Professional Documents

Culture Documents

BSBTEC501 CBSA Business Plan V1

BSBTEC501 CBSA Business Plan V1

Uploaded by

Lis FalisCopyright:

Available Formats

You might also like

- SD BD001 - Business Plan CBSA V1.0 (ID 161466)Document11 pagesSD BD001 - Business Plan CBSA V1.0 (ID 161466)Ṁysterious ṀarufNo ratings yet

- Panasenko Polina SATDocument2 pagesPanasenko Polina SATPolina PanasenkoNo ratings yet

- Deloitte - Case InterviewDocument41 pagesDeloitte - Case InterviewClément Fagon100% (6)

- Trader Voice - Intro Deck: June 2020Document21 pagesTrader Voice - Intro Deck: June 2020Minh HoàngNo ratings yet

- Appendix 1 Case Study - Max Lionel RealtyDocument17 pagesAppendix 1 Case Study - Max Lionel Realtynirajan parajuli100% (1)

- Case Study CIAMDocument5 pagesCase Study CIAMTunde66No ratings yet

- Peer Mediated Instruction ArticleDocument12 pagesPeer Mediated Instruction ArticleMaria Angela B. SorianoNo ratings yet

- Apohan Marketing Presentation v55 16-03-2020 AJDocument62 pagesApohan Marketing Presentation v55 16-03-2020 AJarunjoshi12345No ratings yet

- Mi Primer DocumentoDocument1 pageMi Primer DocumentoDavid PrietoNo ratings yet

- 2022-11-HST Brief Profile2Document24 pages2022-11-HST Brief Profile2sefanitNo ratings yet

- Thecfocentrecompanyprofile 111122142351 Phpapp02Document23 pagesThecfocentrecompanyprofile 111122142351 Phpapp02Pooja MistryNo ratings yet

- Department Structure Telecom Companies: Michel ChamatDocument29 pagesDepartment Structure Telecom Companies: Michel ChamatLaxmi Sharma100% (1)

- Structure 2Document21 pagesStructure 2x.ra5eelahNo ratings yet

- Apohan Marketing Presentation v55 16-03-2020 AJDocument62 pagesApohan Marketing Presentation v55 16-03-2020 AJarunjoshi12345No ratings yet

- Kennis Profile 2019Document28 pagesKennis Profile 2019Ankita ShrivastavaNo ratings yet

- HRM PresnDocument9 pagesHRM Presndilsediltak_01No ratings yet

- Organization Chart Prudential IndonesiaDocument1 pageOrganization Chart Prudential IndonesiaVirginia DivinaNo ratings yet

- 2018 Salary Guide Singapore: About Gemini PersonnelDocument12 pages2018 Salary Guide Singapore: About Gemini PersonnelIkhsan Prajawan FadliNo ratings yet

- ABC Technologies - Coursework Case StudyDocument13 pagesABC Technologies - Coursework Case StudyZaheer AhmadNo ratings yet

- Integrated HR Solutions For Better Management of Your Human CapitalDocument32 pagesIntegrated HR Solutions For Better Management of Your Human CapitalMujtaba MerchantNo ratings yet

- Organisation Chart 21-11-2015Document1 pageOrganisation Chart 21-11-2015Shruti SharmaNo ratings yet

- InCorp Singapore Services Brochure (14dec22)Document5 pagesInCorp Singapore Services Brochure (14dec22)Yuni SartikaNo ratings yet

- 1-HCM-JA+Overview+v1.1 CORE FGDocument25 pages1-HCM-JA+Overview+v1.1 CORE FGIrina ArkhipovaNo ratings yet

- Pemetaan Core Competency N Support Comp1Document5 pagesPemetaan Core Competency N Support Comp1UtaryanaNo ratings yet

- Introduction To ConsultingDocument36 pagesIntroduction To ConsultingChristinaNo ratings yet

- The Coca-Cola Case - Why Transfer Pricing Is Important - Elliott DavisDocument4 pagesThe Coca-Cola Case - Why Transfer Pricing Is Important - Elliott DavisKasif RazaNo ratings yet

- HW1 - Motasem EsaefanDocument2 pagesHW1 - Motasem EsaefanMota D EsafanNo ratings yet

- Dashboard Go Live Oct 2018Document67 pagesDashboard Go Live Oct 2018Jeremy Sigarlaki100% (1)

- Vasan & Sampath - IntroductionDocument5 pagesVasan & Sampath - IntroductionominilightNo ratings yet

- SFS SolutionsDocument16 pagesSFS Solutionssfs solutionsNo ratings yet

- Introducing HR Measurement and ReportingDocument35 pagesIntroducing HR Measurement and Reportingtannen_manahanNo ratings yet

- Presenters: Date:: Department of Administrative ServicesDocument19 pagesPresenters: Date:: Department of Administrative ServicesNuwan Waidya GunasekaraNo ratings yet

- Final Project - Silk Bank1Document25 pagesFinal Project - Silk Bank1Muhammad Danish Rafique100% (1)

- Brochure - 1456132342-Usiness Brochure07.09 PDFDocument56 pagesBrochure - 1456132342-Usiness Brochure07.09 PDFNguanji ElvisNo ratings yet

- Simulated BusinessDocument20 pagesSimulated BusinessTatiana GMNo ratings yet

- MI Capital Services ProfileDocument49 pagesMI Capital Services ProfileUAE CPPBIDNo ratings yet

- PROFILE FINTECH MENARA JAMSOSTEK - ContohDocument18 pagesPROFILE FINTECH MENARA JAMSOSTEK - ContohRioz GonzalezNo ratings yet

- Technologyservicesunits 2017dec5Document11 pagesTechnologyservicesunits 2017dec5api-404869916No ratings yet

- Creating Finance & Accounting Policies Is A Lot of Work.: The Canadian Institute of Chartered AccountantsDocument4 pagesCreating Finance & Accounting Policies Is A Lot of Work.: The Canadian Institute of Chartered AccountantsÇetin ÖĞÜTNo ratings yet

- BUS11 Adept Owl Simulated-OrgChart (Blank Fill In)Document2 pagesBUS11 Adept Owl Simulated-OrgChart (Blank Fill In)alfaleizel leonesNo ratings yet

- CH01Document15 pagesCH01Mahesh ChintuNo ratings yet

- Terri's Resume Office ManagerDocument1 pageTerri's Resume Office ManagerTerri MunseyNo ratings yet

- ASC Corporate Profile EnglishDocument16 pagesASC Corporate Profile EnglishRajdeep SharmaNo ratings yet

- Career RoadmapDocument674 pagesCareer RoadmapBarath NarayanaswamyNo ratings yet

- The CFO ServicesDocument6 pagesThe CFO ServicesHarshil RaichuraNo ratings yet

- Appendices: Appendix 1: J&T Bank Simulated WorkplaceDocument6 pagesAppendices: Appendix 1: J&T Bank Simulated WorkplaceNidhi GuptaNo ratings yet

- On The Job Training ReportDocument16 pagesOn The Job Training ReportpariNo ratings yet

- Structure of The BankDocument1 pageStructure of The Bankabdiaziz hassanNo ratings yet

- Ites Industry Analysis: (Information Tecnology Enable Servies)Document30 pagesItes Industry Analysis: (Information Tecnology Enable Servies)mohan100% (1)

- Telenor Recruitment, Selection, Training, Compensation, Performance Management and International IhrmDocument23 pagesTelenor Recruitment, Selection, Training, Compensation, Performance Management and International IhrmAli Farooqui89% (9)

- Taxation Outlook For 2021Document27 pagesTaxation Outlook For 2021Alverdo RicardoNo ratings yet

- CFO Bridge StartUpsDocument5 pagesCFO Bridge StartUpsUddeshya GoelNo ratings yet

- FS Chapter3.Homebody EscapadeDocument9 pagesFS Chapter3.Homebody EscapadeArchille Laraga JosephNo ratings yet

- Design Design: Manufacturing CompanyDocument3 pagesDesign Design: Manufacturing CompanySharmaine manobanNo ratings yet

- RSM Webinar - Vat Updates 2022Document44 pagesRSM Webinar - Vat Updates 2022Iqbhal RamadhanNo ratings yet

- BSBMGT605 Appendix-1 Business PlanDocument25 pagesBSBMGT605 Appendix-1 Business PlanNida100% (1)

- Enterprise Global MngmentDocument15 pagesEnterprise Global MngmentchalaNo ratings yet

- Plantilla XPDocument1 pagePlantilla XPJhadyr TelloNo ratings yet

- Optimizing the Financial Lives of Clients: Harness the Power of an Accounting Firm's Elite Wealth Management PracticeFrom EverandOptimizing the Financial Lives of Clients: Harness the Power of an Accounting Firm's Elite Wealth Management PracticeNo ratings yet

- Making Technology Investments Profitable: ROI Road Map from Business Case to Value RealizationFrom EverandMaking Technology Investments Profitable: ROI Road Map from Business Case to Value RealizationRating: 3 out of 5 stars3/5 (2)

- Regression After Midterm 5Document80 pagesRegression After Midterm 5NataliAmiranashviliNo ratings yet

- A Comprehensive Investigation On High-Pressure LDPE Manufacturing: Dynamic Modelling of Compressor, Reactor and Separation UnitsDocument6 pagesA Comprehensive Investigation On High-Pressure LDPE Manufacturing: Dynamic Modelling of Compressor, Reactor and Separation UnitsParvınNo ratings yet

- Decolourisation of Water-Wastewater Using Adsorption (Review)Document18 pagesDecolourisation of Water-Wastewater Using Adsorption (Review)Altus Schoeman100% (1)

- Sentence TransformationDocument24 pagesSentence TransformationEric TrầnNo ratings yet

- Is 2798 (1998) - Methods of Test For Plastics ContainersDocument4 pagesIs 2798 (1998) - Methods of Test For Plastics Containersclintdara100% (1)

- 6 - MikroalgaDocument52 pages6 - MikroalgaSyohibhattul Islamiyah BaharNo ratings yet

- FM DocumentationDocument23 pagesFM DocumentationJohnMatthewBancilNo ratings yet

- RL0202O00062ADocument12 pagesRL0202O00062AAlokcargoNo ratings yet

- Mixed Model Assembly Sequencing at Toyota: Project Update: by Bo Liu, Yudhisthir PaudelDocument6 pagesMixed Model Assembly Sequencing at Toyota: Project Update: by Bo Liu, Yudhisthir PaudelyudhidelNo ratings yet

- Lead Carbon 12V 200ah: FeaturesDocument2 pagesLead Carbon 12V 200ah: FeaturesSara Maria GonzalezNo ratings yet

- CP15 Semester 4 PDFDocument33 pagesCP15 Semester 4 PDFmithunprayagNo ratings yet

- Youthpass Learning OutcomesDocument2 pagesYouthpass Learning OutcomesTheSyN100% (1)

- Parveen Model G Bottom Bypass Blanking PlugsDocument2 pagesParveen Model G Bottom Bypass Blanking PlugsJorge Luis vargasNo ratings yet

- Course Title: Transportation Engineering II Lab Course Code: CE 452Document4 pagesCourse Title: Transportation Engineering II Lab Course Code: CE 452Md. Murshedul Islam 173-47-091No ratings yet

- Amnex Corporate Presentation PDFDocument28 pagesAmnex Corporate Presentation PDFShweta SharmaNo ratings yet

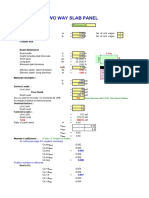

- Slab and Beam Design CalculationsDocument29 pagesSlab and Beam Design CalculationsAwais HameedNo ratings yet

- Air Conditioning PDFDocument74 pagesAir Conditioning PDFDatu JonathanNo ratings yet

- ES4000 Series IPCDocument3 pagesES4000 Series IPCAnderson RamalhoNo ratings yet

- MF8470-8480 каталог PDFDocument641 pagesMF8470-8480 каталог PDFСергій Xрестик100% (1)

- White Paper Dissolved Gas Analysis: © 2014 Schneider Electric All Rights ReservedDocument4 pagesWhite Paper Dissolved Gas Analysis: © 2014 Schneider Electric All Rights ReservedtusarNo ratings yet

- Prashant Jain PJ Sir COMPLETE MATHS PYQ PDF PYQ's ExportDocument20 pagesPrashant Jain PJ Sir COMPLETE MATHS PYQ PDF PYQ's ExportSourabh Singh100% (1)

- Chapter-1 t4b Group 4Document33 pagesChapter-1 t4b Group 4SethbaldovinoNo ratings yet

- HUMSS - DIASS12 - Module-5 - Gertrudes MalvarDocument16 pagesHUMSS - DIASS12 - Module-5 - Gertrudes MalvarAldrich SuarezNo ratings yet

- Laboratory Exercices For Analog and Digital Circuits Using NI ELVIS II NI Multisim 2Document150 pagesLaboratory Exercices For Analog and Digital Circuits Using NI ELVIS II NI Multisim 2zohas13No ratings yet

- The Impact of Current Transformer Saturation On The Distance ProtectionDocument6 pagesThe Impact of Current Transformer Saturation On The Distance ProtectionIRELECNo ratings yet

- Fairchild Display Power SolutionDocument58 pagesFairchild Display Power SolutionFrancisco Antonio100% (1)

- Ibs Ipoh Main, Jsis 1 30/06/20Document6 pagesIbs Ipoh Main, Jsis 1 30/06/20Muhdalihelmy MdYaakobNo ratings yet

- SosoDocument1 pageSosoVita VitaNo ratings yet

BSBTEC501 CBSA Business Plan V1

BSBTEC501 CBSA Business Plan V1

Uploaded by

Lis FalisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BSBTEC501 CBSA Business Plan V1

BSBTEC501 CBSA Business Plan V1

Uploaded by

Lis FalisCopyright:

Available Formats

Business Plan

BSBTEC501 CBSA Business plan V1 Page 1

Business details

Business name: Complete Business Solutions Australia Pty Ltd

Trading name: Complete Business Solutions Australia (CBSA)

Business structure: Company

ABN: 80 999 444 333

GST: Yes. Registered to pay GST

Business location: 300 Fictional Way, Sydney, NSW 2000

Domain names: www.cbsa.com.au

Date established: 10/05/1998

Business owner(s): Gavin Stead

Products/services: B2B Consultancy services

Our target audience

Target market: Small, medium, and enterprise size organisations.

Marketing strategy: Broad strategies of electronic, event based, and traditional advertising.

Tag line: ‘Your business expert’.

Business goals

Vision: To become Australia’s largest provider of business support and advocate of business needs

Mission: Helping businesses by becoming an extension of their business by providing end to end support

services across a wide range of areas. We form an intimate knowledge of our client’s business and therefore

become their partner in business.

Business goals:

▪ To become Australia’s largest business consultancy firm.

▪ To support business owners and their immediate and future needs.

▪ To deliver a first-class customer experience to ensure high levels of customer satisfaction.

▪ To remain up-to-date with the latest business compliance requirements.

BSBTEC501 CBSA Business plan V1 Page 2

Organisational chart

Gavin Stead

Managing Director

Sally Pierce

Personal Assistant

Tina Hughes Henry Thomas Wi Zhang

Sales & Marketing Con Kafatos Glenda Williams Governance Chief Finance Steve Alfonso

Manager IT Manager HR Manager Manager Officer Training Manager

Kelly Munro Jay Gartner

Business Sally Fischer Ian Banks Business Trish Gibbons Tracey White

Development Systems Analyst Contract Specialist Compliance Accounts Officier Trainer

Specialist Specialist

Adrian Russo Zane O'Brien Dave O'Connor

Marketing Tan Yamamoto Human Resources Sustainability May Lee Abby Smith

Strategist Software Developer Consultant Expert Payroll Trainer

Tina Yates Isha Khatri Jimmy Burton

IT Technician Legal Advisor Tax Agent

Sam Tailor Keith Banks Jane Porter

Support Specialist Auditor Financial Advisor

Jason Yee

James Hanson Brenda Hawkins

Health & Safety

Graphic Designer Advisor Accountant

BSBTEC501 CBSA Business Plan V1 Page 3

CBSA Board

To help meet the strategic direction of the organisation as opposed to the operational activities, three senior

staff form the CBSA Board as follows:

▪ Managing Director – Gavin Stead

▪ Chief Financial Officer – Wi Zhang

▪ Governance Manager – Henry Thomas.

The CBSA board objectives are to:

▪ set the strategic direction of the organisation

▪ uphold the organisations values

▪ ensure attainment of the organisations business objectives

▪ ensure the financial stability and viability of the organisation

▪ ensure compliance with legal and ethical obligations.

While CBSA staff are grouped and arranged around functional operational activities, individual staff members

are commonly placed into project teams for specific purposes to meet the many needs of CBSA clients. This

can lead to situations where lines of authority and responsibility of staff members can become blurred. Do

the project responsibilities take precedence or do day-to-day operational responsibilities take precedence?

To avoid potential conflicts, project governance forms a vital part of ensuring the clear roles and

responsibilities, levels of authority, and issue escalation and resolution processes are clearly defined for

each project. By implementing a clear plan, it is hoped that conflict will be minimalised between functional

managers needs and those of project managers.

Products and Services

Due to the wide range of services offered, and the needs of these services for each client, prices are

determined for each client after the initial consultation meeting. A profit ratio of 15-20% is the minimum

amount necessary for each of the client services offered after expenses have been covered.

BSBTEC501 CBSA Business Plan V1 Page 4

An example of the typical rates for major services in the following table:

Service Description Price (per hour

approx.)

Financial services Budgeting $100

Payroll $85–$125

Accountancy $140–$180

Bookkeeping $85–$125

Financial planning $100

Information Systems analyst and integration $200

Technology services

Website/software development $120–$150

Networking and security $120–$150

IT Support $65–$85

Business services Human resources (staff management, recruitment, $85–$125

contracts, position descriptions, etc.)

Auditing $150–$200

Branding and styling $85–$125

Legal advice $250–$500

Business compliance and administration $85–$125

Training services Range of training programs tailored to the client’s needs. $85–$150

Finance

Projected profit and loss for upcoming financial year 20XX

Income

IT Services $600,000.00

Financial Services $1,200,000.00

Business Services $1,200,000.00

HR Services $500,000.00

Training Services $85,000.00

Total income $3,585,000.00

BSBTEC501 CBSA Business Plan V1 Page 5

Costs of Goods Sold

Purchases $20,000.00

Total Costs of Goods Sold

$20,000.00

Expenses

Office Lease $100,000.00

Travel Expenses $85,000.00

Insurance $14,000.00

Wages and Salaries $2,600,000.00

Running Expenses $8,000.00

Utilities $8,000.00

Total Expenses $2,851,000.00

Net Position

Income $3,585,000.00

Cost of Goods Sold $20,000.00

Gross profit $3,565,000.00

Expenses $2,851,000.00

Other income $0.00

Other expenses $0.00

Net Position $750,000.00

Projected Profit Margin Ratio

The profit margin ratio formula is calculated by dividing net income by net sales:

Net income: $750,000.00 ÷

Net sales: $3,585,000.00

Profit margin ratio: 20.92%

Projected cash flow

The projected cash flow shows CBSA will generates sufficient cash flow to support operations:

Cash balance

$450,000.00

$400,000.00

$350,000.00

$300,000.00

$250,000.00

$200,000.00

$150,000.00

$100,000.00

$50,000.00

$-

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

BSBTEC501 CBSA Business Plan V1 Page 6

Advertising & sales

Advertising & promotional strategy

The following provides details of upcoming marketing strategies:

Type Expected business improvement Cost Target date

Website banner ads Generate leads to the website $2,500.00 Annual

Newspaper Targeted to increase sales by 5% $6,200.00 Annual

Radio Targeted to increase sales by 10% $18,900.00 31/06/20XX

Television Targeted to increase sales by 20% $50,575.00 31/10/20XX

Website Targeted to allow easy access to services $9,275.00 Annual

Email newsletter Targeted to retain customer loyalty $1,100.00 Annual

Facebook Targeted to raise organisation profile $600.00 Annual

Twitter Targeted to raise organisation profile $280.00 Annual

Instagram Targeted to raise organisation profile $300.00 Annual

LinkedIn Targeted to raise organisation profile $450.00 Annual

Sponsorship Targeted to raise organisation profile $8,500.00 30/06/20XX

Public events Targeted to raise organisation profile $19,050.00 30/06/20XX

Winter sales campaign Targeted to increase sales by 15% $12,000.00 31/08/20XX

Summer sales Targeted to increase sales by 15% $9,500.00 31/03/20XX

campaign

Sales & Distribution Channels

Channel type Percentage of sales

Electronic 65%

Direct contact 25%

Shopfront 10%

Business model

The business deals directly with B2B - Small, medium, and enterprise size organisations

BSBTEC501 CBSA Business Plan V1 Page 7

Operations

Trading hours

The business is operational during the following hours:

▪ Monday – Friday: 9 a.m. – 5:30 p.m.

▪ Public holidays: Closed.

▪ Exceptions can be made depending on the client requirements. Different hours can be negotiated

depending on circumstance.

Business Services value chain

Plant and equipment

CBSA utilises the following plant and equipment for its operations:

Equipment Purchase date Purchase Running costs

price

29 x Personal Computer/laptops 07/03/20XX $2,000 each $2,500 per month

2 x Network servers 15/02/20XX $4,000 each $300 per month

Network router 15/02/20XX $300 $10 per month

2 x Network switches 15/02/20XX $250 each $20 per month

BSBTEC501 CBSA Business Plan V1 Page 8

Fridge 01/02/20XX $1,800 $20 per month

Microwave 01/02/20XX $400 $15 per month

Television 01/02/20XX $1,500 $20 per month

Technology (Software)

CBSA utilises the following software for its operations:

Software Cost License Expiry

Count

Windows 10 Professional $199 28 None

Windows Server 2016 Standard $849 2 None

Office 365 Enterprise E3 $30 per month/per user 28 Monthly

Salesforce $75 per month/per user 8 Monthly

MYOB AccountRight $55 per month/per user 7 Monthly

Visual Studio 2017 Professional $539 per year 3 Annual

NetBeans IDE 8.0.2 $0 4 None

Brackets 1.13 $0 4 None

WordPress 4.9.8 $0 4 None

Technology e-commerce resourcing, technical and security requirements

Resourcing Technical & security requirements

CBSA will ensure the following resources are CBSA supports the following technical and security

available to support e-commerce business requirements when operating e-commerce business

solutions: solutions:

▪ Computer system 1. Integrity: prevention against unauthorised data

modification

▪ Internet connection

2. Nonrepudiation: prevention against any one

▪ Social media, platforms and applications party from reneging on an agreement after the

fact

▪ Technically qualified staff

3. Authenticity: authentication of data source

▪ System of receiving payments

4. Confidentiality: protection against unauthorized

▪ Well-designed website data disclosure

▪ Effective telecommunication system 5. Privacy: provision of data control and disclosure

6. Availability: prevention against data delays or

removal

BSBTEC501 CBSA Business Plan V1 Page 9

Communication channels

CBSA customers get in contact using the following channels:

▪ telephone

▪ physical location (storefront)

▪ website

▪ social media.

Payment types accepted

Payment types that CBSA accepts include:

▪ cash

▪ credit

▪ Electronic Funds Transfer (EFT)

▪ cheque

▪ PayPal

▪ Stripe.

BSBTEC501 CBSA Business Plan V1 Page 10

You might also like

- SD BD001 - Business Plan CBSA V1.0 (ID 161466)Document11 pagesSD BD001 - Business Plan CBSA V1.0 (ID 161466)Ṁysterious ṀarufNo ratings yet

- Panasenko Polina SATDocument2 pagesPanasenko Polina SATPolina PanasenkoNo ratings yet

- Deloitte - Case InterviewDocument41 pagesDeloitte - Case InterviewClément Fagon100% (6)

- Trader Voice - Intro Deck: June 2020Document21 pagesTrader Voice - Intro Deck: June 2020Minh HoàngNo ratings yet

- Appendix 1 Case Study - Max Lionel RealtyDocument17 pagesAppendix 1 Case Study - Max Lionel Realtynirajan parajuli100% (1)

- Case Study CIAMDocument5 pagesCase Study CIAMTunde66No ratings yet

- Peer Mediated Instruction ArticleDocument12 pagesPeer Mediated Instruction ArticleMaria Angela B. SorianoNo ratings yet

- Apohan Marketing Presentation v55 16-03-2020 AJDocument62 pagesApohan Marketing Presentation v55 16-03-2020 AJarunjoshi12345No ratings yet

- Mi Primer DocumentoDocument1 pageMi Primer DocumentoDavid PrietoNo ratings yet

- 2022-11-HST Brief Profile2Document24 pages2022-11-HST Brief Profile2sefanitNo ratings yet

- Thecfocentrecompanyprofile 111122142351 Phpapp02Document23 pagesThecfocentrecompanyprofile 111122142351 Phpapp02Pooja MistryNo ratings yet

- Department Structure Telecom Companies: Michel ChamatDocument29 pagesDepartment Structure Telecom Companies: Michel ChamatLaxmi Sharma100% (1)

- Structure 2Document21 pagesStructure 2x.ra5eelahNo ratings yet

- Apohan Marketing Presentation v55 16-03-2020 AJDocument62 pagesApohan Marketing Presentation v55 16-03-2020 AJarunjoshi12345No ratings yet

- Kennis Profile 2019Document28 pagesKennis Profile 2019Ankita ShrivastavaNo ratings yet

- HRM PresnDocument9 pagesHRM Presndilsediltak_01No ratings yet

- Organization Chart Prudential IndonesiaDocument1 pageOrganization Chart Prudential IndonesiaVirginia DivinaNo ratings yet

- 2018 Salary Guide Singapore: About Gemini PersonnelDocument12 pages2018 Salary Guide Singapore: About Gemini PersonnelIkhsan Prajawan FadliNo ratings yet

- ABC Technologies - Coursework Case StudyDocument13 pagesABC Technologies - Coursework Case StudyZaheer AhmadNo ratings yet

- Integrated HR Solutions For Better Management of Your Human CapitalDocument32 pagesIntegrated HR Solutions For Better Management of Your Human CapitalMujtaba MerchantNo ratings yet

- Organisation Chart 21-11-2015Document1 pageOrganisation Chart 21-11-2015Shruti SharmaNo ratings yet

- InCorp Singapore Services Brochure (14dec22)Document5 pagesInCorp Singapore Services Brochure (14dec22)Yuni SartikaNo ratings yet

- 1-HCM-JA+Overview+v1.1 CORE FGDocument25 pages1-HCM-JA+Overview+v1.1 CORE FGIrina ArkhipovaNo ratings yet

- Pemetaan Core Competency N Support Comp1Document5 pagesPemetaan Core Competency N Support Comp1UtaryanaNo ratings yet

- Introduction To ConsultingDocument36 pagesIntroduction To ConsultingChristinaNo ratings yet

- The Coca-Cola Case - Why Transfer Pricing Is Important - Elliott DavisDocument4 pagesThe Coca-Cola Case - Why Transfer Pricing Is Important - Elliott DavisKasif RazaNo ratings yet

- HW1 - Motasem EsaefanDocument2 pagesHW1 - Motasem EsaefanMota D EsafanNo ratings yet

- Dashboard Go Live Oct 2018Document67 pagesDashboard Go Live Oct 2018Jeremy Sigarlaki100% (1)

- Vasan & Sampath - IntroductionDocument5 pagesVasan & Sampath - IntroductionominilightNo ratings yet

- SFS SolutionsDocument16 pagesSFS Solutionssfs solutionsNo ratings yet

- Introducing HR Measurement and ReportingDocument35 pagesIntroducing HR Measurement and Reportingtannen_manahanNo ratings yet

- Presenters: Date:: Department of Administrative ServicesDocument19 pagesPresenters: Date:: Department of Administrative ServicesNuwan Waidya GunasekaraNo ratings yet

- Final Project - Silk Bank1Document25 pagesFinal Project - Silk Bank1Muhammad Danish Rafique100% (1)

- Brochure - 1456132342-Usiness Brochure07.09 PDFDocument56 pagesBrochure - 1456132342-Usiness Brochure07.09 PDFNguanji ElvisNo ratings yet

- Simulated BusinessDocument20 pagesSimulated BusinessTatiana GMNo ratings yet

- MI Capital Services ProfileDocument49 pagesMI Capital Services ProfileUAE CPPBIDNo ratings yet

- PROFILE FINTECH MENARA JAMSOSTEK - ContohDocument18 pagesPROFILE FINTECH MENARA JAMSOSTEK - ContohRioz GonzalezNo ratings yet

- Technologyservicesunits 2017dec5Document11 pagesTechnologyservicesunits 2017dec5api-404869916No ratings yet

- Creating Finance & Accounting Policies Is A Lot of Work.: The Canadian Institute of Chartered AccountantsDocument4 pagesCreating Finance & Accounting Policies Is A Lot of Work.: The Canadian Institute of Chartered AccountantsÇetin ÖĞÜTNo ratings yet

- BUS11 Adept Owl Simulated-OrgChart (Blank Fill In)Document2 pagesBUS11 Adept Owl Simulated-OrgChart (Blank Fill In)alfaleizel leonesNo ratings yet

- CH01Document15 pagesCH01Mahesh ChintuNo ratings yet

- Terri's Resume Office ManagerDocument1 pageTerri's Resume Office ManagerTerri MunseyNo ratings yet

- ASC Corporate Profile EnglishDocument16 pagesASC Corporate Profile EnglishRajdeep SharmaNo ratings yet

- Career RoadmapDocument674 pagesCareer RoadmapBarath NarayanaswamyNo ratings yet

- The CFO ServicesDocument6 pagesThe CFO ServicesHarshil RaichuraNo ratings yet

- Appendices: Appendix 1: J&T Bank Simulated WorkplaceDocument6 pagesAppendices: Appendix 1: J&T Bank Simulated WorkplaceNidhi GuptaNo ratings yet

- On The Job Training ReportDocument16 pagesOn The Job Training ReportpariNo ratings yet

- Structure of The BankDocument1 pageStructure of The Bankabdiaziz hassanNo ratings yet

- Ites Industry Analysis: (Information Tecnology Enable Servies)Document30 pagesItes Industry Analysis: (Information Tecnology Enable Servies)mohan100% (1)

- Telenor Recruitment, Selection, Training, Compensation, Performance Management and International IhrmDocument23 pagesTelenor Recruitment, Selection, Training, Compensation, Performance Management and International IhrmAli Farooqui89% (9)

- Taxation Outlook For 2021Document27 pagesTaxation Outlook For 2021Alverdo RicardoNo ratings yet

- CFO Bridge StartUpsDocument5 pagesCFO Bridge StartUpsUddeshya GoelNo ratings yet

- FS Chapter3.Homebody EscapadeDocument9 pagesFS Chapter3.Homebody EscapadeArchille Laraga JosephNo ratings yet

- Design Design: Manufacturing CompanyDocument3 pagesDesign Design: Manufacturing CompanySharmaine manobanNo ratings yet

- RSM Webinar - Vat Updates 2022Document44 pagesRSM Webinar - Vat Updates 2022Iqbhal RamadhanNo ratings yet

- BSBMGT605 Appendix-1 Business PlanDocument25 pagesBSBMGT605 Appendix-1 Business PlanNida100% (1)

- Enterprise Global MngmentDocument15 pagesEnterprise Global MngmentchalaNo ratings yet

- Plantilla XPDocument1 pagePlantilla XPJhadyr TelloNo ratings yet

- Optimizing the Financial Lives of Clients: Harness the Power of an Accounting Firm's Elite Wealth Management PracticeFrom EverandOptimizing the Financial Lives of Clients: Harness the Power of an Accounting Firm's Elite Wealth Management PracticeNo ratings yet

- Making Technology Investments Profitable: ROI Road Map from Business Case to Value RealizationFrom EverandMaking Technology Investments Profitable: ROI Road Map from Business Case to Value RealizationRating: 3 out of 5 stars3/5 (2)

- Regression After Midterm 5Document80 pagesRegression After Midterm 5NataliAmiranashviliNo ratings yet

- A Comprehensive Investigation On High-Pressure LDPE Manufacturing: Dynamic Modelling of Compressor, Reactor and Separation UnitsDocument6 pagesA Comprehensive Investigation On High-Pressure LDPE Manufacturing: Dynamic Modelling of Compressor, Reactor and Separation UnitsParvınNo ratings yet

- Decolourisation of Water-Wastewater Using Adsorption (Review)Document18 pagesDecolourisation of Water-Wastewater Using Adsorption (Review)Altus Schoeman100% (1)

- Sentence TransformationDocument24 pagesSentence TransformationEric TrầnNo ratings yet

- Is 2798 (1998) - Methods of Test For Plastics ContainersDocument4 pagesIs 2798 (1998) - Methods of Test For Plastics Containersclintdara100% (1)

- 6 - MikroalgaDocument52 pages6 - MikroalgaSyohibhattul Islamiyah BaharNo ratings yet

- FM DocumentationDocument23 pagesFM DocumentationJohnMatthewBancilNo ratings yet

- RL0202O00062ADocument12 pagesRL0202O00062AAlokcargoNo ratings yet

- Mixed Model Assembly Sequencing at Toyota: Project Update: by Bo Liu, Yudhisthir PaudelDocument6 pagesMixed Model Assembly Sequencing at Toyota: Project Update: by Bo Liu, Yudhisthir PaudelyudhidelNo ratings yet

- Lead Carbon 12V 200ah: FeaturesDocument2 pagesLead Carbon 12V 200ah: FeaturesSara Maria GonzalezNo ratings yet

- CP15 Semester 4 PDFDocument33 pagesCP15 Semester 4 PDFmithunprayagNo ratings yet

- Youthpass Learning OutcomesDocument2 pagesYouthpass Learning OutcomesTheSyN100% (1)

- Parveen Model G Bottom Bypass Blanking PlugsDocument2 pagesParveen Model G Bottom Bypass Blanking PlugsJorge Luis vargasNo ratings yet

- Course Title: Transportation Engineering II Lab Course Code: CE 452Document4 pagesCourse Title: Transportation Engineering II Lab Course Code: CE 452Md. Murshedul Islam 173-47-091No ratings yet

- Amnex Corporate Presentation PDFDocument28 pagesAmnex Corporate Presentation PDFShweta SharmaNo ratings yet

- Slab and Beam Design CalculationsDocument29 pagesSlab and Beam Design CalculationsAwais HameedNo ratings yet

- Air Conditioning PDFDocument74 pagesAir Conditioning PDFDatu JonathanNo ratings yet

- ES4000 Series IPCDocument3 pagesES4000 Series IPCAnderson RamalhoNo ratings yet

- MF8470-8480 каталог PDFDocument641 pagesMF8470-8480 каталог PDFСергій Xрестик100% (1)

- White Paper Dissolved Gas Analysis: © 2014 Schneider Electric All Rights ReservedDocument4 pagesWhite Paper Dissolved Gas Analysis: © 2014 Schneider Electric All Rights ReservedtusarNo ratings yet

- Prashant Jain PJ Sir COMPLETE MATHS PYQ PDF PYQ's ExportDocument20 pagesPrashant Jain PJ Sir COMPLETE MATHS PYQ PDF PYQ's ExportSourabh Singh100% (1)

- Chapter-1 t4b Group 4Document33 pagesChapter-1 t4b Group 4SethbaldovinoNo ratings yet

- HUMSS - DIASS12 - Module-5 - Gertrudes MalvarDocument16 pagesHUMSS - DIASS12 - Module-5 - Gertrudes MalvarAldrich SuarezNo ratings yet

- Laboratory Exercices For Analog and Digital Circuits Using NI ELVIS II NI Multisim 2Document150 pagesLaboratory Exercices For Analog and Digital Circuits Using NI ELVIS II NI Multisim 2zohas13No ratings yet

- The Impact of Current Transformer Saturation On The Distance ProtectionDocument6 pagesThe Impact of Current Transformer Saturation On The Distance ProtectionIRELECNo ratings yet

- Fairchild Display Power SolutionDocument58 pagesFairchild Display Power SolutionFrancisco Antonio100% (1)

- Ibs Ipoh Main, Jsis 1 30/06/20Document6 pagesIbs Ipoh Main, Jsis 1 30/06/20Muhdalihelmy MdYaakobNo ratings yet

- SosoDocument1 pageSosoVita VitaNo ratings yet