Professional Documents

Culture Documents

1stsem - BBAFBA2023 24 Revised - Syllabus 23

1stsem - BBAFBA2023 24 Revised - Syllabus 23

Uploaded by

gurulinguCopyright:

Available Formats

You might also like

- SWOT Analysis of NIB BankDocument6 pagesSWOT Analysis of NIB BankAbdul Waheed83% (36)

- Im Acco 01bc Fundamentals of Accounting Part 1Document110 pagesIm Acco 01bc Fundamentals of Accounting Part 1Mikaella Del Rosario100% (1)

- AccountsDocument8 pagesAccountsYash Garg100% (1)

- Fundamentals of Accounting and AuditingDocument458 pagesFundamentals of Accounting and Auditingrajeev sharma100% (1)

- Internship Report On Askari Bank LimitedDocument46 pagesInternship Report On Askari Bank Limitedbbaahmad89100% (4)

- Old BBA1 Styear NEPpg 17Document2 pagesOld BBA1 Styear NEPpg 17gurulinguNo ratings yet

- 1stSemFA2023-24 - B.com - Revised Syllabus 2023-24Document2 pages1stSemFA2023-24 - B.com - Revised Syllabus 2023-24gurulinguNo ratings yet

- ACCOUNTINGDocument13 pagesACCOUNTINGchinnimounika901No ratings yet

- Financial Accounting - Financial AccountingDocument2 pagesFinancial Accounting - Financial Accountingsonualamsa259066No ratings yet

- BBA102-1N SyllabusDocument2 pagesBBA102-1N SyllabusRITIKNo ratings yet

- Bba Tumkur NepDocument46 pagesBba Tumkur NepJobin GeorgeNo ratings yet

- AFMDocument2 pagesAFMstylishdolly2000No ratings yet

- Commerce: Accounting & Taxation: Learning OutcomeDocument1 pageCommerce: Accounting & Taxation: Learning Outcomecostumercare85No ratings yet

- Advanced Financial AccountingDocument2 pagesAdvanced Financial AccountingJobin George100% (1)

- Mbaf0701 - Far - SyllabusDocument2 pagesMbaf0701 - Far - SyllabusRahulNo ratings yet

- Online - Accounting and Financial ManagementDocument2 pagesOnline - Accounting and Financial ManagementPranav KompallyNo ratings yet

- Basics of Financial AccountingDocument2 pagesBasics of Financial AccountingGopinath SiddaiahNo ratings yet

- Course DetailDocument3 pagesCourse DetailNajlaNo ratings yet

- Accounting For ManagersDocument2 pagesAccounting For Managersvivekgarg33.vgNo ratings yet

- Nptel: Managerial Accounting - Video CourseDocument3 pagesNptel: Managerial Accounting - Video CourseNajlaNo ratings yet

- BejwnwiwkwnsnnDocument2 pagesBejwnwiwkwnsnnThomas koshyNo ratings yet

- Semester/Year: I Sem / I Year Course Code: 20MBA5101 Title of The Course: Accounting For Managers L: T/A: P: C: 4: 0: 0: 4Document3 pagesSemester/Year: I Sem / I Year Course Code: 20MBA5101 Title of The Course: Accounting For Managers L: T/A: P: C: 4: 0: 0: 4tridib BhattacharjeeNo ratings yet

- Tlaw188l Financial-Accounting TH 1.0 0 Tlaw188lDocument2 pagesTlaw188l Financial-Accounting TH 1.0 0 Tlaw188lShreyaah TSNo ratings yet

- Basic AccountingDocument2 pagesBasic AccountingAnjum MehtabNo ratings yet

- Sub Committee For Curriculum Development Banking & Finance Specialization Post GraduateDocument3 pagesSub Committee For Curriculum Development Banking & Finance Specialization Post Graduatevineet lakraNo ratings yet

- BCOM 3rd and 4th Sem Syallbus NEPDocument37 pagesBCOM 3rd and 4th Sem Syallbus NEPgfgcw yadgirNo ratings yet

- ACC 201: Financial Accounting: Course ObjectivesDocument12 pagesACC 201: Financial Accounting: Course ObjectivesHow HiringNo ratings yet

- T2003-Financial AccountingDocument2 pagesT2003-Financial AccountingKishore KambleNo ratings yet

- T2003-Financial AccountingDocument2 pagesT2003-Financial AccountingDebadri GhoshNo ratings yet

- MBA-23-103 Management AccountingDocument4 pagesMBA-23-103 Management Accountinggadekarganesh977No ratings yet

- Financial Accounting - 1 PDFDocument73 pagesFinancial Accounting - 1 PDFSudhanva RajNo ratings yet

- Syllabus Final For I II III and IV SEM-2022-23Document50 pagesSyllabus Final For I II III and IV SEM-2022-23PrajwalNo ratings yet

- F.A IDocument2 pagesF.A IZara ShoukatNo ratings yet

- New - OBTL Modular Fundamentals of Accounting Part1 - First Semester AY2020 2021Document6 pagesNew - OBTL Modular Fundamentals of Accounting Part1 - First Semester AY2020 2021rebecca lisingNo ratings yet

- Fundamentals of Accounting and Finance - Course Outline - F22Document5 pagesFundamentals of Accounting and Finance - Course Outline - F22Niveditha SrikrishnaNo ratings yet

- 1.3 Accounting For Managers: 1. General InformationDocument4 pages1.3 Accounting For Managers: 1. General InformationKartik KNo ratings yet

- AcctXI PDFDocument41 pagesAcctXI PDFAshwin ChauriyaNo ratings yet

- Accounting I Syllabus: Instructor's Name and Contact InformationDocument6 pagesAccounting I Syllabus: Instructor's Name and Contact InformationDino DizonNo ratings yet

- MC-4 4Document186 pagesMC-4 4Mustafa Bohra100% (1)

- Sylla AccDocument7 pagesSylla Accabhinav200711No ratings yet

- FYBBA AccountingDocument6 pagesFYBBA AccountingcadkthNo ratings yet

- Course Pack FOR Accounting and Financial Management-Mca235Document6 pagesCourse Pack FOR Accounting and Financial Management-Mca235mohd azher sohailNo ratings yet

- Chapter 1 IntroductionDocument30 pagesChapter 1 IntroductionVivek GargNo ratings yet

- D20BB003 - Financial AccountingDocument2 pagesD20BB003 - Financial Accountingmba departmentNo ratings yet

- 6584financial Accounting 2021Document3 pages6584financial Accounting 2021Najia SalmanNo ratings yet

- Mba I Accounting For Management (14mba13) NotesDocument58 pagesMba I Accounting For Management (14mba13) NotesAnonymous 4lXDgDUkQ100% (2)

- AFM Theory Notes-1Document58 pagesAFM Theory Notes-1pradeepNo ratings yet

- Updated Financial Accounting Course Outline-1Document3 pagesUpdated Financial Accounting Course Outline-1HammadNo ratings yet

- Finalcial AccountingDocument3 pagesFinalcial AccountingSiyab MehmetNo ratings yet

- Acct XIDocument41 pagesAcct XIsainimanish170gmailcNo ratings yet

- Acc HelpfulDocument994 pagesAcc HelpfulMoksha JainNo ratings yet

- Syllabus B.com. First 22 23Document24 pagesSyllabus B.com. First 22 23Sadiya TufailNo ratings yet

- Accounting MergedDocument63 pagesAccounting MergedAnnika TrishaNo ratings yet

- Financial Reporting Statements and AnalysisDocument2 pagesFinancial Reporting Statements and AnalysisMadhav RajbanshiNo ratings yet

- CBSE Syllabus For Class 11 Accountancy 2023-24 (Revised) PDF DownloadDocument9 pagesCBSE Syllabus For Class 11 Accountancy 2023-24 (Revised) PDF DownloadBharathi 3280No ratings yet

- Course Title: Financial Accounting Course Code: FM-501 Credit Hours: 3 + 0 Course Instructor: PrerequisitesDocument5 pagesCourse Title: Financial Accounting Course Code: FM-501 Credit Hours: 3 + 0 Course Instructor: Prerequisitessehrish kayaniNo ratings yet

- 320 Accountancy-1 (Final PDFDocument279 pages320 Accountancy-1 (Final PDFNavyaNo ratings yet

- 1 Styear NEPPg 1 SyllabusDocument1 page1 Styear NEPPg 1 SyllabusgurulinguNo ratings yet

- Learning Mod 1 Financial Acct Rep 2Document15 pagesLearning Mod 1 Financial Acct Rep 2FERNANDEZ BEANo ratings yet

- Responsibility Accounting, Transfer Pricing & Balanced ScorecardDocument11 pagesResponsibility Accounting, Transfer Pricing & Balanced Scorecardmartinfaith958No ratings yet

- Questions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)Document4 pagesQuestions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)rishi dhungel100% (1)

- 1.1 Origin of The Report: Prime Bank LimitedDocument93 pages1.1 Origin of The Report: Prime Bank LimitedAami TanimNo ratings yet

- Types of InvestmentDocument6 pagesTypes of InvestmentjashimkhanNo ratings yet

- Dialnet RoleOfBanksInNancialInclusionInIndia 6030517Document13 pagesDialnet RoleOfBanksInNancialInclusionInIndia 6030517AnonymousNo ratings yet

- Diluted Earnings Per ShareDocument2 pagesDiluted Earnings Per ShareGletzmar IgcasamaNo ratings yet

- National Bank For Agriculture and Rural Development (Nabard)Document21 pagesNational Bank For Agriculture and Rural Development (Nabard)HASHMI SUTARIYA100% (1)

- Balance SheetDocument6 pagesBalance SheetBARMER BARMENo ratings yet

- 6 Stock ValuationDocument10 pages6 Stock ValuationIm NayeonNo ratings yet

- Time Value of Money FinalDocument41 pagesTime Value of Money FinalJaveedNo ratings yet

- Sap Infor TypeDocument12 pagesSap Infor TypeDEEP KHATINo ratings yet

- AFM SD21 AsDocument10 pagesAFM SD21 AsSriram RatnamNo ratings yet

- ACTL2111 Module - 1Document101 pagesACTL2111 Module - 1Alex WuNo ratings yet

- BAFS Basic ConceptDocument12 pagesBAFS Basic Conceptmilkbear03No ratings yet

- A Study On Capital Budgeting at Bharathi Cement LTDDocument4 pagesA Study On Capital Budgeting at Bharathi Cement LTDEditor IJTSRDNo ratings yet

- Asoj 2080 PublishDocument195 pagesAsoj 2080 PublishprabindraNo ratings yet

- Ch016 Exporting, Importing, and CountertradeDocument25 pagesCh016 Exporting, Importing, and CountertradeMd. Muhinur Islam AdnanNo ratings yet

- Income Based Valuation Unit Exam Answer Key NewDocument6 pagesIncome Based Valuation Unit Exam Answer Key NewAMIKO OHYANo ratings yet

- Lufax - Swot Analysis: Group Assignment 2Document6 pagesLufax - Swot Analysis: Group Assignment 2Ashish0% (1)

- Silva - Activity For Financial Planning Tools and ConceptsDocument2 pagesSilva - Activity For Financial Planning Tools and ConceptsMhericka SilvaNo ratings yet

- Vince - Cut - Q2 - Business Mathematics Grade 11 AbmDocument6 pagesVince - Cut - Q2 - Business Mathematics Grade 11 AbmVince Romyson VenturaNo ratings yet

- DTJ - 27-Feb-2024-202402271736345286780Document2 pagesDTJ - 27-Feb-2024-202402271736345286780Suranjan BhattacharyyaNo ratings yet

- Trial 1 - DominionDocument17 pagesTrial 1 - Dominionelenasalvazia9No ratings yet

- CH 10 TB Working Capital ManagementDocument22 pagesCH 10 TB Working Capital ManagementFran PranNo ratings yet

- H1 - Account Receivables - PT Samcro 2020Document105 pagesH1 - Account Receivables - PT Samcro 2020Siska TriandriyaniNo ratings yet

- Loan Summary: Congratulations! Welcome To The Home Credit FamilyDocument1 pageLoan Summary: Congratulations! Welcome To The Home Credit FamilyRadha kushwahNo ratings yet

- BE14e Exercise 12.8 - Solution Under Both MethodsDocument6 pagesBE14e Exercise 12.8 - Solution Under Both MethodsJayMandliyaNo ratings yet

- Funds ManualDocument276 pagesFunds ManualSATYAPRAKSH SINGHNo ratings yet

1stsem - BBAFBA2023 24 Revised - Syllabus 23

1stsem - BBAFBA2023 24 Revised - Syllabus 23

Uploaded by

gurulinguOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1stsem - BBAFBA2023 24 Revised - Syllabus 23

1stsem - BBAFBA2023 24 Revised - Syllabus 23

Uploaded by

gurulinguCopyright:

Available Formats

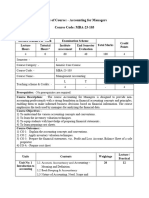

Name of the Program: Bachelor of Business Administration

(BBA)

Course Code: BBA 1.2

Name of the Course: Fundamentals of Business Accounting

Course Credits No. of Hours per Week Total No. of Teaching Hours

4 Credits 4 Hrs 56

Hrs

Pedagogy: Classrooms lecture, tutorials, and problem solving.

Course Outcomes: On successful completion of the course, the Students will demonstrate

a) Understand the framework of accounting as well accounting standards.

b) The Ability to pass journal entries and prepare ledger accounts

c) The Ability to prepare subsidiaries books

d) The Ability to prepare trial balance and final accounts of proprietary concern.

e) Construct final accounts through application of tally.

Syllabus: Hour

s

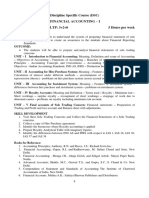

Module No. 1: INTRODUCTION TO FINANCIAL ACCOUNTING 08

Introduction – Meaning and Definition – Objectives of Accounting – Functions of Accounting

– Users of Accounting Information – Limitations of Accounting – Accounting Cycle -

Accounting Principles – Accounting Concepts and Accounting Conventions. Accounting

Standards – objectives- significance of accounting standards. List of Indian

Accounting

Standards.

Module No. 2: ACCOUNTING PROCESS 12

Meaning of Double entry system – Process of Accounting – Kinds of Accounts – Rules -

Transaction Analysis – Journal – Ledger – Balancing of Accounts – Trial Balance – Problems

on Journal, Ledger Posting and Preparation of Trial Balance.

Module No. 3: SUBSIDIARY BOOKS 14

Meaning – Significance – Types of Subsidiary Books –Preparation of Purchases Book, Sales

Book, Purchase Returns Book, Sales Return Book, Bills Receivable Book, Bills Payable Book.

Types of Cash Book- Simple Cash Book , Double Column Cash Book , Three Column Cash

Book and Petty Cash Book(Problems only on Three Column Cash Book and Petty Cash

Book), Bank Reconciliation Statement – Preparation of Bank Reconciliation Statement

(Problems on BRS)

Module No. 4: FINAL ACCOUNTS OF PROPRIETARY CONCERN 10

Preparation of Statement of Profit and Loss and Balance Sheet of a proprietary concern

with special adjustments like depreciation, outstanding and prepaid expenses,

outstanding and received in advance of incomes, provision for doubtful debts, drawings

and interest on

capital.

Module No. 5: ACCOUNTING SOFTWARE 12

9

Introduction-meaning of accounting software, types accounting software-accounting

software Tally-Meaning of Tally software – Features – Advantages, Creating a New

Company, Basic Currency information, other information, Company features and Inventory

features. Working in Tally: Groups, Ledgers, writing voucher, different types of voucher,

voucher entry Problem on Voucher entry - Generating Basic Reports in Tally-Trail

Balance, Accounts books, Cash Book, Bank Books, Ledger Accounts, Group Summary,

Sales Register and Purchase Register, Journal Register, Statement of Accounts, and Balance

Sheet.

Skill Developments Activities:

1. List out the accounting concepts and conventions.

2. Prepare a Bank Reconciliation Statement with imaginary figures

3. Collect the financial statement of a proprietary concern and record it.

4. Prepare a financial statement of an imaginary company using tally software.

Text Books:

1. Hanif and Mukherjee, Financial Accounting, Mc Graw Hill Publishers

2. Arulanandam & Raman; Advanced Accountancy, Himalaya Publishing House

3. S.Anil Kumar,V.Rajesh Kumar and B.Mariyappa–Fundamentals of Accounting,

4. Himalaya Publishing House.

5. Dr. S.N. Maheswari, Financial Accounting, Vikas Publication

6. S P Jain and K. L. Narang, Financial Accounting, Kalyani Publication

7. Radhaswamy and R.L. Gupta, Advanced Accounting , Sultan Chand

8. M.C. Shukla and Goyel, Advaced Accounting , S Chand.

Note: Latest edition of text books may be used.

10

You might also like

- SWOT Analysis of NIB BankDocument6 pagesSWOT Analysis of NIB BankAbdul Waheed83% (36)

- Im Acco 01bc Fundamentals of Accounting Part 1Document110 pagesIm Acco 01bc Fundamentals of Accounting Part 1Mikaella Del Rosario100% (1)

- AccountsDocument8 pagesAccountsYash Garg100% (1)

- Fundamentals of Accounting and AuditingDocument458 pagesFundamentals of Accounting and Auditingrajeev sharma100% (1)

- Internship Report On Askari Bank LimitedDocument46 pagesInternship Report On Askari Bank Limitedbbaahmad89100% (4)

- Old BBA1 Styear NEPpg 17Document2 pagesOld BBA1 Styear NEPpg 17gurulinguNo ratings yet

- 1stSemFA2023-24 - B.com - Revised Syllabus 2023-24Document2 pages1stSemFA2023-24 - B.com - Revised Syllabus 2023-24gurulinguNo ratings yet

- ACCOUNTINGDocument13 pagesACCOUNTINGchinnimounika901No ratings yet

- Financial Accounting - Financial AccountingDocument2 pagesFinancial Accounting - Financial Accountingsonualamsa259066No ratings yet

- BBA102-1N SyllabusDocument2 pagesBBA102-1N SyllabusRITIKNo ratings yet

- Bba Tumkur NepDocument46 pagesBba Tumkur NepJobin GeorgeNo ratings yet

- AFMDocument2 pagesAFMstylishdolly2000No ratings yet

- Commerce: Accounting & Taxation: Learning OutcomeDocument1 pageCommerce: Accounting & Taxation: Learning Outcomecostumercare85No ratings yet

- Advanced Financial AccountingDocument2 pagesAdvanced Financial AccountingJobin George100% (1)

- Mbaf0701 - Far - SyllabusDocument2 pagesMbaf0701 - Far - SyllabusRahulNo ratings yet

- Online - Accounting and Financial ManagementDocument2 pagesOnline - Accounting and Financial ManagementPranav KompallyNo ratings yet

- Basics of Financial AccountingDocument2 pagesBasics of Financial AccountingGopinath SiddaiahNo ratings yet

- Course DetailDocument3 pagesCourse DetailNajlaNo ratings yet

- Accounting For ManagersDocument2 pagesAccounting For Managersvivekgarg33.vgNo ratings yet

- Nptel: Managerial Accounting - Video CourseDocument3 pagesNptel: Managerial Accounting - Video CourseNajlaNo ratings yet

- BejwnwiwkwnsnnDocument2 pagesBejwnwiwkwnsnnThomas koshyNo ratings yet

- Semester/Year: I Sem / I Year Course Code: 20MBA5101 Title of The Course: Accounting For Managers L: T/A: P: C: 4: 0: 0: 4Document3 pagesSemester/Year: I Sem / I Year Course Code: 20MBA5101 Title of The Course: Accounting For Managers L: T/A: P: C: 4: 0: 0: 4tridib BhattacharjeeNo ratings yet

- Tlaw188l Financial-Accounting TH 1.0 0 Tlaw188lDocument2 pagesTlaw188l Financial-Accounting TH 1.0 0 Tlaw188lShreyaah TSNo ratings yet

- Basic AccountingDocument2 pagesBasic AccountingAnjum MehtabNo ratings yet

- Sub Committee For Curriculum Development Banking & Finance Specialization Post GraduateDocument3 pagesSub Committee For Curriculum Development Banking & Finance Specialization Post Graduatevineet lakraNo ratings yet

- BCOM 3rd and 4th Sem Syallbus NEPDocument37 pagesBCOM 3rd and 4th Sem Syallbus NEPgfgcw yadgirNo ratings yet

- ACC 201: Financial Accounting: Course ObjectivesDocument12 pagesACC 201: Financial Accounting: Course ObjectivesHow HiringNo ratings yet

- T2003-Financial AccountingDocument2 pagesT2003-Financial AccountingKishore KambleNo ratings yet

- T2003-Financial AccountingDocument2 pagesT2003-Financial AccountingDebadri GhoshNo ratings yet

- MBA-23-103 Management AccountingDocument4 pagesMBA-23-103 Management Accountinggadekarganesh977No ratings yet

- Financial Accounting - 1 PDFDocument73 pagesFinancial Accounting - 1 PDFSudhanva RajNo ratings yet

- Syllabus Final For I II III and IV SEM-2022-23Document50 pagesSyllabus Final For I II III and IV SEM-2022-23PrajwalNo ratings yet

- F.A IDocument2 pagesF.A IZara ShoukatNo ratings yet

- New - OBTL Modular Fundamentals of Accounting Part1 - First Semester AY2020 2021Document6 pagesNew - OBTL Modular Fundamentals of Accounting Part1 - First Semester AY2020 2021rebecca lisingNo ratings yet

- Fundamentals of Accounting and Finance - Course Outline - F22Document5 pagesFundamentals of Accounting and Finance - Course Outline - F22Niveditha SrikrishnaNo ratings yet

- 1.3 Accounting For Managers: 1. General InformationDocument4 pages1.3 Accounting For Managers: 1. General InformationKartik KNo ratings yet

- AcctXI PDFDocument41 pagesAcctXI PDFAshwin ChauriyaNo ratings yet

- Accounting I Syllabus: Instructor's Name and Contact InformationDocument6 pagesAccounting I Syllabus: Instructor's Name and Contact InformationDino DizonNo ratings yet

- MC-4 4Document186 pagesMC-4 4Mustafa Bohra100% (1)

- Sylla AccDocument7 pagesSylla Accabhinav200711No ratings yet

- FYBBA AccountingDocument6 pagesFYBBA AccountingcadkthNo ratings yet

- Course Pack FOR Accounting and Financial Management-Mca235Document6 pagesCourse Pack FOR Accounting and Financial Management-Mca235mohd azher sohailNo ratings yet

- Chapter 1 IntroductionDocument30 pagesChapter 1 IntroductionVivek GargNo ratings yet

- D20BB003 - Financial AccountingDocument2 pagesD20BB003 - Financial Accountingmba departmentNo ratings yet

- 6584financial Accounting 2021Document3 pages6584financial Accounting 2021Najia SalmanNo ratings yet

- Mba I Accounting For Management (14mba13) NotesDocument58 pagesMba I Accounting For Management (14mba13) NotesAnonymous 4lXDgDUkQ100% (2)

- AFM Theory Notes-1Document58 pagesAFM Theory Notes-1pradeepNo ratings yet

- Updated Financial Accounting Course Outline-1Document3 pagesUpdated Financial Accounting Course Outline-1HammadNo ratings yet

- Finalcial AccountingDocument3 pagesFinalcial AccountingSiyab MehmetNo ratings yet

- Acct XIDocument41 pagesAcct XIsainimanish170gmailcNo ratings yet

- Acc HelpfulDocument994 pagesAcc HelpfulMoksha JainNo ratings yet

- Syllabus B.com. First 22 23Document24 pagesSyllabus B.com. First 22 23Sadiya TufailNo ratings yet

- Accounting MergedDocument63 pagesAccounting MergedAnnika TrishaNo ratings yet

- Financial Reporting Statements and AnalysisDocument2 pagesFinancial Reporting Statements and AnalysisMadhav RajbanshiNo ratings yet

- CBSE Syllabus For Class 11 Accountancy 2023-24 (Revised) PDF DownloadDocument9 pagesCBSE Syllabus For Class 11 Accountancy 2023-24 (Revised) PDF DownloadBharathi 3280No ratings yet

- Course Title: Financial Accounting Course Code: FM-501 Credit Hours: 3 + 0 Course Instructor: PrerequisitesDocument5 pagesCourse Title: Financial Accounting Course Code: FM-501 Credit Hours: 3 + 0 Course Instructor: Prerequisitessehrish kayaniNo ratings yet

- 320 Accountancy-1 (Final PDFDocument279 pages320 Accountancy-1 (Final PDFNavyaNo ratings yet

- 1 Styear NEPPg 1 SyllabusDocument1 page1 Styear NEPPg 1 SyllabusgurulinguNo ratings yet

- Learning Mod 1 Financial Acct Rep 2Document15 pagesLearning Mod 1 Financial Acct Rep 2FERNANDEZ BEANo ratings yet

- Responsibility Accounting, Transfer Pricing & Balanced ScorecardDocument11 pagesResponsibility Accounting, Transfer Pricing & Balanced Scorecardmartinfaith958No ratings yet

- Questions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)Document4 pagesQuestions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)rishi dhungel100% (1)

- 1.1 Origin of The Report: Prime Bank LimitedDocument93 pages1.1 Origin of The Report: Prime Bank LimitedAami TanimNo ratings yet

- Types of InvestmentDocument6 pagesTypes of InvestmentjashimkhanNo ratings yet

- Dialnet RoleOfBanksInNancialInclusionInIndia 6030517Document13 pagesDialnet RoleOfBanksInNancialInclusionInIndia 6030517AnonymousNo ratings yet

- Diluted Earnings Per ShareDocument2 pagesDiluted Earnings Per ShareGletzmar IgcasamaNo ratings yet

- National Bank For Agriculture and Rural Development (Nabard)Document21 pagesNational Bank For Agriculture and Rural Development (Nabard)HASHMI SUTARIYA100% (1)

- Balance SheetDocument6 pagesBalance SheetBARMER BARMENo ratings yet

- 6 Stock ValuationDocument10 pages6 Stock ValuationIm NayeonNo ratings yet

- Time Value of Money FinalDocument41 pagesTime Value of Money FinalJaveedNo ratings yet

- Sap Infor TypeDocument12 pagesSap Infor TypeDEEP KHATINo ratings yet

- AFM SD21 AsDocument10 pagesAFM SD21 AsSriram RatnamNo ratings yet

- ACTL2111 Module - 1Document101 pagesACTL2111 Module - 1Alex WuNo ratings yet

- BAFS Basic ConceptDocument12 pagesBAFS Basic Conceptmilkbear03No ratings yet

- A Study On Capital Budgeting at Bharathi Cement LTDDocument4 pagesA Study On Capital Budgeting at Bharathi Cement LTDEditor IJTSRDNo ratings yet

- Asoj 2080 PublishDocument195 pagesAsoj 2080 PublishprabindraNo ratings yet

- Ch016 Exporting, Importing, and CountertradeDocument25 pagesCh016 Exporting, Importing, and CountertradeMd. Muhinur Islam AdnanNo ratings yet

- Income Based Valuation Unit Exam Answer Key NewDocument6 pagesIncome Based Valuation Unit Exam Answer Key NewAMIKO OHYANo ratings yet

- Lufax - Swot Analysis: Group Assignment 2Document6 pagesLufax - Swot Analysis: Group Assignment 2Ashish0% (1)

- Silva - Activity For Financial Planning Tools and ConceptsDocument2 pagesSilva - Activity For Financial Planning Tools and ConceptsMhericka SilvaNo ratings yet

- Vince - Cut - Q2 - Business Mathematics Grade 11 AbmDocument6 pagesVince - Cut - Q2 - Business Mathematics Grade 11 AbmVince Romyson VenturaNo ratings yet

- DTJ - 27-Feb-2024-202402271736345286780Document2 pagesDTJ - 27-Feb-2024-202402271736345286780Suranjan BhattacharyyaNo ratings yet

- Trial 1 - DominionDocument17 pagesTrial 1 - Dominionelenasalvazia9No ratings yet

- CH 10 TB Working Capital ManagementDocument22 pagesCH 10 TB Working Capital ManagementFran PranNo ratings yet

- H1 - Account Receivables - PT Samcro 2020Document105 pagesH1 - Account Receivables - PT Samcro 2020Siska TriandriyaniNo ratings yet

- Loan Summary: Congratulations! Welcome To The Home Credit FamilyDocument1 pageLoan Summary: Congratulations! Welcome To The Home Credit FamilyRadha kushwahNo ratings yet

- BE14e Exercise 12.8 - Solution Under Both MethodsDocument6 pagesBE14e Exercise 12.8 - Solution Under Both MethodsJayMandliyaNo ratings yet

- Funds ManualDocument276 pagesFunds ManualSATYAPRAKSH SINGHNo ratings yet