Professional Documents

Culture Documents

Uqld2915518153052999 Payment Summary

Uqld2915518153052999 Payment Summary

Uploaded by

lavidisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Uqld2915518153052999 Payment Summary

Uqld2915518153052999 Payment Summary

Uploaded by

lavidisCopyright:

Available Formats

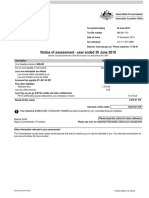

PAYG payment summary - individual non-business

Payment Summary for year ending 30 June 2018

Payee details NOTICE TO PAYEE

If this payment summary shows an amount in the total tax

withheld box, you must lodge a tax return. If no tax was

withheld, you may still have to lodge a tax return.

Nickolas Anastasios Lavidis For more information on whether you have to lodge, or about

this payment and how it is taxed, you can:

13 Nelson Street

. visit www.ato.gov.au

DUTTON PARK QLD 4102

. phone 13 28 61 between 8.00am and 6.00pm, Monday to

Friday.

Day/Month/Year Day/Month/Year

Period of payment 01/07/2017 to 30/06/2018

Payee’s tax file number 136 978 763 TOTAL TAX WITHHELD $ 31416

Type Lump sum payments Type

Gross payments $ 118095 S A $ 0

CDEP payments $ 0 B $ 0

Reportable employer $ 5807 D $ 0

superannuation contributions

Reportable fringe benefits amount $ 0 E $ 0

FBT year 1 April to 31 March

Is the employer exempt from FBT No Yes

under section 57A of the FBTAA 1986?

Total allowances Total allowances are not included in Gross payments above.

$ 0 This amount needs to be shown separately in your tax return.

Deductions:

Workplace Giving:

UQ Staff Giving - Other purposes $8400

Payer details

Payer’s ABN or withholding payer number 63 942 912 684 Branch number

Payer’s name THE UNIVERSITY OF QUEENSLAND

Privacy - For information about your privacy, go to ato.gov.au/privacy

Signature of authorised person AL JURY Date 25/06/2018

FACMBS 1436845

You might also like

- Tangerine-eStatement Jul19 PDFDocument2 pagesTangerine-eStatement Jul19 PDFRudyard Martin Cardozo33% (6)

- Chase Bank SteatmentDocument5 pagesChase Bank SteatmentMasRockey71% (7)

- Notice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäDocument4 pagesNotice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäClaudia AttardNo ratings yet

- Notice of Assessment - Year Ended 30 June 2023: !H!ÎÈ/, g4 Î!Ef6ÄDocument4 pagesNotice of Assessment - Year Ended 30 June 2023: !H!ÎÈ/, g4 Î!Ef6Äjoshiepow3llNo ratings yet

- Notice of Assessment 2019 04 09 13 31 03 966479 PDFDocument4 pagesNotice of Assessment 2019 04 09 13 31 03 966479 PDFyeetus deletusNo ratings yet

- Income Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44Document1 pageIncome Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44wahleng ChewNo ratings yet

- Notice of Assessment Original: Printed Via Mytax PortalDocument1 pageNotice of Assessment Original: Printed Via Mytax PortalAbdul HalimNo ratings yet

- Assesment Notice 2017Document1 pageAssesment Notice 2017Shounak KossambeNo ratings yet

- Legal Aspects of International BusinessDocument25 pagesLegal Aspects of International BusinessLokesh KumarNo ratings yet

- Contract Management-PPT - Case StudyDocument13 pagesContract Management-PPT - Case StudySajeer M100% (1)

- Income Tax - Notice of Assessment (Original) : What Do You Need To Do?Document1 pageIncome Tax - Notice of Assessment (Original) : What Do You Need To Do?tehtarikNo ratings yet

- 26082021-PAYG Payment Summary-G Khajarian (CLAIM-00464429)Document1 page26082021-PAYG Payment Summary-G Khajarian (CLAIM-00464429)Garo KhatcherianNo ratings yet

- Wage Easy ATO Payment Summaries (2018 Jun 28)Document1 pageWage Easy ATO Payment Summaries (2018 Jun 28)Haillander Lopes viannaNo ratings yet

- PAYG Payment Summary Individual Non-Business: Ai Thi Hoai Nguyen 1/3 Mary ST North Melbourne Vic 3051Document1 pagePAYG Payment Summary Individual Non-Business: Ai Thi Hoai Nguyen 1/3 Mary ST North Melbourne Vic 3051hungdahoangNo ratings yet

- Pre-Filling Report 2017: Taxpayer DetailsDocument2 pagesPre-Filling Report 2017: Taxpayer DetailsUsama AshfaqNo ratings yet

- Í DL) 'È TABILIRAN ELIZABETHÂÂ L Çg. - 4HÎ Mrs. Elizabeth Lamdag TabiliranDocument3 pagesÍ DL) 'È TABILIRAN ELIZABETHÂÂ L Çg. - 4HÎ Mrs. Elizabeth Lamdag TabiliranElro Mar TabiliranNo ratings yet

- Au 1Document1 pageAu 1ubattleg5No ratings yet

- PAYG Payment Summary - Individual Non-Business: Fook Ngo 139 Railway Avenue Laverton VIC 3028Document1 pagePAYG Payment Summary - Individual Non-Business: Fook Ngo 139 Railway Avenue Laverton VIC 3028Fook NgoNo ratings yet

- PAYG Payment Summary - Individual Non-BusinessDocument1 pagePAYG Payment Summary - Individual Non-BusinessShubham SurekaNo ratings yet

- PAYG Payment Summary - Individual Non-Business: Matthew Burn 1933b/702 Harris Street Ultimo NSW 2007Document1 pagePAYG Payment Summary - Individual Non-Business: Matthew Burn 1933b/702 Harris Street Ultimo NSW 2007Anonymous JytY5quhSgNo ratings yet

- Pay SumDocument1 pagePay SumEdward LehmannNo ratings yet

- Nat14869 01.2006Document1 pageNat14869 01.2006stive007No ratings yet

- Notice of Assessment 2019 04 29 02 32 21 264865Document4 pagesNotice of Assessment 2019 04 29 02 32 21 264865Dennis EnnsNo ratings yet

- Prefill 2019Document2 pagesPrefill 2019Usama AshfaqNo ratings yet

- Tax Ry 2020Document2 pagesTax Ry 2020Ruth Polimar YamutaNo ratings yet

- Noa-Iit Ob2420230527195835v3iDocument1 pageNoa-Iit Ob2420230527195835v3iRyan TanNo ratings yet

- Notice of Amended Assessment - Year Ended 30 June 2023Document4 pagesNotice of Amended Assessment - Year Ended 30 June 2023carmenzhou2001No ratings yet

- 1.4 Notice of Assessment - Year Ended 30 June 2019Document2 pages1.4 Notice of Assessment - Year Ended 30 June 2019jer2ywangNo ratings yet

- Noa-Iit Ob25202106140521020nzDocument1 pageNoa-Iit Ob25202106140521020nz江宗朋No ratings yet

- Noa-Iit Ob2620150425142233zb4 PDFDocument1 pageNoa-Iit Ob2620150425142233zb4 PDFKanza KhanNo ratings yet

- Social Security System: Collection List Summary For The Month of June 2018Document2 pagesSocial Security System: Collection List Summary For The Month of June 2018Anonymous yIFv8NHHnNo ratings yet

- PAYG Payment Summary - Individual Non-Business: Muhammad Danish 22/324 Woodstock Avenue Mount Druitt NSW 2770Document1 pagePAYG Payment Summary - Individual Non-Business: Muhammad Danish 22/324 Woodstock Avenue Mount Druitt NSW 2770Danish MuhammadNo ratings yet

- Notice of Assessment 2021 03 18 13 33 09 783841Document4 pagesNotice of Assessment 2021 03 18 13 33 09 783841Maria Fe CeleciosNo ratings yet

- Notice of Assessment - Year Ended 30 June 2020: MR Mohamadalamkhan Fajluraheman Pathan 583 Ipswich RD Annerley QLD 4103Document2 pagesNotice of Assessment - Year Ended 30 June 2020: MR Mohamadalamkhan Fajluraheman Pathan 583 Ipswich RD Annerley QLD 4103aalampathan76No ratings yet

- Document PDFDocument2 pagesDocument PDFgregory binghamNo ratings yet

- Globe Bill 09360572245Document2 pagesGlobe Bill 09360572245eddie fernandezNo ratings yet

- Noa-Iit Ob2320170627071310ufp PDFDocument1 pageNoa-Iit Ob2320170627071310ufp PDFjasper haiNo ratings yet

- Tax Credit Certificate 2023 9753768935878Document2 pagesTax Credit Certificate 2023 9753768935878Rogério LimaNo ratings yet

- Noa-Iit Ob212020062419132485y PDFDocument1 pageNoa-Iit Ob212020062419132485y PDFilamahizhNo ratings yet

- Goods and Services Tax/harmonized Sales Tax Credit (GST/HSTC) NoticeDocument3 pagesGoods and Services Tax/harmonized Sales Tax Credit (GST/HSTC) NoticeSam StormeNo ratings yet

- IRS Demand Letter - 14 July 2022Document2 pagesIRS Demand Letter - 14 July 2022KPLC 7 NewsNo ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- Noa-Iit Ob2120200629085533331Document1 pageNoa-Iit Ob2120200629085533331Jay Maung MaungNo ratings yet

- Í Hebnè Juanitoâkingâ&Âso Âââ Â Ç/Â 85?Î Juanito King & Sons, IncDocument4 pagesÍ Hebnè Juanitoâkingâ&Âso Âââ Â Ç/Â 85?Î Juanito King & Sons, IncPrincess Maevelle Chan PecaocoNo ratings yet

- Statements of AccountDocument1 pageStatements of AccountMaricar RoldanNo ratings yet

- Noa-Iit Ob2620220530013620coDocument1 pageNoa-Iit Ob2620220530013620coChan Yin YenNo ratings yet

- Edi - 20689603 - 20689603-Broker-Mrs Febylyn Rodrigue-07 - 04 - 2018-pdx35439512 PDFDocument6 pagesEdi - 20689603 - 20689603-Broker-Mrs Febylyn Rodrigue-07 - 04 - 2018-pdx35439512 PDFVenis ManahanNo ratings yet

- Í U, Joè Masangkay Mikoâââââââ V Çtâ&03:Î Mr. Miko Verbo MasangkayDocument4 pagesÍ U, Joè Masangkay Mikoâââââââ V Çtâ&03:Î Mr. Miko Verbo Masangkayleny artozNo ratings yet

- Globe BillDocument3 pagesGlobe BillPrincess Maevelle Chan PecaocoNo ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 847068Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 847068api-676582318No ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 853056Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 853056api-676582318No ratings yet

- Social Security System: Collection List Summary For The Month of December 2018Document2 pagesSocial Security System: Collection List Summary For The Month of December 2018MARIA SHEENA OCONNo ratings yet

- Notice of Assessment 2022 03 17 11 16 57 195191Document4 pagesNotice of Assessment 2022 03 17 11 16 57 195191api-676582318No ratings yet

- Document PDFDocument3 pagesDocument PDFVal Escobar MagumunNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryRachel A. San DiegoNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 385000Document3 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 385000Rohit kandpalNo ratings yet

- Anshul PCDocument2 pagesAnshul PCNamit DumreNo ratings yet

- Form 16 2 PDFDocument2 pagesForm 16 2 PDFJeevan GogalNo ratings yet

- PSEGDocument6 pagesPSEGyjegen1No ratings yet

- Income Tax - Computation - 2021Document26 pagesIncome Tax - Computation - 2021umasankarNo ratings yet

- AFFIDAVIT SampleDocument2 pagesAFFIDAVIT SampleSyannil VieNo ratings yet

- Civ Digest OctoberDocument24 pagesCiv Digest OctoberSarah TaliNo ratings yet

- Payslip: Firstsource Solutions LimitedDocument1 pagePayslip: Firstsource Solutions LimitedEmmanuel F GarzaNo ratings yet

- Filed ComplaintDocument14 pagesFiled ComplaintKTXL DigitalNo ratings yet

- Black MoneyDocument33 pagesBlack MoneyB.JikkiNo ratings yet

- Decriminalization of Homosexuality in IndiaDocument3 pagesDecriminalization of Homosexuality in IndiaYash SinghNo ratings yet

- People V WagasDocument3 pagesPeople V WagasiptrinidadNo ratings yet

- 2004 Rules On Notarial PracticeDocument10 pages2004 Rules On Notarial PracticeRjay SorianoNo ratings yet

- No 14 AcceptanceDocument3 pagesNo 14 Acceptanceproukaiya7754No ratings yet

- Criminal LawDocument88 pagesCriminal LawNovern Irish PascoNo ratings yet

- Sri Devaraj URS University Act, 2012Document25 pagesSri Devaraj URS University Act, 2012Latest Laws TeamNo ratings yet

- T&E OutlineDocument99 pagesT&E OutlineDrGacheNo ratings yet

- US V ExaltacionDocument1 pageUS V ExaltacionMonique AngNo ratings yet

- Alabang Country Club V NLRCDocument2 pagesAlabang Country Club V NLRCgelatin528No ratings yet

- Chapter 3 - CapacityDocument5 pagesChapter 3 - CapacitySairNo ratings yet

- Philippine Sinter Corp v. Cagayan Electric Power and Light Co. Inc., G.R. No. 127371 (2002) )Document2 pagesPhilippine Sinter Corp v. Cagayan Electric Power and Light Co. Inc., G.R. No. 127371 (2002) )Keyan Motol0% (1)

- Pha First Virtual Regional Conference - Letter To MembersDocument1 pagePha First Virtual Regional Conference - Letter To MembersArnel Lajo FulgencioNo ratings yet

- Regala Vs CarinDocument3 pagesRegala Vs CarinClaudine Bancifra100% (1)

- Pan Form Correction PDFDocument7 pagesPan Form Correction PDFNAZE COMPUTERNo ratings yet

- Sara Lee Philippines Versus MacatlangDocument3 pagesSara Lee Philippines Versus Macatlangganggingski50% (2)

- Galang V CADocument3 pagesGalang V CAlovekimsohyun89No ratings yet

- (G.R. No. 16359: Decision PUNO, J.Document29 pages(G.R. No. 16359: Decision PUNO, J.Gerald RojasNo ratings yet

- Budget Expenditures: Ingilab AhmadovDocument25 pagesBudget Expenditures: Ingilab AhmadovCavid İbrahimliNo ratings yet

- Lockhart v. Nelson, 488 U.S. 33 (1988)Document15 pagesLockhart v. Nelson, 488 U.S. 33 (1988)Scribd Government DocsNo ratings yet

- Ramon Magsaysay: Ramon Magsaysay, (Born Aug. 31, 1907, Iba, Phil.-Died March 17, 1957, NearDocument3 pagesRamon Magsaysay: Ramon Magsaysay, (Born Aug. 31, 1907, Iba, Phil.-Died March 17, 1957, NearRonald EdnaveNo ratings yet

- Schedule CDocument273 pagesSchedule CAzi PaybarahNo ratings yet

- 1987Document17 pages1987Noel SincoNo ratings yet

- SC Rules On The Destruction and DisposalDocument5 pagesSC Rules On The Destruction and DisposalKathrine Chin Lu100% (1)