Professional Documents

Culture Documents

Partnership - Formation

Partnership - Formation

Uploaded by

Jay Mayca TyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership - Formation

Partnership - Formation

Uploaded by

Jay Mayca TyCopyright:

Available Formats

Partnership – Formation

Contributions

1. Cash – When cash is contributed, it shall be accounted for at face value.

2. Non-cash asset – Non-cash assets shall be valued at agreed values, or at fair value in the absence of such. When these

two are not given, these shall be accounted for at book value.

Special Notes:

a. Receivable – This shall be accounted for at the gross amount. Allowance for Doubtful Accounts shall be

established separately in the books of partnership.

b. Property, plant, and equipment – This shall be accounted for at net of Accumulated Depreciation. This means

that the Accumulated Depreciation is not carried forward in the books of the partnership.

3. Service or industry – This is recorded through a memorandum entry.

Formation:

A. All partners are new to the business.

Tine and Sarawat are individuals who have no existing businesses. They decided to form a partnership by

contributing the following:

Tine Sarawat

Cash P50,000 P30,000

Accounts Receivable 70,000 30,000

Allowance for Doubtful Accounts 15,000 10,000

Inventory 90,000 70,000

Land 200,000

Equipment 150,000

Accumulated Depreciation – Equipment 35,000

The partners agreed to the following:

1. P10,000 of Tine’s Accounts Receivable is uncollectible and allowance for doubtful accounts shall be reduced to

P5,000. While Sarawat’s allowance for doubtful accounts shall be increased to P12,000.

2. Inventory of Tine and Sarawat shall be valued ate their fair value at P85,000 and P80,000, respectively.

3. The Equipment is to be valued at P120,000.

Here, we have to establish the values that will be carried at the books of the partnership.

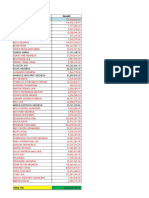

Old Values New Values Total

Tine Sarawat Tine Sarawat

Cash P50,000 P30,000 P50,000 P30,000 P80,000

Accounts Receivable 70,000 30,000 60,000 30,000 90,000

Allowance for Doubtful Accounts 15,000 10,000 5,000 12,000 17,000

Inventory 90,000 70,000 85,000 80,000 165,000

Land 200,000 200,000 200,000

Equipment 150,000 120,000 120,000

Accumulated Depreciation – Equipment 35,000

Total P310,000 P328,000 P638,000

After determining the values, we can now proceed to the entry, as follows:

Cash P80,000

Accounts Receivable 90,000

Inventory 165,000

Land 200,000

Equipment 120,000

Allowance for Doubtful Accounts P17,000

Tine, Capital 310,000

Sarawat, Capital 328,000

B. A sole proprietor and an individual forms a partnership (new partnership books)

Tine is a sole proprietor of a business with the following records:

Tine

Cash P50,000

Accounts Receivable 70,000

Allowance for Doubtful Accounts 15,000

Inventory 90,000

Land 200,000

Equipment 150,000

Accumulated Depreciation – Equipment 35,000

Accounts Payable 90,000

Tine, Capital 420,000

Tine is forming a partnership with Sarawat and Together, both new to the business. Sarawat will contribute P415,000

cash while Together will contribute his industry. As per agreement, Tine’s assets are to be valued as follows:

1. P10,000 of Accounts Receivable is uncollectible and allowance for doubtful accounts is P10,000.

2. Inventory shall be valued ate their fair value at P85,000.

3. The Equipment is to be valued at P120,000.

No other adjustments are to be made.

To start, we have to adjust first Tine’s separate books as follows:

1. We write off P10,000 of Accounts Receivable as follows:

Allowance for Doubtful Accounts P10,000

Accounts Receivable P10,000

Note that the Allowance for Doubtful Accounts should have a P10,000 balance. However, after the entry above, the

current balance of such only amounts to P5,000. Thus, we have to increase the allowance by P5,000 more as follows:

Tine, Capital P5,000

Allowance for Doubtful Accounts P5,000

Alternatively, this could be recorded as follows:

Allowance for Doubtful Accounts P5,000

Tine, Capital 5,000

Accounts Receivable P10,000

2. We decrease the value of the inventory as follows:

Tine, Capital P5,000

Inventory P5,000

3. First, close (reduce to zero) the balance of Accumulated depreciation. This is because this account will not be

carried forward to the partnership books.

Accumulated Depreciation – Equipment P35,000

Equipment P35,000

After the entry above, the current balance of Equipment is P115,000. However, as agreed, Equipment should be

valued at P120,000. Thus, we record the increase as follows:

Equipment P5,000

Tine, Capital P5,000

Alternatively, we adjust the value of the Equipment as follows:

Accumulated Depreciation – Equipment P35,000

Equipment P30,000

Tine, Capital 5,000

The above values are computed as follows:

Gross Value of Equipment P150,000

Agreed Value (New Gross Value) 120,000

Decrease P 30,000 - to be credited to Equipment

Gross Value of Equipment P150,000

Accumulated Depreciation 35,000 - to be closed (debited)

Net Book Value (Carrying Amount) P115,000 - compare to the agreed value to

determine increase or decrease

in the carrying amount.

See below:

Agreed Value P120,000

Net Book Value 115,000

Increase in Carrying Amount P 5,000 - to be credited to Tine, Capital

4. After adjusting the books of Tine, since new partnership books will be used, we now close Tine’s books as

follows:

Tine, Capital P415,000

Allowance for Doubtful Accounts 10,000

Accounts Payable 90,000

Cash P50,000

Accounts Receivable 60,000

Inventory 85,000

Land 200,000

Equipment 120,000

The next step is to open the books of the partnership by recording the investments of the three partners as follows:

a. Tine’s Contribution

Cash P50,000

Accounts Receivable 60,000

Inventory 85,000

Land 200,000

Equipment 120,000

Allowance for Doubtful Accounts P10,000

Accounts Payable 90,000

Tine, Capital 415,000

b. Sarawat’s Contribution

Cash P415,000

Sarawat, Capital P415,000

Alternatively, Tine’s and Sarawat’s contribution may be recorded as follows:

Cash P465,000

Accounts Receivable 60,000

Inventory 85,000

Land 200,000

Equipment 120,000

Allowance for Doubtful Accounts P10,000

Accounts Payable 90,000

Tine, Capital 415,000

Sarawat, Capital 415,000

c. Together’s Contribution – Since Together will only contribute his industry, we record his contribution

through a memorandum entry as follows:

Together is admitted into the partnership as an industrial partner to share one-third in the partnership profit.

Do note that the on-third share is not fixed. Profit sharing may vary depending on the partner’s agreement.

C. A sole proprietor and an individual forms a partnership (using the books of the sole proprietor)

We will use the example in Section B above. Just like above, we adjust the books of Tine as follows:

1. For the Accounts Receivable and Allowance for Doubtful Accounts:

Allowance for Doubtful Accounts P5,000

Tine, Capital 5,000

Accounts Receivable P10,000

2. For the Inventory:

Tine, Capital P5,000

Inventory P5,000

3. For the Equipment and Accumulated Depreciation:

Accumulated Depreciation – Equipment P35,000

Equipment P30,000

Tine, Capital 5,000

We stop here and skip the closing of the books of Tine as we will be using his books as the partnership books. Next,

we record the contribution of Sarawat and Together as follows:

1. Sarawat’s Contribution

Cash P415,000

Sarawat, Capital P415,000

2. Together’s Contribution

Together is admitted into the partnership as an industrial partner to share one-third in the partnership profit.

D. Two or more sole proprietors form a partnership

The partners may choose to set up new set of partnership books like in Section B above. If such is the case, the

steps are the same.

1. Adjust each of the sole proprietor’s separate books to match the agreed values

2. Close the separate books.

3. Set-up the new partnership books by recording their contributions, separately or in a compound entry.

If the partners would agree to use one of the existing sole proprietor books like in Section C, the steps are as follows:

For the one whose books will not be used:

1. Adjust his books to match the agreed values.

2. Close his separate books.

For the one whose books will be used:

1. Adjust his books to match the agreed values.

2. Record the contribution of the partner/s whose books were closed.

Do note, that only Natural Persons (humans) can for a partnership. That is, an existing partnership cannot become a

partner, nor can corporations and joint ventures. But if partners of two different partnerships would form a new

partnership, this is possible.

To illustrate, A and B are partners of CD partnership, while Z and Y are partners of XW Partnership. In this case, A, B, Z

and Y may form a partnership because they are natural persons. However, CD partnership cannot form a partnership with

Z, Y, or XW partnership. The same goes with XW partnership where it cannot form a partnership with A, B, or CD

partnership. The reason for such is because CD partnership and XW partnership are juridical persons, that is, they

acquired a personality only by virtue of the law.

You might also like

- Advanced Accounting Dayag Solution Manual PDFDocument234 pagesAdvanced Accounting Dayag Solution Manual PDFAnggë Crüz89% (9)

- Problem #6 A Sole Proprietorship and An Individual With No Business Form A PartnershipDocument1 pageProblem #6 A Sole Proprietorship and An Individual With No Business Form A Partnershipstudentone93% (15)

- QUIZ 1 - Preparation of Financial StatementsDocument3 pagesQUIZ 1 - Preparation of Financial StatementsDorothy Romagos100% (7)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Partnership Exercise 12 PDFDocument2 pagesPartnership Exercise 12 PDFFrancis CabasNo ratings yet

- Ch. 02 Bank Reconciliation Intermediate Accounting Volume 1 2021 Edition ValixDocument7 pagesCh. 02 Bank Reconciliation Intermediate Accounting Volume 1 2021 Edition ValixNathalie GetinoNo ratings yet

- Advanced Accounting SOLMANDocument229 pagesAdvanced Accounting SOLMANgaille77% (22)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- ILLUSTRATIVE PROBLEMS - Formation of A PartnershipDocument7 pagesILLUSTRATIVE PROBLEMS - Formation of A PartnershipKathleen MangualNo ratings yet

- Practical Accounting P-2Document7 pagesPractical Accounting P-2KingChryshAnneNo ratings yet

- Ansay, Allyson Charissa T - Activity 3Document9 pagesAnsay, Allyson Charissa T - Activity 3カイ みゆきNo ratings yet

- Test Bank Paccounting Information Systems Test Bank Paccounting Information SystemsDocument23 pagesTest Bank Paccounting Information Systems Test Bank Paccounting Information SystemsFrylle Kanz Harani PocsonNo ratings yet

- FABM Assignment WS FS P C TB 1Document34 pagesFABM Assignment WS FS P C TB 1memae0044No ratings yet

- Chapter 05 Modern Advanced Accountingreview Q ExrDocument20 pagesChapter 05 Modern Advanced Accountingreview Q Exrjujubeetrippin100% (10)

- MGMT 30A: Midterm 2Document25 pagesMGMT 30A: Midterm 2FUSION AcademicsNo ratings yet

- Chapter 17 Answer Key-1Document4 pagesChapter 17 Answer Key-1NCTNo ratings yet

- Multiple Choice ProblemsDocument5 pagesMultiple Choice ProblemsHannahbea LindoNo ratings yet

- Formation 2022 RDocument5 pagesFormation 2022 Rpamriri8No ratings yet

- Partnership Accounting With AnsDocument22 pagesPartnership Accounting With Ansjessica amorosoNo ratings yet

- LEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Document2 pagesLEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Kim FloresNo ratings yet

- ACFAR Partnership ExercisesDocument12 pagesACFAR Partnership ExercisesJhannamae PamugasNo ratings yet

- AC 42 DIY Drill For Unit I 2021 2022Document3 pagesAC 42 DIY Drill For Unit I 2021 2022MARK JHEN SALANGNo ratings yet

- Answer KeyDocument10 pagesAnswer KeyEvelina Del RosarioNo ratings yet

- Accounting For Business Combination - Practice Material 2Document5 pagesAccounting For Business Combination - Practice Material 2ZYRENE HERNANDEZNo ratings yet

- Guerrero CH14 - ProblemsDocument14 pagesGuerrero CH14 - ProblemsClaireNo ratings yet

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #13 To 20Document2 pages(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #13 To 20John Carlos Doringo100% (1)

- Sample P-FDocument3 pagesSample P-FMYDMIOSYL ALABENo ratings yet

- Nature and Formation of A PartnershipDocument10 pagesNature and Formation of A PartnershipHans ManaliliNo ratings yet

- PARCOR Exercises PFormationDocument4 pagesPARCOR Exercises PFormationangelovilladoresNo ratings yet

- Solution Chapter 14Document26 pagesSolution Chapter 14grace guiuanNo ratings yet

- ACC 100 Partnership FormationDocument3 pagesACC 100 Partnership FormationAlfred DalaganNo ratings yet

- Lesson Title: Business Combination (Part 1) : Learning Targets: MDocument4 pagesLesson Title: Business Combination (Part 1) : Learning Targets: MjhammyNo ratings yet

- Chapter 1 Partnership Basic Considerations and FormationDocument20 pagesChapter 1 Partnership Basic Considerations and FormationMIKASANo ratings yet

- Acfar1130 - Chapter 12 ProblemsDocument2 pagesAcfar1130 - Chapter 12 ProblemsMae BarsNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Partnership - Chapter 1 Test BankDocument8 pagesPartnership - Chapter 1 Test BankCaile SalcedoNo ratings yet

- Partnership RequirementDocument6 pagesPartnership RequirementAlyssa Marie Miguel100% (1)

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- Partnership-Formation HandoutDocument1 pagePartnership-Formation HandoutKarl SolomeroNo ratings yet

- Advacc - Intercompany PDFDocument143 pagesAdvacc - Intercompany PDFGelyn CruzNo ratings yet

- AP-Correction of Error Straight Problems Problem 1: RequiredDocument6 pagesAP-Correction of Error Straight Problems Problem 1: RequiredAldrin LiwanagNo ratings yet

- Activity 1Document1 pageActivity 1Cris TineNo ratings yet

- Afar Assign 1Document8 pagesAfar Assign 1버니 모지코No ratings yet

- Chapter 12, Assignment 2Document4 pagesChapter 12, Assignment 2Gedelle Marie GaleraNo ratings yet

- PartnershipDocument10 pagesPartnershipJasmine Marie Ng Cheong50% (2)

- Acctg EquationDocument4 pagesAcctg EquationMichael John DayondonNo ratings yet

- Exam in Taxation Exam in Taxation: Business Tax (Naga College Foundation) Business Tax (Naga College Foundation)Document29 pagesExam in Taxation Exam in Taxation: Business Tax (Naga College Foundation) Business Tax (Naga College Foundation)jhean dabatosNo ratings yet

- Final Requirement in AdvaccDocument143 pagesFinal Requirement in AdvaccShaina Kaye De Guzman100% (1)

- Sol ManDocument144 pagesSol ManShr Bn100% (1)

- Dayag Chapter 1 To 5Document14 pagesDayag Chapter 1 To 5Mazikeen DeckerNo ratings yet

- Mahusay, Bsa 315, Module 1-CaseletsDocument9 pagesMahusay, Bsa 315, Module 1-CaseletsJeth MahusayNo ratings yet

- Accounting For Business CombinationsDocument5 pagesAccounting For Business CombinationsJohn JackNo ratings yet

- Accouncting ProblemDocument3 pagesAccouncting ProblemShaneNo ratings yet

- Fish R UsDocument2 pagesFish R UsJohn Clinton PeñafloridaNo ratings yet

- 01 Long QuizDocument6 pages01 Long Quizgiana riveraNo ratings yet

- To Record The Purchase of EquipmentDocument13 pagesTo Record The Purchase of EquipmentShane Nayah100% (1)

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Account Receivable (A/R) : ReceivablesDocument12 pagesAccount Receivable (A/R) : ReceivablesAndiBrianatanAffandiNo ratings yet

- M. VILLANUEVA GO KART GROCERY - xlsx-1Document51 pagesM. VILLANUEVA GO KART GROCERY - xlsx-1belliissiimmaaNo ratings yet

- Chopra3 PPT ch02Document21 pagesChopra3 PPT ch02SatishNo ratings yet

- Jurnal Umum Clening ServiceDocument1 pageJurnal Umum Clening ServiceKhoirunisaNo ratings yet

- University of Santo Tomas Department of Nutrition and Dietetics MODULE 4: Accounting Cycle ProblemDocument5 pagesUniversity of Santo Tomas Department of Nutrition and Dietetics MODULE 4: Accounting Cycle ProblemEbina WhiteNo ratings yet

- DocDocument31 pagesDocjikee11No ratings yet

- AP Batch Gantung 300523Document19 pagesAP Batch Gantung 300523Dhoni KurniawanNo ratings yet

- T 3Document3 pagesT 3moiseelenaNo ratings yet

- Accounting ch9 Solutions QuestionDocument49 pagesAccounting ch9 Solutions Questionaboodyuae2000No ratings yet

- Estatement-202308 20230912082652Document5 pagesEstatement-202308 20230912082652Hasif WowNo ratings yet

- FINALS EXAM - FinAcctg SetADocument4 pagesFINALS EXAM - FinAcctg SetAJennifer RasonabeNo ratings yet

- Accounting Book 1 Lupisan Baysa Answer KeyDocument176 pagesAccounting Book 1 Lupisan Baysa Answer KeyAngel ChuaNo ratings yet

- Chapter 15Document12 pagesChapter 15Nikki GarciaNo ratings yet

- Company Profile EL Revisi-1Document6 pagesCompany Profile EL Revisi-1Muhamad IqbalNo ratings yet

- Accounting Task 5Document11 pagesAccounting Task 5Mohamed Bilal HamoushNo ratings yet

- Control Case 1 PC DepotDocument8 pagesControl Case 1 PC DepotAbs PangaderNo ratings yet

- BP Op Entpr S4hana1709 04 Prerequisites Matrix en UsDocument38 pagesBP Op Entpr S4hana1709 04 Prerequisites Matrix en UskiranNo ratings yet

- Enbanc: Republic of The Philippines Court Oft Ax Appeals Quezon CityDocument28 pagesEnbanc: Republic of The Philippines Court Oft Ax Appeals Quezon CityAemie JordanNo ratings yet

- Payment IDR - Mega - Januari 2009 - UPdatedDocument115 pagesPayment IDR - Mega - Januari 2009 - UPdatedirfanafiffudinNo ratings yet

- Bsa 2103 Cost Accounting and ControlDocument17 pagesBsa 2103 Cost Accounting and ControlshaylieeeNo ratings yet

- Accounting 25th Edition Warren Solutions Manual 1Document36 pagesAccounting 25th Edition Warren Solutions Manual 1edwardharrisontqdrjcogix100% (24)

- Chapter 3Document72 pagesChapter 3MichelleneChenTadleNo ratings yet

- Analyzing Transaction Through Source DocumentsDocument13 pagesAnalyzing Transaction Through Source Documentsnegi_hinataNo ratings yet

- CurrentAccountStatement 07102023Document4 pagesCurrentAccountStatement 07102023caraleighjaneNo ratings yet

- Unit 1 - Introduction To Principles of AccountingDocument100 pagesUnit 1 - Introduction To Principles of AccountingNgonga FumbeloNo ratings yet

- AccountingDocument19 pagesAccountinggigigiNo ratings yet