Professional Documents

Culture Documents

Bir Form For Tax Exception

Bir Form For Tax Exception

Uploaded by

Public Safety OfficeCopyright:

Available Formats

You might also like

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Joeanna100% (13)

- Annex C.1: Sworn Application For Tax ClearanceDocument1 pageAnnex C.1: Sworn Application For Tax ClearanceKrizza MadridNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Andoy Domingo Carullo100% (2)

- Income Payee'S Sworn Declaration of Gross Receipts/SalesDocument1 pageIncome Payee'S Sworn Declaration of Gross Receipts/SalesTacloban Rebs100% (4)

- Notice of Availment of Substituted Filing of Percentage Tax ReturnsDocument1 pageNotice of Availment of Substituted Filing of Percentage Tax ReturnsJomar TenezaNo ratings yet

- ANNEX eDocument2 pagesANNEX eChristian Sadia0% (1)

- Notice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnDocument1 pageNotice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnWarlie Zambales DiazNo ratings yet

- Notice of Availment of The Substituted Filing of Percentage Tax ReturnDocument1 pageNotice of Availment of The Substituted Filing of Percentage Tax ReturnArgielJedTabalBorras100% (1)

- Annex E RR14 - 2003Document1 pageAnnex E RR14 - 2003Jomar Teneza100% (1)

- Notice of Availment of The Option To Pay The Tax Through The Withholding ProcessDocument2 pagesNotice of Availment of The Option To Pay The Tax Through The Withholding ProcessArgielJedTabalBorrasNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal Revenue Revenue Region No. 15 Revenue District Office No. 93A Zamboanga CityDocument1 pageRepublic of The Philippines Department of Finance Bureau of Internal Revenue Revenue Region No. 15 Revenue District Office No. 93A Zamboanga CitySindangan Adventist CenterChurch ChoirNo ratings yet

- Annex FDocument1 pageAnnex FJoyNo ratings yet

- Rmo No 9-06 TCVD Tax Mapping Annex A-C, FDocument5 pagesRmo No 9-06 TCVD Tax Mapping Annex A-C, FGil PinoNo ratings yet

- Sworn Application For Tax Clearance: Annex CDocument1 pageSworn Application For Tax Clearance: Annex CJose Edmundo DayotNo ratings yet

- Annex J.5 - TCGP - IndividualDocument1 pageAnnex J.5 - TCGP - Individualmaureen.lumbao95No ratings yet

- Annex J.3 - TCBP - Non-IndividualDocument1 pageAnnex J.3 - TCBP - Non-Individualmaureen.lumbao95No ratings yet

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-IndArchie Lazaro0% (1)

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-IndJyznareth Tapia75% (4)

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-Indejay niel100% (1)

- Annex J.2 - TCBP - IndividualDocument1 pageAnnex J.2 - TCBP - Individualmaureen.lumbao95No ratings yet

- Sworn Application For Tax Clearance - Non-IndDocument1 pageSworn Application For Tax Clearance - Non-IndIdan AguirreNo ratings yet

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-IndKeith HernandezNo ratings yet

- Sworn Application For Tax Clearance: Annex CDocument1 pageSworn Application For Tax Clearance: Annex CpatrickkayeNo ratings yet

- Annex CDocument1 pageAnnex CAileen TeoNo ratings yet

- RR No. 11-2018 Annex FDocument1 pageRR No. 11-2018 Annex FRegina MontesNo ratings yet

- Tax FormDocument1 pageTax FormChriestal SorianoNo ratings yet

- Form B-2 Sworn Declaration (1) .DocxXDocument1 pageForm B-2 Sworn Declaration (1) .DocxXsernakeisharaeNo ratings yet

- Annex C Tax ClearanceDocument1 pageAnnex C Tax Clearanceanalisa sealmoyNo ratings yet

- BIR Abatement FormDocument1 pageBIR Abatement FormJecky Delos ReyesNo ratings yet

- Annex J.6 - TCGP - Non-IndividualDocument1 pageAnnex J.6 - TCGP - Non-Individualmaureen.lumbao95No ratings yet

- Sworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersdiopenesjoelNo ratings yet

- Annex CDocument1 pageAnnex CJoel SyNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018grecelyn bianesNo ratings yet

- BIR Sworn Declaration Annex FDocument1 pageBIR Sworn Declaration Annex FgfgfdgfdgdgfdgfdNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Renz Lorenz100% (1)

- Annex RR 11-2018Document1 pageAnnex RR 11-2018jayNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Gerynes Mae Bacarra100% (1)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018ehhmehhfNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Erica MailigNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Kisu ShuteNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Joyce CabatanNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018julieta m. timoganNo ratings yet

- Annex FDocument1 pageAnnex FgfgfdgfdgdgfdgfdNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018JeZkYNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018reneth davidNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018유니스No ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018___wena100% (2)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Pfda Camaligan Fish PortNo ratings yet

- Joborder - Annex - A1 Lone Income PayorDocument1 pageJoborder - Annex - A1 Lone Income PayorNDP InfantaNo ratings yet

- Annex A - Mission OrderDocument1 pageAnnex A - Mission OrderLeomar ContilloNo ratings yet

- Annex A - Mission OrderDocument1 pageAnnex A - Mission OrderReymund S Bumanglag0% (1)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018chari cruzmanNo ratings yet

- RMO No 9-06 TCVD Tax Mapping Annex N-QDocument5 pagesRMO No 9-06 TCVD Tax Mapping Annex N-QGil PinoNo ratings yet

- Sworn Application For Tax Clearance For General Purposes Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For General Purposes Individual Taxpayersjdsindustrial23No ratings yet

- Annex B 1 RR 11 20181 2023Document1 pageAnnex B 1 RR 11 20181 2023danilotinio2No ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

Bir Form For Tax Exception

Bir Form For Tax Exception

Uploaded by

Public Safety OfficeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bir Form For Tax Exception

Bir Form For Tax Exception

Uploaded by

Public Safety OfficeCopyright:

Available Formats

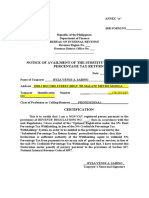

ANNEX “A”

BIR FORM NO. ____________

Republic of the Philippines

Department of Finance

BEREAU OF INTERNAL REVENUE

Revenue Region No. 10

Revenue District Office No. 067

NOTICE OF AVAILMENT OF THE SUBSTITUTED FILING OF

PERCENTAGE TAX RETURN

Date ______________

Name of Taxpayer _____________________________________________________________

Address ______________________________________________________________________

Taxpayer Identification Number _________________________________________________

Class of Profession or Calling/Business ____________________________________________

CERTIFICATION

This is to certify that I am a NON-VAT registered person pursuant to the Provisions

of REVENUE REGULATIONS NO. 11-2018; that, in accordance with the said

Regulations, I have availed of the “Optional Registration under the 3% Final

Percentage Tax Withholding, in lieu of the 3% Creditable Percentage Tax

Withholding” System, in order to be entitled to the privileges accorded by the

“Substituted Percentage Tax Return System" prescribed thereunder; that, this

Declaration is sufficient authority of the Withholding Agent to withhold 3%

Percentage Tax from payments to me on my sale of goods and/or services, in lieu of

the said 3% Creditable Percentage Tax Withholding; and that, I have executed this

Declaration under penalty of perjury pursuant to the provisions of Section 267,

National Internal Revenue Code of 1997.

____________________________

Taxpayer’s Name and Signature

You might also like

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Joeanna100% (13)

- Annex C.1: Sworn Application For Tax ClearanceDocument1 pageAnnex C.1: Sworn Application For Tax ClearanceKrizza MadridNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Andoy Domingo Carullo100% (2)

- Income Payee'S Sworn Declaration of Gross Receipts/SalesDocument1 pageIncome Payee'S Sworn Declaration of Gross Receipts/SalesTacloban Rebs100% (4)

- Notice of Availment of Substituted Filing of Percentage Tax ReturnsDocument1 pageNotice of Availment of Substituted Filing of Percentage Tax ReturnsJomar TenezaNo ratings yet

- ANNEX eDocument2 pagesANNEX eChristian Sadia0% (1)

- Notice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnDocument1 pageNotice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnWarlie Zambales DiazNo ratings yet

- Notice of Availment of The Substituted Filing of Percentage Tax ReturnDocument1 pageNotice of Availment of The Substituted Filing of Percentage Tax ReturnArgielJedTabalBorras100% (1)

- Annex E RR14 - 2003Document1 pageAnnex E RR14 - 2003Jomar Teneza100% (1)

- Notice of Availment of The Option To Pay The Tax Through The Withholding ProcessDocument2 pagesNotice of Availment of The Option To Pay The Tax Through The Withholding ProcessArgielJedTabalBorrasNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal Revenue Revenue Region No. 15 Revenue District Office No. 93A Zamboanga CityDocument1 pageRepublic of The Philippines Department of Finance Bureau of Internal Revenue Revenue Region No. 15 Revenue District Office No. 93A Zamboanga CitySindangan Adventist CenterChurch ChoirNo ratings yet

- Annex FDocument1 pageAnnex FJoyNo ratings yet

- Rmo No 9-06 TCVD Tax Mapping Annex A-C, FDocument5 pagesRmo No 9-06 TCVD Tax Mapping Annex A-C, FGil PinoNo ratings yet

- Sworn Application For Tax Clearance: Annex CDocument1 pageSworn Application For Tax Clearance: Annex CJose Edmundo DayotNo ratings yet

- Annex J.5 - TCGP - IndividualDocument1 pageAnnex J.5 - TCGP - Individualmaureen.lumbao95No ratings yet

- Annex J.3 - TCBP - Non-IndividualDocument1 pageAnnex J.3 - TCBP - Non-Individualmaureen.lumbao95No ratings yet

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-IndArchie Lazaro0% (1)

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-IndJyznareth Tapia75% (4)

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-Indejay niel100% (1)

- Annex J.2 - TCBP - IndividualDocument1 pageAnnex J.2 - TCBP - Individualmaureen.lumbao95No ratings yet

- Sworn Application For Tax Clearance - Non-IndDocument1 pageSworn Application For Tax Clearance - Non-IndIdan AguirreNo ratings yet

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-IndKeith HernandezNo ratings yet

- Sworn Application For Tax Clearance: Annex CDocument1 pageSworn Application For Tax Clearance: Annex CpatrickkayeNo ratings yet

- Annex CDocument1 pageAnnex CAileen TeoNo ratings yet

- RR No. 11-2018 Annex FDocument1 pageRR No. 11-2018 Annex FRegina MontesNo ratings yet

- Tax FormDocument1 pageTax FormChriestal SorianoNo ratings yet

- Form B-2 Sworn Declaration (1) .DocxXDocument1 pageForm B-2 Sworn Declaration (1) .DocxXsernakeisharaeNo ratings yet

- Annex C Tax ClearanceDocument1 pageAnnex C Tax Clearanceanalisa sealmoyNo ratings yet

- BIR Abatement FormDocument1 pageBIR Abatement FormJecky Delos ReyesNo ratings yet

- Annex J.6 - TCGP - Non-IndividualDocument1 pageAnnex J.6 - TCGP - Non-Individualmaureen.lumbao95No ratings yet

- Sworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersdiopenesjoelNo ratings yet

- Annex CDocument1 pageAnnex CJoel SyNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018grecelyn bianesNo ratings yet

- BIR Sworn Declaration Annex FDocument1 pageBIR Sworn Declaration Annex FgfgfdgfdgdgfdgfdNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Renz Lorenz100% (1)

- Annex RR 11-2018Document1 pageAnnex RR 11-2018jayNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Gerynes Mae Bacarra100% (1)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018ehhmehhfNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Erica MailigNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Kisu ShuteNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Joyce CabatanNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018julieta m. timoganNo ratings yet

- Annex FDocument1 pageAnnex FgfgfdgfdgdgfdgfdNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018JeZkYNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018reneth davidNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018유니스No ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018___wena100% (2)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Pfda Camaligan Fish PortNo ratings yet

- Joborder - Annex - A1 Lone Income PayorDocument1 pageJoborder - Annex - A1 Lone Income PayorNDP InfantaNo ratings yet

- Annex A - Mission OrderDocument1 pageAnnex A - Mission OrderLeomar ContilloNo ratings yet

- Annex A - Mission OrderDocument1 pageAnnex A - Mission OrderReymund S Bumanglag0% (1)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018chari cruzmanNo ratings yet

- RMO No 9-06 TCVD Tax Mapping Annex N-QDocument5 pagesRMO No 9-06 TCVD Tax Mapping Annex N-QGil PinoNo ratings yet

- Sworn Application For Tax Clearance For General Purposes Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For General Purposes Individual Taxpayersjdsindustrial23No ratings yet

- Annex B 1 RR 11 20181 2023Document1 pageAnnex B 1 RR 11 20181 2023danilotinio2No ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)