Professional Documents

Culture Documents

2019 10 20 11 13 28 743 - Cixpm4133k - 2016

2019 10 20 11 13 28 743 - Cixpm4133k - 2016

Uploaded by

tarun mathurOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2019 10 20 11 13 28 743 - Cixpm4133k - 2016

2019 10 20 11 13 28 743 - Cixpm4133k - 2016

Uploaded by

tarun mathurCopyright:

Available Formats

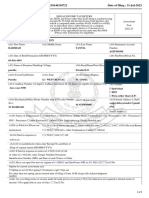

A1. First Name A2. Middle Name A3. Last Name A4.

PAN

SONALI TARUN MATHUR CIXPM4133K

A5. Sex A6. Date of Birth (YYYY/MM/DD) A7. Income Tax Ward/Circle

Female 1982-09-16 24(3)(4)

INFORMATION

A8. Flat / Door / Building A9. Name of Premises / Building / Village A10. Road / Street

PERSONAL

353 RAJANI VIHAR HEERA PURA

A11. Area / Locality A12. Town / City / District A13. State

JAIPUR JAIPUR RAJASTHAN

A14. Country A15. Pincode Status

91- INDIA 302024 Individual

A16. Email Address A17. Residential/Office Mobile No. 1 A18. Mobile No. 2

Phone No. with STD

Code

tmathur11@yahoo.com ( )- 9892748065

A19 Employer Category OTH

A20 Tax Status Tax Refundable

A21 Residential Status RES- Resident

A22 Return filed under section 11- Voluntarily on or befo

re the due date under secti

on 139(1)

A23 Whether Person governed by Portuguese Civil Code under section 5A No

FILING STATUS

A24 If A23 is applicable, PAN of the Spouse

Whether original or revised return? Original

A25 If under section: 139(5) - revised return:

Original Acknowledgement Number

Date of filing of Original Return(DD/MM/YYYY)

If under section: 139(9) - return in response to defective return notice:

Original Acknowledgment Number

Date of filing of Original Return (DD/MM/YYYY)

Notice Number.

A26 If filed in response to notice u/s 139(9)/142(1)/148/153A/153C,enter the date of such notice

A27 Whether you have Aadhaar Number ?

A28 If A27 is Yes, please provide

B1 Income from Salary / Pension(Ensure to fill Sch TDS1) 1 260369

B2 Type of House Property

Income from one House Property 0

B3 Income from Other Sources (Ensure to fill Sch TDS2) 17682

B4 Gross Total Income (B1+B2+B3) 4 278051

C Deductions under chapter VI A (Section)

C1 80C 3636 3636C11 80G 0 0

C2 80CCC 0 0C12 80GG 0 0

INCOME & DEDUCTIONS

C3 80 CCD (1) 0 0C13 80GGA 0 0

(Employees /

Self Employed

Contribution)

C4 80CCD(1B) 0 0C14 80GGC 0 0

C5 80CCD (2) 0 0C15 80RRB 0 0

(Employers

Contribution)

C6 80CCG 0 0C16 80QQB 0 0

C7 80D 0 0C17 80TTA 10000 10000

C8 80DD 0 0C18 80U 0 0

C9 80DDB 0 0

C1080E 0 0

C19 Total Deductions (Total of C1 to C18) C19 13636

C20 Taxable Total Income (B4 - C19) C20 264420

D1 Tax Payable on Total Income (C20) D1 1442

D2 Rebate u/s 87A D2 1442

D3 Tax Payable after Rebate (D1-D2) D3 0

D4 Surcharge, if C20 exceeds 1 crore D4 0

COMPUTATION

D5 Cess on (D3+D4) D5 0

D6 Total Tax, Surcharge & Cess (D3+D4+D5) D6 0

TAX

D7 Relief u/s 89 D7 0

D8 Balance Tax After Relief (D6 - D7) D8 0

D9 Total Interest u/s 234A D9 0

D10 Total Interest u/s 234B D10 0

D11 Total Interest u/s 234C D11 0

Total Interest Payable (D9 + D10 + D11) 0

D12 Total Tax and Interest (D8 + D9 + D10 + D11) D12 0

Taxes Paid

D13 Total Advance Tax Paid D13 0

TAXES PAID

D14 Total Self Assessment Tax Paid D14 0

D15 Total TDS Claimed D15 1769

D16 Total TCS Collected D16 0

D17 Total Taxes Paid(D13 + D14 + D15 + D16) D17 1769

D18 Tax Payable(D12 - D17, if D12 > D17) D18 0

D19 Refund(D17 - D12, if D17 > D12) D19 1770

D20 Exempt income only for reporting purposes D20 0

D21 Details of all Bank Accounts (excluding dormant accounts) held in India at any time during the previous year (Mandatory

irrespective of refund due or not)

Total number of savings and current bank accounts held by you at any time during the previous year (excluding 1

dormant accounts)

a) Bank Account in which refund, if any, shall be credited

S.No.IFS Code of the bank Name of the Bank Account Number Bank Account Type

1 ALLA0212473 ALLAHABAD BANK 5017637947 Savings

b) Other Bank account details

S.No.IFS Code of the bank Name of the Bank Account Number Bank Account Type

SCH TDS2-Details of Tax Deducted at Source on Income Other than Salary [As per FORM 16 A issued by Deductor(s)]

SI.NO Tax Deduction Name of the Deductor Unique TDS Deducted Year Tax Deducted Amount out If A23 is

Account Certificate No. of (5) claimed applicable,

Number (TAN) for this year Amount

of the Deductor Claimed in

the Hands

of Spouse

1 MUMA38623E ALLAHABAD BANK 2015 1769 1769 0

Total 1769

Schedule Asset and Liability at the end of the year (Applicable in a case where total income exceeds Rs. 50 lakh)

AL

A Particulars of Asset Amount (Cost)

(Rs.)

1 Immovable Asset

a Land 0

b Building 0

2 Movable Asset

a Cash in hand 0

b Jewellery, bullion etc. 0

c Vehicles, yachts, boats and aircrafts 0

3 Total 0

B Liability in relation to Assets at A 0

VERIFICATION

xyz

I, SONALI TARUN MATHUR, son/daughter of, JYOTI PRASAD UDAWAT, solemnly declare that to the best of my knowledge and

belief, the information given in the return is correct and complete and that the amount of total income and other particulars shown therein

are truly stated and are in accordance with the provisions of the Income- tax Act 1961, in respect of income chargeable to Income-tax for

the previous year relevant to the Assessment Year 2016-17.

Place MUMBAI Date 2016-08-05 PAN CIXPM4133K

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

TRP PIN [10 Digit] Name of the TRP TRP Signature

Amount to be paid to TRP

You might also like

- Investments Analysis and Management 12th Edition Charles P Jones Test BankDocument10 pagesInvestments Analysis and Management 12th Edition Charles P Jones Test BankMohmed GodaNo ratings yet

- BOP NumericalsDocument7 pagesBOP NumericalsSushobhan DasNo ratings yet

- Gov Act 1 PDFDocument18 pagesGov Act 1 PDFJoana Medina80% (10)

- B1 Income From Salary / Pension (Ensure To Fill SCH TDS1) 1Document3 pagesB1 Income From Salary / Pension (Ensure To Fill SCH TDS1) 1Varun GuptaNo ratings yet

- Form PDF Year 2015-16Document3 pagesForm PDF Year 2015-16HARISH CHANDRA MISHRANo ratings yet

- Form PDF 167791990060516Document3 pagesForm PDF 167791990060516ganesh2sharma4No ratings yet

- Form PDF 758837930310815Document2 pagesForm PDF 758837930310815deepkaryan1988No ratings yet

- B1 Income From Salary / Pension (Ensure To Fill SCH TDS1) 1Document3 pagesB1 Income From Salary / Pension (Ensure To Fill SCH TDS1) 1santoshkumarNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnDc InnovatorsNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturngrafikeysNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnAman AnandNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnImpactianRajenderNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnramnik20098676No ratings yet

- DocumentDocument5 pagesDocumentAkshay KumarNo ratings yet

- PDF From XMLDocument5 pagesPDF From XMLNirbhay KumarNo ratings yet

- Itr-1 Sahaj: Individual Income Tax ReturnDocument7 pagesItr-1 Sahaj: Individual Income Tax ReturnRinku SoraishamNo ratings yet

- Form PDF 278241510300722Document68 pagesForm PDF 278241510300722jawedNo ratings yet

- ITR 4 Sugam Form For Assessment Year 2018 19Document9 pagesITR 4 Sugam Form For Assessment Year 2018 19sureshstipl sureshNo ratings yet

- Form PDF 957530660230722Document68 pagesForm PDF 957530660230722kmuditkNo ratings yet

- Form PDF 893408120301222Document40 pagesForm PDF 893408120301222Ayush RawatNo ratings yet

- Form PDF 501225711170922Document71 pagesForm PDF 501225711170922Kundan SharmaNo ratings yet

- Form PDF 398153220310722Document40 pagesForm PDF 398153220310722Ayush RawatNo ratings yet

- Form PDF 630396840101022Document38 pagesForm PDF 630396840101022RahamTullaNo ratings yet

- Form Itr-4 SugamDocument9 pagesForm Itr-4 SugamAccounting & TaxationNo ratings yet

- Form PDF 860011410060114Document2 pagesForm PDF 860011410060114prakashdebleyNo ratings yet

- Form PDF 432385000170822Document9 pagesForm PDF 432385000170822Khan kingNo ratings yet

- Form PDF 858747220180722Document38 pagesForm PDF 858747220180722sonu singhNo ratings yet

- Form PDF 765250410080722Document69 pagesForm PDF 765250410080722Naresh KUMAR GUPTANo ratings yet

- Form PDF 893006160301222Document9 pagesForm PDF 893006160301222manish.toshniwal1No ratings yet

- Form PDF 717976660131022Document9 pagesForm PDF 717976660131022paridarashmi12No ratings yet

- Form PDF 484935510120922Document6 pagesForm PDF 484935510120922republicfoodsindiaNo ratings yet

- Form PDF 638844880230723Document8 pagesForm PDF 638844880230723Srikanth Chowdary DareNo ratings yet

- Form PDF 266758010200623Document9 pagesForm PDF 266758010200623vssm1989No ratings yet

- Form PDF 340519100221221AVTPC0987CDocument8 pagesForm PDF 340519100221221AVTPC0987Csmadvocate049No ratings yet

- ITRForm Arjun 2022Document39 pagesITRForm Arjun 2022Shahrukh Ahmed AnsariNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 Previewsanthoush sankarNo ratings yet

- Form PDF 215347070090623Document10 pagesForm PDF 215347070090623m sinhaNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnShivam JainNo ratings yet

- Form PDF 202423770060623Document7 pagesForm PDF 202423770060623shashidharNo ratings yet

- Form PDF 910494870311222Document9 pagesForm PDF 910494870311222Navin DongreNo ratings yet

- Form PDF 146451900270722Document39 pagesForm PDF 146451900270722raqviNo ratings yet

- Form PDF 360019890310722Document9 pagesForm PDF 360019890310722Sumit SainiNo ratings yet

- Form PDF 774514440031122Document9 pagesForm PDF 774514440031122krishna salesNo ratings yet

- Form PDF 114320560260722Document9 pagesForm PDF 114320560260722DeepNo ratings yet

- Form PDF 276720890300722Document6 pagesForm PDF 276720890300722atifmd250No ratings yet

- Form PDF 621098631061022Document68 pagesForm PDF 621098631061022nlr726371No ratings yet

- Form PDF 166180900050823Document8 pagesForm PDF 166180900050823AshokNo ratings yet

- Form PDF 230861000130623Document6 pagesForm PDF 230861000130623Sunil AccountsNo ratings yet

- Form PDF 383130140310722 PDFDocument9 pagesForm PDF 383130140310722 PDFsandeep kuamr ChoubeyNo ratings yet

- Form PDF 302828890260623Document9 pagesForm PDF 302828890260623Jaswanth KumarNo ratings yet

- 2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017Document6 pages2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017ApoorvNo ratings yet

- Form PDF 614955380220723Document9 pagesForm PDF 614955380220723Chandra PrakashNo ratings yet

- Indian Income Tax Return Assessment Year 2021 - 22: SugamDocument9 pagesIndian Income Tax Return Assessment Year 2021 - 22: SugamAvnish BhasinNo ratings yet

- Form PDF 658202480080622Document6 pagesForm PDF 658202480080622Chandrasekhar NandigamNo ratings yet

- Form PDF 172586610110424Document9 pagesForm PDF 172586610110424Niraj JaiswalNo ratings yet

- Jaspal Singh ItrDocument9 pagesJaspal Singh Itrvarunyadav3050No ratings yet

- Rktarai DetailDocument9 pagesRktarai DetailDeepak SwainNo ratings yet

- Form PDF 165223390030424Document9 pagesForm PDF 165223390030424officialmosessahotaNo ratings yet

- Form PDF 303820080270623Document9 pagesForm PDF 303820080270623rahul.harpreetNo ratings yet

- Form PDF 992301420310723Document10 pagesForm PDF 992301420310723tax advisorNo ratings yet

- 2019 10 20 11 11 26 114 - Cixpm4133k - 2019Document8 pages2019 10 20 11 11 26 114 - Cixpm4133k - 2019tarun mathurNo ratings yet

- Science Enrichment Activity: Name: Vanya Mathur Class:8EDocument8 pagesScience Enrichment Activity: Name: Vanya Mathur Class:8Etarun mathurNo ratings yet

- Onyx Embolization With The Apollo Detachable Tip Microcatheter: A Single-Center ExperienceDocument6 pagesOnyx Embolization With The Apollo Detachable Tip Microcatheter: A Single-Center Experiencetarun mathurNo ratings yet

- Neurintsurg 2017 013256Document7 pagesNeurintsurg 2017 013256tarun mathurNo ratings yet

- Position of Adverbs WorksheetsDocument7 pagesPosition of Adverbs Worksheetstarun mathurNo ratings yet

- Recurring Headaches After COVID-19: Is It Possible To Prevent Headaches?Document2 pagesRecurring Headaches After COVID-19: Is It Possible To Prevent Headaches?tarun mathurNo ratings yet

- Sample Paper Class VDocument24 pagesSample Paper Class Vtarun mathurNo ratings yet

- Simple Santa Drawing Face - Google Search PDFDocument5 pagesSimple Santa Drawing Face - Google Search PDFtarun mathurNo ratings yet

- Business CombinationDocument10 pagesBusiness CombinationCloudKielGuiang0% (1)

- Kholipah & Suryandari (2019)Document14 pagesKholipah & Suryandari (2019)Riyandi JoshuaNo ratings yet

- 230-Executive Board Meeting of NHADocument36 pages230-Executive Board Meeting of NHAHamid Naveed100% (1)

- North Atlantic Treaty Organization (NATO) :: Played An Instrumental Role 1968 TreatyDocument3 pagesNorth Atlantic Treaty Organization (NATO) :: Played An Instrumental Role 1968 TreatyDenise LabagnaoNo ratings yet

- Psa 120Document14 pagesPsa 120Kimberly LimNo ratings yet

- CAPE Accounting Unit 1 2008 P2Document7 pagesCAPE Accounting Unit 1 2008 P2Sachin Bahadoorsingh0% (1)

- Whistleblowers - Info RebuttalDocument4 pagesWhistleblowers - Info RebuttalAnonymous zjQEWkAKNo ratings yet

- Keshav Khandelwal - ResumeDocument1 pageKeshav Khandelwal - Resumedeepak.sharmaNo ratings yet

- LME Trading Calendar 2021 2031Document2 pagesLME Trading Calendar 2021 2031strip1No ratings yet

- Kedah Land (Amendment) Rules 1993Document10 pagesKedah Land (Amendment) Rules 1993Kelly LimNo ratings yet

- Palmares Vs CaDocument4 pagesPalmares Vs CaFermari John ManalangNo ratings yet

- Firm or Obligor Credit RiskDocument60 pagesFirm or Obligor Credit RiskPALLAVI DUREJANo ratings yet

- Amended Notice of Deposition of Jason Oquendo For May 19, 2017, May 4, 2017Document2 pagesAmended Notice of Deposition of Jason Oquendo For May 19, 2017, May 4, 2017larry-612445No ratings yet

- Upstocx Demat-Account-Closure-Form PDFDocument1 pageUpstocx Demat-Account-Closure-Form PDFGautam DixitNo ratings yet

- Week 5 - Tutorial SolutionsDocument5 pagesWeek 5 - Tutorial SolutionsDivya chandNo ratings yet

- Shermin Williams Offering Memorandum-2Document16 pagesShermin Williams Offering Memorandum-2paul sukholinskiyNo ratings yet

- Revised Corporation CodeDocument18 pagesRevised Corporation CodeClarisse GonzalesNo ratings yet

- Sbi SynopsisDocument7 pagesSbi SynopsisvenkibgvNo ratings yet

- It 000144384093 2024 10Document1 pageIt 000144384093 2024 10Sheeraz AhmedNo ratings yet

- Dividend KingsDocument6 pagesDividend KingsVelmurugan JeyavelNo ratings yet

- Gordon Gekko Greed Is Good Full Speech Read The DescriptionDocument3 pagesGordon Gekko Greed Is Good Full Speech Read The DescriptionHenryNo ratings yet

- AA (F8) - Test (Part I + Part II) - F8 - SolutionDocument12 pagesAA (F8) - Test (Part I + Part II) - F8 - SolutionPham Cam Anh QP0146No ratings yet

- DiversificationDocument18 pagesDiversificationVinod PandeyNo ratings yet

- The Term Structure of Interest Rates: Denitsa StefanovaDocument41 pagesThe Term Structure of Interest Rates: Denitsa StefanovathofkampNo ratings yet

- Salary Slip FormatDocument8 pagesSalary Slip Formatshrija nairNo ratings yet

- A Project On "Study of BSE and NASDAQ - A Comparision of Two Stock Exchanges"Document36 pagesA Project On "Study of BSE and NASDAQ - A Comparision of Two Stock Exchanges"Kshitij ThakurNo ratings yet

- FORECLOSURE FRAUD - Motion To StrikeDocument19 pagesFORECLOSURE FRAUD - Motion To StrikeGRANADAFRAUDNo ratings yet