Professional Documents

Culture Documents

Amfpp0747gptd001

Amfpp0747gptd001

Uploaded by

pachikollasrinivasaraoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amfpp0747gptd001

Amfpp0747gptd001

Uploaded by

pachikollasrinivasaraoCopyright:

Available Formats

Reminder-II

GREATER VISAKHAPATNAM MUNICIPAL CORPORATION

Office of the

Joint Director, Financial Advisor & Accounts Officer, Room No.308,

Tenneti Bhavan, Asilmetta junction,Visakhapatnam.

PT Cell Mobile No. 9133429966, 9618603366.

Date:01-12-2019

PT Enrollment No. AMFPP0747GPTD001

URGENT NOTICE

M/s.M/S SEETHARAMA TRADERS, VISAKHAPATNAM is informed that

you are enrolled under AP VAT ACT 2005/ GST ACT,2017 and you are liable for

payment of Profession Tax under Andhra Pradesh Tax on Profession, Trades, callings

and employment Act, 1987. But you have not paid the profession Tax for the

financialYear 2017-2018.

If any assessee/individual fails to pay the Profession Tax within the time

specified in the Act, he is liable for penalty of 25% to 50% the amount of Tax in

addition to the interest of 24%. Further the arrears of tax, interest, penalty or any

other amount due under this Act, shall be recoverable as arrear of land revenue.

If you have already paid the above said tax, Please furnish the particulars.

It is to inform that you are requested to quote your PT Enrollment Number in all

your future correspondence.

It is already informed to you through our previous notice on 29-06-2019 &23-09-

2019 to make the payment of Profession Tax. But till now you had not paid the dues.

Hence you are once again requested to make the payment on or before 16-12-2019 to

avoid levy of penalty.

G Satyanarayana

Joint Director, Financial

Advisor & Accounts Officer

VISAKHAPATNAM.

Note: This is a system generated notice, signature is not required.

You might also like

- Natebu2019sepm15 4583314268 4466459800Document14 pagesNatebu2019sepm15 4583314268 4466459800NarasimmaNo ratings yet

- Dipankar BarmanDocument2 pagesDipankar Barmanmanishasurywanshi91No ratings yet

- TAN UnlockedDocument1 pageTAN UnlockedthimothiNo ratings yet

- 03 Internet-July To Sep-18Document5 pages03 Internet-July To Sep-18aakashNo ratings yet

- TAN - Sanjayrekha Aggregator - PNES82580BDocument1 pageTAN - Sanjayrekha Aggregator - PNES82580BHarshad JathotNo ratings yet

- Aegon BillDocument1 pageAegon BillKSPNo ratings yet

- GST DeclarationDocument1 pageGST DeclarationHari HaranNo ratings yet

- LIPCReport Statement 20240325045610786 C273951342Document1 pageLIPCReport Statement 20240325045610786 C273951342Navdeep SinghNo ratings yet

- Aatma Bodha667 Knowledge of SelfDocument6 pagesAatma Bodha667 Knowledge of SelfAnvith KingNo ratings yet

- TAN No - EasyfinDocument1 pageTAN No - EasyfinsantoshrdmcsNo ratings yet

- Calling of Option For New Personal Taxation Regime S - Extension of Last Date For Opting Reg 23-04-20 PDFDocument1 pageCalling of Option For New Personal Taxation Regime S - Extension of Last Date For Opting Reg 23-04-20 PDFnsreddy3613No ratings yet

- BillDocument5 pagesBillsagarNo ratings yet

- Sub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961Document1 pageSub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961hssharmaNo ratings yet

- Sta Lucia - SOA For Marketing TrendsDocument1 pageSta Lucia - SOA For Marketing TrendsChandria CalderonNo ratings yet

- By Shoba Kanakraj: Mstu, ChennaiDocument20 pagesBy Shoba Kanakraj: Mstu, ChennaiVasanthNo ratings yet

- Handbook of Profession Tax E-ServicesDocument55 pagesHandbook of Profession Tax E-ServicesRajendra D AdsulNo ratings yet

- Mamta RaniDocument2 pagesMamta RaniAjay AroraNo ratings yet

- Guidance Note On Annual Return of GSTDocument124 pagesGuidance Note On Annual Return of GSTABC 123No ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticenielNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuNaveen YadavNo ratings yet

- PROHLR010513527 PremiumCertificate 02232018Document1 pagePROHLR010513527 PremiumCertificate 02232018shreerajpatiloppNo ratings yet

- Circular No. 5152020o Dated 24.08.2020 - One Month Notice For 30.09.2020 RetireesDocument6 pagesCircular No. 5152020o Dated 24.08.2020 - One Month Notice For 30.09.2020 RetireesSuresh SuriNo ratings yet

- Ramdas PDFDocument3 pagesRamdas PDFNarsing BasudeNo ratings yet

- Renewal Premium Notice: Mr. Ganesh Vasant Karalkar Insured Name: MR - Ganesh Vasant KaralkarDocument1 pageRenewal Premium Notice: Mr. Ganesh Vasant Karalkar Insured Name: MR - Ganesh Vasant KaralkarGanesh KaralkarNo ratings yet

- A Step-By-step Guide For Obtaining Your GSTIN - Business Standard NewsDocument4 pagesA Step-By-step Guide For Obtaining Your GSTIN - Business Standard Newsaditya0291No ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticerajaNo ratings yet

- Your GST RegistrationDocument2 pagesYour GST RegistrationdennisNo ratings yet

- Zprmnotc 23280183 15838155Document1 pageZprmnotc 23280183 15838155devabhutada111coolNo ratings yet

- Profile FintuneDocument6 pagesProfile FintuneSachin KulkarniNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Form 16 Generator (Blank) With 3 in 1 Calculator FY 2018 19Document27 pagesForm 16 Generator (Blank) With 3 in 1 Calculator FY 2018 19roneysfa644No ratings yet

- SSG TAX SAVING FD PDFDocument1 pageSSG TAX SAVING FD PDFamirunnbegamNo ratings yet

- GST Bill Format in ExcelDocument184 pagesGST Bill Format in Excelkrishna chaitanyaNo ratings yet

- Atexxxxx5j T16Document1 pageAtexxxxx5j T16Kamlakar SadavarteNo ratings yet

- Proforma CredoDocument1 pageProforma CredoOmkar NiruduNo ratings yet

- AA - 2019-20 - 38 FluxDocument1 pageAA - 2019-20 - 38 FluxvenkatesanmuraliNo ratings yet

- UndertakingDocument1 pageUndertakingK D EnterprisesNo ratings yet

- Renewal Notice: Policy No.P/151115/01/2018/008058Document1 pageRenewal Notice: Policy No.P/151115/01/2018/008058Khel Manoranjan Mitra MandalNo ratings yet

- Au 1Document1 pageAu 1ubattleg5No ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAmit KumarNo ratings yet

- UnlockedDocument1 pageUnlockedDeepak SahooNo ratings yet

- Ìnpç F,!3 "Æqè9Yî: Agent Name:-Mrs. Rekha Rani, Agent Code - 70019050, Agent Contact Number - 9829666010Document2 pagesÌnpç F,!3 "Æqè9Yî: Agent Name:-Mrs. Rekha Rani, Agent Code - 70019050, Agent Contact Number - 9829666010Mukul BajjarNo ratings yet

- Mohit Creations BillDocument1 pageMohit Creations Billkajal YSPNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuAshok GNo ratings yet

- TAN CertificateDocument1 pageTAN Certificatesabir hussainNo ratings yet

- AcknowledgementDocument2 pagesAcknowledgementdebanwitaNo ratings yet

- AESL - New VRF Format 02122023 - NewattDocument2 pagesAESL - New VRF Format 02122023 - NewattDarshit VyasNo ratings yet

- C301149660-Renewal Premium ReceiptDocument1 pageC301149660-Renewal Premium ReceiptsaivenkateswarNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeSai Kiran KodipyakaNo ratings yet

- 80D PDFDocument2 pages80D PDFPandu SathishNo ratings yet

- Goods and Services TaxDocument5 pagesGoods and Services TaxphukerakeshraoNo ratings yet

- Fee Structure 2018-19Document1 pageFee Structure 2018-19Shw AB XmnNo ratings yet

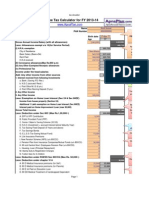

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- Zprmnotc 24501025 25787073Document1 pageZprmnotc 24501025 25787073user-289514No ratings yet

- Collection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)Document2 pagesCollection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)fio communicationNo ratings yet

- AB Amanah: Dorothy Paulus Adam KG Lingkudau Lama 89308 Ranau MalaysiaDocument3 pagesAB Amanah: Dorothy Paulus Adam KG Lingkudau Lama 89308 Ranau MalaysiaGary StyronNo ratings yet

- Estimate 2926 FP - Culina & TraditionesDocument1 pageEstimate 2926 FP - Culina & Traditionesdeborah.tourNo ratings yet

- Zprmrnot 21163309 8704721Document1 pageZprmrnot 21163309 8704721Arnav MishraNo ratings yet