Professional Documents

Culture Documents

It 000146384671 2022 00

It 000146384671 2022 00

Uploaded by

zohaib hassan ShahCopyright:

Available Formats

You might also like

- English Grammar & Composition 9th 10th (Freebooks - PK) PDFDocument196 pagesEnglish Grammar & Composition 9th 10th (Freebooks - PK) PDFzohaib hassan Shah88% (17)

- Pcem 06 Swot Analysis Kaha FinalDocument23 pagesPcem 06 Swot Analysis Kaha FinalziadNo ratings yet

- It 000152365852 2023 00Document1 pageIt 000152365852 2023 00nabeelshahzad0035dnbNo ratings yet

- It 000144391613 2022 00Document1 pageIt 000144391613 2022 00Muhammad Aamir AbbasNo ratings yet

- It 000154735437 2023 00Document1 pageIt 000154735437 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000141511985 2022 00Document1 pageIt 000141511985 2022 00Abdul Basit KtkNo ratings yet

- Nawaz Challan Tax Year 2022 It-000146079994-2022-00Document1 pageNawaz Challan Tax Year 2022 It-000146079994-2022-00Shahid AminNo ratings yet

- It 000144586598 2022 00Document1 pageIt 000144586598 2022 00hizbullahjantankNo ratings yet

- It 000153285706 2023 00Document1 pageIt 000153285706 2023 00Muhammad AneesNo ratings yet

- It 000153477861 2023 00Document1 pageIt 000153477861 2023 00Muhammad salman SalmanNo ratings yet

- It 000145493451 2022 00Document1 pageIt 000145493451 2022 00Salman AhmedNo ratings yet

- It 000155658731 2023 00Document1 pageIt 000155658731 2023 00Atif JaveadNo ratings yet

- It 000154454559 2023 00Document1 pageIt 000154454559 2023 00xabimoviesNo ratings yet

- It 000141516198 2022 00Document1 pageIt 000141516198 2022 00Abdul Basit KtkNo ratings yet

- It 000154116473 2023 00Document1 pageIt 000154116473 2023 00sibghatullahmiranibNo ratings yet

- It 000154735501 2023 00Document1 pageIt 000154735501 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000141614736 2022 00Document1 pageIt 000141614736 2022 00Shahbaz MuhammadNo ratings yet

- It 000144747898 2022 00Document1 pageIt 000144747898 2022 00hizbullahjantankNo ratings yet

- It 000154735387 2023 00Document1 pageIt 000154735387 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000154568930 2023 00Document1 pageIt 000154568930 2023 00xabimoviesNo ratings yet

- It 000147296140 2022 00Document1 pageIt 000147296140 2022 00MUHAMMAD TABRAIZNo ratings yet

- Muhammad Mehtab Aslam FBR ChallanDocument1 pageMuhammad Mehtab Aslam FBR ChallanKingRafayIINo ratings yet

- Saeed KhanDocument1 pageSaeed Khanattock jadeedNo ratings yet

- It 000154264298 2023 00Document1 pageIt 000154264298 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000154735269 2023 00Document1 pageIt 000154735269 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000154262354 2023 00Document1 pageIt 000154262354 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000152669656 2023 00Document1 pageIt 000152669656 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000144378527 2022 00Document1 pageIt 000144378527 2022 00حنفیت اور شیعت مقلدNo ratings yet

- It 000144271793 2022 00Document1 pageIt 000144271793 2022 00online69979No ratings yet

- It-000147630388-2022-00 123Document1 pageIt-000147630388-2022-00 123cofini2389No ratings yet

- Income Tax Payment Challan: PSID #: 175921882Document1 pageIncome Tax Payment Challan: PSID #: 175921882taxhouse.kasur786No ratings yet

- Income Tax Payment Challan: PSID #: 164638694Document1 pageIncome Tax Payment Challan: PSID #: 164638694Syed Tahir ImamNo ratings yet

- It 000150863456 2022 00Document1 pageIt 000150863456 2022 00MUHAMMAD TABRAIZNo ratings yet

- It 000145577881 2023 00Document1 pageIt 000145577881 2023 00Hazrat BilalNo ratings yet

- It 000142649015 2022 00Document1 pageIt 000142649015 2022 00MUHAMMAD TABRAIZNo ratings yet

- It 000151339382 2023 00Document1 pageIt 000151339382 2023 00shaheenmagamartNo ratings yet

- Income Tax Payment Challan: PSID #: 145879823Document1 pageIncome Tax Payment Challan: PSID #: 145879823farhan aliNo ratings yet

- Income Tax Payment Challan: PSID #: 144740076Document1 pageIncome Tax Payment Challan: PSID #: 144740076usama ameenNo ratings yet

- It 000154543078 2023 00Document1 pageIt 000154543078 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000153644004 2023 00Document1 pageIt 000153644004 2023 00sibghatullahmiranibNo ratings yet

- It 000137673641 2022 00Document1 pageIt 000137673641 2022 00ayanNo ratings yet

- Income Tax Payment Challan: PSID #: 148473028Document1 pageIncome Tax Payment Challan: PSID #: 148473028Haseeb RazaNo ratings yet

- It 000152688444 2023 00Document1 pageIt 000152688444 2023 00MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 139758233Document1 pageIncome Tax Payment Challan: PSID #: 139758233umaar99No ratings yet

- It 000136721186 2022 00Document1 pageIt 000136721186 2022 00wali khelNo ratings yet

- Income Tax Payment Challan: PSID #: 148472556Document1 pageIncome Tax Payment Challan: PSID #: 148472556Haseeb RazaNo ratings yet

- It 000152818667 2023 00Document1 pageIt 000152818667 2023 00b3024345No ratings yet

- Income Tax Payment Challan: PSID #: 148643587Document1 pageIncome Tax Payment Challan: PSID #: 148643587Ehtsham AliNo ratings yet

- Income Tax Payment Challan: PSID #: 150493633Document1 pageIncome Tax Payment Challan: PSID #: 150493633Shehla FarooqNo ratings yet

- It 000130702686 2021 00Document1 pageIt 000130702686 2021 00Qazi zubairNo ratings yet

- It 000154263018 2023 00Document1 pageIt 000154263018 2023 00MUHAMMAD TABRAIZNo ratings yet

- Musthtaq Azeem Atl Challan PDFDocument1 pageMusthtaq Azeem Atl Challan PDFFarhan AliNo ratings yet

- Reema KhanDocument1 pageReema Khanattock jadeedNo ratings yet

- It 000151392010 2023 00Document1 pageIt 000151392010 2023 00aminabutt4524No ratings yet

- Income Tax Payment Challan: PSID #: 143186538Document1 pageIncome Tax Payment Challan: PSID #: 143186538talhaNo ratings yet

- Income Tax Payment Challan: PSID #: 165120097Document1 pageIncome Tax Payment Challan: PSID #: 165120097FBR GujranwalaNo ratings yet

- PSID# 36803358 (Junaid Paracha) PDFDocument1 pagePSID# 36803358 (Junaid Paracha) PDFAsif JavidNo ratings yet

- Waris Ali ChallanDocument1 pageWaris Ali ChallanMuhammad AsimNo ratings yet

- It 000143553567 2022 00Document1 pageIt 000143553567 2022 00danishahmed2126No ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- Khula Case DraftDocument4 pagesKhula Case Draftzohaib hassan ShahNo ratings yet

- Ashfaq Ahmed Withdrawal ApplicationDocument1 pageAshfaq Ahmed Withdrawal Applicationzohaib hassan ShahNo ratings yet

- Amjad Bail Application High Court 479 (Khaista Rahman)Document8 pagesAmjad Bail Application High Court 479 (Khaista Rahman)zohaib hassan ShahNo ratings yet

- 6-Prem Chowdhry 20 - 2Document24 pages6-Prem Chowdhry 20 - 2zohaib hassan ShahNo ratings yet

- Federal Budget Bulletin13 June 2022Document16 pagesFederal Budget Bulletin13 June 2022zohaib hassan ShahNo ratings yet

- What Caused The Cold War?: Inquiry Lesson PlanDocument21 pagesWhat Caused The Cold War?: Inquiry Lesson Planzohaib hassan ShahNo ratings yet

- Political Philosophy - An IntroductionDocument5 pagesPolitical Philosophy - An Introductionzohaib hassan ShahNo ratings yet

- Assignment: Political ScienceDocument9 pagesAssignment: Political Sciencezohaib hassan ShahNo ratings yet

- John Higley: "Elite Theory in Political Sociology": Elite) Is Always in Control Over Entities/institutions of ForceDocument3 pagesJohn Higley: "Elite Theory in Political Sociology": Elite) Is Always in Control Over Entities/institutions of Forcezohaib hassan ShahNo ratings yet

- 180 Opinio Seguridad AngDocument3 pages180 Opinio Seguridad Angzohaib hassan ShahNo ratings yet

- Moeed Yusuf Youth RadicalisationDocument30 pagesMoeed Yusuf Youth Radicalisationzohaib hassan ShahNo ratings yet

- Economic and Political Weekly Economic and Political WeeklyDocument5 pagesEconomic and Political Weekly Economic and Political Weeklyzohaib hassan ShahNo ratings yet

- Democracy, Governance and Development: A Conceptual FrameworkDocument24 pagesDemocracy, Governance and Development: A Conceptual Frameworkzohaib hassan ShahNo ratings yet

- First Merit List A 2017-2018Document4 pagesFirst Merit List A 2017-2018zohaib hassan ShahNo ratings yet

- Governance and Good Governance: A Conceptual Perspective: DR .Muhammad Ali, Assistant Professor, Department of PoliticalDocument13 pagesGovernance and Good Governance: A Conceptual Perspective: DR .Muhammad Ali, Assistant Professor, Department of Politicalzohaib hassan ShahNo ratings yet

- Santas ReviewDocument6 pagesSantas Reviewzohaib hassan ShahNo ratings yet

- Mixed Banking:: System Refers To That Banking System Under Which TheDocument7 pagesMixed Banking:: System Refers To That Banking System Under Which TheLOKESH RAMNo ratings yet

- Bioinformatics Assignment Topic: Phylogenetics Analysis SoftwaresDocument12 pagesBioinformatics Assignment Topic: Phylogenetics Analysis Softwaresnidhi teotiaNo ratings yet

- Netflix Ing British English StudentDocument8 pagesNetflix Ing British English StudentДианка МотыкаNo ratings yet

- Architecture and Technology Components For 5G Mobile and Wireless CommunicationDocument7 pagesArchitecture and Technology Components For 5G Mobile and Wireless CommunicationGaurav VishalNo ratings yet

- Fundamentals of Linear Stability: Neil DennehyDocument35 pagesFundamentals of Linear Stability: Neil Dennehyfoxbat81No ratings yet

- Classic Subcontracting - Outsourcing Production - SAP BlogsDocument10 pagesClassic Subcontracting - Outsourcing Production - SAP BlogswertghjhgrNo ratings yet

- MIUI 12 Latest Update Features 2020Document5 pagesMIUI 12 Latest Update Features 2020johnson veigasNo ratings yet

- Article - Harper's - February 2011 - Adam Hochschild Reviews Timothy Snyder's Blood LandsDocument4 pagesArticle - Harper's - February 2011 - Adam Hochschild Reviews Timothy Snyder's Blood Landsbear clawNo ratings yet

- Certification Course On: Machine Learning For Data Science Using PythonDocument2 pagesCertification Course On: Machine Learning For Data Science Using PythonsamNo ratings yet

- 43 CA CPT Dec 2010 Question Paper With Answer Key 2Document6 pages43 CA CPT Dec 2010 Question Paper With Answer Key 2Vishal Gattani100% (1)

- LAB 6 7-ElectroMechanical PneumaticDocument9 pagesLAB 6 7-ElectroMechanical PneumaticBien MedinaNo ratings yet

- Edu TrekDocument3 pagesEdu TrekMrs. LibbyNo ratings yet

- Virtual Screening of FOXO3a Activators From Natural Product Like Compound LibraryDocument16 pagesVirtual Screening of FOXO3a Activators From Natural Product Like Compound Libraryelbizco8No ratings yet

- National ConferenceDocument2 pagesNational Conferenceconference2011No ratings yet

- Performance of Recron-3s Fiber On Black Cotton SoilDocument6 pagesPerformance of Recron-3s Fiber On Black Cotton SoilInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Negative Diode ClamperDocument5 pagesNegative Diode ClamperLavishNo ratings yet

- Rega Planet 2000 ManualDocument4 pagesRega Planet 2000 ManualjamocasNo ratings yet

- Letter of TransmittalDocument7 pagesLetter of TransmittalGolam Samdanee TaneemNo ratings yet

- BookmarksDocument2 pagesBookmarkshilly_deeNo ratings yet

- Tally Exrercise 2: Date Description AmountDocument1 pageTally Exrercise 2: Date Description AmountExcel WaysNo ratings yet

- CCI, MACD, ZIG ZAG Trading System - Forex Strategies - Forex Resources - Forex Trading-Free Forex TraDocument6 pagesCCI, MACD, ZIG ZAG Trading System - Forex Strategies - Forex Resources - Forex Trading-Free Forex TraJames LiuNo ratings yet

- PLC Notes Unit 1Document14 pagesPLC Notes Unit 1126 N.EZHILARASAN EEERNo ratings yet

- The Dual in LPDocument17 pagesThe Dual in LPShreeyesh MenonNo ratings yet

- Precedents For The Reply of The Coca COla CompanyDocument3 pagesPrecedents For The Reply of The Coca COla CompanyLex OraculiNo ratings yet

- Practical Work in Geography Ch-6 Gis NewDocument44 pagesPractical Work in Geography Ch-6 Gis NewSooraj ChoukseyNo ratings yet

- Чолаков, В. Български народен сборник PDFDocument492 pagesЧолаков, В. Български народен сборник PDFKA NenovNo ratings yet

- 4357r 85 PDFDocument14 pages4357r 85 PDFFred PrzNo ratings yet

- V.1 Comment Opposiiton To Defendant's Motion For Extension of Time To File AnswerDocument2 pagesV.1 Comment Opposiiton To Defendant's Motion For Extension of Time To File AnswerRhows Buergo100% (1)

- Canon 12Document67 pagesCanon 12Roe DeeNo ratings yet

It 000146384671 2022 00

It 000146384671 2022 00

Uploaded by

zohaib hassan ShahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

It 000146384671 2022 00

It 000146384671 2022 00

Uploaded by

zohaib hassan ShahCopyright:

Available Formats

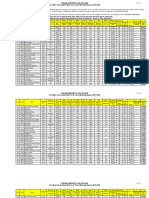

INCOME TAX PAYMENT CHALLAN

For 1-Bill Payment through member PSID # : 173186204

bank please add prefix 999999 with PSID

RTO PESHAWAR 6 3 2022

Name of LTU/MTU/RTO LTU/MTU/RTO Code Tax Year

Nature of Tax Admitted Income Tax Misc. CVT Month/Year

Payment

Demanded Income Tax Advance Income Tax Withheld Income Tax (Final) (only for payment u/s 149)

Withheld Income Tax (Adjustible) WPPF/WWF

Payment Section 182(A) Surcharge for ATL Payment Section Code 920601

(Section) (Description of Payment Section) Account Head (NAM) B01134

Taxpayer's Particulars (To be filled for payments other than Withholding Taxes) (To be filled in by the bank)

CNIC/Reg./Inc. No. 15602-9071792-5

Taxpayer's Name IMRAN ALI KHAN Status BUSINESS INDIVIDUAL

Business Name

Address 1, Jukhtai, Miandam, Khwaza Khela, Swat, Swat. , SWAT

FOR WITHHOLDING TAXES ONLY

CNIC/Reg./Inc. No.

Name of withholding agent

Total no. of Taxpayers Total Tax Deducted

Amount of tax in words: One Thousand Rupees And No Paisas Only Rs. 1,000

Modes & particulars of payment

Sr. Type No. Amount Date Bank City Branch Name & Address

1 ADC (e- 1,000 No Branch

payment)

DECLARATION

I hereby declare that the particulars mentioned in this challan are correct.

CNIC of Depositor 15602-9071792-5

Name of Depositor IMRAN ALI KHAN

Date

Stamp & Signature

PSID-IT-000146384671-002022

Prepared By : guest_user - Guest_User Date: 06-Dec-2023 09:57 PM

Note: This is an input form and should not be signed/stamped by the Bank. However, a CPR should be issued after receipt of payment by

the Bank.

You might also like

- English Grammar & Composition 9th 10th (Freebooks - PK) PDFDocument196 pagesEnglish Grammar & Composition 9th 10th (Freebooks - PK) PDFzohaib hassan Shah88% (17)

- Pcem 06 Swot Analysis Kaha FinalDocument23 pagesPcem 06 Swot Analysis Kaha FinalziadNo ratings yet

- It 000152365852 2023 00Document1 pageIt 000152365852 2023 00nabeelshahzad0035dnbNo ratings yet

- It 000144391613 2022 00Document1 pageIt 000144391613 2022 00Muhammad Aamir AbbasNo ratings yet

- It 000154735437 2023 00Document1 pageIt 000154735437 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000141511985 2022 00Document1 pageIt 000141511985 2022 00Abdul Basit KtkNo ratings yet

- Nawaz Challan Tax Year 2022 It-000146079994-2022-00Document1 pageNawaz Challan Tax Year 2022 It-000146079994-2022-00Shahid AminNo ratings yet

- It 000144586598 2022 00Document1 pageIt 000144586598 2022 00hizbullahjantankNo ratings yet

- It 000153285706 2023 00Document1 pageIt 000153285706 2023 00Muhammad AneesNo ratings yet

- It 000153477861 2023 00Document1 pageIt 000153477861 2023 00Muhammad salman SalmanNo ratings yet

- It 000145493451 2022 00Document1 pageIt 000145493451 2022 00Salman AhmedNo ratings yet

- It 000155658731 2023 00Document1 pageIt 000155658731 2023 00Atif JaveadNo ratings yet

- It 000154454559 2023 00Document1 pageIt 000154454559 2023 00xabimoviesNo ratings yet

- It 000141516198 2022 00Document1 pageIt 000141516198 2022 00Abdul Basit KtkNo ratings yet

- It 000154116473 2023 00Document1 pageIt 000154116473 2023 00sibghatullahmiranibNo ratings yet

- It 000154735501 2023 00Document1 pageIt 000154735501 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000141614736 2022 00Document1 pageIt 000141614736 2022 00Shahbaz MuhammadNo ratings yet

- It 000144747898 2022 00Document1 pageIt 000144747898 2022 00hizbullahjantankNo ratings yet

- It 000154735387 2023 00Document1 pageIt 000154735387 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000154568930 2023 00Document1 pageIt 000154568930 2023 00xabimoviesNo ratings yet

- It 000147296140 2022 00Document1 pageIt 000147296140 2022 00MUHAMMAD TABRAIZNo ratings yet

- Muhammad Mehtab Aslam FBR ChallanDocument1 pageMuhammad Mehtab Aslam FBR ChallanKingRafayIINo ratings yet

- Saeed KhanDocument1 pageSaeed Khanattock jadeedNo ratings yet

- It 000154264298 2023 00Document1 pageIt 000154264298 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000154735269 2023 00Document1 pageIt 000154735269 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000154262354 2023 00Document1 pageIt 000154262354 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000152669656 2023 00Document1 pageIt 000152669656 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000144378527 2022 00Document1 pageIt 000144378527 2022 00حنفیت اور شیعت مقلدNo ratings yet

- It 000144271793 2022 00Document1 pageIt 000144271793 2022 00online69979No ratings yet

- It-000147630388-2022-00 123Document1 pageIt-000147630388-2022-00 123cofini2389No ratings yet

- Income Tax Payment Challan: PSID #: 175921882Document1 pageIncome Tax Payment Challan: PSID #: 175921882taxhouse.kasur786No ratings yet

- Income Tax Payment Challan: PSID #: 164638694Document1 pageIncome Tax Payment Challan: PSID #: 164638694Syed Tahir ImamNo ratings yet

- It 000150863456 2022 00Document1 pageIt 000150863456 2022 00MUHAMMAD TABRAIZNo ratings yet

- It 000145577881 2023 00Document1 pageIt 000145577881 2023 00Hazrat BilalNo ratings yet

- It 000142649015 2022 00Document1 pageIt 000142649015 2022 00MUHAMMAD TABRAIZNo ratings yet

- It 000151339382 2023 00Document1 pageIt 000151339382 2023 00shaheenmagamartNo ratings yet

- Income Tax Payment Challan: PSID #: 145879823Document1 pageIncome Tax Payment Challan: PSID #: 145879823farhan aliNo ratings yet

- Income Tax Payment Challan: PSID #: 144740076Document1 pageIncome Tax Payment Challan: PSID #: 144740076usama ameenNo ratings yet

- It 000154543078 2023 00Document1 pageIt 000154543078 2023 00MUHAMMAD TABRAIZNo ratings yet

- It 000153644004 2023 00Document1 pageIt 000153644004 2023 00sibghatullahmiranibNo ratings yet

- It 000137673641 2022 00Document1 pageIt 000137673641 2022 00ayanNo ratings yet

- Income Tax Payment Challan: PSID #: 148473028Document1 pageIncome Tax Payment Challan: PSID #: 148473028Haseeb RazaNo ratings yet

- It 000152688444 2023 00Document1 pageIt 000152688444 2023 00MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 139758233Document1 pageIncome Tax Payment Challan: PSID #: 139758233umaar99No ratings yet

- It 000136721186 2022 00Document1 pageIt 000136721186 2022 00wali khelNo ratings yet

- Income Tax Payment Challan: PSID #: 148472556Document1 pageIncome Tax Payment Challan: PSID #: 148472556Haseeb RazaNo ratings yet

- It 000152818667 2023 00Document1 pageIt 000152818667 2023 00b3024345No ratings yet

- Income Tax Payment Challan: PSID #: 148643587Document1 pageIncome Tax Payment Challan: PSID #: 148643587Ehtsham AliNo ratings yet

- Income Tax Payment Challan: PSID #: 150493633Document1 pageIncome Tax Payment Challan: PSID #: 150493633Shehla FarooqNo ratings yet

- It 000130702686 2021 00Document1 pageIt 000130702686 2021 00Qazi zubairNo ratings yet

- It 000154263018 2023 00Document1 pageIt 000154263018 2023 00MUHAMMAD TABRAIZNo ratings yet

- Musthtaq Azeem Atl Challan PDFDocument1 pageMusthtaq Azeem Atl Challan PDFFarhan AliNo ratings yet

- Reema KhanDocument1 pageReema Khanattock jadeedNo ratings yet

- It 000151392010 2023 00Document1 pageIt 000151392010 2023 00aminabutt4524No ratings yet

- Income Tax Payment Challan: PSID #: 143186538Document1 pageIncome Tax Payment Challan: PSID #: 143186538talhaNo ratings yet

- Income Tax Payment Challan: PSID #: 165120097Document1 pageIncome Tax Payment Challan: PSID #: 165120097FBR GujranwalaNo ratings yet

- PSID# 36803358 (Junaid Paracha) PDFDocument1 pagePSID# 36803358 (Junaid Paracha) PDFAsif JavidNo ratings yet

- Waris Ali ChallanDocument1 pageWaris Ali ChallanMuhammad AsimNo ratings yet

- It 000143553567 2022 00Document1 pageIt 000143553567 2022 00danishahmed2126No ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- Khula Case DraftDocument4 pagesKhula Case Draftzohaib hassan ShahNo ratings yet

- Ashfaq Ahmed Withdrawal ApplicationDocument1 pageAshfaq Ahmed Withdrawal Applicationzohaib hassan ShahNo ratings yet

- Amjad Bail Application High Court 479 (Khaista Rahman)Document8 pagesAmjad Bail Application High Court 479 (Khaista Rahman)zohaib hassan ShahNo ratings yet

- 6-Prem Chowdhry 20 - 2Document24 pages6-Prem Chowdhry 20 - 2zohaib hassan ShahNo ratings yet

- Federal Budget Bulletin13 June 2022Document16 pagesFederal Budget Bulletin13 June 2022zohaib hassan ShahNo ratings yet

- What Caused The Cold War?: Inquiry Lesson PlanDocument21 pagesWhat Caused The Cold War?: Inquiry Lesson Planzohaib hassan ShahNo ratings yet

- Political Philosophy - An IntroductionDocument5 pagesPolitical Philosophy - An Introductionzohaib hassan ShahNo ratings yet

- Assignment: Political ScienceDocument9 pagesAssignment: Political Sciencezohaib hassan ShahNo ratings yet

- John Higley: "Elite Theory in Political Sociology": Elite) Is Always in Control Over Entities/institutions of ForceDocument3 pagesJohn Higley: "Elite Theory in Political Sociology": Elite) Is Always in Control Over Entities/institutions of Forcezohaib hassan ShahNo ratings yet

- 180 Opinio Seguridad AngDocument3 pages180 Opinio Seguridad Angzohaib hassan ShahNo ratings yet

- Moeed Yusuf Youth RadicalisationDocument30 pagesMoeed Yusuf Youth Radicalisationzohaib hassan ShahNo ratings yet

- Economic and Political Weekly Economic and Political WeeklyDocument5 pagesEconomic and Political Weekly Economic and Political Weeklyzohaib hassan ShahNo ratings yet

- Democracy, Governance and Development: A Conceptual FrameworkDocument24 pagesDemocracy, Governance and Development: A Conceptual Frameworkzohaib hassan ShahNo ratings yet

- First Merit List A 2017-2018Document4 pagesFirst Merit List A 2017-2018zohaib hassan ShahNo ratings yet

- Governance and Good Governance: A Conceptual Perspective: DR .Muhammad Ali, Assistant Professor, Department of PoliticalDocument13 pagesGovernance and Good Governance: A Conceptual Perspective: DR .Muhammad Ali, Assistant Professor, Department of Politicalzohaib hassan ShahNo ratings yet

- Santas ReviewDocument6 pagesSantas Reviewzohaib hassan ShahNo ratings yet

- Mixed Banking:: System Refers To That Banking System Under Which TheDocument7 pagesMixed Banking:: System Refers To That Banking System Under Which TheLOKESH RAMNo ratings yet

- Bioinformatics Assignment Topic: Phylogenetics Analysis SoftwaresDocument12 pagesBioinformatics Assignment Topic: Phylogenetics Analysis Softwaresnidhi teotiaNo ratings yet

- Netflix Ing British English StudentDocument8 pagesNetflix Ing British English StudentДианка МотыкаNo ratings yet

- Architecture and Technology Components For 5G Mobile and Wireless CommunicationDocument7 pagesArchitecture and Technology Components For 5G Mobile and Wireless CommunicationGaurav VishalNo ratings yet

- Fundamentals of Linear Stability: Neil DennehyDocument35 pagesFundamentals of Linear Stability: Neil Dennehyfoxbat81No ratings yet

- Classic Subcontracting - Outsourcing Production - SAP BlogsDocument10 pagesClassic Subcontracting - Outsourcing Production - SAP BlogswertghjhgrNo ratings yet

- MIUI 12 Latest Update Features 2020Document5 pagesMIUI 12 Latest Update Features 2020johnson veigasNo ratings yet

- Article - Harper's - February 2011 - Adam Hochschild Reviews Timothy Snyder's Blood LandsDocument4 pagesArticle - Harper's - February 2011 - Adam Hochschild Reviews Timothy Snyder's Blood Landsbear clawNo ratings yet

- Certification Course On: Machine Learning For Data Science Using PythonDocument2 pagesCertification Course On: Machine Learning For Data Science Using PythonsamNo ratings yet

- 43 CA CPT Dec 2010 Question Paper With Answer Key 2Document6 pages43 CA CPT Dec 2010 Question Paper With Answer Key 2Vishal Gattani100% (1)

- LAB 6 7-ElectroMechanical PneumaticDocument9 pagesLAB 6 7-ElectroMechanical PneumaticBien MedinaNo ratings yet

- Edu TrekDocument3 pagesEdu TrekMrs. LibbyNo ratings yet

- Virtual Screening of FOXO3a Activators From Natural Product Like Compound LibraryDocument16 pagesVirtual Screening of FOXO3a Activators From Natural Product Like Compound Libraryelbizco8No ratings yet

- National ConferenceDocument2 pagesNational Conferenceconference2011No ratings yet

- Performance of Recron-3s Fiber On Black Cotton SoilDocument6 pagesPerformance of Recron-3s Fiber On Black Cotton SoilInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Negative Diode ClamperDocument5 pagesNegative Diode ClamperLavishNo ratings yet

- Rega Planet 2000 ManualDocument4 pagesRega Planet 2000 ManualjamocasNo ratings yet

- Letter of TransmittalDocument7 pagesLetter of TransmittalGolam Samdanee TaneemNo ratings yet

- BookmarksDocument2 pagesBookmarkshilly_deeNo ratings yet

- Tally Exrercise 2: Date Description AmountDocument1 pageTally Exrercise 2: Date Description AmountExcel WaysNo ratings yet

- CCI, MACD, ZIG ZAG Trading System - Forex Strategies - Forex Resources - Forex Trading-Free Forex TraDocument6 pagesCCI, MACD, ZIG ZAG Trading System - Forex Strategies - Forex Resources - Forex Trading-Free Forex TraJames LiuNo ratings yet

- PLC Notes Unit 1Document14 pagesPLC Notes Unit 1126 N.EZHILARASAN EEERNo ratings yet

- The Dual in LPDocument17 pagesThe Dual in LPShreeyesh MenonNo ratings yet

- Precedents For The Reply of The Coca COla CompanyDocument3 pagesPrecedents For The Reply of The Coca COla CompanyLex OraculiNo ratings yet

- Practical Work in Geography Ch-6 Gis NewDocument44 pagesPractical Work in Geography Ch-6 Gis NewSooraj ChoukseyNo ratings yet

- Чолаков, В. Български народен сборник PDFDocument492 pagesЧолаков, В. Български народен сборник PDFKA NenovNo ratings yet

- 4357r 85 PDFDocument14 pages4357r 85 PDFFred PrzNo ratings yet

- V.1 Comment Opposiiton To Defendant's Motion For Extension of Time To File AnswerDocument2 pagesV.1 Comment Opposiiton To Defendant's Motion For Extension of Time To File AnswerRhows Buergo100% (1)

- Canon 12Document67 pagesCanon 12Roe DeeNo ratings yet