Professional Documents

Culture Documents

Access Controller

Access Controller

Uploaded by

jstocks747Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Access Controller

Access Controller

Uploaded by

jstocks747Copyright:

Available Formats

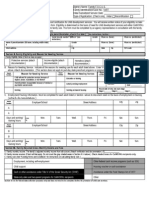

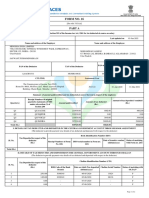

FoodShare Six-Month Report

F-16076A (06/2022) SMRF

CDPU

CENTRALIZED DOCUMENT PROCESSING UNIT

PO BOX 5234 State of Wisconsin

JANESVILLE WI 53547 5234

Case #: 4101430845

Mailing Date: 11/20/2023

Wisconsin's Kenosha Racine Partners

000837 Toll Free Number: 1-888-794-5820

CDPU Fax Number: 1-855-293-1822

VIRGINIA D COMFORT

9049 29TH AVE

Use Fax to send verifications

KENOSHA WI 53143 6601 Online at access.wisconsin.gov

The State of Wisconsin is an equal opportunity service provider. This letter contains information

that affects your benefits. If you need this material in a different format because of a disability or

if you need this letter translated or explained in your own language, please call 1-888-794-5820.

These services are free.

FOODSHARE SIX-MONTH REPORT FORM COMPLETION INSTRUCTIONS

As a FoodShare member, you must report current information about your household by completing and

submitting the FoodShare Six-Month Report Form. You must complete and submit your FoodShare Six-

Month Report Form by 12/08/2023 if you want to keep getting FoodShare benefits without any delays.

You have the following options for completing and submitting your FoodShare Six-Month Report Form:

1. ACCESS website: Report your information online:

· Go to access.wi.gov.

· Log in to your account.

· Click the Six-Month Report Form link under Alerts.

· Follow the on-screen instructions.

Note: If you do not have an ACCESS account, you can go to access.wi.gov to create one.

2. Mailing the paper form: Complete the enclosed paper form using the completion instructions on the

following pages. Use the provided envelope to mail the form and any proof to the address listed on the

form.

3. Faxing the paper form: Complete the enclosed paper form using the completion instructions on the

following pages.

4. Telephone: Complete the form over the telephone by calling your local agency.

5. MyACCESS app: Submit the form through MyACCESS app if you are reporting that there are no

changes. Note: no changes can also be reported through the options listed above.

If you need help completing your FoodShare Six-Month Report Form, contact your agency using the contact

information at the top of this page.

Case: 4101430845 Date: 11/20/2023 Page 1 of 15

FoodShare Six-Month Report

F-16076A (06/2022) SMRF

You may need to provide proof of some of your answers. See the instructions for each section for examples

of proof you can provide. Your agency will contact you if you need to provide more proof.

Instructions for Completing Paper FoodShare Six-Month Report Form

Print your answers using blue or black ink. Use an additional sheet of paper if more room is needed to answer

any question. Personally identifiable information is kept private and is only used for the direct administration

of FoodShare benefits.

SECTION 1 – ADDRESS/SHELTER INFORMATION

Address: The address that is currently on file for your household is preprinted. If you moved, check “Yes”

and complete the rest of Section 1. If the address is correct, check “No” and go to Section 2 – Household

Members. If you are homeless, write “Homeless” in the space provided.

Phone Number: Write in your phone number(s). If you do not have a phone, write in a number where you

can be reached if one is available.

Email (optional): Check “Yes” or “No” to answer if you have changed your email address. Write in your

email address if you want to give your agency more options to contact you. Check “Yes” or “No” to answer

if you would like to get communications from the State through email.

Rent: If you pay apartment rent or lot rent (rent for use of land on which to park a mobile home), write in the

amount that you pay each month. If you live in subsidized housing, such as Section 8 or public housing, write

in the amount that you must pay each month.

Utility: If you have any utility bills, such as electric, gas, phone, water, or trash removal, check the box for

the utility that you pay each month. Check “Yes” or “No” based on whether a utility is used for heat.

Mortgage: If you have a mortgage payment, write in the amount that you pay each month.

Property Taxes: If your property taxes are paid separately from your mortgage payment, write in the amount

that you pay each month.

Homeowner's Insurance: If your homeowner’s insurance is paid separately from your mortgage payment,

write in the amount you pay each month.

You may need to provide proof of some of your answers. Some examples of proof you can provide are your

lease, mortgage papers, real estate tax statement, or homeowner’s insurance policy.

SECTION 2 – HOUSEHOLD MEMBERS

We need to collect current information about the people who live with you. The information that is currently

on file for your household is preprinted. Check “Yes” next to each person who still lives with you. Check

“No” next to each person who does not still live with you.

If there are new members in your household, write in the requested information in the space provided. Use an

additional sheet of paper if more room is needed. Please check the box or boxes that best describe this

person's ethnicity and/or race. You don't have to answer these questions if you don't want to. We’re asking

Case: 4101430845 Date: 11/20/2023 Page 2 of 15

FoodShare Six-Month Report

F-16076A (06/2022) SMRF

these questions to help improve our programs and make sure they do not discriminate based on ethnicity or

race. Your answers will not be used to make a decision about your programs and benefits.

Providing Social Security numbers and information on U.S. citizenship is voluntary; however, if this

information is not provided, FoodShare benefits will be denied. The collection of a Social Security number

for each household member applying for or getting benefits is authorized under the Food Stamp Act of 1977,

as amended, 7 U.S.C. 2011-2036. Social Security numbers, as well as other information provided, are used

for verification with the Internal Revenue Service, Social Security Administration, Unemployment Insurance

Division, and Department of Transportation. Social Security numbers are also used to check the identity of

household members to prevent duplicate participation and to make sure the household meets enrollment

rules.

SECTION 3 – JOB INCOME AND WAGES

A. Employment Income

The job income information that is currently on file for your household is preprinted.

Check “Yes” if there has been a change to the preprinted information. Some examples of a change are a

change in an hourly rate of pay, a change in the number of hours worked, loss of job, start of a new job, or a

change from full-time or part-time status. If someone left a job, write in the last day worked. If you check

“Yes” in any of the boxes, go to Part B – Report Income.

Check “No” if the preprinted information has not changed. If you check “No” in all the boxes and all jobs for

all members of your household are listed, go to Part C – Self-Employment.

If someone in your household has a job that is not listed, go to Part B – Report Income.

B. Report Income

If you checked “Yes” in Part A or you need to report a new job that is not listed, complete this section. Due

to limited space, the form only lists pay and hours for five employers.

Write in the name of the person with the job, the employer’s name, and the date the job began. Check the box

for how often the person is paid. Write in the rate of pay per hour or the salary if the person is not paid

hourly.

You may need to provide proof of some of your answers. Some examples of proof of wages you can provide

are:

All pay stubs received in the last month.

A signed statement from the employer that includes gross earnings (income before taxes or any

deductions are taken out) and pay dates for the last month. The statement must list the rate of pay and

average number of hours expected to be worked in the next month.

C. Self-Employment

The self-employment information currently on file for your household is preprinted. Note that the average

monthly income shown is income before allowable business expenses are taken out. If any of the information

has changed, explain the change in the space provided. Use an additional sheet of paper if more room is

needed.

Case: 4101430845 Date: 11/20/2023 Page 3 of 15

FoodShare Six-Month Report

F-16076A (06/2022) SMRF

If anyone in your household is self-employed and his or her self-employment information is not listed, write

in the person’s name, business’s name, business ownership type, business type (for example, bakery, farm,

plumbing), date the business started, business’s tax information, whether the business has had a significant

change in income or expenses, average monthly income before expenses are taken out, average monthly

expenses, and the average number of hours the person works for the business each month.

Some examples of a significant change are:

The self-employed person is ill or injured and is unable to work for a month or more.

A farmer has suffered unusual crop loss due to the weather or other circumstances and will not be

paid for the loss.

There has been a substantial increase in business-related expenses without an increase in income.

You may need to provide proof of some of your answers. Some examples of proof you can provide are tax

returns or bookkeeping records.

SECTION 4 – OTHER INCOME

A. Has there been a change in other income?

The other income that is currently on file for your household is preprinted. You must report changes of more

than $125 in other income. Some examples of other income are payments from child support, unemployment

insurance, worker’s compensation, veterans benefits, Social Security income, or Foster Care.

If the other income has changed by more than $125, check “Yes” and go to Part B – Report Other Income.

If there is no change to the other income, check “No.” If you check “No” and all other income for all

members of your household is listed, go to 5 – Child Support Payments.

If someone in your household has other income that is not listed, go to Part B – Report Other Income.

B. Report Other Income

If you checked “Yes” in Part A – Has there been a change in other income? or you need to report other

income that is not listed, complete this section.

Write in the person’s name, source of income, and the monthly amount received.

You may need to provide proof of some of your answers. Some examples of proof you can provide are an

award letter, a pension statement, or a copy of the last check stub.

Note: If you do not report a decrease in your household’s monthly income or the loss of any household

income, you will not get any resulting increase in your FoodShare benefits.

SECTION 5 – CHILD SUPPORT PAYMENTS

A. Report Change in Child Support:

The current child support information on file for your household is filled out below. Check “Yes” if there has

been a change to the information and complete Part B - Report Child Support to report changes.

Case: 4101430845 Date: 11/20/2023 Page 4 of 15

FoodShare Six-Month Report

F-16076A (06/2022) SMRF

Check “No” if the information has not changed and go to Section 6 – Lottery or Gambling Winning.

Name of Member: This is the member in your household who has a change in child support.

Begin Date: This is the date the child support obligation started.

Support Type: This is the type of support the person pays (child support, guardianship support, alimony,

etc.)

Ordered Amount: This is the amount of the child support obligation. Write the amount of child support the

person actually pays each month.

B. Report Child Support

Use this section to report a change or to add new child support information.

Ordered Amount: Write in the amount of the new or changed child support obligation.

Date Change Began: Write in the date of the new or changed child support obligation.

How Often: Check the box to indicate how often payment is required.

Date of Out-of-State Court Order: Write in the date of the out-of-state court order.

You may need to provide proof of your answers. Some examples of proof you can provide are a court order

or payment record from another state.

Note: You do not need to provide proof for child support payments ordered by a Wisconsin court.

If you no longer have to pay child support or guardianship obligations, check the box for no child support or

guardianship obligations and complete Section 6 – Lottery or Gambling Winning.

SECTION 6 – LOTTERY OR GAMBLING WINNING

We need to collect current information about any substantial lottery or gambling winning that anyone in your

household has won that has not already been reported to your agency.

Name of Member: This is the member in your household who had a substantial lottery or gambling winning.

Date of Winning: Write in the date the lottery or gambling winning occurred.

If you have no change to report, check the box for “no member in the household has a substantial lottery or

gambling winning” and complete Section 7 – Signature.

SECTION 7 – SIGNATURE

Signature: Review all the information you provided, and sign and date the form.

Return the form to the agency that is listed on the form. An envelope has been provided for your

convenience.

Checklist:

Case: 4101430845 Date: 11/20/2023 Page 5 of 15

FoodShare Six-Month Report

F-16076A (06/2022) SMRF

¨ Make sure you answered all the questions.

¨ Remember to sign the form.

¨ Do not forget to send proof of your answers. For example, if reporting wages in Section 3 – Part B,

include dated check stubs for the previous 30 days, an earnings report, or a statement from your

employer.

¨ Either mail the completed form and any proof to the address listed in the gray box at the top of the

first page of the form, or fax the form and proof to 1-855-293-1822 (if you do not live in Milwaukee

County) or 1-888-409-1979 (if you live in Milwaukee County).

Note: If you are mailing your form, make sure you can see your agency’s address through the

window of the provided envelope.

USE OF SOCIAL SECURITY NUMBERS / PERSONALLY IDENTIFIABLE INFORMATION /

COLLECTION OF INFORMATION

The information required on your application, including the Social Security number of each

household member applying for benefits, is authorized under the Food and Nutrition Act of

2008, as amended PL 110-246 (7 United States Code 2011-2036. If you do not have a Social

Security number due to religious beliefs or because of your immigration status, you will not be

required to give a Social Security number.

The information will be used to determine if your household can get or keep getting benefits.

Information you give will be verified through computer matching programs. This information

will also be used to monitor compliance with program rules and for program management.

This information may be given to other federal and state agencies for official examination and

to law enforcement officials for the purpose of apprehending people fleeing to avoid the law.

Providing information on your application, including the Social Security number of each

household member, is voluntary. However, any person who is asking for FoodShare benefits

but does not give a Social Security number will not be able to get benefits. Any Social Security

number provided for members who are not enrolled will be used and disclosed in the same way

as Social Security numbers of enrolled household members.

Your Social Security number will not be shared with United States Citizenship and

Immigration Services.

IMMIGRATION STATUS

To be able to get FoodShare, you must be a U.S. citizen or have qualifying immigration status with

United States Citizenship and Immigration Services (USCIS). Immigration status of all individuals

applying for FoodShare will be verified with USCIS and may affect FoodShare enrollment and

benefits. Immigration status will not be verified with USCIS for any individual who is not applying

Case: 4101430845 Date: 11/20/2023 Page 6 of 15

FoodShare Six-Month Report

F-16076A (06/2022) SMRF

for FoodShare or who indicates he or she does not have qualifying immigration status with USCIS.

However, income from those individuals may affect FoodShare enrollment or benefits.

Case: 4101430845 Date: 11/20/2023 Page 7 of 15

FoodShare Six-Month Report

F-16076A (06/2022)

SMRF

USDA Nondiscrimination Statement

In accordance with Federal civil rights law and U.S. Department of Agriculture (USDA) civil rights

regulations and policies, the USDA, its Agencies, offices, and employees, and institutions

participating in or administering USDA programs are prohibited from discriminating based on race,

color, national origin, sex, religious creed, disability, age, political beliefs, or reprisal or retaliation for

prior civil rights activity in any program or activity conducted or funded by USDA.

Persons with disabilities who require alternative means of communication for program information

(e.g. Braille, large print, audiotape, American Sign Language, etc.), should contact the Agency (State

or local) where they applied for benefits. Individuals who are deaf, hard of hearing or have speech

disabilities may contact USDA through the Federal Relay Service at (800) 877-8339. Additionally,

program information may be made available in languages other than English.

To file a program complaint of discrimination, complete the USDA Program Discrimination Complaint

Form, (AD-3027) found online at: https://www.ascr.usda.gov/how-file-program-discrimination-

complaint, and at any USDA office, or write a letter addressed to USDA and provide in the letter all of

the information requested in the form. To request a copy of the complaint form, call (866) 632-9992.

Submit your completed form or letter to USDA by:

(1) mail: U.S. Department of Agriculture

Office of the Assistant Secretary for Civil Rights

1400 Independence Avenue, SW

Washington, D.C. 20250-9410;

(2) fax: (202) 690-7442; or

(3) email: program.intake@usda.gov.

This institution is an equal opportunity provider.

Case: 4101430845 Date: 11/20/2023 Page 8 of 15

FoodShare Six-Month Report

F-16076 (06/2022)

SMRF

FOODSHARE SIX-MONTH REPORT FORM

To avoid a delay in your FoodShare benefits, Case Number: 4101430845

complete, sign and return this form by 12/08/2023 Case Name: VIRGINIA D

COMFORT

To : CDPU Agency Information

CENTRALIZED DOCUMENT PROCESSING UNIT Wisconsin's Kenosha Racine

PO BOX 5234

Partners

JANESVILLE WI 53547 5234

Toll Free Number: 1-888-794-5820

CDPU Fax Number: 1-855-293-1822

Use Fax to send verifications

Online at access.wisconsin.gov

Complete and submit your FoodShare Six-Month Report Form in one of the following ways:

· Online through the ACCESS website. Log into your ACCESS account at access.wi.gov, and click the

Six-Month Report link under Alerts.

· By mobile app: If reporting no changes from the information we already have, submit through the

MyACCESS app.

· By mail: Complete and return this form to the address in the box at the top of this form.

· By telephone: Call your local agency and complete the form over the telephone.

· By fax: If you live in Milwaukee County, fax the completed paper form and any proof to 888-409-1979.

If you do not live in Milwaukee County, fax the completed paper form and any proof to 855-293-1822.

Fax both sides of the paper form.

-------------- COMPLETE THIS FORM USING BLUE OR BLACK INK. PLEASE PRINT. -----------

Include all required proof of your answers. You can find more details in the instructions. Your agency will

contact you if more information is needed. Make sure to include your most current contact information so the

agency will be able to contact you.

SECTION 1 – ADDRESS/SHELTER INFORMATION

The address listed below is what we have on file for your household.

9049 29TH AVE

KENOSHA WI 53143 6601

Have you moved to a different address? ☐ Yes ☐ No

If “Yes,” complete the information below for the new address. If “No,” complete the email

question below, then go to Section 2 – Household Members. If you are homeless, write

“homeless” in the space below.

What is your new address?

Street Apt. Number

Case: 4101430845 Date: 11/20/2023 Page 9 of 15

FoodShare Six-Month Report

F-16076 (06/2022)

SMRF

City Zip Code

Home Phone Cell Phone

If you do not have a phone, what is a number where you can be reached?

Is there a change in your email address? ☐ Yes ☐ No

Do you prefer to get communications from the State through email? ☐ Yes ☐ No

If you pay rent or lot rent, how much do you pay per month? (If you live in subsidized $

housing, write in the amount of rent you must pay.)

If you pay rent, is heat included in your rent? ☐ Yes ☐ No

Is your household required to pay any of the following utilities, and is the utility used for heat?

Used for heat? Used for heat?

☐ Gas (Natural) ☐ Yes ☐ No ☐ Fuel Oil/Kerosene ☐ Yes ☐ No

☐ Electric ☐ Yes ☐ No ☐ Coal ☐ Yes ☐ No

☐ Liquid Propane Gas ☐ Yes ☐ No ☐ Wood ☐ Yes ☐ No

Check the box if your household is required to pay for any of the following utilities:

☐ Phone ☐ Water ☐ Sewer

☐ A/C Surcharge ☐ Trash Removal ☐ Other:

If you have a mortgage, how much do you pay? Property Taxes (if paid separately from your mortgage)

$ $

Homeowner’s Insurance (if paid separately from your mortgage)

$

SECTION 2 – HOUSEHOLD MEMBERS

Below are the names of all the people we have as living in your household. Review the names and check

“Yes” if they still live with you or “No” if they do not.

Yes No

VIRGINIA D COMFORT ☐ ☐

Complete the information below for new household members who are not preprinted above. Use an

additional sheet of paper if more room is needed or if more people have moved in with you. You don’t have

to answer the questions below on ethnicity and race. We are asking these questions to help improve our

programs and make sure they do not discriminate based on ethnicity or race. Your answers will not be used

to make a decision about your benefits.

Case: 4101430845 Date: 11/20/2023 Page 10 of 15

FoodShare Six-Month Report

F-16076 (06/2022)

SMRF

First Name Last Name Date of Birth (mm/dd/yy)

Ethnicity (optional) Race (optional): check all that apply

☐ Hispanic or Latino(a) ☐ American Indian/Alaskan Native ☐ Asian

☐ Not Hispanic or Latino(a) ☐ Black/African American ☐ Native Hawaiian/Pacific Islander

☐ I don’t know ☐ White ☐ Other

☐ I prefer not to answer ☐ I don’t know ☐ I prefer not to answer

Sex U.S. Citizen Social Security Number

☐ Male ☐ Female ☐ Yes ☐ No

Alien Registration Number When did this person move in with you? (mm/dd/yy)

Does this person buy, prepare, or share food with you? ☐ Yes ☐ No

Is this person related to you? ☐ Yes ☐ No

If “Yes,” explain in the space below how they are related to you (for example, son, mother, brother, sister)?

SECTION 3 – JOB INCOME AND WAGES

A. Employment Income

Listed below is the information we have about members of your household who have a job. Check “Yes”

next to the job if there has been a change in rate, pay, or hours worked or if the job ended. If this individual

no longer works with this employer, list the date the job ended. Check “No” if there are no changes.

Has there been a change in the rate of pay or hours worked at this job?

Name Employer

☐ Yes ☐ No

VIRGINIA D COMFORT CHRISTIAN SERVANTS HOME

Rate of Pay Hours Worked Per Pay Period Type of Pay Date Ended(mm/dd/yy)

15.82 SALARY

Name Employer

☐ Yes ☐ No

Rate of Pay Hours Worked Per Pay Period Type of Pay Date Ended(mm/dd/yy)

Name Employer

☐ Yes ☐ No

Rate of Pay Hours Worked Per Pay Period Type of Pay Date Ended(mm/dd/yy)

Name Employer

☐ Yes ☐ No

Rate of Pay Hours Worked Per Pay Period Type of Pay Date Ended(mm/dd/yy)

Name Employer

☐ Yes ☐ No

Rate of Pay Hours Worked Per Pay Period Type of Pay Date Ended(mm/dd/yy)

Case: 4101430845 Date: 11/20/2023 Page 11 of 15

FoodShare Six-Month Report

F-16076 (06/2022)

SMRF

If you checked “Yes” to any job detail, go to Part B – Report Income. Answer all questions about any

household member who had a change in rate of pay or hours worked or who started a new job. If there are

no changes in job income (all boxes are checked “No”), go to Part C – Self Employment.

☐ Check here if no one is employed.

B. Report Income

Use an additional sheet of paper if more room is needed to report changes in job income. For employed

household members with income reported below, enclose all pay stubs received in the last 30 days. An

employer statement may also be used to verify current wages.

Member Name Employer Name

Date Started (mm/dd/yy) How Often Paid? Number of Hours Worked

☐ Weekly ☐ Every Two Weeks

☐ Monthly ☐ Twice a Month ☐ Other

Rate of Pay Per Hour Salary (if not paid hourly)

$ $

Member Name Employer Name

Date Started (mm/dd/yy) How Often Paid? Number of Hours Worked

☐ Weekly ☐ Every Two Weeks

☐ Monthly ☐ Twice a Month ☐ Other

Rate of Pay Per Hour Salary (if not paid hourly)

$ $

Member Name Employer Name

Date Started (mm/dd/yy) How Often Paid? Number of Hours Worked

☐ Weekly ☐ Every Two Weeks

☐ Monthly ☐ Twice a Month ☐ Other

Rate of Pay Per Hour Salary (if not paid hourly)

$ $

C. Self-Employment

Listed below is the information we have on file for people in your household who are self-employed. If the

information has changed, check “Yes,” and explain the change in the lines below. If the information has not

changed, check “No.”

Case: 4101430845 Date: 11/20/2023 Page 12 of 15

FoodShare Six-Month Report

F-16076 (06/2022)

SMRF

Has this information changed? Name

☐ Yes ☐ No

Business Name Business Type

Average Monthly Income Average Monthly Expenses Average Hours Worked Per Month

If any information has changed, please explain the change below. Use an additional sheet of paper if more

room is needed.

If anyone in your household is self-employed and his or her information is not listed above, complete the

following:

Household Member’s Name Business Name

Business Ownership Type

☐ Partnership ☐ S corporation ☐ Sole proprietorship ☐ Other ☐ I don’t know

Business Type Date Business Started

Has the business filed taxes? ☐ Yes ☐ No

If yes, for what year did the business last file taxes?

Has the business had a significant change in income or expenses (more than $125)?

☐ Yes ☐ No ☐ I don’t know

Average Monthly Income Average Monthly Expenses Average Hours Worked Per Month

SECTION 4 – OTHER INCOME

A. Has there been a change in other income?

Listed below is what we have on file for members of your household.

You only need to report changes of more than $125 in other income. Check “Yes” under “Change of More

Than $125” if the member’s other income has changed by more than $125.

Examples of other income are payments from child support, unemployment insurance, workers’

compensation, or Social Security income.

Change of More Name of Member Source of Other Income Monthly Amount

Than $125

☐ Yes ☐ No $

Case: 4101430845 Date: 11/20/2023 Page 13 of 15

FoodShare Six-Month Report

F-16076 (06/2022)

SMRF

☐ Yes ☐ No $

☐ Yes ☐ No $

☐ Yes ☐ No $

If you checked “No” to all the boxes above AND no one in your household is getting any other income from

another source, go to Section 5 – Child Support Payments.

If you checked “Yes” above OR to add information about a new source of other income, go to Part B –

Report Other Income.

☐ Check here if there is no other income.

B. Report Other Income

Member Name Source of Other Income Monthly Amount

SECTION 5 – CHILD SUPPORT PAYMENTS

A. Report Change in Child Support

Listed below is the information we have on file for your household. Please review to make sure this

information is still correct.

Was There a Name of Member Begin Date Support Type Ordered Amount

Change?

☐ Yes ☐ No

How much child support is being paid per month?

If you checked “No” to all the boxes above AND no one in your household is obligated to pay child support

or guardianship to another source, go to Section 6 – Lottery or Gambling Winning.

If you checked “Yes” above OR need to add a new child support, go to Part B – Report Child Support.

☐ Check here if there are no child support or guardianship obligations.

B. Report Child Support

Fill out the information below to report child support for any member in the household.

Case: 4101430845 Date: 11/20/2023 Page 14 of 15

FoodShare Six-Month Report

F-16076 (06/2022)

SMRF

Name of Person Paying Child Support (First and Last Name)

Ordered Amount Date Change Began (mm/dd/yy)

$

How often? Date of Out-of-State Court Order (mm/dd/yy)

☐ Weekly ☐ Every Two Weeks

☐ Twice a Month ☐ Monthly

How much child support is being paid per month?

SECTION 6 – LOTTERY OR GAMBLING WINNING

A. Report Change in Lottery or Gambling Winning

Please report if anyone in your household has a substantial lottery or gambling winning defined as a single

winning of $4,250.00 or more before tax deductions from a single hand, game, ticket, or bet.

Name of Member Date of Winning

☐ Check here if no member in the household has a substantial lottery or gambling winning from a single

hand, game, ticket, or bet that are over the program amount listed above.

SECTION 7 – SIGNATURE

I certify that my answers on this form are correct and complete to the best of my knowledge. I understand

that the information I provide on this form may result in a change or termination of my benefits. I also

understand that if I intentionally give incorrect information, it may result in a fine and/or imprisonment.

SIGNATURE Date Signed (mm/dd/yy)

To avoid a delay in your FoodShare benefits,

return this form by Dec 08, 2023.

Case: 4101430845 Date: 11/20/2023 Page 15 of 15

You might also like

- Visa Granted PDFDocument5 pagesVisa Granted PDFalex miguel vergara soto100% (1)

- Georgia DOL Application For Overpayment WaiverDocument6 pagesGeorgia DOL Application For Overpayment WaiverLindsey BasyeNo ratings yet

- FEIN Assignment LetterDocument2 pagesFEIN Assignment LetterKealamākia Foundation0% (1)

- TAXATION NOTES by PKAODocument67 pagesTAXATION NOTES by PKAOSHMASHNo ratings yet

- Medicaid ApplicationDocument27 pagesMedicaid ApplicationIndiana Family to Family100% (2)

- History of Social WorkDocument44 pagesHistory of Social WorkS.Rengasamy94% (32)

- Ethical Issues in Project ManagementDocument3 pagesEthical Issues in Project ManagementLee0% (1)

- Employment Contract Staff Nurse 1Document3 pagesEmployment Contract Staff Nurse 1Charm Tanya100% (2)

- Tracer Study ResearchDocument14 pagesTracer Study ResearchMinti BravoNo ratings yet

- 26 Noa-Fs-Ds 20231013212257 164103576Document10 pages26 Noa-Fs-Ds 20231013212257 164103576v7fmwkscktNo ratings yet

- Loan Rein Ex InfoDocument5 pagesLoan Rein Ex InfoGomezLiliNo ratings yet

- Income-Driven Repayment Plan Request How To Complete YourDocument13 pagesIncome-Driven Repayment Plan Request How To Complete YourAnonymous 6jR6DuNo ratings yet

- 2015-2016 Dependent Verification FormDocument2 pages2015-2016 Dependent Verification FormxxxtoyaxxxNo ratings yet

- Income Driven Repayment FormDocument13 pagesIncome Driven Repayment Formtumi50No ratings yet

- 2018-2019 Verification Worksheet Independent StudentDocument3 pages2018-2019 Verification Worksheet Independent StudentHoney JanNo ratings yet

- Application For Refund of Educational Contributions: (VEAP, Chapter 32, Title 38, U.S.C.)Document2 pagesApplication For Refund of Educational Contributions: (VEAP, Chapter 32, Title 38, U.S.C.)Emette E. MasseyNo ratings yet

- FSSA Document Center PO Box 1810 Marion, IN 46952: FSS407AE00121YU2SE8Document8 pagesFSSA Document Center PO Box 1810 Marion, IN 46952: FSS407AE00121YU2SE8Tonya JohnsonNo ratings yet

- Maternity Benefit: What Do I Need To Complete This Application Form?Document16 pagesMaternity Benefit: What Do I Need To Complete This Application Form?Vlad PerjuNo ratings yet

- Follow The Below Directions ToDocument11 pagesFollow The Below Directions ToDC DobNo ratings yet

- 71 Interim Report Reminder 20230120233759 185d29e7b01-44f72099Document4 pages71 Interim Report Reminder 20230120233759 185d29e7b01-44f72099ELLA PATTERSONNo ratings yet

- 2015 Application Request and Checklist: Neighborhood Centers Inc. Housing and Energy ManagementDocument11 pages2015 Application Request and Checklist: Neighborhood Centers Inc. Housing and Energy ManagementMichael KingNo ratings yet

- LHS ExemptionForm Final-1Document6 pagesLHS ExemptionForm Final-1rayghanaachmatNo ratings yet

- Claim ConfirmationDocument7 pagesClaim Confirmationdebra hillNo ratings yet

- SNAP VA Paper ApplicationDocument16 pagesSNAP VA Paper ApplicationMichelle HuynhNo ratings yet

- LVD App PY22 1Document7 pagesLVD App PY22 1Billy McNo ratings yet

- FIS Statement Website Packet Rev. 6 6 5 19 2Document10 pagesFIS Statement Website Packet Rev. 6 6 5 19 2Rob WrightNo ratings yet

- SAFHR For Renters Application Worksheet 08.30.2021Document16 pagesSAFHR For Renters Application Worksheet 08.30.2021cookseyecuritycorpNo ratings yet

- Family Energy Rebate Application Form On Supply (v7)Document4 pagesFamily Energy Rebate Application Form On Supply (v7)Trang NguyenNo ratings yet

- DhhsDocument4 pagesDhhsJaime WhiteNo ratings yet

- Rights and Responsibilities of Supplemental Nutrition Assistance Program (Snap) Households Your RightsDocument21 pagesRights and Responsibilities of Supplemental Nutrition Assistance Program (Snap) Households Your RightsAsh FoxxNo ratings yet

- Income Based Repayment Plan Request and or RenewalDocument5 pagesIncome Based Repayment Plan Request and or RenewalaquarianflowerNo ratings yet

- Assurance WirelessDocument1 pageAssurance WirelessNicole FowlerNo ratings yet

- Homelessness Prevention Application 3.19.2020Document5 pagesHomelessness Prevention Application 3.19.2020juanNo ratings yet

- Dependent Verification WorksheetDocument3 pagesDependent Verification Worksheetmvalenc3No ratings yet

- Choong K KIM 1 1 0 8 8 1 X 345 S Gramercy PL Apt#206 Los Angeles L.A. CA 90020Document1 pageChoong K KIM 1 1 0 8 8 1 X 345 S Gramercy PL Apt#206 Los Angeles L.A. CA 90020topsytablesNo ratings yet

- FAFDocument3 pagesFAFFritz PrejeanNo ratings yet

- 2015-16 Independent Standard Verification Worksheet (V1)Document3 pages2015-16 Independent Standard Verification Worksheet (V1)stanlygit96No ratings yet

- Document PDFDocument2 pagesDocument PDFsherrimcateeNo ratings yet

- Tate of Onnecticut: Family Child Care Home Initial Application ChecklistDocument14 pagesTate of Onnecticut: Family Child Care Home Initial Application ChecklistA MaldonadoNo ratings yet

- About Your Benefits: State of WisconsinDocument6 pagesAbout Your Benefits: State of WisconsinJanelle GarrisonNo ratings yet

- Assurance Wireless ApplicationDocument2 pagesAssurance Wireless ApplicationMichelle KajikawaNo ratings yet

- English Free School MealsDocument2 pagesEnglish Free School MealsarktindalNo ratings yet

- Direct Deposit Enrollment & Changes: SECTION 1: Annuitant InformationDocument3 pagesDirect Deposit Enrollment & Changes: SECTION 1: Annuitant InformationdesireeNo ratings yet

- DATE: To: FROM: April 6, 2009 Director of A LicensedDocument29 pagesDATE: To: FROM: April 6, 2009 Director of A Licensedapi-26136370No ratings yet

- Junior Level Science Scholarships Application Form: FORM A - Personal InformationDocument4 pagesJunior Level Science Scholarships Application Form: FORM A - Personal InformationAbigail SaballeNo ratings yet

- Help With School ExpensesDocument4 pagesHelp With School Expensesapi-140120973No ratings yet

- Claimant Rights and Responsibilities Rules For Filing A Claim and Appeal RightsDocument7 pagesClaimant Rights and Responsibilities Rules For Filing A Claim and Appeal Rightsanon_26882226No ratings yet

- 230 Short Sale Packet - BayviewDocument16 pages230 Short Sale Packet - BayviewrapiddocsNo ratings yet

- Application Tenant Rent&UtilityAssistance 658250Document30 pagesApplication Tenant Rent&UtilityAssistance 658250morepal2No ratings yet

- CD 9600Document6 pagesCD 9600api-2812926660% (1)

- Child Care Application: Keep For Your Records InstructionsDocument14 pagesChild Care Application: Keep For Your Records InstructionsLaToya CrossNo ratings yet

- ODB Senior Copayment ApplicationDocument6 pagesODB Senior Copayment ApplicationRebecca LuiNo ratings yet

- Ci Benefits Rights InformationDocument15 pagesCi Benefits Rights Informationchris johnNo ratings yet

- IBR Application CDocument6 pagesIBR Application CChasley PraterNo ratings yet

- Washington Assurance Wireless Free Cell PhoneDocument2 pagesWashington Assurance Wireless Free Cell PhoneCindaRose100% (1)

- Application To Change An Adult's NameDocument19 pagesApplication To Change An Adult's NameSunshine ShewaybickNo ratings yet

- Non Custodial Parents Guide To Navigating Through Child Support Enforcement ActionsDocument139 pagesNon Custodial Parents Guide To Navigating Through Child Support Enforcement ActionsMommii CampbellNo ratings yet

- Application To Change An Adult's NameDocument19 pagesApplication To Change An Adult's NameDanniNo ratings yet

- River Place 2Document7 pagesRiver Place 2zzsnoopyNo ratings yet

- Badgercare Plus Application Packet: F-10182 - July 2020Document76 pagesBadgercare Plus Application Packet: F-10182 - July 2020PuRe Sp3ctreNo ratings yet

- Telephone Assistant Plan (TAP) Application: Step 1: Fill Out Information About The ApplicantDocument2 pagesTelephone Assistant Plan (TAP) Application: Step 1: Fill Out Information About The ApplicantSundeeNo ratings yet

- Graduate Assistant PacketDocument23 pagesGraduate Assistant PacketfznmominNo ratings yet

- Correspondence SBALTAZARDocument11 pagesCorrespondence SBALTAZARsandral.baltazar17No ratings yet

- Credit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!From EverandCredit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!Rating: 1 out of 5 stars1/5 (2)

- From Start to Finish: The Guide to Your Own Personal Credit RepairFrom EverandFrom Start to Finish: The Guide to Your Own Personal Credit RepairNo ratings yet

- Bensingh Form 16 - SignedDocument2 pagesBensingh Form 16 - SignedGloryNo ratings yet

- City of Gold Coast: Erecruit Job Applicant GuideDocument24 pagesCity of Gold Coast: Erecruit Job Applicant GuideraphaelsantanasouzaNo ratings yet

- Jss Priya Singh 22222Document94 pagesJss Priya Singh 22222rahul555sarojNo ratings yet

- ContractDocument16 pagesContractMuaz MisranNo ratings yet

- ArticleDocument96 pagesArticlekritim81No ratings yet

- HCL HRM PoliciesDocument1 pageHCL HRM PoliciesMALATHI MNo ratings yet

- Coaching, Careers Talent MGMTDocument28 pagesCoaching, Careers Talent MGMTVatsal BembeyNo ratings yet

- GTN Project UpdatedDocument78 pagesGTN Project Updatedrejoy7No ratings yet

- Public Management GlobalDocument537 pagesPublic Management GlobalMohamed Saad AliNo ratings yet

- IRD Project 1Document16 pagesIRD Project 1Gokul KrishnanNo ratings yet

- Serrano vs. NLRC, G.R. No. 117040. January 27, 2000Document3 pagesSerrano vs. NLRC, G.R. No. 117040. January 27, 2000Mark Joseph DelimaNo ratings yet

- Objective of Assignment: To Be Unique and The Market Leader Providing QualityDocument15 pagesObjective of Assignment: To Be Unique and The Market Leader Providing QualityPRIYA GHOSHNo ratings yet

- (POM) Module 1Document49 pages(POM) Module 1Vinay kumarNo ratings yet

- Career Guidance Advocacy Program For Grade 12 Students: Patin-Ay National High SchoolDocument9 pagesCareer Guidance Advocacy Program For Grade 12 Students: Patin-Ay National High Schoolmaria kristine marcos100% (1)

- Hmee5043 Assignment 2Document18 pagesHmee5043 Assignment 2Norihan Kamal100% (1)

- Moving Forward LetterDocument2 pagesMoving Forward LettercrainsnewyorkNo ratings yet

- FSRID11020Document8 pagesFSRID11020SaleemNo ratings yet

- Master Iron Labor vs. NLRC DigestDocument3 pagesMaster Iron Labor vs. NLRC DigestAngelo Lopez100% (1)

- Group Members Lesaca, Jane Cresthyl Jordan, Michelle Inot, Hannah Carla Dalagan, Raina Section TopicsDocument5 pagesGroup Members Lesaca, Jane Cresthyl Jordan, Michelle Inot, Hannah Carla Dalagan, Raina Section TopicsJane Cresthyl LesacaNo ratings yet

- New ManagementDocument183 pagesNew ManagementSachin MahajanNo ratings yet

- The Dilemma: Goodbye, Jimmy, Goodbye.: HIRE Verified WriterDocument9 pagesThe Dilemma: Goodbye, Jimmy, Goodbye.: HIRE Verified WriterBritney Anne H. PasionNo ratings yet

- RLC Code of Health & Safety PracticeDocument329 pagesRLC Code of Health & Safety PracticeMichelle MoraNo ratings yet

- English HindiDocument7 pagesEnglish HindiZeba LubabaNo ratings yet

- Internal Stakeholders - SimplicableDocument16 pagesInternal Stakeholders - Simplicablemoinahmed99No ratings yet