Professional Documents

Culture Documents

Understanding Securitization1

Understanding Securitization1

Uploaded by

Gordon SchumwayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Understanding Securitization1

Understanding Securitization1

Uploaded by

Gordon SchumwayCopyright:

Available Formats

Understanding Securitization

It is important to have a general familiarity with mortgage securitization in order to

understand the foreclosure process. Securitization involves a series of conveyances of the

note evidencing the residential loan and assignment of the mortgage or trust deed securing

it. Therefore, chain of title and beneficial interest issues frequently turn on the

securitization trajectories.

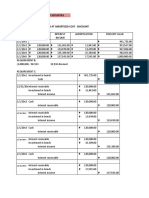

Securitization is the process pooling loans into “mortgage‐ backed securities” or

“MBS” for sale to investors. MBS is an investment instrument backed by an undivided

interest in a pool of mortgages or trust deeds. Income from the underlying mortgages is

used to pay interest and principal on the securities. Figure A below is a simplified

schematic depicting the general securitization process and some of the parties involved.

The process begins with Originators, which are the lenders (such as banks or finance

companies) that initially make the loans to homeowners. Sponsor/Sellers (or “sponsors”)

purchase these loans from one or more Originators to form the pool of assets to be

securitized. (Most large financial institutions are both Originators and Sponsor/Sellers.) A

Depositor creates a Securitization Trust, a special‐purpose entity, for the securitized

transaction. The depositor acquires the pooled assets from the Sponsor/Seller and in

turn deposits them into the Securitization Trust. An Issuer acquires the Securitization

Trust and issues certificates to eventually be sold to investors. However, the Issuer does

not directly offer the certificates for sale to the investors. Instead, the Issuer conveys the

certificate to the Depositor in exchange for the pooled assets. An Underwriter, usually an

investment bank, purchases all of the certificates from the Depositor with the responsibility

of offering to them for sale to the ultimate investors.

What’s important to understand is that to effect the securitization process both the

note and trust deed (the security interest) must be assigned from the Originator to

the Sponsor/Seller, then from the Sponsor/Seller to the Depositor and, finally, from the

Depositor to the Securitization Trust. Each assignee, up until it makes an assignment to the

next party along the chain of title, is the beneficiary under the trust deed. There is a break

in this chain of title where an assignment is not made or is otherwise invalid.

Also worth noting is that almost all Securitization Trusts elect to be treated as “Real

Estate Mortgage Investment Trusts” or “REMICS” pursuant to the rules and regulations

of Sections 860A‐F of the Internal Revenue Code (“IRC”). Consequently, a Securitization

Trust must adhere to certain strict and absolute requirements involving transfers of assets

into the trust. The IRC 860 outlines these requirements, which include a condition that all

loans that are stated to be in the REMIC trust must be acquired on the startup day of the

trust or within three months thereafter. Any other contributions to the REMIC after the

startup date or the subsequent 90 day window are treated as a “prohibited

transaction”.

A “prohibited transaction” is catastrophic to a Securitization Trust as it subjects the

entire cash flows of the trust to a minimum 100% tax. For this reason, all parties to a

Securitization Trust must strictly adhere to the rules of the trust’s Pooling and

Servicing Agreement and the Mortgage Loan Purchase Agreement, especially the

guidelines regarding conveyances (and assignments) of the assets.

You might also like

- A Guide Book of United States Coins (PDFDrive)Document212 pagesA Guide Book of United States Coins (PDFDrive)Jd Diaz80% (5)

- 2018 US Coin Key ListDocument2 pages2018 US Coin Key ListGordon Schumway50% (2)

- UPAS L/C: An Innovative Payment Scheme For International TradeDocument2 pagesUPAS L/C: An Innovative Payment Scheme For International TradesomsemNo ratings yet

- Chap 10Document5 pagesChap 10Shiela DimaculanganNo ratings yet

- PCGS VarietiesDocument2 pagesPCGS VarietiesGordon Schumway100% (1)

- Shapiro CHAPTER 5 SolutionsDocument11 pagesShapiro CHAPTER 5 SolutionsIgor LeiteNo ratings yet

- PhiladelphiaBusinessJournal April 13, 2018Document44 pagesPhiladelphiaBusinessJournal April 13, 2018Craig EyNo ratings yet

- Babalu BK DeclarationDocument28 pagesBabalu BK Declarationthe kingfishNo ratings yet

- Wellness RevolutionDocument4 pagesWellness RevolutionWaqar GhoryNo ratings yet

- Safe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesFrom EverandSafe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesNo ratings yet

- IRS Field Offices 2018 Criminal Investigation Annual ReportDocument127 pagesIRS Field Offices 2018 Criminal Investigation Annual ReportSeniorNo ratings yet

- 2016-11-28 - Robert Wallace - Lis Pendens Fed CTDocument4 pages2016-11-28 - Robert Wallace - Lis Pendens Fed CTapi-339692598No ratings yet

- Underwriter NotesDocument6 pagesUnderwriter Notessambamurthy sunkaraNo ratings yet

- Branch ReviewDocument5 pagesBranch ReviewMichelle TNo ratings yet

- United States v. Williams, 514 U.S. 527 (1995)Document18 pagesUnited States v. Williams, 514 U.S. 527 (1995)Scribd Government DocsNo ratings yet

- Form.31A - Amendment To Trust AgreementDocument3 pagesForm.31A - Amendment To Trust AgreementBrian LitNo ratings yet

- Levy Treasury of The Commonwealth of Pennsylvania $107 - 110 - 000Document5 pagesLevy Treasury of The Commonwealth of Pennsylvania $107 - 110 - 000akil kemnebi easley elNo ratings yet

- Registered Owner Vs Beneficial Owner A Curtain RaiserDocument6 pagesRegistered Owner Vs Beneficial Owner A Curtain RaiserTaxmann PublicationNo ratings yet

- Statutory Declaration FormDocument2 pagesStatutory Declaration FormRomil BadamiNo ratings yet

- Assignment NoteDocument2 pagesAssignment NoteMark VasquezNo ratings yet

- Deed of Hypothecation - Draft TemplateDocument18 pagesDeed of Hypothecation - Draft Templateluvisfact7616100% (1)

- Identity Theft ComplaintDocument7 pagesIdentity Theft ComplaintBINGE TV EXCLUSIVENo ratings yet

- Records RequestDocument1 pageRecords RequestRyan Hobbs100% (1)

- Deutche Bank V Brock Did Not Question Endorsements On Allonge As InvalidDocument22 pagesDeutche Bank V Brock Did Not Question Endorsements On Allonge As InvalidBeth Stoops Jacobson0% (1)

- Admin Order Re Registry FundsDocument3 pagesAdmin Order Re Registry FundsCarlosNo ratings yet

- The Terms Lien of SharesDocument6 pagesThe Terms Lien of SharesAmit MakwanaNo ratings yet

- Affidavit of Identifying WitnessDocument2 pagesAffidavit of Identifying Witnessdouglas jonesNo ratings yet

- Macm-R000000001 Affidavit of Ucc1 Conns Home Plus - Synchrony Bank - Georgia CorporationsDocument5 pagesMacm-R000000001 Affidavit of Ucc1 Conns Home Plus - Synchrony Bank - Georgia CorporationsKing ElNo ratings yet

- MOSL Pledge Request FormDocument2 pagesMOSL Pledge Request FormPushpa Devi100% (1)

- Nmims Sec A Test No 1Document6 pagesNmims Sec A Test No 1ROHAN DESAI100% (1)

- Bank P.O Preparation Exam GuideDocument166 pagesBank P.O Preparation Exam GuideHimanshu Goel100% (1)

- Blakely Amended Motion For Bond Pending SentencingDocument2 pagesBlakely Amended Motion For Bond Pending SentencingFOX54 News Huntsville100% (1)

- Thornton Master File RedactedDocument39 pagesThornton Master File Redactedthe kingfishNo ratings yet

- Luna, Joane LawDocument6 pagesLuna, Joane LawMarrie Chu100% (1)

- ADS Chapter 625 Accounts Receivable and Debt CollectionDocument48 pagesADS Chapter 625 Accounts Receivable and Debt CollectionShabbir BukhariNo ratings yet

- Savings BondsDocument2 pagesSavings BondsffsdfsfdftrertNo ratings yet

- The Banks Newest Sweetheart DealDocument4 pagesThe Banks Newest Sweetheart Dealmichael s rozeffNo ratings yet

- T1 Checklist Establishment of A TrustDocument4 pagesT1 Checklist Establishment of A TrustRod NewmanNo ratings yet

- SS4 Fax 12 10 02Document2 pagesSS4 Fax 12 10 02wealth2520No ratings yet

- Form of Bailee Letter (Warehouse Bank) Exhibit III-35 (Cash Purchase) FORM OF BAILEE LETTER (Warehouse Bank) (Cash Purchase)Document3 pagesForm of Bailee Letter (Warehouse Bank) Exhibit III-35 (Cash Purchase) FORM OF BAILEE LETTER (Warehouse Bank) (Cash Purchase)Valerie Lopez100% (1)

- Banking Abbreviations and Terms BankDocument36 pagesBanking Abbreviations and Terms Bankdheeru18No ratings yet

- Warehouse Receipt ActrevisedDocument2 pagesWarehouse Receipt ActrevisedMarc Boyer100% (1)

- Registration of Titles ActDocument126 pagesRegistration of Titles ActDebbian Livingstone100% (1)

- Offering MemorandumDocument115 pagesOffering MemorandumMigle Bloom100% (1)

- Diplomatic Passports Regulations: 2008 Revised Edition CAP. 24.20.2Document8 pagesDiplomatic Passports Regulations: 2008 Revised Edition CAP. 24.20.2sig325No ratings yet

- Certificate of Existence Claim Form - 01112019-1Document1 pageCertificate of Existence Claim Form - 01112019-1Richard mosesNo ratings yet

- c75s3 PDFDocument1,724 pagesc75s3 PDFRichard LucianoNo ratings yet

- Chapter 4 - Co-Ownership, Estates and TrustsDocument8 pagesChapter 4 - Co-Ownership, Estates and TrustsLiRose SmithNo ratings yet

- Bank United Master List of REMICs p938 - 2007 REMICs-TrustDocument224 pagesBank United Master List of REMICs p938 - 2007 REMICs-TrustZAYLE777No ratings yet

- Form 2220Document15 pagesForm 2220Kam 87No ratings yet

- Mortgage - Unknown - Real Estate TerminologiesDocument5 pagesMortgage - Unknown - Real Estate TerminologiesJaykumar PrajapatiNo ratings yet

- Horace V LaSalle Memo in Support of Motion For Summary JudgmentDocument25 pagesHorace V LaSalle Memo in Support of Motion For Summary JudgmentRichie CollinsNo ratings yet

- Settlement Agreement 34Document4 pagesSettlement Agreement 34Ankita100% (1)

- Organization: Organization: The One Peoples Public Trust 1776 (Debtor)Document2 pagesOrganization: Organization: The One Peoples Public Trust 1776 (Debtor)MaxBestNo ratings yet

- Dustin Rollins V Mers Class Action SuitDocument46 pagesDustin Rollins V Mers Class Action Suitrebecca1966220% (1)

- Fdic Trust Examination Manual PDFDocument2 pagesFdic Trust Examination Manual PDFAshley0% (1)

- Exhibit A Deed TrustDocument16 pagesExhibit A Deed Trustjohnadams552266No ratings yet

- Judicial Foreclosures and Constitutional Challenges: What Every Estate Planning Attorney Needs To KnowDocument9 pagesJudicial Foreclosures and Constitutional Challenges: What Every Estate Planning Attorney Needs To KnowElaine Diane EtingoffNo ratings yet

- CIM 05 Arion Banki HFDocument74 pagesCIM 05 Arion Banki HFVivek SrinivasanNo ratings yet

- Untermeyer 6751 Registration Statement 20191119 1Document7 pagesUntermeyer 6751 Registration Statement 20191119 1Yvonne LarsenNo ratings yet

- PrivateSide Modernization TrainingGuideDocument30 pagesPrivateSide Modernization TrainingGuiderutbutNo ratings yet

- AHMI Trust 2004-4 Pooling and Servicing AgreementDocument451 pagesAHMI Trust 2004-4 Pooling and Servicing AgreementCelebguardNo ratings yet

- Processed: Form6 Full and Public Disclosure of 2012 Financial InterestsDocument2 pagesProcessed: Form6 Full and Public Disclosure of 2012 Financial InterestsMy-Acts Of-SeditionNo ratings yet

- Constitution of the State of Minnesota — 1876 VersionFrom EverandConstitution of the State of Minnesota — 1876 VersionNo ratings yet

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryFrom EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryNo ratings yet

- 2025 Global GovernanceDocument82 pages2025 Global Governancedelight888No ratings yet

- Mortgage Fraud Examiners Scam AuditDocument64 pagesMortgage Fraud Examiners Scam AuditGordon SchumwayNo ratings yet

- Sample Foreclosure AnswerDocument2 pagesSample Foreclosure AnswerGordon SchumwayNo ratings yet

- Criminal+Court+Script+3 0Document21 pagesCriminal+Court+Script+3 0Gordon Schumway100% (3)

- Confirmatio CartarumDocument3 pagesConfirmatio CartarumGordon SchumwayNo ratings yet

- Spotting A Hidden HandgunDocument1 pageSpotting A Hidden HandgunGordon SchumwayNo ratings yet

- Affidavit of TruthDocument8 pagesAffidavit of TruthGordon Schumway100% (1)

- Coneca Top 100 RPMsDocument3 pagesConeca Top 100 RPMsGordon SchumwayNo ratings yet

- Wexler Top 100 RPMsDocument3 pagesWexler Top 100 RPMsGordon SchumwayNo ratings yet

- Chapter 20 Ia2Document24 pagesChapter 20 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- DRHP 20190221140816Document436 pagesDRHP 20190221140816SubscriptionNo ratings yet

- Printut LP5Document9 pagesPrintut LP5Juliet TorrefrancaNo ratings yet

- Navjeevan Press ReportDocument38 pagesNavjeevan Press ReportDarshitSejpara100% (3)

- Journal of Retailing, Executive SummaryDocument6 pagesJournal of Retailing, Executive SummaryOrko AhmedNo ratings yet

- Insights: The Intended and Collateral Effects of Short-Sale Bans As A Regulatory ToolDocument9 pagesInsights: The Intended and Collateral Effects of Short-Sale Bans As A Regulatory ToolAnonymous yVibQxNo ratings yet

- An Easy Guide To Taxation For Startup EntrepreneursDocument2 pagesAn Easy Guide To Taxation For Startup EntrepreneursWell BestNo ratings yet

- Imm PPT Group 6Document24 pagesImm PPT Group 6ShravanNo ratings yet

- Prepared By:: Sakia Sultana ID: EB143221Document83 pagesPrepared By:: Sakia Sultana ID: EB143221Naomii HoneyNo ratings yet

- Thesis Muhammad Satar WholeDocument34 pagesThesis Muhammad Satar WholeSupermanNo ratings yet

- Bss Course ListDocument12 pagesBss Course ListMagnateIndiaNo ratings yet

- Kxu Chap12 SolutionDocument18 pagesKxu Chap12 SolutionDenise Cynth Ortego ValenciaNo ratings yet

- Affiliated To Dr. A.P.J Abdul Kalam Technical UniversityDocument76 pagesAffiliated To Dr. A.P.J Abdul Kalam Technical UniversityAgam MittalNo ratings yet

- Answers To Chapter 7 QuestionsDocument7 pagesAnswers To Chapter 7 QuestionsAnna OsmanNo ratings yet

- Sinclair Company Group Case StudyDocument20 pagesSinclair Company Group Case StudyNida Amri50% (4)

- FAR 10 - Borrowing CostsDocument2 pagesFAR 10 - Borrowing Costsmrsjeon0501No ratings yet

- 285 AA445 D 01Document21 pages285 AA445 D 01tkkg854No ratings yet

- Chapter 7 Guerrero PDFDocument17 pagesChapter 7 Guerrero PDFIrene Eloisa100% (2)

- Personal Selling Presentation: Presented By: Rumsha Suhail Sanjana Sumaira Khaliq Muhammad NehalDocument38 pagesPersonal Selling Presentation: Presented By: Rumsha Suhail Sanjana Sumaira Khaliq Muhammad NehalSpamsong onwTwiceNo ratings yet

- Agricultural Investment Opportunities in Ethiopia ATA 2012Document2 pagesAgricultural Investment Opportunities in Ethiopia ATA 2012SolomonkmNo ratings yet

- 2005 Canlii 19664Document30 pages2005 Canlii 19664Chris BamfordNo ratings yet

- Tugas B.ing Aisyah NiadyDocument2 pagesTugas B.ing Aisyah NiadyisnaeniNo ratings yet

- OVDV Bloomberg Equity Volatilities: Features and Benefits 21 June 2010Document8 pagesOVDV Bloomberg Equity Volatilities: Features and Benefits 21 June 2010Raphaël FromEverNo ratings yet

- Lamp IrancDocument1 pageLamp IrancaaaaNo ratings yet

- Nishant Trading System For Nse v27.1Document96 pagesNishant Trading System For Nse v27.1Marcus James0% (3)