Professional Documents

Culture Documents

Corp Part

Corp Part

Uploaded by

Aira Mae MendozaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corp Part

Corp Part

Uploaded by

Aira Mae MendozaCopyright:

Available Formats

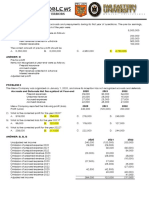

Prob.

1

MM Corp., a DC, established in 2010 had the ff. data during the year:

2022 2023

Gross sales 45,600,000 40,350,000

Cost of sales 8,700,000 10,200,000

Non-operating income 300,000 -

Dividend from a DC 25,000 -

Expenses 36,700,000 26,850,000

1. Tax due in 2022 if it is qualified on the 20% rate? ________________

2. Income tax payable in 2023 _______________________

Prob. 2

MM Corp., a RFC, established in 2015 had the ff. amount of gross income and expenses from 2020 to 2023:

Year Gross Income Expenses

2020 50,000,000 49,600,000

2021 38,000,000 37,700,000

2022 51,200,000 49,250,000

2023 70,000,000 57,500,000

1. Tax due in 2020 _____________

2. Tax due in 2021 ____________

3. Tax due in 2022 _____________

3. Tax due in 2023 ________________

Prob. 3

BimBam Partnership, a business partnership, had the ff. data of income and expenses:

Gross income 7,500,000

Expenses 2,000,000

Partners Bim and Bam share profits and losses in the ration of 55% and 45% respectively.

Income tax payable of BimBam Partnership ______________

Final taxes on respective shares of Bim _________________ and Bam _______________

You might also like

- Ia2 Prob 1-24 & 25Document2 pagesIa2 Prob 1-24 & 25maryaniNo ratings yet

- AFAR Self Test - 9002Document7 pagesAFAR Self Test - 9002Jennifer RueloNo ratings yet

- Errors - Discussion ProblemsDocument2 pagesErrors - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- Error Correction Quiz CompressDocument9 pagesError Correction Quiz CompressArvelyn AtaydeNo ratings yet

- Topic 2 Installment Sales Module Part 1Document5 pagesTopic 2 Installment Sales Module Part 1Maricel Ann BaccayNo ratings yet

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet

- Far-Single Entry PDFDocument7 pagesFar-Single Entry PDFJanica June FiscalNo ratings yet

- NU - Correction of Errors Single Entry Cash To AccrualDocument8 pagesNU - Correction of Errors Single Entry Cash To AccrualJem ValmonteNo ratings yet

- T8 - Exam Revision 2 - SDocument4 pagesT8 - Exam Revision 2 - Skst-26024No ratings yet

- Auditing Problems: Ap - 01: Correction of ErrorsDocument15 pagesAuditing Problems: Ap - 01: Correction of ErrorsPrinces100% (2)

- Numbers 36 and 37 (Installment Sales)Document2 pagesNumbers 36 and 37 (Installment Sales)elsana philipNo ratings yet

- Assumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceDocument4 pagesAssumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceAireyNo ratings yet

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- A6-A7. Ikon Paints ValuationDocument2 pagesA6-A7. Ikon Paints Valuationmohantyrishita2000No ratings yet

- Special Trans Activity 2Document15 pagesSpecial Trans Activity 2Rachelle JoseNo ratings yet

- Income Taxation On Corporations Exercise Problems BSADocument2 pagesIncome Taxation On Corporations Exercise Problems BSARico, Jalaica B.No ratings yet

- Miscellaneous TopicsDocument93 pagesMiscellaneous Topicsgean eszekeilNo ratings yet

- Intermediate Accounting II Chapter 18Document2 pagesIntermediate Accounting II Chapter 18izza zahratunnisaNo ratings yet

- SCM Budget BSA2ADocument3 pagesSCM Budget BSA2AKaymark Lorenzo0% (2)

- 8506 - Installment Sales - 113910598Document4 pages8506 - Installment Sales - 113910598Ryan CornistaNo ratings yet

- Afar 3Document7 pagesAfar 3Diana Faye CaduadaNo ratings yet

- ACCTG 105 Midterm - Quiz No. 02 - Accounting Changes and Errors (Answers)Document2 pagesACCTG 105 Midterm - Quiz No. 02 - Accounting Changes and Errors (Answers)Lucas BantilingNo ratings yet

- Universidad de ManilaDocument2 pagesUniversidad de ManilaShiela Mae Pon AnNo ratings yet

- Acc. For D.M. MQP April 2021Document4 pagesAcc. For D.M. MQP April 2021Rohith RNo ratings yet

- FAR MA-2023 QuestionDocument4 pagesFAR MA-2023 QuestionMd HasanNo ratings yet

- Accounting For Taxes Employee BenefitsDocument6 pagesAccounting For Taxes Employee BenefitsBess Tuico MasanqueNo ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- Activity McitDocument1 pageActivity McitJenny AguilaNo ratings yet

- LiabilitiesDocument2 pagesLiabilitiesFrederick AbellaNo ratings yet

- Accounting For Income Tax QuizDocument5 pagesAccounting For Income Tax QuizTorico BryanNo ratings yet

- INSTALLMENT SALES Part 2Document1 pageINSTALLMENT SALES Part 2Shaina GarciaNo ratings yet

- AP 200 3 Change in Accounting Estimates Change in Accounting Policy and Correction of Errors StudentsDocument4 pagesAP 200 3 Change in Accounting Estimates Change in Accounting Policy and Correction of Errors StudentsMonica mangobaNo ratings yet

- Installment SalesDocument4 pagesInstallment Saleskat kaleNo ratings yet

- Chapter 18 ProblemsDocument4 pagesChapter 18 ProblemsAhritch DalanginNo ratings yet

- CSS Accounting Papers-1Document2 pagesCSS Accounting Papers-1rabia khanNo ratings yet

- Construction ContractsDocument4 pagesConstruction ContractsAnjelica MarcoNo ratings yet

- 1BSA Final ExamDocument11 pages1BSA Final ExamcamillaNo ratings yet

- Reviewer For Final Examination - ProblemsDocument11 pagesReviewer For Final Examination - Problemsreynald animosNo ratings yet

- TX Zwe Examiner's Report June 2022Document10 pagesTX Zwe Examiner's Report June 2022Sean ChigagaNo ratings yet

- Classroom Exercise - Unit 1-1Document2 pagesClassroom Exercise - Unit 1-1Hannah Jane ToribioNo ratings yet

- Ap02 Error Corrections and Accounting ChangesDocument2 pagesAp02 Error Corrections and Accounting ChangesJean Fajardo BadilloNo ratings yet

- Installment-Sales-Supplementary-Problems & NotesDocument3 pagesInstallment-Sales-Supplementary-Problems & NotesAlliah Mae ArbastoNo ratings yet

- Axis Bank AR 2022-23 - MD-ADocument34 pagesAxis Bank AR 2022-23 - MD-Aomprakashjangili29No ratings yet

- Intermediate Accounting III: Pre-Test - Errors and ChangesDocument2 pagesIntermediate Accounting III: Pre-Test - Errors and ChangesMay RamosNo ratings yet

- Jobb Internet AdvertisingDocument2 pagesJobb Internet Advertisingrethaxaba82No ratings yet

- Case Study Invetment DecisionDocument8 pagesCase Study Invetment DecisionKelsy NguyenNo ratings yet

- The Company's Related Parties Include:: Key Management PersonnelDocument4 pagesThe Company's Related Parties Include:: Key Management PersonnelUNITED REBUILDERS INC.No ratings yet

- Tut TaxDocument6 pagesTut TaxKieu Anh Bui LeNo ratings yet

- 92 08 DeductionsDocument18 pages92 08 DeductionsNikkoNo ratings yet

- Actng For Taxes Employees BenefitsDocument3 pagesActng For Taxes Employees BenefitsBridget Zoe Lopez BatoonNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Problem 1: A) Schedule To Determine The Amount of Income That The Company Should Recognizie On Every YearDocument13 pagesProblem 1: A) Schedule To Determine The Amount of Income That The Company Should Recognizie On Every YearCiarwena PangcogaNo ratings yet

- Ia2 Prob 1-20 & 21Document2 pagesIa2 Prob 1-20 & 21maryaniNo ratings yet

- Quiz Discontinued OperationsDocument2 pagesQuiz Discontinued OperationsMENDOZA, GLENDA S.No ratings yet

- Pembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 2019Document64 pagesPembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 201917HARISA SETYA HANDININo ratings yet

- Income Taxes Batch 4 (Repaired)Document10 pagesIncome Taxes Batch 4 (Repaired)Lealyn Martin BaculoNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- Tutorial Set 2 Public Sector BudgetngDocument7 pagesTutorial Set 2 Public Sector Budgetngq9dpc6fyd2No ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet