Professional Documents

Culture Documents

Quiz 1 Instructions

Quiz 1 Instructions

Uploaded by

syed mujtubaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 1 Instructions

Quiz 1 Instructions

Uploaded by

syed mujtubaCopyright:

Available Formats

tep Instructions

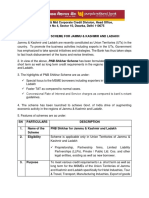

1 Start Excel. Download and open the file

named Exp22_Excel_Ch02_ML2_Vacation Property.xlsx.

Grader has automatically added your last name to the

beginning of the filename.

2 Write an IF function in cell D9 that calculates the down

payment for the mortgage. The down payment is 15% of the

purchase price if the customer is considered high risk or 5%

of the purchase price if considered low risk. The criteria to

assess the risk of the loan is based on the credit score value

in cell B6. Be sure to use the appropriate absolute or mixed

cell references when referencing the input values in the

range B4:B6. Then use the fill handle to copy the formula

down, stopping in cell D28.

3 Enter a formula to calculate the percent financed in cell E9.

The percent financed is the amount financed/purchase price.

Next use the fill handle to copy the formula down, stopping

cell E28.

4 Enter a formula in cell F9 to calculate the amount financed.

The amount financed is the purchase price-down payment.

After entering the formula, use the fill handle to copy the

formula down, stopping in cell F28.

5 Use the VLOOKUP function in cell G9 to lookup the

mortgage rate based on the customer credit score and the

data in the range D4:E6. Be sure to use the appropriate

absolute or mixed cell references. Use the fill handle to copy

the formula down, stopping in cell G28.

6 Calculate the rate per period in cell H9. All mortgages being

financed will be paid monthly. After completing the formula,

use the fill handle to copy the formula down, stopping in cell

H28.

7 Calculate the total number of payment periods in cell J9

based on the years financed in cell I9. After completing the

formula, use the fill handle to copy the formula down,

stopping in cell J28.

8 Use the PMT function to calculate the total monthly payment

in cell K10 based on the periodic interest rate, number of

periods, and amount financed. Ensure the results are a

positive value then use the fill handle to copy the function,

down stopping in cell K28.

9 Use Quick Analysis to calculate the total of all payments in

cell K29. (Quick Analysis is not available for Mac. If using a

Mac, use AutoSum to calculate the SUM of the range

K9:K28).

tep Instructions

1 Start Excel. Download and open the file

named Exp22_Excel_Ch02_ML2_Vacation Property.xlsx.

Grader has automatically added your last name to the

beginning of the filename.

2 Write an IF function in cell D9 that calculates the down

payment for the mortgage. The down payment is 15% of the

purchase price if the customer is considered high risk or 5%

of the purchase price if considered low risk. The criteria to

assess the risk of the loan is based on the credit score value

in cell B6. Be sure to use the appropriate absolute or mixed

cell references when referencing the input values in the

range B4:B6. Then use the fill handle to copy the formula

down, stopping in cell D28.

3 Enter a formula to calculate the percent financed in cell E9.

The percent financed is the amount financed/purchase price.

Next use the fill handle to copy the formula down, stopping

cell E28.

4 Enter a formula in cell F9 to calculate the amount financed.

The amount financed is the purchase price-down payment.

After entering the formula, use the fill handle to copy the

formula down, stopping in cell F28.

5 Use the VLOOKUP function in cell G9 to lookup the

mortgage rate based on the customer credit score and the

data in the range D4:E6. Be sure to use the appropriate

absolute or mixed cell references. Use the fill handle to copy

the formula down, stopping in cell G28.

6 Calculate the rate per period in cell H9. All mortgages being

financed will be paid monthly. After completing the formula,

use the fill handle to copy the formula down, stopping in cell

H28.

7 Calculate the total number of payment periods in cell J9

based on the years financed in cell I9. After completing the

formula, use the fill handle to copy the formula down,

stopping in cell J28.

8 Use the PMT function to calculate the total monthly payment

in cell K10 based on the periodic interest rate, number of

periods, and amount financed. Ensure the results are a

positive value then use the fill handle to copy the function,

down stopping in cell K28.

9 Use Quick Analysis to calculate the total of all payments in

cell K29. (Quick Analysis is not available for Mac. If using a

Mac, use AutoSum to calculate the SUM of the range

K9:K28).

tep Instructions

1 Start Excel. Download and open the file

named Exp22_Excel_Ch02_ML2_Vacation Property.xlsx.

Grader has automatically added your last name to the

beginning of the filename.

2 Write an IF function in cell D9 that calculates the down

payment for the mortgage. The down payment is 15% of the

purchase price if the customer is considered high risk or 5%

of the purchase price if considered low risk. The criteria to

assess the risk of the loan is based on the credit score value

in cell B6. Be sure to use the appropriate absolute or mixed

cell references when referencing the input values in the

range B4:B6. Then use the fill handle to copy the formula

down, stopping in cell D28.

3 Enter a formula to calculate the percent financed in cell E9.

The percent financed is the amount financed/purchase price.

Next use the fill handle to copy the formula down, stopping

cell E28.

4 Enter a formula in cell F9 to calculate the amount financed.

The amount financed is the purchase price-down payment.

After entering the formula, use the fill handle to copy the

formula down, stopping in cell F28.

5 Use the VLOOKUP function in cell G9 to lookup the

mortgage rate based on the customer credit score and the

data in the range D4:E6. Be sure to use the appropriate

absolute or mixed cell references. Use the fill handle to copy

the formula down, stopping in cell G28.

6 Calculate the rate per period in cell H9. All mortgages being

financed will be paid monthly. After completing the formula,

use the fill handle to copy the formula down, stopping in cell

H28.

7 Calculate the total number of payment periods in cell J9

based on the years financed in cell I9. After completing the

formula, use the fill handle to copy the formula down,

stopping in cell J28.

8 Use the PMT function to calculate the total monthly payment

in cell K10 based on the periodic interest rate, number of

periods, and amount financed. Ensure the results are a

positive value then use the fill handle to copy the function,

down stopping in cell K28.

9 Use Quick Analysis to calculate the total of all payments in

cell K29. (Quick Analysis is not available for Mac. If using a

Mac, use AutoSum to calculate the SUM of the range

K9:K28).

tep Instructions

10 Use the appropriate statistical functions in the range

B32:B36 to calculate descriptive statistics based on the row

headings in the range A32:B36. In cell B32, calculate the

total count of loans based on column A, lowest payment in

cell B33 based on the data in column K, highest payment in

B34, average payment in B35, and median payment in B36.

11 Use the XLOOKUP function in cell E32 to lookup the

employee number in cell D32 and return the corresponding

down payment, % finances, and amount financed.

12 Use the appropriate function to insert the current date and

time in cell B2.

13 Save and close the workbook. Submit the file as directed.

Close

tep Instructions

10 Use the appropriate statistical functions in the range

B32:B36 to calculate descriptive statistics based on the row

headings in the range A32:B36. In cell B32, calculate the

total count of loans based on column A, lowest payment in

cell B33 based on the data in column K, highest payment in

B34, average payment in B35, and median payment in B36.

11 Use the XLOOKUP function in cell E32 to lookup the

employee number in cell D32 and return the corresponding

down payment, % finances, and amount financed.

12 Use the appropriate function to insert the current date and

time in cell B2.

13 Save and close the workbook. Submit the file as directed.

Close

tep Instructions

10 Use the appropriate statistical functions in the range

B32:B36 to calculate descriptive statistics based on the row

headings in the range A32:B36. In cell B32, calculate the

total count of loans based on column A, lowest payment in

cell B33 based on the data in column K, highest payment in

B34, average payment in B35, and median payment in B36.

11 Use the XLOOKUP function in cell E32 to lookup the

employee number in cell D32 and return the corresponding

down payment, % finances, and amount financed.

12 Use the appropriate function to insert the current date and

time in cell B2.

13 Save and close the workbook. Submit the file as directed.

Close

Close

You might also like

- No Dues Certificate - 13!32!39 PDFDocument1 pageNo Dues Certificate - 13!32!39 PDFAkshay Patole67% (3)

- EX2013 ChallengeYourself 3 3 Instructions PDFDocument3 pagesEX2013 ChallengeYourself 3 3 Instructions PDFjakez0% (2)

- Excel Black Belt Answers OwnselfDocument76 pagesExcel Black Belt Answers Ownself21Y6C41 SHARMAINE SEET SHIENNo ratings yet

- Wild Planet Conservation: Data Validation, Advanced Functions, Tables, and PivottablesDocument11 pagesWild Planet Conservation: Data Validation, Advanced Functions, Tables, and PivottablesTamara Zuñiga VargasNo ratings yet

- Money-Book 1-2Document46 pagesMoney-Book 1-2Ashlee Rousey100% (1)

- Instructions SC EX19 EOM4-1Document3 pagesInstructions SC EX19 EOM4-1ry0% (1)

- Exam 3 InstructionsDocument4 pagesExam 3 InstructionskjmadniNo ratings yet

- Case Problem 1: Gorecki ConstructionDocument5 pagesCase Problem 1: Gorecki ConstructionkarthikNo ratings yet

- Instructions IL EX19 EOM1-2Document3 pagesInstructions IL EX19 EOM1-2hhdhdhdhhd0% (1)

- EX2013 IndependentProject 2 4 InstructionsDocument3 pagesEX2013 IndependentProject 2 4 InstructionsYeyo Camilo Rueda0% (1)

- Instructions K201 GP6 Spring14Document9 pagesInstructions K201 GP6 Spring14Edwin HolmesNo ratings yet

- E Ch02 Expv1 Ircd InstructionsDocument2 pagesE Ch02 Expv1 Ircd InstructionsSpenser Andrew SnyderNo ratings yet

- EX2013 Capstone Level3 InstructionsDocument5 pagesEX2013 Capstone Level3 InstructionsThomas Matheny0% (2)

- Excel Proficiency TestDocument3 pagesExcel Proficiency Testakoe_2No ratings yet

- Instructions SC EX19 EOM2-2Document3 pagesInstructions SC EX19 EOM2-2Sha'Landis HillNo ratings yet

- Notes ReceivableDocument1 pageNotes ReceivableJohn Carlo Lorenzo75% (4)

- Exp22 Excel ch02 ml2 - Vacation Property InstructionsDocument2 pagesExp22 Excel ch02 ml2 - Vacation Property Instructionsapi-572422586No ratings yet

- Exp22 Excel Ch07 CumulativeAssessment Variation Shipping InstructionsDocument3 pagesExp22 Excel Ch07 CumulativeAssessment Variation Shipping Instructionssramnarine1991No ratings yet

- Instructions NP OFF19 M1-4aDocument12 pagesInstructions NP OFF19 M1-4aHarpreet KaurNo ratings yet

- Flex Cab Company: M Project NameDocument6 pagesFlex Cab Company: M Project NameAmandaNo ratings yet

- EXP ECH02 H3 - Mortgage Calculator 13 InstructionsDocument2 pagesEXP ECH02 H3 - Mortgage Calculator 13 InstructionsAshhab MahdiNo ratings yet

- Excel Exercise#2Document2 pagesExcel Exercise#2Kennedy yaShiimbiNo ratings yet

- Exp19 Excel Ch07 HOEAssessment Employees InstructionsDocument3 pagesExp19 Excel Ch07 HOEAssessment Employees InstructionsMoazzazahNo ratings yet

- Exploring Microsoft Office Excel 2013: Exam #1 Modules 1-3Document3 pagesExploring Microsoft Office Excel 2013: Exam #1 Modules 1-3D McCarthyNo ratings yet

- E2010 EXPV1 CAP InstructionsDocument3 pagesE2010 EXPV1 CAP InstructionsSpenser Andrew SnyderNo ratings yet

- Hands-On Exercise-Chap 02-Part 3-Loans (2019) - InstructionsDocument4 pagesHands-On Exercise-Chap 02-Part 3-Loans (2019) - InstructionsKaylee FreemanNo ratings yet

- Cello Worldwide: Create and Format A Financial AnalysisDocument5 pagesCello Worldwide: Create and Format A Financial AnalysisVarsheni VageeswaranNo ratings yet

- Exp22 - Excel - Ch02 - Cumulative - Garten Furniture - Instructions - Docx - InstructionsDocument2 pagesExp22 - Excel - Ch02 - Cumulative - Garten Furniture - Instructions - Docx - Instructionsngyanchi11No ratings yet

- Assignment On Excel FunctionsDocument5 pagesAssignment On Excel Functionssanjeev05No ratings yet

- Springleaf Designs: Formatting, Formulas, and ChartsDocument5 pagesSpringleaf Designs: Formatting, Formulas, and ChartsPhan YvesNo ratings yet

- Lab 11 InstructionsDocument2 pagesLab 11 InstructionsChase ParkerNo ratings yet

- Activity 3 36 PointsDocument3 pagesActivity 3 36 PointsFatima AnsariNo ratings yet

- Project 2: The Capital Asset Pricing Model and Portfolio TheoryDocument11 pagesProject 2: The Capital Asset Pricing Model and Portfolio TheoryNaqqash SajidNo ratings yet

- MSF 503 F12 Problem Set 3Document5 pagesMSF 503 F12 Problem Set 3rdixit2No ratings yet

- Porcupine Excel AssignmentDocument25 pagesPorcupine Excel AssignmentAndrea XiaoNo ratings yet

- Math 1090 Project 6 Futurepresent ValueDocument4 pagesMath 1090 Project 6 Futurepresent Valueapi-382153962No ratings yet

- TextDocument6 pagesTextusefNo ratings yet

- Instructions SC EX19 EOM2-1Document3 pagesInstructions SC EX19 EOM2-1Glory RajiNo ratings yet

- Instructions IL EX19 3aDocument3 pagesInstructions IL EX19 3aBharat KoiralaNo ratings yet

- E CH07 EXPV2 H1 InstructionsDocument2 pagesE CH07 EXPV2 H1 InstructionsJustin MunozNo ratings yet

- Avero International: Create A Sales Projection WorksheetDocument3 pagesAvero International: Create A Sales Projection WorksheetryNo ratings yet

- Session 18-Financial FunctionsDocument4 pagesSession 18-Financial Functionsking coNo ratings yet

- After-Mid Assignments On Ms-ExcelDocument10 pagesAfter-Mid Assignments On Ms-Excelarham buttNo ratings yet

- Student Instructions Porcupine PPEDocument6 pagesStudent Instructions Porcupine PPEAndrea XiaoNo ratings yet

- Excel 2007 Chapter 8 To 15Document235 pagesExcel 2007 Chapter 8 To 15sujai_saNo ratings yet

- MGMT 2080 - Introduction To Information Systems Excel Exercise 2Document2 pagesMGMT 2080 - Introduction To Information Systems Excel Exercise 2Sardar AftabNo ratings yet

- Academy: Managerial and Financial Accounting Fi Paper: 8Document4 pagesAcademy: Managerial and Financial Accounting Fi Paper: 8baburamNo ratings yet

- IT 111 Assignment Two 27 Jan 2023Document6 pagesIT 111 Assignment Two 27 Jan 2023Jago BankNo ratings yet

- Excel Project - Chapter 08Document3 pagesExcel Project - Chapter 08G JhaNo ratings yet

- Practice Excel 2Document3 pagesPractice Excel 2Ashish P SharmaNo ratings yet

- Exp19 Excel Ch02 Cap Appliances InstructionsDocument2 pagesExp19 Excel Ch02 Cap Appliances Instructionsdylandumont1314No ratings yet

- Instructions SC EX16 2bDocument4 pagesInstructions SC EX16 2bNur NazirahNo ratings yet

- Pakistan International School Jeddah - English Section: Task 1Document2 pagesPakistan International School Jeddah - English Section: Task 1fsdffNo ratings yet

- Instructions SC EX16 3aDocument4 pagesInstructions SC EX16 3am shoshanNo ratings yet

- Overview and Purpose: Solve Real-World Problems While Clearly Communicating Financial Math Processes and CalculationsDocument5 pagesOverview and Purpose: Solve Real-World Problems While Clearly Communicating Financial Math Processes and Calculationsayushi kNo ratings yet

- Exp22 - Excel - Ch11 - Cumulative - Client FICO Scores - InstructionsDocument3 pagesExp22 - Excel - Ch11 - Cumulative - Client FICO Scores - Instructionssramnarine1991No ratings yet

- Instructions SC EX365 2021 8aDocument5 pagesInstructions SC EX365 2021 8ajsgiganteNo ratings yet

- Lab ExerciseDocument1 pageLab ExerciseReignNo ratings yet

- Essential Spreadsheets ExercisesDocument23 pagesEssential Spreadsheets ExercisesBharath BkrNo ratings yet

- Attachment 1Document5 pagesAttachment 1Luquitas EzeNo ratings yet

- Board PracticalDocument5 pagesBoard PracticalJayeeta nayakNo ratings yet

- Revised DASAP Application For MicrograntDocument4 pagesRevised DASAP Application For Micrograntabrshseven8No ratings yet

- BUSINESS FINANCE 12 - Q1 - W6 - Mod6Document15 pagesBUSINESS FINANCE 12 - Q1 - W6 - Mod6LeteSsie100% (3)

- Business Finance12 Q3 M3Document16 pagesBusiness Finance12 Q3 M3Chriztal TejadaNo ratings yet

- G7 Accounting Note Chapter 2Document5 pagesG7 Accounting Note Chapter 2Anggi Pradila PutriNo ratings yet

- CGTMSE - Scheme Document CGS I - Updated As On March 31, 2022 PDFDocument26 pagesCGTMSE - Scheme Document CGS I - Updated As On March 31, 2022 PDFkarthik kvNo ratings yet

- Ashok KumarDocument2 pagesAshok Kumarapexlofi93421100% (1)

- Simple InterestDocument46 pagesSimple InterestHiroshi MinamotoNo ratings yet

- SOA WineDocument2 pagesSOA WinePharmastar Int'l Trading Corp.No ratings yet

- Retail Collection PolicyDocument39 pagesRetail Collection PolicyK Praveen RajNo ratings yet

- SLF066 CalamityLoanApplicationForm V07Document2 pagesSLF066 CalamityLoanApplicationForm V07Mervin BauyaNo ratings yet

- Credit and Collection 1.5Document17 pagesCredit and Collection 1.5giezele ballatanNo ratings yet

- Mudiraj Educational SocietyDocument1 pageMudiraj Educational SocietyKoyalkar RenukaNo ratings yet

- Income Tax Calculation ChartDocument29 pagesIncome Tax Calculation Chartnaveed ansariNo ratings yet

- Herrypramono,+##Default - Groups.name - ProductionEditor##,+Layout 2+Artikel+2+JMan+Vol+19+No.+1+ (CC)Document21 pagesHerrypramono,+##Default - Groups.name - ProductionEditor##,+Layout 2+Artikel+2+JMan+Vol+19+No.+1+ (CC)Rasda MuhammadNo ratings yet

- Cash and ReceivablesDocument74 pagesCash and ReceivablesChitta LeeNo ratings yet

- Statement of Account:: Bengalore: Personal LoanDocument2 pagesStatement of Account:: Bengalore: Personal LoanJEETENDRANo ratings yet

- Deffered ANNUITYDocument11 pagesDeffered ANNUITYNathan DrakeNo ratings yet

- Aniya 4-5Document6 pagesAniya 4-5Clyde ThomasNo ratings yet

- PNB Shikhar SchemeDocument3 pagesPNB Shikhar Schemeomkar maharanaNo ratings yet

- Crónica Gai1-240202501-Aa4-Ev01Document3 pagesCrónica Gai1-240202501-Aa4-Ev01Ricardo padilla AcostaNo ratings yet

- Askari Bank Internship ReportDocument76 pagesAskari Bank Internship Reportmalik omerNo ratings yet

- POS Loans, Merchant Cash Advance, Loans Against Card Swipe, Apply Now - FlexiLoansDocument5 pagesPOS Loans, Merchant Cash Advance, Loans Against Card Swipe, Apply Now - FlexiLoansCissé AssaneNo ratings yet

- 3 Required (B) Prepare The Following Accounts For The Year Ended 30 September 2020. Close The AccountsDocument18 pages3 Required (B) Prepare The Following Accounts For The Year Ended 30 September 2020. Close The AccountsalpNo ratings yet

- ProjectDocument111 pagesProjectGanesh KumarNo ratings yet

- Cfas Fa 2Document3 pagesCfas Fa 2mercyvienhoNo ratings yet

- Lecture 3 ExercisesDocument2 pagesLecture 3 ExercisesSam TaylorNo ratings yet

- Meressa Paper 2021Document24 pagesMeressa Paper 2021Mk FisihaNo ratings yet