Professional Documents

Culture Documents

Bourguignon

Bourguignon

Uploaded by

Télesphore NgogaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bourguignon

Bourguignon

Uploaded by

Télesphore NgogaCopyright:

Available Formats

Spreading the Wealth

Fiscal instruments can reduce inequality, the bottom. Giving poor children access to better

education and paying for it by taxing the affluent

but some yield short-term results while is one way to reduce inequality while also fostering

others bear fruit over the long term future growth and poverty reduction. Redistributive

policies could also help narrow the gap between rich

François Bourguignon

A

and poor in countries with high inequality, where

fter years of quasi-neglect, economic social and political tensions or the rise of populist

inequality has taken center stage in the regimes might prove bad for growth in the long run.

policy debate worldwide. In advanced Knowing that a more equal distribution of resources

economies, the apparent impact of glo- may be good for development is one thing; having

balization and technological change and the cost the right instruments to implement it is another.

of counteracting these forces is raising concern. In These instruments—from progressive taxation, cash

developing economies, where inequality is higher, transfers, and investment in human capital to regu-

the issue is whether it poses a major obstacle to lation and inclusive growth strategies—do exist. But

raising growth and reducing poverty. In both cases, they are vastly underused in developing economies.

the redistribution of income might achieve not

only greater equality but also faster growth and, Straight income redistribution

ART: ISTOCK / TOPP_YIMGRIMM

for developing economies, faster poverty reduction. Taxation and income transfers to the poorest segment

In countries where growth is satisfactory but ben- of society are the most direct way to keep inequality

efits the poor much less than the non-poor, there in check and reduce poverty in the short term. These

obviously is a strong case for shifting resources from instruments are particularly appropriate when the

those at the top of the income scale to those at benefits of growth fail to reach the poor. But most

22 FINANCE & DEVELOPMENT | March 2018

BALANCING ACT

Transfers to the poor should not consist merely of cash; they

should also boost people’s capacity to generate income.

of the time they are too small to really make a dif- structure of tax rates and the consumption basket

ference. On average, taxes on personal income and of households at various rungs of the income scale

cash benefits to the poor are almost 10 times lower, (Higgins and Lustig 2016). In any case, lowering

as a proportion of GDP, than in advanced economies. taxes on goods such as food that weigh more in

The success of conditional cash transfer programs the budget of poor people achieves relatively little

has demonstrated that it is possible to transfer cash redistribution because wealthier people also consume

efficiently to poor people in developing economies. these goods, perhaps as a lower proportion of their

These cash transfer programs give money to house- budget but possibly in larger quantity. The same

holds on the condition that they comply with certain argument applies to subsidies for purchases of basic

pre-defined requirements, such as up-to-date vac- goods like bread or fuel. Income transfers are prefer-

cinations or regular school attendance by children. able to subsidies because they cost less and are better

The spread of such initiatives as Mexico’s Prospera targeted to the truly needy, as evidenced by the pilot

(previously Progresa), or Brazil’s Bolsa Família from experiments on the replacement of food subsidies

Latin America to other developing regions—as well by “direct benefit transfers” in some Indian states

as the results of several pilots in poorer sub-Saharan (Muralidharan, Niehaus, and Sukhtankar 2017).

African countries—shows the progress made in the There is therefore a strong case for the expansion of

last 15 years or so in the field of redistribution. New redistribution in developing economies when growth

methods of means testing and cash distribution have is satisfactory but poverty reduction is slow. There

made it possible (see “Reaching Poor People” in the are political obstacles to doing so, however, as well

December 2017 F&D). as challenges related to the country’s administrative

Such programs should continue to improve in the capacity. Political opposition may well remain, but

future, thanks to advances in information technology, modern information technology is likely to improve

particularly the use of mobile money. But their current administrative capacity.

impact on poverty and inequality is limited. Their

main weakness is their size, which amounts to 0.5 Increasing opportunities

percent of GDP at most in middle-income countries. Income redistribution will lower poverty by reducing

In poorer countries, they are still at the pilot stage. inequality, if done properly. But it may not accelerate

Expanding those programs requires more growth in any major way, except perhaps by reducing

resources. A higher and more effective income social tensions arising from inequality and allowing

tax in the upper part of the income scale could poor people to devote more resources to human and

help raise the necessary funds. In this respect, the physical asset accumulation. Directly investing in

generalized use of bank accounts, credit cards, opportunities for poor people is essential. Transfers

and debit cards by higher-income people in most to the poor should not consist merely of cash; they

countries should make it easier to monitor personal should also boost people’s capacity to generate income,

incomes and reduce tax evasion. Political economy today and in the future. Education and training as well

issues aside, this should lead developing economies’ as access to health care, micro-credit, water, energy,

governments to place more emphasis on direct and transportation are powerful instruments. Social

taxation than they presently do. assistance is critical to prevent people from falling

Developing economies tend to rely relatively more into poverty traps when adverse shocks hit. Programs

than advanced economies on the indirect taxation of such as India’s Mahatma Gandhi National Rural

domestic and imported goods and services. Indirect Employment Guarantee, in which the state acts as

taxes are said to be regressive because they tax con- the employer of last resort, do precisely that.

sumption rather than income, and wealthier people Conditional cash transfers have been shown to

save a higher proportion of their income. But in motivate families to send their children to school,

addition, indirect taxation in developing econo- improve their nutrition, and monitor their health.

mies may even increase poverty depending on the But facilities to meet this additional demand must

March 2018 | FINANCE & DEVELOPMENT 23

BALANCING ACT

be made available and must be financed. The same workers, as predicted by the efficiency wage theory.

is true of other programs focusing on improving Part of the drop in inequality observed in Brazil at

opportunities for the poor. Financing these pro- the turn of the century just as growth was accelerating

grams through progressive taxation while providing has been partly attributed to the significant increase

cash transfer incentives to poor households thus in the minimum wage (Komatsu and Filho 2016).

reduces inequality and poverty in the short term Anti-discrimination laws can also promote

and helps these households generate more income equality and foster growth by improving work

over the medium and long term. and training incentives for minority groups. And

Is such a strategy of static and dynamic income anti-corruption strategies, by reducing rent seeking,

equalization immune to the efficiency cost of redistri- are probably the best candidates for both enhancing

bution? In other words, do these taxes and transfers growth and income equality, even if the inequality

take away the incentives for people to work, save, and arising from corruption is often difficult to observe.

become entrepreneurs? Given the limited scope of Governments can draw on an array of policies to

redistribution in developing economies, it is unlikely foster growth by reducing inequality and ensuring

that it would have much effect on economic incen- that growth reduces poverty. The policies they

tives. Substantial income tax progressivity may indeed adopt will depend on the relative importance of

be achieved with marginal tax rates much below these two objectives and the time horizon over

those in advanced economies, where redistribution is which they can be expected to deliver results.

not considered to be an obstacle to growth (Lindert Pure income redistribution policies generate less

2004). Also, replacing distortionary indirect taxes or future growth than those policies that expand the

economic opportunities of poor people—but they

The choice is difficult because reduce poverty immediately. They also alleviate

social tensions and may thus free growth con-

some parties will necessarily straints in the case of excessive inequality. On the

other hand, policies that enhance opportunities for

lose in the short run. the poor do less to reduce inequality today, essen-

tially through taxation, but result in faster growth,

subsidies with income transfers should improve effi- less poverty, and greater equality tomorrow.

ciency. Moreover, conditional cash transfers appear It is up to governments to choose their preferred

to have no significant negative effect on labor supply; policy combination. The choice is difficult because

they may even encourage entrepreneurship (Bianchi some parties will necessarily lose in the short run and

and Boba 2013). might not make up for this loss anytime soon. Yet

Strategies that promote greater equality and instruments are available today that would benefit all

stronger growth rely on raising resources in a pro- in the long run, through faster growth, more rapid

gressive way and spending them on programs that poverty reduction, and less inequality. It would

benefit the poorest segment of the population in be a serious mistake not to make use of them.

this generation or the next one. Other policies

that do not rely on redistribution may achieve the FRANÇOIS BOURGUIGNON is a professor emeritus at the

same goals. Before contemplating redistribution, Paris School of Economics. He was the World Bank’s chief

however, governments ought to consider enhanc- economist from 2003 to 2007.

ing the pro-poor nature or inclusiveness of their

growth strategies, in particular through fostering References:

employment for unskilled workers. Bianchi, M., and M. Boba, 2013, “Liquidity, Risk, and Occupational Choices.” Review of

Other policies besides straight redistribution are Economic Studies, 80 (2): 491–511.

also available. Minimum wage laws—although con- Higgins, Sean, and Nora Lustig. 2016. “Can a Poverty-Reducing and Progressive Tax and

troversial in advanced economies because of their Transfer System Hurt the Poor?” Journal of Development Economics 122: 63-75.

potentially negative effects on employment when Komatsu, B. Kawaoka, and N. Menezes Filho. 2016. “Does the Rise of the Minimum Wage

the minimum is set too high—generate more equal- Explain the Fall of Wage Inequality in Brazil?” Policy Paper 16, INSPER, São Paulo.

ity in the distribution of earnings. In developing Lindert, P. 2004. Growing Public. Cambridge, United Kingdom: Cambridge University Press.

economies, such policies may actually increase labor Muralidharan, K., Paul Niehaus, and Sandip Sukhtankar. 2017. “Direct Benefit Transfers in

productivity by improving the physical condition of Food: Results from One Year of Process Monitoring in Union Territories.” UC San Diego.

24 FINANCE & DEVELOPMENT | March 2018

You might also like

- L4-M1 ProcScope PPT 6-19Document226 pagesL4-M1 ProcScope PPT 6-19Sorna Khan100% (3)

- NSU ECO 631 Spring 2020 Assignment SolutionDocument13 pagesNSU ECO 631 Spring 2020 Assignment SolutionTawhid QurisheNo ratings yet

- CrossIndustry v721 Vs v611Document977 pagesCrossIndustry v721 Vs v611andhika_sotaxNo ratings yet

- Mallya Judgment 10.12.18 FINALDocument74 pagesMallya Judgment 10.12.18 FINALThe Wire86% (7)

- My Part of The PresentationDocument3 pagesMy Part of The PresentationjihanNo ratings yet

- Government and The Cost of Living: Income-Based vs. Cost-Based Approaches To Alleviating PovertyDocument28 pagesGovernment and The Cost of Living: Income-Based vs. Cost-Based Approaches To Alleviating PovertyCato InstituteNo ratings yet

- Over The Last Decade or So, Conditional Cash Transfer (CCT) Programs Have Proliferated in LatinDocument3 pagesOver The Last Decade or So, Conditional Cash Transfer (CCT) Programs Have Proliferated in LatinElizabeth AgNo ratings yet

- Who Gets What? The Political Economy of RedistributionDocument2 pagesWho Gets What? The Political Economy of RedistributionSTEPHEN NEIL CASTAÑONo ratings yet

- Discussion For Chap. 4Document2 pagesDiscussion For Chap. 4Juvilyn PaccaranganNo ratings yet

- Problems of PoliciesDocument2 pagesProblems of PoliciesAirah Jane TiglaoNo ratings yet

- 2016 SR Paraguay EngDocument3 pages2016 SR Paraguay EngSinergias ConsultoraNo ratings yet

- Does Economic Growth Reduce Poverty?: Michael Roemer and Mary Kay GugertyDocument33 pagesDoes Economic Growth Reduce Poverty?: Michael Roemer and Mary Kay GugertyLoredel Doria LueteNo ratings yet

- Ie More Than Proportional-In Wealth or GDP Due To A Sound Adaptation To The Newly Formed SocialDocument3 pagesIe More Than Proportional-In Wealth or GDP Due To A Sound Adaptation To The Newly Formed SocialnoeljeNo ratings yet

- Should Equity Be A Goal of EconomicDocument8 pagesShould Equity Be A Goal of EconomicMuzna AijazNo ratings yet

- Social Issue (World History)Document2 pagesSocial Issue (World History)HaKaHiNaNo ratings yet

- Policy Options On Income Inequality and Poverty: Some Basic ConsiderationsDocument10 pagesPolicy Options On Income Inequality and Poverty: Some Basic ConsiderationskathNo ratings yet

- A) Altering The Functional DistributionDocument2 pagesA) Altering The Functional Distributionalways, dandiNo ratings yet

- Curato, Strawberry D.Document5 pagesCurato, Strawberry D.Strawberry CuratoNo ratings yet

- AE 210 - Assignment # 2Document3 pagesAE 210 - Assignment # 2Jinuel PodiotanNo ratings yet

- Economic Development - Chapter 1Document3 pagesEconomic Development - Chapter 1July StudyNo ratings yet

- Module 4 6Document9 pagesModule 4 6Nakhwal, Baldev II S.No ratings yet

- SSRN Id3865087Document37 pagesSSRN Id3865087Felipe SilvaNo ratings yet

- Low To Moderate Economic Growth For The Past 40 YearsDocument2 pagesLow To Moderate Economic Growth For The Past 40 YearsMarkean CondeNo ratings yet

- Social Cash TransfersDocument6 pagesSocial Cash TransfersAliya TokpayevaNo ratings yet

- Poverty Reduction Thesis PDFDocument6 pagesPoverty Reduction Thesis PDFcrystalalvarezpasadena100% (2)

- Developmental EconomicsDocument30 pagesDevelopmental EconomicsMarilyn M. MendozaNo ratings yet

- Inclusive GrowthDocument8 pagesInclusive GrowthAarthi PadmanabhanNo ratings yet

- Ten Solutions To PovertyDocument19 pagesTen Solutions To PovertyLeilaAviorFernandezNo ratings yet

- As#3 Prelim GragaslaoDocument2 pagesAs#3 Prelim GragaslaoAira Mae R. GragaslaoNo ratings yet

- Agam - Draft of Synthesis Paper 23-24Document24 pagesAgam - Draft of Synthesis Paper 23-24agampreet8500No ratings yet

- How Should The US Reduce Economic Inequality? Student EssayDocument2 pagesHow Should The US Reduce Economic Inequality? Student EssayShizatar LindorNo ratings yet

- MidtermDocument13 pagesMidtermnimbus1208No ratings yet

- Fiscal FunctionsDocument3 pagesFiscal FunctionsAshashwatmeNo ratings yet

- Universal Basic IncomeDocument31 pagesUniversal Basic IncomeumairahmedbaigNo ratings yet

- Econ 1 NPerformance TaskDocument5 pagesEcon 1 NPerformance TaskJan Mike T. MandaweNo ratings yet

- What Is IGDocument16 pagesWhat Is IGSonu SyalNo ratings yet

- Evolution of Thinking About Poverty: Phase I: Income and Expenditure Based ThinkingDocument9 pagesEvolution of Thinking About Poverty: Phase I: Income and Expenditure Based ThinkingShoaib ShaikhNo ratings yet

- SAPsDocument2 pagesSAPsMekhi ReidNo ratings yet

- There Are Four Reasons To Measure Poverty:: One ApproachDocument6 pagesThere Are Four Reasons To Measure Poverty:: One ApproachHilda Roseline TheresiaNo ratings yet

- Towards Poverty Reduction StrategyDocument11 pagesTowards Poverty Reduction Strategytjuttje596No ratings yet

- #4 The Tax Base and The Dependency Ratio in The Less Developed WorldDocument3 pages#4 The Tax Base and The Dependency Ratio in The Less Developed World조병연No ratings yet

- Barro 2000 - Inequality and Growth in A Panel of CountriesDocument28 pagesBarro 2000 - Inequality and Growth in A Panel of Countriesbb_tt_AANo ratings yet

- Neg - MMT Job Guarantee - Michigan 7 2023 BEJJPDocument120 pagesNeg - MMT Job Guarantee - Michigan 7 2023 BEJJPbonnettesadieNo ratings yet

- Executive Summary: Chapter 1: Fiscal Policies To Address The COVID-19 PandemicDocument3 pagesExecutive Summary: Chapter 1: Fiscal Policies To Address The COVID-19 PandemicVdasilva83No ratings yet

- Income Inequality, Poverty and GrowthDocument18 pagesIncome Inequality, Poverty and Growthpinkranger-4No ratings yet

- Structural Reforms-The Only Way To Escape The Poverty TrapDocument5 pagesStructural Reforms-The Only Way To Escape The Poverty TrapAQEEL AHMED BAZMINo ratings yet

- CSS Essay Poverty Alleviation - Complete Solved Essay (CSS Exams 2005)Document5 pagesCSS Essay Poverty Alleviation - Complete Solved Essay (CSS Exams 2005)Muhammad Gulraiz Muhammad GulraizNo ratings yet

- Ch2 - Income Inequality and Structural ChangeDocument22 pagesCh2 - Income Inequality and Structural ChangeJazmene BasitNo ratings yet

- Poverty and Inequality. Todaro and SmithDocument4 pagesPoverty and Inequality. Todaro and SmithzoeNo ratings yet

- 1.7 W: JAM: Economic Outlook, Prospects, and Policy ChallengesDocument1 page1.7 W: JAM: Economic Outlook, Prospects, and Policy ChallengesSagargn SagarNo ratings yet

- Asias Journey Chapter 11Document26 pagesAsias Journey Chapter 11MikedaNo ratings yet

- Alawan-Roumasset - Article ReviewDocument3 pagesAlawan-Roumasset - Article ReviewNathalia AlawanNo ratings yet

- Impact and Solution For Inequality-Bernardo Gumarang-MST-Soc. SciDocument2 pagesImpact and Solution For Inequality-Bernardo Gumarang-MST-Soc. SciNard Kindipan GumarangNo ratings yet

- JETIR2310318Document1 pageJETIR2310318Manisha ChoudhuryNo ratings yet

- 1892 - Economics-1 - Approach Answer - E - 2022Document5 pages1892 - Economics-1 - Approach Answer - E - 2022sinchaNo ratings yet

- Help Poor Countries With MoneyDocument4 pagesHelp Poor Countries With MoneyLưu Lê Thục NhiênNo ratings yet

- Social Issue PTDocument3 pagesSocial Issue PTYukiiNo ratings yet

- CSS Essays PDFDocument25 pagesCSS Essays PDFAr NaseemNo ratings yet

- Key Highlights of NITI Aayog's Occassional Paper On "Eliminating Poverty: Creating Jobs and Strengthening Social Programs"Document4 pagesKey Highlights of NITI Aayog's Occassional Paper On "Eliminating Poverty: Creating Jobs and Strengthening Social Programs"akash agarwalNo ratings yet

- Session 6 Reading 3 Universal - Basic - IncomeDocument3 pagesSession 6 Reading 3 Universal - Basic - Incomemohit gargNo ratings yet

- Ending Poverty: How People, Businesses, Communities and Nations can Create Wealth from Ground - UpwardsFrom EverandEnding Poverty: How People, Businesses, Communities and Nations can Create Wealth from Ground - UpwardsNo ratings yet

- Swindled: If Government is ‘for the people’, Why is the King Wearing No Clothes?From EverandSwindled: If Government is ‘for the people’, Why is the King Wearing No Clothes?Rating: 5 out of 5 stars5/5 (2)

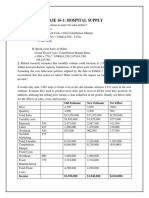

- Case 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Document6 pagesCase 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Lalit SapkaleNo ratings yet

- Project On Compensation and Benefits Ufone: Submitted To: Respected MR - Habib KhanDocument22 pagesProject On Compensation and Benefits Ufone: Submitted To: Respected MR - Habib KhanAbdul QadoosNo ratings yet

- Managers Can't Do It AllDocument1 pageManagers Can't Do It AllJuliana AnselmoNo ratings yet

- Financial StatementsDocument12 pagesFinancial StatementsDino DizonNo ratings yet

- Ukcs Production Efficiency GuidanceDocument13 pagesUkcs Production Efficiency GuidanceLesly RiveraNo ratings yet

- Squart Trading ViewDocument2 pagesSquart Trading ViewChandrashekar BNo ratings yet

- Rekapitulasi Anggaran Biaya: NO Uraian Jumlah HargaDocument2 pagesRekapitulasi Anggaran Biaya: NO Uraian Jumlah HargaSyamsuddinNo ratings yet

- WP 243Document87 pagesWP 243instt_engNo ratings yet

- "A Highly Skilled Workforce Is A Must ... ": - Rohan Gulati, Projects Director, Sundex Process Engineers Pvt. LTDDocument2 pages"A Highly Skilled Workforce Is A Must ... ": - Rohan Gulati, Projects Director, Sundex Process Engineers Pvt. LTDPrashant Bansod100% (1)

- The Product Guide: A Look at Our Platform's Newest Advertising SolutionsDocument36 pagesThe Product Guide: A Look at Our Platform's Newest Advertising SolutionsHECTOR BARRERA VILLAMILNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument23 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsFery AnnNo ratings yet

- Test Bank For M Finance 3rd Edition by CornettDocument36 pagesTest Bank For M Finance 3rd Edition by Cornettcorinneheroismf19wfo100% (42)

- Mahul Patta Processing Unit - SonhatDocument22 pagesMahul Patta Processing Unit - Sonhatharsh vardhanNo ratings yet

- Fco Oficial Company Brahm Inc...Document9 pagesFco Oficial Company Brahm Inc...Phill BonatoNo ratings yet

- COVID 19 S Impact On Globalization and InnovationDocument7 pagesCOVID 19 S Impact On Globalization and InnovationRabiya TungNo ratings yet

- Week3 Intermediate1 - PracticeDocument12 pagesWeek3 Intermediate1 - PracticeRaj Kothari MNo ratings yet

- Contract - RegularDocument5 pagesContract - Regularabanganjm08No ratings yet

- Scaling Robotic Process AutomationDocument17 pagesScaling Robotic Process Automationserge ziehiNo ratings yet

- 31.05.2023 Notificari Sunset PT - Postat Incepand Cu Luna IUNIE 2016Document20 pages31.05.2023 Notificari Sunset PT - Postat Incepand Cu Luna IUNIE 2016Anca ToaderNo ratings yet

- Implementing Information Security System: Prof. Georgette Carpio-Balajadia, Cpa, PHDDocument33 pagesImplementing Information Security System: Prof. Georgette Carpio-Balajadia, Cpa, PHDMike AntolinoNo ratings yet

- Right To SafetyDocument5 pagesRight To SafetyAshu BhoirNo ratings yet

- Cost Acc BBA VDocument3 pagesCost Acc BBA VHamza TariqNo ratings yet

- Types of Supply ChainDocument6 pagesTypes of Supply ChainLusimer AtencioNo ratings yet

- 05 Quiz 1Document2 pages05 Quiz 1prettyboiy19No ratings yet

- Forecasting and PurchasingDocument25 pagesForecasting and PurchasingPartha Pratim SenguptaNo ratings yet

- Fabm 2 and FinanceDocument5 pagesFabm 2 and FinanceLenard TaberdoNo ratings yet

- Themes (AQA) Test Questions - AQA - GCSE English Language Revision - BBC BitesizeDocument5 pagesThemes (AQA) Test Questions - AQA - GCSE English Language Revision - BBC Bitesizemegolov536No ratings yet