Professional Documents

Culture Documents

Jupiter International Limited

Jupiter International Limited

Uploaded by

Rahul syalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jupiter International Limited

Jupiter International Limited

Uploaded by

Rahul syalCopyright:

Available Formats

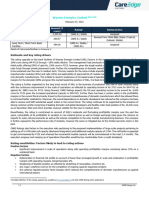

Press Release

Jupiter International Limited

March 11, 2022

Ratings

Amount

Facilities/Instruments Rating1 Rating Action

(Rs. crore)

CARE BB (Is); Stable

Issuer Rating^ 0.00 Assigned

[Double B (Issuer Rating); Outlook: Stable]

0.00

Total Instrument

(Rs. Only)

Non Convertible CARE BB; Stable

120.00 Reaffirmed

Debentures (Double B; Outlook: Stable)

120.00

Total Long Term

(Rs. One Hundred Twenty

Instruments

Crore Only)

Details of instruments/facilities in Annexure-1

^The issuer rating is subject to overall gearing not exceeding 2.50 times as on March 31,2022

Detailed Rationale & Key Rating Drivers

The rating assigned for issuer rating and the reaffirmation in rating to the instrument of Jupiter International Limited (JIL)

considers satisfactory financial performance during 9MFY22 (refers to April 01 to December 31, 2021). The rating continues to be

constrained by volatility in raw material and finished goods prices and highly regulated nature of solar industry. However, the

rating weaknesses are partially offset by group’s presence of more than a decade in manufacturing of solar cell coupled with

moderate capital structure and debt protection metrics.

Rating Sensitivities

Positive Factors - Factors that could lead to positive rating action/upgrade:

• Growth in scale of operations as marked by combined total operating income of above Rs.400 crore on a sustained basis.

• Completion of the proposed project within envisaged time and cost.

Negative Factors- Factors that could lead to negative rating action/downgrade:

• Decline in combined total operating income below Rs.300cr or PBILDT margin below 10% on a sustained basis.

• Deterioration in capital structure marked by overall gearing above 2.50x on a sustained basis.

Detailed description of the key rating drivers

Key Rating Weaknesses

Volatility in raw material prices and finished goods

Silicon wafer is the primary raw material for manufacturing SPV cells which is imported from China. Since raw material prices are

volatile in nature, the profitability margin of the company is susceptible to input price fluctuation. The company sources the

material at spot rates. So, the company is exposed to forex fluctuation risk as it makes the payment in USD. However, there’s a

natural hedge to some extent as the selling prices of cells are quoted in USD.

Highly regulated industry

India imports majority of solar equipment from China, Malaysia, Vietnam, and Thailand. Domestic Content Requirement (DCR)

was instituted in the Jawaharlal Nehru National Solar Mission from the beginning of 2010 in an effort to promote domestically

manufactured solar cells and modules for solar projects in India. However, the same was withdrawn subsequently with

intervention by WTO. Further, in order to promote domestic solar manufacturers, Government of India has launched various

schemes viz. Rooftop Program, Central public sector undertaking scheme (CPSU) and PM Kusum Scheme, which emphasizes on

using domestic manufactured modules and solar cells. Along with these schemes, Product Linked Incentive (PLI) and imposition

of Basic Custom Duty (BCD) augurs well for small sized solar project developers, rooftop power projects and residential customers

who rely largely on domestic solar modules. With the focus of government to encourage domestic cell manufacturers, Jupiter

group is expected to reap benefits out of the scheme & incentives along with the increase in demand for cells.

Project Risk

The group is setting up a new production line of 500 MW mono PERC cell in its existing facility in Baddi, Himachal Pradesh and

decommissioning JSPL’s existing line of 133 MW such that the total installed capacity of the group would be 801 MW. The company

expects to incur total capex cost of ~Rs 140 crore which would be funded partly by Non-Convertible Debentures and Optionally

Convertible Debentures to the tune of Rs 120 crore and remaining through internal accruals. The new production line is expected

to commence operations by August’2022.

Key Rating Strengths

Presence of over a decade of group in solar cell manufacturing business

Jupiter group is an established player in the solar cell manufacturing sector, with an operational track record of over a decade.

The installed capacity of the solar cell manufacturing facility stands at 434 MW. Mr. Alok Garodia (MD), son of Mr. R. K Garodia,

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

with an experience of more than a decade in solar industry is actively involved in the family business and looks after the day to

day affairs of the group. A team of qualified & experienced personnel assist the directors to oversee the business.

Satisfactory financial performance in the last two years

The performance of the group deteriorated in FY19 leading to significant decline in profitability which ultimately led to stretched

liquidity and delays in debt servicing with accounts of the company moving to NPA. This was due to sharp reduction in prices by

the Chinese manufacturers for both solar cells and modules. In FY20, with the government intervention to support the domestic

solar cell manufacturers through various schemes introduced coupled with the impact of safeguard duty, new orders at favorable

prices started pouring in for domestic solar manufacturers. This led to the improvement in financial performance for the company

in FY20 and FY21. PBILDT rose significantly from Rs -19 cr in FY19 to Rs 43 cr in FY20 and Rs 103 cr in FY21 due to the increase

in volumes of solar cells coupled with reduction in raw material cost. This resulted in an increase in PBILDT margins to 32.61%

in FY21 (3.88% in FY18). The group reported a TOI of Rs 317 cr in FY21 vis-à-vis Rs 231 cr in FY19. With improvement in PBILDT

and lower capital charge, GCA improved significantly in FY21. In 9MFY22, the group reported PBILDT of Rs 50.00 crore on TOI

of Rs 254 crore.

Moderate capital structure and debt protection metrics

The group has entered in a One Time Settlement (OTS) with its lenders in FY21. Also, part facilities of lenders were taken over

by Phoenix ARC as an ‘assignment of debt’, which is scheduled to be repaid by Jupiter Solar Power Limited (JSPL) in a deferred

payment schedule ending in Oct ’23. OTS settlement along with repayment of debt reduced the total debt of the group from Rs

283 cr as on March 31, 2020 to Rs 108 cr as on March 31, 2021. This reduction in total debt coupled with increase in networth

of the group led to improvement in leverage ratios in FY21. Interest coverage ratio increased from 4.05x in FY20 to 9.14x in FY21

on account of increase in PBILDT levels.

In order to expand its existing manufacturing facility, the group is setting up a new production line of 500 MW with an estimated

project cost of Rs 140 crore. The company has raised Rs 170 crore by way of issuance of Non-Convertible and Optionally

Convertible Debentures and the proceeds of the same shall be utilized partly for funding of project to the tune of Rs 120 crore

and partly for refinancing of existing term loans, payment of creditors and other working capital purposes. The company has

already repaid its existing term loan of ~Rs 27 crore from Phoenix ARC from these proceeds. With the issuance of debentures,

the overall gearing is expected to deteriorate in the near term, however; the same is expected to improve in the medium term

from the incremental cash flows generated post commercialization of new production line.

Industry Outlook

India has set an ambitious target of achieving 175 GW of installed renewable energy capacity, including 100 GW of solar power

by 2022. The long-term renewable energy capacity target stood at 450 GW by 2030, wherein solar power capacity shall have a

major share. The solar power sector in India is heavily dependent on imported solar cells and modules. India imports 80 to 90%

of solar equipment from China, Malaysia, Vietnam, and Thailand etc. To promote domestic solar cell & module manufacturing in

India and reduce dependence on imports, Ministry of New & Renewable Energy (MNRE) proposed the Basic Customs Duty (BCD)

structure w.e.f. April 01, 2022. Further, Union Cabinet also approved an outlay of ₹4,500 crore under PLI scheme for domestic

manufacturing of ‘High-efficiency Solar PV Modules’. With both the schemes in force, it is expected that the cost of domestic

modules largely at par with imported one going forward.

Liquidity: Adequate

The liquidity position of the company is adequate marked by gross cash accruals of Rs 89.07 crore at the consolidated level. The

average utilization of working capital limits stood at 89% for the last six months ended December 30, 2021. Going forward, the

projected cash accruals of the company are expected to be sufficient to meet the debt repayment obligations of the company.

Analytical approach: Consolidated

CARE has taken Consolidated approach as JIL’s subsidiary viz JSPL is engaged in similar line of business and there is operational

linkage between both the companies. This apart, JIL has also extended corporate guarantee for borrowings of JSPL.

Applicable Criteria

Criteria on assigning Outlook to Credit Ratings

CARE’s Policy on Default Recognition

Criteria for Short Term Instruments

Financial ratios – Non-Financial Sector

Rating Methodology-Manufacturing Companies

Liquidity Analysis of Non-Financial Sector Entities

Consolidation

About the Company

Jupiter International Ltd (JIL) was incorporated in 1978 by its founder-promoter Mr. Raj Kumar Garodia of Kolkata. JIL was

engaged in manufacturing and trading of computer peripherals and related products in the domestic market under the brand

name ‘Frontech’. In FY17 the company discontinued the manufacturing of IT peripherals due to lower demand for products.

However, trading of IT peripherals was continued till FY19. Further, the company had set up a solar cell manufacturing plant of

301 MW at its existing manufacturing facility which commenced operation in January 2017. The promoters have prior experience

2 CARE Ratings Ltd.

Press Release

in solar cell manufacturing through its subsidiary Jupiter Solar Power Limited (JSPL). JSPL was set up to foray into manufacturing

of solar photo voltaic cell (SPC) by setting up a unit at Baddi, Himachal Pradesh. The unit has an installed capacity of 133 MW.

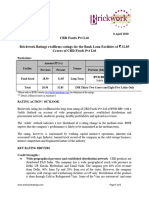

Brief Financials (Rs. crore) FY20 (A) FY21 (A) 9MFY22 (UA)

Total operating income 263.18 316.67 254.00

PBILDT 43.32 103.26 50.00

PAT 6.99 52.03 NA

Overall gearing (times) -3.84 1.50 NA

Interest coverage (times) 4.05 9.14 NA

A: Audited, UA: Unaudited, NA: Not Available

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Rating History for last three years: Please refer Annexure-2

Covenants of rated instrument / facility: Detailed explanation of covenants of the rated instruments/facilities is given in

Annexure-3

Complexity level of various instruments rated for this company: Annexure 4

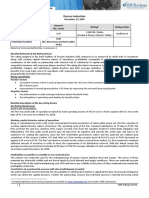

Annexure-1: Details of Instruments / Facilities

Size of

Rating assigned

Name of the Date of Coupon Maturity the Issue

ISIN along with Rating

Instrument Issuance Rate Date (Rs.

Outlook

crore)

Issuer Rating-Issuer

- - - - 0.00 CARE BB (Is); Stable

Ratings

Debentures-Non March 03, March 31,

INE467C07016 12% 120.00 CARE BB; Stable

Convertible Debentures 2022 2026

3 CARE Ratings Ltd.

Press Release

Annexure-2: Rating History of last three years

Current Ratings Rating history

Date(s)

Date(s) & &

Sr. Name of the Amount Date(s) & Date(s) &

Rating(s) Rating(s

No Instrument/Ban Outstandin Ratin Rating(s) Rating(s)

Type assigned )

. k Facilities g (Rs. g assigned in assigned in

in 2021- assigned

crore) 2020-2021 2018-2019

2022 in 2019-

2020

1)CARE D;

1)CARE BB;

ISSUER NOT

Stable 1)CARE D;

COOPERATING

CARE (27-Jan-22) ISSUER NOT

Fund-based - LT- *

1 LT 18.30 BB; COOPERATING -

Cash Credit (07-Mar-19)

Stable 2)CARE BB- *

; Stable (10-Jun-20)

2)CARE D

(06-Aug-21)

(16-Nov-18)

1)CARE D;

ISSUER NOT

1)CARE D;

COOPERATING

1)Withdraw ISSUER NOT

Term Loan-Long *

2 LT - - n COOPERATING -

Term (07-Mar-19)

(06-Aug-21) *

(10-Jun-20)

2)CARE D

(16-Nov-18)

1)CARE D /

CARE D;

1)CARE D / ISSUER NOT

CARE D; COOPERATING

1)Withdraw

Fund-based/Non- ISSUER NOT *

3 LT/ST - - n -

fund-based-LT/ST COOPERATING (07-Mar-19)

(06-Aug-21)

*

(10-Jun-20) 2)CARE D /

CARE D

(16-Nov-18)

1)CARE D;

ISSUER NOT

1)CARE D;

COOPERATING

Non-fund-based - 1)Withdraw ISSUER NOT

*

4 ST-Forward ST - - n COOPERATING -

(07-Mar-19)

Contract (06-Aug-21) *

(10-Jun-20)

2)CARE D

(16-Nov-18)

Debentures-Non CARE 1)CARE BB;

5 Convertible LT 120.00 BB; Stable - - -

Debentures Stable (27-Jan-22)

CARE

Issue

Issuer Rating- BB

6 r 0.00

Issuer Ratings (Is);

rating

Stable

4 CARE Ratings Ltd.

Press Release

Annexure-3: Detailed explanation of covenants of the rated instrument / facilities

Name of the Instrument Detailed explanation

NCD Issue of Rs 120 crore

I Capacity expansion Any further capacity expansion undertaken by the Issuer to be under a

separate 100% SPV of the Issuer. No guarantee obligation shall be

undertaken by the Issuer for any debt raised at the SPV level.

II Management control Promoters cannot step down from the Board/and or their executive positions

which they hold at the time of investment, except with the approval of the

investors.

III Fixed assets The issuer, Guarantor and the security providers shall not sell, lease,

transfer, alienate, deal with, dispose or in any manner deal with any of their

respective assets (including but not limited to the mortgaged properties) or

create any encumbrance thereon whatsoever without prior approval of

investors.

Annexure 4: Complexity level of various instruments rated for this company

Sr. No Name of instrument Complexity level

1 Debentures-Non Convertible Debentures Simple

Annexure 5: Bank Lender Details for this Company

To view the lender wise details of bank facilities please click here

Note on complexity levels of the rated instrument: CARE Ratings Ltd. has classified instruments rated by it on the basis of

complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any clarifications.

5 CARE Ratings Ltd.

Press Release

Contact us

Media Contact

Name: Mradul Mishra

Contact no.: +91-22-6754 3573

Email ID: mradul.mishra@careedge.in

Analyst Contact

Name: Anil More

Contact no.: 033-4018-1623

Email ID: anil.more@careedge.in

Relationship Contact

Name: Lalit Sikaria

Contact no.: + 91-033- 40181600

Email ID: lalit.sikaria@careedge.in

About CARE Ratings Limited:

Established in 1993, CARE Ratings Ltd. is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India (SEBI), it has also been acknowledged as an External Credit Assessment Institution (ECAI) by the

Reserve Bank of India (RBI). With an equitable position in the Indian capital market, CARE Ratings Limited provides a wide array

of credit rating services that help corporates to raise capital and enable investors to make informed decisions backed by knowledge

and assessment provided by the company.

With an established track record of rating companies over almost three decades, we follow a robust and transparent rating process

that leverages our domain and analytical expertise backed by the methodologies congruent with the international best practices.

CARE Ratings Limited has had a pivotal role to play in developing bank debt and capital market instruments including CPs,

corporate bonds and debentures, and structured credit.

Disclaimer

The ratings issued by CARE Ratings Limited are opinions on the likelihood of timely payment of the obligations under the rated

instrument and are not recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or

hold any security. These ratings do not convey suitability or price for the investor. The agency does not constitute an audit on

the rated entity. CARE Ratings Limited has based its ratings/outlooks based on information obtained from reliable and credible

sources. CARE Ratings Limited does not, however, guarantee the accuracy, adequacy or completeness of any information and

is not responsible for any errors or omissions and the results obtained from the use of such information. Most entities whose

bank facilities/instruments are rated by CARE Ratings Limited have paid a credit rating fee, based on the amount and type of

bank facilities/instruments. CARE Ratings Limited or its subsidiaries/associates may also be involved with other commercial

transactions with the entity. In case of partnership/proprietary concerns, the rating /outlook assigned by CARE Ratings Limited

is, inter-alia, based on the capital deployed by the partners/proprietor and the current financial strength of the firm. The

rating/outlook may undergo a change in case of withdrawal of capital or the unsecured loans brought in by the

partners/proprietor in addition to the financial performance and other relevant factors. CARE Ratings Limited is not responsible

for any errors and states that it has no financial liability whatsoever to the users of CARE Ratings Limited’s rating.

Our ratings do not factor in any rating related trigger clauses as per the terms of the facility/instrument, which may involve

acceleration of payments in case of rating downgrades. However, if any such clauses are introduced and if triggered, the

ratings may see volatility and sharp downgrades.

**For detailed Rationale Report and subscription information, please contact us at www.careedge.in

6 CARE Ratings Ltd.

You might also like

- Solar UpsDocument17 pagesSolar UpsSwaroop88% (16)

- Waaree Energies LimitedDocument6 pagesWaaree Energies LimitedHasik JainNo ratings yet

- Myra Hygiene Products Private LimitedDocument7 pagesMyra Hygiene Products Private Limitedanuj7729No ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- Tube Investments of India LimitedDocument8 pagesTube Investments of India Limitedpraveen kumarNo ratings yet

- Coral AssociatesDocument5 pagesCoral AssociatesFunny CloudsNo ratings yet

- PR Waaree Energies 13 05 2020Document7 pagesPR Waaree Energies 13 05 2020Komori YahatruNo ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- KrazyBee Services Private LimitedDocument9 pagesKrazyBee Services Private LimitedBalakrishnan IyerNo ratings yet

- Best Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument5 pagesBest Finance Corporation Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Care Rating Sterling - Addlife - India - Private - LimitedDocument6 pagesCare Rating Sterling - Addlife - India - Private - Limitedrahul.tibrewalNo ratings yet

- Naresh Kumar and Company Private LimitedDocument5 pagesNaresh Kumar and Company Private LimitedKunalNo ratings yet

- Press Release Udaipur Cement Works LimitedDocument6 pagesPress Release Udaipur Cement Works Limitedflying400No ratings yet

- Unit OperatorDocument7 pagesUnit OperatorJimmyNo ratings yet

- Vivriti Capital Private Limited PDFDocument9 pagesVivriti Capital Private Limited PDFIb SulochanaNo ratings yet

- Parasakti - IndRa - Dec 2022 - BBB+Document5 pagesParasakti - IndRa - Dec 2022 - BBB+SaranNo ratings yet

- Press Release: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release: Details of Instruments/facilities in Annexure-1Aman DubeyNo ratings yet

- JCBL India Private LimitedDocument6 pagesJCBL India Private LimitedRAMODSNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- TGV SRAAC LimitedDocument6 pagesTGV SRAAC Limitedjayadeep akasamNo ratings yet

- Aria CR Jun21Document5 pagesAria CR Jun21swamih.knightfrankNo ratings yet

- Godrej Industries LimitedDocument8 pagesGodrej Industries LimitedJigarNo ratings yet

- Home First Finance Company India LimitedDocument8 pagesHome First Finance Company India LimitedRAROLINKSNo ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- PSK Engineering Construction & Co-08-06-2020Document5 pagesPSK Engineering Construction & Co-08-06-2020The JdNo ratings yet

- CRD Foods 8apr2020Document6 pagesCRD Foods 8apr2020samudragupta05No ratings yet

- PR Baidyanath 19dec22Document6 pagesPR Baidyanath 19dec22tusharj0934No ratings yet

- Press Release Jash Engineering LTD.: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Jash Engineering LTD.: Details of Instruments/ Facilities in Annexure-1ArunVenkatachalamNo ratings yet

- Future Retail Limited: Carved Out of Working Capital Limits Details of Instruments/facilities in Annexure-1Document9 pagesFuture Retail Limited: Carved Out of Working Capital Limits Details of Instruments/facilities in Annexure-1Nostalgic MediatorNo ratings yet

- CG Power Credit RatingDocument6 pagesCG Power Credit Ratingdilipnayak101406No ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- Y-Wildcraft-India-18Oct 2022Document8 pagesY-Wildcraft-India-18Oct 2022PratyushNo ratings yet

- Emcer Tiles Private LimitedDocument4 pagesEmcer Tiles Private LimitedRudra RoyNo ratings yet

- Bhuwalka and Sons Private LimitedDocument4 pagesBhuwalka and Sons Private LimiteddoctorsabeehNo ratings yet

- Credit Rating Post March 2023Document26 pagesCredit Rating Post March 2023Sumiran BansalNo ratings yet

- Continental Carbon India LimitedDocument4 pagesContinental Carbon India LimitedKamaldeep MaanNo ratings yet

- IMC LimitedDocument5 pagesIMC LimitedMayank AgarwalNo ratings yet

- Gokak Textiles Limited: Ratings Reaffirmed Long-Term Rating Withdrawn Summary of Rating ActionDocument6 pagesGokak Textiles Limited: Ratings Reaffirmed Long-Term Rating Withdrawn Summary of Rating Actionabhi MestriNo ratings yet

- Press Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionDocument7 pagesPress Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionhamsNo ratings yet

- Roha Dyechem Private Limited: Rating RationaleDocument8 pagesRoha Dyechem Private Limited: Rating RationaleForall PainNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- Press Release: Positive Factors - Factors That Could Lead To Positive Rating Action/upgradeDocument4 pagesPress Release: Positive Factors - Factors That Could Lead To Positive Rating Action/upgradeACE CONSULTANTSNo ratings yet

- Save Microfinance Private Limited: RatingsDocument4 pagesSave Microfinance Private Limited: RatingsSubhamNo ratings yet

- Gna Gears LimitedDocument7 pagesGna Gears Limitedankityad129No ratings yet

- Mehala Machines India LimitedDocument4 pagesMehala Machines India LimitedKarthikeyan RK SwamyNo ratings yet

- Pump DesignDocument4 pagesPump Designmarathasanatani6No ratings yet

- Cleanmax IPP 2 Private LimitedDocument5 pagesCleanmax IPP 2 Private LimitedDhawal VasavadaNo ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Indotech Transformers LimitedDocument7 pagesIndotech Transformers Limitedpiyush.kundraNo ratings yet

- Subros LimitedDocument8 pagesSubros LimitedrajpersonalNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Sun Home Appliances Private - R - 25082020Document7 pagesSun Home Appliances Private - R - 25082020DarshanNo ratings yet

- Jodhani Papers Private LimitedDocument5 pagesJodhani Papers Private LimitedPunit PansariNo ratings yet

- Credit Rating - Jun 2021 - Atmastco - LimitedDocument4 pagesCredit Rating - Jun 2021 - Atmastco - LimitedSaurav GanguliNo ratings yet

- Olectra Greentech Limited - R - 27082020Document8 pagesOlectra Greentech Limited - R - 27082020eichermguptaNo ratings yet

- Document Service V2Document6 pagesDocument Service V2UTSAV DUBEYNo ratings yet

- Guidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaNo ratings yet

- Literature ReviewDocument15 pagesLiterature ReviewRahul syalNo ratings yet

- JIL Project File RAHUL SYAL-2Document24 pagesJIL Project File RAHUL SYAL-2Rahul syalNo ratings yet

- MSC Env 1Document4 pagesMSC Env 1Rahul syalNo ratings yet

- Rahul CV ...Document3 pagesRahul CV ...Rahul syalNo ratings yet

- Cover Letter BNYDocument1 pageCover Letter BNYRahul syalNo ratings yet

- RF Controlled Solar Energy CarDocument2 pagesRF Controlled Solar Energy CarIJIERT-International Journal of Innovations in Engineering Research and TechnologyNo ratings yet

- Design and Fabrication of Solar Electric VehicleDocument5 pagesDesign and Fabrication of Solar Electric VehicleVIVA-TECH IJRINo ratings yet

- Cheetah HC 72M: 390-410 WattDocument2 pagesCheetah HC 72M: 390-410 WattWilmerNo ratings yet

- PVC395 MP: Mono Crystalline PERC Photovoltaic (PV) ModuleDocument2 pagesPVC395 MP: Mono Crystalline PERC Photovoltaic (PV) ModuleNicolae ChirilaNo ratings yet

- Michell Zappa: @envisioningtechDocument51 pagesMichell Zappa: @envisioningtechJameel MoidheenNo ratings yet

- Renewable Energy Resources-UNIT-1Document9 pagesRenewable Energy Resources-UNIT-1kavya guptaNo ratings yet

- Automatic Cleaning System For Solar PanelDocument8 pagesAutomatic Cleaning System For Solar PanelSHIELDNo ratings yet

- Development in Dye Sensitized Solar CellsDocument15 pagesDevelopment in Dye Sensitized Solar CellsJyoti Ranjan Nanda100% (1)

- Simulation of A Solar MPPT Charger Using Cuk Converter For Standalone ApplicationDocument6 pagesSimulation of A Solar MPPT Charger Using Cuk Converter For Standalone ApplicationcashnuiNo ratings yet

- Testing and Performance Assessment of 1Kwp Solar Rooftop SystemDocument5 pagesTesting and Performance Assessment of 1Kwp Solar Rooftop Systemlaw100% (1)

- Related Studies 2Document4 pagesRelated Studies 2Aeron jay ZuelaNo ratings yet

- Gnaser H., Huber B., Ziegler C. - Nanocrystalline TiO2 For Photocatalysis (2004) PDFDocument32 pagesGnaser H., Huber B., Ziegler C. - Nanocrystalline TiO2 For Photocatalysis (2004) PDFoscuraNo ratings yet

- Sanyo Hip-205 200nkhb5Document2 pagesSanyo Hip-205 200nkhb5SolarShop AustraliaNo ratings yet

- P-Si Solar PanelsDocument18 pagesP-Si Solar PanelsNur AdlinaNo ratings yet

- CHAPTER 2 PV Tech PDFDocument35 pagesCHAPTER 2 PV Tech PDFPal KycNo ratings yet

- Solar PV FinalDocument24 pagesSolar PV FinalSakshi TaleNo ratings yet

- 154 Icrera2013 SpainDocument10 pages154 Icrera2013 SpainMarian EnachescuNo ratings yet

- Testing and Performance Assessment of 1KWp Solar Rooftop SystemDocument5 pagesTesting and Performance Assessment of 1KWp Solar Rooftop Systemsoumen sardarNo ratings yet

- EE6801-Electric Energy Generation, Utilization and ConservationDocument16 pagesEE6801-Electric Energy Generation, Utilization and ConservationDhanalakshmiNo ratings yet

- Improvise Solar Panel With The Use of Tinted Glasses and Aluminum FoilDocument3 pagesImprovise Solar Panel With The Use of Tinted Glasses and Aluminum Foiljonathangnolledo18No ratings yet

- Design of Autonomous Mobile PV System For Remote RegionsDocument4 pagesDesign of Autonomous Mobile PV System For Remote RegionsÇağrı UZAYNo ratings yet

- Materials Today: Proceedings: Shivanshu DixitDocument12 pagesMaterials Today: Proceedings: Shivanshu DixitGeo MatzarNo ratings yet

- DSP Lab 10Document25 pagesDSP Lab 10Komal EjazNo ratings yet

- Thermal Modeling of A Combined System of Photovoltaic Thermal PVT Solar Water HeaterDocument11 pagesThermal Modeling of A Combined System of Photovoltaic Thermal PVT Solar Water HeaterUmer AbbasNo ratings yet

- Solar ProposalDocument11 pagesSolar Proposalapi-236075673No ratings yet

- CNT in Solar Panel (Roll No 8)Document17 pagesCNT in Solar Panel (Roll No 8)Amruta Kharadkar50% (2)

- 12cb UNIT 8 - 3 TESTDocument8 pages12cb UNIT 8 - 3 TESTHuỳnh Lê Quang ĐệNo ratings yet

- A Presentation On Solar Water Pumping System: Department of Mechanical EngineeringDocument19 pagesA Presentation On Solar Water Pumping System: Department of Mechanical EngineeringDipak Khadka100% (1)

- Cheetah HC 72M-V: 390-410 WattDocument2 pagesCheetah HC 72M-V: 390-410 WattRaphael JimenezNo ratings yet