000

You are required to prepare the Profit and Loss Account of the bank, maintaining the

provisions for income tax at Rs.84,000 and provision for bad debts at Rs.52,000 for the year

ended December 31, 2018. All workings should form part of your answer.

CA_STUDENTS’ STUDY CIRCLE 100

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

CAPITAL ADEQUACY RATIO

Capital adequacy ratio is the ratio which determines the bank's capacity to meet the time

liabilities and other risks such as credit risk, operational risk, etc. To be precise, a bank's

capital is the "cushion" for potential losses, and protects the bank's depositors and other

lenders.

Every bank should maintain a minimum capital adequacy ratio based on capital funds and

risk assets. All banks (excluding RRB’s) are required to maintain a capital adequacy ratio (or

Capital to Risk Weighted Assets Ratio) which is specified by RBI from time to time. At present

capital adequacy ratio is 9%.

Step: 1 Calculate Capital Funds

Step: 2 Calculate Risk adjusted/weighted Assets

Step: 3 Calculate Risk adjusted/Weighted Assets Ratio

Step: 4 Compare the computed ratio with 9%

Step: 1 Calculation of Capital Funds (According to BASLE COMMITTEE)

A) Tier – I Capital xxxx

B) Tier – II Capital xxxx

Capital Funds xxxx

Tier- I Capital

A) Paid up Capital Xxxx

Less: Equity Investment in subsidiaries (Xxxx)

Less: Intangible Assets (including Deferred Tax Assets) (Xxxx)

Less: Current and brought forward losses (Xxxx) Xxxx

B) Reserves and Surplus.

1. Statutory Reserves Xxxx

2. Security Premium Xxxx

3. Capital Reserve Xxxx Xxxx

(representing surplus on sale of assets)

Tier – I Capital [A + B] Xxxx

TIER – II CAPITAL

a) Undisclosed reserves and cumulative perpetual preference shares Xxxx

b) Revaluation reserves @ discount of 55% Xxxx

c) General provision and loss reserves Xxxx

d) Hybrid debt capital instruments Xxxx

e) Subordinate debts Xxxx

Tier – II Capital Xxxx

Note: The quantum of Tier II Capital is limited to a maximum of 100% of Tier I Capital. It may

be clarified that the Tier II capital of a bank can exceed its Tier I Capital; however, in such a

case, the excess will be ignored for the purpose of computing the capital adequacy ratio.

CA_STUDENTS’ STUDY CIRCLE 101

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Step: 2 Calculation of Risk Adjusted Assets

Funded Risk Assets I.e. Balance Sheet items Xxxx

Non-funded Risk Assets i.e. Off-Balance Sheet items Xxxx

Risk Adjusted Assets Xxxx

A) Funded Risk Assets

Particulars Book Risk Adjusted

Value Weight Value

I) Balances

Cash and Balance with RBI 0

Balance in current account with other banks 20%

Claims on Bank 20%

II) Investments

Government and other approved securities 0

Others (net of depreciation provided) 100%

III) Loans and Advances

Guaranteed by Government of India/State 0

Government

Granted to public sector undertaking of Government 100%

of India/state government

Others 100%

IV) Other Assets (premises, furniture etc.) 100%

Non Funded Risk Assets = Face Value of “Off Balance Sheet Items” x Credit

Conversion Factor x Risk weights

B) Non-Funded Risk Asset

Particulars Book Credit Equivalent Risk Risk

Value Conversion Value Weight Adjusted

Factor Value

Acceptances, Endorsement and

Letters of Credit guaranteed by

a. Central/State government 100% 0

b. Other banks 100% 20%

c. Others 100% 100%

Guarantee and other obligations 100% 100%

Step: 3

Capital Adequacy Ratio= [CAPITAL FUNDS/RISK WEIGHTED ASSETS] X 100

CA_STUDENTS’ STUDY CIRCLE 102

ADVANCED ACCOUNTING SHORT NOTES PROBLEMS

Q. 12 A commercial bank has the following capital funds and assets. Segregate the capital

funds into Tier I and Tier II capitals. Find out the risk-adjusted asset and risk weighted

assets ratio -.

Capital Funds: Rs. In Lakhs

Equity Share Capital 4,80,00

Statutory Reserve 2,80,00

Capital Reserve (Rs. 280 lakhs were due to revaluation of assets & sale) 12,10

Assets:

Cash Balance with RBI 4,80

Balances with other Bank 12,50

Certificate of Deposits with other 28,50

Commercial Banks

Other Investments 782,50

Loans and Advances:

(i) Guaranteed by government 128,20

(ii) Guaranteed by public sector undertakings of Government of India 702,10

(iii) Others 52,02,50

Premises, furniture and fixtures 182,00

Other Assets 201,20

Off-Balance Sheet Items:

Acceptances, endorsements and letters of credit 37,02,50

CA_STUDENTS’ STUDY CIRCLE 103

You might also like

- Receivables (Part 1) With AnswersDocument7 pagesReceivables (Part 1) With AnswersUzziehllah Ratuita83% (6)

- Case Study No.4Document1 pageCase Study No.4sasiganthNo ratings yet

- Quizzes - Chapter 4 - Types of Major Accounts.Document4 pagesQuizzes - Chapter 4 - Types of Major Accounts.Amie Jane Miranda100% (3)

- Mark Elliot Zuckerberg: 5.02 - A Private Enterprise SystemDocument3 pagesMark Elliot Zuckerberg: 5.02 - A Private Enterprise Systemapi-535858416No ratings yet

- Audit of Receivable PDFDocument7 pagesAudit of Receivable PDFRyan Prado Andaya100% (1)

- Prudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesDocument47 pagesPrudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesRAJESH MAHTO 2058No ratings yet

- Irrecoverable Debts & Provision For Irrecoverables DebtsDocument5 pagesIrrecoverable Debts & Provision For Irrecoverables DebtsYomi AmvNo ratings yet

- C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C CDocument19 pagesC C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C CKapil PardeshiNo ratings yet

- Chapter 2 Cash and Cash EquivalentsDocument3 pagesChapter 2 Cash and Cash EquivalentsMisiah Paradillo Jangao100% (1)

- Income Recognition and Asset ClassificationDocument21 pagesIncome Recognition and Asset Classificationsagar7No ratings yet

- Audit of AdvancesDocument29 pagesAudit of AdvancesHemanshu SolankiNo ratings yet

- Term Paper Banking and InsuranceDocument27 pagesTerm Paper Banking and InsuranceneenajoshiNo ratings yet

- NPA NotesDocument33 pagesNPA NotesAdv Sheetal SaylekarNo ratings yet

- Prudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesDocument21 pagesPrudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesSubrahmanya ShastryNo ratings yet

- Financial Statements of Banking CompaniesDocument20 pagesFinancial Statements of Banking CompaniesBashu GuragainNo ratings yet

- Libby Chapter 6 Study NotesDocument6 pagesLibby Chapter 6 Study NoteshatanoloveNo ratings yet

- Performance Evaluation of Banks - IIM Indore Session 3,4,5Document99 pagesPerformance Evaluation of Banks - IIM Indore Session 3,4,5LEO BABU PGP 2021-23 BatchNo ratings yet

- Final Accounts - That's It BatchDocument16 pagesFinal Accounts - That's It BatchKunika PimparkarNo ratings yet

- Non Performing AssetsDocument12 pagesNon Performing AssetsVikram SinghNo ratings yet

- 66649bos53803 Cp8u4 PDFDocument30 pages66649bos53803 Cp8u4 PDFpratham.mishra1809No ratings yet

- Emperical ProjectDocument11 pagesEmperical ProjectSajal ChakarvartyNo ratings yet

- NPA Management by Indian Banks-LATEST: Dr. Deepak Tandon IMI New DelhiDocument40 pagesNPA Management by Indian Banks-LATEST: Dr. Deepak Tandon IMI New Delhidev mhaispurkarNo ratings yet

- Chapter 4 Accounts Receivable Learning Objectives: Receivables."Document4 pagesChapter 4 Accounts Receivable Learning Objectives: Receivables."Misiah Paradillo JangaoNo ratings yet

- Basic Banking CRM-CBSDocument60 pagesBasic Banking CRM-CBSAkshayNo ratings yet

- Understanding NPA, SMA and NPA ProvisioningDocument8 pagesUnderstanding NPA, SMA and NPA ProvisioningabhinavNo ratings yet

- Income Recognition & Asset Classification CA Pankaj TiwariDocument42 pagesIncome Recognition & Asset Classification CA Pankaj TiwariRakesh RajpurohitNo ratings yet

- Audit of Accounts ReceivablesDocument5 pagesAudit of Accounts ReceivablesIzza Mae Rivera KarimNo ratings yet

- 6 Gleim FarDocument15 pages6 Gleim Farsendbad_m32450No ratings yet

- A Study On Npa of Public Sector Banks in India: Sulagna Das, AbhijitduttaDocument9 pagesA Study On Npa of Public Sector Banks in India: Sulagna Das, AbhijitduttaSunil Kumar PalikelaNo ratings yet

- Audit of ArDocument8 pagesAudit of ArRizzel SubaNo ratings yet

- Intermediate Accounting, Part 1Document7 pagesIntermediate Accounting, Part 1dfsdfdsfNo ratings yet

- Factors For Rise in NpasDocument10 pagesFactors For Rise in NpasRakesh KushwahNo ratings yet

- Skip To Main ContentDocument28 pagesSkip To Main Contentshreeya salunkeNo ratings yet

- ACC 01 - Completion of The Accounting Cycle For Merchandising - Notes 7Document18 pagesACC 01 - Completion of The Accounting Cycle For Merchandising - Notes 7Hans MosquedaNo ratings yet

- Mob NpaDocument44 pagesMob NpaParthNo ratings yet

- ReceivablesDocument6 pagesReceivablessafe.skies00No ratings yet

- Acc05 Take Home Quiz Cash and ReceivablesDocument12 pagesAcc05 Take Home Quiz Cash and ReceivablesJullia BelgicaNo ratings yet

- Understanding The SelfDocument9 pagesUnderstanding The SelfNatalie SerranoNo ratings yet

- Chapter 21Document10 pagesChapter 21soniadhingra1805No ratings yet

- "The Impact of NPA On The Net Profit of SBI and Axis BankDocument9 pages"The Impact of NPA On The Net Profit of SBI and Axis BankJayesh SonawaneNo ratings yet

- Consumer EducationDocument3 pagesConsumer EducationteconsvillagemapNo ratings yet

- Report On Non Performing Assets of BankDocument53 pagesReport On Non Performing Assets of Bankhemali chovatiya75% (4)

- Income Recognition and Asset Classification Norms (IRAC) : - by CA KVS ShyamsunderDocument10 pagesIncome Recognition and Asset Classification Norms (IRAC) : - by CA KVS ShyamsunderMukesh SinghNo ratings yet

- UntitledDocument22 pagesUntitledAayush TareNo ratings yet

- Company A:c-Banking CompaniesDocument30 pagesCompany A:c-Banking CompaniessarahhussainNo ratings yet

- 08 - Receivables PDFDocument2 pages08 - Receivables PDFJamie ToriagaNo ratings yet

- Branch Audit Planning & ExecutionDocument32 pagesBranch Audit Planning & Executionkumarbk3No ratings yet

- Rbi Instructions On Prudential Norms On Income Recognition Asset Classification and ProvisioningDocument7 pagesRbi Instructions On Prudential Norms On Income Recognition Asset Classification and ProvisioningSanjenbam SumitNo ratings yet

- Non Performing AssetsDocument13 pagesNon Performing AssetsVinayaka McNo ratings yet

- Chapter 9Document8 pagesChapter 9Jagadeesh ind7No ratings yet

- Piecemeal RealizationDocument6 pagesPiecemeal RealizationSethwilsonNo ratings yet

- Sayali ProjectDocument63 pagesSayali ProjecthemangiNo ratings yet

- Chapter 9 - NPA PDFDocument98 pagesChapter 9 - NPA PDFSuraj ChauhanNo ratings yet

- Chapter 8 Lecture NoteDocument37 pagesChapter 8 Lecture Note김가온No ratings yet

- FARAP 4702 ReceivablesDocument8 pagesFARAP 4702 Receivablesliberace cabreraNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Credit Repair 101: A Comprehensive Guide to Restoring Your Personal CreditFrom EverandCredit Repair 101: A Comprehensive Guide to Restoring Your Personal CreditNo ratings yet

- School Assignment On Agricultural Practices in IndiaDocument2 pagesSchool Assignment On Agricultural Practices in IndiaUma Ganesan100% (1)

- CIMA F2 Notes 2018 PDFDocument154 pagesCIMA F2 Notes 2018 PDFsolstice567567No ratings yet

- Mea Assignment WordDocument23 pagesMea Assignment WordNabila Afrin RiyaNo ratings yet

- Shut Down PriceDocument14 pagesShut Down PriceNoor NabiNo ratings yet

- DSP App - Dspfinance - Com - A Document Received As Part of A Job Scam, Likely A Cheque Fraud NetworkDocument3 pagesDSP App - Dspfinance - Com - A Document Received As Part of A Job Scam, Likely A Cheque Fraud NetworkJames BarlowNo ratings yet

- Macroeconomics 6th Edition Williamson Solutions ManualDocument36 pagesMacroeconomics 6th Edition Williamson Solutions Manualstirrupsillon.d8yxo100% (42)

- Bus 2101 - Chapter 2Document24 pagesBus 2101 - Chapter 2HarshaBorresAlamoNo ratings yet

- Introduction To Goods and Services Tax (GST)Document6 pagesIntroduction To Goods and Services Tax (GST)Tax NatureNo ratings yet

- 142 Mcqs Good - Financial ManagementDocument26 pages142 Mcqs Good - Financial ManagementMuhammad Arslan Usman71% (7)

- I To B Ok AssignmentDocument4 pagesI To B Ok AssignmentHashim MalikNo ratings yet

- Sample 1 Bakery Business PlanDocument18 pagesSample 1 Bakery Business PlanJohn Leric Dela MercedNo ratings yet

- The Role of Purchasing in The OrganisationDocument20 pagesThe Role of Purchasing in The OrganisationThomo MolwaneNo ratings yet

- Project Justification: Increase OEEDocument21 pagesProject Justification: Increase OEEKaran Singh RaiNo ratings yet

- JohnsonDocument12 pagesJohnsonJannah Victoria AmoraNo ratings yet

- Sikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Document11 pagesSikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Alaji Bah CireNo ratings yet

- Modern Auditing and Assurance Services 6th Edition Leung Solutions ManualDocument6 pagesModern Auditing and Assurance Services 6th Edition Leung Solutions ManualSonam ChophelNo ratings yet

- QUESTIONNAIREDocument5 pagesQUESTIONNAIREMuneebVpMuniCholayilNo ratings yet

- BSP Circular 1107Document7 pagesBSP Circular 1107Maya Julieta Catacutan-EstabilloNo ratings yet

- GIN - 05820402 - Priyadarshan Hasigala Narayanaswamy - STA - Passport and US VisaDocument5 pagesGIN - 05820402 - Priyadarshan Hasigala Narayanaswamy - STA - Passport and US VisaALexNo ratings yet

- Chapter 7 Strategy Formulation: Corporate Strategy: Strategic Management & Business Policy, 13e (Wheelen/Hunger)Document22 pagesChapter 7 Strategy Formulation: Corporate Strategy: Strategic Management & Business Policy, 13e (Wheelen/Hunger)Anonymous 7CxwuBUJz3No ratings yet

- Principles of Business For CSEC®: 2nd EditionDocument3 pagesPrinciples of Business For CSEC®: 2nd Editionyuvita prasadNo ratings yet

- Analyzing Farming Systems DeterminantsDocument12 pagesAnalyzing Farming Systems Determinantsadmirechawaz100% (1)

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- Eco162 Report - Mba1112gDocument19 pagesEco162 Report - Mba1112gNUR WIRDANI ALANINo ratings yet

- #1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldDocument5 pages#1 - Inventory Turnover Ratio: One Accounting Period Cost of Goods SoldMarie Frances SaysonNo ratings yet

- Cost of Capital NotesDocument6 pagesCost of Capital NotesAmy100% (1)

- Taxation of Business Entities 2017 8th Edition Spilker Solutions ManualDocument11 pagesTaxation of Business Entities 2017 8th Edition Spilker Solutions Manualotisviviany9zoNo ratings yet