Professional Documents

Culture Documents

Exercise 12-6

Exercise 12-6

Uploaded by

jood aljuhanaiCopyright:

Available Formats

You might also like

- Ricardo Pangan CompanyDocument38 pagesRicardo Pangan CompanyAndrea Tugot67% (15)

- Final Accounts SumDocument2 pagesFinal Accounts SumRohit Aswani25% (4)

- Assignment#1 ADRIANOCAÑADADocument4 pagesAssignment#1 ADRIANOCAÑADAADRIANO, Glecy C.78% (9)

- Accounting For Merchandizing Operations Problem 1-A) O'Quinn Co. Distributes Suitcases To Retail Stores and Extends Credit Terms of 1/10Document4 pagesAccounting For Merchandizing Operations Problem 1-A) O'Quinn Co. Distributes Suitcases To Retail Stores and Extends Credit Terms of 1/10Qasim Khan0% (1)

- Bfar Chapter 8 Problems 6 7Document9 pagesBfar Chapter 8 Problems 6 7Rhoda Claire M. GansobinNo ratings yet

- P5-1A Dan P5-2ADocument6 pagesP5-1A Dan P5-2ASherly Meliana Geraldine100% (1)

- Session 4 - Mohali Gifts ShopDocument12 pagesSession 4 - Mohali Gifts ShopArpita DalviNo ratings yet

- Acctng FinalDocument3 pagesAcctng FinalWindelyn ButraNo ratings yet

- Merchandising OperationsDocument2 pagesMerchandising OperationsMary JullianneNo ratings yet

- Mock Test PreparationDocument6 pagesMock Test PreparationHà Quảng TâyNo ratings yet

- Accounting For Merchandising Operations ExercisesDocument4 pagesAccounting For Merchandising Operations ExercisesthachuuuNo ratings yet

- CH 5 Practice Questions SolutionsDocument24 pagesCH 5 Practice Questions SolutionsChloe IbrahimNo ratings yet

- Akuntansi Pengantar 2Document4 pagesAkuntansi Pengantar 2Lingga ArgianitaNo ratings yet

- Vat IllustrationsDocument5 pagesVat Illustrationsamora elyseNo ratings yet

- Problem# 17 Mariano Lerin Bookstore Journalizing MARCH 2021 Date Account Titles PR Debit CreditDocument3 pagesProblem# 17 Mariano Lerin Bookstore Journalizing MARCH 2021 Date Account Titles PR Debit CreditAndrea Tugot50% (2)

- Let'S Check: PROBLEM 1 Garliet CompanyDocument5 pagesLet'S Check: PROBLEM 1 Garliet Companymaica G.No ratings yet

- Group 8 Assignment Acc 2023Document4 pagesGroup 8 Assignment Acc 2023Adi PutraNo ratings yet

- 01 Elms Activity 2 Ia3Document1 page01 Elms Activity 2 Ia3Jen DeloyNo ratings yet

- Principles of Accounting ExerciseDocument4 pagesPrinciples of Accounting ExerciseAin FatihahNo ratings yet

- Bbca1033 Assignment 1Document6 pagesBbca1033 Assignment 1Nabila Abu BakarNo ratings yet

- 213Document1 page213yoeliyyNo ratings yet

- Joel Amos Periodic InventoryDocument7 pagesJoel Amos Periodic InventoryJasmine P. Manlungat - EMERALDNo ratings yet

- 補修作業3Document2 pages補修作業38scqgrsjb4No ratings yet

- POA Exercise 28.11, 28.12A, 28.13Document6 pagesPOA Exercise 28.11, 28.12A, 28.13Ain FatihahNo ratings yet

- Chapter 1 - Current Liabilities, Provisions and ContingenciesDocument9 pagesChapter 1 - Current Liabilities, Provisions and ContingenciesPatrick GoNo ratings yet

- Accounting NavjotDocument1 pageAccounting Navjotyour0samNo ratings yet

- SW-16 UTB Merchandising AsDocument4 pagesSW-16 UTB Merchandising AsAlexis Marie Balagot100% (1)

- Bryan Maulana Ibrahim - XII AKL 2 - PT Nusa Raya - Keseluruhan JurnalDocument3 pagesBryan Maulana Ibrahim - XII AKL 2 - PT Nusa Raya - Keseluruhan JurnalBryan Maulana IbrahimNo ratings yet

- SW and ASSIGNMENT - TUGOTDocument9 pagesSW and ASSIGNMENT - TUGOTAndrea TugotNo ratings yet

- Audit of Inventory: Download NowDocument1 pageAudit of Inventory: Download NowMariz Julian Pang-aoNo ratings yet

- Problem 1-1Document3 pagesProblem 1-1Frencess Mae MayolaNo ratings yet

- Accounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Document16 pagesAccounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Fider GracianNo ratings yet

- Finanical Accounting AkbarDocument19 pagesFinanical Accounting AkbarShah MuradNo ratings yet

- Assignment, ANdallo, Ransey Ace DDocument3 pagesAssignment, ANdallo, Ransey Ace DRansey Ace AndalloNo ratings yet

- FoA2 Week 2 Lesson and HW 3Document8 pagesFoA2 Week 2 Lesson and HW 3Christine Joyce MagoteNo ratings yet

- MODULE 2 JOINT ARRANGEMENTS ASSIGNMENT AAC2 Mar 2023 - Copy-1Document3 pagesMODULE 2 JOINT ARRANGEMENTS ASSIGNMENT AAC2 Mar 2023 - Copy-1Lorifel Antonette Laoreno TejeroNo ratings yet

- Requirements: Provide The Journal Entries. Determine The Total Net Gail (Loss) FromDocument1 pageRequirements: Provide The Journal Entries. Determine The Total Net Gail (Loss) FromJaneNo ratings yet

- LAURILLA Angela - FAR Sheet1 4Document1 pageLAURILLA Angela - FAR Sheet1 4Angela LaurillaNo ratings yet

- Project 3 Problem 17Document3 pagesProject 3 Problem 17Jaquilyn JavierNo ratings yet

- Assignment Bballb BDocument4 pagesAssignment Bballb BTavnish SinghNo ratings yet

- Lecture 5Document5 pagesLecture 5oluwafemioyeyemi077No ratings yet

- Untitled NotebookDocument4 pagesUntitled Notebook21000780No ratings yet

- Keseluruhan Jurnal: Ud Buana (Diana Puspitasari)Document3 pagesKeseluruhan Jurnal: Ud Buana (Diana Puspitasari)diana puspitasariNo ratings yet

- At 5Document4 pagesAt 5Thùy NguyễnNo ratings yet

- BookDocument2 pagesBookAshley Gutierrez JacintoNo ratings yet

- Practice ProblemDocument3 pagesPractice ProblemAnne Thea AtienzaNo ratings yet

- MerchDocument10 pagesMerchWere dooomedNo ratings yet

- Chapter 7 Problems: Problem #14 P. 7-57 Problem #15 P. 7-58Document3 pagesChapter 7 Problems: Problem #14 P. 7-57 Problem #15 P. 7-58Zyrene Kei ReyesNo ratings yet

- Ramos and Cammayo Merch JournalsDocument7 pagesRamos and Cammayo Merch JournalsCol JuanNo ratings yet

- Mock Solution FAR 1-KnSDocument12 pagesMock Solution FAR 1-KnSMuhammad YahyaNo ratings yet

- ULOa Let's Analyze Week 8 9Document2 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Exercise-1 Merchandising Melanie-RodilDocument13 pagesExercise-1 Merchandising Melanie-RodilShiela RengelNo ratings yet

- Introduction To Accounting: Suggested Answers Certificate in Accounting and Finance - Autumn 2018Document6 pagesIntroduction To Accounting: Suggested Answers Certificate in Accounting and Finance - Autumn 2018Asad ShahNo ratings yet

- Sales - Purchase Transaction (2242002)Document15 pagesSales - Purchase Transaction (2242002)Ghost Music OfficialNo ratings yet

- 12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Document6 pages12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Tess CoaryNo ratings yet

- AST Outcome 1 ResitDocument3 pagesAST Outcome 1 Resit6p86m84qb2No ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- Problem SolvingDocument14 pagesProblem SolvingJericho EncarnacionNo ratings yet

- Tutorial 1. FA2Document11 pagesTutorial 1. FA2bolaemil20No ratings yet

Exercise 12-6

Exercise 12-6

Uploaded by

jood aljuhanaiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 12-6

Exercise 12-6

Uploaded by

jood aljuhanaiCopyright:

Available Formats

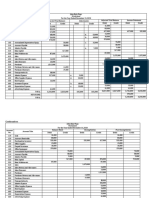

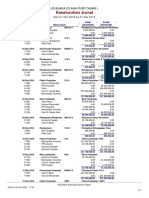

part 1

6 Nov purchase merchandise from AGT

276,000

account payable 276,000

(600,000×0.460)

5 Nov Account Receivable

200,000

Sold merchandise to SLS

2001000

18 Nov Account Receivable 192,000

Sold merchandise to NTL

192,000

(130,000×1,482)

20 Nov

purchase merchandise from SDS

160,000

Account payable 1601000

Account Receivable : Account payable :

5 Nov sale 200,000 6 Nov

purchase 276,000

18 Nov sale 192

,

ooo 20 Nov purchase 160,000

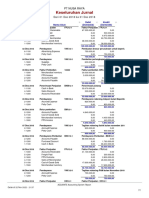

part B :

Nov 6 → Goo ,

ooo ✗ 0.490=294,000 Account payable 18

,

ooo

>

294,000-276,000 =

18,000 Transaction gain 18,000

NOV 18 → 130,000 ✗ 1.506--195,780 Transaction loss 3,120

>

account

195,780-192,660=(3/120) payable 3,120

You might also like

- Ricardo Pangan CompanyDocument38 pagesRicardo Pangan CompanyAndrea Tugot67% (15)

- Final Accounts SumDocument2 pagesFinal Accounts SumRohit Aswani25% (4)

- Assignment#1 ADRIANOCAÑADADocument4 pagesAssignment#1 ADRIANOCAÑADAADRIANO, Glecy C.78% (9)

- Accounting For Merchandizing Operations Problem 1-A) O'Quinn Co. Distributes Suitcases To Retail Stores and Extends Credit Terms of 1/10Document4 pagesAccounting For Merchandizing Operations Problem 1-A) O'Quinn Co. Distributes Suitcases To Retail Stores and Extends Credit Terms of 1/10Qasim Khan0% (1)

- Bfar Chapter 8 Problems 6 7Document9 pagesBfar Chapter 8 Problems 6 7Rhoda Claire M. GansobinNo ratings yet

- P5-1A Dan P5-2ADocument6 pagesP5-1A Dan P5-2ASherly Meliana Geraldine100% (1)

- Session 4 - Mohali Gifts ShopDocument12 pagesSession 4 - Mohali Gifts ShopArpita DalviNo ratings yet

- Acctng FinalDocument3 pagesAcctng FinalWindelyn ButraNo ratings yet

- Merchandising OperationsDocument2 pagesMerchandising OperationsMary JullianneNo ratings yet

- Mock Test PreparationDocument6 pagesMock Test PreparationHà Quảng TâyNo ratings yet

- Accounting For Merchandising Operations ExercisesDocument4 pagesAccounting For Merchandising Operations ExercisesthachuuuNo ratings yet

- CH 5 Practice Questions SolutionsDocument24 pagesCH 5 Practice Questions SolutionsChloe IbrahimNo ratings yet

- Akuntansi Pengantar 2Document4 pagesAkuntansi Pengantar 2Lingga ArgianitaNo ratings yet

- Vat IllustrationsDocument5 pagesVat Illustrationsamora elyseNo ratings yet

- Problem# 17 Mariano Lerin Bookstore Journalizing MARCH 2021 Date Account Titles PR Debit CreditDocument3 pagesProblem# 17 Mariano Lerin Bookstore Journalizing MARCH 2021 Date Account Titles PR Debit CreditAndrea Tugot50% (2)

- Let'S Check: PROBLEM 1 Garliet CompanyDocument5 pagesLet'S Check: PROBLEM 1 Garliet Companymaica G.No ratings yet

- Group 8 Assignment Acc 2023Document4 pagesGroup 8 Assignment Acc 2023Adi PutraNo ratings yet

- 01 Elms Activity 2 Ia3Document1 page01 Elms Activity 2 Ia3Jen DeloyNo ratings yet

- Principles of Accounting ExerciseDocument4 pagesPrinciples of Accounting ExerciseAin FatihahNo ratings yet

- Bbca1033 Assignment 1Document6 pagesBbca1033 Assignment 1Nabila Abu BakarNo ratings yet

- 213Document1 page213yoeliyyNo ratings yet

- Joel Amos Periodic InventoryDocument7 pagesJoel Amos Periodic InventoryJasmine P. Manlungat - EMERALDNo ratings yet

- 補修作業3Document2 pages補修作業38scqgrsjb4No ratings yet

- POA Exercise 28.11, 28.12A, 28.13Document6 pagesPOA Exercise 28.11, 28.12A, 28.13Ain FatihahNo ratings yet

- Chapter 1 - Current Liabilities, Provisions and ContingenciesDocument9 pagesChapter 1 - Current Liabilities, Provisions and ContingenciesPatrick GoNo ratings yet

- Accounting NavjotDocument1 pageAccounting Navjotyour0samNo ratings yet

- SW-16 UTB Merchandising AsDocument4 pagesSW-16 UTB Merchandising AsAlexis Marie Balagot100% (1)

- Bryan Maulana Ibrahim - XII AKL 2 - PT Nusa Raya - Keseluruhan JurnalDocument3 pagesBryan Maulana Ibrahim - XII AKL 2 - PT Nusa Raya - Keseluruhan JurnalBryan Maulana IbrahimNo ratings yet

- SW and ASSIGNMENT - TUGOTDocument9 pagesSW and ASSIGNMENT - TUGOTAndrea TugotNo ratings yet

- Audit of Inventory: Download NowDocument1 pageAudit of Inventory: Download NowMariz Julian Pang-aoNo ratings yet

- Problem 1-1Document3 pagesProblem 1-1Frencess Mae MayolaNo ratings yet

- Accounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Document16 pagesAccounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Fider GracianNo ratings yet

- Finanical Accounting AkbarDocument19 pagesFinanical Accounting AkbarShah MuradNo ratings yet

- Assignment, ANdallo, Ransey Ace DDocument3 pagesAssignment, ANdallo, Ransey Ace DRansey Ace AndalloNo ratings yet

- FoA2 Week 2 Lesson and HW 3Document8 pagesFoA2 Week 2 Lesson and HW 3Christine Joyce MagoteNo ratings yet

- MODULE 2 JOINT ARRANGEMENTS ASSIGNMENT AAC2 Mar 2023 - Copy-1Document3 pagesMODULE 2 JOINT ARRANGEMENTS ASSIGNMENT AAC2 Mar 2023 - Copy-1Lorifel Antonette Laoreno TejeroNo ratings yet

- Requirements: Provide The Journal Entries. Determine The Total Net Gail (Loss) FromDocument1 pageRequirements: Provide The Journal Entries. Determine The Total Net Gail (Loss) FromJaneNo ratings yet

- LAURILLA Angela - FAR Sheet1 4Document1 pageLAURILLA Angela - FAR Sheet1 4Angela LaurillaNo ratings yet

- Project 3 Problem 17Document3 pagesProject 3 Problem 17Jaquilyn JavierNo ratings yet

- Assignment Bballb BDocument4 pagesAssignment Bballb BTavnish SinghNo ratings yet

- Lecture 5Document5 pagesLecture 5oluwafemioyeyemi077No ratings yet

- Untitled NotebookDocument4 pagesUntitled Notebook21000780No ratings yet

- Keseluruhan Jurnal: Ud Buana (Diana Puspitasari)Document3 pagesKeseluruhan Jurnal: Ud Buana (Diana Puspitasari)diana puspitasariNo ratings yet

- At 5Document4 pagesAt 5Thùy NguyễnNo ratings yet

- BookDocument2 pagesBookAshley Gutierrez JacintoNo ratings yet

- Practice ProblemDocument3 pagesPractice ProblemAnne Thea AtienzaNo ratings yet

- MerchDocument10 pagesMerchWere dooomedNo ratings yet

- Chapter 7 Problems: Problem #14 P. 7-57 Problem #15 P. 7-58Document3 pagesChapter 7 Problems: Problem #14 P. 7-57 Problem #15 P. 7-58Zyrene Kei ReyesNo ratings yet

- Ramos and Cammayo Merch JournalsDocument7 pagesRamos and Cammayo Merch JournalsCol JuanNo ratings yet

- Mock Solution FAR 1-KnSDocument12 pagesMock Solution FAR 1-KnSMuhammad YahyaNo ratings yet

- ULOa Let's Analyze Week 8 9Document2 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Exercise-1 Merchandising Melanie-RodilDocument13 pagesExercise-1 Merchandising Melanie-RodilShiela RengelNo ratings yet

- Introduction To Accounting: Suggested Answers Certificate in Accounting and Finance - Autumn 2018Document6 pagesIntroduction To Accounting: Suggested Answers Certificate in Accounting and Finance - Autumn 2018Asad ShahNo ratings yet

- Sales - Purchase Transaction (2242002)Document15 pagesSales - Purchase Transaction (2242002)Ghost Music OfficialNo ratings yet

- 12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Document6 pages12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Tess CoaryNo ratings yet

- AST Outcome 1 ResitDocument3 pagesAST Outcome 1 Resit6p86m84qb2No ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- Problem SolvingDocument14 pagesProblem SolvingJericho EncarnacionNo ratings yet

- Tutorial 1. FA2Document11 pagesTutorial 1. FA2bolaemil20No ratings yet