Professional Documents

Culture Documents

NG Debt Press Release June 2023 1

NG Debt Press Release June 2023 1

Uploaded by

Ma. Theresa BerdanCopyright:

Available Formats

You might also like

- Kawanihan NG Ingatang-Yaman: Press ReleaseDocument2 pagesKawanihan NG Ingatang-Yaman: Press ReleasejessNo ratings yet

- NG Debt Press Release December 2018 - Ed 2 PDFDocument2 pagesNG Debt Press Release December 2018 - Ed 2 PDFROXAN magalingNo ratings yet

- Financial Accounts of The United States: First Quarter 2022Document205 pagesFinancial Accounts of The United States: First Quarter 2022AchmAd AlimNo ratings yet

- Chart PackDocument83 pagesChart PackDksndNo ratings yet

- 2022 Franchising Economic OutlookDocument36 pages2022 Franchising Economic OutlookNguyệt Nguyễn MinhNo ratings yet

- Spanish Treasury Chart Pack: April 2022Document81 pagesSpanish Treasury Chart Pack: April 2022andres rebosoNo ratings yet

- IDirect Banking SectorReport Apr21Document12 pagesIDirect Banking SectorReport Apr21Vipul Braj BhartiaNo ratings yet

- Indonesia: The Delta Variant and Lagging Vaccination Have Set Back The RecoveryDocument4 pagesIndonesia: The Delta Variant and Lagging Vaccination Have Set Back The RecoveryTopan ArdiansyahNo ratings yet

- Country Economic Forecasts - ThailandDocument10 pagesCountry Economic Forecasts - Thailandthanhphong17vnNo ratings yet

- Federal Budget 2022-23 - First CutDocument6 pagesFederal Budget 2022-23 - First CutMuhammad Raheel AnwarNo ratings yet

- Yardeni - Stategist Handbook - 2019Document24 pagesYardeni - Stategist Handbook - 2019scribbugNo ratings yet

- Branch FormatDocument1 pageBranch FormatShweta YaragattiNo ratings yet

- Monthly Bulletin July 2023 EnglishDocument13 pagesMonthly Bulletin July 2023 EnglishNirmal MenonNo ratings yet

- CPG Financial Model and Valuation v2Document10 pagesCPG Financial Model and Valuation v2Mohammed YASEENNo ratings yet

- Jan FileDocument1 pageJan FileAshwin GophanNo ratings yet

- Budget Review 2023 24 1685465682Document15 pagesBudget Review 2023 24 1685465682Sanjay ChaudharyNo ratings yet

- City of Charlottesville, Virginia City Council Agenda: Agenda Date: Action RequiredDocument12 pagesCity of Charlottesville, Virginia City Council Agenda: Agenda Date: Action RequiredreadthehookNo ratings yet

- US Fixed Income Securities Statistics SIFMADocument31 pagesUS Fixed Income Securities Statistics SIFMAÂn TrầnNo ratings yet

- 1SOMEA2022002Document108 pages1SOMEA2022002South West Youth Council AssociationNo ratings yet

- 18 Statistics Key Economic IndicatorsDocument17 pages18 Statistics Key Economic Indicatorsjohnmarch146No ratings yet

- Country Economic Forecasts - ThailandDocument10 pagesCountry Economic Forecasts - ThailandSireethus SaovaroNo ratings yet

- Chile's Public Finances in The Context of The Pandemic July 2021Document24 pagesChile's Public Finances in The Context of The Pandemic July 2021Ian Carrasco TufinoNo ratings yet

- Property and Title 2022 Mid-Year Industry ReportDocument11 pagesProperty and Title 2022 Mid-Year Industry ReportDaniela TunaruNo ratings yet

- Committee For Development Policy 24 Plenary SessionDocument30 pagesCommittee For Development Policy 24 Plenary SessionDivino EntertainmentNo ratings yet

- Annual Budget Report 2020Document20 pagesAnnual Budget Report 2020L.E.A.D Holding LLCNo ratings yet

- ProvisionsDocument7 pagesProvisionsStanleyNo ratings yet

- Credits Provided by Banks - 2006.Document1 pageCredits Provided by Banks - 2006.Sofiene-bNo ratings yet

- Williamstown Five-Year Revenue Projection 2010Document1 pageWilliamstown Five-Year Revenue Projection 2010iBerkshires.comNo ratings yet

- Downgrading Estimates On Higher Provisions Maintain BUY: Bank of The Philippine IslandsDocument8 pagesDowngrading Estimates On Higher Provisions Maintain BUY: Bank of The Philippine IslandsJNo ratings yet

- Data Col PDFDocument2 pagesData Col PDFNelson ArturoNo ratings yet

- (In US Billion Dollars) : 2020 PH Outstanding DebtsDocument6 pages(In US Billion Dollars) : 2020 PH Outstanding DebtsEdison VillamerNo ratings yet

- BNM - Analisis Financiero Estructural Nov 2000 - Oct 2001Document2 pagesBNM - Analisis Financiero Estructural Nov 2000 - Oct 2001gonzaloromaniNo ratings yet

- 2021 라오스 진출전략Document65 pages2021 라오스 진출전략SunnyNo ratings yet

- Japan Country Report: The 20 Asia Construct ConferenceDocument54 pagesJapan Country Report: The 20 Asia Construct ConferenceDista Fildzah AmalinaNo ratings yet

- 1ARMEA2022002Document69 pages1ARMEA2022002animertarchianNo ratings yet

- FPTS Outlook 2022 No04 KeepFaithDocument16 pagesFPTS Outlook 2022 No04 KeepFaithLinh TRAN Thi AnhNo ratings yet

- Money Market Instrumennts AnalysisDocument5 pagesMoney Market Instrumennts AnalysisManu KrishNo ratings yet

- Philippines Economic OutlookDocument9 pagesPhilippines Economic Outlookrain06021992No ratings yet

- Money & Banking Project (Best)Document10 pagesMoney & Banking Project (Best)jamilkhannNo ratings yet

- 2 Financial Statements of Bank - For StudentDocument75 pages2 Financial Statements of Bank - For StudenttusedoNo ratings yet

- 22nd Japan Country-ReportDocument16 pages22nd Japan Country-ReportDavid MarlisNo ratings yet

- Macro Economics Aspects of BudgetDocument44 pagesMacro Economics Aspects of Budget6882535No ratings yet

- Analysts Meeting BM Q2-2019 (LONG FORM)Document104 pagesAnalysts Meeting BM Q2-2019 (LONG FORM)RadiSujadi24041977No ratings yet

- SummaryDocument1 pageSummaryfarhanNo ratings yet

- Country Economic Forecasts - EcuadorDocument7 pagesCountry Economic Forecasts - EcuadorFLAVIO JOSE AGUIRRE BURGOSNo ratings yet

- 2020 10 07 PH S Bdo PDFDocument7 pages2020 10 07 PH S Bdo PDFJNo ratings yet

- FD Vs Debt Fund SelectorDocument4 pagesFD Vs Debt Fund SelectorAbhay MishraNo ratings yet

- Fed - Flows of Funds Rate - 1Q 2020Document198 pagesFed - Flows of Funds Rate - 1Q 2020Sam RobnettNo ratings yet

- Country Economic Forecasts - VietnamDocument7 pagesCountry Economic Forecasts - Vietnamthanhphong17vnNo ratings yet

- Pakistan Federal Budget FY2022-23 - Sustainable Growth - A Balance Between Austerity and Relief - 11062022Document20 pagesPakistan Federal Budget FY2022-23 - Sustainable Growth - A Balance Between Austerity and Relief - 11062022Mohammad BilalNo ratings yet

- Macroeconomic Analysis Key Economic VariablesDocument6 pagesMacroeconomic Analysis Key Economic VariablesShaikh Saifullah KhalidNo ratings yet

- Japan Statistical 2010Document2 pagesJapan Statistical 2010Gabriel KanekoNo ratings yet

- Economic Outlook: 1.1 OverviewDocument12 pagesEconomic Outlook: 1.1 OverviewMuhammad AbrarNo ratings yet

- PWC Ghana 2023 Budget DigestDocument49 pagesPWC Ghana 2023 Budget DigestAl SwanzyNo ratings yet

- Select Economic IndicatorsDocument1 pageSelect Economic Indicatorspls2019No ratings yet

- Q3 2020 High Yield Bank Loan ReportDocument16 pagesQ3 2020 High Yield Bank Loan Reportrwmortell3580No ratings yet

- Economic Outlook 2H22Document30 pagesEconomic Outlook 2H22AriefNoviantoWongsoharjoNo ratings yet

- CRISIL - Indian Pharmaceutical and CDMO MarketDocument69 pagesCRISIL - Indian Pharmaceutical and CDMO Marketnandhiniravi90100% (1)

- Investor Fact Sheet q3 Fy23Document16 pagesInvestor Fact Sheet q3 Fy23Anshul SainiNo ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Monthly Statement: Name Address Account Number Statement PeriodDocument8 pagesMonthly Statement: Name Address Account Number Statement PeriodAzeez AyomideNo ratings yet

- SOAL CASE 14 - 33 Dan CASE 16-35Document4 pagesSOAL CASE 14 - 33 Dan CASE 16-35Rictu SempakNo ratings yet

- Patron KlienDocument8 pagesPatron Kliennowo heriyonoNo ratings yet

- Solved Explain Why You Agree or Disagree With The Following StatementsDocument1 pageSolved Explain Why You Agree or Disagree With The Following StatementsM Bilal SaleemNo ratings yet

- Principles of Costs and CostingDocument50 pagesPrinciples of Costs and CostingSOOMA OSMANNo ratings yet

- Chapter-02 Determination of Interest RateDocument9 pagesChapter-02 Determination of Interest RatebishwajitNo ratings yet

- CHP 2 Powerpoint Slides 27th EdDocument69 pagesCHP 2 Powerpoint Slides 27th EdChewy SuarezNo ratings yet

- CII Innovation Awards 2024 BrochureDocument14 pagesCII Innovation Awards 2024 BrochurePreeti Sharma EEELNo ratings yet

- Payment Under ProtestDocument2 pagesPayment Under ProtestNorman CorreaNo ratings yet

- Abubeker Thesis 1-6Document112 pagesAbubeker Thesis 1-6Ye Geter Lig NegnNo ratings yet

- University of Gondar Institute of Technology Dep't of Civil EngineeringDocument35 pagesUniversity of Gondar Institute of Technology Dep't of Civil Engineeringbereket gNo ratings yet

- Course PRINCIPLES OF ECONOMICSDocument4 pagesCourse PRINCIPLES OF ECONOMICSftn sukriNo ratings yet

- General Conditions of Sale of Mondial Foods B.VDocument6 pagesGeneral Conditions of Sale of Mondial Foods B.VKodjoNo ratings yet

- Lyes PDFDocument18 pagesLyes PDFWalid HANo ratings yet

- Od 223000769117259000Document2 pagesOd 223000769117259000Sanyasi JiNo ratings yet

- Banking Crises 80s 90sDocument84 pagesBanking Crises 80s 90ssuksesNo ratings yet

- Swing Trading TemplateDocument2 pagesSwing Trading Templatesangram24No ratings yet

- Background: Chapter 11 Debtor/telecommunications Carrier and Its Debtor-Subsidiary Brought AdversaryDocument10 pagesBackground: Chapter 11 Debtor/telecommunications Carrier and Its Debtor-Subsidiary Brought AdversaryJun MaNo ratings yet

- Accenture Fiscal 2020 Annual ReportDocument106 pagesAccenture Fiscal 2020 Annual ReportSadasivuni007No ratings yet

- Deed of Agreement Blank-V9-Doa-SblcDocument20 pagesDeed of Agreement Blank-V9-Doa-SblcLIOE JINNo ratings yet

- Audit - Section 4.financial Proposal - Standard FormsDocument8 pagesAudit - Section 4.financial Proposal - Standard FormsTran AnhNo ratings yet

- 2438 Draft Development Agreement-03.02.2023Document27 pages2438 Draft Development Agreement-03.02.2023Aniket Parikh100% (1)

- CurriculumDocument167 pagesCurriculumChukwuka Justina NjidekaNo ratings yet

- Economy (2011-21) Prelims QuestionsDocument36 pagesEconomy (2011-21) Prelims QuestionsChinmay JenaNo ratings yet

- CH 09 MBADocument20 pagesCH 09 MBAManvitha ReddyNo ratings yet

- Perpetual Inventory System Every Sales Transaction, You Are Already Recording The Cost Periodic Inventory SystemDocument5 pagesPerpetual Inventory System Every Sales Transaction, You Are Already Recording The Cost Periodic Inventory SystemjepsyutNo ratings yet

- Bcoc 136Document4 pagesBcoc 136piyushsinha9829No ratings yet

- Hosteller 4 TH 5 THDocument4 pagesHosteller 4 TH 5 THDhriti AgarwalNo ratings yet

- Profit Maximization VS Wealth Maximization: - The ConflictDocument10 pagesProfit Maximization VS Wealth Maximization: - The Conflictanurag kumarNo ratings yet

- Economy Current Affairs by Teju, Nextgen Ias - November 2020Document50 pagesEconomy Current Affairs by Teju, Nextgen Ias - November 2020akshaygmailNo ratings yet

NG Debt Press Release June 2023 1

NG Debt Press Release June 2023 1

Uploaded by

Ma. Theresa BerdanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NG Debt Press Release June 2023 1

NG Debt Press Release June 2023 1

Uploaded by

Ma. Theresa BerdanCopyright:

Available Formats

REPUBLIKA NG PILIPINAS

KAGAWARAN NG PANANALAPI

KAWANIHAN NG INGATANG-YAMAN

(BUREAU OF THE TREASURY)

Funding the Republic Intramuros, Manila

Press Release

National Government Debt Recorded at

P14.15 Trillion as of end-June 2023

MANILA, Philippines, 1 August 2023 – The National Government’s (NG) total

outstanding debt stood at P14.15 trillion as of end-June 2023. The NG's debt portfolio

increased by P51.31 billion or 0.4% compared to the previous month, primarily due to

the net issuance of domestic securities. Of the total debt stock, 31.4% was sourced

externally while 68.6% were domestic borrowings.

NG domestic debt amounted to P9.70 trillion, P114.32 billion or 1.2% higher compared

to the end-May 2023 level. For the month, domestic debt growth amounted to P114.32

billion due to the net issuance of government bonds driven by the NG’s financing

requirements. Year-to-Date, domestic debt has an increment of P494.44 billion or

5.4%.

NG’s external debt amounted to P4.45 trillion, P63.01 billion or 1.4% lower from the

previous month. The reduction in foreign debt was driven by the impact of currency

adjustments affecting both USD- and third-currency equivalents leading to a decrease

in the peso value of the debt, amounting to P69.98 billion and P8.28 billion,

respectively. These more than offset the availment of foreign loans amounting to

P15.25 billion. NG external debt has increased by P234.55 billion or 5.6% from the

end-December 2022 level.

Total NG guaranteed obligations decreased by P9.98 billion or 2.6% Month-over-

Month to P369.73 billion as of end-June 2023. For the month, the decline in

guaranteed debt was attributed to the net repayment of both domestic and external

guarantees amounting to P4.36 billion and P0.89 billion, respectively. This was further

trimmed because of the effect of currency adjustments on both USD- and third-

currency-denominated guarantees amounting to P2.78 billion and P1.95 billion,

respectively. From the end-December 2022 level, NG guaranteed debt has decreased

by P29.32 billion or 7.3%.

###

ISO 9001:2015 Quality Management System

Certificate No. SCP000233Q

Ayuntamiento Building, Cabildo Street corner A. Soriano Avenue, Intramuros, 1002 Manila

Trunkline (+632) 8663-2287 URL: www.treasury.gov.ph

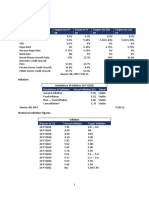

National Government Outstanding Debt

As of the Period Indicated

(In billion Pesos)

Difference

2022 2023 Y-o-Y YTD M-o-M % Change

Particulars Jun Dec May Jun Jun Jun/Dec Jun/May Jun Jun/Dec Jun/May

TOTAL 12,791.8 13,418.9 14,096.5 14,147.9 1,356 729 51 10.6% 5.4% 0.4%

Domestic 8,767.1 9,208.4 9,588.5 9,702.8 936 494 114 10.7% 5.4% 1.2%

Loans 0.2 0.2 0.2 0.2 0 0 0 0.0% 0.0% 0.0%

Direct Loans 0.2 0.2 0.2 0.2 0 0 0 0.0% 0.0% 0.0%

Availed by Agencies 0.2 0.2 0.2 0.2 0 0 0 0.0% 0.0% 0.0%

NG Other Domestic 0.2 0.2 0.2 0.2 0 0 0 0.0% 0.0% 0.0%

BSP Provisional Advances 0.0 0.0 0.0 0.0 0 0 0

Assumed Loans 0.0 0.0 0.0 0.0 0 0 0

Government Securities 8,767.0 9,208.2 9,588.4 9,702.7 936 494 114 10.7% 5.4% 1.2%

External 4,024.7 4,210.5 4,508.0 4,445.0 420 235 -63 10.4% 5.6% -1.4%

Loans 1,795.6 1,883.0 2,036.2 2,009.7 214 127 -27 11.9% 6.7% -1.3%

Direct Loans 1,795.6 1,883.0 2,036.2 2,009.7 214 127 -27 11.9% 6.7% -1.3%

Availed by Agencies 1,781.7 1,869.3 2,024.0 1,998.2 216 129 -26 12.1% 6.9% -1.3%

Relent to GOCCs 13.9 13.7 12.3 11.6 -2 -2 -1 -16.9% -15.7% -5.7%

Assumed Loans 0.0 0.0 0.0 0.0 0 0 0

External Debt Securities 2,229.1 2,327.5 2,471.8 2,435.3 206 108 -36 9.2% 4.6% -1.5%

US Dollar Bonds/Notes 1,803.2 1,931.8 2,115.3 2,082.4 279 151 -33 15.5% 7.8% -1.6%

Euro Bonds 233.4 241.1 207.4 208.4 -25 -33 1 -10.7% -13.6% 0.5%

Japanese Yen Bonds 107.0 99.8 94.3 89.7 -17 -10 -5 -16.2% -10.1% -5.0%

Chinese Yuan Bonds 0.0 0.0 0.0 0.0 0 0 0

Peso Global Bonds 85.6 54.8 54.8 54.8 -31 0 0 -36.0% 0.0% 0.0%

Forex Rate Used 54.970 55.815 56.241 55.368

Totals may not sum up due to rounding.

Source: DMAD-BTr

Prepared b y: SDAD-BTr

18-Jul-23

National Government Outstanding Guaranteed Debt

As of the Period Indicated

(In Billion Pesos)

Difference

2022 2023 Jun Jun/Dec Jun/May % Change

Particulars Jun Dec May Jun Y-o-Y YTD M-o-M Jun Jun/Dec Jun/May

T O T AL 413.9 399.0 379.7 369.7 -44 -29 -10 -10.7% -7.3% -2.6%

Domestic 195.2 205.8 200.7 196.4 1 -9 -4 0.6% -4.6% -2.2%

NG Direct Guarantee 195.1 205.6 200.6 196.2 1 -9 -4 0.6% -4.6% -2.2%

Assumed GFI Guarantee 0.1 0.1 0.1 0.1 0 0 0 0.0% 0.0% 0.0%

External 218.7 193.3 179.0 173.4 -45 -20 -6 -20.7% -10.3% -3.1%

NG Direct Guarantee 214.0 188.5 174.2 168.6 -45 -20 -6 -21.2% -10.6% -3.2%

Assumed GFI Guarantee 4.7 4.8 4.8 4.7 0 0 0 0.7% -0.8% -1.5%

Forex Rate Used 54.970 55.815 56.241 55.368

* NG Direct and NG assumed GFI Guaranteed only.

Totals may not sum up due to rounding.

Source: DMAD-BTr

Prepared b y: SDAD-BTr

18-Jul-23

You might also like

- Kawanihan NG Ingatang-Yaman: Press ReleaseDocument2 pagesKawanihan NG Ingatang-Yaman: Press ReleasejessNo ratings yet

- NG Debt Press Release December 2018 - Ed 2 PDFDocument2 pagesNG Debt Press Release December 2018 - Ed 2 PDFROXAN magalingNo ratings yet

- Financial Accounts of The United States: First Quarter 2022Document205 pagesFinancial Accounts of The United States: First Quarter 2022AchmAd AlimNo ratings yet

- Chart PackDocument83 pagesChart PackDksndNo ratings yet

- 2022 Franchising Economic OutlookDocument36 pages2022 Franchising Economic OutlookNguyệt Nguyễn MinhNo ratings yet

- Spanish Treasury Chart Pack: April 2022Document81 pagesSpanish Treasury Chart Pack: April 2022andres rebosoNo ratings yet

- IDirect Banking SectorReport Apr21Document12 pagesIDirect Banking SectorReport Apr21Vipul Braj BhartiaNo ratings yet

- Indonesia: The Delta Variant and Lagging Vaccination Have Set Back The RecoveryDocument4 pagesIndonesia: The Delta Variant and Lagging Vaccination Have Set Back The RecoveryTopan ArdiansyahNo ratings yet

- Country Economic Forecasts - ThailandDocument10 pagesCountry Economic Forecasts - Thailandthanhphong17vnNo ratings yet

- Federal Budget 2022-23 - First CutDocument6 pagesFederal Budget 2022-23 - First CutMuhammad Raheel AnwarNo ratings yet

- Yardeni - Stategist Handbook - 2019Document24 pagesYardeni - Stategist Handbook - 2019scribbugNo ratings yet

- Branch FormatDocument1 pageBranch FormatShweta YaragattiNo ratings yet

- Monthly Bulletin July 2023 EnglishDocument13 pagesMonthly Bulletin July 2023 EnglishNirmal MenonNo ratings yet

- CPG Financial Model and Valuation v2Document10 pagesCPG Financial Model and Valuation v2Mohammed YASEENNo ratings yet

- Jan FileDocument1 pageJan FileAshwin GophanNo ratings yet

- Budget Review 2023 24 1685465682Document15 pagesBudget Review 2023 24 1685465682Sanjay ChaudharyNo ratings yet

- City of Charlottesville, Virginia City Council Agenda: Agenda Date: Action RequiredDocument12 pagesCity of Charlottesville, Virginia City Council Agenda: Agenda Date: Action RequiredreadthehookNo ratings yet

- US Fixed Income Securities Statistics SIFMADocument31 pagesUS Fixed Income Securities Statistics SIFMAÂn TrầnNo ratings yet

- 1SOMEA2022002Document108 pages1SOMEA2022002South West Youth Council AssociationNo ratings yet

- 18 Statistics Key Economic IndicatorsDocument17 pages18 Statistics Key Economic Indicatorsjohnmarch146No ratings yet

- Country Economic Forecasts - ThailandDocument10 pagesCountry Economic Forecasts - ThailandSireethus SaovaroNo ratings yet

- Chile's Public Finances in The Context of The Pandemic July 2021Document24 pagesChile's Public Finances in The Context of The Pandemic July 2021Ian Carrasco TufinoNo ratings yet

- Property and Title 2022 Mid-Year Industry ReportDocument11 pagesProperty and Title 2022 Mid-Year Industry ReportDaniela TunaruNo ratings yet

- Committee For Development Policy 24 Plenary SessionDocument30 pagesCommittee For Development Policy 24 Plenary SessionDivino EntertainmentNo ratings yet

- Annual Budget Report 2020Document20 pagesAnnual Budget Report 2020L.E.A.D Holding LLCNo ratings yet

- ProvisionsDocument7 pagesProvisionsStanleyNo ratings yet

- Credits Provided by Banks - 2006.Document1 pageCredits Provided by Banks - 2006.Sofiene-bNo ratings yet

- Williamstown Five-Year Revenue Projection 2010Document1 pageWilliamstown Five-Year Revenue Projection 2010iBerkshires.comNo ratings yet

- Downgrading Estimates On Higher Provisions Maintain BUY: Bank of The Philippine IslandsDocument8 pagesDowngrading Estimates On Higher Provisions Maintain BUY: Bank of The Philippine IslandsJNo ratings yet

- Data Col PDFDocument2 pagesData Col PDFNelson ArturoNo ratings yet

- (In US Billion Dollars) : 2020 PH Outstanding DebtsDocument6 pages(In US Billion Dollars) : 2020 PH Outstanding DebtsEdison VillamerNo ratings yet

- BNM - Analisis Financiero Estructural Nov 2000 - Oct 2001Document2 pagesBNM - Analisis Financiero Estructural Nov 2000 - Oct 2001gonzaloromaniNo ratings yet

- 2021 라오스 진출전략Document65 pages2021 라오스 진출전략SunnyNo ratings yet

- Japan Country Report: The 20 Asia Construct ConferenceDocument54 pagesJapan Country Report: The 20 Asia Construct ConferenceDista Fildzah AmalinaNo ratings yet

- 1ARMEA2022002Document69 pages1ARMEA2022002animertarchianNo ratings yet

- FPTS Outlook 2022 No04 KeepFaithDocument16 pagesFPTS Outlook 2022 No04 KeepFaithLinh TRAN Thi AnhNo ratings yet

- Money Market Instrumennts AnalysisDocument5 pagesMoney Market Instrumennts AnalysisManu KrishNo ratings yet

- Philippines Economic OutlookDocument9 pagesPhilippines Economic Outlookrain06021992No ratings yet

- Money & Banking Project (Best)Document10 pagesMoney & Banking Project (Best)jamilkhannNo ratings yet

- 2 Financial Statements of Bank - For StudentDocument75 pages2 Financial Statements of Bank - For StudenttusedoNo ratings yet

- 22nd Japan Country-ReportDocument16 pages22nd Japan Country-ReportDavid MarlisNo ratings yet

- Macro Economics Aspects of BudgetDocument44 pagesMacro Economics Aspects of Budget6882535No ratings yet

- Analysts Meeting BM Q2-2019 (LONG FORM)Document104 pagesAnalysts Meeting BM Q2-2019 (LONG FORM)RadiSujadi24041977No ratings yet

- SummaryDocument1 pageSummaryfarhanNo ratings yet

- Country Economic Forecasts - EcuadorDocument7 pagesCountry Economic Forecasts - EcuadorFLAVIO JOSE AGUIRRE BURGOSNo ratings yet

- 2020 10 07 PH S Bdo PDFDocument7 pages2020 10 07 PH S Bdo PDFJNo ratings yet

- FD Vs Debt Fund SelectorDocument4 pagesFD Vs Debt Fund SelectorAbhay MishraNo ratings yet

- Fed - Flows of Funds Rate - 1Q 2020Document198 pagesFed - Flows of Funds Rate - 1Q 2020Sam RobnettNo ratings yet

- Country Economic Forecasts - VietnamDocument7 pagesCountry Economic Forecasts - Vietnamthanhphong17vnNo ratings yet

- Pakistan Federal Budget FY2022-23 - Sustainable Growth - A Balance Between Austerity and Relief - 11062022Document20 pagesPakistan Federal Budget FY2022-23 - Sustainable Growth - A Balance Between Austerity and Relief - 11062022Mohammad BilalNo ratings yet

- Macroeconomic Analysis Key Economic VariablesDocument6 pagesMacroeconomic Analysis Key Economic VariablesShaikh Saifullah KhalidNo ratings yet

- Japan Statistical 2010Document2 pagesJapan Statistical 2010Gabriel KanekoNo ratings yet

- Economic Outlook: 1.1 OverviewDocument12 pagesEconomic Outlook: 1.1 OverviewMuhammad AbrarNo ratings yet

- PWC Ghana 2023 Budget DigestDocument49 pagesPWC Ghana 2023 Budget DigestAl SwanzyNo ratings yet

- Select Economic IndicatorsDocument1 pageSelect Economic Indicatorspls2019No ratings yet

- Q3 2020 High Yield Bank Loan ReportDocument16 pagesQ3 2020 High Yield Bank Loan Reportrwmortell3580No ratings yet

- Economic Outlook 2H22Document30 pagesEconomic Outlook 2H22AriefNoviantoWongsoharjoNo ratings yet

- CRISIL - Indian Pharmaceutical and CDMO MarketDocument69 pagesCRISIL - Indian Pharmaceutical and CDMO Marketnandhiniravi90100% (1)

- Investor Fact Sheet q3 Fy23Document16 pagesInvestor Fact Sheet q3 Fy23Anshul SainiNo ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Monthly Statement: Name Address Account Number Statement PeriodDocument8 pagesMonthly Statement: Name Address Account Number Statement PeriodAzeez AyomideNo ratings yet

- SOAL CASE 14 - 33 Dan CASE 16-35Document4 pagesSOAL CASE 14 - 33 Dan CASE 16-35Rictu SempakNo ratings yet

- Patron KlienDocument8 pagesPatron Kliennowo heriyonoNo ratings yet

- Solved Explain Why You Agree or Disagree With The Following StatementsDocument1 pageSolved Explain Why You Agree or Disagree With The Following StatementsM Bilal SaleemNo ratings yet

- Principles of Costs and CostingDocument50 pagesPrinciples of Costs and CostingSOOMA OSMANNo ratings yet

- Chapter-02 Determination of Interest RateDocument9 pagesChapter-02 Determination of Interest RatebishwajitNo ratings yet

- CHP 2 Powerpoint Slides 27th EdDocument69 pagesCHP 2 Powerpoint Slides 27th EdChewy SuarezNo ratings yet

- CII Innovation Awards 2024 BrochureDocument14 pagesCII Innovation Awards 2024 BrochurePreeti Sharma EEELNo ratings yet

- Payment Under ProtestDocument2 pagesPayment Under ProtestNorman CorreaNo ratings yet

- Abubeker Thesis 1-6Document112 pagesAbubeker Thesis 1-6Ye Geter Lig NegnNo ratings yet

- University of Gondar Institute of Technology Dep't of Civil EngineeringDocument35 pagesUniversity of Gondar Institute of Technology Dep't of Civil Engineeringbereket gNo ratings yet

- Course PRINCIPLES OF ECONOMICSDocument4 pagesCourse PRINCIPLES OF ECONOMICSftn sukriNo ratings yet

- General Conditions of Sale of Mondial Foods B.VDocument6 pagesGeneral Conditions of Sale of Mondial Foods B.VKodjoNo ratings yet

- Lyes PDFDocument18 pagesLyes PDFWalid HANo ratings yet

- Od 223000769117259000Document2 pagesOd 223000769117259000Sanyasi JiNo ratings yet

- Banking Crises 80s 90sDocument84 pagesBanking Crises 80s 90ssuksesNo ratings yet

- Swing Trading TemplateDocument2 pagesSwing Trading Templatesangram24No ratings yet

- Background: Chapter 11 Debtor/telecommunications Carrier and Its Debtor-Subsidiary Brought AdversaryDocument10 pagesBackground: Chapter 11 Debtor/telecommunications Carrier and Its Debtor-Subsidiary Brought AdversaryJun MaNo ratings yet

- Accenture Fiscal 2020 Annual ReportDocument106 pagesAccenture Fiscal 2020 Annual ReportSadasivuni007No ratings yet

- Deed of Agreement Blank-V9-Doa-SblcDocument20 pagesDeed of Agreement Blank-V9-Doa-SblcLIOE JINNo ratings yet

- Audit - Section 4.financial Proposal - Standard FormsDocument8 pagesAudit - Section 4.financial Proposal - Standard FormsTran AnhNo ratings yet

- 2438 Draft Development Agreement-03.02.2023Document27 pages2438 Draft Development Agreement-03.02.2023Aniket Parikh100% (1)

- CurriculumDocument167 pagesCurriculumChukwuka Justina NjidekaNo ratings yet

- Economy (2011-21) Prelims QuestionsDocument36 pagesEconomy (2011-21) Prelims QuestionsChinmay JenaNo ratings yet

- CH 09 MBADocument20 pagesCH 09 MBAManvitha ReddyNo ratings yet

- Perpetual Inventory System Every Sales Transaction, You Are Already Recording The Cost Periodic Inventory SystemDocument5 pagesPerpetual Inventory System Every Sales Transaction, You Are Already Recording The Cost Periodic Inventory SystemjepsyutNo ratings yet

- Bcoc 136Document4 pagesBcoc 136piyushsinha9829No ratings yet

- Hosteller 4 TH 5 THDocument4 pagesHosteller 4 TH 5 THDhriti AgarwalNo ratings yet

- Profit Maximization VS Wealth Maximization: - The ConflictDocument10 pagesProfit Maximization VS Wealth Maximization: - The Conflictanurag kumarNo ratings yet

- Economy Current Affairs by Teju, Nextgen Ias - November 2020Document50 pagesEconomy Current Affairs by Teju, Nextgen Ias - November 2020akshaygmailNo ratings yet