Professional Documents

Culture Documents

Income Tax Slab Rate For A.Y.2012-13: Lost Your Password? Register

Income Tax Slab Rate For A.Y.2012-13: Lost Your Password? Register

Uploaded by

tambithambi1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Slab Rate For A.Y.2012-13: Lost Your Password? Register

Income Tax Slab Rate For A.Y.2012-13: Lost Your Password? Register

Uploaded by

tambithambi1Copyright:

Available Formats

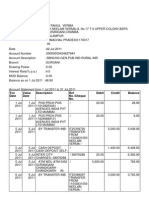

INCOME TAX SLAB RATE FOR A.Y.

2012-13 | Ca Group India

RSS Email Twitter Facebook

Page 1 of 4

Search in this site...

HOME

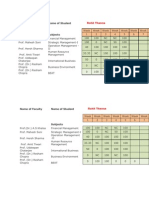

STUDENT

EXPERT ADVISORY COMMITTE COMMENTS SHARE INFORMATION

SHARE INFORMATION

ABOUT US

ASK QUESTION

CONTACT US SEPTEMBER 30, 5384 1:17 PM

YOU ARE HERE: HOME

INCOME TAX SLAB RATE FOR A.Y.2012-13

INCOME TAX SLAB RATE FOR A.Y.2012-13

Posted by Nikunj Mundra on February 28, 2011 in Share Information | 19 Comments

SEARCH

Search

LOG IN

The new and revised income tax slabs and rates applicable for the financial year (FY) 2011-12 and assessment year (AY) 2012-13 are mentioned below:

Username For Individual male,Age less than 60 Years Up to 180000 : Nil 180001-500000 : 10% 500001-800000 : 20% 800001 & above : 30% For Individual female,Age less 60 years

POPULAR LATEST COMMENTS TAGS

Password Log In Remember Me Lost your password? Register

Up to 190000 : Nil 190001-500000 : 10% 500001-800000 : 20% 800001 & above : 30% For Individual, Age more than 60 Years ( Senior Citizen) Up to 250000 : Nil 250001-500000 : 10% 500001-800000 : 20%

AUDIT OF ACCOUNTS

27 COMMENTS

INCOME TAX SLAB RATE FOR A.Y.2012-13

19 COMMENTS

how to upload rectification

10 COMMENTS

Head of Income Salary

7 COMMENTS

ICAI -IMPORTANT 800001 & above : 30% For Individual ,Age more than 80 Years ( Super Citizen ) Up to 500000 : Nil 500001-800000 : 20% 800001 & above : 30% Further there is no change in education and other cess. ANNOUNCEMENT (CHANGE OF TIME)

6 COMMENTS

About Nikunj Mundra

View all posts by Nikunj Mundra ping rss

http://cagroupindia.com/share/income-tax-slab-rate-for-a-y-2012-13/

30/09/2011

INCOME TAX SLAB RATE FOR A.Y.2012-13 | Ca Group India

19 RESPONSES JOIN US

Page 2 of 4

Julia Brooks

March 4, 2011 at 3:05 PM

Cheers for the site. I enjoyed reading it.thanks for giving this latest information.

REPLY

mehak vohra

June 9, 2011 at 2:07 PM

INDIA STOCK MARKET

Thanks for updatingthats very benefical

Market Watch by Appuonline.com

NSE

REPLY

Gainers

Losers

MFNew!

Company Name Saathish

June 16, 2011 at 9:59 AM NSE Indices NIFTY (S&P CNX) CNX Midcap

REPLY

Search

Change -77.90 (-1.55%)

Current 4937.55

Thanks it is very easy to remember, and it is good

50 CNX Nifty Junior CNX 100

2100.05

-15.10 (-0.71%)

Rajendra M. Pawar

August 23, 2011 at 1:37 PM

9796.85 4852.40 7083.60 9452.30 5674.70

-119.50 (-1.21%) -74.65 (-1.52%) -35.35 (-0.50%) -201.10 (-2.08%) -71.45 (-1.24%)

thanks it is very useful to file income tax return.

CNX Midcap Bank Nifty

REPLY

CNX IT

sulochana

July 9, 2011 at 3:23 PM

Last Updated: 30 Sep 2011 02:58:00 PM

It is very useful to us

Gadgets powered by Google REPLY

CALCULATE YOUR TAX

i.m.m.krishna kumar

July 10, 2011 at 9:19 AM

please send rates for a.yr -2012-13 & 2011-12

REPLY

Income Tax Calculator (India) Powered by www.etaxindia.org 2009-10 A.Y. Male Status GrossIncome Less:Deduction TotalIncome IncomeTax Surcharge EducationCess Total Tax liability 0 0 0 0 0 0

Gadgets powered by Google

ravi vyas

July 11, 2011 at 5:39 PM

for the rates of a.y. 2011-12 click on following link A.Y. 2011-2012 for the rates of a.y. 2012-13 click on following link A.Y. 2012-2013

REPLY

G S MISRA

July 26, 2011 at 8:53 AM

easy presentation. pl continue.a lot of success will follow u.

REPLY

Manish Singh

July 26, 2011 at 5:57 PM

thank you sir.

REPLY

http://cagroupindia.com/share/income-tax-slab-rate-for-a-y-2012-13/

30/09/2011

INCOME TAX SLAB RATE FOR A.Y.2012-13 | Ca Group India

Manohar Manikonda

July 29, 2011 at 5:10 PM

Page 3 of 4

Sir i want update tax information

REPLY

ravi vyas

July 29, 2011 at 7:51 PM

what type of information you need in tax for update.

REPLY

Dr. G.V.Ramalingeswara Rao

August 13, 2011 at 8:37 PM

The information is fine. Surcharge (education cess,etc.,) information will also may be provided for more use

REPLY

Manish Singh

August 14, 2011 at 10:55 PM

Thank You Sir, We Will Sure Update.

REPLY

JIGNESH PRAJAPATI

August 17, 2011 at 4:59 PM

sir send last three f.year income tax rate for above my e mail id

REPLY

Manish Singh

August 18, 2011 at 8:46 AM

Click on This Link

REPLY

srikanth

August 22, 2011 at 4:15 PM

thaks for giving the updates relating to tax slabs

REPLY

pathik

September 23, 2011 at 1:30 PM

Que. is Name of Emp:- Mr. X Mr. Xs Birthday :- 07-09-1951 Taxable Income Rs. 7,00,000/How to calcute Tax (TDS) for assessment Year 2012-13?

REPLY

ravi vyas

September 25, 2011 at 11:23 AM

age as on the date- 61 yrs, total income 700000

http://cagroupindia.com/share/income-tax-slab-rate-for-a-y-2012-13/

30/09/2011

INCOME TAX SLAB RATE FOR A.Y.2012-13 | Ca Group India

Page 4 of 4

tds amount 72000+edu. cess. @3%= 74160/-.

REPLY

RVR Perumal

September 25, 2011 at 7:35 PM

Dear Sir, Thanks for your valuble information. My question :- I own two houses. One we stay and other is vacant. I pay income tax for second houses notional rent. If I gift one house to my wife, can I avoid paying income tax on notional rent?

REPLY

LEAVE A REPLY

Your email address will not be published. Required fields are marked * Name * Email * Website Comment

Submit Comment

HOME

ABOUT US

PRIVACY POLICY

CONTACT US

SITEMAP

5384 Ca Group India. All rights reserved. XHTML / CSS Valid.

proudly powered by Jagprem And CA Group.

http://cagroupindia.com/share/income-tax-slab-rate-for-a-y-2012-13/

30/09/2011

You might also like

- SAP Payroll Training DocumentsDocument15 pagesSAP Payroll Training Documentskb200933% (3)

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Annex 4 EchrDocument74 pagesAnnex 4 EchrStas SplavnicNo ratings yet

- Project On GSTDocument42 pagesProject On GSTMegha R57% (7)

- VAT Transfer PostingDocument1 pageVAT Transfer PostingabbasxNo ratings yet

- Reply: Padmanabhan Said On Saturday, February 27, 2010, 12:31Document15 pagesReply: Padmanabhan Said On Saturday, February 27, 2010, 12:31Aaditya PhanseNo ratings yet

- BEL: Results of Graduate Engineer Apprentices 2011-12 Batch ReleasedDocument14 pagesBEL: Results of Graduate Engineer Apprentices 2011-12 Batch ReleasedTrcStaffNo ratings yet

- Budget Booklet Ready Reckoner 2012 13Document62 pagesBudget Booklet Ready Reckoner 2012 13www.TdsTaxIndia.comNo ratings yet

- (JOHOR 2013) Additional Mathematics Project Work - HOUSEHOLD EXPENDITURE SURVEYDocument15 pages(JOHOR 2013) Additional Mathematics Project Work - HOUSEHOLD EXPENDITURE SURVEYWCKelvin82% (28)

- Payroll Compliance ChartDocument1 pagePayroll Compliance ChartVeerkumar PuttaNo ratings yet

- Interest Calculator New1Document24 pagesInterest Calculator New1Vinod SwaminathanNo ratings yet

- Interest Calculator 01.04.2012Document41 pagesInterest Calculator 01.04.2012Abhishek TiwariNo ratings yet

- West Bengal Economic ReviewDocument42 pagesWest Bengal Economic ReviewSantosh GarbhamNo ratings yet

- Instructions To Use This ProgrammeDocument27 pagesInstructions To Use This ProgrammeSatish HMNo ratings yet

- Area Principal Salary Calc2011Document4 pagesArea Principal Salary Calc2011plaestineNo ratings yet

- Economic Analysis RepoertDocument21 pagesEconomic Analysis RepoertM.Nabeel Shahzad SiddiquiNo ratings yet

- ABFDocument6 pagesABFTarak Nath BagchiNo ratings yet

- A Project Report On Direct TaxDocument44 pagesA Project Report On Direct Taxrani26oct100% (2)

- Mass Insight Q2 Consumer Confidence Index StabilizesDocument6 pagesMass Insight Q2 Consumer Confidence Index StabilizesMassLiveNo ratings yet

- Interest RatesDocument1 pageInterest RatesKishore RepakulaNo ratings yet

- Florida's January Employment Figures Released: Governor Interim Executive DirectorDocument14 pagesFlorida's January Employment Figures Released: Governor Interim Executive DirectorMichael AllenNo ratings yet

- Income Tax Volume - 1Document272 pagesIncome Tax Volume - 1VideshSharmaNo ratings yet

- Data Presentation and AnalysisDocument13 pagesData Presentation and AnalysisViru PatelNo ratings yet

- Can You Work Under PressureDocument7 pagesCan You Work Under PressureAmay JainNo ratings yet

- Unemployment in India: Submitted byDocument23 pagesUnemployment in India: Submitted byjanhavi aryaNo ratings yet

- Aps PSC Group 1 NotificationDocument7 pagesAps PSC Group 1 NotificationGeeta SankuNo ratings yet

- No-88 Vaikkalmettu Street Gangaikondan Village Mandhrakuppam Neyveli-607802 9840210531,8754708618Document2 pagesNo-88 Vaikkalmettu Street Gangaikondan Village Mandhrakuppam Neyveli-607802 9840210531,8754708618jvmuruganNo ratings yet

- Q2FY12 Results Tracker 13.10.11Document2 pagesQ2FY12 Results Tracker 13.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Ci and Si FormulaeDocument5 pagesCi and Si FormulaeMayankNo ratings yet

- 3rd Floor, A-Wing, SRA Administrative Building, Anant Kanekar Marg, Bandra East,: 022 2659 0028Document37 pages3rd Floor, A-Wing, SRA Administrative Building, Anant Kanekar Marg, Bandra East,: 022 2659 0028NORBERT PRAKASH EKKANo ratings yet

- Income Tax Calculation IndiaDocument2 pagesIncome Tax Calculation Indiajustinmark99No ratings yet

- ESICDocument1 pageESICMadhu KumarNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesTXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSmriti SrivastvaNo ratings yet

- Reliving BhubneswerDocument1 pageReliving BhubneswerAnil DubeyNo ratings yet

- Mindleap Payslip - PDF AUG PDFDocument1 pageMindleap Payslip - PDF AUG PDFChalla SandeepReddyNo ratings yet

- Fahadh T Moosan's Pay Slip of February-2016Document1 pageFahadh T Moosan's Pay Slip of February-2016fahadhtmNo ratings yet

- Why Are Not You Earning More Money at This Stage of Your CareerDocument8 pagesWhy Are Not You Earning More Money at This Stage of Your Careergajendrabanshiwal8905No ratings yet

- Income Tax Volume 1Document274 pagesIncome Tax Volume 1Rahul SinghNo ratings yet

- April 2011 Vol 55: Rig VedaDocument52 pagesApril 2011 Vol 55: Rig VedaKrystal RiveraNo ratings yet

- Infosys LTD: FM Concept Ratio Analysys of " "Document22 pagesInfosys LTD: FM Concept Ratio Analysys of " "Shiva ShettyNo ratings yet

- On-Line Application For Recruitment of Team Leader, System Analyst, Jr. Engineer, Dy - Executive Engineer, Steno TypistDocument3 pagesOn-Line Application For Recruitment of Team Leader, System Analyst, Jr. Engineer, Dy - Executive Engineer, Steno Typisthss2020No ratings yet

- WWW - Apteacher.n Et: Enter DetailsDocument58 pagesWWW - Apteacher.n Et: Enter DetailsSanthosh Kumar BaswaNo ratings yet

- 2011-2012 Compensation & Benefits Survey QuestionnaireDocument17 pages2011-2012 Compensation & Benefits Survey Questionnairesinghashish5444No ratings yet

- LDLDH00166770000004895 2Document6 pagesLDLDH00166770000004895 2Sanjeev SharmaNo ratings yet

- Bank Vacancies: Bank Post & Vacancies Last Date For Applying Written Test DateDocument6 pagesBank Vacancies: Bank Post & Vacancies Last Date For Applying Written Test DateShali VarNo ratings yet

- Ftxmys Pilot PaperDocument19 pagesFtxmys Pilot Paperaqmal16No ratings yet

- Affix Recent Colour Photograph of The CandidateDocument3 pagesAffix Recent Colour Photograph of The Candidatemadan023No ratings yet

- Ujjwal Kumar Singh: Career ObjectiveDocument2 pagesUjjwal Kumar Singh: Career ObjectiveROHIT008RAJNo ratings yet

- Ahluwalia Paper On Labour ReformsDocument184 pagesAhluwalia Paper On Labour ReformsOMEN21No ratings yet

- How To Calculate Ur Income TaxDocument3 pagesHow To Calculate Ur Income TaxrazeemshipNo ratings yet

- Final Maths IaDocument20 pagesFinal Maths IaVishnupriya PremkumarNo ratings yet

- Trim III - NoticeDocument13 pagesTrim III - NoticeRohit ThannaNo ratings yet

- Share Market Breakout India 2012Document4 pagesShare Market Breakout India 2012atewarigrNo ratings yet

- NSW Business Chamber SurveyDocument21 pagesNSW Business Chamber SurveyABC News OnlineNo ratings yet

- HRM 370 Assignment 01: Independent University, Bangladesh (IUB)Document16 pagesHRM 370 Assignment 01: Independent University, Bangladesh (IUB)Najia MuktaNo ratings yet

- 26 November To 2 DecemberDocument24 pages26 November To 2 DecemberpratidinNo ratings yet

- MP Cencus 2011Document110 pagesMP Cencus 2011Sawan SahuNo ratings yet

- Stock Market India - Share Market Analysis - Best Stock Trading TipsDocument11 pagesStock Market India - Share Market Analysis - Best Stock Trading TipsdanishraiNo ratings yet

- NREGADocument10 pagesNREGAAbhishekNo ratings yet

- 48 - NSDocument2 pages48 - NSshonit08No ratings yet

- C.H.A.P.P.S.: CLOCKABLE HOURS APPLICATION PROCESS AND PAY SYSTEMFrom EverandC.H.A.P.P.S.: CLOCKABLE HOURS APPLICATION PROCESS AND PAY SYSTEMNo ratings yet

- Investment and Agricultural Development in Developing Countries: The Case of VietnamFrom EverandInvestment and Agricultural Development in Developing Countries: The Case of VietnamNo ratings yet

- IGCSE-OL - Bus - CH - 23 - Answers To CB ActivitiesDocument4 pagesIGCSE-OL - Bus - CH - 23 - Answers To CB ActivitiesOscar WilliamsNo ratings yet

- 1103566576Document2 pages1103566576Ramesh BabuNo ratings yet

- Week 3 Course Material For Income TaxationDocument11 pagesWeek 3 Course Material For Income TaxationAshly MateoNo ratings yet

- Doing Business in The Philippines (Why The Philippines?)Document14 pagesDoing Business in The Philippines (Why The Philippines?)Lianna RodriguezNo ratings yet

- June 2014Document1 pageJune 2014Deepak GuptaNo ratings yet

- Civil Aspect Collection CasesDocument18 pagesCivil Aspect Collection CasesHNicdaoNo ratings yet

- Taste of The FutureDocument20 pagesTaste of The FutureDeejaHayatNo ratings yet

- NM Substitute W9Document2 pagesNM Substitute W9marcelNo ratings yet

- Keynes.1925.A Short View On RussiaDocument20 pagesKeynes.1925.A Short View On RussiaPrieto PabloNo ratings yet

- Solman Tax2 Transfer Bus Tax 2018 Edition Chapters 1 To 8Document43 pagesSolman Tax2 Transfer Bus Tax 2018 Edition Chapters 1 To 8sammie helsonNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Akhilesh GuptaNo ratings yet

- Historical Development of The Customs Act and Customs DutyDocument47 pagesHistorical Development of The Customs Act and Customs Dutysuyash dugarNo ratings yet

- Standard Apartment Cost Sheet: 24K OpulaDocument1 pageStandard Apartment Cost Sheet: 24K OpulaRavi NigamNo ratings yet

- Conventional Versus Non Conventional Cash4079Document10 pagesConventional Versus Non Conventional Cash4079Amna SaeedNo ratings yet

- FRAZIER0113Document1 pageFRAZIER0113shani ChahalNo ratings yet

- Titan Shoppers Stop Ratio Analysis - 2014Document25 pagesTitan Shoppers Stop Ratio Analysis - 2014Jigyasu PritNo ratings yet

- Chapter 9 - RIT - Inclusions in Gross IncomeDocument3 pagesChapter 9 - RIT - Inclusions in Gross Incomeclaritaquijano526No ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- Saral: ITS-2D Form No. 2DDocument2 pagesSaral: ITS-2D Form No. 2DPrasanta KarmakarNo ratings yet

- 2 - CIR V Filinvest PDFDocument2 pages2 - CIR V Filinvest PDFSelynn CoNo ratings yet

- Pidato ScriptDocument2 pagesPidato ScriptvikneswaranNo ratings yet

- The Role of The UN: Directing Global Resources To The Rural PoorDocument19 pagesThe Role of The UN: Directing Global Resources To The Rural PoorKassyap VempalliNo ratings yet

- Introduction To The Historical Tables: Structure, Coverage, and ConceptsDocument25 pagesIntroduction To The Historical Tables: Structure, Coverage, and ConceptsimplyingnopeNo ratings yet

- Answer (A) Indirect MethodDocument2 pagesAnswer (A) Indirect MethodKyriye OngilavNo ratings yet

- 3rd Year BusCom Intercompany TransactionsDocument2 pages3rd Year BusCom Intercompany TransactionsJoshua UmaliNo ratings yet

- IE MergedDocument173 pagesIE MergedOm PrakashNo ratings yet

- Rendering The Correctness of The Cash in Bank Account DoubtfulDocument7 pagesRendering The Correctness of The Cash in Bank Account DoubtfulJuan Luis LusongNo ratings yet