Professional Documents

Culture Documents

Director Kyc

Director Kyc

Uploaded by

vasanthaw0 ratings0% found this document useful (0 votes)

9 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

9 views2 pagesDirector Kyc

Director Kyc

Uploaded by

vasanthawCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 2

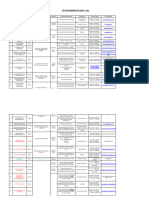

eee pensar sen tame Us}

cae =

| Customer CIF No. | |

Please Note: The information requested is in compllance ofthe rules and regulations sot out by the Financial Intelligence Unit (FIU) of

Contra! Bank of Sri Lanka and wil be trated with utmost confdentiaty

| Cargills Bank Limited

| Branch oa

Dear Si! Madam,

| the undersigned do hereby agree to comply with and be bound by all the prevailing Rules and Regulations relating tothe account to which |

‘am a party to, and further be bound by any variation, amendment and change made to the same as may be prescribed by the Bank from time

tote in future. | agree that this agreement shall be governed and construed in accordance with the laws of Si Lanka.

1. Name in ful : Rew Mr Mrs. Miss. =

Date of bith = 00107 3, Place of bith

4. "National Identity Card No.(PIDy" Date of issue

Nationality? saturn Othe Dualit Nanette county

ves Tee Couey snc Det ay I

5. Permanent address

Tol(Fixed) (Mobile) Fax E-mail

6. Correspondence address (it dies from above):

(7. Maiden name {8 Occupation / Position:

8. Name and address of employer (if applicable):

Tek -

410. Source(s) of income 11. Expected annual income

Expected Monthly Income: * LKR | tess nan 5,009 ‘000-1000 | waonanin |

22001 300,000 s0.0040,009 m0-100000 [| Above 000000 |] Netaptete

Wealth generated from * [| polesonersnpoment [| Gunese Omang || itatance | | vestments | | Savge |_| Oe spect)

|dentcaton of Poltically Exposed Person : Are you of any member of your family a Politically Exposed Person (PEP)"?

Primary Applicant: [| ves [| wo

In anyway relate to any ofthe persons refered to above: Yee | |no _Ifyes please stato the relationship

|am a subject of the USA Taxes as por tho Foreign Account Tax Compliant Act (FATCA) and fal within the categories mention herein

yes | |No 5

1) UsActtzens 2) USA.Citizens resident in another country

3) Individuals bon in the USA and resident in another country 4) Lawful residents ofthe USA, including a Green Card Holder

'5) Persons residing in the USA, 6) US Corporations, estates and trusts

7) Nor-UISA Entities! persons with substantial interest 8) ‘Non-USA Enites with at east one USA person

tony USA entity ‘asa substantial beneficial owner

9) Joint accounts where atleast one party falls within any of the above categories

“PID. Personal Identification No. — NIC, Passport, Driving License

OPS-Form-15-E-V5

your response is "Yes",

1. Please submit the Foreign Account Tax Compliant Act (FATCA) compliance form! obtained trom the Bank, along with your account

‘opening application,

2, | authorize Cargils Bank to furnish my information tothe US Inland Revenue services.

iF Enty: ‘Account Entry:

CF Auth: ‘Account Auth:

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Corporate Internet Banking Application v2Document4 pagesCorporate Internet Banking Application v2vasanthawNo ratings yet

- Annex 1.2Document2 pagesAnnex 1.2vasanthawNo ratings yet

- Signature CardsDocument1 pageSignature CardsvasanthawNo ratings yet

- Amadeus E LearningDocument2 pagesAmadeus E LearningvasanthawNo ratings yet

- AKOFE Life Members - 2012Document27 pagesAKOFE Life Members - 2012vasanthawNo ratings yet

- AKOFE Life Members - 2010Document4 pagesAKOFE Life Members - 2010vasanthawNo ratings yet

- 4Document1 page4vasanthawNo ratings yet

- AKOFE Life Members - 2013Document6 pagesAKOFE Life Members - 2013vasanthawNo ratings yet

- 2Document1 page2vasanthawNo ratings yet

- AKOFE Life Members - 2011Document8 pagesAKOFE Life Members - 2011vasanthawNo ratings yet

- 1Document1 page1vasanthawNo ratings yet

- 3Document1 page3vasanthawNo ratings yet

- 5Document1 page5vasanthawNo ratings yet

- 1Document1 page1vasanthawNo ratings yet