Professional Documents

Culture Documents

Numerical Problem On ROI and Residual Income

Numerical Problem On ROI and Residual Income

Uploaded by

mahanteshkuriCopyright:

Available Formats

You might also like

- Highland Malt Accounting Project PDFDocument12 pagesHighland Malt Accounting Project PDFEng Chee Liang100% (1)

- Problem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGDocument6 pagesProblem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGJohn Richard Bonilla100% (4)

- Financial Management ExercisesDocument6 pagesFinancial Management ExercisesLeanne Quinto100% (1)

- Activity 3 CAMINGAWAN BSMA 2B PDFDocument7 pagesActivity 3 CAMINGAWAN BSMA 2B PDFMiconNo ratings yet

- CFIN 4 4th Edition Besley Solutions Manual PDFDocument9 pagesCFIN 4 4th Edition Besley Solutions Manual PDFbill334No ratings yet

- Financial Ratios 2017Document5 pagesFinancial Ratios 2017Marian PajarNo ratings yet

- Week 1 621 NotesDocument6 pagesWeek 1 621 NotesSameera VithanaNo ratings yet

- Quiz Finma 0920Document5 pagesQuiz Finma 0920Danica RamosNo ratings yet

- Financial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesDocument7 pagesFinancial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesAndy MoralesNo ratings yet

- Use The Following Information To Answer Items 5 - 7Document4 pagesUse The Following Information To Answer Items 5 - 7acctg2012No ratings yet

- Mid Term ExamDocument6 pagesMid Term ExamWaizin KyawNo ratings yet

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- Final Account, Income Statement and Financial Analysis Practice QuestionsDocument36 pagesFinal Account, Income Statement and Financial Analysis Practice QuestionsMansi GoelNo ratings yet

- Comparative Income StatementDocument12 pagesComparative Income StatementBISHAL ROYNo ratings yet

- Solution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFDocument30 pagesSolution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFtiffany.kunst387100% (16)

- CFIN 4th Edition Besley by Besley and Brigham ISBN Solution ManualDocument9 pagesCFIN 4th Edition Besley by Besley and Brigham ISBN Solution Manualrussell100% (30)

- G Manufacturing Company Is An Important Producer of Lawn Furniture and Decorative Objectives For The Patio and GardensDocument3 pagesG Manufacturing Company Is An Important Producer of Lawn Furniture and Decorative Objectives For The Patio and GardensNidhi ChawdheryNo ratings yet

- CFS Company Has The Following Details For Two-Year Period, 2019 and 2018Document7 pagesCFS Company Has The Following Details For Two-Year Period, 2019 and 2018MiconNo ratings yet

- Financial Plan: Start-Up Capital:: Profit Loss StatementDocument6 pagesFinancial Plan: Start-Up Capital:: Profit Loss Statementparthi 23No ratings yet

- 11 To 20Document96 pages11 To 20JorniNo ratings yet

- Home Depot Balance SheetDocument4 pagesHome Depot Balance SheetNicolas ErnestoNo ratings yet

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDocument5 pagesAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNo ratings yet

- Advanced AccountingDocument12 pagesAdvanced AccountingmayuriNo ratings yet

- Agabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cDocument7 pagesAgabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cJasmine Cate JumillaNo ratings yet

- Management Accounting SchemeDocument8 pagesManagement Accounting SchemeSpandana Madhan SmrbNo ratings yet

- 04 Edu91 FM Practice Sheets FM Solution (Not To Print)Document154 pages04 Edu91 FM Practice Sheets FM Solution (Not To Print)Krutarth VyasNo ratings yet

- Inclusion To Gross Income - Part 3 (TORREON, Kimberly Shane) - Sheet3Document1 pageInclusion To Gross Income - Part 3 (TORREON, Kimberly Shane) - Sheet3Shane TorrieNo ratings yet

- Financial Management Economics For Finance 2023 1671444516Document36 pagesFinancial Management Economics For Finance 2023 1671444516RADHIKANo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- Gross Working CapitalDocument14 pagesGross Working Capitalfizza amjadNo ratings yet

- Perfect Practice SolutionDocument41 pagesPerfect Practice Solutionnarutevarsha5No ratings yet

- Fabm 2. Final ExamDocument3 pagesFabm 2. Final ExamSHIERY MAE FALCONITINNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument23 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementZrake 24No ratings yet

- Quiz Finma 0920Document6 pagesQuiz Finma 0920Danica Jane RamosNo ratings yet

- BBS 1st Year QuestionDocument2 pagesBBS 1st Year Questionsatya100% (1)

- Ce Quiz II (A+b+c)Document3 pagesCe Quiz II (A+b+c)Mohaiminur ArponNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- Practice Exam Chapters 1-5 (2) Solutions: Problem IDocument4 pagesPractice Exam Chapters 1-5 (2) Solutions: Problem IAtif RehmanNo ratings yet

- Act AssignmentDocument33 pagesAct AssignmentLabib KhanNo ratings yet

- Problem Ratio 2022Document1 pageProblem Ratio 2022Mohd shariqNo ratings yet

- Traditional Theory Approach: Illustrations 1Document7 pagesTraditional Theory Approach: Illustrations 1PRAMOD VNo ratings yet

- Financial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDDocument10 pagesFinancial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Solution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Document4 pagesSolution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Eyasu DestaNo ratings yet

- Solution For FM Extra QuestionsDocument130 pagesSolution For FM Extra Questionsdeepu deepuNo ratings yet

- Liquidity RatiosDocument3 pagesLiquidity RatiosMckenzie PalaganasNo ratings yet

- Chapter 5 Leverages - PracticeDocument10 pagesChapter 5 Leverages - PracticeAkshat SinghNo ratings yet

- Chapter 13 SCMDocument12 pagesChapter 13 SCMAliyah Francine Gojo CruzNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Financial Planning and Pro Forma Statements Simplistic Approach Part 2Document17 pagesFinancial Planning and Pro Forma Statements Simplistic Approach Part 2ishaNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- 6167f0c20cf2c12cd8917628 OriginalDocument34 pages6167f0c20cf2c12cd8917628 OriginalTM GamingNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Ratio Analysis Numericals - chp14Document5 pagesRatio Analysis Numericals - chp14Akshara DesaiNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- Assignment Ficd113Document4 pagesAssignment Ficd113Eiril DanielNo ratings yet

- Management 3Document6 pagesManagement 3Romnick TuboNo ratings yet

- The Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceDocument3 pagesThe Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceAbdullah Tousif MajumderNo ratings yet

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowTang De MelanciaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Quantitative Research Methods ScribdDocument6 pagesQuantitative Research Methods ScribdmahanteshkuriNo ratings yet

- Stepwise GuideDocument5 pagesStepwise GuidemahanteshkuriNo ratings yet

- Stevenson KeyWordsDocument1 pageStevenson KeyWordsmahanteshkuriNo ratings yet

- Residual Income ExampleDocument1 pageResidual Income ExamplemahanteshkuriNo ratings yet

- Budgeting and Reporting Template ExamplesDocument25 pagesBudgeting and Reporting Template ExamplesmahanteshkuriNo ratings yet

Numerical Problem On ROI and Residual Income

Numerical Problem On ROI and Residual Income

Uploaded by

mahanteshkuriOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Numerical Problem On ROI and Residual Income

Numerical Problem On ROI and Residual Income

Uploaded by

mahanteshkuriCopyright:

Available Formats

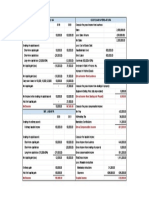

Numerical Problem on ROI and

Residual Income

The average asset balances of the Apparel division's of Ibis

for 2019 are given below:

Cash

Receivable 2,50,000

s 3,75,000

Inventory

Raw materials 2,50,000

Works in process 1,30,000

Finished goods 2,45,000 6,25,000

Gross fixed assets 25,00,000

Accumulated 10,00,000 15,00,000

depreciation

Total: 27,50,000

Solution:

Current liabilities 7,50,000

Equity

1) Return on investment = 20,00,000

Total liabilities and 27,50,000

equity

(Profit before tax/Investment base) x 100

ROI = (Rs. 3,00,000/20,00,000) x 100

Questions: =15%

During 2019 the Apparel division earned a profit of Rs. 3,00,000

2)

before taxes Residual

on total saleIncome:

of Rs. 40,00,000.

Profit before tax

1) Compute ROI using net total assets (that is total assets less

currentRs. 3,00,000

liabilities) as the investment base.

2) Compute RI using a capital charge of 10% on net total

Net Total Assets=Total Assets-Current Liabilities

assets.

27,50,000-7,50,000 = 20,00,000

Capital charge (Rs. 20,00,000 x .10)

2,00,000

Residual Income = 3,00,000-2,00,000 =

Rs. 1,00,000

You might also like

- Highland Malt Accounting Project PDFDocument12 pagesHighland Malt Accounting Project PDFEng Chee Liang100% (1)

- Problem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGDocument6 pagesProblem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGJohn Richard Bonilla100% (4)

- Financial Management ExercisesDocument6 pagesFinancial Management ExercisesLeanne Quinto100% (1)

- Activity 3 CAMINGAWAN BSMA 2B PDFDocument7 pagesActivity 3 CAMINGAWAN BSMA 2B PDFMiconNo ratings yet

- CFIN 4 4th Edition Besley Solutions Manual PDFDocument9 pagesCFIN 4 4th Edition Besley Solutions Manual PDFbill334No ratings yet

- Financial Ratios 2017Document5 pagesFinancial Ratios 2017Marian PajarNo ratings yet

- Week 1 621 NotesDocument6 pagesWeek 1 621 NotesSameera VithanaNo ratings yet

- Quiz Finma 0920Document5 pagesQuiz Finma 0920Danica RamosNo ratings yet

- Financial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesDocument7 pagesFinancial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesAndy MoralesNo ratings yet

- Use The Following Information To Answer Items 5 - 7Document4 pagesUse The Following Information To Answer Items 5 - 7acctg2012No ratings yet

- Mid Term ExamDocument6 pagesMid Term ExamWaizin KyawNo ratings yet

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- Final Account, Income Statement and Financial Analysis Practice QuestionsDocument36 pagesFinal Account, Income Statement and Financial Analysis Practice QuestionsMansi GoelNo ratings yet

- Comparative Income StatementDocument12 pagesComparative Income StatementBISHAL ROYNo ratings yet

- Solution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFDocument30 pagesSolution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFtiffany.kunst387100% (16)

- CFIN 4th Edition Besley by Besley and Brigham ISBN Solution ManualDocument9 pagesCFIN 4th Edition Besley by Besley and Brigham ISBN Solution Manualrussell100% (30)

- G Manufacturing Company Is An Important Producer of Lawn Furniture and Decorative Objectives For The Patio and GardensDocument3 pagesG Manufacturing Company Is An Important Producer of Lawn Furniture and Decorative Objectives For The Patio and GardensNidhi ChawdheryNo ratings yet

- CFS Company Has The Following Details For Two-Year Period, 2019 and 2018Document7 pagesCFS Company Has The Following Details For Two-Year Period, 2019 and 2018MiconNo ratings yet

- Financial Plan: Start-Up Capital:: Profit Loss StatementDocument6 pagesFinancial Plan: Start-Up Capital:: Profit Loss Statementparthi 23No ratings yet

- 11 To 20Document96 pages11 To 20JorniNo ratings yet

- Home Depot Balance SheetDocument4 pagesHome Depot Balance SheetNicolas ErnestoNo ratings yet

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDocument5 pagesAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNo ratings yet

- Advanced AccountingDocument12 pagesAdvanced AccountingmayuriNo ratings yet

- Agabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cDocument7 pagesAgabongeverotabino Elaborate Cash Flow Preparation and Other Performance Measure Baba2cJasmine Cate JumillaNo ratings yet

- Management Accounting SchemeDocument8 pagesManagement Accounting SchemeSpandana Madhan SmrbNo ratings yet

- 04 Edu91 FM Practice Sheets FM Solution (Not To Print)Document154 pages04 Edu91 FM Practice Sheets FM Solution (Not To Print)Krutarth VyasNo ratings yet

- Inclusion To Gross Income - Part 3 (TORREON, Kimberly Shane) - Sheet3Document1 pageInclusion To Gross Income - Part 3 (TORREON, Kimberly Shane) - Sheet3Shane TorrieNo ratings yet

- Financial Management Economics For Finance 2023 1671444516Document36 pagesFinancial Management Economics For Finance 2023 1671444516RADHIKANo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- Gross Working CapitalDocument14 pagesGross Working Capitalfizza amjadNo ratings yet

- Perfect Practice SolutionDocument41 pagesPerfect Practice Solutionnarutevarsha5No ratings yet

- Fabm 2. Final ExamDocument3 pagesFabm 2. Final ExamSHIERY MAE FALCONITINNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument23 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementZrake 24No ratings yet

- Quiz Finma 0920Document6 pagesQuiz Finma 0920Danica Jane RamosNo ratings yet

- BBS 1st Year QuestionDocument2 pagesBBS 1st Year Questionsatya100% (1)

- Ce Quiz II (A+b+c)Document3 pagesCe Quiz II (A+b+c)Mohaiminur ArponNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- Practice Exam Chapters 1-5 (2) Solutions: Problem IDocument4 pagesPractice Exam Chapters 1-5 (2) Solutions: Problem IAtif RehmanNo ratings yet

- Act AssignmentDocument33 pagesAct AssignmentLabib KhanNo ratings yet

- Problem Ratio 2022Document1 pageProblem Ratio 2022Mohd shariqNo ratings yet

- Traditional Theory Approach: Illustrations 1Document7 pagesTraditional Theory Approach: Illustrations 1PRAMOD VNo ratings yet

- Financial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDDocument10 pagesFinancial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Solution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Document4 pagesSolution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Eyasu DestaNo ratings yet

- Solution For FM Extra QuestionsDocument130 pagesSolution For FM Extra Questionsdeepu deepuNo ratings yet

- Liquidity RatiosDocument3 pagesLiquidity RatiosMckenzie PalaganasNo ratings yet

- Chapter 5 Leverages - PracticeDocument10 pagesChapter 5 Leverages - PracticeAkshat SinghNo ratings yet

- Chapter 13 SCMDocument12 pagesChapter 13 SCMAliyah Francine Gojo CruzNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Financial Planning and Pro Forma Statements Simplistic Approach Part 2Document17 pagesFinancial Planning and Pro Forma Statements Simplistic Approach Part 2ishaNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- 6167f0c20cf2c12cd8917628 OriginalDocument34 pages6167f0c20cf2c12cd8917628 OriginalTM GamingNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Ratio Analysis Numericals - chp14Document5 pagesRatio Analysis Numericals - chp14Akshara DesaiNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- Assignment Ficd113Document4 pagesAssignment Ficd113Eiril DanielNo ratings yet

- Management 3Document6 pagesManagement 3Romnick TuboNo ratings yet

- The Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceDocument3 pagesThe Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceAbdullah Tousif MajumderNo ratings yet

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowTang De MelanciaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Quantitative Research Methods ScribdDocument6 pagesQuantitative Research Methods ScribdmahanteshkuriNo ratings yet

- Stepwise GuideDocument5 pagesStepwise GuidemahanteshkuriNo ratings yet

- Stevenson KeyWordsDocument1 pageStevenson KeyWordsmahanteshkuriNo ratings yet

- Residual Income ExampleDocument1 pageResidual Income ExamplemahanteshkuriNo ratings yet

- Budgeting and Reporting Template ExamplesDocument25 pagesBudgeting and Reporting Template ExamplesmahanteshkuriNo ratings yet