Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

4 viewsCW 9.12.23

CW 9.12.23

Uploaded by

Aashima BajajThe document defines different types of working capital including gross working capital, which equals current assets, and net working capital, which equals current assets minus current liabilities. It then provides an example calculation of the length of an operating cycle by summing the number of days for raw materials, work in progress, finished goods, and debtors, then subtracting the creditors payment period. The operating cycle length for the example given is 196 days.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- CH2 Practice QuestionsDocument11 pagesCH2 Practice QuestionsenkeltvrelseNo ratings yet

- Working Capital and Operating CycleDocument24 pagesWorking Capital and Operating Cyclesaurabh chaturvediNo ratings yet

- Working Capital Management PDFDocument46 pagesWorking Capital Management PDFNizar AhamedNo ratings yet

- Working Capital ManagementDocument32 pagesWorking Capital ManagementrutikaNo ratings yet

- Working Capital Management: Department of Finance and Accountancy Vavuniya Campus FIN2213 Financial ManagementDocument22 pagesWorking Capital Management: Department of Finance and Accountancy Vavuniya Campus FIN2213 Financial ManagementWathz NawarathnaNo ratings yet

- Cash Operating Cycle NotesDocument5 pagesCash Operating Cycle Notesgoitsemodimoj31100% (1)

- 2.1 Working Capital ManagementDocument26 pages2.1 Working Capital ManagementMANAV ROYNo ratings yet

- 11 - Working Capital ManagementDocument39 pages11 - Working Capital Managementrajeshkandel345No ratings yet

- Intermediate - FM - Suggested Answer PaperDocument4 pagesIntermediate - FM - Suggested Answer Paperchromabooka111No ratings yet

- Unit - 5 (Working Capital)Document36 pagesUnit - 5 (Working Capital)DarsNo ratings yet

- Working Capital ManagementDocument32 pagesWorking Capital Managementnaveen penugondaNo ratings yet

- UNIT-4 Working Capital ManagementDocument13 pagesUNIT-4 Working Capital ManagementChandanN81No ratings yet

- # Selected+study+guide-Problem - Solutions - SU 5, 6, 7, 8Document7 pages# Selected+study+guide-Problem - Solutions - SU 5, 6, 7, 8PHilipNo ratings yet

- Chapter 4 Management of WCDocument15 pagesChapter 4 Management of WCAbhishek TiwariNo ratings yet

- FN502 Additional ProblemsDocument3 pagesFN502 Additional Problemsdpr7033No ratings yet

- Working Capital ManagementDocument2 pagesWorking Capital ManagementGhias KhanNo ratings yet

- Corporate FinanceDocument10 pagesCorporate Financeyjayai2309No ratings yet

- Cash Operating Cycle / Working Capital CyclesDocument3 pagesCash Operating Cycle / Working Capital CyclesRUKUDZO KNOWLEDGE DAWANo ratings yet

- Working CapitalDocument61 pagesWorking CapitalSharmistha Banerjee100% (1)

- Ratios PresentationDocument13 pagesRatios PresentationAakash A. OzaNo ratings yet

- Working CapitalDocument38 pagesWorking CapitalMonicaNo ratings yet

- UNIT 3 Tutorial Q & ADocument14 pagesUNIT 3 Tutorial Q & AAlicia AbsolamNo ratings yet

- Calculation of Operating Cycle and Cash CycleDocument5 pagesCalculation of Operating Cycle and Cash CyclePrayag GokhaleNo ratings yet

- Corporate Finance Case StudyDocument12 pagesCorporate Finance Case Studypapa_didi700100% (3)

- WC Review ExamplesDocument17 pagesWC Review Examplesbuse3erginNo ratings yet

- Managerial Finance GitmanDocument3 pagesManagerial Finance GitmanjessicaNo ratings yet

- Working Capital Management Work Sheet-Cash Operation Cycle - AR-AP-July 2022Document6 pagesWorking Capital Management Work Sheet-Cash Operation Cycle - AR-AP-July 2022Marc WrightNo ratings yet

- Working Capital Management (Divya Jadi Booti)Document61 pagesWorking Capital Management (Divya Jadi Booti)Michael AdhikariNo ratings yet

- Numericals 1Document6 pagesNumericals 1Amita ChoudharyNo ratings yet

- Null 5Document12 pagesNull 5Pragna SreeNo ratings yet

- Financial Ratio AnalysisDocument34 pagesFinancial Ratio AnalysisamahaktNo ratings yet

- CH 08 A Solution SET 1Document3 pagesCH 08 A Solution SET 1kolidishant692No ratings yet

- Chapter 14working Capital and Current Assets ManagementDocument1 pageChapter 14working Capital and Current Assets ManagementMaricris RellinNo ratings yet

- RATIO Practice QuestionsDocument14 pagesRATIO Practice Questionspranay raj rathoreNo ratings yet

- Small Scale IndustriesDocument15 pagesSmall Scale IndustriesSumit KumarNo ratings yet

- Tutorial 3 Solutions - ERPsDocument2 pagesTutorial 3 Solutions - ERPsKhathutshelo KharivheNo ratings yet

- Assignment 1 SolutionDocument2 pagesAssignment 1 Solutiondivya kalyaniNo ratings yet

- Assignment LDocument6 pagesAssignment Lphprcffj2rNo ratings yet

- Tutorial 7 Chapter 15: Cash Conversion CycleDocument8 pagesTutorial 7 Chapter 15: Cash Conversion CycleAlvaroNo ratings yet

- Corporate FinanceDocument9 pagesCorporate FinanceMayur AgarwalNo ratings yet

- Bsa 2 - Finman - Group 8 - Lesson 3Document7 pagesBsa 2 - Finman - Group 8 - Lesson 3Allyson Charissa AnsayNo ratings yet

- 2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxDocument7 pages2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxBryent GawNo ratings yet

- Short-Term ExamDocument6 pagesShort-Term Examymkuzangwe16No ratings yet

- Financial Management - Notes NumericalsDocument6 pagesFinancial Management - Notes NumericalsSandeep SahadeokarNo ratings yet

- Chapter 5Document42 pagesChapter 5Aamrh AmrnNo ratings yet

- Working Capital ManagementDocument32 pagesWorking Capital ManagementAkash RanjanNo ratings yet

- Working Capital Practical QuestionsDocument8 pagesWorking Capital Practical Questionsfatimabiriq799No ratings yet

- Interim AcquisitionsDocument13 pagesInterim AcquisitionsValerie Verity MarondedzeNo ratings yet

- Orchid Business Group Balance Sheet As at December 31 Assets 2012 2011Document9 pagesOrchid Business Group Balance Sheet As at December 31 Assets 2012 2011Amanuel DemekeNo ratings yet

- Liquidity and Its TestDocument41 pagesLiquidity and Its TestSiddharth AroraNo ratings yet

- CMA April - 14 Exam Question SolutionDocument55 pagesCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- Muhammad Amjid Assignment Working CapitalDocument3 pagesMuhammad Amjid Assignment Working CapitalMaliCk TaimoorNo ratings yet

- CH 05 Evaluating Financial PerformanceDocument42 pagesCH 05 Evaluating Financial Performancebia070386100% (1)

- PAN African E-Network Project: Working Capital ManagementDocument89 pagesPAN African E-Network Project: Working Capital ManagementEng Abdulkadir MahamedNo ratings yet

- Chapter 6 Homework QuestionsDocument3 pagesChapter 6 Homework QuestionsLovepreet malhiNo ratings yet

- Day Per Sold Goods of Cost InventoryDocument2 pagesDay Per Sold Goods of Cost InventoryJohn Brian D. SorianoNo ratings yet

- Chapter 7 Excel 05 Dec 2022Document6 pagesChapter 7 Excel 05 Dec 2022night dreamersNo ratings yet

- Financial Management July 18, 2021Document7 pagesFinancial Management July 18, 2021Bhie JaneeNo ratings yet

CW 9.12.23

CW 9.12.23

Uploaded by

Aashima Bajaj0 ratings0% found this document useful (0 votes)

4 views1 pageThe document defines different types of working capital including gross working capital, which equals current assets, and net working capital, which equals current assets minus current liabilities. It then provides an example calculation of the length of an operating cycle by summing the number of days for raw materials, work in progress, finished goods, and debtors, then subtracting the creditors payment period. The operating cycle length for the example given is 196 days.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document defines different types of working capital including gross working capital, which equals current assets, and net working capital, which equals current assets minus current liabilities. It then provides an example calculation of the length of an operating cycle by summing the number of days for raw materials, work in progress, finished goods, and debtors, then subtracting the creditors payment period. The operating cycle length for the example given is 196 days.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageCW 9.12.23

CW 9.12.23

Uploaded by

Aashima BajajThe document defines different types of working capital including gross working capital, which equals current assets, and net working capital, which equals current assets minus current liabilities. It then provides an example calculation of the length of an operating cycle by summing the number of days for raw materials, work in progress, finished goods, and debtors, then subtracting the creditors payment period. The operating cycle length for the example given is 196 days.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

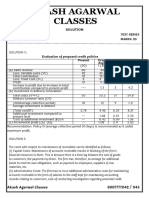

Types of working capital

1. Gross Working Capital = Current Assets

2. Net Working = Current Assets – Current Liabilities

Cash = 1,00,000

Cash = 50,000 + Raw material 50,000

Cash= 20,000 + WIP = 80,000

Finished Goods = 1,00,000

Debtors (Cost) = 1,00,000

Cash = 1,00,000

Calculation of Length of Operating Cycle

OC = R + W + F + D

R = Raw materials holding period

= (Average stock of raw material/ Annual cost of raw material) x 360

= (25,000/1,00,000) x 360 = 90 days

W= Work-in-progress period (Production period)

= (Average Stock of WIP/Annual Cost of Production) x 360

=(16,000/1,50,000) x 360= 38 days

F = Finished goods holding period

= (Average stock of FG/ Annual Cost of Sales) x 360

= (24,000/ 1,50,000) x 360= 58 days

D = Debtors Collection Period (Credit period allowed to debtors)

= (Average debtors/Annual Credit sales) x 360

=(40,000/1,75,000) x 360= 82 days

Gross Duration of Operating Cycle (90+38+58+82)= 268 days

Less C= Creditors Payment Period (Credit allowed by suppliers)

= (Average Creditors/Annual Credit Purchases) x 360

= (20,000/ 1,00,000) x 360= (-72 days)

Net Operating Cycle period 196 days

You might also like

- CH2 Practice QuestionsDocument11 pagesCH2 Practice QuestionsenkeltvrelseNo ratings yet

- Working Capital and Operating CycleDocument24 pagesWorking Capital and Operating Cyclesaurabh chaturvediNo ratings yet

- Working Capital Management PDFDocument46 pagesWorking Capital Management PDFNizar AhamedNo ratings yet

- Working Capital ManagementDocument32 pagesWorking Capital ManagementrutikaNo ratings yet

- Working Capital Management: Department of Finance and Accountancy Vavuniya Campus FIN2213 Financial ManagementDocument22 pagesWorking Capital Management: Department of Finance and Accountancy Vavuniya Campus FIN2213 Financial ManagementWathz NawarathnaNo ratings yet

- Cash Operating Cycle NotesDocument5 pagesCash Operating Cycle Notesgoitsemodimoj31100% (1)

- 2.1 Working Capital ManagementDocument26 pages2.1 Working Capital ManagementMANAV ROYNo ratings yet

- 11 - Working Capital ManagementDocument39 pages11 - Working Capital Managementrajeshkandel345No ratings yet

- Intermediate - FM - Suggested Answer PaperDocument4 pagesIntermediate - FM - Suggested Answer Paperchromabooka111No ratings yet

- Unit - 5 (Working Capital)Document36 pagesUnit - 5 (Working Capital)DarsNo ratings yet

- Working Capital ManagementDocument32 pagesWorking Capital Managementnaveen penugondaNo ratings yet

- UNIT-4 Working Capital ManagementDocument13 pagesUNIT-4 Working Capital ManagementChandanN81No ratings yet

- # Selected+study+guide-Problem - Solutions - SU 5, 6, 7, 8Document7 pages# Selected+study+guide-Problem - Solutions - SU 5, 6, 7, 8PHilipNo ratings yet

- Chapter 4 Management of WCDocument15 pagesChapter 4 Management of WCAbhishek TiwariNo ratings yet

- FN502 Additional ProblemsDocument3 pagesFN502 Additional Problemsdpr7033No ratings yet

- Working Capital ManagementDocument2 pagesWorking Capital ManagementGhias KhanNo ratings yet

- Corporate FinanceDocument10 pagesCorporate Financeyjayai2309No ratings yet

- Cash Operating Cycle / Working Capital CyclesDocument3 pagesCash Operating Cycle / Working Capital CyclesRUKUDZO KNOWLEDGE DAWANo ratings yet

- Working CapitalDocument61 pagesWorking CapitalSharmistha Banerjee100% (1)

- Ratios PresentationDocument13 pagesRatios PresentationAakash A. OzaNo ratings yet

- Working CapitalDocument38 pagesWorking CapitalMonicaNo ratings yet

- UNIT 3 Tutorial Q & ADocument14 pagesUNIT 3 Tutorial Q & AAlicia AbsolamNo ratings yet

- Calculation of Operating Cycle and Cash CycleDocument5 pagesCalculation of Operating Cycle and Cash CyclePrayag GokhaleNo ratings yet

- Corporate Finance Case StudyDocument12 pagesCorporate Finance Case Studypapa_didi700100% (3)

- WC Review ExamplesDocument17 pagesWC Review Examplesbuse3erginNo ratings yet

- Managerial Finance GitmanDocument3 pagesManagerial Finance GitmanjessicaNo ratings yet

- Working Capital Management Work Sheet-Cash Operation Cycle - AR-AP-July 2022Document6 pagesWorking Capital Management Work Sheet-Cash Operation Cycle - AR-AP-July 2022Marc WrightNo ratings yet

- Working Capital Management (Divya Jadi Booti)Document61 pagesWorking Capital Management (Divya Jadi Booti)Michael AdhikariNo ratings yet

- Numericals 1Document6 pagesNumericals 1Amita ChoudharyNo ratings yet

- Null 5Document12 pagesNull 5Pragna SreeNo ratings yet

- Financial Ratio AnalysisDocument34 pagesFinancial Ratio AnalysisamahaktNo ratings yet

- CH 08 A Solution SET 1Document3 pagesCH 08 A Solution SET 1kolidishant692No ratings yet

- Chapter 14working Capital and Current Assets ManagementDocument1 pageChapter 14working Capital and Current Assets ManagementMaricris RellinNo ratings yet

- RATIO Practice QuestionsDocument14 pagesRATIO Practice Questionspranay raj rathoreNo ratings yet

- Small Scale IndustriesDocument15 pagesSmall Scale IndustriesSumit KumarNo ratings yet

- Tutorial 3 Solutions - ERPsDocument2 pagesTutorial 3 Solutions - ERPsKhathutshelo KharivheNo ratings yet

- Assignment 1 SolutionDocument2 pagesAssignment 1 Solutiondivya kalyaniNo ratings yet

- Assignment LDocument6 pagesAssignment Lphprcffj2rNo ratings yet

- Tutorial 7 Chapter 15: Cash Conversion CycleDocument8 pagesTutorial 7 Chapter 15: Cash Conversion CycleAlvaroNo ratings yet

- Corporate FinanceDocument9 pagesCorporate FinanceMayur AgarwalNo ratings yet

- Bsa 2 - Finman - Group 8 - Lesson 3Document7 pagesBsa 2 - Finman - Group 8 - Lesson 3Allyson Charissa AnsayNo ratings yet

- 2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxDocument7 pages2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxBryent GawNo ratings yet

- Short-Term ExamDocument6 pagesShort-Term Examymkuzangwe16No ratings yet

- Financial Management - Notes NumericalsDocument6 pagesFinancial Management - Notes NumericalsSandeep SahadeokarNo ratings yet

- Chapter 5Document42 pagesChapter 5Aamrh AmrnNo ratings yet

- Working Capital ManagementDocument32 pagesWorking Capital ManagementAkash RanjanNo ratings yet

- Working Capital Practical QuestionsDocument8 pagesWorking Capital Practical Questionsfatimabiriq799No ratings yet

- Interim AcquisitionsDocument13 pagesInterim AcquisitionsValerie Verity MarondedzeNo ratings yet

- Orchid Business Group Balance Sheet As at December 31 Assets 2012 2011Document9 pagesOrchid Business Group Balance Sheet As at December 31 Assets 2012 2011Amanuel DemekeNo ratings yet

- Liquidity and Its TestDocument41 pagesLiquidity and Its TestSiddharth AroraNo ratings yet

- CMA April - 14 Exam Question SolutionDocument55 pagesCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- Muhammad Amjid Assignment Working CapitalDocument3 pagesMuhammad Amjid Assignment Working CapitalMaliCk TaimoorNo ratings yet

- CH 05 Evaluating Financial PerformanceDocument42 pagesCH 05 Evaluating Financial Performancebia070386100% (1)

- PAN African E-Network Project: Working Capital ManagementDocument89 pagesPAN African E-Network Project: Working Capital ManagementEng Abdulkadir MahamedNo ratings yet

- Chapter 6 Homework QuestionsDocument3 pagesChapter 6 Homework QuestionsLovepreet malhiNo ratings yet

- Day Per Sold Goods of Cost InventoryDocument2 pagesDay Per Sold Goods of Cost InventoryJohn Brian D. SorianoNo ratings yet

- Chapter 7 Excel 05 Dec 2022Document6 pagesChapter 7 Excel 05 Dec 2022night dreamersNo ratings yet

- Financial Management July 18, 2021Document7 pagesFinancial Management July 18, 2021Bhie JaneeNo ratings yet