Professional Documents

Culture Documents

Abrevaya Projectionapproachunbalanced 2013

Abrevaya Projectionapproachunbalanced 2013

Uploaded by

DWI NOVA WIJAYAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abrevaya Projectionapproachunbalanced 2013

Abrevaya Projectionapproachunbalanced 2013

Uploaded by

DWI NOVA WIJAYACopyright:

Available Formats

The projection approach for unbalanced panel data

Author(s): Jason Abrevaya

Source: The Econometrics Journal , 2013, Vol. 16, No. 2 (2013), pp. 161-178

Published by: Oxford University Press on behalf of the Royal Economic Society

Stable URL: http://www.jstor.com/stable/43697634

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide

range of content in a trusted digital archive. We use information technology and tools to increase productivity and

facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

https://about.jstor.org/terms

Royal Economic Society and Oxford University Press are collaborating with JSTOR to digitize,

preserve and extend access to The Econometrics Journal

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

Econometrics Journal (2013), volume 16, pp. 161-178.

doi: 10.1 1 1 l/j.l368-423X.2012.00389.x

The projection approach for unbalanced panel data

Jason Abrevaya1

t Department of Economics, The University of Texas at Austin, Austin, 2225 Speedway Stop

C3100, TX 78712, USA.

E-mail: abrevayaOeco . utexas . edu

First version received: August 2010; final version accepted: September 2012

Summary The Chamberlain projection approach, a powerful tool for the analysis of linear

fixed-effects models, was introduced within the context of balanced panels. This paper extends

the Chamberlain projection approach to unbalanced panels. The extension is especially useful

for models with sequential exogeneity , where existing control-variable approaches are not

applicable. A generalized method of moments (GMM) estimation framework is considered,

and hypothesis tests (testing strict exogeneity, testing random effects, etc.) are discussed within

the GMM context.

Keywords: Fixed effects , Linear projections, Unbalanced panel data.

1. INTRODUCTION

Unbalanced panel data sets are commonly encountered in empirical research.1

unbalanced nature of panels does not affect applicability of many commonly used

(such as the within estimator or the random-effects estimator), this is not true of al

In this paper, we discuss one such estimation approach, the projection approach of

(1982), for which unbalanced panels pose a difficulty. The original idea of Chamber

projecting the (unobserved) fixed effect upon covariates from all time periods, is not

applicable in unbalanced panels. We introduce a modified Chamberlain approac

the fixed-effect projection depends on the form of missingness for a given cr

unit. The resulting projections lead to orthogonality conditions that depend upon t

exogeneity assumption maintained. We focus on the alternative assumptions of strict

and sequential exogeneity.

Related work by Wooldridge (2009) considers the use of Mundlak (1978) p

(i.e. projections of fixed effects onto averages of covariates) in the context of

panels under an assumption of strict exogeneity. Wooldridge (2009) shows that poo

squares regressions that use covariate averages as control variables are numerically

1 Baltagi and Song (2006) give an extensive survey of the econometrics literature on unbalanced panels.

2 These remain applicable as long as the missingness is not informative about the error disturbances, an

in Section 2.

© 2013 The Author(s).

The Econometrics Journal © 2013 Royal Economic Society. Published by John Wiley & Sons Ltd, 9600 Garsington

Road, Oxford OX4 2DQ, UK and 350 Main Street, Maiden, MA, 02148, USA.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

162 J. Abrevaya

to the traditional fixed-effects (wit

a projection approach in the strictly

to point out that a Chamberlain ap

as we view the resulting orthogonal

(GMM) framework, efficiency gains

obtain.

A drawback of the Mundlak approa

strict exogeneity fails, for example,

'predetermined'). The Mundlak project

covariates, making the usual applicat

or lagged covariates as instruments) i

In contrast, the modified Chamberla

sequential exogeneity.

Among empirical researchers, the u

The fixed-effects estimator is used

estimators based upon first differen

are used in the presence of predeterm

and are included as part of statistical

the addition of general GMM comma

outlined in this paper is also easy to

Chamberlain GMM estimator can pr

estimator. The Chamberlain framew

noted in the literature, including (a) t

(or weaker versions of exogeneity), (b

and (c) the ability to estimate the rel

(from the estimated projection coeffi

The paper is organized as follows. S

data missingness that can lead to an

for the balanced-panel case is review

balanced-panel case is also reviewed. F

an example is provided to illustrate

inconsistent estimates of the mod

case in more detail. A modified Ch

The approach requires additional pro

for the cross-sectional units. The pr

in a GMM framework to develop e

GMM framework allows for straigh

For the sequentially exogenous case

inconsistency of the Mundlak appro

Chamberlain-based orthogonality con

assumption. Section 4 illustrates the

panel data set on wages, first assum

the strict exogeneity assumption of

also compared to commonly used esti

3 Wooldridge (2009) also generalizes the Mu

models.

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

Unbalanced panel data 163

exogeneity and Arellano-Bond-type first-difference in

sequential exogeneity.

2. THE MODEL

Consider the standard linear fixed-effects model

yit = Xitßo + Ci + Uit (i = 1, . . . , n' t = 1, . . . , T' (2.1)

where T represents the maximum number of time periods that a cross-sectional unit i would

be observed. As in Chamberlain (1982), we consider the case of large-n ( n -> oo), fixed-

T asymptotics. Let k denote the number of covariates in x ¡t (so that ßo is a A: -vector). The

unbalanced nature of the panel is introduced by allowing time periods to be 'missing'. Following

the notation of (Wooldridge, 2002, subsection 17.7.1), an observability indicator is defined as

{1 00ifotherwise.

otherwise. (yit , xit) observed

For missing observations (sit = 0), we use the convention that xit = 0 and ytř = 0. W

sit denoting the total number of time periods observed for cross-sectional unit /,

transformations (used for the standard fixed-effects (or within) estimator of (2.1)) are

% = yit - T~x ^ Sirytr , Xi, = xit - Trl y^sirXjr.

r r

We w

no di

follow

y¡ = (yn . • • • , yn)' Xi = (xn, xiT)' U¡ = (un , . . . , uiT)', Si = (s, , siTy.

Each of these is a column vector, with jc, of dimension Tk x 1 and y i , u¡ and s¡ each of dimension

T x 1.

To complete the set-up of the model, we introduce two assumptions. First, the strict

exogeneity assumption is given by:

Assumption 2. 1 (Strict Exogeneity). E(u¡ 'x c,- , s¡) = 0.

This assumption allows observability (s¡) to be related in arbitrary ways with and c,

but restricts the error disturbances (u¡) to be conditionally mean independent of (x/, q, s¡).5

Assumption 2.1 is a stronger version of the usual strict exogeneity assumption, as it maintains

strict exogeneity of observability (selection) in addition to strict exogeneity of covariates.

Observability of (yitixit) can not be systematically related to any of the disturbances uis

(s = 1, . . . , T) once unobserved heterogeneity and observables are controlled for.

4 If the missingness mechanism causes only a single observation to remain for a cross-sectional unit, we simply assume

that this unit has already been dropped from the observed data. Note that this implicit assumption would not require

anything stronger than Assumption 2. 1 below, which already assumes that the error disturbances are conditionally mean

independent of the missingness indicators.

5 This assumption is identical to the assumption made by Wooldridge (2002) in his textbook treatment of unbalanced

panel data and also in Wooldridge (2009).

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

164 J.Abrevaya

Secondly, to guarantee parameter

possible missingness is required.6

ASSUMPTION 2.2 (Full Rank). Let

s e S and t e {1, . . . , T] such that

The Chamberlain (1982) projection

effect Ci upon (xu , . . . , t),

ci = ÝO + xi'^0' H" xi2^02 H" • * • + XíjXqj + <2/, (2.2)

where ýo is a scalar, each Ào, is a k x 1 vector, and E[x'itai] = 0 by construction (for e

Plugging (2.2) into (2.1) yields a model from which (ßo, Ýo, ^oi> • • • » t) can be es

A simple estimation method is the pooled ordinary least squares (OLS) regression o

(xa, 1, Xu , . . . , xiT). It is now well-known (e.g. Imbens and Wooldridge, 2007, and Woo

2009) that this estimator is numerically equivalent to the within estimator and also the

(1978) regression estimator, as stated in the following result:

Proposition 2.1 (Equivalence Result for Balanced Panels and No Missingness). The

following estimators of ßo are numerically equivalent: (a) the within estimator ( OLS of y u

on xit ); (b) the Chamberlain regression estimator (OLS of yit on (xit, 1, jc/i, . . . , *,t)); (c) the

Mundlak regression estimator (OLS of y u on (x íř, 1, *,)); (d) the least-squares dummy variable

(LSDV) regression (OLS of y¿t on (*„, ¿/1/, d2¡, . . . , dN¿), where d ji is an indicator variable

equal to one if i = j and zero if i ± j ).

When missingness causes the panel to be unbalanced, the Chamberlain approach is no longer

directly applicable. If a researcher blindly attempts to apply the projection (e.g. by plugging in

zeros for xit in periods without data), this will generally cause inconsistency of the resulting

estimators. We provide a simple three-period ( T = 3) example with scalar covariates to illustrate

this point. Consider the model

y u =xit -b Cļ +uit (t = 1,2, 3),

Ci = */3,

where E(j ct) = 0 and var(jc;) = /3. That is, the covariates are each mean zero with unit vari

and no serial correlation. The third period is missing for unit i with probability p. (When

third period is missing, it is still the case that c,- = JC/3 but (^/3, JC/3) are just not observed.)

'blind' Chamberlain approach in this situation would be a pooled OLS regression with xits a

control variables but JC/3 = 0 used in the case of a missing observation. To easily evaluate

probability limit of the Chamberlain pooled OLS estimator, we insert a row of zeroes (so as n

to otherwise affect estimation) for missing t = 3 observations. Then, the Chamberlain covari

6 Note that Assumption 2.2 is somewhat stronger than the assumption made by Wooldridge (2002, Assumption 17

Whereas the latter assumption is sufficient for identification of the within estimator, the former assumption is need

guarantee identification of all parameters within the Chamberlain projection approach.

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

Unbalanced panel data 165

matrix, denoted X,- is given by

r Xii 1 Xn xi2 Xi3

Xi = xi2 1 Xn xi2 Xi3 (2.3)

_Xi3 1 Xn Xi 2 Xi 3_

for fully observed /, and by

Xn 1 Xn Xi 2 0

Xi = xi2 1 xn Xi2 0 (2.4)

0 0 0 o 0_

for i with missing t = 3. The probability limit of the pooled OL

E(X¡Xi)~l E(X¡yi). The distributional assumption on x¿ and the model fo

"30111] [20110"

03000 02000

E(X¡Xi) = (l- p) 1 0300 + p 1 0200

10030 10020

_1 0 0 0 3

and

"41 [3'

0 0

E(X¡yi) = (1 - p) 1 +p 1 .

1 1

_4J [o_

We focus on the model's ß parameter (equal to one in our design), corresponding to the first

component of the pooled OLS estimator. Figure 1 graphs the probability limit of the Chamberlain

estimator of ß versus the probability of t = 3 missingness (/?). With no missingness (p = 0), the

Chamberlain estimator is consistent and has probability limit equal to one. The inconsistency

worsens as p increases, with a probability limit that reaches twice as large as the true value when

p gets close to l.7

Interestingly, as Wooldridge (2009) notes, the Mundlak regression (with x¡ = T¡~x Ylt sitxu)

remains consistent and numerically identical to the within estimator in the presence of

unbalanced panels.8 Unfortunately, while fine for estimation purposes under strict exogeneity,

the Mundlak approach does not offer the researcher the same flexibility for handling (and testing)

less stringent assumptions like sequential exogeneity.

3. CHAMBERLAIN PROJECTION FOR UNBALANCED PANELS

The T = 3 case is considered for ease of exposition. The methods discussed

naturally to larger T but with more moment conditions and additional paramet

7 Note that E{X'Xi) is not invertible when p = 1 but is otherwise non-singular for p < 1. The p

reported in Figure 1 were calculated for values of p strictly less than 1 .

8 Others have recommended the use of covariate averages as control variables to handle unbalanced p

linear models (Wooldridge 2002, 2009) and quantile regression models (Bach et al., 2008).

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

166 J. Abrevaya

Figure 1. Inconsistency of Chamb

case of model (2.1) is

yu = Xitßo + Ci + Uit (/ = 1, . . . , n' t = 1, 2, 3). (3.1)

Recall that 7} >2 for all i , so that 7} is either two (one missing period) or three (no mis

periods) here.

The possible s¡ values for the Tt =2 observations are (0, 1, 1/, (1, 0, 1/ and (1,1, 0/. There

are two possible methods for dealing with the 7} = 2 subsample: (a) combining all possible

configurations into a single projection method or (b) handling each possible s¡ configuration

as a separate projection method. Method (a) has the virtue of being simpler to implement

and requiring fewer moment conditions for estimation/testing purposes. By treating different s¡

configurations differently, method (b) offers the researcher the ability to check the sensitivity of

the model specification to violations of strict exogeneity that depend upon which time periods are

missing (and not just how many time periods are missing). These two methods, which we call 7}-

dependent projections and s i -dependent projections , respectively, are described in Sections 3.1

and 3.3.

3.1. Tļ -dependent projections

To use a single method for all st configurations for 7} =2 observations, the easiest approach is

to simply shift the time indices for unit i such that £¿=(1,1,0)'. That is, the last time period

(, t = 3) is made to be missing for each Tļ =2 observation.9 The shift of the time indices should

be done in such a way that the ordering of time is maintained , which allows for a treatment of

9 Note that this relabelling of the time indices does not affect estimation of time dummies (or other /-dependent

covariates) since we are not changing any of the covariate values themselves.

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

Unbalanced panel data 167

the sequentially exogenous case in subsection 3.2. Specifi

be left alone, a unit i with = (1, 0, 1)' would have t = 3 s

unit i with Si = (0, 1, 1)' would have t = 2 and t = 3 shift

respectively.

For fully observed cross-sectional units (7} = 3), the usual projection is applied:

Ci = ýo + */i*oi + *¿2*02 + */3*03 + at (fully observed), (3.2)

where E(x'nãi) = E(x'i2ai) = E(x'i3ai) = 0 by construction. For the T¡ = 2 observations, where

jc/3 is not observed, the fixed eífect c, is projected, onto only *n and x¿2'

Ci = Ýo + *zi*oi + *i2*02 + aì (ř = 3 missing), (3.3)

where E(x'naf) = E(x'i2af) = 0 by construction. Superscripts are used for parameters and

projection errors as a convention for denoting which period is missing data (period t = 3 here).

Plugging the two projections (3.2) and (3.3) back into the original model (3.1) yields,

respectively,

yit - xitßo H- Ýo + */i*oi + */2*02 + */3*03 + ai + uit for t = 1, 2, 3 and 7} = 3 (3.4)

and

yit = Xitßo + V^o "ł* */i*oi */2 *02 + aì + uit f°r ř = 1» 2 and 7} = 2. (3.5)

For (3.4) and (3.5), the composite error disturbances a¡ + uit and a? -h uit , respectively, are

uncorrected with the regressors due to Assumption 2.1 and the linear projections. These

orthogonality conditions can naturally be represented as moment conditions to allow for GMM

estimation. To simplify notation, let 0 = ( ß , x/r, Ài, À2, *3, *1» *2) denote the full vector of

parameters and #0 = (ßo, Ýo, *01 » *02, *03» V'o» *01 ' *02) true parameters.

Specifically, consider the following set of moment functions corresponding to the

orthogonality conditions for (3.4) and (3.5):

' 1 "

* •

SiiSiìSiì J1 • (y¡, - Xitß -ý - Xi 1X1 - xi2^2 - XiļX3) for t = 1, 2, 3, (3.6)

¡2

~ 1 1

5/15/2(1 - S/3) x'n ( y¡ , - xitß - Ý3 - Xu*.] - Xi2xļ) for t = 1, 2. (3.7)

_*;2J

Let g(zi , 0) denote the stacked vector of all these functions, where = (>>/, */, sř). There are a

total of 13A: + 5 moments conditions and 6k + 2 parameters (Ik + 3 overidentifying restrictions).

In contrast, the usual situation with no missing data would be based solely upon (3.6), with 9k -f 3

moment conditions and 4Ä: H- 1 parameters (5Ā: + 2 overidentifying restrictions).

Note that we have additional overidentifying restrictions from the proposed orthogonality

conditions as compared to the non-missing case. These additional restrictions arise since the

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

168 J. Abrevaya

orthogonality conditions must hold

The additional restrictions need not y

not make sense to purposefully throw

The orthogonality conditions imply

true parameter values.

LEMMA 3.1. Under Assumption 2.

moment functions given in (3.6) and

G ± Bo.

Let 0 denote the unweighted GMM estimator obtained by minimizing

YlsiZi, 0)^ 2^g(Zh 0)j . (3.8)

The GMM estimator can be implemented without numerical optimization by using instrumental-

variables methods. Specifically, define the instrumental- variable matrix Z, as

'in 0 0"

Z, S o Za. 0 , (3.9)

o 0 Z,3_

where

Zfl = [-5/3 i/3*/l i/3*/2 Í/3X/3 (I-Í/3) d - Siļ)xn (1 - í/3)*/2] . (3.10)

Zi2 = [í/3 Si3Xii S¡1Xi2 SiiXji (1 í/3) (1 - í/3)*/ 1 (1 - í/3 fe] , (3.11)

Z/3 = [í/3 í/3*/l í/3*/2 S/3JC/3]. (3.12)

and the Os in (3.9) are row vectors of appropriate dimensio

Note that (3.4) and (3.5) can be combined into a single e

y it = Xi,ßo + 5/3(^0+^/1^01 +x/2^02 +-*/3^03 + 0/ ) + ( 1

(3.13)

Then, defining

Xi 1 Í/ 3 Í/3JC/1 SiļXi2 SiļXjļ (1 - 5i3) (1 - Í/

X¡ = X¡2 í/3 S/3*/i SjļXj2 Si 3X¡1 (1 - í/3) (1 ~ í/3)*/l (1 - í/3).X/2 ,(3.14)

_X¡3 í/3 í/3*/l í/3*/2 í/3*/3 (1 - í/3) (1 ~ í/3)*/l (1 ~ Siļ)xi2 _

the unweighted GMM estimator 9 from (3.8) can be obtained directly as the system IV estimator

ê = (X'ZZ'X)-'(X'ZZ'Y), (3.15)

10 An alternative way to proceed, which maintains the same number of ortho

case, is provided in the Appendix. This alternative approach would be particula

of orthogonality conditions will increase rapidly in T.

© 2013 The Author(s). The Econometrics Journal © 2013

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

Unbalanced panel data 169

where X, Z and Y are the stacked versions of X¿, Z,-

x (13* + 5) and nT x 1, respectively.

The unweighted GMM estimator is, in general, ineff

allows for weighting is

w^n-'¿g(zi,0

The system 2SLS estimator has W2sls = (^)_1,so

Oisls = (X'ZWTSLsZ'XyilX'ZWtsLsZ

Let fa s lš denote the components of §2sls correspon

also not necessarily efficient, is equivalent to the with

PROPOSITION 3.1. The following estimators of ßo

estimator ( OLS of y u on x it)', (b) the 2SLS Chamber

on Xc, ( d ) the Mundlak regression estimator (OLS of

(e) the LSDV regression for sit = 1 observations.

This proposition extends the equivalence results

Looking at the combined model in (3.13), the validity

in the unbalanced-panel setting by interacting the app

missingness configuration. Equivalently, one can think

a specific missingness configuration as in the moment

Finally, the optimal GMM estimator can be obtained

instance, after obtaining the 2SLS estimator 62SLS , t

objective function (3.16) where the optimal weighting

w = #2 SLs)g(Zi, 025L5)^

The optimal GMM estimator can be obtained directly as 6 = (X'ZWZ'Xy^iX'ZWZ'Y).

3.1.1. Test of overidentifying restrictions. If the moment conditions are correctly specified

(which will occur if the model itself is correctly specified and Assumption 2.1 holds), then

the optimal GMM estimator Õ can be used directly for a test of overidentifying restrictions.

Specifically, under correct specification

J = n ¿ gin, (9)^ W ^T1 ¿ g(z¡, Õ)j Xn+3-

Rejection based upon this test statistic (i.e. a value greater than the appropriately chosen critical

value from the Xn+3 distribution) is evidence of a violation of strict exogeneity.

Note that the degrees of freedom for the test of overidentifying restrictions can be quite

large, even for the T = 3 case considered here. As a result, it is quite possible that such tests will

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

170 J. Abrevaya

have low power. This property is cert

balanced panels and has been noted a

3.1.2. Test of a random-effects

heterogeneity c, is independent of a

À parameters in the Chamberlain pr

interest is

Ho : A.01 = ^02 = A.03 = A.0

which could be tested in a variety o

a Wald test based upon an estimator

distribution under Hq. LM- and LR-t

3.2. Sequential exogeneit

An appealing feature of the Chambe

(Assumption 2.1) can be weakened di

researcher would like to relax. In t

assumption with a sequential-exogen

Whereas the Mundlak approach is

projections does not seem to provide

exogenous case, even for a balanced

period balanced panel example with

y it =xit+Ci +uit ( t = 1,

ci =xn,

where the violation of strict exogeneity comes from a strong form of fee

Ui'. This model satisfies the following sequential-exogeneity assumption

E(uii'xn, Ci) = 0 and E(ui2'xn, xi2, q) = 0.

The Mundlak and Chamberlain projections would lead to corresponding 'residuals' given

by y it - ß*it - and y¿t - ßxu - ÀiJC/i - A.2JC/2» respectively. The Mundlak residual is not

guaranteed to be orthogonal to x¿ ' or xt2 for either t = 1 or t = 2. In contrast, the Chamberlain

residual is orthogonal to x¡' and xi2 for t = 2 and orthogonal to x¡' for t = 1. We conducted a

simple GMM exercise using the model above, drawing jc, 1 , un and u¿ 2 as independent standard

normal random variables (and ct , */2, yn, y /2 resulting from the specification). We used a sample

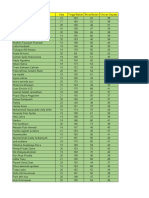

size of n = 1,000,000 to ensure precision. Table 1 reports the results from the exercise. Four sets

of (efficient) GMM estimates are reported, corresponding to Mundlak and Chamberlain under

strict exogeneity and sequential exogeneity. For strict exogeneity, both covariates are used in the

orthogonality conditions in both time periods. For sequential exogeneity, jt/2 is dropped from

the first time period's orthogonality conditions. Both estimators are clearly inconsistent when

strict exogeneity is incorrectly assumed, with the Chamberlain estimator actually performing

worse than the Mundlak estimator. When sequential exogeneity is correctly assumed, however,

the Chamberlain estimator works perfectly and recovers both the true ß parameter and the correct

projection parameters. The Mundlak estimator remains inconsistent.

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

Unbalanced panel data 171

Table 1. Failure of Mundlak approach under sequ

Assuming Assuming

strict exogeneity sequential exogeneity

Mundlak Chamberlain Mundlak Chamberlain

ß (true value = 1) 0.6686 0.5015 0.6673 1.0000

(0.0006) (0.0009) (0.0013) (0.0014)

Projection coefficient 1 .9995 2.0022

on X (0.0005) (0.0024)

Projection coefficient 1.3492 1.0002

on x¡' (0.0008) (0.0010)

Projection coefficient 0.8497 0.0007

on jc,2 (0.0003) (0.0017)

Note: Efficient GMM estimates

and Chamberlain uses a projection

periods. The last two columns do n

Returning to the T = 3

one is interested in impo

easily restore the mome

exogeneity, incorporati

exogeneity assumption E(u

The error disturbance is

and lagged covariates but

back effects in the dyna

observability is still restri

Note that only a subset o

sequential exogeneity, spe

" 1 "

xf.

Siisi2Siļ (y¡ 3 - xi3ß -ý - *nA.i - xi2X2 - xnkļ), (3.17)

/2

"1"

susnsn x'n (yi2 - xi2ß - f - xi2X2 - xi3k3), (3.18)

_ Xi2 _

Si'si2Si 3 ^ j (yn - xnß -ý - xn>-i - xi2X2 - xi3k3), (3.19)

"1]

s<isi2(l - si3) x'n (yi2 - xi2ß - V3 - *¡1*1 - *¿2^2) • (3.20)

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

172 J. Abrevaya

Silnil - si3) J (y,i - x

A total of 4 k moment functions have b

leaving 9k + 5 moment functions and

the stacked moment functions (3.1

an optimal GMM estimator (denote

instrument matrix for IV estimation

corresponding to the dropped orthogo

Zi I = [s,'3 Si 3*n (1 - si3) (1-5,3 )*ii], (3.22)

z¡2 = [í,3 Sj3xn SiļXi2 (1-5,-3) (1 - s,3)*, i (1 - ^,3)^2] , (3.23)

Zi3 = [5/3 i/3*/l Si3Xi2 5, 3*, 3]. (3.24)

Redefining Z, using these rows (and Z as the stacked version

Osec.lSLS = ( X'ZW2SLsZ'Xrl(X'ZW2SLsZ'Y ),

where 'V2s1_s = (^)~l ■ The optimal GMM estimator is

Õseq = (X'ZWseqZ'X)-'X'ZWseqZ'Y),

where

W seq - ^ ^ 8seq(Zi 1 @seq,2SLs)8seq(.Zi y @seq,

3.2.1. Overidentification test. The overidentification test stati

estimator Bseq is

Jseq = ^ ^ ^ gseqiZr , 0 W Seq ^ ^ > &seq(j>i ? @

and, under correct model specification and sequential exogeneity, has a Xm+s limiting

distribution.

3.2.2. Test of strict exogeneity. To test the stronger assumption of strict exogeneity (Assumption

2.1) against the alternative of sequential exogeneity, one wants to test the validity of the extra

moments used for GMM estimation under strict exogeneity. There are several ways of performing

such a test, but a particularly simple method is the GMM-based approach of Eichenbaum

et al. (1988) (EHS hereafter).12 The EHS test statistic is simply the difference between the two

1 1 In the case with no missingness, there are 6k + 3 moment functions and 4k + 1 parameters.

,z See Hall (2005) for an excellent discussion of the EHS test and its asymptotic properties.

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

Unbalanced panel data 173

overidentification test statistics given above (one unde

exogeneity):

J EHS = J - Jseq-

Under the null hypothesis that the full set of mome

d ?

J EHS - ► xtk' ? Note that the degrees of freedom here is the number o

used for 0.

3. 3. Si -dependent projections

In this subsection, the GMM approach of subsection 3.1 is modified to

conditions to be conditional on specific configurations rather than

of the aforementioned specification tests will apply to the GMM estim

subsection; as these tests only require a change in the degrees of freedo

described below.

Whereas the 7} -dependent projection approach allows for two types of projections (one for

Ti = 2, one for 7} = 3), the s i -dependent projection approach specifies four different projections

(three for 7} = 2, one for 7} = 3):

Ci = Ýo + */i*oi + */2*02 + */3*03 + «/ (fully observed), (3.25)

Ci = Ýo + *12*02 + */3*03 + ai = 1 missing), (3.26)

Ci = Ýo + *¿i*oi + *¿3*03 + aì (f = 2 missing), (3.27)

ci = Ýo + *¿1*01 + *¿2*02 + aì (' = 3 missing). (3.28)

Recall that the superscript notation is used to denote the missing time period. For each projection,

the projection error is, by construction, uncorrelated with the xits that appear on the right-hand

side of the projection equation (e.g. a] is uncorrelated with xn and */3). The total number of

estimable parameters has increased to lOfc + 4, with the true parameter vector given by 0q =

(ßOi Ýo, *01» *02» *03» V^o » *02' *03» ^0' *01' *03» ^0' *01' *02^'

Using the projections (3.25)-(3.28) in conjunction with the model (3.1), the following

moment functions are implied by the resulting orthogonality conditions under strict exogeneity :

" 1 "

X•

snsnsn J1 • (yu - xitß -f- x(l^i - xi2k2 - xi3X3) for t = 1, 2, 3, (3.29)

12

~1"

(1 - 5,i)s,-2i¿3 x¡2 (y¡t - xitß - x¡2''- xnX') fori =2, 3, (3.30)

_*;3J

■i■

5/i(l - si2)si3 x'n ( yit - xitß - Ý2 - xnk] - XijXj) for t = 1, 3, (3.31)

_*;3J

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

174 J. Abrevaya

~ 1 "

Si'si2(l - Su) x[ļ (yit - xitß

M

There are 2lk + 9 moment functions within (3.29)-(3.32) and, therefore, llfc + 5

overidentifying restrictions. For sequential exogeneity, one would drop the necessary

orthogonality conditions from the set above, similar to subsection 3.2.

To keep the notation simple, re-define g(zi , 0) to be the stacked moment functions above

and 02SLS and 9 to be the 2SLS and optimal GMM estimators, respectively. Similarly, re-define

gseqizi, 0) to be the stacked moment functions under sequential exogeneity (removing a total of

6k moments) and 0seq,2SLS and 0seq to be the corresponding 2SLS and optimal GMM estimators,

respectively. Finally, let J and Jseq denote the overidentification test statistics associated with

the optimal GMM estimators 6 and Õseq, respectively. With this notation, it is straightforward to

extend the various tests introduced above. A Wald test of the random-effects specification (all X

parameters being equal to zero) would have 9k degrees of freedom. The overidentification tests

based upon J and Jseq have 1 Ik + 5 and 5k + 5 degrees of freedom, respectively. The EHS test

of the additional moment restrictions used under strict exogeneity, based upon the test statistic

J - Jseq, has 6k degrees of freedom.

The larger number of moment conditions for the s¡ -dependent approach could yield efficiency

gains over the 7} -dependent approach. It is important to note, however, that even though there

are additional moments, each of these moments will have fewer associated observations within

the sample (i.e. observations for which the moment function is not trivially equal to zero). Any

efficiency gain would come from the fact that the form of residual heteroscedasticity and/or serial

correlation varies with s¿ even after conditioning on 7}. If this is not the case, the 7} -dependent

and Si -dependent estimators should yield extremely similar results.

4. AN EMPIRICAL EXAMPLE

To illustrate the projection method described in Section 3, we consider the pane

wages originally studied by Velia and Verbeek (1998). Their original sample, take

National Longitudinal Survey (Youth Sample), was a balanced panel of 545 full-ti

males for the 8 years between 1980 and 1987. 13 Starting from this original sample

created an unbalanced panel data set. Specifically, for a random sample of 25% of

in the data, we dropped 4 years of data (1981, 1983, 1985, 1987). 14 The resultin

panel has 409 individuals with complete data (8 years) and 136 individuals with i

(4 years).

Since our primary purpose is an illustrative one, we focus on a simple specification of the

fixed-effects model for log- wages that includes indicator variables for marital (1 if married) and

union status (1 if union member) and a quadratic specification in experience (measured in years):

In (wage)it = ß'marriedit + ß2 unionu + ß?>experit + ß4experft + c¡ + un.

Table 2 reports the results from several different estimators and hypothesis tests for this model.

13 Velia and Verbeek (1998) provide additional details on the choice of sample.

14 Every fourth observation from the original data was dropped, so the missingness mechanism is totally random and,

by itself, would not cause a violation of the strict exogeneity assumption.

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

Unbalanced panel data 175

✓ - '

^ - ' /-V ' O V)

osmvoo^Hvo^H^H

<; ^hcsooinoscNQQ

Êa <; _J osmvoo^Hvo^H^H

_J OOOOOOOO i^-iSvoriOmvo^H ^hcsooinoscNQQ OOOOOOOO

«3 (NoÖOOÖÖOÖ

¡3 w W W ļ w

o

s

ôû ^

0 ^ ^ ^ in es

>< ^ rh VOVOr^r-^OOtNO

<t> ^ <u /-N^5 cs»noo»nr-om^H

ś> S <u ^ÊÖOÖÖOÖOO

j S82SS888

<D

§ O 'g w w w , w

3 C ^

CT1 cd ✓ - s OO ^ - '

<ü 'TS rd ' - v X - s VO VO CS ✓ - s

** .o 25 ^n^oo^cn^

on .o c Sá -«èmvocN^Hr-mò ^ m (S o ^ m

P ¿='

fā ^ a^ fi

c *3 S ^^ON(NOOOO

OOOO-HOOO (S^H^OooO

r-vooo-H»n

tž o ww

ÖOÖÖOÖÖÖ (N¡ O O O co O

W W WlW^W^W^W

1

^ ) t^<Nr-r-^(Ncor- /■ s X s oo ^

! ) /■

ZSl m(N^H*nOS'- |^-Q (N Q

J w O

C/3 OO*- 'O'- 'OOO ^ O

^ ÖOOOÖOOO ¿é

s

^ (N

r3 /^-v /- s ✓ - s VO VO

2 5 o'^)oooi-o'mi r-H^oo^

<u Ea oo^HCNcomvomo w O (N Q

ā 'à ^ oooo2888 S S (N S

C fi

■4-»

3 ~ O dddddddo in ö ö ö

Td W w wiw^wfi-jw '

C

2 8 wiw^wfi-jw ' ^ <N

O § ^

1

73 ^ ^ ^ o' w ^

_o cncMcnONCS^Hcnr- oo ^

e tM^^"ONHî5 <N o

•a i_) W TTCNOOCN'- i'- 'OO WQ

Cfl £ ^ onE oooo-hooo m o

u 3 <N,W dddddddo o' ©

H g w w w , w OS w

4>

Ž -

I aj

c

^ ✓ - s /

2«^t^»nor-r->nooTj-

c S g,<^csvo(Nr-r-cnd

- s ✓ - s ł- i r-

g> S f| g,<^csvo(Nr-r-cnd 3 S S S 2 8 8 8

S o

Q

Is«2 ^ ^ OO *

*-h es oo o oo o'

T3 ^ OO ^ (N M CO O

^ ^ p CO (N ^ (N I Q O

3 Uh O O O O OO

fc dodo do

S_^ I s_^

^ ^ ^ O Os

mo^HOooNr-mvo

e«n^HCS(NvOO^O

e«n^HCS(NvOO^O ^■(N00<N-H-HOO

^■(N00<N-H-HOO

OOOO^HOOO OOOO^HOOO

dodooooo

/ - ' r-V

<+H ^ ^

T3 T3 «4-3

w w -J

-t-» co

CA -4- > -

D O

-t-> (U C

g Sc o

1 g §

g I -8 1 1 1 1 § I

1 c 1 g ! s 1 1 ¿ 1 1 1

I I ¿1 £ o £ S

© 2013 The Authors). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

176 J.Abrevaya

The first five columns of Table 2

first three columns provide the fu

optimal GMM

estimates as a baselin

optimal GMM) for the unbalanced p

by Assumption 2.1 are utilized. The

with previous studies. The FE point

in magnitude, as expected given th

(FE) estimator has standard errors

to lower number of observations.

in standard errors as compared to

estimates, standard errors are cut n

evidence of misspecification (p-v a

case has standard errors very simi

Note, however, that the unbalance

the implicit assumption that the

Assumption 2. 1 .

The final four columns of Table 2

relaxed to allow for correlation between error disturbances and future union status. Strict

exogeneity is maintained for marital status and experience, whereas sequential exogeneity i

maintained for union status. Four different estimators are considered. The 2SLS and optima

GMM estimators from the modified Chamberlain approach are used. As a comparison, t

different IV estimators based upon a first-difference model are also presented. FD-1LAG is

first-difference estimator where unioni t-' is used as an instrument for union¿t - union¿1t-' ,

FD-2LAG is a first-difference estimator where unioni j- ' and unioni t~ 2 are used as instrumen

for unionit - unioniit-'.15 These two FD estimators, based upon 2SLS rather than efficient I

are used since they correspond closely to popular practice by empirical researchers.

Looking at the results, for either 2SLS or optimal GMM, the coefficient estimates a

standard errors for the non-union variables do not change much. As expected, the standard err

on the union variable increase (e.g. going from 0.0130 to 0.0223 for optimal GMM estimatio

The difference in estimated union premium between the sequential-exogeneity optimal GMM

estimator (0.0963) and strict-exogeneity optimal GMM estimator (0.0628) is quite large

magnitude. A back-of-the-envelope Hausman-type test has an associated z-statistic of rough

(0.0963 - 0.0628)/ VO.02232 - 0.01302 ^ 1.85, meaning the difference is nearly statistica

significant at the 5% level.16 As for the strict exogeneity case, the optimal GMM estimator

exhibits substantial efficiency gains relative to the 2SLS estimator. The optimal GMM standar

errors are roughly one-third lower than the 2SLS standard errors.

The optimal GMM estimator also exhibits substantial efficiency gains relative to the FD-

1LAG and FD-2LAG estimators. The standard error on the union estimate for FD-1LAG is the

same as the 2SLS standard error. There is sensitivity in the standard error to the inclusion of

the additional lag, as the FD-2LAG standard error for the union estimate is substantially higher.

The standard errors for the non-union variables are also higher for the FD-1LAG and FD-2LAG

estimators as compared to even the 2SLS standard errors.

15 Note that the 'Experience' coefficient is identified by these estimators, whereas it is not by the FD estimator on the

full data. The reason is that missingness causes the first difference of experience to be equal to two for a quarter of the

observations.

16 1 am grateful to a referee for pointing this out.

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

Unbalanced panel data Yll

The conclusion from the overidentification test (n

the strict-exogeneity case. To test the additional or

exogeneity GMM, we conducted the EHS test. The E

of 0.508, providing little statistical evidence against

used for the strict-exogeneity GMM estimation. Fin

specification is soundly rejected across all estimator

ACKNOWLEDGMENTS

Financial support from the National Science Foundation (grant SES-092120

acknowledged. The author thanks Stephen Donald and seminar participants at Univ

Columbia for useful comments and Badi Baltagi and Peter Schmidt for useful motiv

Suggestions from the Editor and two anonymous referees greatly enhanced this p

code necessary to replicate the paper's empirical results are available from the journ

REFERENCES

Arellano, M. and S. Bond (1991). Some tests of specification for panel data: Monte Carlo e

application to employment equations. Review of Economic Studies 58 , 277-97.

Bach, S. H., C. Dahl and J. T. Kristensen (2008). Headlights on tobacco road to low birthwe

evidence from a battery of quantile regression estimators and a heterogeneous panel. Rese

2008-20, CREATES, Aarhus University.

Baltagi, B. H. and S. H. Song (2006). Unbalanced panel data: a survey. Statistical Papers 4

Bowsher, C. G. (2002). On testing overidentifying restrictions in dynamic panel data mo

Letters 77, 21 1-20.

Chamberlain, G. (1982). Multivariate regression models for panel data. Journal of Econom

Eichenbaum, M., L. P. Hansen and K. J. Singleton (1988). A time series analysis of repre

models of consumption and leisure choice under uncertainty. Quarterly Journal of E

51-78.

Hall, A. R. (2005). Generalized Method of Moments. New York: Oxford University Press.

Imbens, G. and J. M. Wooldridge (2007). Linear panel data models. What's New in Econometrics , Summer

Institute 2008 Lectures, National Bureau of Economic Research. See http://www.nber.org/WNE/

Lect_2Jinpanel.pdf.

Mundlak, Y. (1978). On the pooling of time series and cross sectional data. Econometrica 56 , 69-86.

Velia, F. and M. Verbeek (1998). Whose wages do unions raise? a dynamic model of unionism and wage

rate determination for young men. Journal of Applied Econometrics 13 , 163-83.

Wooldridge, J. M. (2002). Econometric Analysis of Cross Section and Panel Data. Cambridge, MA: MIT

Press.

Wooldridge, J. M. (2009). Correlated random effects models with unbalanced panels. Working paper,

Michigan State University.

APPENDIX

Estimation with fewer moments: The approach of subsection 3.1 considers separate o

conditions for each value of 7}, with associated moment functions in (3.6) and (3.7). The res

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Society.

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

178 J. Abrevaya

of moments (13/: -h 5) is a significant

there are many covariates ( k large), th

the orthogonality conditions by using mo

^1*/1 Ui,(yi,Xi,Si) fori =1,2,3, (A.l)

si2x¡2

_ SÍ3x¡3 _

where

Cv. r. C.Ï = í y" ~ Xi'P -Ý - -*<1^1 - xn*-2 - *.3*3 for T¡ = 3

" Cv. y" r. " C.Ï • = - ļ y.t - xitß - ý* -J,,*] - JC,2X| for T¡ = 2.

This formulation has 9 k + 3 moments and 6k + 2 parameters. The consolidation of orthogonality conditions

will generally result in a loss of efficiency relative to the original GMM estimator - optimal weighting for

that estimator will provide efficiency gains when the form of heteroscedasticity and/or serial correlation

depends upon T¡. The overidentification test for the GMM estimator based upon (A.l) would test

orthogonality unconditionally , whereas the original overidentification test tests orthogonality conditional

on Ti . The formulation in (A. 1) may still be preferable in cases where k and/or T are large. Also, the idea to

consolidate orthogonality conditions can also be used in a similar way for s, -dependent GMM estimation

(Section 3.3).

Proof of Proposition 3.1: It is well-known that (a) and (d) are equivalent even in unbalanced panels. The

other equivalence results are most easily seen in a partitioned regression framework. For the pooled OLS in

(c), the regression of xit upon the other partition yields fitted values Jč, for both sl3 = 1 cross-sectional units

and 5i3 = 0 cross-sectional units and, thus, residuals xit - Jč, for all observations. Therefore, (a) and (c) are

numerically equivalent. The Mundlak regression in (d) yields the same partitioned-regression residuals as

the pooled OLS (trivially xit - x¡ since x¡ is part of the non-*,, partition). For the 2SLS estimator in (b),

the first-stage regression is vacuous in the sense that the fitted values from the first stage are identical to the

original covariates (specifically, Z{Z'ZYxZ'X = X). Then, the 2SLS estimator is immediately equivalent

to the pooled OLS estimator in (c). □

SUPPORTING INFORMATION

Additional Supporting Information may be found in the online version of this artic

publisher's web site:

Replication Files Data and Code

© 2013 The Author(s). The Econometrics Journal © 2013 Royal Economic Socie

This content downloaded from

86.59.13.237 on Mon, 11 Dec 2023 22:50:44 +00:00

All use subject to https://about.jstor.org/terms

You might also like

- Using Econometrics A Practical Guide 7th Edition Studenmund Solutions ManualDocument4 pagesUsing Econometrics A Practical Guide 7th Edition Studenmund Solutions ManualDebraChambersrimbo100% (15)

- Data Analysis With R Boston Housing Dataset Academic FP RP 007 PDFDocument15 pagesData Analysis With R Boston Housing Dataset Academic FP RP 007 PDFSaurabh SharmaNo ratings yet

- Apollo Hospital Specializes in Outpatient Surgeries For Relatively Minor ProceduresDocument3 pagesApollo Hospital Specializes in Outpatient Surgeries For Relatively Minor ProceduresElliot Richard100% (1)

- Zellner - 1962 - An Efficient Method of Estimating Seemingly Unreleted Regressions and TestDocument22 pagesZellner - 1962 - An Efficient Method of Estimating Seemingly Unreleted Regressions and TestCuentita ParatodoNo ratings yet

- BBBBBBBBDocument22 pagesBBBBBBBBhi babyNo ratings yet

- Reliability-Based Robust Design For Structural System With Multiple Failure ModesDocument22 pagesReliability-Based Robust Design For Structural System With Multiple Failure ModesAdji SutamaNo ratings yet

- Contribution of The Experimental Designs For A ProbabilisticDocument13 pagesContribution of The Experimental Designs For A ProbabilistickeanshengNo ratings yet

- Modeling of Lamb Waves in Composites Using New Third-Order Plate TheoriesDocument15 pagesModeling of Lamb Waves in Composites Using New Third-Order Plate TheoriesesatecNo ratings yet

- Karakaplan 2017Document14 pagesKarakaplan 2017zdenkaNo ratings yet

- Modal Analysis of Laminated Composite Plates by A New Hybrid Assumed Strain Finite ElementDocument11 pagesModal Analysis of Laminated Composite Plates by A New Hybrid Assumed Strain Finite ElementKarthik KNo ratings yet

- Arellano BondDocument22 pagesArellano BondVu Thi Duong BaNo ratings yet

- Goodness-Of-Fit Tests For The General Cox Regression ModelDocument18 pagesGoodness-Of-Fit Tests For The General Cox Regression ModelwonduNo ratings yet

- Arellano 1991Document22 pagesArellano 1991Brayan TillaguangoNo ratings yet

- A Robust Optimal Sliding-Mode Control Approach For Magnetic Levitation SystemsDocument8 pagesA Robust Optimal Sliding-Mode Control Approach For Magnetic Levitation Systemsankurgoel1975No ratings yet

- ACTA Mechanica-2012Document18 pagesACTA Mechanica-2012wzhang8No ratings yet

- An Adaptive High-Gain Observer For Nonlinear Systems: Nicolas Boizot, Eric Busvelle, Jean-Paul GauthierDocument8 pagesAn Adaptive High-Gain Observer For Nonlinear Systems: Nicolas Boizot, Eric Busvelle, Jean-Paul Gauthiertidjani73No ratings yet

- Damage 99Document29 pagesDamage 99ing_costeroNo ratings yet

- A Two-Scale Damage Model With Material Length: Cristian DascaluDocument8 pagesA Two-Scale Damage Model With Material Length: Cristian DascaluyycNo ratings yet

- Holtz-Eakin, Newey and Rosen (1988)Document26 pagesHoltz-Eakin, Newey and Rosen (1988)trofffNo ratings yet

- The Econometric SocietyDocument16 pagesThe Econometric SocietyAdriana SenaNo ratings yet

- Stata Journal XtserialDocument11 pagesStata Journal Xtserial黃琬婷0% (1)

- J of Applied Econometrics - 2002 - Bai - Computation and Analysis of Multiple Structural Change ModelsDocument22 pagesJ of Applied Econometrics - 2002 - Bai - Computation and Analysis of Multiple Structural Change ModelsemiNo ratings yet

- Machine Learning Applications For Blast Performance Assessment of Cold Formed Steel Girt SystemsDocument14 pagesMachine Learning Applications For Blast Performance Assessment of Cold Formed Steel Girt SystemsAhmed Saleh100% (1)

- SJ Belotti Hughes Pianomortari PDFDocument40 pagesSJ Belotti Hughes Pianomortari PDFakita_1610No ratings yet

- Senturk D. - Covariate-Adjusted Varying Coefficient Models (2006)Document17 pagesSenturk D. - Covariate-Adjusted Varying Coefficient Models (2006)Anonymous idBsC1No ratings yet

- Jennifer S. K. Chan Anthony Y. C. KukDocument13 pagesJennifer S. K. Chan Anthony Y. C. KukSnow StarNo ratings yet

- LW1 Test ExampleDocument4 pagesLW1 Test ExampleBalta AndreiNo ratings yet

- Choquet Integral With Stochastic Entries: SciencedirectDocument15 pagesChoquet Integral With Stochastic Entries: SciencedirectKumar palNo ratings yet

- Dados em Paineis - XTDPDMLDocument30 pagesDados em Paineis - XTDPDMLcm_feipe0% (1)

- 2sls Note PDFDocument18 pages2sls Note PDFzkNo ratings yet

- SSRN Id2896087 PDFDocument49 pagesSSRN Id2896087 PDFFousséni ZINSONNINo ratings yet

- Be Lotti 2019Document32 pagesBe Lotti 2019zdenkaNo ratings yet

- Lo 0 OODocument14 pagesLo 0 OOAlvaro MejiaNo ratings yet

- Common Correlated Effects Estimation For Dynamic Heterogeneous Panels With Non-Stationary Multi-Factor Error StructuresDocument27 pagesCommon Correlated Effects Estimation For Dynamic Heterogeneous Panels With Non-Stationary Multi-Factor Error StructuresLeandro AndradeNo ratings yet

- Xbond2-Dynamic Panel Data EstimatorsDocument50 pagesXbond2-Dynamic Panel Data Estimatorszvika.de100% (1)

- Flexural Analysis of Thick Beams Using Single Variable Shear Deformation TheoryDocument13 pagesFlexural Analysis of Thick Beams Using Single Variable Shear Deformation TheoryIAEME PublicationNo ratings yet

- Forecasting in Ine Cient Commodity MarketsDocument15 pagesForecasting in Ine Cient Commodity MarketsanavasisNo ratings yet

- 1 s2.0 S1474667016418835 MainDocument6 pages1 s2.0 S1474667016418835 MainSamir AhmedNo ratings yet

- Xfem Dyn Part1Document43 pagesXfem Dyn Part1kiet.phamk20bkNo ratings yet

- Stability of Kalman Filtering With Multiple Sensors Inv - 2014 - IFAC ProceedingDocument6 pagesStability of Kalman Filtering With Multiple Sensors Inv - 2014 - IFAC ProceedingNguyễn Văn TrungNo ratings yet

- Fault Detection Based On Observer For Nonlinear Dynamic Power SystemDocument8 pagesFault Detection Based On Observer For Nonlinear Dynamic Power SystemAbdulazeez Ayomide AdebimpeNo ratings yet

- Extraction of Ritz Vectors Using A Complete Flexibility MatrixDocument6 pagesExtraction of Ritz Vectors Using A Complete Flexibility MatrixRamprasad SrinivasanNo ratings yet

- Smart BracketsDocument6 pagesSmart BracketslahyouhNo ratings yet

- Multi Scale CrackDocument17 pagesMulti Scale CrackSakib RajiunNo ratings yet

- Modeling of Large Deformations of Hyperelastic MaterialsDocument4 pagesModeling of Large Deformations of Hyperelastic MaterialsSEP-PublisherNo ratings yet

- Orjuela ADHS 09Document6 pagesOrjuela ADHS 09p26q8p8xvrNo ratings yet

- App 1975 070190723Document26 pagesApp 1975 070190723ARUN KRISHNA B J am21d400No ratings yet

- Crack Detection and Vibration Behavior of Cracked Beams: P.N. Saavedra, L.A. Cuiti NoDocument9 pagesCrack Detection and Vibration Behavior of Cracked Beams: P.N. Saavedra, L.A. Cuiti Nohmsedighi459No ratings yet

- 1 s2.0 S1474667016433926 MainDocument6 pages1 s2.0 S1474667016433926 MainSamir AhmedNo ratings yet

- A Parameter Study of A Machine Tool With Multiple BoundariesDocument18 pagesA Parameter Study of A Machine Tool With Multiple Boundariestina1augmentosNo ratings yet

- Casero - Etal - 2014 - Finite Element Updating Using Cross-Entropy Combined With Random Field TheoryDocument13 pagesCasero - Etal - 2014 - Finite Element Updating Using Cross-Entropy Combined With Random Field TheoryArturoNo ratings yet

- Development of Robust Design Under Contaminated and Non-Normal DataDocument21 pagesDevelopment of Robust Design Under Contaminated and Non-Normal DataVirojana TantibadaroNo ratings yet

- An Assessment of Safety Factor For Tunnels Excavated in Soils and Jointed Rock MassDocument8 pagesAn Assessment of Safety Factor For Tunnels Excavated in Soils and Jointed Rock MassHarold TaylorNo ratings yet

- Ices Report 13-20: July 2013Document41 pagesIces Report 13-20: July 2013Andrea InfusoNo ratings yet

- Yoo1994 HybridDocument18 pagesYoo1994 HybridBrendon MenezesNo ratings yet

- 2009 - Stiffness DistributionDocument9 pages2009 - Stiffness DistributionpaulkohanNo ratings yet

- Royal Statistical Society, Wiley Journal of The Royal Statistical Society. Series B (Methodological)Document10 pagesRoyal Statistical Society, Wiley Journal of The Royal Statistical Society. Series B (Methodological)Ong Van HoangNo ratings yet

- GMM by WooldridgeDocument15 pagesGMM by WooldridgemeqdesNo ratings yet

- John Wiley & SonsDocument35 pagesJohn Wiley & SonsLeulNo ratings yet

- Estimating Long Run Effects in Models With Cross-Sectional Dependence Using Xtdcce2Document37 pagesEstimating Long Run Effects in Models With Cross-Sectional Dependence Using Xtdcce2fbn2377No ratings yet

- Static Analysis of Spur Gear Using Finite Element Analysis: Mrs - Shinde S.P., Mr. Nikam A.A., Mr. Mulla T.SDocument6 pagesStatic Analysis of Spur Gear Using Finite Element Analysis: Mrs - Shinde S.P., Mr. Nikam A.A., Mr. Mulla T.SSameOldHatNo ratings yet

- Wooldridge InstrumentalVariablesEstimation 2005Document6 pagesWooldridge InstrumentalVariablesEstimation 2005DWI NOVA WIJAYANo ratings yet

- Tamimi 2017Document25 pagesTamimi 2017DWI NOVA WIJAYANo ratings yet

- Do Environmental, Social, and Governance Activities Improve Corporate Financial Performance?Document15 pagesDo Environmental, Social, and Governance Activities Improve Corporate Financial Performance?DWI NOVA WIJAYANo ratings yet

- Sustainability 12 01866Document18 pagesSustainability 12 01866DWI NOVA WIJAYANo ratings yet

- STA 342-TH9-Correlation and RegressionDocument13 pagesSTA 342-TH9-Correlation and Regressionsolomon mwatiNo ratings yet

- Data Regresi Berganda Kelompok 4Document4 pagesData Regresi Berganda Kelompok 4Tiara putri citrianiNo ratings yet

- Hasil Perhitungan SPSS - EditDocument10 pagesHasil Perhitungan SPSS - EditKing AsNo ratings yet

- Linear Regression and AnovaDocument11 pagesLinear Regression and AnovaDeep NarayanNo ratings yet

- Regression III: Advanced Methods: William G. Jacoby Department of Political ScienceDocument21 pagesRegression III: Advanced Methods: William G. Jacoby Department of Political ScienceAmmi JanNo ratings yet

- Seleksi Model: K-Way and Higher-Order EffectsDocument3 pagesSeleksi Model: K-Way and Higher-Order EffectsRyka RoestNo ratings yet

- Review Final ExDocument20 pagesReview Final ExNguyet Tran Thi Thu100% (1)

- Lecture 12 - Testing For Structural Breaks I. Known Breakpoint (Chow Tests) II. Unknown BreakpointDocument8 pagesLecture 12 - Testing For Structural Breaks I. Known Breakpoint (Chow Tests) II. Unknown Breakpointhareesh babuNo ratings yet

- Tutorial Exercise IIDocument2 pagesTutorial Exercise IILemma MuletaNo ratings yet

- Analisis Runtun Waktu Dan Peramalan Tugas 4Document12 pagesAnalisis Runtun Waktu Dan Peramalan Tugas 4Qardawi HamzahNo ratings yet

- Lecture 10Document14 pagesLecture 10Rasim Ozan SomaliNo ratings yet

- Assignment 3Document15 pagesAssignment 3Siddhant MurkudkarNo ratings yet

- Beta Regression ModelsDocument24 pagesBeta Regression ModelsAnonymous hCLZ9WgfkDNo ratings yet

- Economics Curriculum (FULL - List Courses) May2016Document1 pageEconomics Curriculum (FULL - List Courses) May2016Pua Suan Jin RobinNo ratings yet

- Assumptions of Multiple Regression Running Head: Assumptions of Multiple Regression 1Document17 pagesAssumptions of Multiple Regression Running Head: Assumptions of Multiple Regression 1api-290668891No ratings yet

- Chapter 2: Causal and Noncausal Models: Advanced Econometrics 1Document31 pagesChapter 2: Causal and Noncausal Models: Advanced Econometrics 1Dana7117No ratings yet

- Arnold Zellner - Statistics, Econometrics & Forecasting PDFDocument186 pagesArnold Zellner - Statistics, Econometrics & Forecasting PDFTyler DurdenNo ratings yet

- Econometrics I: Professor William Greene Stern School of Business Department of EconomicsDocument47 pagesEconometrics I: Professor William Greene Stern School of Business Department of EconomicsAnonymous 1tv9MspNo ratings yet

- Linear Regression: DSCI 5240 Data Mining and Machine Learning For Business Russell R. TorresDocument39 pagesLinear Regression: DSCI 5240 Data Mining and Machine Learning For Business Russell R. TorresFurqan ArshadNo ratings yet

- CardhektestDocument37 pagesCardhektestPragathi T NNo ratings yet

- شابتر 1Document18 pagesشابتر 1Omar SalehNo ratings yet

- Practice Exam2 PDFDocument8 pagesPractice Exam2 PDFcse0909100% (1)

- Hasil Output SPSS 22 MenggunakanDocument7 pagesHasil Output SPSS 22 MenggunakanZakia JulianiNo ratings yet

- Regression AnalysisDocument15 pagesRegression Analysisdolly kate cagadasNo ratings yet

- Linearregression PDFDocument30 pagesLinearregression PDFYana CovarNo ratings yet

- Tarun Das ADB Nepal Inception Report Final-AnnexDocument55 pagesTarun Das ADB Nepal Inception Report Final-AnnexProfessor Tarun DasNo ratings yet

- Latex CV NRDocument7 pagesLatex CV NRapi-529155888No ratings yet