Professional Documents

Culture Documents

12 Economics23 24sp11

12 Economics23 24sp11

Uploaded by

Dr. Anuradha ChugOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Economics23 24sp11

12 Economics23 24sp11

Uploaded by

Dr. Anuradha ChugCopyright:

Available Formats

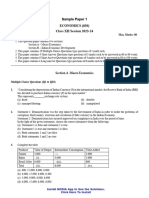

myCBSEguide

Class 12 - Economics

Sample Paper - 11 (2023-24)

Maximum Marks: 80

Time Allowed: : 3 hours

General Instructions:

1. This question paper contains two sections:

Section A – Macro Economics

Section B – Indian Economic Development

2. This paper contains 20 Multiple Choice Questions type questions of 1 mark each.

3. This paper contains 4 Short Answer Questions type questions of 3 marks each to be answered in 60 to 80 words.

4. This paper contains 6 Short Answer Questions type questions of 4 marks each to be answered in 80 to 100 words.

5. This paper contains 4 Long Answer Questions type questions of 6 marks each to be answered in 100 to 150 words.

SECTION A – MACRO ECONOMICS

1. Statement I: External Borrowings, e.g External Commercial Borrowings, Short-term Debt, etc are included in the

capital account of BOP.

Statement II: Direct Investments, e.g. Foreign Direct Investments (FDIs), Equity Capital, Reinvested Earnings and

other Direct Capital Flows are included in the current account of BOP.

a) Statement II is true and statement I is false.

b) Both the statements are true.

c) Both the statements are false.

d) Statement I is true and statement II is false.

2. Total deposits created by commercial banks is ₹20,000 crore and LRR is 20%. Calculate the amount of initial deposits.

a) ₹3000 crore

b) ₹6000 crore

c) ₹4000 crore

d) ₹5000 crore

3. If APC = 0.6, APS = ________

a) 2.4

b) 1

c) 0.4

d) None of these

4. Occasional intervention by central bank to influence price of foreign exchange is known as ________.

a) Hedging

b) Depreciation

c) Dirty floating

d) Appreciation

5. If C = Y, the value of multiplier (k) will be:

a) None of these

b) Infinity

c) 1

d) 2

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

1 / 14

myCBSEguide

6. The main cause(s) of deficit demand is/are

a) decrease in investment demand

b) Both decrease in money supply and decrease in investment demand

c) increase in public expenditure

d) decrease in money supply

To practice more questions & prepare well for exams, download myCBSEguide App. It provides complete study

material for CBSE, NCERT, JEE (main), NEET-UG and NDA exams. Teachers can use Examin8 App to create similar

papers with their own name and logo.

7. With the increase in income, autonomous expenditure ________.

a) will increase proportionately

b) will remain unaffected

c) will decrease

d) will increase

8. Consumption of all goods and services in the economy during the period of an accounting year is known as:

a) aggregate supply

b) none of these

c) aggregate demand

d) aggregate consumption

9. ________ and ________ currency notes of old Mahatma Gandhi series were banned as legal tender money on 8th

November, 2016. (Choose the correct alternative)

a) ₹ 500 and ₹ 1000

b) ₹ 500 and ₹ 200

c) ₹ 50 and ₹ 100

d) ₹ 500 and ₹ 2000

10. The equilibrium exchange rate is determined at the point where the

a) Demand for and Supply of foreign exchange has maximum gap

b) None of these

c) Demand for and Supply of foreign exchange has minimum gap

d) Demand for and Supply of foreign exchange is equal

11. State the three components of Income from Property and Entrepreneurship.

12. Write any three points of difference between BOT and BOP.

OR

Give the meanings of fixed, flexible and managed floating exchange rates.

13. Explain the role of Bank rate in influencing the availability of credit in an economy.

14. Does an excess of AD over AS always imply a situation of inflationary gap? Explain.

OR

Complete the following table.

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

2 / 14

myCBSEguide

Income (Y) Consumption (C) Marginal Propensity to Save (MPS) Average Propensity to Consume (APC)

0 15

50 50 ............. ..............

100 85 ............ ..............

150 120 ........... .............

15. Explain the varying reserve requirements method of credit control by the central bank.

16. Answer the following questions:

1. i. Calculate Net National Product at Market and Gross National Disposable Income:

Items (Rs.in Arab)

Consumption of fixed capital 40

Change in stock (-) 10

Net imports 20

Gross domestic fixed capital formation 100

Private final consumption expenditure 800

Net current transfers to rest of the world 5

Government final consumption expenditure 250

Net factor income to abroad 40

Net indirect tax 130

ii. Suppose a lumber produces 50 tons of wood pulp and sells it to a paper mill for Rs.5,000. The paper mill

converted it into paper and sells to publisher for Rs.8,000. The publisher printed books on it and sold in the

market for Rs.10,000. Now, while calculating national income a student has shown the total value of output as

Rs.23,000.

(i) Is it a correct value ? Justify your answer.

(ii) Mention any social cost involved in producing paper.

2. OR

i. Calculate Domestic Income.

Items (₹ in crore)

(i) Dividends 50

(ii) Social security contributions by employers 40

(iii) Corporate profit tax 30

(iv) Consumption of Fixed Capital 60

(v) Retained earnings of private corporate sector net of retained earnings of foreign companies 20

(vi) Interest paid by firms 150

(vii) Rent 70

(viii) Royalty 30

(ix) Wages and salaries 600

(x) Interest paid by households 10

ii. Calculate ‘Net Domestic Product at Factor Cost’.

S.no. Contents (Rs. in Crores)

(i) Net Current Transfers to Abroad 15

(ii) Private Final Consumption Expenditure 800

(iii) Net Imports (-) 20

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

3 / 14

myCBSEguide

(iv) Net Domestic Capital Formation 100

(v) Net Factor Income to Abroad 10

(vi) Depreciation 50

(vii) Change in Stocks 17

(viii) Net Indirect Tax 120

(ix) Government Final Consumption Expenditure 200

(x) Exports 30

17. Answer the following questions:

1. Giving reasons, classify the following into direct and indirect tax.

i. Wealth tax

ii. Value added tax

2. Explain the concept of fiscal deficit in a government budget. What does it indicate?

SECTION B – INDIAN ECONOMIC DEVELOPMENT

18. Unemployment in rural areas can be divided into:

A. Seasonal Unemployment

B. Disguised unemployment

C. Industrial unemployment

a) A, B, C

b) A only

c) B only

d) A, B

19. OECD stands for

a) Organisation for Economic Co-operation and Development

b) Organisation of European Environment Co-operation and Development

c) Organisation of European Economic Co-operation and Development

d) Organisation of European Economic Countries and Development

20. Inward looking trade strategy is also known as a policy of ________.

a) Import promotion

b) None of these

c) Import relaxation

d) Import substitution

21. Under which system people below the poverty line (BPL) could get essential goods at low subsidised rates:

a) Public distribution system

b) None of these

c) Minimum support price

d) Buffer stock

22. Assertion (A): In the initial years performance of public sector undertaking was encouraging but thereafter most of these

started showing losses.

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

4 / 14

myCBSEguide

Reason (R): Public sector undertaking degenerated into a liability.

a) Both A and R are true and R is the correct explanation of A.

b) Both A and R are true but R is not the correct explanation of A.

c) A is true but R is false.

d) A is false but R is true.

23. Investments in education convert human beings into ________.

a) None of these

b) Human Capital Formation

c) Human Capital

d) Economic Growth

24. _____ announce its five year plan in 1951. While _____ announced its five year plan in 1956.____ announced its five

year plan in 1953.

a) Pakistan, India, China

b) Pakistan, China, India

c) India, China, Pakistan

d) India, Pakistan, China

25. Ozone layer prevents most harmful wavelengths of ______ light from passing through the earth’s atmosphere.

a) Gama violet

b) Beta violet

c) None

d) Ultraviolet

26. Statement I: Under the colonial regime, the motive behind infrastructure development was to provide basic amenities to

the people.

Statement II: The real motive behind infrastructure development was to subserve various colonial interests.

a) Statement I is true, but statement II is false.

b) Both the statements are false.

c) Statement II is true, but statement I is false.

d) Both the statements are true.

27. Match the following. options are as follows

a. Industries Act i. 1973

b. MRTP ii. 1951

c. FERA iii. 1956

a)

a. (i)

b. (iii)

c. (i)

b)

a. (iii)

b. (ii)

c. (i)

c)

a. (ii)

b. (i)

c. (iii)

d)

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

5 / 14

myCBSEguide

a. (ii)

b. (iii)

c. (i)

To practice more questions & prepare well for exams, download myCBSEguide App. It provides complete study

material for CBSE, NCERT, JEE (main), NEET-UG and NDA exams. Teachers can use Examin8 App to create similar

papers with their own name and logo.

28. 70 lakhs cars get added on the roads of metropolitans every year. Is it justified? What policy measures can you suggest?

OR

‘Sustainable development is a paradigm shift in development thinking’. Comment.

29. What is likely to be the impact of efforts towards reducing unemployment on the production potential of the economy?

Explain.

30. What is Planning Commission? What are its functions?

31. Economic reforms have reduced the role of the public sector. Comment.

OR

Do you think outsourcing is good for India? Why are developed countries opposing it?

32. How does education and training lead to technological improvement?

33. Answer the following questions:

1. i. Why has rural banking not been able to give adequate credit to farmers?

ii. State any three main drawbacks of rural banking.

2. OR

i. Write a note on National Bank for Agricultural and Rural Development (NABARD).

ii. Write the role of multinational companies in rural development.

34. Read the following text carefully and answer the questions given below:

SINO-PAK FRIENDSHIP CORRIDOR

The China-Pakistan Economic Corridor (CPEC) relationship between the two nations. But it has also sparked criticism

for burdening Pakistan with mountains of debt and allowing China to use its debt strategic assets of Pakistan.

The foundations of CPEC, part of China’s Belt and Road Initiative, were laid in May 2013. At the time, Pakistan was

reeling under weak economic growth. China committed to play an integral role in supporting Pakistan’s economy.

Pakistan and China have a strategic relationship that goes back decades. Pakistan turned to China at a time when it

needed a rapid increase in external financing to meet critical investments in hard infrastructure, particularly power plants

and highways. CPEC’s early harvest projects met this need, leading to a dramatic increase in Pakistan’s power generation

capacity, bringing an end to supply-side constraints that had made rolling blackouts a regular occurrence across the

country.

Pakistan leaned into CPEC, leveraging Chinese financing and technical assistance in an attempt to end power shortages

that had paralyzed its country’s economy. Years later, China’s influence in Pakistan has increased at an unimaginable

pace.

China As Pakistan’s Largest Bilateral Creditor: China’s ability to exert influence on Pakistan’s economy has grown

substantially in recent years, mainly due to the fact that Beijing is now Islamabad’s largest creditor. According to

documents released by Pakistan’s finance ministry, Pakistan’s total public and publicly guaranteed external debt stood at

USD 44.35 billion in June 2013, just 9.3 percent of which was owed to China. By April 2021, this external debt had

ballooned to USD 90.12 billion, with Pakistan owing 27.4 percent —USD 24.7 billion — of its total external debt to

China, according to the International Monetary Fund (IMF).

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

6 / 14

myCBSEguide

Additionally, China provided financial and technical expertise to help Pakistan build its road infrastructure, expanding

north-south connectivity to improve the efficiency of moving goods from Karachi all the way to Gilgit-Baltistan (POK).

These investments were critical in better integrating the country’s ports, especially Karachi, with urban centers in Punjab

and KhyberPakhtunkhwa provinces.

Despite power asymmetries between China and Pakistan, the latter still has tremendous agency in determining its own

policies, even if such policies come at the expense of the longterm socioeconomic welfare of Pakistani citizens.

Questions:

i. Outline and discuss any two economic advantages of China Pakistan Economic Corridor (CPEC) accruing to the

economy of Pakistan.

ii. Analyse the implication of bilateral ‘debt-trap’ situation of Pakistan vis-à-vis the Chinese Economy.

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

7 / 14

myCBSEguide

Class 12 - Economics

Sample Paper - 11 (2023-24)

Solution

SECTION A – MACRO ECONOMICS

1. (d) Statement I is true and statement II is false.

Explanation: Statement I is true and statement II is false.

2. (c) ₹4000 crore

Explanation: ₹4000 crore

3. (c) 0.4

Explanation: 0.4

4. (c) Dirty floating

Explanation: Intervention of central bank to keep the exchange rate in a band is known as managed floating or dirty

floating exchange rate.

5. (a) None of these

Explanation: None of these

To practice more questions & prepare well for exams, download myCBSEguide App. It provides complete study material

for CBSE, NCERT, JEE (main), NEET-UG and NDA exams. Teachers can use Examin8 App to create similar papers with

their own name and logo.

6. (b) Both decrease in money supply and decrease in investment demand

Explanation: Deficit demand occurs due to fall in government expenditure, fall in level of autonomous investment, fall in

supply of money and credit and decrease in marginal propensity to consume.

7. (b) will remain unaffected

Explanation: If income increases then autonomous expenditure will remain unaffected.

8. (d) aggregate consumption

Explanation: Consumption of all goods and services in the economy during the period of an accounting year is known as

aggregate consumption.

9. (a) ₹ 500 and ₹ 1000

Explanation: ₹ 500 and ₹ 1000 currency notes banned in demonetization process.

10. (d) Demand for and Supply of foreign exchange is equal

Explanation: At this point, the market for foreign exchange gets cleared.

11. Three components of Income from Property and Entrepreneurship are:-

a. Rent/Royalty

b. Interest

c. Profit

Profit is further split into 3 components: Dividends, Corporate profit tax, undistributed profit.

12. Balance of trade Balance of payment

1.Balance of Trade is a statement that captures the 1.Balance of Payment is a statement that keeps track of all

country's export and import of goods with the economic transactions done by the country with the remaining

remaining world. world.

2. Transactions related to goods are recorded only. 2. Transactions related to both goods and services are recorded.

3. It gives a partial view of the country's economic 3. It gives a clear view of the economic position of the country.

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

8 / 14

myCBSEguide

status.

OR

Fixed exchange rate:

In a fixed exchange rate system, the rate of exchange is officially fixed or determined by Government or Monetary

Authority of the country. The central authority or government maintain their exchange rate fixed either against gold or

some other foreign currency (say USD).

Flexible exchange rate:

In a system of the flexible exchange rate (also known as floating exchange rates), the exchange rate is determined by the

forces of market demand and supply of foreign exchange. However, the excessive fluctuation is checked by the Central

Bank.

Managed floating system:

It is a system in which the central bank allows the exchange rate to be determined by market forces but intervenes at times

to influence the rate. When central bank finds the rate is too high, it starts selling foreign exchange from its reserve to

bring down it. When it finds the rate is too low. It starts buying to raise the rate.

13. 1. Bank rate is the rate at which central bank lend money to commercial banks to meet their long term needs.

2. RBI actively uses bank rate to control credit creations.

3. EFFECT:

4. In case of inflation, Central Bank increases Bank Rate.

5. This results in increased rate of interest recovered by commercial banks, which discourages borrowing.

6. As a result Consumption and AD falls and there is reduction in inflationary gap.

7. In case of deflation, Central Bank decreases Bank Rate.

8. This results in decrease in rate of interest, which encourages borrowing.

9. As a result Consumption and then AD rises and there is reduction in deflationary gap.

14. Yes, Inflationary gap is a consequence of excess demand. Excess demand is a situation in which actual AD is more than

the AD required at full employment level of equilibrium.

(AD is more than AS corresponding to full employment level of equilibrium.)

OR

Income (Y) Consumption (C) Saving (S) (Y-C) Marginal Propensity to Save Average Propensity to Consume

0 15 -15 - -

50 50 0 0.3 1.0

100 85 15 0.3 0.85

150 120 30 0.3 0.8

Formulae used here:

S = Y - C, MPS =Change in savings/Change in income, APC = C/Y.

15. Commercial banks have the power to create credit on the basis of deposits they receive. The central bank exercises control

over this power by changing the legal reserve requirements from time to time.

Following are the components of the Legal Reserve Ratio:

i. Cash Reserve Ratio- Cash reserve ratio is a minimum proportion of cash reserve which is kept by commercial banks

with the central bank against its deposits. The cash reserve ratio is fixed by the central bank to control the creation of

credit. Central banks will reduce the cash reserve ratio to expand credit for reducing deficient demand. Central banks

will raise the cash reserve ratio to discourage the creation of credit for reducing excess demand.

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

9 / 14

myCBSEguide

ii. Statutory Liquidity Ratio- Statutory liquidity ratio is the proportion of total demand and time liabilities which is to be

kept by commercial banks in the form of liquid assets including cash, gold and unencumbered approved securities. If

the statutory liquidity ratio is increased by the central bank, the ability of commercial banks to give credit is reduced.

Central banks will reduce the statutory liquidity ratio to encourage commercial banks to create more credit.

16. Answer the following questions:

1. i. Gross Domestic Product at Market Price:

GDPMP = Private final consumption expenditure + Government final consumption expenditure + Gross

Domestic Capital Formation (Gross domestic fixed capital formation + Change in stock) - Net imports

= 800 + 250 + 100 + (-) 10 - 20

= Rs.1120 Arab

Net National Product at Market Price:

NNPMP = GDPMP - Consumption of fixed capital - Net factor income to abroad

= 1120 - 40 - 40

= Rs.1040 Arab

Gross National Disposable Income:

= GDPMP - Net factor income to abroad - Net current transfers to rest of the world

= 1120 - 40 - 5

= Rs.1075 Arab

ii. (i) No, he is not calculating correctly. He has failed to avoid the problem of double counting. The correct

value is Rs.10,000 as while calculating national income intermediate consumption is not to be added only the

value of final goods will be considered.

(ii) Cutting of trees.

2. OR

i. NDPfc = Compensation of employees + operating surplus+ Mixed-Income

Items (₹ in crore)

Compensation of employees (ix + ii) 640

Interest paid by firms 150

Rent 70

Royalty 30

Profits (i + iii + v) 100

Domestic income (NDPfc) 990

ii. Net Domestic Product at Market Price is calculated as:

(NDPmp)= Private Final Consumption Expenditure + Government Final Consumption Expenditure + Net

Domestic Capital Formation - Net Imports

NDPmp = 800 + 200 + 100 - (-20)

= Rs. 1,120 crores

Net Domestic Product at Factor Cost is calculated as:

(NDPfc) = NDPmp- Net Indirect Tax

NDPfc = 1,120 - 120

= Rs. 1,000 crores.

Therefore Net Domestic Product at factor Cost is termed as the Domestic Income.

17. Answer the following questions:

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

10 / 14

myCBSEguide

1. i. Wealth tax: It is a kind of direct tax as it is paid by the same person on which it is levied or imposed, i.e. burden of

this tax is not possible to shift to the other person.

ii. Value added tax: Value added tax is imposed on one person and its burden shifts to another person therefore it is an

indirect tax because in case of indirect taxes burden is shifted to another person.

2. Fiscal deficit in the budget is an important measure of deficit. IMF and the World Bank generally prescribe targets for

the budget deficit in terms of fiscal deficit. Fiscal deficit is the excess of total expenditure over revenue receipts and

only non-debt type of capital receipts such as recoveries of loans. In other words fiscal deficit is the difference between

the government's total expenditure and total receipts excluding borrowings.

Fiscal Deficit = Total Budget Expenditure - Total Budget Receipts ( Excluding borrowings ) or Fiscal Deficit =

Borrowings

Implications of fiscal deficit are:

i. Borrowing requirements of government.

ii. High interest payments by government.

iii. High level of inflation due to high government expenditure.

iv. Increased foreign dependence on the economy.

SECTION B – INDIAN ECONOMIC DEVELOPMENT

18. (d) A, B

Explanation: Rural unemployment can be further classified into disguised and seasonal unemployment. Disguised

unemployment is a situation in which the number of workers engaged a job becomes much more than is actually required

to complete it. Seasonal unemployment is an elevated level of unemployment that is expected to occur in certain parts of

the year.

19. (a) Organisation for Economic Co-operation and Development

Explanation: The Organisation for Economic Co-operation and Development (OECD) is an intergovernmental economic

organisation with 35 member countries, founded in 1960 to stimulate economic progress and world trade.It is a forum of

countries describing themselves as committed to democracy and the market economy, providing a platform to compare

policy experiences, seeking answers to common problems, identify good practices and coordinate domestic and

international policies of its members.

20. (d) Import substitution

Explanation: Import substitution

21. (a) Public distribution system

Explanation: PDS implies distribution of food grains through fair price shops at subsidised rates.

22. (a) Both A and R are true and R is the correct explanation of A.

Explanation: In the initial years, performance of public sector undertaking was encouraging but thereafter most of these

started showing losses. Because of this poor performance, public sector undertaking degenerated into a liability.

23. (c) Human Capital

Explanation: Human Capital

24. (d) India, Pakistan, China

Explanation: Five-Year Plans (FYPs) are centralized and integrated national economic programs. The process began

with setting up of Planning Commision in March 1950 in pursuance of declared objectives of the Government to promote

a rapid rise in the standard of living of the people by efficient exploitation of the resources of the country, increasing

production and offering opportunities to all for employment in the service of the community.

25. (d) Ultraviolet

Explanation: The ozone layer prevents most harmful wavelengths of ultraviolet light from passing through the Earth’s

atmosphere.

26. (c) Statement II is true, but statement I is false.

Explanation: Statement II is true, but statement I is false.

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

11 / 14

myCBSEguide

27. (d)

a. (ii)

b. (iii)

c. (i)

Explanation: Industries Act was established in the year 1951 for the regulation and development of certain industries.

Monopolies and Restrictive Trade Practices act aims to prevent concentration of economic power, provide for control of

monopolies, and protect consumer interest. FERA was established to conserve the foreign exchange resources of the

country.

28. It is not justified from environment point of view but no individual is so concerned for the environment that he sacrifices

his own comfort for the sake of environment. I feel surprised when even the managers and employees of environment

related organizations are also found indulged in such activities. First thing is to create a true awareness about environment

which is not at mouth level but at actions level. Secondly, we need to improve public transport system so that people need

not run after a personal car. Construction of metro train is a good step in this direction by the government.

OR

Sustainability is a paradigm for thinking about a future in which environmental, social and economic considerations are

balanced in the pursuit of development and an improved quality of life. World population is projected to increase [by

around 2 billion] by 2050. Practically all that growth will be in the developing countries of Asia and Africa. This will put

increased strain on resources and systems that are already insufficient in many cases (Emerging Risks in the 21st Century:

An Agenda for Action). The sustainability paradigm is a major change from the previous paradigm of economic

development with its damaging social and environmental consequences. Until recently these consequences have been seen

as inevitable and acceptable.

29. When an economy is producing below its potential level because of unemployment, it implies that the economy is not

functioning on the PPC but below the PPC, i.e. Point P as shown in the below diagram. Given the resources and

technology, along with the initiation of government schemes, the employment level will increase. Therefore, Point P will

shift nearer to PPC.

30. Immediately after the adaptation of new constitution on January 26, 1950, the Planning commission came in to existence.

Planning Commission is a constitutional body. Prime Minister is ex-officio chairman of this commission. The broad

functions of Planning Commission are:

i. Assessment of material, capital and human resources

ii. Formulation of plan for their most effective and balanced utilization

iii. Determination of priorities and allocation of resources etc.

iv. To execute suitable policies for the economic development of India.

31. Economic reforms have definitely reduced the role of the public sector in the Indian economy. Privatisation was the major

component of the economic reforms programme. Privatisation means a greater role for private capital and enterprise. The

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

12 / 14

myCBSEguide

main objective of economic reforms is to make use of privately owned resources for the collective welfare of the people.

Following steps have been taken to reduce the role of the public sector in the Indian economy:

i. Denationalisation i.e. transfer of the ownership of public sector enterprises to the private sector.

ii. Disinvestment i.e. sale of a part of equity of public sector enterprises to private capitalists. It is taken as a remedial

measure to improve production and managerial efficiency as well as to facilitate modernization.

iii. Restrictions on the further expansion and setting up of new units in the public sector.

iv. Restricting the areas of public sector to the following:

a. Essential manufactured goods.

b. Exploration and exploitation of oil and mineral resources.

c. Strategic areas i.e. defence equipment.

OR

Yes, outsourcing is good for India. The following points suggest that outsourcing is good for India.

1. Employment: It avails employment.

2. Exchange of technical know-how: Outsourcing enables the exchange of ideas and technical know-how.

3. International worthiness: Outsourcing to India also enhances India’s international worthiness credibility.

4. Encourages other sectors: Outsourcing affects other related sectors like industrial and agricultural sector through

various backward and forward linkages.

5. Better standard of living and eradication of poverty: By creating more and higher paying jobs, outsourcing improves

the standard and quality of living of the people.

However, Outsourcing to India is good but developed countries oppose this because outsourcing leads to the outflow of

investments and funds from the developed countries to the less developed countries. Also, the MNCs contribute more to

the development of the host country than the home country. Further, outsourcing reduces the employment generation in the

developed countries as the same jobs can be done in the less developed countries at relatively cheap wages. Moreover, this

leads to job insecurity in the developed countries as at a point of time jobs can be outsourced to the developing countries.

32. We know that a person needs a good deal of training and skill to do things efficiently. The labour skill of an educated

person is more than that of an uneducated person. Education and training enables a person to make better choices in life. It

creates people who innovate and imitate technology. It is shown in the diagram given below:

To practice more questions & prepare well for exams, download myCBSEguide App. It provides complete study material

for CBSE, NCERT, JEE (main), NEET-UG and NDA exams. Teachers can use Examin8 App to create similar papers with

their own name and logo.

33. Answer the following questions:

1. i. Rural banking has not been able to give adequate credit to farmers mainly due to following reasons:

1. Lack of proper infrastructure and instruments to dispense credit to needy farmers.

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

13 / 14

myCBSEguide

2. Agriculture loan default rates are also high with a high incidence of overdue instalments by the farmers.

3. It has also failed to develop a culture of deposit mobilisation, lending to worthwhile borrowers and

effective loan recovery.

ii. Following are the three drawbacks of rural banking:

i. Inadequate- The volume of rural credit in India is not sufficient to meet the demand for rural credit.

ii. Less Attention to Poor Farmers- Most of the lenders insist on security before granting loans. Since poor

farmers are not in a position to offer any security for loans, poor farmers do not avail of credit facilities.

Well-to-do farmers get more attention.

iii. Unfavourable Conditions- Lenders often impose unfavourable conditions for granting loans including

high-interest rates.

2. OR

i. National Bank for Agriculture and Rural Development (NABARD) is an apex development finance institution

fully owned by Government of India. The bank has been entrusted with matters concerning policy, planning,

and operations in the field of credit for agriculture and other economic activities in rural areas in India. The

Committee to Review Arrangements for Institutional Credit for Agriculture and Rural Development

(CRAFICARD) under the Chairmanship of Shri B. Sivaraman, conceived and recommended the

establishment of the National Bank for Agriculture and Rural Development (NABARD).

An apex body to coordinate the activities of all institutions involved in the rural financing system. The main

objective behind the set up of NABARD was to uplift rural India by increasing the credit flow for elevation of

agriculture & rural non farm sector.

NABARD is active in developing financial inclusion policy and is a member of the Alliance for Financial

Inclusion. NABARD replaced the Agricultural Credit Department (ACD) and Rural Planning and Credit Cell

(RPCC) of Reserve Bank of India, and Agricultural Refinance and Development Corporation

(ARDC). Headquarters of NABARD is situated in Mumbai, Maharashtra, India.

ii. Economic reforms provide opportunities to multinational companies to expand their functions all around the

country. Many multinational companies are entering in rural marketing.

They are doing well for the sake of farmers as stated below:

i. They are offering them pre-decided prices.

ii. They are making contracts with farmers.

iii. They are providing them seeds and other inputs.

iv. They are motivating farmers to grow desirable food, fruits and vegetables of the desired quality.

34. i. Economic advantages of China Pakistan Economic Corridor (CPEC) to the economy of Pakistan are:

a. China provided financial and technical expertise to help Pakistan build its road infrastructure, supporting

employment and income in the economy

b. CPCE has led to a massive increase in power generation capacity of Pakistan. It has brought an end to supply-side

constraints in the nation, which had made blackouts a regular phenomenon across the country.

ii. China has become famous for its ‘Debt Trap Diplomacy’ in recent times. Under this China provides financial and

technical expertise/assistance to help various nations to bring them under its direct or indirect influence. The first and

the foremost implication of the diplomacy is that Beijing has now become Islamabad’s largest creditor. According to

documents released by Pakistan’s finance ministry, its total public external debt stood at USD 44.35 billion in June

2013, just 9.3 percent of which was owed to China. By April 2021, this external debt had ballooned to USD 90.12

billion, with Pakistan owing 27.4 percent —USD 24.7 billion — of its total external debt to China, according to the

IMF.

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited.

14 / 14

You might also like

- Wolfe Wave: Linda RaschkeDocument32 pagesWolfe Wave: Linda RaschkeDasharath Patel100% (3)

- Im2 3Document35 pagesIm2 3musheeb1No ratings yet

- 12 Economcis t2 sp02Document9 pages12 Economcis t2 sp02ShivanshNo ratings yet

- CBSE Class 12 Economics Sample Paper 02 (2019-20)Document19 pagesCBSE Class 12 Economics Sample Paper 02 (2019-20)Anonymous 01HSfZENo ratings yet

- 12 Economics Sp07Document19 pages12 Economics Sp07devilssksokoNo ratings yet

- 12 Economics Sp03Document19 pages12 Economics Sp03devilssksokoNo ratings yet

- SQP 20 Sets EconomicsDocument160 pagesSQP 20 Sets Economicsmanav18102006No ratings yet

- 12 Economics23 24sp10Document14 pages12 Economics23 24sp10prakharg503No ratings yet

- EC Sample Paper 1 UnsolvedDocument8 pagesEC Sample Paper 1 Unsolvedhiruh5396No ratings yet

- Pre Board Class XII EconomicsDocument6 pagesPre Board Class XII EconomicsShubhamNo ratings yet

- 12 Economics Sp02Document21 pages12 Economics Sp02devilssksokoNo ratings yet

- EC Sample Paper 16 UnsolvedDocument7 pagesEC Sample Paper 16 UnsolvedMilan TomarNo ratings yet

- 2021 Economics Solved Guess Paper Set 6Document20 pages2021 Economics Solved Guess Paper Set 6NitikaNo ratings yet

- 12 Economics Sp09Document19 pages12 Economics Sp09devilssksokoNo ratings yet

- Doc-20231219-Wa0005 231221 211706Document13 pagesDoc-20231219-Wa0005 231221 211706Paawni GuptaNo ratings yet

- EconomicsDocument113 pagesEconomicsdevanshsoni4116No ratings yet

- Most Expected Questions Economics Section A MicroDocument3 pagesMost Expected Questions Economics Section A MicroRaju RanjanNo ratings yet

- Xii Mock TestDocument5 pagesXii Mock Testaryanmadnani50No ratings yet

- Week4 QuestionpaperDocument8 pagesWeek4 QuestionpaperSouth KoreaNo ratings yet

- Cbse Commerce Pre Final-1 EconomicsDocument9 pagesCbse Commerce Pre Final-1 EconomicsGaurisha SharmaNo ratings yet

- Economicsquestionbank2022 23Document33 pagesEconomicsquestionbank2022 23imtidrago artsNo ratings yet

- 12 Economics Sp05Document20 pages12 Economics Sp05devilssksokoNo ratings yet

- EconomicsDocument157 pagesEconomicsportableawesomeNo ratings yet

- 12 Economics Sp06Document21 pages12 Economics Sp06devilssksokoNo ratings yet

- CBSE Class 12 Economics Sample Paper 01 (2019-20)Document21 pagesCBSE Class 12 Economics Sample Paper 01 (2019-20)Anonymous 01HSfZENo ratings yet

- Pb23eco02 QPDocument7 pagesPb23eco02 QPAfiya NazimNo ratings yet

- XII Economics Guess Paper - 2Document5 pagesXII Economics Guess Paper - 2kawaljeetsingh121666No ratings yet

- Preboard EcoDocument5 pagesPreboard EcoPuja BhardwajNo ratings yet

- Practice Paper Class XII Eco PaperDocument12 pagesPractice Paper Class XII Eco PaperAarush100% (1)

- 12 EconomicsDocument7 pages12 Economicsshuklajaya349No ratings yet

- RKG Guess Paper 2Document6 pagesRKG Guess Paper 2sanjaykr4991No ratings yet

- MLL For Late Bloomers - Class 12 ECON 2023-24Document59 pagesMLL For Late Bloomers - Class 12 ECON 2023-24nagpalmadhur5No ratings yet

- 12 Economics Sp10Document20 pages12 Economics Sp10devilssksokoNo ratings yet

- St. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Document3 pagesSt. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Harsahib SinghNo ratings yet

- XII Economics Guess Paper - 1Document5 pagesXII Economics Guess Paper - 1kawaljeetsingh121666No ratings yet

- Eco Set B XiiDocument7 pagesEco Set B XiicarefulamitNo ratings yet

- 9000 Crores. What Is The Value of Exports?Document3 pages9000 Crores. What Is The Value of Exports?V S VIJITHNo ratings yet

- Economics Half Yearly Question PaperDocument6 pagesEconomics Half Yearly Question PaperBhumika MiglaniNo ratings yet

- EC Sample Paper 20 UnsolvedDocument8 pagesEC Sample Paper 20 Unsolvedmanjotsingh.000941No ratings yet

- Sample Paper 1 Economics Class 12thDocument15 pagesSample Paper 1 Economics Class 12thdmsd3991No ratings yet

- Economics Set I QPDocument4 pagesEconomics Set I QPsaju pkNo ratings yet

- Omn XDu 8 Seiqk 1 OWSs XLNDocument20 pagesOmn XDu 8 Seiqk 1 OWSs XLNAnonymous 01HSfZENo ratings yet

- Ut - 1 Economics - Xii 2021-22Document5 pagesUt - 1 Economics - Xii 2021-22Nandini JhaNo ratings yet

- National Income Review Questions PDFDocument30 pagesNational Income Review Questions PDFseverinmsangi100% (1)

- The Title of KingdomDocument6 pagesThe Title of KingdomKailash RNo ratings yet

- Practicepaper 3 Class XIIEconomics EMDocument6 pagesPracticepaper 3 Class XIIEconomics EMAvnish kumarNo ratings yet

- MycbseguideDocument10 pagesMycbseguideBinoy TrevadiaNo ratings yet

- SESSION 2020-21 First Terminal Exam Xii Economics Time: 3 Hour M/M:80 General InstructionsDocument5 pagesSESSION 2020-21 First Terminal Exam Xii Economics Time: 3 Hour M/M:80 General InstructionsAnupama RawatNo ratings yet

- Cbse Class 12 Economics Sample Paper Set 3 QuestionsDocument6 pagesCbse Class 12 Economics Sample Paper Set 3 QuestionsPhototronixNo ratings yet

- Economics Term TestDocument4 pagesEconomics Term Testniranjankumar jeyaramanNo ratings yet

- Economics Prepboard 1SET - BDocument6 pagesEconomics Prepboard 1SET - Bjainehalll28No ratings yet

- Class 12 CBSE Economics Worksheet ABS Vidhya MandhirDocument8 pagesClass 12 CBSE Economics Worksheet ABS Vidhya Mandhiryazhinirekha4444No ratings yet

- GR+XII +Chapter++Test +National+IncomeDocument7 pagesGR+XII +Chapter++Test +National+IncomeAkshatNo ratings yet

- Pre-Board Papers With MS EconomicsDocument160 pagesPre-Board Papers With MS Economicsbksbharatkumar22005No ratings yet

- 112Document3 pages112SHIVRAJ CYBERNo ratings yet

- Shaheed Rajpal D.A.V. Public School PRE BOARD EXAM (2019-20) Economics (Set - A) TIME: 1 Hr. Class: XII M.M.: 80 General InstructionsDocument8 pagesShaheed Rajpal D.A.V. Public School PRE BOARD EXAM (2019-20) Economics (Set - A) TIME: 1 Hr. Class: XII M.M.: 80 General InstructionsmeghanaNo ratings yet

- 12 Economics Eng PP 2023 24 1Document8 pages12 Economics Eng PP 2023 24 1Shivansh JaiswalNo ratings yet

- Delhi Public School, Hyderabad Class: XII Time: 1 HR Subject: Economics Max. Marks:30Document2 pagesDelhi Public School, Hyderabad Class: XII Time: 1 HR Subject: Economics Max. Marks:30Lekhana WesleyNo ratings yet

- 12 Economics Sp04Document21 pages12 Economics Sp04devilssksokoNo ratings yet

- Xii Commerce Unit Test-1 Exam Economics Q.paper Dt.2021Document3 pagesXii Commerce Unit Test-1 Exam Economics Q.paper Dt.2021mekavinashNo ratings yet

- Cbse Class 12 Economics Sample Paper Set 1 QuestionsDocument6 pagesCbse Class 12 Economics Sample Paper Set 1 QuestionsSaturo GojoNo ratings yet

- MarkList - 12TH PCM 23.09Document1 pageMarkList - 12TH PCM 23.09Dr. Anuradha ChugNo ratings yet

- NCERT Class 12 Political Science Part 1Document37 pagesNCERT Class 12 Political Science Part 1Dr. Anuradha ChugNo ratings yet

- Cbse Yuva Tourism ClubDocument8 pagesCbse Yuva Tourism ClubDr. Anuradha ChugNo ratings yet

- Electoral Bonds PicturesDocument1 pageElectoral Bonds PicturesDr. Anuradha ChugNo ratings yet

- "Mother Can't Be Asked To Choose Between Child & Career": Bombay High Court Permits Woman To Go Abroad With Daughter (2022)Document5 pages"Mother Can't Be Asked To Choose Between Child & Career": Bombay High Court Permits Woman To Go Abroad With Daughter (2022)Dr. Anuradha ChugNo ratings yet

- Atnduwidual Seruie: Thu Art - Maunly 3 Miawe Ok Mianang - Tentrad TenduncyDocument7 pagesAtnduwidual Seruie: Thu Art - Maunly 3 Miawe Ok Mianang - Tentrad TenduncyDr. Anuradha ChugNo ratings yet

- Meritnation Sociology NotesDocument2 pagesMeritnation Sociology NotesDr. Anuradha ChugNo ratings yet

- What Is The Difference Between Vertical Analysis and Horizontal AnalysisDocument2 pagesWhat Is The Difference Between Vertical Analysis and Horizontal AnalysisfranklinNo ratings yet

- Currencies in Fixed Asset AccountingDocument4 pagesCurrencies in Fixed Asset AccountingPavan UlkNo ratings yet

- Strategic Management 1: Strategic Management Jorge Chedraui Final Professor: Thomas SchindlerDocument34 pagesStrategic Management 1: Strategic Management Jorge Chedraui Final Professor: Thomas SchindlerChitraNo ratings yet

- IndicatorsDocument22 pagesIndicatorsManda Satyanarayana ReddyNo ratings yet

- Question and Answers On D.C.F: See You in My ClassDocument26 pagesQuestion and Answers On D.C.F: See You in My ClassSiddhant AggarwalNo ratings yet

- My Engineering Economics EssayDocument19 pagesMy Engineering Economics EssayChris Ba Aiden MabuwaNo ratings yet

- Financial Analysis and ReportingDocument20 pagesFinancial Analysis and ReportingAnastasha Grey100% (1)

- Samsung Semiconductors: Expansion & Marketing Plan in Hungarian MarketDocument51 pagesSamsung Semiconductors: Expansion & Marketing Plan in Hungarian MarketNarino JamBooNo ratings yet

- Resource Mobilization Action Plan UpdateDocument13 pagesResource Mobilization Action Plan UpdateRuby GarciaNo ratings yet

- Reno ChartDocument8 pagesReno ChartabhishekNo ratings yet

- AppppDocument3 pagesAppppMaria Regina JavierNo ratings yet

- Personal Loan ProjectDocument18 pagesPersonal Loan Projectlasyaharsha63No ratings yet

- What Is NPA?: Banking Businesses Is Mainly That of Borrowing From The Public and LendingDocument5 pagesWhat Is NPA?: Banking Businesses Is Mainly That of Borrowing From The Public and LendingbhagatamitNo ratings yet

- Desarollo EndogenoDocument17 pagesDesarollo EndogenoWildor Gosgot AngelesNo ratings yet

- AJoCS.03.02.86 95Document10 pagesAJoCS.03.02.86 95guandaru1No ratings yet

- Homework 10Document4 pagesHomework 10Gia Hân TrầnNo ratings yet

- History of AccountingDocument22 pagesHistory of AccountingGia Patricia SalisiNo ratings yet

- Islamic StoriesDocument39 pagesIslamic StoriesShahzad ShameemNo ratings yet

- Money Back PolicyDocument58 pagesMoney Back PolicyUppal Patel83% (6)

- Support and Resistance Trading Method 4Document6 pagesSupport and Resistance Trading Method 4Bv Rao100% (1)

- EASMB 54 43-52 LuhJ378Document10 pagesEASMB 54 43-52 LuhJ378Rasi framesNo ratings yet

- Deleveraging Investing Optimizing Capital StructurDocument42 pagesDeleveraging Investing Optimizing Capital StructurDanaero SethNo ratings yet

- Tutorial 8 AnswersDocument7 pagesTutorial 8 AnswersFahad Afzal Cheema100% (1)

- FINANCIAL ACCOUNTING COURSE OUTLINE - HorngrenDocument11 pagesFINANCIAL ACCOUNTING COURSE OUTLINE - HorngrenAsħîŞĥLøÝåNo ratings yet

- Introduction To EconimicsDocument12 pagesIntroduction To EconimicsFerdous FaridiNo ratings yet

- ITP - Foreign Exchange RateDocument29 pagesITP - Foreign Exchange RateSuvamDharNo ratings yet

- ConciseRefSheet07 - Colosseum CorrectedDocument3 pagesConciseRefSheet07 - Colosseum CorrectedInmaculadaNo ratings yet

- Industry Analysis Report (IAR) Automobile IndustryDocument35 pagesIndustry Analysis Report (IAR) Automobile Industrybalaji bysaniNo ratings yet