Professional Documents

Culture Documents

Budgeting and Goal Setting 27715 20231031183226

Budgeting and Goal Setting 27715 20231031183226

Uploaded by

Nicolle MoranOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budgeting and Goal Setting 27715 20231031183226

Budgeting and Goal Setting 27715 20231031183226

Uploaded by

Nicolle MoranCopyright:

Available Formats

Budgeting and Goal Setting / Course Introduction

Course Introduction

Use the arrows at the top right of your page to navigate through your learning.

© 2023 PF High School, LLC Page: 1 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Course Introduction

Course Overview

Course Introduction

This course is designed to review basic math operations and how they're used in real-life

situations. The course consists of three lessons, each designed to further your knowledge

of how math is used in everyday life. You’ll review the basic operations found in math.

You'll focus on everyday situations, such as calculating your salary, evaluating payment

options, and designing a personal budget to track your income and expenses. You'll also

explore ways to save and invest your money and design a master plan for your personal

life.

External

Reference(https://cdnapisec.kaltura.com/p/4258593/sp/425859300/embedIframeJs/uiconf_id/49148332/partner_id/4258593?

iframeembed=true&playerId=kaltura_player&entry_id=1_2zgiktn8&flashvars[streamerType]=auto&flashvars[localizationCode]=en&flashvars[leadW

Course Materials

All of your course materials are included in this course experience. You'll find it easiest to

study this course by following these steps:

1. Look over the syllabus, paying close attention to the course and lesson objectives.

2. Read each objective. Pay close attention to main concepts and de nitions.

3. Complete each assignment as you come to it.

4. When you've completed each section, look over the lesson review.

5. When you're con dent you understand the material, complete the lesson exam.

Course Objectives

By the end of this course, you'll be able to

Apply basic math skills to everyday life

Determine best practices for money management

Analyze nancial areas of your life

© 2023 PF High School, LLC Page: 2 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Money Management

© 2023 PF High School, LLC Page: 3 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Lesson 2 Overview

You may have been handling your own money for some time, or you may be just beginning

to do so. Either way, the information presented in this lesson will make your money

handling easier and more efficient. With this new knowledge, you’ll be able to make more

intelligent decisions regarding your budget, purchases, credit, loans, and other financial

aspects of your life. You work hard for your money. It’s only sensible to make the most of it

through wise money management.

Before you need to worry about how to handle your money, you obviously must have some

money to handle! So, this lesson begins with a discussion on securing a job, which will

most likely be your primary source of income.

There’s a lot of helpful material ahead, so let’s get started.

© 2023 PF High School, LLC Page: 4 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Lesson Objectives

Describe the basic math operations needed for a job search

Calculate salary and purchase costs

Identify the total costs of payment options

Develop a spending budget and record-keeping plan

List homeowner expenses

© 2023 PF High School, LLC Page: 5 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Calculate Salary and Purchase Costs

© 2023 PF High School, LLC Page: 6 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Salary and Purchases

Determining Your Salary

There are several ways in which your income may be determined:

By an hourly rate

By a weekly, monthly, or annual rate

By straight commission

By a base salary plus a commission

Let’s look briefly at each method.

Hourly Rate

The most common method of calculating wages is the hourly rate. When paid at an hourly

rate, an employee usually punches a time clock or fills out a time sheet to record the

number of hours worked. The number of hours is then multiplied by the hourly rate to

determine the money earned for that time period.

For example, if Mike, who earns $10.50 per hour, worked 40 hours each week, he would

calculate his weekly earnings this way:

40 × $10.50 = $420.00

According to the Fair Labor Standards Act, FLSA, employees of companies involved in

interstate (between states) business must be paid time-and-a-half (overtime) for all hours

worked beyond the regular 40 hours each week. There are exceptions to the rule. For

more information, access the Department of

Labor’s(http://www.dol.gov/general/topic/wages/overtimepay) website.

Using the FLSA rule, let’s calculate Mike’s pay if he were to work 50 hours during one

week.

Regular pay = 40 × $10.50 = $420.00

Overtime hours = 50 – 40 = 10 hours

Overtime pay rate = 11/2 × $10.50 = $15.75

Overtime pay = 10 × $15.75 = $157.50

Total pay = $420.00 + $157.50 = $577.50

Weekly, Monthly, or Annual Rate

© 2023 PF High School, LLC Page: 7 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

An employee is sometimes paid a fixed amount for a week, month, or year. Employees in

management positions are usually paid this way. Salaries aren’t affected by the number of

hours worked, and the employee isn’t paid overtime. But some sort of recording system

may be used (an electronic form, for example), to monitor the employee’s working hours.

IT'S THE LAW

A minimum rate of pay is set by federal law. This rate changes from time to

time. If you have any questions concerning this rate, you may contact

US Department of Labor

Employment Standards Administration

Wage and Hour Division

Frances Perkins Building

200 Constitution Ave., N.W.

Washington, DC 20210

The Wage and Hour Division(http://www.dol.gov/whd/) can also give you

information on child labor protection laws, overtime pay, and equal pay for

equal work (regardless of sex).

Straight Commission

Salespeople who are paid a straight commission receive no set salary. Rather, they’re paid

a percentage of the total sales they make.

For example, let’s say that a bicycle salesperson working on a straight commission sold (in

a single day) six bicycles priced at $180 each. If he receives a 7% commission, his

earnings for that day would be calculated this way:

Commission for each bicycle = 7% × $180 = 0.07 × $180 = $12.60

Commission for six bicycles = 6 × $12.60 = $75.60

Therefore, for one day, this salesperson earned $75.60.

Base Salary Plus a Commission

Salespeople who work on salary plus commission are guaranteed a minimum base salary,

plus a commission on all sales over a specified amount, or sometimes on total sales. Let’s

look at a couple of example situations that illustrate the method used to calculate this type

© 2023 PF High School, LLC Page: 8 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

of income.

Suppose that John Blum receives a base salary of $200 per week and a 4% commission

on all sales. Let's figure his total earnings for a week in which he sold $1,500 worth of

merchandise

4% of $1,500 = 0.04 x $1,500 = $60 Calculate John's commission.

To determine the total earnings, add the commission

$200 + $60 = $260

to the weekiy salary.

Let's say that Jill Wysok is paid a base salary of $235 per week, plus a 3% commission on

all sales over $600. If her sales for the week totaled $950, you would figure her salary in

this manner:

$950 - $600 = $350 Determine the amount over $600.

3% of $350 = 0.03 x $350 = $10.50 Calculate the commission of $350.

To determine the total earnings, add the commission

$235.00 + $10.50 = $245.50

to the weekiy salary.

Deductions

You may have heard of someone who found a summer job working in a grocery store 30

hours a week for $7.25 per hour. At the end of the first week she eagerly awaited her

$217.50 pay. Imagine her dismay when she received a paycheck for only $165.21. It

seems that this young person never learned about deductions.

Deductions are the amounts taken out of a salary for taxes, medical insurance, union dues,

charity contributions, retirement funds, and so on. The salaries we previously discussed

were gross salaries—that is, total salaries before deductions are subtracted. The money

you actually receive after deductions are taken is the net salary, or take-home pay.

The taxes that are deducted from your salary may be collected by local governments (city,

borough, township, parish), state governments, or the federal government.

Federal Taxes

© 2023 PF High School, LLC Page: 9 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

There are three types of federal taxes—FICA (Federal Insurance Contributions Act),

Medicare tax, and income tax.

1. The FICA tax is also known as the Social Security tax, since it’s your contribution

to your own government life insurance plan, disability insurance plan, and

retirement fund. The FICA tax is based on a changing (usually increasing) rate

and a changing (usually increasing) wage.

2. The Medicare tax is withheld for the purpose of hospital insurance. The

employee’s portion of Medicare is matched by his or her employer, and there’s

currently no ceiling on the earned income wage base, as there is with FICA.

3. Thefederal income tax helps the federal government to operate. As you probably

know, the IRS (Internal Revenue Service) is the agency that collects the tax. The

amount of income tax you pay depends primarily on your total earnings and the

number of exemptions you claim. An exemption is a tax break for each person

you support.

When you’re hired, your employer asks you to list your exemptions. If you’re single, for

example, and you support only yourself, you’re allowed one exemption (yourself). A

married couple has two exemptions; if they have two children, they would have four

exemptions. The more exemptions you have, the less the tax that’s taken from your pay.

When you prepare your annual tax form, you can find out what you’re to pay in yearly tax

from income tax tables similar to the one in the figure below. You must first determine your

total gross income and your total exemptions. Your employer must furnish you with a W-2

form showing your total annual earnings from the preceding year and the total of the taxes

deducted. If more tax was withheld than you owe, you’ll receive a refund. If less tax was

withheld, you’ll owe the balance.

© 2023 PF High School, LLC Page: 10 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

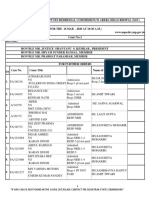

If your income doesn’t exceed a certain amount, you can use a tax table like this one to

figure your yearly income tax. Click here to have an enlarged view of the tax table and also

to know what a tax table contains."

(https://courses.portal2learn.com/d2l/common/dialogs/quickLink/quickLink.d2l?

ou=17692&type=coursefile&fileId=2013+Tax+Table.html)

© 2023 PF High School, LLC Page: 11 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Let’s look at an example.

Suppose that one year Mae Browning's taxable income is $24,442, and $3,546 was with-

held for federal income taxes during that year. Mae is single and supports only herself.

Using the sample tax table shown in Figure 5, let's determine her tax.

Look under the heading "If line 37 (taxable income) is—." Mae's taxable income of $24,442

falls into the range of "at least $24,400 but less than $24,450." Next look at the "Single"

column under the heading "Your tax is—." Mae finds that her tax is $3,218. Since she had

$3,546 withheld from her pay, she's due a refund of $328 ($3,546 – $3,218 = $328). Mae

will receive this refund after she files her income tax form.

Determining the tax you owe isn’t as simple as in the preceding example. There are many

categories of deductions that may apply to you, which change your taxable income.

Complete instructions come with the tax form you receive. Study them carefully.

Since tax laws change often and the directions are extremely complex, you may want to

consult a professional tax preparer. The comparatively small cost of such a consultation

may save you money, and the preparer will answer any questions you may have.

State and Local Income Taxes

Depending upon where you live, state and local income taxes may be deducted from your

pay. These taxes are usually at a fixed rate, such as 1% or 3%.

Other Deductions

In addition to taxes, you should be aware of other possible deductions that will affect your

take-home pay.

Hospitalization

If you belong to a group health insurance plan through your employer, the premiums are

deducted from your pay. Since medical costs are continually rising, health insurance is

practically a necessity.

Union Dues

If you belong to a union, your dues may be deducted from your pay.

Pension Plan

Your company may have a retirement plan to which you contribute. There are three types

of qualified plans: pension, profit sharing, and stock bonus plans. Pension plan benefits are

generally measured by and based on factors such as years of service and employee

compensation. A deferred-arrangement plan, also known as a 401(k) plan, allows

© 2023 PF High School, LLC Page: 12 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

participants to make contributions to a profit-sharing or stock bonus plan, usually without

being taxed on the earnings contributed to the plan. These contributions are also usually

matched at a certain percentage by the employer.

Calculating Net Pay

As you learned earlier, your net (take-home) pay is your gross pay minus all deductions. To

illustrate how net pay is figured, let’s use the example of Tyrone Jones, whose weekly

gross pay is $480.77. He has the following deductions:

FICA tax $29.81 1.45%

1.45% Medicare tax 6.97

Federal withholding (income) tax 63.62

Charities fund 1.00

2% state tax 9.61

1% city tax + 4.81

Total deductions $115.82

Gross pay $480.77

Total deductions — 115.82

Net pay $364.95

Purchases

During the course of your life, you’ll purchase a wide variety of items. For some purchases

you’ll pay cash, for some you’ll write checks, and for others you may use a credit or debit

card. To be sure you get the most for your money, it’s important to become familiar with

© 2023 PF High School, LLC Page: 13 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

sales taxes, unit prices, and credit charges. All of these factors affect the price you actually

pay for your purchases.

A credit card allows you to purchase items and pay for them later; a debit

card, on the other hand, is like paying cash. The amount of your purchases

is deducted from your bank or credit union account.

Sales Taxes

A sales tax is levied in most states and some cities as a percentage of the purchase price

of retail items. The tax is usually collected by the retailer selling the item and is then

passed on to the agency levying the tax. Retail food items are usually exempted from such

sales taxes, as are items of clothing in some states.

Let’s see how sales tax is figured.

Suppose Ruthann Channing bought a $49.95 dress, a $30.00 blouse, and an $11.00 slip. If

there's a 6% sales tax on clothes in her state, what's the total cost of her purchases?

© 2023 PF High School, LLC Page: 14 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

$49.95 + $30.00 + $11.00 = $90.95 Calculate the total cost.

6% of $90.95 = .06 x $90.95 = $5.46 Calculate the sales tax.

Add the sales tax to the cost of the items. The total

$90.95 + $5.46 = $96.41

cost of Ruthann's purchases is $96.41.

REAP THE REWARDS OF RESEARCH

When you’re shopping for complex, expensive items such as stereos, cars,

vacuum cleaners, and so on, it can be difficult to determine which brand is

best. Very often, the cheapest brand doesn’t remain the cheapest for long,

when repair bills or premature replacement are figured in. On the other

hand, purchasing the most expensive, deluxe model doesn’t necessarily

guarantee you years of trouble-free service, either.

Wouldn’t it be easier to make an intelligent consumer decision if you were

able to “test drive” every popular brand for a month or maybe even a year?

Obviously, no dealers or retailers would allow you to use their merchandise

for personal research of this sort; however, you do have access to the

results of this type of extensive research right at your newsstand and on

your computer.

Consumer magazines and websites are available let you compare the

quality, price, and performance of several brands of quite an array of items

—from mouthwashes to microwave ovens to money market funds! The

producers of these publications do thorough tests and investigations of all

products before describing and rating them. A consumer magazine that’s

available nationally is Consumer Reports(http://www.consumerreports.org).

So, if you’re faced with making a major purchase, take advantage of the

research compiled in these magazines and on the Web. The time you

invest now may prevent headaches—and unnecessary expense—for years

to come.

Unit Prices

© 2023 PF High School, LLC Page: 15 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

If three bunches of celery were selling for $3.85 in one store and two bunches of celery

(the same size) cost $3.40 in another store, could you determine which store had the

cheaper celery? You could if you figured out the unit price of each bunch.

A unit price is the price of a single item. To determine the unit price, divide the price by the

number of units or items. Then round off any fraction of a cent to the nearest whole cent.

Thus, in the first store, one bunch of celery would cost $3.85 ÷ 3 = $1.283 or $1.28. In the

second store, a bunch would cost $3.40 ÷ 2 = $1.70.

The celery example is a simple one, because the cost of the celery bunches wasn’t

determined by their size. But what if the size or weights are different? You must then find a

unit of size or weight common to both items. Here’s an example.

If a 16 oz (ounce) can of one brand of beans is priced at $1.50 and a 12 oz can at $1.33,

which is cheaper per ounce? To calculate the price per ounce of each can, divide the price

by the number of ounces.

$1.50 ÷ 16 = $0.09 Determine the price of the 16 oz can.

$1.33 ÷ 12 = $0.11 Determine the price of the 12 oz can.

So, per ounce, the first brand is cheaper. Of course you must consider other factors, such

as the quality of each brand and the quantity you want to buy. But by comparing unit

prices, you can at least determine which brand is least expensive per unit.

In the past, it was up to the consumer to calculate and compare unit prices. Because of

growing pressure from consumer groups, grocery stores must now display the unit prices

for each item they sell. Be sure to look for these unit prices. They can usually be found on

the edge of the shelf that holds the item. You’ll shop more intelligently by comparing unit

prices.

© 2023 PF High School, LLC Page: 16 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Key Points and Links

Key Points

Income can be earned by an hourly rate; by a weekly, monthly or annual rate; by straight commission; or by a base

salary plus a commission.

A gross salary is the total amount earned before deductions are subtracted. Net salary is the amount earned after

deductions are subtracted.

Money may be deducted for federal, state, and local taxes.

A sales tax is levied in most states and some cities as a percentage of the purchase price of retail items.

Wise research can help you make better purchasing decisions.

A unit price is the price of a single item.

Links

Wage Laws(http://www.dol.gov/whd/)

© 2023 PF High School, LLC Page: 17 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Practice: Calculate Salary and Purchase Costs

This practice is ungraded, and you can take it as many times as you want. For

written responses, you can type your answers in the box. When you finish, click

“View Feedback” to expand sample answers that you can compare to your answers.

You won’t be allowed to go back and click “View Feedback” again, so be sure to

note of topics you may need to study more. Because this is a self-check practice,

you won’t receive a score.

Question 1 (1.00 Points)

Exercise

Based on what you've read, answer the following questions.

1. Jose Ramirez worked 38 hours last week at a pay rate of $7.25 per hour. What was his gross pay?

2. Bill Green, a storm-door salesman, sold $5,000 worth of doors and received a commission of $400. What was

his rate of commission? (Remember the basic formula p = br, in which p = percentage, b = base, and r =

percent.)

3. With a base salary of $250 and a commission of 4% of all sales, compute Cindy Nelson’s salary for the

following weeks:

Base Total

Week Sales Commission

Salary Salary

1 $250.00 $890.00 ? ?

2 $250.00 $1,126.00 ? ?

3 $250.00 $975.00 ? ?

4 $250.00 $824.00 ? ?

4. Suppose you worked 45 hours at a rate of $7.25 per hour, plus overtime pay (time-and-a-half) for any hours

over 40. You also received a 2% commission on the $800 of china tableware you sold. Your paycheck lists

$324.25 as your gross earnings. Is that correct?

5. Arlene Grossman earns $235 per week. Her federal income tax is $36.00. Her FICA tax is 6.2%. Arlene is also

subject to a 3% state income tax and a 1% city tax. What’s her net pay?

© 2023 PF High School, LLC Page: 18 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

6. Will Brown, who pays weekly union dues of $3.00, earns $289 per week. His federal income tax is $39.13 and

his FICA tax is 6.2%. He pays a 4% state income tax, a $15.00 annual city tax, and 2% of his pay to his

retirement fund. What’s his net income for the week he pays the city tax?

(Long answer)

© 2023 PF High School, LLC Page: 19 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Identify the Total Costs of Payment Options

© 2023 PF High School, LLC Page: 20 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Buy Now, Pay Later

If you’re like most people, there will be times when you may not be able to pay for your

purchases by cash or check, especially if they’re rather expensive. You’ll then use a plan in

which you “buy now and pay later.” Examples of such plans include an installment plan, a

department-store charge card, a credit card, or a loan from a bank, finance company, or

credit union. Whatever source you use, you’re borrowing money at a specified interest rate.

You must repay both the money you borrowed and the interest charged on that money. So,

you should become aware of just what percent of interest you pay on any money you

borrow. Note: Every time you purchase an item and don’t pay for it by cash, check, or

debit, you’re borrowing money, no matter what term is used. (Sometimes a check may be

based on borrowed money, as we’ll discuss later.)

Credit Cards

The major purpose of credit cards is to increase sales. For the banks and other institutions

issuing these cards, the interest charges and the discounts received from merchants

create a tremendous source of income. For industrial groups, such as oil companies, credit

cards can ensure customer loyalty to their brands.

For consumers, credit cards provide instant access to many goods and services they

couldn’t otherwise obtain. They also eliminate the need to carry cash. (Debit cards also

eliminate the need to carry cash. Today, cash isn’t often used to make purchases such as

groceries.)

Because credit cards come from many sources, for separate purposes, consumers were

loaded with too many cards and received separate billings from each card every month.

Visa and MasterCard allowed for the consolidation these separate billings. Two other all-

purpose cards are American Express and Discover.

Retail Cards

You may not think of your utility bills (gas, electricity, and water) and other common bills as

extensions of credit, but they are. You use the goods or services before you pay for them.

Service charges are applied to late payments.

Another form of retail credit is the department-store charge account. You’re billed at the

end of each month for any purchases you’ve made. Interest calculations are often

complex. APRs (annual percentage rates) on store cards are typically around 20%,

depending on your credit score. For specific rates and interest calculations, refer to the

terms and conditions provided by the company issuing the credit.

You may also purchase on the installment plan, which extends the period of payment. You

pay so much down and so much per month for a specified period of time, with interest

© 2023 PF High School, LLC Page: 21 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

rates added. The seller retains ownership of the purchase until all payments are made.

Installment purchases are usually made for larger items, like appliances.

Personal Finance Companies

Sometimes a person needs immediate cash because of an unanticipated expense. A

personal finance company, or small-loan company, may provide the answer to such a

need. These companies lend money on your signature alone. They’re fast and convenient,

since all that’s usually required is a steady income and a long-time residence at one

address. Another point in your favor is home ownership.

Many people turn to personal loan companies because they’re private. No one is looking

over your shoulder while you’re making an application. Larger loans carry a smaller interest

rate, but small loans from such companies could carry an annual interest rate of 36% or

more, depending on the state you live in. So, the major disadvantage of personal finance

loans is the high interest rates.

Bank Loans

Banks extend loans for a variety of purposes. Banks usually ask many more questions

than the personal finance company. The following material provides information on three

types of bank loans: personal loans, home-improvement loans, and overdraft loans.

Personal Loans

Banks, like personal finance companies, grant personal loans to applicants who meet their

requirements. Usually, such personal loans, on your signature alone, are limited to 20% of

your annual income. For example, if your annual income is $30,000, the most you could

borrow on your signature is 20% of $30,000, or $6,000.

Home-Improvement Loans

Loans may also be obtained from a bank for needed home repairs or improvements. The

sum you can borrow is usually larger than that for a personal loan and runs for a longer

period of time. You must assure the bank that you’ll use the money for the intended

purposes.

Overdraft Loans

In the past, if a checking account was overdrawn—that is, if checks were written for more

money than was in the account—the check was returned to the issuer with a charge for

handling the check. But now, the issuer can arrange beforehand for the bank to honor a

check, within a certain limit (say, $500), covering that check or any other checks with bank

© 2023 PF High School, LLC Page: 22 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

funds. Those funds become an overdraft loan from the bank. Such an arrangement is

called a credit line.

Life Insurance Loans

Some life insurance policies generate reserves of money that can be borrowed by the

policyholder. Such loans can be obtained quickly without the borrower being investigated

or having to state why he or she needs the money.

The disadvantage of such loans is obvious. When you take out a life insurance policy, you

do it because you think you need that protection. When you borrow that money and don’t

pay it back, you (and your family) no longer have that protection.

Credit Unions

Your fellow employees or club members may operate a credit union. Credit unions are non-

profit institutions operated at low cost to offer loans at low interest rates to credit union

members. Federal credit unions are insured for up to $250,000 for each individual account.

Pawnshops

A pawnshop is usually the last resort for obtaining money. A person who needs money

surrenders a possession of some value, like a camera or ring, to the pawnbroker in return

for a sum of money that’s a fraction of the item’s value. To reclaim the pawned item, the

borrower must repay the sum plus interest of 20% or more, usually within a year.

Otherwise, the item is sold.

Payday Loans

When all other sources of obtaining money fail, an individual may turn to borrowing money

against their next paycheck. Individuals in this position may turn to what’s referred to as a

payday lender. Payday lenders are known for charging very high interest rates. These

lenders require an individual to pay the amount borrowed from the next paycheck in full.

This is often very difficult for those suffering financial difficulties. If a borrower is unable to

make the payment in full, the payday lender charges hefty fees on top of the already high

interest rate. The interest and fees from such loans, especially if repayment is delayed,

may amount to two or three times the original amount borrowed.

There have been calls for increased regulation to ensure borrowers are not being taken

advantage of. If you turn to a payday lender be sure to read all of the terms of the loan

carefully before accepting the loan.

Interest Rates

© 2023 PF High School, LLC Page: 23 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Before you consider purchasing something on the installment plan or other credit plan, you

should determine the true interest rate you’re paying.

The Truth in Lending Act requires that sellers disclose the amount or percent of interest

charged for any credit purchase. You can compare the interest rate you’ll pay with the

interest rate for money borrowed from other sources. (Remember that you’re still

“borrowing” money when paying on an installment plan.)

You can determine the interest rate for any credit purchase by using the following formula,

which is employed by the Federal Reserve System.

R = 2 ml⁄P(n + 1)

in which,

R = actual yearly rate of interest

m = number of installment payments per year (monthly, 12 payments; or weekly, 52

payments)

I = interest or installment charges

P = amount borrowed

n = number of payments to be made

Now let’s see how we can apply the formula in an actual situation.

Suppose Mr. Martin bought a sweater priced at $45.00. He accepted credit terms of $5.00

down and $2.85 per week for 16 weeks. The extra cost on the credit plan was equal to

what actual yearly rate of interest? Let’s find out. First, determine what information you

have and what you need:

2 ml

R =

P (n + 1)

R = unknown yearly rate of interest

m = 52 (since payments are weekly)

P = $45.00 − $5.00 = $40.00 Since he has put $5.00 down, he is nancing only

$40.00.

© 2023 PF High School, LLC Page: 24 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

I = ($2.85 × 16) − $40.00 =

$45.60 − $40.00 = $5.60 To calculate the amount of interest charged, multiply

the weekly payment ($2.85) by the number of

payments (16). From this subtract the principal.

n = 16

Let’s substitute this information into the formula and perform the calculations.

2(52)(5.60)

R = = 0.85647, or 0.8565 rounded off

40(16 + 1)

0.8565 = 85.65% Change your answer to a percent.

So, we’ve determined that Mr. Martin paid a whopping 85.65% interest on his sweater!

You’ll probably be amazed at the very high rate of interest charged in many of the so-called

“easy” plans.

Your Credit Rating

If you’re included in the 60% or more of the population who buy now and pay later, one of

your most precious possessions is a good credit rating. No matter what legitimate source

(other than an insurance policy) you may use to borrow money or obtain credit, your record

will be investigated. This investigation is usually conducted through a credit reporting

agency. The agency gathers and evaluates data about your personal and financial

character. These credit reporting agencies are called credit bureaus.

You’ll be given a credit rating based on such factors as your job, your residence, your

marital status, your bank accounts, and your credit record. Any failure in the past to have

paid bills (utilities, department stores, car payments, and so on) on time will probably be

discovered and will influence your rating.

If you apply for credit and are denied it, you have a legal right to find out what it was in your

credit record that caused the problem. To find out your current credit score, request a free

report from at least one of the three major credit reporting agencies. Specific information

can be found at USA.gov(http://www.usa.gov). Once you’ve received your credit record,

closely examine your file. If you find items in it that are false, undocumented, or more than

seven years old, you can insist they be removed from your file and that an amended report

be sent to the person or company who had requested your credit rating. Also, if you

discover a charge on your bill that you know you didn’t make, you can question that

charge.

© 2023 PF High School, LLC Page: 25 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

KEEPING YOUR CREDIT RATING

Once you’ve acquired a good credit rating, strive to keep it. A guideline for

most people is that your payments—interest and principal (amount

borrowed)—should never exceed 20% of your net income. Some personal

finance experts believe 20% to be too high, considering it a danger point, so

it’s wise to think of 20% as your absolute outside limit.

The major rule to maintaining a good credit rating is to be punctual with

your payments. Always pay on time. And be sure the check doesn’t bounce

(get returned by the bank because of insufficient funds). A bounced check

will affect your rating more adversely than a late payment.

© 2023 PF High School, LLC Page: 26 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Actual Yearly Interest Rate

Read assigned reading in 2.3 under Interest Rate, then watch Actual Yearly Interest

Rate(https://www.youtube.com/embed/pVQyQd79q78?rel=0&showinfo=0) for more

instructions on how to calculate the actual yearly interest rate (R) using the special formula

given.

© 2023 PF High School, LLC Page: 27 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Key Points

Key Points

Credit is available to consumers through a wide variety of options, including credit cards, retail credit, personal

nance companies, banks, life insurance, credit unions, and pawnshops.

When someone purchases something on an installment plan or some other credit plan, that person will pay

interest on the money borrowed.

A credit bureau is an agency that evaluates individuals’ credit ratings.

© 2023 PF High School, LLC Page: 28 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Practice: Identify the Total Costs of Payment Options

This practice is ungraded, and you can take it as many times as you want. For

written responses, you can type your answers in the box. When you finish, click

“View Feedback” to expand sample answers that you can compare to your answers.

You won’t be allowed to go back and click “View Feedback” again, so be sure to

note of topics you may need to study more. Because this is a self-check practice,

you won’t receive a score.

Question 1 (1.00 Points)

Exercise

Find the difference between the cash price and the payment plan and calculate the

interest rate for the following questions.

1. A food processor for $149.50 cash, or $5.00 down and $10.00 per month for 15 months

2. A television for $675.00 cash, or $52.00 down and $120.00 per month for 6 months

3. A smartphone for $150.00 cash, or $25.00 down and $12.00 per month for 11 months

4. Bedroom furniture for $1,985.00 cash, or $400 down and $74.00 per month for 24 months

5. A jacket for $75.00 cash, or $25.00 down and $4.75 per week for 11 weeks

6. e Smiths bought new furniture that cost $3,298.00. e store o ered them an option of putting $600 down

and making equal payments of $300 a month for 10 months. Use the Federal Reserve System formula to nd

the APR the Smiths will pay for taking this plan.

(Long answer)

© 2023 PF High School, LLC Page: 29 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Develop a Spending Budget and Record-Keeping Plan

© 2023 PF High School, LLC Page: 30 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Budgeting and Keeping Accurate Records

If you’re like most individuals, you have less money than you need to buy everything you

want. Therefore, you must decide how you’ll spend your resources. Budgeting and record

keeping will help you to determine if you’re spending your money efficiently to get what you

want. These steps will also help you adjust your spending habits so you can work toward a

financial goal, whether your goal is debt-free living or a trip around the world.

Why Budget?

Do you have mixed reactions to the word budget? After reading this section, you should

have very positive feelings about making a budget. A well-thought-out budget can prevent

excessive debts and disagreements over money. Knowing your family’s resources and

exactly how they’re going to be spent can lead to more pleasant, open family relations and

a healthier attitude toward money management.

A budget is a plan for spending your money. It tells you where you’ll spend your money and

in what amounts. But first, you have to determine your total income, so you’ll know how

much you have available to spend.

Income

To make up a budget, you’ll have to estimate your total income from all sources. Figure

your net income—the money you take home after taxes and deductions. If your income

exceeds your expenses, the budgeting process is easy. However, since your expenses will

almost undoubtedly exceed your income, you must decide what your priorities are and

what you want the most. Then you must adjust your expenses to match your income—

which is the purpose of a budget.

Budget Categories

A budget usually covers your pay period—one week, two weeks, or a month. To prepare a

budget, group all expenditures under general categories and then determine how much

you plan to spend in each category. The following groups include most expenditures.

They’re broad groups that will be broken down later.

Food purchased from restaurants, cafeterias, and vending machines, as well as from grocery stores

Clothing and its cost of upkeep (laundry and dry-cleaning)

Transportation, including all car expenses—payments, insurance, gas, oil, repairs—and plane, train, or bus fares

Housing, which includes rent or mortgage payments, repairs and improvements, insurance, and property taxes

Household operations such as utilities, supplies, payments for furniture or appliances, and so on

© 2023 PF High School, LLC Page: 31 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Health expenses, including health insurance, doctors’ fees, and medicine

Education, which includes tuition, books, supplies, and student fees

Recreation, including entertainment, vacations, magazines, and materials for hobbies

Gifts and contributions given for birthdays or Christmas, or to churches and charities

Savings, which includes payments for life insurance, savings accounts, bonds, individual retirement accounts, and

so on

Miscellaneous, which encompasses any recurring expenditures that don’t seem to t into any other category

Involving all family members in establishing nancial goals makes budgeting more pleasant and increases cooperation.

The important point here is that you become aware of all of your expenses. Including your

entire household in the preparation of a budget can also be very helpful. For a household

budget to be effective, each family member needs to be aware of the general financial

picture.

Types of Expenses

Think of your expenses as falling into two categories—fixed expenses and flexible

expenses. Fixed expenses are those bills you must pay every month in which the amount

due can’t be changed. Flexible expenses are those that change from month to month and

over which you can exercise some measure of control.

The category—fixed or flexible—into which you place each item depends to some extent

on your goals and your lifestyle. For example, some people may place all of their utilities—

electricity, gas, water, telephone—under fixed expenses. They might think that they have

© 2023 PF High School, LLC Page: 32 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

little or no control over them, or they may have no desire to change them. Others, when

they start budgeting and find they’re spending too much for their utilities, might consider

them flexible expenses over which they can exert some control. So, it’s really up to you

where you place each expenditure.

Most people place all debts (car, furniture, credit payments), insurance premiums,

mortgage or rent, and taxes under fixed expenses. Some also place utilities under fixed

expenses. All other expenses—including food and clothing—are considered flexible

expenses.

Budget Sheet

Now you’re ready to prepare a budget sheet, which will serve both as a plan for what you

want to spend and as a check on what you actually do spend.

Here’s a good process to get started:

1. Group all of your expenditures into the budget categories listed previously.

2. Divide the categories into xed and exible expenses, as shown in the sample budget sheet that follows, which is

broken down by months. You can make your budget for a week or two weeks, depending on how often you’re paid.

3. Collect and add up all the bills for a xed period of time—say, one month.

4. Divide each expense by your pay period. For example, if your monthly rent is $500 and you’re paid twice a month,

you’ll budget $500 ÷ 2 = $250 for rent for each pay period. For such expenses, you should save the money so it will

be available when the payment is due.

5. Once you’ve determined the categories and periods, gather all of your records (cash receipts, charge slips, and

cancelled checks) to determine how much you’re now spending in each area. en look at exible expenses, and

decide whether this is the amount you actually want to spend. You can budget the amount that you feel you should

be spending there.

6. When you’ve budgeted all of your expenses, add them up. If they exceed your income, you’ll have to decide where

you should cut back to balance your budget.

7. At the end of each pay period, ll in the “actual” column by adding the amounts from your cash, charge, and check

records. If you discover a category (recreation, perhaps) that seems excessively high, you might want to break that

down into a separate listing of each expense to determine which of them can be eliminated or reduced.

IMPULSE BUYING

Are you an impulse buyer? During a shopping trip, do you buy many more

items than you need or can afford? If so, plan before you shop. Make a list

of the items you actually need. Try to stick to that list when you shop. Check

off each item as you find it. When there are no more items on your list, go

directly to the checkout.

© 2023 PF High School, LLC Page: 33 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Every three months (or more often, if you desire), you can add up your expenses and

examine your budget sheet to see how nearly you succeeded in keeping them to the

budgeted amounts. If there are large differences, sit down and think about the problem or

discuss it with the other family members who are involved. You’ll have to decide what steps

you can take to bring expenses into line. Or you may find you have to budget more realistic

amounts to be in line with what you actually spend.

The important point of a budget is that it makes you aware of what you’re spending. You

may not change your spending habits, but you’ll at least know where your money goes.

© 2023 PF High School, LLC Page: 34 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

All expenditures can be divided into xed expenses and exible expenses, as shown on this budget form that can be used for a four-month

period.

Keeping Records

You pay for most of your purchases either with cash, debit card, or check. For budgeting

purposes, you should keep records of all such transactions so you know exactly what

you’ve spent. You should also keep a record of the total cash received by the family or

household.

The following paragraphs describe some important records.

Record of Income

Most people and families have only one or two major sources of income, so their incomes

can be easily determined. However, if you have several sources of income, you may wish

to keep records like the sample in the figure below.

Income Record

Date Source Amount

Jan. 4 Janice, net income, Dec. 15-31 $329.00

5 Rebate from appliance purchase 30.00

7 Jim, net income, Dec. 15-31 492.13

8 Garage Sale 92.56

Total $943.69

Cash Records

You need to keep records of all items for which you pay cash. Even though most of the

amounts may be small, they can add up to a significant percent of your budget. Each cash

payment can be recorded on a form like the one shown below.

© 2023 PF High School, LLC Page: 35 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Checking Account Records

Most of your income will probably be deposited in a checking account. This eliminates your

having to carry large amounts of cash, while providing a record of all payments made by

check or debit card.

You deposit money in your checking account and then write checks or use a debit card that

draws from that account when you pay your bills. The amount for which you write checks

should never exceed the amount you deposit in your checking account. If it does, you’ll

have to pay a penalty for each overdrawn check (unless you’ve arranged for overdraft

protection).

As you write each check, make a record of it on the check stub or ledger contained in your

checkbook. Subtract each check from your balance. Add any deposits to your balance.

Balancing Your Checkbook

Each month, most banks send a paper or electronic statement of your deposits and

withdrawals. Some banks also return your cancelled checks, although this practice is

becoming less common.

It’s important to reconcile the bank statement with your checkbook balance by comparing

the deposits and withdrawals shown on the bank statement with those in your checkbook.

When they agree, place a small check mark near each.

© 2023 PF High School, LLC Page: 36 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Subtract all checks written and add all deposits to determine the current checking account balance, as shown here.

If there’s a difference between your balance and the bank’s balance, it may be due to

outstanding checks—that is, checks that you wrote that haven’t yet reached your bank.

Look through your checkbook to see if any of your listed checks are omitted in the bank

statement. Deduct those from the bank statement.

Also, the bank statement may include service charges, which you should deduct from your

checkbook balance. If your balance still doesn’t equal that of the bank, check both your

math and the bank’s.

The first time you reconcile your checkbook balance with the bank’s figures, the job may

seem tedious. But you’ll soon learn to do it quickly. It’s not wasted time—keeping an

accurate checkbook register can save you the embarrassment and expense of an

overdrawn check. Also, you may find the bank has erred in listing your deposits and

withdrawals.

Let’s use an example to illustrate the steps involved in balancing your checkbook. Suppose

that Jim Janus had a balance of $255.25 in his checkbook. His monthly bank statement

showed a balance of $289.60. He put a check mark in front of every check listed in both his

checkbook and bank statement. He discovered that three checks he had written were not

yet listed on his bank statement—#321 for $9.30, #322 for $11.05, and #323 for $9.00. He

also noticed an ATM surcharge of $5.00 that was not on his bank statement. To determine

if his balance was correct, here’s how Jim arranged the items:

© 2023 PF High School, LLC Page: 37 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Monthly bank Checkbook balance after deducting checks =

statement balance = $289.60 $260.25

Check #321 − 9.30 ATM surcharge 5.00

Check #322 − 11.05 $255.25

Check #323 − 9.00

Checkbook balance

after deducting checks = 260.25

Since Jim’s actual balance and his checkbook balance are the same, Jim’s checkbook is

correct. He would, of course, look for those three outstanding checks and the ATM

surcharge on his next monthly bank statement.

© 2023 PF High School, LLC Page: 38 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Key Points

Key Points

A budget is a plan for spending and saving your money.

Fixed expenses are those bills you must pay every month in which the amount due can’t be changed. Flexible

expenses are those that change from month to month and over which you can exercise some measure of control.

Keeping careful records is an important part of the budgeting process.

An individual’s checkbook should be reconciled every time he or she receives a statement.

© 2023 PF High School, LLC Page: 39 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Practice: Develop a Spending Budget and Record-Keeping Plan

This practice is ungraded, and you can take it as many times as you want. For

written responses, you can type your answers in the box. When you finish, click

“View Feedback” to expand sample answers that you can compare to your answers.

You won’t be allowed to go back and click “View Feedback” again, so be sure to

note of topics you may need to study more. Because this is a self-check practice,

you won’t receive a score.

Question 1 (1.00 Points)

Exercise

Based on what you've read, answer the following questions.

1. For the month of June, Mae Green budgeted the following amounts: $180 for food, $475 for rent, $15 for

transportation, $50 for insurance, $65 for utilities, $25 for a gift for her sister, $150 for a car payment, and $30

for clothing. She actually spent $182 for food, $475 for rent, $12 for transportation, $65 for insurance, $68 for

utilities, $12.50 for the gift, $150 for the car payment, and $36 for clothing. Did Mae stay within the total

amount allocated for her budget?

2. Eleanor Raymond works full time while her husband, Peter, attends college and works part time. eir

income for the last two weeks consisted of an August 17 paycheck of Eleanor’s for $380.48, $16.50 for a

birthday present Peter returned on August 19, Peter’s paycheck on August 21 for $120.00, Peter’s sale of some

of his college textbooks on August 23 for $13.65, and a check from Peter’s father for $100.00 that arrived

August 25. Record and total Eleanor and Peter’s income for this two-week period.

3. During the period of October 1 to 15, Cathy Powers spent the following: October 1, rent, $540; October 6,

electricity, $48.55; October 7, food, $34.15; October 8, dinner at the China Palace, $12.80; October 12, blouse,

$18.95; October 14, food, $38.60; October 15, magazine, $2.00, and batteries, $6.50. Make a cash record of her

expenses and total them.

4. MarieHernandez’s checking account balance is $250.65. She then writes check

#346 on July 14 in the amount of $21.95 for a bathing suit. On July 16 she writes

check #347 for $48.50 to cover her bus fare. Check #348 to the Sunset Motel is

for $75.60. She deposits $55.00 on July 18 when she returns from her weekend

vacation. Use the figure below to list all transactions and calculate Marie’s new

balance.

Check Transaction Payment Deposit

Date Balance

Number Description Amount Amount

$250.65

© 2023 PF High School, LLC Page: 40 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

5. Grace Peters spent $230 of her net income of $825 on food. What percent of her net income does the food

represent? (Round your answer to the nearest tenth of a percent.)

(Long answer)

© 2023 PF High School, LLC Page: 41 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

List Homeowner Expenses

© 2023 PF High School, LLC Page: 42 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Your Home

Whether you rent an apartment or house or whether own your own home, you’ll incur

expenses related to that dwelling. If you’re to stay within your budget, your total home

expenses shouldn’t exceed 20% to 25% of your net income.

Whether you rent or buy your home depends on many factors—whether your job requires

you to move often, the possibility of a change in the family’s size or status, the availability

of rental property, your family’s feelings about owning a home, local economic conditions,

and so on.

Renting, of course, allows you greater mobility. If the neighborhood deteriorates or you get

a much better job in a different locale, your family can easily move to a better

neighborhood or different town.

Renting may be cheaper than buying, but in the end you have nothing to show for it. The

money you pay on a mortgage, however, goes toward a home that you will eventually own.

In addition, a family that owns its own home may feel more physically and socially secure.

Buying a home requires quite a bit of capital at the start. There are expenses such as

inspections, appraisal fees, points (a percentage of the purchase price paid to the bank),

closing costs, taxes, and recording fees. All of these items add up. You should be sure

you’re prepared to handle such expenses before deciding to buy a house.

The term capital refers to the value of accumulated goods. In the case here,

it refers to money.

You can make an intelligent decision on the home ownership question only after

considering all of these factors. Talk with both renters and owners to see what problems

they encounter. Then sit down and list all of the advantages and disadvantages of each

before deciding.

Service Bills

Whether you own or rent your home, you’ll have service bills. These may include electricity,

gas, water, and telephone charges. These bills may come once a month or every two

months.

The amounts of electricity, gas, and water you use are measured by meters. Your bills are

based on the meters’ records. You should know how to check these bills for accuracy, in

© 2023 PF High School, LLC Page: 43 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

case you feel a bill is in error. You might want to read your own meters to verify the

readings shown on your bills. Several types of meters are used to record the amount of

gas, water, and electricity you use.

Electricity

Electricity is measured in kilowatt-hours (kwh). Some elective meters are arranged like an

odometer (mileage indicator) on a car, with only the numbers showing for the actual

reading.

Other meters have dials like the one shown in the figure below. The dials on an electric

meter are read from left to right, and the reading is taken from the last figure the pointer

has passed. Since the pointer always follows the value of the numbers, the first and third

clocks go counterclockwise, and the second and fourth (as you’re reading left to right) go

clockwise. The kwh you’re charged for is the difference between the new reading and the

previous reading. You’re charged at a certain rate for these kilowatt-hours. A state tax or

surcharge will probably be added.

Let’s look at an example.

Let’s say Mrs. Anderson’s previous meter

reading on January 1 was 1,875. Her meter

reading on February 1 is shown in the figure

here. How many kilowatt-hours of electricity

did she use during January?

The dials are read from left to right, using the last number passed. The first dial, which

swings counterclockwise, reads 2. The second is 1. The third is 9 and the fourth is 8.

Therefore, Mrs. Anderson’s current meter reading is 2,198.

To determine the kilowatt-hours used in January, subtract the previous reading from the

current reading.

2,198 – 1,875 = 323 kwh

Mrs. Anderson used 323 kwh in January.

Gas

Gas for cooking or heating is measured in cubic feet. As with electricity, the dials are read

from left to right and the amount used is multiplied by a standard rate per cubic foot.

Water

Water is measured by the cubic foot or the gallon. Measuring devices vary in different

places, as do methods and periods of billing. Usually the consumer is billed every quarter

© 2023 PF High School, LLC Page: 44 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

(three months). So divide your quarterly bill by three to find your monthly rate for budgeting

purposes.

The water utility company, as well as the electric company, usually charges a minimum

amount regardless of how much you use. Any additional charge is figured by determining

the amount that actually was used—the current reading minus the previous reading (as

with the electric bill).

Here’s an example.

Suppose your current meter reading for October 29 is 623 (representing thousands of

gallons). If your previous reading for August 1 was 619, how much water did you use for

this billing period?

623 – 619 = 4

Since the number represents thousands of gallons, you used 4,000 gallons of water in

three months.

Oil

Fuel oil is usually delivered by a truck that contains a meter. The delivery person reads the

meter before and after delivering the oil to determine the number of gallons that you

received. The meter shows the number of gallons used to the nearest tenth of a gallon.

The number of gallons is multiplied by the current rate per gallon to determine your bill.

Let’s say the top portion of your oil bill looks like this:

Reading No. Gallons

112 00000

113 00722

The underlined digits represent the nearest tenth, so the oil company delivered 72.2

gallons. If the current rate of fuel oil is $3.799 per gallon, your bill would be 72.2 × $3.799 =

$274.29.

Phone

Landline use has become less common as cell phone reliability and range has improved.

Landline service is often bundled or sold with television and internet packages. If you

maintain a landline and have a cell phone, you may want to take a closer look at your

landline charges. Be sure to calculate your landline charges separate from your television

© 2023 PF High School, LLC Page: 45 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

and internet charges. You may find the savings from cancelling your phone outweigh the

benefits of keeping it.

Cell phone costs vary from carrier to carrier. It’s wise to shop around from time to time to

ensure you are getting the best price for the features you want. Competition for consumers

has led to better deals being offered.

Your phone bill is issued monthly. It lists your basic or recurring charges, plus any

additional services or features that you opt to use. If you decided to use a payment plan for

your cell phone, the monthly charge will be listed on your statement. Phone bills also list

taxes, surcharges, and regulatory fees that may be applied.

Homeowner Expenses

If you own your own home, you’ll have more expenses than someone renting a home.

You’ll be financially responsible for all repairs and improvements made on that home. You’ll

also have to pay taxes and carry insurance. Since most homes are mortgaged, you’ll

probably be making mortgage payments, too.

Mortgages

Most homes are purchased, in part, with money borrowed from a bank or other source.

That money, which is usually borrowed for 20 or 30 years, carries an annual interest rate.

© 2023 PF High School, LLC Page: 46 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Usually, the money is repaid in monthly installments that repay a small part of the loan plus

the interest on the balance of the loan. This sort of loan is called a mortgage, which means

that the borrower signs a note giving the lender rights to the property. If the borrower fails

to make payments, the lender can take possession of the property.

Usually the borrower must deposit money for taxes and property insurance with the lender.

This process is referred to as the escrowing of money.

An escrow account is established to pay for a future expense. In the case of

home ownership, escrow accounts are set up to pay for insurance and

taxes. Your lender adds the cost for insurance and taxes on top of

your mortgage payment, maintains your escrow account, and pays the total

amount required by the due date.

When the homeowner pays off the mortgage, the cancelled mortgage is returned to him or

her. When that happens, tax officials should be notified that property tax bills should be

sent to the homeowner, instead of the mortgage holder.

Taxes

The district in which your home is located levies a property tax on that home. There may

be several separate property taxes—one for the local government, one for the school

district, and usually one for the county.

A property tax is based on the assessed value of your property. The assessed value may

be less than the market value. Market value is the price you could get if you sold your

home.

In some communities, the tax rate is expressed in mills, one for each $1.00 of assessed

value. (One mill equals 1⁄10 of a cent, or 1⁄1,000 of a dollar). In other situations, the rate is a

fixed number of dollars for each $1,000 of assessed value. Here's an example.

Bill and Marie Jenkins own property that’s assessed at 80% of its $70,000 market value. If

the tax rate is 23 mills, we would determine their property tax this way:

Assessed value = 80% of $70,000 = $56,000

One mill = $0.001 per $1.00 of assessed value

23 mills = 23 × $0.001 = $0.023

Tax = $56,000 × $0.023 = $1,288

© 2023 PF High School, LLC Page: 47 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Insurance

Before you sign the final papers for your new home, be sure you’ve acquired insurance to

protect yourself against loss due to fire or other causes.

Home insurance rates are usually a certain amount per $1,000 of insured value. This

amount varies with your location and the availability of water and firefighting equipment.

To illustrate the method used to determine insurance premiums, we’ll calculate the

Winstons’ annual premium for insuring their house and furniture for $68,000. The rate is

$0.60 per $100, so we would first determine the number of times $100 is contained in

$68,000:

$68,000 ÷ $100 = 680

Premium = 680 × $0.60 = $408

© 2023 PF High School, LLC Page: 48 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Tax Mills

Read the assigned readings for lesson 2.5 under Homeowner Expenses - Taxes, then

watch this video for more instructions on how to calculate property taxes.

External

Reference(https://cdnapisec.kaltura.com/p/4258593/sp/425859300/embedIframeJs/uiconf_id/49148332/partner_id/4258593?

iframeembed=true&playerId=kaltura_player&entry_id=1_magotsp2&flashvars[streamerType]=auto&flashvars[localizationCode]=en&flashvars[lead

© 2023 PF High School, LLC Page: 49 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Key Points and Links

Key Points

Both owning and renting a home involves many bills including electricity, gas, water, oil, telephone, taxes, and

insurance.

Links

How to Balance a Checkbook (http://www.wikihow.com/Balance-a-Checkbook)

© 2023 PF High School, LLC Page: 50 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Practice: List Homeowner Expenses

This practice is ungraded, and you can take it as many times as you want. For

written responses, you can type your answers in the box. When you finish, click

“View Feedback” to expand sample answers that you can compare to your answers.

You won’t be allowed to go back and click “View Feedback” again, so be sure to

note of topics you may need to study more. Because this is a self-check practice,

you won’t receive a score.

Question 1 (1.00 Points)

Exercise

Calculate the amount of property tax Alice Brown owes on her home, which has an

assessed value of $90,000. The tax rate in her community is $31.00 per $1,000 of

assessed value.

(Long answer)

© 2023 PF High School, LLC Page: 51 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Unit Review

In this Review, you’ll complete practice activities, which may include a Practice Quiz, to

help you test your knowledge. The Review activities and Practice Quiz are ungraded. You

can complete the Review activities and Practice Quiz as many times as you want. When

you feel ready, you can complete the graded assessment.

© 2023 PF High School, LLC Page: 52 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Try to define the term before you flip the card. You should write down the term and definition in

your notebook. Consider making your own note cards to study with.

Capital Definition: The value of accumulated goods

Escrow account Definition: An account that's established to pay for a future expense

Proportion Definition: Two ratios that are equivalent

Definition: Also known as the average, the statistical mean is found

Statistical Mean by adding all measures together and dividing by the number of

measures.

Mode Definition: The measure that occurs most often

Definition: Amounts taken directly out of gross wage earnings for

Deductions

medical insurance, union fees, taxes, and so on

Median Definition: A measure that's in the exact middle of all measures taken

Definition: Related measures that are used to calculate for one

Time, Rate, and Distance another Time = Distance ÷ Rate Rate = Distance ÷ Time Distance =

Rate × Time

Definition: Earnings based on sales, services provided, or some

Commission similar measure. Commissions may comprise one's sole income, or

they can be combined with a base salary.

Unit Price Definition: The price of an individual item

Definition: A tax levied as a percentage of the selling price of a retail

Sales Tax

purchase

Definition: Known for charging exceptionally high interest rates,

payday lenders require borrowed money to be repaid by your next

Payday Lender

paycheck, and service charges and interest rates may amount to

twice or three times as much as you originally borrow

Definition: R = 2 ml/P(n + 1) in which:R = actual yearly rate of

interestm = number of installment payments per year (monthly, 12

Interest Rate Formula

payments; or weekly,52 payments)I = interest or installment

chargesP = amount borrowedn = number of payments to be made

Definition: A predictive score of your ability to pay back debts you

Credit Rating

take on for buy now, pay later purchases

Definition: A low-cost, nonprofit financial instution that offers low

Credit Union

interest loans to members

Definition: Requires that sellers disclose what buyers get charged for

Truth In Lending Act

credit purchases

Definition: A plan for spending your money based on total income

Budget

and likely expenses

Definition: Expenses that don't change and are due at regular

Fixed Expenses

intervals, such as mortgage payments

Definition: Expenses that change from month to month, such as

Flexible Expenses

groceries or fuel

© 2023 PF High School, LLC Page: 53 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Record of Income Definition: An itemized list of income sources and amounts

Definition: Comparing your bank statement balance with your

Balancing Your Checkbook

income/spending record

Definition: Bills for expenses such as fuel oil, electricity, telephone,

Service Bills

and water/sewer

Definition: A kind of home buying loan in which the lending institution

Mortgage (usually a bank) holds ownership of the property until the loan is paid

in full

Definition: Local taxes that vary depending on a property's location

Property Taxes

and assessed value

© 2023 PF High School, LLC Page: 54 of 111

© 2023 Career Step, LLC

© 2023 Education Holdings 1, LLC

© 2023 Sokanu Interactive

Budgeting and Goal Setting / Money Management

Practice Quiz: Money Management

This Practice Quiz is ungraded, and you can take it as many times as you want.

When you finish, you’ll be able to view whether your answer was correct or

incorrect. Click “View Feedback” after each item to see an explanation for the

correct answers. You won’t be allowed to go back and click “View Feedback” again,

so be sure to note of topics you may need to study more.

Question 1 (5.00 Points)