Professional Documents

Culture Documents

Consignments and Bill of Exchange

Consignments and Bill of Exchange

Uploaded by

Nurfarhanis Bt Azamuddin AnisOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consignments and Bill of Exchange

Consignments and Bill of Exchange

Uploaded by

Nurfarhanis Bt Azamuddin AnisCopyright:

Available Formats

CONSIGNMENTS AND BILLS OF EXCHANGE

DEFINITION Goods are delivered to another company with the understanding that payment for the goods is only made once the goods are sold. Consignment can cover just about any type of business. It is advantageous for the seller of consigned goods, because they don't need to pay suppliers upfront. The act of sending goods is called Consigning. Consignor The person sending the goods has ownership and risk in the goods, consignee holds the goods on behalf of the consignor. The consignor is responsible for the acts of the consignee in his status as an agent.

Consignee

The person receiving the goods and selling acts as the agent of the consignor only. The Consignee sells goods on behalf of the consignor and receives commission for his efforts. Any incidental expenses on the sale are to be reimbursed by the consignor or as agreed between them

DIFFERENCES BETWEEN CONSIGNMENT BUSSINESS AND NORMAL BUSSINESS

1. Transfer of Legal Ownership of the Goods: In case of sale, the legal ownership of the goods sold is transferred to the purchaser of goods. Whereas in case of a consignment of goods, the legal ownership of the goods is not transferred to the consignment but the ownership of the goods remains vested in the consignor till the goods consigned are sold by the consignee. 2. Relationship Between Consignor and Consignee: In case of a sale of goods, the relationship between the seller and the purchaser of the goods is that of a creditor and a debtor whereas in case of a consignment the relationship between the consignor and the consignee is that of a principal and agent. because the consignee is to sell goods on behalf of the consignor.

3. Expenses Incurred: In consignment, expenses incurred by the consignee in connection with the goods consigned to him are usually borne by the consignor whereas in case of a sale, expenses incurred after sale of goods are born by the purchaser. 4. Risk Attached to the Goods: In case of consignment, risk attached to the goods sold lies with the consignor till the goods consigned are sold by the consignee. But in case of a sale, risk attached to the goods sold is transferred to the buyer of goods. 5. Return of Goods: In case of consignment, return of goods is possible if the goods are not sold by the consignee. But in case of sale, return of goods is not possible as goods once sold are not returnable. 6. Requirement of Account Sale: In case of consignment, account sale is required to be submitted periodically by the consignee to the consignor. But in case of sales no account sale is required to be submitted by the purchaser to the seller.

PREPARATION ACCOUNT ON CONSIGNORS BOOKS As the goods sent on consignment by the consigner are not his sales, he must not record consignment as sales and the consignee must not record them as purchases. The consigner should not take up any profit on the transaction until the goods have been actually sold by the consignee. Since the goods still belong to the consignor, any unsold goods in the hands of the consignee at the end of the trading period should be included in the consignor's stock. The recording of the consignment transactions in the books of the consignor and consignee will be made in the following manner: (1) On dispatch of goods:Dr. Consignment account Cr. To Goods sent on consignment account (2) On payment of expenses on dispatch:Dr. Consignment account Cr. To Bank account (3) On receiving advance: Dr. Cash or bills receivable account Cr. To Consignee's personal account

(With the cost of goods)

(With the amount spent as expenses)

(With the amount cash or bill)

(4) On the consignee reporting sale (as per A/S):Dr. Consignee's personal account Cr. To Consignment account (5) For expenses incurred by the consignee (as per A/S):Dr. Consignment account Cr. To Consignee's personal account (6) For commission payable to the consignee:Dr. Consignment account Cr. To Consignee's personal account

(With gross proceeds of sales)

(With the amount of expenses)

(With the amount of expenses)

Assuming that all the goods sent have been sold, the consignment account will show at this stage the actual profit or loss made on it. The same is transferred to profit and loss account. The entry in case of profit is: Dr. Consignment account Cr. To profit and loss account In case of loss the entry is: Dr. Profit and loss account Cr. To Consignment account Note: The goods sent on consignment account may be closed by a transfer to trading account. When Consignment is Partly Sold: When all the goods sent on consignment have not been sold., the value of unsold goods in the hands of the consignee must be ascertained and the profit or loss should be found out by taking this stock into account. The entry is: Dr. Stock on consignment account Cr. To Consignment account Stock on consignment account is an asset and will be shown in the balance sheet of the consignor. Valuation of stock is discussed on valuation of stock page.

PREPARATION ACCOUNT ON CONSIGNEE BOOKS (1) When consignment goods are received:No entry is made in the books of account. The consignee is not the owner of the goods and therefore he makes no entry when he receives the goods. (2) For expenses incurred by the consignee:Dr. Consignor's personal account Cr. To Cash account (3) When advance is given:Dr. Consignor's personal account Cr. To Cash or bills payable account (4) When goods are sold:Dr. Cash or bank account Cr. To Consignor's personal account (5) For commission due:Dr. Consignor's personal account Cr. To commission account The consignor's account will be closed by debiting it with cash or final bill or draft in settlement.

THE CONCEPT BILLS OF EXCHANGE A bill of exchange or "draft" is a written order by the drawer to the drawee to pay money to the payee. A common type of bill of exchange is the cheque, defined as a bill of exchange drawn on a banker and payable on demand. Bills of exchange are used primarily in international trade, and are written orders by one person to his bank to pay the bearer a specific sum on a specific date. Prior to the advent of paper currency, bills of exchange were a common means of exchange. They are not used as often today. A bill of exchange is an unconditional order in writing addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at fixed or determinable future time a sum certain in money to order or to bearer. It is essentially an order made by one person to another to pay money to a third person. A bill of exchange requires in its inception three partiesthe drawer, the drawee, and the payee. The person who draws the bill is called the drawer. He gives the order to pay money to the third party. The party upon whom the bill is drawn is called the drawee. He is the person to whom the bill is addressed and who is ordered to pay. He becomes an acceptor when he indicates his willingness to pay the bill. The party in whose favor the bill is drawn or is payable is called the payee.

You might also like

- Bill 10296080Document1 pageBill 10296080luminitamihai775No ratings yet

- Notification of Change of OwnershipDocument3 pagesNotification of Change of OwnershipMark BurkeNo ratings yet

- Test Bank 3 - GitmanDocument62 pagesTest Bank 3 - GitmanCamille Santos20% (5)

- Supply and Demand How To Find and Trade The Best ZonesNew PDFDocument25 pagesSupply and Demand How To Find and Trade The Best ZonesNew PDFYagnesh Patel100% (12)

- Summer Internship Project Report On "Overview Study of Stock Exchange Market of India" Submitted byDocument31 pagesSummer Internship Project Report On "Overview Study of Stock Exchange Market of India" Submitted byDurgesh YadavNo ratings yet

- Agreement On Rentage of Cocoa Farm LandDocument1 pageAgreement On Rentage of Cocoa Farm LandAlex100% (1)

- Parcel Perfect Integration Service - v7Document8 pagesParcel Perfect Integration Service - v7Ross SaundersNo ratings yet

- Standard Operating Procedure For Collecting CASH On DELIVERYDocument2 pagesStandard Operating Procedure For Collecting CASH On DELIVERYKartik Bhandari100% (3)

- 100kg Fco Trial Shipment of Alluvial Au Gold Dust Available Urgent For Shipment To Buyers IonDocument2 pages100kg Fco Trial Shipment of Alluvial Au Gold Dust Available Urgent For Shipment To Buyers IonSte Desire SarlNo ratings yet

- Introduction Letter - Postnet The Glen: Theglen@Postnet - Co.ZaDocument2 pagesIntroduction Letter - Postnet The Glen: Theglen@Postnet - Co.ZaSimbarashe MarisaNo ratings yet

- CMR Consignment Note FormDocument5 pagesCMR Consignment Note FormGlobal NegotiatorNo ratings yet

- Ms Word Format Audit Engagement Letter Cos Act 2013Document10 pagesMs Word Format Audit Engagement Letter Cos Act 2013kanavNo ratings yet

- Application Form For Foreign Exchange Services: Specify)Document7 pagesApplication Form For Foreign Exchange Services: Specify)Reena Rizza Ocampo0% (1)

- KYC Form (Final)Document1 pageKYC Form (Final)plr.postNo ratings yet

- 2018-11-01 DNA Magazine PDFDocument103 pages2018-11-01 DNA Magazine PDFShane Erasmus20% (5)

- Consignment Accounts: Consignment-What Is It?Document6 pagesConsignment Accounts: Consignment-What Is It?neeraj goyal100% (1)

- CONSIGNMENT ACCOUNT - Docx2Document8 pagesCONSIGNMENT ACCOUNT - Docx2Gamer nestNo ratings yet

- Summary of Accounting EntriesDocument7 pagesSummary of Accounting EntriesABINASHNo ratings yet

- A1 For Import Goods PaymentsDocument3 pagesA1 For Import Goods PaymentskollarajasekharNo ratings yet

- KYC DocumentsDocument3 pagesKYC DocumentsnaseemNo ratings yet

- Customs AssignmentDocument6 pagesCustoms AssignmentBlessing MapokaNo ratings yet

- Advance Payment DisbursementDocument4 pagesAdvance Payment DisbursementAb WahabNo ratings yet

- PB Fees and ChargesDocument32 pagesPB Fees and ChargesechipbkNo ratings yet

- 1 Sea Logistics Business Operation Process Management System 1.1 PurposeDocument6 pages1 Sea Logistics Business Operation Process Management System 1.1 PurposeK58 Phạm Thị Hồng NgọcNo ratings yet

- Military Leave Approval LetterDocument2 pagesMilitary Leave Approval LetterMy love of LifeNo ratings yet

- Investment Application FormDocument2 pagesInvestment Application FormAdnan Zahid100% (1)

- Dormant CompanyDocument3 pagesDormant CompanyAvaniJainNo ratings yet

- Vintage Animal Shippers: Vintage Animalshippers Refunds Form G43Document1 pageVintage Animal Shippers: Vintage Animalshippers Refunds Form G43ABS CONSULTORIANo ratings yet

- Gold ProceduresDocument4 pagesGold ProceduresHoainam2468No ratings yet

- Proof of Funds Letter Template 05Document1 pageProof of Funds Letter Template 05Dk KimNo ratings yet

- How The Shipping Process Works Step by SDocument10 pagesHow The Shipping Process Works Step by SPablo Godoy OssesNo ratings yet

- Hazardous Waste Consignee ReturnsDocument26 pagesHazardous Waste Consignee ReturnsanyinyiaungNo ratings yet

- Attorney and Agent FeesDocument55 pagesAttorney and Agent FeesJimNo ratings yet

- Shipping & Delivery PDFDocument14 pagesShipping & Delivery PDFDozami MarketingNo ratings yet

- Application Format Application For The Post of by AbsorptionDocument3 pagesApplication Format Application For The Post of by Absorptionbonat07No ratings yet

- Build Card Military Lending Act Cardholder AgreementDocument8 pagesBuild Card Military Lending Act Cardholder Agreementprateekmehta92No ratings yet

- Courier 7.18.12Document20 pagesCourier 7.18.12Claremont CourierNo ratings yet

- Letter FormateDocument6 pagesLetter FormateRobin SahaNo ratings yet

- Export Procedure in IndiaDocument16 pagesExport Procedure in IndiaRohan AroraNo ratings yet

- Business Proposition From Dr. Aminudin Abdul KarimDocument2 pagesBusiness Proposition From Dr. Aminudin Abdul KarimViji Raj KumarNo ratings yet

- Management Practices At: Orient Cargo (PVT) LTDDocument16 pagesManagement Practices At: Orient Cargo (PVT) LTDKhuram ManzoorNo ratings yet

- 1 - Engagement Letter FormatDocument3 pages1 - Engagement Letter FormatMuhammad AsimNo ratings yet

- Client Care LetterDocument6 pagesClient Care Letteranh98762No ratings yet

- US Payroll SetupDocument43 pagesUS Payroll Setupgkumarraos100% (1)

- Mcs Depot Drop Ship AgreementDocument5 pagesMcs Depot Drop Ship Agreementpeshkov7No ratings yet

- Letter of Certification - Marital StatusDocument1 pageLetter of Certification - Marital Statusมดน้อย ผู้น่ารักNo ratings yet

- Georgian Customs SystemDocument22 pagesGeorgian Customs SystemRajesh GuptaNo ratings yet

- Courier FormDocument1 pageCourier FormArooz Paul Paul SinghNo ratings yet

- Subscription AgreementDocument5 pagesSubscription AgreementjfmohamadNo ratings yet

- 1.3 Export Shipping DocDocument9 pages1.3 Export Shipping Docjayesh vasaniNo ratings yet

- Trust DeedDocument2 pagesTrust DeedLorrenzo Public SchoolNo ratings yet

- Cash Against DocumentsDocument4 pagesCash Against DocumentsKureshi Sana100% (2)

- Used Cars For Sale Offer FormDocument3 pagesUsed Cars For Sale Offer FormRaymond GabrielNo ratings yet

- Introduction and Brief History of Fund (Read Deligently)Document2 pagesIntroduction and Brief History of Fund (Read Deligently)አረጋዊ ሐይለማርያምNo ratings yet

- Congratulation Contact United Nations Office LondonDocument7 pagesCongratulation Contact United Nations Office Londonmanjeet.singh837824No ratings yet

- Export-Import DocumentationDocument34 pagesExport-Import DocumentationSiddharth OjahNo ratings yet

- APPENDIX 25 B (Legal Agreement-Undertaking Format)Document4 pagesAPPENDIX 25 B (Legal Agreement-Undertaking Format)PrashantNo ratings yet

- Export Customs ProcedureDocument3 pagesExport Customs Procedurefaz_abbasNo ratings yet

- Futro Terms and ConditionsDocument3 pagesFutro Terms and ConditionsMohitNo ratings yet

- MD Riyad VisaDocument3 pagesMD Riyad Visamzu2441139No ratings yet

- Billing and CollectionDocument24 pagesBilling and CollectionRoby IbeNo ratings yet

- Montana LLC Articles of OrgranizationDocument3 pagesMontana LLC Articles of OrgranizationRocketLawyerNo ratings yet

- The Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderDocument1 pageThe Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderarvinfoNo ratings yet

- My Online Dating Experience: I Believe in My Success and Yours TooFrom EverandMy Online Dating Experience: I Believe in My Success and Yours TooNo ratings yet

- 2848 Unit 1 Specialized Financial Accounting Chapter - 1 Consignment RevisedDocument12 pages2848 Unit 1 Specialized Financial Accounting Chapter - 1 Consignment RevisedKersey AquinoNo ratings yet

- TelephoneBill 8253069363Document3 pagesTelephoneBill 8253069363sourajpatelNo ratings yet

- Fin C 000002Document14 pagesFin C 000002Nageshwar SinghNo ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- FLS011 Application For PenCon Special STLDocument2 pagesFLS011 Application For PenCon Special STLwillienorNo ratings yet

- 77 FDocument3 pages77 FJohn CalvinNo ratings yet

- Housing Development Finance Corporation LimitedDocument3 pagesHousing Development Finance Corporation LimitedHoney AliNo ratings yet

- EBIT - EPS QuestionsDocument6 pagesEBIT - EPS QuestionsTaliya ShaikhNo ratings yet

- Tutorial 5Document5 pagesTutorial 5Jian Zhi TehNo ratings yet

- Lecture 14Document57 pagesLecture 14Billiee ButccherNo ratings yet

- ReceiptDocument1 pageReceiptjohn belhaNo ratings yet

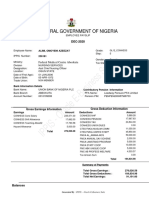

- IPPIS - Oracle E-Business Suite: Federal Government of NigeriaDocument1 pageIPPIS - Oracle E-Business Suite: Federal Government of NigeriaAlimi kehinde100% (1)

- FM CH 2Document18 pagesFM CH 2sosina eseyewNo ratings yet

- Advantages and Disadvantages of Equity SharesDocument2 pagesAdvantages and Disadvantages of Equity Sharespiyush chauhanNo ratings yet

- Lembar Kerja Mengelola Buku Jurnal: Praktek Akuntansi Keuangan (Manual)Document11 pagesLembar Kerja Mengelola Buku Jurnal: Praktek Akuntansi Keuangan (Manual)Putri AgustinaNo ratings yet

- Muthoot Fincorp CalrificationsDocument6 pagesMuthoot Fincorp CalrificationslulughoshNo ratings yet

- Cash and CequizDocument5 pagesCash and CequizMaria Emarla Grace CanozaNo ratings yet

- Case 3 CemexDocument20 pagesCase 3 CemexAsep KurniawanNo ratings yet

- Ecovisionnaire Most Expected TopicsDocument4 pagesEcovisionnaire Most Expected Topicsmayank698945No ratings yet

- Business and MoneyDocument4 pagesBusiness and MoneyPaz MorenoNo ratings yet

- Cash and Proof of Cash ProblemsDocument2 pagesCash and Proof of Cash ProblemsDivine MungcalNo ratings yet

- Money Laundering in IndiaDocument9 pagesMoney Laundering in IndiaRajhas PoonuruNo ratings yet

- Corporation TaxationDocument16 pagesCorporation TaxationMeg Lee0% (1)

- Telus 40042789 2023 03 25Document10 pagesTelus 40042789 2023 03 25Harold KumarNo ratings yet

- 93f9821f Fee Schedule 2023 2024Document16 pages93f9821f Fee Schedule 2023 2024ismaelomugshaNo ratings yet

- Assotech Windsor Court Price ListDocument3 pagesAssotech Windsor Court Price ListGreen Realtech Projects Pvt LtdNo ratings yet