Professional Documents

Culture Documents

Serrano v. Court of Appeals

Serrano v. Court of Appeals

Uploaded by

Jico FarinasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Serrano v. Court of Appeals

Serrano v. Court of Appeals

Uploaded by

Jico FarinasCopyright:

Available Formats

SECOND DIVISION

[G.R. No. L-35529. July 16, 1984.]

NORA CANSING SERRANO, petitioner, vs. COURT OF APPEALS

and SOCIAL SECURITY COMMISSION, respondents.

Zosimo M. Cuasay for petitioner.

DECISION

MAKASIAR, J : p

This petition for certiorari seeks to review the decision of the then

Court of Appeals (now Intermediate Appellate Court under BP 129) dated

August 31, 1972, affirming the validity of the resolution of the Social Security

Commission denying favorable consideration of the claim for benefits of the

petitioner under the Group Redemption Insurance plan of the Social Security

System (SYSTEM). The dispositive portion of the respondent Court's decision

reads as follows:

"WHEREFORE, the Court hereby upholds the validity of the

appealed resolution No. 1365, dated December 24, 1968, of appellee

Social Security Commission; without pronouncement as to costs" (p.

31, Rec.).

The undisputed facts are as follows:

On or about January 1, 1965, upon application of the SYSTEM, Group

Mortgage Redemption Policy No. GMR-1 was issued by Private Life Insurance

Companies operating in the Philippines for a group life insurance policy on

the lives of housing loan mortgagors of the SYSTEM. Under this Group

Mortgage Redemption scheme, a grantee of a housing loan of the SYSTEM is

required to mortgage the house constructed out of the loan and the lot on

which it stands. The SYSTEM takes a life insurance on the eligible mortgagor

to the extent of the mortgage indebtedness such that if the mortgagor dies,

the proceeds of his life insurance under the Group Redemption Policy will be

used to pay his indebtedness to the SYSTEM and the deceased's heirs will

thereby be relieved of the burden of paying for the amortization of the

deceased's still unpaid loan to the SYSTEM (p. 25, rec.).

Petitioner herein is the widow of the late Bernardo G. Serrano, who, at

the time of his death, was an airline pilot of Air Manila, Inc. and as such was

a member of the Social Security System.

On November 10, 1967, the SYSTEM approved the real estate

mortgage loan of the late Bernardo G. Serrano for P37,400.00 for the

construction of the applicant's house (pp. 25-26, rec.).

On December 26, 1967, a partial release in the amount of P35,400.00

was effected and devoted to the construction of the house (p. 2, rec.). As a

consequence, a mortgage contract was executed in favor of the SYSTEM by

the late Captain Serrano with his wife as co-mortgagor.

On March 8, 1968, Captain Serrano died in a plane crash and because

of his death, the SYSTEM closed his housing loan account to the released

amount of P35,400.00 (p. 26, rec.).

On December 2, 1968, the petitioner sent a letter addressed to the

Chairman of the Social Security Commission requesting that the benefits of

the Group Mortgage Redemption Insurance be extended to her.

The letter of the petitioner was referred to the Administrator of the

SYSTEM, who recommended its disapproval on the ground that the late

Captain Serrano was not yet covered by the Group Mortgage Redemption

Insurance policy at the time of his death on March 8, 1968. In its resolution

No. 1365 dated December 24, 1968, the Social Security Commission

sustained the said stand of the SYSTEM and thereby formally denied the

request of the petitioner (p. 26, rec.).

On appeal to the then Court of Appeals, the respondent Court affirmed

the decision of the Social Security Commission.

Hence, this petition.

The only issue to be resolved is the correctness of the interpretation

given by the respondent Commission which was upheld by the respondent

Court as to the applicability of the Mortgage Redemption Insurance plan

particularly on when coverage on the life of the mortgagor commences.

Article II (Insurance Coverage) of the Group Mortgage Redemption

Police No. GMR-1 provides:

"Section 1. Â Eligibility. — Every mortgagor who is not over

age 65 nearest birthday at the time the Mortgage Loan is granted (or,

in the case of a Mortgagor applying for insurance coverage on a

Mortgage Loan granted before the Date of Issue, at the time he makes

such application) and who would not be over 75 nearest birthday on

the date on which the original term of the Mortgage Loan expires shall

be eligible for insurance coverage under this Policy, provided that if the

total indebtedness to the Creditor under the new Mortgage Loan and

the outstanding balance of any prior Mortgage Loan or Loans insured

hereunder, exceeds P70,000.00, he will be eligible for insurance

coverage up to this maximum limit only.

"Co-makers or co-signers of mortgage contract are not eligible for

coverage under this Policy.

"Section 2. Â Mode of Acceptance. — Any Mortgagor who is

eligible for coverage on or after the Date of Issue shall be automatically

insured, subject to the amount of insurance limit in Section 1 hereof,

without proof of insurability provided that he is not more than age 60

nearest birthday at the time the Mortgage Loan is granted. Such a

mortgagor who is over age 60 nearest birthday at the time the

Mortgage Loan is granted may be accepted for insurance only subject

to the submission of evidence of insurability satisfactory to the

Subscribing Companies.

"Any eligible Mortgagor who was already a Mortgagor before the

Date of Issue shall be automatically insured, subject to the amount of

insurance limit in Section 1 hereof, without proof of insurability

provided that he is not more than age 60 nearest birthday on the Date

of Issue and that he makes written application to the Creditor for

coverage within ninety (90) days from the Date of Issue. If such a

Mortgagor applies for coverage after ninety (90) days from the Date of

Issue, he may be accepted for insurance upon written application

therefor, subject to the submission of evidence of insurability to the

Subscribing Companies.

"Section 3. Â Effective Date of Insurance. — The insurance on

the life of each eligible Mortgagor Loan or partial release of Mortgage

Loan accepted for coverage who becomes a Mortgagor on or after the

Date of Issue shall take effect from the beginning of the amortization

period of such Mortgage Loan or partial release of Mortgage Loan.

"The beginning of the amortization period as used herein shall

mean the first day of the month preceding the month in which the first

monthly amortization payment falls due.

"It is hereby understood that before any release on any approved

Mortgage Loan is made by the Creditor, the requisites binding the

Mortgagor and the Creditor as regards to said Mortgage Loan shall

have been completed.

xxx xxx xxx

(pp. 59-60, rec.; emphasis supplied).

A careful analysis of the provisions leads to the conclusion that the

respondent Court of Appeals erred in construing the effectivity date of

insurance coverage from the beginning of the amortization period of the

loan.

WE REVERSE.

There can be no doubt as to the eligibility of the late Captain Serrano

for coverage under Section 1 of Article II of the Group Mortgage Redemption

Insurance Policy as he was a mortgagor of the Social Security System not

over the age of 65 nearest his birthday at the time when the mortgage loan

was granted to him (p. 26, rec.). This fact was admitted not only by the

Social Security Commission but also accepted by the Court of Appeals.

The problem manifests itself in Sections 2 and 3 of the same article of

the Group Mortgage Redemption Insurance Policy. Section 2 provides that

"any mortgagor who is eligible for coverage on or after the Date of Issue

shall be automatically insured, . . ." (italics supplied); while Section 3

provides that the insurance "shall take effect from the beginning of the

amortization period of such Mortgage Loan or partial release of Mortgage

Loan" (italics supplied).

Section 2 of Article II of the Group Mortgage Redemption Insurance

Policy provides that insurance coverage shall be "automatic" and limited only

by the amount of insurance and age requirement. While the same section

has for its title the mode of acceptance, what is controlling is the meaning of

the provision itself. The said section can only convey the idea that the

mortgagor who is eligible for coverage on or after the date of issue shall be

automatically insured. The only condition is that the age requirement should

be satisfied, which had been complied with by the deceased mortgagor in

the instant case.

Under said Section 2, mortgage redemption insurance is not just

automatic; it is compulsory for all qualified borrowers. This is the same

automatic redemption insurance applied to all qualified borrowers by the

GSIS (Government Service Insurance System) and the DBP (Development

Bank of the Philippines). Indeed, the Mortgage Redemption Insurance Policy

of the GSIS provides:

"Sec. 2. Â . . . This policy is granted subject to the terms and

conditions set forth at the back hereof and in consideration of the

application therefor and shall take effect on the date of the first date of

the aforementioned loan" (p. 126, CA rec.; emphasis supplied).

WE take judicial notice of the Mortgage Contract being issued by the

Social Security System in connection with applications for housing loans,

specifically Section 16 thereof:

"Section 16. — (a) The loan shall be secured against the death of

the borrower through the Mortgage Redemption Insurance Plan; (b)

Coverage shall take effect on the date of the first release voucher of

the loan and shall continue until the real estate mortgage loan is fully

paid; . . ." (emphasis supplied).

However, Section 3 of Article II presents an ambiguity. The effective

date of coverage can be interpreted to mean that the insurance contract

takes effect "from the beginning of the amortization period of such Mortgage

Loan" or "partial release of Mortgage Loan."

Applying Article 1374 of the new Civil Code, the mortgagor in the

instant case was already covered by the insurance upon the partial release

of the loan.

Article 1374, NCC, reads thus:

"The various stipulations of a contract shall be interpreted

together, attributing to the doubtful ones that sense which may result

from all of them taken jointly."

The ambiguity in Section 3 of Article II should be resolved in favor of

the petitioner. "The interpretation of obscure words or stipulations in a

contract shall not favor the party who caused the obscurity" (Article 1377,

Civil Code). WE have held that provisions, conditions or exceptions tending

to work a forfeiture of insurance policies should be construed most strongly

against those for whose benefit they are inserted, and most favorably

toward those against whom they are intended to operate (Trinidad vs. Orient

Protective Ass., 67 Phil. 181).

While the issuance of the Group Mortgage Redemption Insurance is a

contract between the Social Security System and the Private Life Insurance

Companies, the fact is that the SYSTEM entered into such a contract to

afford protection not only to itself should the mortgagor die before fully

paying the loan but also to afford protection to the mortgagor. WE take note

of the following:

"I. Â Insurance Coverage.

"1. Â Fire insurance — The SSS-financed house shall be

covered by fire insurance equal to its appraised value or the amount of

the loan, whichever is lesser.

"2. Â Mortgage Redemption Insurance. — Coverage shall be

compulsory for any mortgagor who is not more than 60 years old.

"The insured indebtedness on the mortgage as provided in the

policy shall be deemed paid upon the death of a mortgagor covered

under the MRI" (Employees' Benefits & Social Welfare, 1983 Rev. Ed.,

CBSI, pp. 50-51; emphasis supplied).

It is imperative to dissect the rationale of the insurance scheme

envisioned by the Social Security System. The Mortgage Redemption

Insurance device is not only for the protection of the SYSTEM but also for the

benefit of the mortgagor. On the part of the SYSTEM, it has to enter into such

form of contract so that in the event of the unexpected demise of the

mortgagor during the subsistence of the mortgage contract, the proceeds

from such insurance will be applied to the payment of the mortgage debt,

thereby relieving the heirs of the mortgagor from paying the obligation. The

SYSTEM insures the payment to itself of the loan with the insurance

proceeds. It also negates any future problem that can crop up should the

heirs be not in a position to pay the mortgage loan. In short, the process of

amortization is hastened and possible litigation in the future is avoided. In a

similar vein, ample protection is given to the mortgagor under such a

concept so that in the event of his death; the mortgage obligation will be

extinguished by the application of the insurance proceeds to the mortgage

indebtedness.

The interpretation of the Social Security Commission goes against the

very rationale of the insurance scheme. It cannot unjustly enrich itself at the

expense of another (Nemo cum alterius detrimento protest). "Every person

must, in the exercise of his rights and in the performance of his duties, act

with justice, give everyone his due, and observe honesty and good faith"

(Article 19, Civil Code). Simply put, the SYSTEM cannot be allowed to have

the advantage of collecting the insurance benefits from the private life

insurance companies and at the same time avoid its responsibility of giving

the benefits of the Mortgage Redemption Insurance plan to the mortgagor.

The very reason for the existence of the Social Security System is to extend

social benefits. For SSS to be allowed to deny benefits to its members, is

certainly not in keeping with its policy ". . . to establish, develop, promote

and perfect a sound and viable tax-exempt social security service suitable to

the needs of the people throughout the Philippines, which shall provide to

covered employees and their families protection against the hazards of

disability, sickness, old age, and death with a view to promote their well-

being in the spirit of social justice" (The Social Security Law, R.A. No. 1161,

as amended).

To sustain the position of the SSS is to allow it to collect twice the same

amount — first from the insurance companies which paid to it the amount of

the MRI and then from the heirs of the deceased mortgagor. This result is

unconscionable as it is iniquitous.

It is very clear that the spirit of social justice permeates the insurance

scheme under the Group Mortgage Redemption Insurance. It is a welcome

innovation in these times when the concept of social justice is not just an

empty slogan nor a mere shibboleth. Social justice is explicitly

institutionalized and guaranteed under the Constitution (Article II, Section 6,

1973 Constitution). The construction that would enhance the State's

commitment on social justice mandates Us to hold for the petitioner.

Usually, among the items to be deducted by the SYSTEM from the first

release of the loan is the premium corresponding to the mortgage

redemption insurance (MRI). However, if the premium corresponding to the

amount to be deducted from the first release of the loan was not paid by the

borrower, the deceased mortgagor, the said unpaid premium should be

refunded by the heirs of the borrower.

WHEREFORE, THE DECISION OF THE RESPONDENT COURT OF APPEALS

AFFIRMING RESOLUTION NO. 1365 OF RESPONDENT COMMISSION IS HEREBY

SET ASIDE. THE SOCIAL SECURITY SYSTEM IS HEREBY DIRECTED TO RELEASE

THE PETITIONER FROM PAYING THE MORTGAGE LOAN. THE PETITIONER IS

HEREBY DIRECTED TO REFUND TO THE SSS THE PREMIUM CORRESPONDING

TO THE RELEASED AMOUNT, IF THE SAME HAD NOT BEEN DEDUCTED

THEREFROM, NO COSTS.

SO ORDERED.

Concepcion, Jr., Guerrero, Abad Santos, Escolin and Cuevas, JJ ., concur.

Aquino, J ., concurs in the result.

Â

You might also like

- Insurance ReviewerDocument37 pagesInsurance ReviewerDiane88% (8)

- Shriram Finace Sip ReportDocument64 pagesShriram Finace Sip Reportshiv khillari75% (4)

- Checklist Bank Branch AuditDocument5 pagesChecklist Bank Branch AuditPratik Sankpal0% (1)

- Landicho Vs GSISDocument2 pagesLandicho Vs GSISEl G. Se ChengNo ratings yet

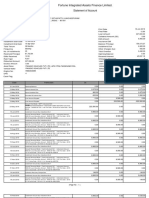

- Fortune Integrated Assets Finance Limited.: Statement of AccountDocument2 pagesFortune Integrated Assets Finance Limited.: Statement of AccountSanthosh SehwagNo ratings yet

- Serano vs. CA Additional Case 3Document2 pagesSerano vs. CA Additional Case 3Tootsie GuzmaNo ratings yet

- Serrano v. CA (1984)Document3 pagesSerrano v. CA (1984)Krizzia GojarNo ratings yet

- Nora Sewrrano Vs CA July 16, 1984Document2 pagesNora Sewrrano Vs CA July 16, 1984Alvin-Evelyn GuloyNo ratings yet

- Insurance Final Exam NotesDocument5 pagesInsurance Final Exam NotesJaymee Andomang Os-agNo ratings yet

- Plaintiffs-Appellees, vs. vs. Defendant-Appellant. Vedasto J Hernandez Government Corporate Counsel Leopoldo M Abellera and Arsenio J MagpaleDocument5 pagesPlaintiffs-Appellees, vs. vs. Defendant-Appellant. Vedasto J Hernandez Government Corporate Counsel Leopoldo M Abellera and Arsenio J MagpaleVSBNo ratings yet

- Serano V CA InsuranceDocument2 pagesSerano V CA InsuranceIhon Baldado100% (1)

- Kevin S. King, as of the Estate of Arnie Naiditch, Deceased v. The Guardian Life Insurance Company of America, Defendant-Interpleading v. Julie Riley Andrus, S/k/a Julia R. Naiditch, Interpleaded, 686 F.2d 894, 11th Cir. (1982)Document8 pagesKevin S. King, as of the Estate of Arnie Naiditch, Deceased v. The Guardian Life Insurance Company of America, Defendant-Interpleading v. Julie Riley Andrus, S/k/a Julia R. Naiditch, Interpleaded, 686 F.2d 894, 11th Cir. (1982)Scribd Government DocsNo ratings yet

- Del Rosario V Equitable InsuranceDocument7 pagesDel Rosario V Equitable InsuranceAngela B. LumabasNo ratings yet

- NORA CANSING SERRANO vs. CA Case DigestDocument2 pagesNORA CANSING SERRANO vs. CA Case DigestMonikka DeleraNo ratings yet

- UCPB General Insurance Co., Inc. vs. Masagana Telamart, Inc.Document17 pagesUCPB General Insurance Co., Inc. vs. Masagana Telamart, Inc.Jaja Ordinario Quiachon-AbarcaNo ratings yet

- GRN 57308Document4 pagesGRN 57308James Bryan Viejo EsteleydesNo ratings yet

- JAIME T. GAISANO, Petitioner, vs. DEVELOPMENT INSURANCE AND SURETY CORPORATION, RespondentDocument3 pagesJAIME T. GAISANO, Petitioner, vs. DEVELOPMENT INSURANCE AND SURETY CORPORATION, RespondentWilliam Azucena100% (1)

- Progressive Enterprises, Inc. v. New England Mutual Life Insurance Company, 538 F.2d 1057, 4th Cir. (1976)Document9 pagesProgressive Enterprises, Inc. v. New England Mutual Life Insurance Company, 538 F.2d 1057, 4th Cir. (1976)Scribd Government DocsNo ratings yet

- Pointers in Insurance Law PDFDocument5 pagesPointers in Insurance Law PDFMaria Diory RabajanteNo ratings yet

- Incontestability ClauseDocument2 pagesIncontestability ClauseSamJadeGadianeNo ratings yet

- NOTES On Insurance PremiumDocument3 pagesNOTES On Insurance PremiumMark DevomaNo ratings yet

- October-19-Lecture-Notes SLUDocument5 pagesOctober-19-Lecture-Notes SLUPrincess ParasNo ratings yet

- Machuca Tile Co., Inc. vs. Social Security SystemDocument9 pagesMachuca Tile Co., Inc. vs. Social Security SystemgryffindorkNo ratings yet

- Insurance LawDocument3 pagesInsurance LawJoe BuenoNo ratings yet

- Insurance VI IXDocument16 pagesInsurance VI IXMa Jean Baluyo CastanedaNo ratings yet

- Gaisano Vs Development InsuranceDocument2 pagesGaisano Vs Development InsuranceMicaela Dela PeñaNo ratings yet

- Claims Settlement and SubrogationDocument16 pagesClaims Settlement and SubrogationRaymund ArcosNo ratings yet

- PAZ LOPEZ DE CONSTANTINO, Plaintiff-Appellant, ASIA LIFE INSURANCE COMPANY, Defendant-AppelleeDocument7 pagesPAZ LOPEZ DE CONSTANTINO, Plaintiff-Appellant, ASIA LIFE INSURANCE COMPANY, Defendant-AppelleeAdam WoodNo ratings yet

- IllustrationDocument34 pagesIllustrationsaina khuhsuNo ratings yet

- Insurance Report - OutlineDocument3 pagesInsurance Report - OutlineKristine PacariemNo ratings yet

- When, What and How of Insurance Contract (Perfection) When Is It Perfected?Document9 pagesWhen, What and How of Insurance Contract (Perfection) When Is It Perfected?Jexelle Marteen Tumibay PestañoNo ratings yet

- 60 SCRA 714 - Business Organization - Corporation Law - Rule On Moral Damages When It Comes To CorporationsDocument4 pages60 SCRA 714 - Business Organization - Corporation Law - Rule On Moral Damages When It Comes To CorporationsRock StoneNo ratings yet

- ACME Shoe Rubber & Plastic vs. CADocument2 pagesACME Shoe Rubber & Plastic vs. CAcmv mendozaNo ratings yet

- Manila Bankers V AbanDocument4 pagesManila Bankers V AbanChanel GarciaNo ratings yet

- Insurance Case Digests (F)Document10 pagesInsurance Case Digests (F)Mara VinluanNo ratings yet

- Manila Bankers Life Insurance Corp. vs. Cresencia P. Aban, GRDocument6 pagesManila Bankers Life Insurance Corp. vs. Cresencia P. Aban, GRCharmaine Valientes CayabanNo ratings yet

- 16 50 InsuranceDocument25 pages16 50 InsuranceMartha IlaganNo ratings yet

- PREMIUMDocument9 pagesPREMIUMInais GumbNo ratings yet

- 11 July PM Commerical LawDocument2 pages11 July PM Commerical LawgsvgsvNo ratings yet

- Commercial Law 2021Document385 pagesCommercial Law 2021Roberto Galano Jr.0% (1)

- Manila Bankers Life Insurance Corp. vs. Cresencia P. Aban, GR. No. 175666, July 29, 2013 (Incontestability)Document5 pagesManila Bankers Life Insurance Corp. vs. Cresencia P. Aban, GR. No. 175666, July 29, 2013 (Incontestability)Charmaine Valientes CayabanNo ratings yet

- Insurance DigestDocument2 pagesInsurance DigestBlue MoonNo ratings yet

- Vedasto J. Hernandez For Plaintiffs-Appellees - Government Corporate Counsel Leopoldo M. Abellera and Trial Attorney Arsenio J. Magpale Defendant-AppellantDocument4 pagesVedasto J. Hernandez For Plaintiffs-Appellees - Government Corporate Counsel Leopoldo M. Abellera and Trial Attorney Arsenio J. Magpale Defendant-AppellantAnjo AldeneseNo ratings yet

- MANILA BANKERS LIFE INSURANCE CORPORATION, Petitioner, Vs - CRESENCIA P. ABAN, RespondentDocument2 pagesMANILA BANKERS LIFE INSURANCE CORPORATION, Petitioner, Vs - CRESENCIA P. ABAN, RespondentWilliam AzucenaNo ratings yet

- MercRev Insurance Syllabus (My Part)Document8 pagesMercRev Insurance Syllabus (My Part)p95No ratings yet

- Machuca Vs SSSDocument3 pagesMachuca Vs SSSDeniseEstebanNo ratings yet

- No. L 35529. July 16, 1984. Nora Cansing Serrano, Petitioner, vs. Court of Appeals and Social Security Commission, RespondentsDocument10 pagesNo. L 35529. July 16, 1984. Nora Cansing Serrano, Petitioner, vs. Court of Appeals and Social Security Commission, RespondentsdanexrainierNo ratings yet

- Insurance Law: The Kingdom of CambodiaDocument12 pagesInsurance Law: The Kingdom of CambodiaKhunlong ChaNo ratings yet

- Warranties-Loss CasesDocument8 pagesWarranties-Loss CasesSachieCasimiroNo ratings yet

- Makati Tuscany Condominium Corp VS CaDocument5 pagesMakati Tuscany Condominium Corp VS CaJohn Henry CasugaNo ratings yet

- Commercial Law Notes April 2Document29 pagesCommercial Law Notes April 2Barnz ShpNo ratings yet

- Landicho vs. GSIS, 46 SCRA 7 (1972)Document4 pagesLandicho vs. GSIS, 46 SCRA 7 (1972)Joena GeNo ratings yet

- Bessie Florine Miner v. Standard Life and Accident Insurance Company, A Corporation, 451 F.2d 1273, 10th Cir. (1972)Document6 pagesBessie Florine Miner v. Standard Life and Accident Insurance Company, A Corporation, 451 F.2d 1273, 10th Cir. (1972)Scribd Government DocsNo ratings yet

- COMMERCIAL LAW Hand NotesDocument3 pagesCOMMERCIAL LAW Hand NotesAl-ridzma SaralNo ratings yet

- Premium Case DigestsDocument8 pagesPremium Case DigestsGladysAnneMiqueNo ratings yet

- Insurance Digest Case 1 77Document63 pagesInsurance Digest Case 1 77EdvangelineManaloRodriguezNo ratings yet

- 2022 ALF LMT Commercial LawDocument38 pages2022 ALF LMT Commercial LawDianalyn QuitebesNo ratings yet

- 13 Gaisano v. Development InsuranceDocument3 pages13 Gaisano v. Development InsuranceRoger Montero Jr.No ratings yet

- Life InsuranceDocument23 pagesLife InsuranceSruthi RavindranNo ratings yet

- Landicho Vs GsisDocument4 pagesLandicho Vs GsisShiena Lou B. Amodia-RabacalNo ratings yet

- 3 Manila Bankers V AbanDocument2 pages3 Manila Bankers V AbanRoger Pascual CuaresmaNo ratings yet

- Case Digest - Tan Vs CADocument2 pagesCase Digest - Tan Vs CAMaricris GalingganaNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Chapter 1 5Document100 pagesChapter 1 5Bijaya DhakalNo ratings yet

- Annual Report 2019Document179 pagesAnnual Report 2019YudyChenNo ratings yet

- Chapter 4: Money Time Relationships and EquivalenceDocument12 pagesChapter 4: Money Time Relationships and EquivalenceAbed SolimanNo ratings yet

- HIJC JuneDocument19 pagesHIJC JunekarnakagawaNo ratings yet

- Practice Examination For The TOEIC Test (1) - 23-40Document18 pagesPractice Examination For The TOEIC Test (1) - 23-40EstyleNo ratings yet

- 111928-2005-Mondragon Leisure and Resorts Corp. v. Court PDFDocument8 pages111928-2005-Mondragon Leisure and Resorts Corp. v. Court PDFjrNo ratings yet

- Prudential Bank V AlviarDocument3 pagesPrudential Bank V AlviarmoniquehadjirulNo ratings yet

- B.inggris N Kel.2Document34 pagesB.inggris N Kel.2Putra RakhmadaniNo ratings yet

- Chapter 12 PPT - FinmanDocument73 pagesChapter 12 PPT - FinmanMariane LandichoNo ratings yet

- Indian Institute of Banking & Finance: Certificate Course For Non-Banking Financial CompaniesDocument6 pagesIndian Institute of Banking & Finance: Certificate Course For Non-Banking Financial CompaniesChanchal MisraNo ratings yet

- BCG Digital Lending Report Tcm21 197622Document48 pagesBCG Digital Lending Report Tcm21 197622Krishna Chaitanya KothapalliNo ratings yet

- HBA RulesDocument95 pagesHBA RulesatanuchandrimaNo ratings yet

- 89planters Development Bank v. Lopez (Mier - Keith Jasper)Document2 pages89planters Development Bank v. Lopez (Mier - Keith Jasper)Keith Jasper MierNo ratings yet

- Case Facts Issues Ruling: To Secure, There Can Be No SecurityDocument2 pagesCase Facts Issues Ruling: To Secure, There Can Be No SecurityRogelio Rubellano IIINo ratings yet

- CIB ReportDocument3 pagesCIB ReportSheikh RonyNo ratings yet

- Grade 10 Business Quiz 1Document2 pagesGrade 10 Business Quiz 1alanoud obeidatNo ratings yet

- Ranjini FinanceDocument3 pagesRanjini FinanceAyanleke Julius OluwaseunfunmiNo ratings yet

- Ashok Leyland Annual Report 2014 15Document159 pagesAshok Leyland Annual Report 2014 15rohit keluskarNo ratings yet

- SARFESIADocument25 pagesSARFESIApriyammhashilkarNo ratings yet

- NHA - Revised GEHP Application FormDocument2 pagesNHA - Revised GEHP Application FormMark Earvin CervantesNo ratings yet

- MC 006 2019 - PRRDDocument6 pagesMC 006 2019 - PRRDmarjNo ratings yet

- 7 - U.S. v. Igpuara (1914)Document4 pages7 - U.S. v. Igpuara (1914)StrugglingStudentNo ratings yet

- Sample Business Proposal Impact of Microfinance in KenyaDocument64 pagesSample Business Proposal Impact of Microfinance in Kenyayedinkachaw shferawNo ratings yet

- Project Report On Indusind BankDocument80 pagesProject Report On Indusind Bankrosy tudu100% (1)

- Online Test Series: Jaiib Caiib Mock Test & Study Materias PageDocument130 pagesOnline Test Series: Jaiib Caiib Mock Test & Study Materias PageSurabandhu DasNo ratings yet

- REPORT P3 - JAVIER, DANICA T. (Evolution of Philippine Housing Policy and Institution)Document4 pagesREPORT P3 - JAVIER, DANICA T. (Evolution of Philippine Housing Policy and Institution)DaNica Tomboc Javier0% (1)

- Steals & Deals Southeastern Edition 9-27-18Document16 pagesSteals & Deals Southeastern Edition 9-27-18Roger Waynick100% (1)