Professional Documents

Culture Documents

Assignment Four

Assignment Four

Uploaded by

mugabolionel8Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment Four

Assignment Four

Uploaded by

mugabolionel8Copyright:

Available Formats

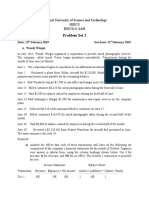

Principles of Accounting I

Assignment 4

Haggar Roofing Company, owned by R. Haggar, began operations in the month of July, 2022 and completed the following

transactions during that first month of operations.

July 1 R. Haggar invested Rwf 180,000 cash in a company

2 Purchased Rwf 50,000 in office equipment. It paid Rwf 20,000 in cash and signed a note payable

promising to pay the Rwf 30,000 over the next three years.

2 Rented office space and paid Rwf 6,000 for the July rent.

6 Installed a new roof for a customer and immediately collected Rwf 10,000.

7 Paid a supplier Rwf 4,000 for roofing materials used on the 6th July, Job.

8 Purchased a Rwf 4,000 machine for office use on credit.

9 Completed work for additional customers on credit in the amount of Rwf 23,000.

15 Paid its employees’ salaries Rwf 4,600 for the first half of the month.

17 Installed a new roof for a customer and immediately collected Rwf 4,800.

20 Received Rwf 20,000 in payments from the customers billed on 9th July.

25 Withdrew Rwf 20,000 from the business to pay fees for his child at Kigali Parents Primary School

28 Paid Rwf 3,000 on the copy machine purchased on 8th July. It will pay the remaining balance in June.

31 Paid its employees’ salaries Rwf 4,800 for the second half of the month.

31 Paid a supplier Rwf 10,600 for roofing materials used on the remaining jobs completed during July.

31 Paid Rwf 900 for this month’s utility Bill.

Required

1. Arrange the following asset, liability, and equity titles in a table like that discussed in class. The Business uses the following

accounts: Cash/Bank; Accounts receivable/Debtors; Equipment; Accounts payable/creditors; Notes payable; R. Haggar,

Capital; R. Haggar, withdrawals; Service Revenues; Expenses (Rent, Salaries & Wages, and Utility)

2. Show effects of the transactions on the accounts of the accounting equation by recording increases and decreases in the

appropriate columns. Do not determine new account balances after each transaction. Determine the final total for each

account and verify that the equation is in balance.

3. Prepare the Journal entries in the General Journal.

4. Post to the Ledger using the given account titles and determine the balance of each account

You might also like

- E-Statement of Account: Meezan Bank LTDDocument1 pageE-Statement of Account: Meezan Bank LTDMudassir IjazNo ratings yet

- Bookkeeping ActivityDocument11 pagesBookkeeping ActivityIest HinigaranNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Q No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsDocument6 pagesQ No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsMuhammad Haris100% (1)

- Questions For Practice - Transaction AnalysisDocument2 pagesQuestions For Practice - Transaction AnalysisAsvag Onda100% (2)

- Work Sheet Class 1Document1 pageWork Sheet Class 1Smriti singhNo ratings yet

- CRH LimitedDocument16 pagesCRH LimitedAfsheen Danish Naqvi100% (1)

- Ib Business Management 3.3c Activity Break Even Analysis PDFDocument2 pagesIb Business Management 3.3c Activity Break Even Analysis PDF이유태No ratings yet

- The Winslow Clock CompanyDocument4 pagesThe Winslow Clock CompanyZam Zety50% (2)

- F.E.D-ACCT 8112 RevisionDocument1 pageF.E.D-ACCT 8112 Revisionmugabolionel8No ratings yet

- Questions For Practice - Transaction AnalysisDocument2 pagesQuestions For Practice - Transaction Analysispranay raj rathoreNo ratings yet

- TUTORIAL 1 - Question Accounting EquationDocument1 pageTUTORIAL 1 - Question Accounting EquationThando Majola-MasondoNo ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- A. B. C. D. E. F. G. H. I.: Class Illustrations For PracticeDocument5 pagesA. B. C. D. E. F. G. H. I.: Class Illustrations For PracticePrajaktaNo ratings yet

- Class Exercise Session 1,2Document7 pagesClass Exercise Session 1,2sheheryar50% (4)

- Assignment For 2021 January June 2021: ProblemDocument2 pagesAssignment For 2021 January June 2021: ProblemZunaeid Mahmud LamNo ratings yet

- General JournalDocument5 pagesGeneral Journalmuhammad.16032.acNo ratings yet

- Business Finance Tha 4th QTRDocument1 pageBusiness Finance Tha 4th QTRYuwon Angelo AguilarNo ratings yet

- Practice Questions On AEDocument21 pagesPractice Questions On AERahul ManglaNo ratings yet

- Assignment OneDocument6 pagesAssignment OneUser50% (2)

- Assignment No. 01 FAPDocument4 pagesAssignment No. 01 FAPUmar FaridNo ratings yet

- Funda Manual Chapter 5 ExercisesDocument8 pagesFunda Manual Chapter 5 ExercisesRimuruNo ratings yet

- 3A Accounting Cycle Journal TBDocument1 page3A Accounting Cycle Journal TBDUDUNG dudongNo ratings yet

- Financial Accounting Practice ProblemsDocument15 pagesFinancial Accounting Practice ProblemsFaryal Mughal100% (1)

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- Financial Accounting and Business Management 1 - Activity SheetsDocument5 pagesFinancial Accounting and Business Management 1 - Activity Sheetseric galenoNo ratings yet

- Journaling ExerciseDocument2 pagesJournaling ExerciseSammy Marquez100% (1)

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDocument11 pagesPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoNo ratings yet

- SPJIMR: PGMPW 2021: Financial Statement Analysis: Topic: Introduction To Financial AccountingDocument4 pagesSPJIMR: PGMPW 2021: Financial Statement Analysis: Topic: Introduction To Financial AccountingSmriti singhNo ratings yet

- Mr. Ali: Use The Following Information For The Question Numbers 5 To 10Document2 pagesMr. Ali: Use The Following Information For The Question Numbers 5 To 10rajguptaNo ratings yet

- Acc 31: Quiz 2Document1 pageAcc 31: Quiz 2Felimar CalaNo ratings yet

- Bram Wear CaseDocument2 pagesBram Wear CaseHabtamu Ye Asnaku Lij89% (9)

- Quiz - Ppe Cost 2Document1 pageQuiz - Ppe Cost 2Ana Mae HernandezNo ratings yet

- Quiz BowlDocument2 pagesQuiz Bowlaccounting probNo ratings yet

- Accounting ProblemsDocument31 pagesAccounting ProblemsJanna Gunio100% (1)

- Accounting Equation Exercises PDFDocument1 pageAccounting Equation Exercises PDFAdelle Bert DiazNo ratings yet

- Example of Accounting TransactionDocument3 pagesExample of Accounting TransactionMylen Noel Elgincolin Manlapaz100% (1)

- Jerome Garcia Acctg EquationDocument1 pageJerome Garcia Acctg EquationAudrey Rose SarazaNo ratings yet

- Truro Excavating Co Owned by Raul Truro Began Operations In: Unlock Answers Here Solutiondone - OnlineDocument1 pageTruro Excavating Co Owned by Raul Truro Began Operations In: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Accounting Ex3.0Document3 pagesAccounting Ex3.0Kanishka Singh RaghuvanshiNo ratings yet

- Activity 1Document1 pageActivity 1jhayrinemaeNo ratings yet

- Exercises of Session 3Document3 pagesExercises of Session 3tranhlthNo ratings yet

- Exercises On Accounting EquationDocument4 pagesExercises On Accounting EquationNeelu AggrawalNo ratings yet

- Accounts Worksheet 1.4 Class XIDocument4 pagesAccounts Worksheet 1.4 Class XIMuskan AgarwalNo ratings yet

- Test 1Document3 pagesTest 1super manNo ratings yet

- Accounting Problems - 2018Document31 pagesAccounting Problems - 2018Albert Moreno100% (4)

- Accounting Equations-Practice MaterialDocument4 pagesAccounting Equations-Practice MaterialTejas DesaiNo ratings yet

- Merchandising Bus Prub Periodic MethodDocument2 pagesMerchandising Bus Prub Periodic MethodChristopher Keith BernidoNo ratings yet

- Accounting Equation and General JournalDocument3 pagesAccounting Equation and General JournalWaqar AhmadNo ratings yet

- Final Quiz FAPDocument4 pagesFinal Quiz FAPAfif KhanNo ratings yet

- Asm 2670Document3 pagesAsm 2670Pushkar MittalNo ratings yet

- Accounting Case StudyDocument1 pageAccounting Case StudyAhmad ZakariaNo ratings yet

- # CH-1 - Transaction - AnalysisDocument3 pages# CH-1 - Transaction - AnalysisGetaneh ZewuduNo ratings yet

- FA - Excercises & Answers PDFDocument17 pagesFA - Excercises & Answers PDFRasanjaliGunasekera100% (1)

- Assignment 2Document2 pagesAssignment 2Zafar Farooq50% (2)

- Adjusting Entry ProblemsDocument5 pagesAdjusting Entry ProblemsRize Takatsuki100% (1)

- Tutorial Questions: Topic 1: Introduction To AccountingDocument28 pagesTutorial Questions: Topic 1: Introduction To AccountingBernard OwusuNo ratings yet

- Reviewer 4Document2 pagesReviewer 4Zamantha TiangcoNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Accounting Equation - EworkbookDocument20 pagesAccounting Equation - EworkbookDENCY THOMASNo ratings yet

- Exercises On Acc Eqn - 26 QuesDocument12 pagesExercises On Acc Eqn - 26 QuesNeelu AggrawalNo ratings yet

- ExercisesDocument2 pagesExercisesJanine IgdalinoNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2Rubab MirzaNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

- Flyer - SAP EWM - ENG - WebDocument4 pagesFlyer - SAP EWM - ENG - Webbharath sudeneniNo ratings yet

- Jennifer Barnes: Background Report OnDocument53 pagesJennifer Barnes: Background Report OnDed MarozNo ratings yet

- Group5 PGFinance KotakINGDocument39 pagesGroup5 PGFinance KotakINGRoli DubeNo ratings yet

- Chapter 5.4 Location: Analyse and ApplyDocument11 pagesChapter 5.4 Location: Analyse and ApplyNishant AgarwalNo ratings yet

- DHFL Corporate PPT q4 Fy17 PDFDocument52 pagesDHFL Corporate PPT q4 Fy17 PDFAkshay MehtaNo ratings yet

- Nism Series II B Registrar To An Issue Mutual Funds Workbook in PDFDocument188 pagesNism Series II B Registrar To An Issue Mutual Funds Workbook in PDFManiesh MahajanNo ratings yet

- Burs - Tax Brochures 2Document2 pagesBurs - Tax Brochures 2loli2323No ratings yet

- Application For VAT Zero RatingDocument9 pagesApplication For VAT Zero RatingHanabishi RekkaNo ratings yet

- Actividad B1. INVENTORY MANAGEMENT.Document1 pageActividad B1. INVENTORY MANAGEMENT.israel cisneros100% (1)

- Sample Cover Letter For Job in GermanyDocument20 pagesSample Cover Letter For Job in GermanyShejoy T.JNo ratings yet

- Perspectives On Retail & Consumer Goods - Summer 2014 FINALDocument84 pagesPerspectives On Retail & Consumer Goods - Summer 2014 FINALzskebapciNo ratings yet

- Fra1 CP1 - Q&aDocument4 pagesFra1 CP1 - Q&arafav10100% (1)

- Michael Samis WorkshopDocument150 pagesMichael Samis Workshopxixo1234No ratings yet

- Blue Ocean StrategyDocument17 pagesBlue Ocean StrategyakshitaNo ratings yet

- Marketing Research PROJECTDocument41 pagesMarketing Research PROJECTMukunda MukundaNo ratings yet

- AssignmentDocument6 pagesAssignmentMuhammad Eqrash Mansoor QureshiNo ratings yet

- Principles of Accounts 11Document47 pagesPrinciples of Accounts 11Godfrey LwandoNo ratings yet

- 5s Methodology by Gbededo MautonDocument51 pages5s Methodology by Gbededo MautonrudypatilNo ratings yet

- Oracle Database 11g: Administration Workshop IDocument2 pagesOracle Database 11g: Administration Workshop IFilipe Santos100% (1)

- Paper2 Quality Management MagutuDocument15 pagesPaper2 Quality Management MagutuJoseph McDonaldNo ratings yet

- POB F2016 Unit 5.00 MPADocument52 pagesPOB F2016 Unit 5.00 MPAJeremae Rauza TenaNo ratings yet

- Profile of Mehrotra MehrotraDocument38 pagesProfile of Mehrotra MehrotraRahul BhanNo ratings yet

- Professional SummaryDocument3 pagesProfessional SummaryVijay LS SolutionsNo ratings yet

- TQM 2 and 16 Marks PDFDocument127 pagesTQM 2 and 16 Marks PDFanand_duraiswamyNo ratings yet

- SMME DirectoryDocument92 pagesSMME DirectoryhthieroffNo ratings yet

- Benefits Realisation Management Framework: Part 1: PrinciplesDocument14 pagesBenefits Realisation Management Framework: Part 1: Principlestitli123No ratings yet