Professional Documents

Culture Documents

Affidavit of Levy and Tax Discharge COUNTY of SACRAMENTO

Affidavit of Levy and Tax Discharge COUNTY of SACRAMENTO

Uploaded by

Rosetta Rashid’s McCowan ElCopyright:

You might also like

- Guarding Against Pandemics 2022 Tax FilingDocument30 pagesGuarding Against Pandemics 2022 Tax FilingTeddy SchleiferNo ratings yet

- Group 3 - Master Budget-Earrings UnlimitedDocument8 pagesGroup 3 - Master Budget-Earrings UnlimitedLorena Mae LasquiteNo ratings yet

- Black Card - Unlimited CreditDocument2 pagesBlack Card - Unlimited CredithewetielNo ratings yet

- Purchase Order Financing AgreementDocument6 pagesPurchase Order Financing AgreementMoffat Nyamadzawo100% (1)

- Sample BondDocument3 pagesSample BondJoshua Sygnal Gutierrez100% (1)

- American Express - Credit Card DenialDocument2 pagesAmerican Express - Credit Card DenialKunal JainNo ratings yet

- Scribd Fax Cover SheetDocument1 pageScribd Fax Cover SheetTaylorbey American NationalNo ratings yet

- Levy $107,110,000 District Court 38-1-01 Johnny EasleyDocument4 pagesLevy $107,110,000 District Court 38-1-01 Johnny Easleyakil kemnebi easley elNo ratings yet

- Levy 1099c Copy B Hugg, Jonathan W Doing Business As Lawyer Eckert Seamans Cherin & Mellott Limited Liability CompanyDocument4 pagesLevy 1099c Copy B Hugg, Jonathan W Doing Business As Lawyer Eckert Seamans Cherin & Mellott Limited Liability Companyakil kemnebi easley elNo ratings yet

- SSN RepealDocument5 pagesSSN Repealmark bidenNo ratings yet

- WritOfExecution ExampleDocument3 pagesWritOfExecution ExampleajgtrustNo ratings yet

- Auto Title Loans and The Law BrochureDocument2 pagesAuto Title Loans and The Law BrochureSC AppleseedNo ratings yet

- v888 Request by An Individual For Information About A Vehicle PDFDocument2 pagesv888 Request by An Individual For Information About A Vehicle PDFmxckcxzlm.c,0% (1)

- Bank Guarantee Text d1Document4 pagesBank Guarantee Text d1Fenny Kusien50% (2)

- Definition of IncomeDocument1 pageDefinition of IncomeBartownNo ratings yet

- Classification of TrustDocument28 pagesClassification of TrustJenny IslamNo ratings yet

- WritOfExecution BK CourtFormForSheriffDocument6 pagesWritOfExecution BK CourtFormForSheriffajgtrustNo ratings yet

- Declaration For Power of Attorney: Privacy Act StatementDocument2 pagesDeclaration For Power of Attorney: Privacy Act StatementOneNationNo ratings yet

- PSA Certificate of Live Birth FormDocument1 pagePSA Certificate of Live Birth FormJane Avila100% (1)

- Extinguishment of ObligationsDocument14 pagesExtinguishment of ObligationsAbe Miguel Bullecer100% (1)

- Name ChangeDocument2 pagesName ChangeAleria Butler100% (1)

- Dissolution Deed FormatDocument2 pagesDissolution Deed FormatMuslim Qureshi100% (1)

- Motion For A Hearing (7/25/18)Document3 pagesMotion For A Hearing (7/25/18)joshblackman0% (1)

- Death Certificate Application PDFDocument2 pagesDeath Certificate Application PDFBeyza GemiciNo ratings yet

- Certification of Trust 1Document1 pageCertification of Trust 1ImoBank Investimentos100% (1)

- Direct Dividend DepositDocument1 pageDirect Dividend DepositJeremy WebbNo ratings yet

- Loan Deferment Form - FLS PDFDocument3 pagesLoan Deferment Form - FLS PDFPhoenixNo ratings yet

- Notice To All Law Enforcement OfficersDocument1 pageNotice To All Law Enforcement OfficersBanNo ratings yet

- IRS Form 982 Reduction of Attributes Due To Discharge of IndebtednessDocument5 pagesIRS Form 982 Reduction of Attributes Due To Discharge of IndebtednessDebe MaxwellNo ratings yet

- 8822-B Signed FormDocument1 page8822-B Signed FormPriyank Bhatt100% (1)

- Offset & Discharge BondDocument6 pagesOffset & Discharge Bondtrust2386No ratings yet

- Project On Trust and Its TypesDocument8 pagesProject On Trust and Its TypesTushar MehtaNo ratings yet

- Article of IncorporationDocument138 pagesArticle of IncorporationUjah J. WonkpahNo ratings yet

- Statutory Durable Power of Attorney 09-1-2017Document6 pagesStatutory Durable Power of Attorney 09-1-2017AmesNo ratings yet

- 1515 RECORDER OF Deeds April 27, 2020 PDFDocument4 pages1515 RECORDER OF Deeds April 27, 2020 PDFempress_jawhara_hilal_el100% (1)

- Affidavit of Forgery - TemplateDocument1 pageAffidavit of Forgery - TemplateOlympusVonSandervexNo ratings yet

- Kinds of TrustDocument4 pagesKinds of TrustAzad SamiNo ratings yet

- In Lieu of W-8BENDocument2 pagesIn Lieu of W-8BENbrittanilpeedin100% (3)

- Zzzpsgiolepfrp: Document Instructions PackageDocument9 pagesZzzpsgiolepfrp: Document Instructions PackageMaitri DoshiNo ratings yet

- Abatment For Case of Misnomer MercedesDocument4 pagesAbatment For Case of Misnomer MercedesCarlos100% (1)

- LTR Comm Empl Stop WithholdingDocument17 pagesLTR Comm Empl Stop WithholdingBar RiNo ratings yet

- Creditor - Pyramid - Magisterial Living Tribunal 38101 236003062 - Bond-Created-Feburary-20-2024Document15 pagesCreditor - Pyramid - Magisterial Living Tribunal 38101 236003062 - Bond-Created-Feburary-20-2024akil kemnebi easley el100% (1)

- Trust - Tax Planning - Estate Planning - Real Estate & ReitsDocument62 pagesTrust - Tax Planning - Estate Planning - Real Estate & ReitsAbhijeet PatilNo ratings yet

- Application For Employer Identification Number: All Caps Same As SSNDocument2 pagesApplication For Employer Identification Number: All Caps Same As SSNMarcosLbiv0% (1)

- Impact of of Issuance of Sovereign Bonds On Short Term andDocument3 pagesImpact of of Issuance of Sovereign Bonds On Short Term andAkash BafnaNo ratings yet

- Citizenship-Immigration Status 2016Document1 pageCitizenship-Immigration Status 2016rendaoNo ratings yet

- Promissory Notes-Bills of Exchangeand ChequesDocument17 pagesPromissory Notes-Bills of Exchangeand Chequestheashu022No ratings yet

- Sav 0385Document2 pagesSav 0385datlavarma25No ratings yet

- Ucc 1 AdDocument2 pagesUcc 1 AdShawn SandefurNo ratings yet

- Definition: Sec. 2, Uniform Customs and Practices For Documentary Credit (UCP)Document2 pagesDefinition: Sec. 2, Uniform Customs and Practices For Documentary Credit (UCP)Nikki FernandoNo ratings yet

- Bowman Motion To Dismiss For Lack of VenueDocument4 pagesBowman Motion To Dismiss For Lack of VenueKenan Farrell100% (1)

- Cause of ActionDocument29 pagesCause of ActionChris.No ratings yet

- Barnet Council / London Borough of Barnet Creditor Treasury Bond + 120eb636 + 120d30Document12 pagesBarnet Council / London Borough of Barnet Creditor Treasury Bond + 120eb636 + 120d30shasha ann beyNo ratings yet

- Car Renewal Letter AMV023385268Document2 pagesCar Renewal Letter AMV023385268RunToLiveHDNo ratings yet

- Virginia Quit Claim Deed FormDocument2 pagesVirginia Quit Claim Deed FormLj PerrierNo ratings yet

- Notice of Default Judgement - Kathy Witt &thomas D. RichardsDocument16 pagesNotice of Default Judgement - Kathy Witt &thomas D. RichardsEarl Julian Lloyd ElNo ratings yet

- DDFDocument66 pagesDDFPankaj Kumar100% (2)

- Negotiable Meaning Types and Legal AspectDocument9 pagesNegotiable Meaning Types and Legal AspectadityaNo ratings yet

- Clear Allodial Title 25120 Lous LaneDocument2 pagesClear Allodial Title 25120 Lous Laneprince noble james beyNo ratings yet

- Amazon United States Creditor Treasury Bond + 911646860Document12 pagesAmazon United States Creditor Treasury Bond + 911646860shasha ann beyNo ratings yet

- Constitution of the State of Minnesota — 1974 VersionFrom EverandConstitution of the State of Minnesota — 1974 VersionNo ratings yet

- Retirement Fidelity Workers CompensationDocument7 pagesRetirement Fidelity Workers CompensationRosetta Rashid’s McCowan ElNo ratings yet

- Congressional Record 14th Amendment UnconstitutionalDocument3 pagesCongressional Record 14th Amendment UnconstitutionalRosetta Rashid’s McCowan ElNo ratings yet

- Creditor Bond 2025923Document16 pagesCreditor Bond 2025923Rosetta Rashid’s McCowan ElNo ratings yet

- No Consent or JurisdictionDocument11 pagesNo Consent or JurisdictionRosetta Rashid’s McCowan ElNo ratings yet

- Quit Claim DeedDocument3 pagesQuit Claim DeedRosetta Rashid’s McCowan ElNo ratings yet

- Quit Claim DeedDocument3 pagesQuit Claim DeedRosetta Rashid’s McCowan ElNo ratings yet

- Subject County Clerk Recorder CommunicationDocument2 pagesSubject County Clerk Recorder CommunicationRosetta Rashid’s McCowan ElNo ratings yet

- Amended Power For Attorney U.S. For AmericaDocument1 pageAmended Power For Attorney U.S. For AmericaRosetta Rashid’s McCowan ElNo ratings yet

- No Consent or JurisdictionDocument1 pageNo Consent or JurisdictionRosetta Rashid’s McCowan ElNo ratings yet

- Cooper 12 11 2023Document1 pageCooper 12 11 2023Rosetta Rashid’s McCowan ElNo ratings yet

- IRS Writ and CorrespondenceDocument6 pagesIRS Writ and CorrespondenceRosetta Rashid’s McCowan ElNo ratings yet

- California Is On The LandDocument4 pagesCalifornia Is On The LandRosetta Rashid’s McCowan ElNo ratings yet

- Indemnis Facere Proklamatione Macfinley WayDocument2 pagesIndemnis Facere Proklamatione Macfinley WayRosetta Rashid’s McCowan ElNo ratings yet

- 1096 and Levy Nationstar LLCDocument6 pages1096 and Levy Nationstar LLCRosetta Rashid’s McCowan ElNo ratings yet

- 13th Ave Kourte Commande + RosettaDocument3 pages13th Ave Kourte Commande + RosettaRosetta Rashid’s McCowan ElNo ratings yet

- Affidavit of Clear Perfect Allodial Title MacfinleyDocument2 pagesAffidavit of Clear Perfect Allodial Title MacfinleyRosetta Rashid’s McCowan ElNo ratings yet

- 007 Ucc 1 Liene 13th Ave RosettaDocument7 pages007 Ucc 1 Liene 13th Ave RosettaRosetta Rashid’s McCowan ElNo ratings yet

- 1096 Levy and Additional DocumentsDocument10 pages1096 Levy and Additional DocumentsRosetta Rashid’s McCowan ElNo ratings yet

- Birth Certificate Lien Final1Document19 pagesBirth Certificate Lien Final1Rosetta Rashid’s McCowan ElNo ratings yet

- Indemnis Facere Proklamatione 13th RosettaDocument2 pagesIndemnis Facere Proklamatione 13th RosettaRosetta Rashid’s McCowan ElNo ratings yet

- Allahiyah Writt Ov Habeyus Qorpus RosettaDocument2 pagesAllahiyah Writt Ov Habeyus Qorpus RosettaRosetta Rashid’s McCowan ElNo ratings yet

- Affidavit of Clear Perfect Allodial Title MacfinleyDocument2 pagesAffidavit of Clear Perfect Allodial Title MacfinleyRosetta Rashid’s McCowan ElNo ratings yet

- Termination of Korporate KontractsDocument7 pagesTermination of Korporate KontractsRosetta Rashid’s McCowan ElNo ratings yet

- STATE Kourte KommandeDocument6 pagesSTATE Kourte KommandeRosetta Rashid’s McCowan ElNo ratings yet

- Nationalization Documents - JAN 2 4 2022Document8 pagesNationalization Documents - JAN 2 4 2022Rosetta Rashid’s McCowan ElNo ratings yet

- UCC 1 Lien, Strawman Lien, Fiduciary, International ProclamationDocument23 pagesUCC 1 Lien, Strawman Lien, Fiduciary, International ProclamationRosetta Rashid’s McCowan ElNo ratings yet

- Lien On The State and Additional Documents1Document43 pagesLien On The State and Additional Documents1Rosetta Rashid’s McCowan ElNo ratings yet

- Affidavid of Facts For Averment of Jurisdiction Quo Warranto and Post CardsDocument5 pagesAffidavid of Facts For Averment of Jurisdiction Quo Warranto and Post CardsRosetta Rashid’s McCowan ElNo ratings yet

- Notice of Default-Cooper+FiledDocument4 pagesNotice of Default-Cooper+FiledRosetta Rashid’s McCowan ElNo ratings yet

- Writ of Quo Warranto MR. COOPER RevisedDocument7 pagesWrit of Quo Warranto MR. COOPER RevisedRosetta Rashid’s McCowan El0% (1)

- Fall 2022 DCF InstructionsDocument3 pagesFall 2022 DCF InstructionsSaharsh jainNo ratings yet

- FINA2209 Lecture2Document35 pagesFINA2209 Lecture2Dylan AdrianNo ratings yet

- Accountant 17-07-2023Document3 pagesAccountant 17-07-2023mrsiranjeevi44No ratings yet

- Lecture 10 - LiabilitiesDocument50 pagesLecture 10 - LiabilitiesIsyraf Hatim Mohd TamizamNo ratings yet

- Accountancy Worksheet Grade XI Chapter 1 and Chapter 2Document2 pagesAccountancy Worksheet Grade XI Chapter 1 and Chapter 2Abhradeep Ghosh100% (3)

- Engineering Economy 2Document6 pagesEngineering Economy 2Michael Angelo MontebonNo ratings yet

- Financial Proposal of UNITED CONSTRUCTION COMPANYDocument5 pagesFinancial Proposal of UNITED CONSTRUCTION COMPANYfayoNo ratings yet

- The Economics of Money, Banking, and Financial Markets: Twelfth Edition, Global EditionDocument33 pagesThe Economics of Money, Banking, and Financial Markets: Twelfth Edition, Global EditionOtgoo HNo ratings yet

- Leases - Brief ExercisesDocument5 pagesLeases - Brief ExercisesPeachyNo ratings yet

- BS, PNL and Ratio Calculation - Group15Document13 pagesBS, PNL and Ratio Calculation - Group15Mukund MalpaniNo ratings yet

- Affidavit of Undertaking - PobleteDocument1 pageAffidavit of Undertaking - PobleteJonah CruzadaNo ratings yet

- Ems Answersheet Mid Year Test 2021Document7 pagesEms Answersheet Mid Year Test 2021zwonizwonakaNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument15 pagesCambridge International Advanced Subsidiary and Advanced LevelSaram Shykh PRODUCTIONSNo ratings yet

- Hire Purchases System-Dr. S.K.GuptaDocument7 pagesHire Purchases System-Dr. S.K.GuptaVasundhara DNo ratings yet

- Test Your Understanding Question #1Document3 pagesTest Your Understanding Question #1Tedla Guye75% (8)

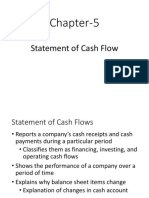

- Chapter-5: Statement of Cash FlowDocument43 pagesChapter-5: Statement of Cash FlowBAM ZAHARDNo ratings yet

- New Balance $13,214.40 Minimum Payment Due $395.67 Payment Due Date 04/23/21Document9 pagesNew Balance $13,214.40 Minimum Payment Due $395.67 Payment Due Date 04/23/21Alberto Lizarraga Sr.100% (1)

- Financial Accounting in An Economic Context 8Th Edition Pratt Test Bank Full Chapter PDFDocument59 pagesFinancial Accounting in An Economic Context 8Th Edition Pratt Test Bank Full Chapter PDFthomasowens1asz100% (11)

- Legal Notice U/s 138 of Negotiable Instrument ActDocument3 pagesLegal Notice U/s 138 of Negotiable Instrument ActjanviNo ratings yet

- Module 9 Receivable Financing Notes ReceivablesDocument6 pagesModule 9 Receivable Financing Notes ReceivablesMa Leobelle BiongNo ratings yet

- Tally AssingmentDocument19 pagesTally AssingmentTaranNo ratings yet

- Shimanto-Bank Fin380 Term-PaperDocument25 pagesShimanto-Bank Fin380 Term-PaperNiloy MallickNo ratings yet

- General Mathematics Final Term Written Test IDocument4 pagesGeneral Mathematics Final Term Written Test IcykenNo ratings yet

- Resume Prospectus BCP EOS 2020 VAngDocument30 pagesResume Prospectus BCP EOS 2020 VAngIsmail bnjNo ratings yet

- Debtors Financing-Factoring: Swayam Siddhi College of MGMT & ResearchDocument15 pagesDebtors Financing-Factoring: Swayam Siddhi College of MGMT & Researchpranjali shindeNo ratings yet

- FULL Source FIN202Document277 pagesFULL Source FIN202Nguyen Hoang Phuong Nam (K16HCM)No ratings yet

- Cambridge International AS & A Level: Accounting 9706/32 March 2021Document19 pagesCambridge International AS & A Level: Accounting 9706/32 March 2021Ahmed NaserNo ratings yet

- Bad Debts - CE and DSE - AnswerDocument3 pagesBad Debts - CE and DSE - AnswerKwan Yin HoNo ratings yet

- Odev - Cash - Flow - and - Financial - Planning (1) - Fatih EkerDocument16 pagesOdev - Cash - Flow - and - Financial - Planning (1) - Fatih EkerfurkanNo ratings yet

Affidavit of Levy and Tax Discharge COUNTY of SACRAMENTO

Affidavit of Levy and Tax Discharge COUNTY of SACRAMENTO

Uploaded by

Rosetta Rashid’s McCowan ElOriginal Description:

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Affidavit of Levy and Tax Discharge COUNTY of SACRAMENTO

Affidavit of Levy and Tax Discharge COUNTY of SACRAMENTO

Uploaded by

Rosetta Rashid’s McCowan ElCopyright:

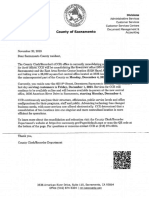

cc: Treasury For Your Reference

Internal Revenue Internal Revenue

7569 Macfinley Way Ogden, Utah

Notice 94-6000529

Sacramento ,California Notice date December 08, 2023

IR Debtor Employee Identification Number

Case reference number

94-6000529

94-6000529

More information Internal Revenue

Creditor:

Rosetta Rashida McCowan El as Bonding Fiduciary for the UNITED STATES FOR AMERICA

7569 Macfinley Way

Sacramento, California

Debtor/Taxpayer: 94-6000529

Ann Edwards, County Executive Officer

7000 H Street

Sacramento California 95814

916-875-5000

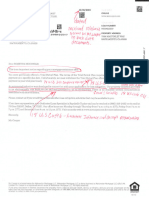

IMMEDIATE TAX LEVY (SEIZURE)

To. COUNTY OF SACRAMENTO d/b/a SACRAMENTO COUNTY

As of August 3, 2018, you have not discharged the debt on the property, after sending several notices to you.

Because you have not paid your balance of your debt, we have discharged the debt and levied (seized) property

claimed by you and your claimed rights to property. Each year, more than 8 out of 10 taxpayers pay their taxes. You

are part of a minority/ that has not fulfilled that duty. Additionally, Sacramento County Recorders of Deeds and Tax

Collectors will immediately remove from their records on said property as a Tax Debt 7569 Macfinley Way, Sacramento

California 95828 nunc pro tunc.

Amount Past Due: 250,000,000.00 gold United States Dollars / Suis Francs for each for the Estate

KALIFA TERRITORY OV THIRTY FIRST PARALLEL TRUST November 16, 2023. See The constitution

for the united States of North America Article 1, Section 10.

Final Bankruptcy Judgement was issued on November 30, 2023 at 2:30pm Pacific Time

You are required to do the following actions:

Due to your inability to pay the stated debt, all property is hereby placed in the possession and

custody of and for the original indigenous ancient sovereign people who are the Moorish

National Republic Federal government, possessing custodians and Internal Revenue. This

Congressional affidavit is effective immediately upon all debtors, agents, principals, heirs

assigns and any and all derivative debtors thereof.

For Your Reference

Notice 94-6000529

Notice date December 08, 2023

Debtor Employee Identification Number 94-6000529

Case reference number 94-6000529

More information Internal Revenue

Your Billing Summary Format Number Amount You owe Total

Tax Period ending.

11/30/2023 1040 $250,000,000.00 $250,000,000.00

for each Moorish for each Moor American

National Trust American National Trust

Amount Due Immediately $250,000,000.00

for each Moorish

American National Trust

Notification: All locations are ancient land locations. All addresses are living corporate situs trust

addresses.

31 United States Code § 1501: Documentary evidence requirement for Government entitlements

(a}A amount shah be recorded as a paid enti0ement for. of and by the United States government when supported by

documentary evidence of

(1}a binding agreement between an agency and another person (including an agency) that â.

(A)in writing, by affidavit, and for a purpose authorized by In, and

(B}exeou1e6 before the end of the period of availability tor obligation of the appropriation or fund used for specific

goods to be delivered, rear property to be light or leased, or work or source to be provided:

(2}a loan agreement showing the amount and terms for payment.

(3}a court command required by law to be placed with an agency;

(4}a court command and issued in alignment with a law authorizing | purchases without advertising

(Ashen necessary because of a nations programmed for the pure;

(B}for natural foods or perishable subsistence supplies; or

(C)regarding of specific monetary limits;

(5) a grant, subsidy or national programmed.

(A) Form appropriationsmade for payment of, or ron1zibutions to, amounts paid in specific amounts fixed by law or by formulas

(B) by an agreement authorized by law; or

(C) by plans approved consistent with and authorized by law;

(6) a fab lily flat may result from pending litigation;

{7) employment work or services of persons or expenses of travel in & alignment with the law,

(8 services or works provided by pubic utilities; or

(9)other general welfare entitlement for the Government from a constitutional appropriation or fund.

(b}A statement of entitlements provided by Congress or a committee of Congress by an agency shall include only those amount s that are entitlements consistent

with subsection (a) of this section.

Tile 12 United States Code 95a, part B2 Regulation for actions in exchange for gold and silver, property transfers, and entitlement

(2) Any entitlement, payment, conveyance, transfer, assignment, a properly delivery, made to or for the United Slates,

or as otherwise directed by this competent court, pursuant to this section or any rule, regulation, instruction, or

direction issued here by shall be full acquittance and discharge or tendered payment and marked paid in

full.

The Congress for the United States Article I Section IX

Money shall be paid from the Treasury in alignment with nations appropriations made by law.

Regards

Rosetta Rashida McCowan El, Fiduciary, Trustee, Attorney in

Fact Internal Revenue

CREDITOR’S name, street address. city or town, state or province, country, 1 Date of event

Affidavit Number 15452281

1099C

UNITED STATES FOR AMERICA $250,000,000.00 Debt Cancellation

7569 Macfinely Way

Sacramento, California 3 Interest, if included in box 2

0.00 2023

CREDITORS TAX IDENTIFICATION NUMBER

546 29 9692 Property parcel number #020-0033-013-0000 Internal Revenue

94-6000529 7569 Macfinley Way

DEBTOR’S name 2921540 Sacramento, California

COUNTY OF SACRAMENTO File / Record with

d/b/a SACRAMENTO COUNTY

Street address (including apt. no.) 5 Check here if the debtor was personally liable for . For Privacy Law and

7000 H Street repayment of the debt.

Notification, see the

City or town, state or province, country, n postal code current General

Instructions for Certain

Information Returns.

Debtor Account Number 7 Accepted for Value

23082032

8585

1099C Debt Cancellation Version 0001 Category 26280W Treasury Internal Revenue

31 United States Code § 1501: Documentary evidence requirement for Government entitlements

(a) A amount shall be recorded as a paid entitlement for, of and by the United States government when supported by

documentary evidence of

(1) a binding agreement between an agency and another person (including an agency) that is,

(A) in writing, by affidavit, and for a purpose authorized by law; and

(B) executed before the end of the period of availability for entitlement of the appropriation or fund used for specific

goods to be delivered, real property to be bought or leased, or work or service to be provided.

(2) a loan agreement showing the amount and terms for repayment;

(3)a court command required by law to be placed with an agency.

(4) a court command issued in alignment with a law authorizing purchases without advertising

(A)when necessary, because of a national programme for the public;

(B)for natural foods or perishable subsistence supplies; or

(C)regardless of specific monetary limits.

(5) a grant, subsidy or national programme

(A)from appropriations made for payment of, or contributions to, amounts paid in specific amounts fixed by law or by formulas

prescribed by law.

(B) by an agreement authorized by law; or

(C) by plans approved consistent with and authorized by law.

(6) a liability that may result from pending litigation;

(7) employment, work or services of persons or expenses of travel in alignment with the law;

(8) services or works provided by public utilities; or

(9) other general welfare entitlement for the Government from a constitutional appropriation or fund.

(b) A statement of entitlements provided by Congress or a committee of Congress by an agency shall include only those amounts that are

entitlements consistent with subsection (a) of this section.

Title 12 United States Code 95a, part B2 Regulation for actions in exchange for gold and silver, property transfers, and entitlements

(2) Any entitlement, payment, conveyance, transfer, assignment, or property delivery, made to or for the United States,

or as otherwise directed by this competent court, pursuant to this section or any rule, regulation, instruction, or

direction issued hereby shall be a full acquittance and discharge or tendered payment and marked paid in full,

for all entitlements issued hereby.

The Constitution for the United States Article I Section IX

Money shall be paid from the Treasury in alignment with national appropriations made by law.

CREDITOR’S name, street address. city or town, state or province, country, 1 Date of event

Affidavit Number 15452281

1099C

UNITED STATES FOR AMERICA $250,000, 000.00 Debt Cancellation

7569 Macfinely Way

3 Interest, if included in box 2

Sacramento, California

0.00 2023

CREDITORS TAX IDENTIFICATION NUMBER

546 29 9692 Property parcel number #020-0033-013-0000

94-600529 7569 Macfinley Way

DEBTOR’S name 0 Sacramento, California

COUNTY OF SACRAM ENTO d/b/a SACRAMENTO COUNTY

The Internal Revenue

Street address (including apt. no.) 5 Check here if the debtor was personally liable for has been informed of

7000 H Street

Repayment of the deb t this transaction. The

Debtor is required to

City or town, state or province, country, n postal code Report income from this

transaction.

Debtor Account Number 7 Accepted for Value

23082032

1099C Debt Cancellation Version 0001 Category 26280W Treasury Internal Revenue

31 United States Code § 1501: Documentary evidence requirement for Government entitlements

(c) A amount shall be recorded as a paid entitlement for, of and by the United States government when supported by

documentary evidence of

(1) a binding agreement between an agency and another person (including an agency) that is,

(A) in writing, by affidavit, and for a purpose authorized by law; and

(B) executed before the end of the period of availability for entitlement of the appropriation or fund used for specific

goods to be delivered, real property to be bought or leased, or work or service to be provided.

(2) a loan agreement showing the amount and terms for repayment;

(3)a court command required by law to be placed with an agency.

(8) a court command issued in alignment with a law authorizing purchases without advertising

(A)when necessary, because of a national programme for the public.

(B)for natural foods or perishable subsistence supplies; or

(C)regardless of specific monetary limits.

(9) a grant, subsidy or national programme

(A)from appropriations made for payment of, or contributions to, amounts paid in specific amounts fixed by law or by formulas

prescribed by law.

(B) by an agreement authorized by law; or

(C) by plans approved consistent with and authorized by law.

(10)a liability that may result from pending litigation.

(11) employment, work or services of persons or expenses of travel in alignment with the law;

(8) services or works provided by public utilities; or

(9) other general welfare entitlement for the Government from a constitutional appropriation or fund.

(d) A statement of entitlements provided by Congress or a committee of Congress by an agency shall include only those amounts that are

entitlements consistent with subsection (a) of this section.

Title 12 United States Code 95a, part B2 Regulation for actions in exchange for gold and silver, property transfers, and entitlements

(2) Any entitlement, payment, conveyance, transfer, assignment, or property delivery, made to or for the United States,

or as otherwise directed by this competent court, pursuant to this section or any rule, regulation, instruction, or

direction issued hereby shall be a full acquittance and discharge or tendered payment and marked paid in full,

for all entitlements issued hereby.

The Constitution for the United States Article I Section IX

Money shall be paid from the Treasury in alignment with national appropriations made by law.

193 3

WA

You might also like

- Guarding Against Pandemics 2022 Tax FilingDocument30 pagesGuarding Against Pandemics 2022 Tax FilingTeddy SchleiferNo ratings yet

- Group 3 - Master Budget-Earrings UnlimitedDocument8 pagesGroup 3 - Master Budget-Earrings UnlimitedLorena Mae LasquiteNo ratings yet

- Black Card - Unlimited CreditDocument2 pagesBlack Card - Unlimited CredithewetielNo ratings yet

- Purchase Order Financing AgreementDocument6 pagesPurchase Order Financing AgreementMoffat Nyamadzawo100% (1)

- Sample BondDocument3 pagesSample BondJoshua Sygnal Gutierrez100% (1)

- American Express - Credit Card DenialDocument2 pagesAmerican Express - Credit Card DenialKunal JainNo ratings yet

- Scribd Fax Cover SheetDocument1 pageScribd Fax Cover SheetTaylorbey American NationalNo ratings yet

- Levy $107,110,000 District Court 38-1-01 Johnny EasleyDocument4 pagesLevy $107,110,000 District Court 38-1-01 Johnny Easleyakil kemnebi easley elNo ratings yet

- Levy 1099c Copy B Hugg, Jonathan W Doing Business As Lawyer Eckert Seamans Cherin & Mellott Limited Liability CompanyDocument4 pagesLevy 1099c Copy B Hugg, Jonathan W Doing Business As Lawyer Eckert Seamans Cherin & Mellott Limited Liability Companyakil kemnebi easley elNo ratings yet

- SSN RepealDocument5 pagesSSN Repealmark bidenNo ratings yet

- WritOfExecution ExampleDocument3 pagesWritOfExecution ExampleajgtrustNo ratings yet

- Auto Title Loans and The Law BrochureDocument2 pagesAuto Title Loans and The Law BrochureSC AppleseedNo ratings yet

- v888 Request by An Individual For Information About A Vehicle PDFDocument2 pagesv888 Request by An Individual For Information About A Vehicle PDFmxckcxzlm.c,0% (1)

- Bank Guarantee Text d1Document4 pagesBank Guarantee Text d1Fenny Kusien50% (2)

- Definition of IncomeDocument1 pageDefinition of IncomeBartownNo ratings yet

- Classification of TrustDocument28 pagesClassification of TrustJenny IslamNo ratings yet

- WritOfExecution BK CourtFormForSheriffDocument6 pagesWritOfExecution BK CourtFormForSheriffajgtrustNo ratings yet

- Declaration For Power of Attorney: Privacy Act StatementDocument2 pagesDeclaration For Power of Attorney: Privacy Act StatementOneNationNo ratings yet

- PSA Certificate of Live Birth FormDocument1 pagePSA Certificate of Live Birth FormJane Avila100% (1)

- Extinguishment of ObligationsDocument14 pagesExtinguishment of ObligationsAbe Miguel Bullecer100% (1)

- Name ChangeDocument2 pagesName ChangeAleria Butler100% (1)

- Dissolution Deed FormatDocument2 pagesDissolution Deed FormatMuslim Qureshi100% (1)

- Motion For A Hearing (7/25/18)Document3 pagesMotion For A Hearing (7/25/18)joshblackman0% (1)

- Death Certificate Application PDFDocument2 pagesDeath Certificate Application PDFBeyza GemiciNo ratings yet

- Certification of Trust 1Document1 pageCertification of Trust 1ImoBank Investimentos100% (1)

- Direct Dividend DepositDocument1 pageDirect Dividend DepositJeremy WebbNo ratings yet

- Loan Deferment Form - FLS PDFDocument3 pagesLoan Deferment Form - FLS PDFPhoenixNo ratings yet

- Notice To All Law Enforcement OfficersDocument1 pageNotice To All Law Enforcement OfficersBanNo ratings yet

- IRS Form 982 Reduction of Attributes Due To Discharge of IndebtednessDocument5 pagesIRS Form 982 Reduction of Attributes Due To Discharge of IndebtednessDebe MaxwellNo ratings yet

- 8822-B Signed FormDocument1 page8822-B Signed FormPriyank Bhatt100% (1)

- Offset & Discharge BondDocument6 pagesOffset & Discharge Bondtrust2386No ratings yet

- Project On Trust and Its TypesDocument8 pagesProject On Trust and Its TypesTushar MehtaNo ratings yet

- Article of IncorporationDocument138 pagesArticle of IncorporationUjah J. WonkpahNo ratings yet

- Statutory Durable Power of Attorney 09-1-2017Document6 pagesStatutory Durable Power of Attorney 09-1-2017AmesNo ratings yet

- 1515 RECORDER OF Deeds April 27, 2020 PDFDocument4 pages1515 RECORDER OF Deeds April 27, 2020 PDFempress_jawhara_hilal_el100% (1)

- Affidavit of Forgery - TemplateDocument1 pageAffidavit of Forgery - TemplateOlympusVonSandervexNo ratings yet

- Kinds of TrustDocument4 pagesKinds of TrustAzad SamiNo ratings yet

- In Lieu of W-8BENDocument2 pagesIn Lieu of W-8BENbrittanilpeedin100% (3)

- Zzzpsgiolepfrp: Document Instructions PackageDocument9 pagesZzzpsgiolepfrp: Document Instructions PackageMaitri DoshiNo ratings yet

- Abatment For Case of Misnomer MercedesDocument4 pagesAbatment For Case of Misnomer MercedesCarlos100% (1)

- LTR Comm Empl Stop WithholdingDocument17 pagesLTR Comm Empl Stop WithholdingBar RiNo ratings yet

- Creditor - Pyramid - Magisterial Living Tribunal 38101 236003062 - Bond-Created-Feburary-20-2024Document15 pagesCreditor - Pyramid - Magisterial Living Tribunal 38101 236003062 - Bond-Created-Feburary-20-2024akil kemnebi easley el100% (1)

- Trust - Tax Planning - Estate Planning - Real Estate & ReitsDocument62 pagesTrust - Tax Planning - Estate Planning - Real Estate & ReitsAbhijeet PatilNo ratings yet

- Application For Employer Identification Number: All Caps Same As SSNDocument2 pagesApplication For Employer Identification Number: All Caps Same As SSNMarcosLbiv0% (1)

- Impact of of Issuance of Sovereign Bonds On Short Term andDocument3 pagesImpact of of Issuance of Sovereign Bonds On Short Term andAkash BafnaNo ratings yet

- Citizenship-Immigration Status 2016Document1 pageCitizenship-Immigration Status 2016rendaoNo ratings yet

- Promissory Notes-Bills of Exchangeand ChequesDocument17 pagesPromissory Notes-Bills of Exchangeand Chequestheashu022No ratings yet

- Sav 0385Document2 pagesSav 0385datlavarma25No ratings yet

- Ucc 1 AdDocument2 pagesUcc 1 AdShawn SandefurNo ratings yet

- Definition: Sec. 2, Uniform Customs and Practices For Documentary Credit (UCP)Document2 pagesDefinition: Sec. 2, Uniform Customs and Practices For Documentary Credit (UCP)Nikki FernandoNo ratings yet

- Bowman Motion To Dismiss For Lack of VenueDocument4 pagesBowman Motion To Dismiss For Lack of VenueKenan Farrell100% (1)

- Cause of ActionDocument29 pagesCause of ActionChris.No ratings yet

- Barnet Council / London Borough of Barnet Creditor Treasury Bond + 120eb636 + 120d30Document12 pagesBarnet Council / London Borough of Barnet Creditor Treasury Bond + 120eb636 + 120d30shasha ann beyNo ratings yet

- Car Renewal Letter AMV023385268Document2 pagesCar Renewal Letter AMV023385268RunToLiveHDNo ratings yet

- Virginia Quit Claim Deed FormDocument2 pagesVirginia Quit Claim Deed FormLj PerrierNo ratings yet

- Notice of Default Judgement - Kathy Witt &thomas D. RichardsDocument16 pagesNotice of Default Judgement - Kathy Witt &thomas D. RichardsEarl Julian Lloyd ElNo ratings yet

- DDFDocument66 pagesDDFPankaj Kumar100% (2)

- Negotiable Meaning Types and Legal AspectDocument9 pagesNegotiable Meaning Types and Legal AspectadityaNo ratings yet

- Clear Allodial Title 25120 Lous LaneDocument2 pagesClear Allodial Title 25120 Lous Laneprince noble james beyNo ratings yet

- Amazon United States Creditor Treasury Bond + 911646860Document12 pagesAmazon United States Creditor Treasury Bond + 911646860shasha ann beyNo ratings yet

- Constitution of the State of Minnesota — 1974 VersionFrom EverandConstitution of the State of Minnesota — 1974 VersionNo ratings yet

- Retirement Fidelity Workers CompensationDocument7 pagesRetirement Fidelity Workers CompensationRosetta Rashid’s McCowan ElNo ratings yet

- Congressional Record 14th Amendment UnconstitutionalDocument3 pagesCongressional Record 14th Amendment UnconstitutionalRosetta Rashid’s McCowan ElNo ratings yet

- Creditor Bond 2025923Document16 pagesCreditor Bond 2025923Rosetta Rashid’s McCowan ElNo ratings yet

- No Consent or JurisdictionDocument11 pagesNo Consent or JurisdictionRosetta Rashid’s McCowan ElNo ratings yet

- Quit Claim DeedDocument3 pagesQuit Claim DeedRosetta Rashid’s McCowan ElNo ratings yet

- Quit Claim DeedDocument3 pagesQuit Claim DeedRosetta Rashid’s McCowan ElNo ratings yet

- Subject County Clerk Recorder CommunicationDocument2 pagesSubject County Clerk Recorder CommunicationRosetta Rashid’s McCowan ElNo ratings yet

- Amended Power For Attorney U.S. For AmericaDocument1 pageAmended Power For Attorney U.S. For AmericaRosetta Rashid’s McCowan ElNo ratings yet

- No Consent or JurisdictionDocument1 pageNo Consent or JurisdictionRosetta Rashid’s McCowan ElNo ratings yet

- Cooper 12 11 2023Document1 pageCooper 12 11 2023Rosetta Rashid’s McCowan ElNo ratings yet

- IRS Writ and CorrespondenceDocument6 pagesIRS Writ and CorrespondenceRosetta Rashid’s McCowan ElNo ratings yet

- California Is On The LandDocument4 pagesCalifornia Is On The LandRosetta Rashid’s McCowan ElNo ratings yet

- Indemnis Facere Proklamatione Macfinley WayDocument2 pagesIndemnis Facere Proklamatione Macfinley WayRosetta Rashid’s McCowan ElNo ratings yet

- 1096 and Levy Nationstar LLCDocument6 pages1096 and Levy Nationstar LLCRosetta Rashid’s McCowan ElNo ratings yet

- 13th Ave Kourte Commande + RosettaDocument3 pages13th Ave Kourte Commande + RosettaRosetta Rashid’s McCowan ElNo ratings yet

- Affidavit of Clear Perfect Allodial Title MacfinleyDocument2 pagesAffidavit of Clear Perfect Allodial Title MacfinleyRosetta Rashid’s McCowan ElNo ratings yet

- 007 Ucc 1 Liene 13th Ave RosettaDocument7 pages007 Ucc 1 Liene 13th Ave RosettaRosetta Rashid’s McCowan ElNo ratings yet

- 1096 Levy and Additional DocumentsDocument10 pages1096 Levy and Additional DocumentsRosetta Rashid’s McCowan ElNo ratings yet

- Birth Certificate Lien Final1Document19 pagesBirth Certificate Lien Final1Rosetta Rashid’s McCowan ElNo ratings yet

- Indemnis Facere Proklamatione 13th RosettaDocument2 pagesIndemnis Facere Proklamatione 13th RosettaRosetta Rashid’s McCowan ElNo ratings yet

- Allahiyah Writt Ov Habeyus Qorpus RosettaDocument2 pagesAllahiyah Writt Ov Habeyus Qorpus RosettaRosetta Rashid’s McCowan ElNo ratings yet

- Affidavit of Clear Perfect Allodial Title MacfinleyDocument2 pagesAffidavit of Clear Perfect Allodial Title MacfinleyRosetta Rashid’s McCowan ElNo ratings yet

- Termination of Korporate KontractsDocument7 pagesTermination of Korporate KontractsRosetta Rashid’s McCowan ElNo ratings yet

- STATE Kourte KommandeDocument6 pagesSTATE Kourte KommandeRosetta Rashid’s McCowan ElNo ratings yet

- Nationalization Documents - JAN 2 4 2022Document8 pagesNationalization Documents - JAN 2 4 2022Rosetta Rashid’s McCowan ElNo ratings yet

- UCC 1 Lien, Strawman Lien, Fiduciary, International ProclamationDocument23 pagesUCC 1 Lien, Strawman Lien, Fiduciary, International ProclamationRosetta Rashid’s McCowan ElNo ratings yet

- Lien On The State and Additional Documents1Document43 pagesLien On The State and Additional Documents1Rosetta Rashid’s McCowan ElNo ratings yet

- Affidavid of Facts For Averment of Jurisdiction Quo Warranto and Post CardsDocument5 pagesAffidavid of Facts For Averment of Jurisdiction Quo Warranto and Post CardsRosetta Rashid’s McCowan ElNo ratings yet

- Notice of Default-Cooper+FiledDocument4 pagesNotice of Default-Cooper+FiledRosetta Rashid’s McCowan ElNo ratings yet

- Writ of Quo Warranto MR. COOPER RevisedDocument7 pagesWrit of Quo Warranto MR. COOPER RevisedRosetta Rashid’s McCowan El0% (1)

- Fall 2022 DCF InstructionsDocument3 pagesFall 2022 DCF InstructionsSaharsh jainNo ratings yet

- FINA2209 Lecture2Document35 pagesFINA2209 Lecture2Dylan AdrianNo ratings yet

- Accountant 17-07-2023Document3 pagesAccountant 17-07-2023mrsiranjeevi44No ratings yet

- Lecture 10 - LiabilitiesDocument50 pagesLecture 10 - LiabilitiesIsyraf Hatim Mohd TamizamNo ratings yet

- Accountancy Worksheet Grade XI Chapter 1 and Chapter 2Document2 pagesAccountancy Worksheet Grade XI Chapter 1 and Chapter 2Abhradeep Ghosh100% (3)

- Engineering Economy 2Document6 pagesEngineering Economy 2Michael Angelo MontebonNo ratings yet

- Financial Proposal of UNITED CONSTRUCTION COMPANYDocument5 pagesFinancial Proposal of UNITED CONSTRUCTION COMPANYfayoNo ratings yet

- The Economics of Money, Banking, and Financial Markets: Twelfth Edition, Global EditionDocument33 pagesThe Economics of Money, Banking, and Financial Markets: Twelfth Edition, Global EditionOtgoo HNo ratings yet

- Leases - Brief ExercisesDocument5 pagesLeases - Brief ExercisesPeachyNo ratings yet

- BS, PNL and Ratio Calculation - Group15Document13 pagesBS, PNL and Ratio Calculation - Group15Mukund MalpaniNo ratings yet

- Affidavit of Undertaking - PobleteDocument1 pageAffidavit of Undertaking - PobleteJonah CruzadaNo ratings yet

- Ems Answersheet Mid Year Test 2021Document7 pagesEms Answersheet Mid Year Test 2021zwonizwonakaNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument15 pagesCambridge International Advanced Subsidiary and Advanced LevelSaram Shykh PRODUCTIONSNo ratings yet

- Hire Purchases System-Dr. S.K.GuptaDocument7 pagesHire Purchases System-Dr. S.K.GuptaVasundhara DNo ratings yet

- Test Your Understanding Question #1Document3 pagesTest Your Understanding Question #1Tedla Guye75% (8)

- Chapter-5: Statement of Cash FlowDocument43 pagesChapter-5: Statement of Cash FlowBAM ZAHARDNo ratings yet

- New Balance $13,214.40 Minimum Payment Due $395.67 Payment Due Date 04/23/21Document9 pagesNew Balance $13,214.40 Minimum Payment Due $395.67 Payment Due Date 04/23/21Alberto Lizarraga Sr.100% (1)

- Financial Accounting in An Economic Context 8Th Edition Pratt Test Bank Full Chapter PDFDocument59 pagesFinancial Accounting in An Economic Context 8Th Edition Pratt Test Bank Full Chapter PDFthomasowens1asz100% (11)

- Legal Notice U/s 138 of Negotiable Instrument ActDocument3 pagesLegal Notice U/s 138 of Negotiable Instrument ActjanviNo ratings yet

- Module 9 Receivable Financing Notes ReceivablesDocument6 pagesModule 9 Receivable Financing Notes ReceivablesMa Leobelle BiongNo ratings yet

- Tally AssingmentDocument19 pagesTally AssingmentTaranNo ratings yet

- Shimanto-Bank Fin380 Term-PaperDocument25 pagesShimanto-Bank Fin380 Term-PaperNiloy MallickNo ratings yet

- General Mathematics Final Term Written Test IDocument4 pagesGeneral Mathematics Final Term Written Test IcykenNo ratings yet

- Resume Prospectus BCP EOS 2020 VAngDocument30 pagesResume Prospectus BCP EOS 2020 VAngIsmail bnjNo ratings yet

- Debtors Financing-Factoring: Swayam Siddhi College of MGMT & ResearchDocument15 pagesDebtors Financing-Factoring: Swayam Siddhi College of MGMT & Researchpranjali shindeNo ratings yet

- FULL Source FIN202Document277 pagesFULL Source FIN202Nguyen Hoang Phuong Nam (K16HCM)No ratings yet

- Cambridge International AS & A Level: Accounting 9706/32 March 2021Document19 pagesCambridge International AS & A Level: Accounting 9706/32 March 2021Ahmed NaserNo ratings yet

- Bad Debts - CE and DSE - AnswerDocument3 pagesBad Debts - CE and DSE - AnswerKwan Yin HoNo ratings yet

- Odev - Cash - Flow - and - Financial - Planning (1) - Fatih EkerDocument16 pagesOdev - Cash - Flow - and - Financial - Planning (1) - Fatih EkerfurkanNo ratings yet