Professional Documents

Culture Documents

Revenue Policy

Revenue Policy

Uploaded by

Rafeek MunnolliCopyright:

Available Formats

You might also like

- Linear Algebra A Modern Introduction 3rd Edition Poole Solutions ManualDocument26 pagesLinear Algebra A Modern Introduction 3rd Edition Poole Solutions Manualwoollyprytheeuctw100% (30)

- Revenue Policy v1 - 1660736081Document3 pagesRevenue Policy v1 - 1660736081Essaar EnterprisesNo ratings yet

- Are You A Day Trader ?Document7 pagesAre You A Day Trader ?jayshankar yadavNo ratings yet

- Service Charges and Fees-Federal BankDocument10 pagesService Charges and Fees-Federal Bankakhil kurianNo ratings yet

- Federal Bank Service ChargesDocument11 pagesFederal Bank Service ChargesAlbin GeorgeNo ratings yet

- Kfs Sheet IDEP874184698182I8AP 925567482114388Document5 pagesKfs Sheet IDEP874184698182I8AP 925567482114388DK ForeverGaminGNo ratings yet

- Brockrage FDDocument2 pagesBrockrage FDRameshwar RathodNo ratings yet

- Service Charges and FeeDocument10 pagesService Charges and Feehgfh hgfNo ratings yet

- Rate of Interest and Charges Applicable To Micro & Small Enterprises (Mses) Covered Under Priority SectorDocument2 pagesRate of Interest and Charges Applicable To Micro & Small Enterprises (Mses) Covered Under Priority SectorAjoydeep DasNo ratings yet

- Service Charges and Fees Wef 01st Oct 2022Document12 pagesService Charges and Fees Wef 01st Oct 2022ranjith ananthNo ratings yet

- Service Charges 01st OCT 2022Document11 pagesService Charges 01st OCT 2022SpeakupNo ratings yet

- Kfs Sheet IDEP782188813627SZDW 511629824784788Document5 pagesKfs Sheet IDEP782188813627SZDW 511629824784788dhirendrapradhan372No ratings yet

- Service Charges and FeeDocument10 pagesService Charges and FeeShanNo ratings yet

- Trad Free ChargesDocument3 pagesTrad Free Chargestejasparmar12345678No ratings yet

- GFCBJJVDFBKKDocument1 pageGFCBJJVDFBKKHare KrishnaNo ratings yet

- Ev Set Aug2014Document1 pageEv Set Aug2014Anis Raihana Abdul AzizNo ratings yet

- Term SheetDocument1 pageTerm SheetSathya JaganNo ratings yet

- Threshold Limit For CasaDocument2 pagesThreshold Limit For CasaLipsa DhalNo ratings yet

- LICs New GGCA PDFDocument7 pagesLICs New GGCA PDFJemila SatchiNo ratings yet

- Idirect - Brokerage PlansDocument7 pagesIdirect - Brokerage PlansJitenNo ratings yet

- Service Charges and FeesDocument10 pagesService Charges and FeesAkhil MohanNo ratings yet

- Service Charges and FeesDocument11 pagesService Charges and FeesajmalNo ratings yet

- Revised Schedule of ChargesDocument2 pagesRevised Schedule of Chargesmayankmehta052No ratings yet

- OCBC ChargesDocument10 pagesOCBC ChargesAndrewHuiosNo ratings yet

- PlanDocument4 pagesPlanrajritesNo ratings yet

- Presentation On CGTMSE and Upcoming OpportunitiesDocument16 pagesPresentation On CGTMSE and Upcoming OpportunitiesAkshay JainNo ratings yet

- BOI MSME Loan ProductsDocument95 pagesBOI MSME Loan ProductsganpatigajanandganeshNo ratings yet

- Educative Series Green Housing LoanDocument2 pagesEducative Series Green Housing LoanRohith RaoNo ratings yet

- Amendment To Service Provider Agreement 1Document3 pagesAmendment To Service Provider Agreement 1myloan partnerNo ratings yet

- Service Charges and Fees 01-10-2020Document10 pagesService Charges and Fees 01-10-2020mshafeeqksNo ratings yet

- Investing Procedure PSEDocument11 pagesInvesting Procedure PSEGiella MagnayeNo ratings yet

- Chapter - 16 Tax Collection at Source: What Is TCS?Document7 pagesChapter - 16 Tax Collection at Source: What Is TCS?kuvira LodhaNo ratings yet

- FM2 EndtermDocument22 pagesFM2 EndtermSuraj RanaNo ratings yet

- SWATI SBI - OrganizedDocument5 pagesSWATI SBI - OrganizedVinod MNo ratings yet

- Schemes of JK BankDocument8 pagesSchemes of JK Bankigupta_4No ratings yet

- Bank Loan OffersDocument11 pagesBank Loan OffersAnandNo ratings yet

- Service Charges and Fees (With Effect From 01st June 2024)Document12 pagesService Charges and Fees (With Effect From 01st June 2024)skerketa14No ratings yet

- Most Important Terms and ConditionsDocument20 pagesMost Important Terms and Conditionsdharmendra palNo ratings yet

- Oct' 2013 DP LC Rate Card North Punjab & SouthDocument5 pagesOct' 2013 DP LC Rate Card North Punjab & SouthSahil KumarNo ratings yet

- Service Charges and Fees (With Effect From 01st April 2024)Document12 pagesService Charges and Fees (With Effect From 01st April 2024)kbrc0405No ratings yet

- Paper - 2: Strategic Financial Management Questions Future ContractDocument24 pagesPaper - 2: Strategic Financial Management Questions Future ContractRaul KarkyNo ratings yet

- TAX RATE CARD 2021-22 Income Tax Withholding Rates Sales Tax Withholding RatesDocument14 pagesTAX RATE CARD 2021-22 Income Tax Withholding Rates Sales Tax Withholding RatesTax Management ConsultingNo ratings yet

- Broking Idirect Linked Savings AccountDocument7 pagesBroking Idirect Linked Savings Accounttrue chartNo ratings yet

- Service Charges Wef 01-Oct-2023Document11 pagesService Charges Wef 01-Oct-2023Loona KKNo ratings yet

- Commission Structure - May 2019Document16 pagesCommission Structure - May 2019Sabuj MollaNo ratings yet

- Service Charges and FeesDocument12 pagesService Charges and FeestirNo ratings yet

- Treasury & Market Risk DivisionDocument3 pagesTreasury & Market Risk DivisionShahrun NaharNo ratings yet

- Financing Decisions 10-12Document48 pagesFinancing Decisions 10-12Rajat ShrinetNo ratings yet

- FM Smart WorkDocument17 pagesFM Smart WorkmaacmampadNo ratings yet

- Capital Budgeting-ClassDocument91 pagesCapital Budgeting-ClassAditi AgrawalNo ratings yet

- Crest Mitc LowDocument12 pagesCrest Mitc LowswastikNo ratings yet

- CONT .: (15 Minutes Extra Time Will Be Given Due To Slow Internet or Electricity Issues)Document2 pagesCONT .: (15 Minutes Extra Time Will Be Given Due To Slow Internet or Electricity Issues)ALEEM MANSOORNo ratings yet

- Personal Loan - Governement emDocument2 pagesPersonal Loan - Governement emrajesh.dhawan74No ratings yet

- A Project Has Initial Investment of Rs.40,000/-.It ProvidesDocument3 pagesA Project Has Initial Investment of Rs.40,000/-.It ProvidesAkshay KumarNo ratings yet

- Carry Forward & Badla TransactionDocument10 pagesCarry Forward & Badla Transaction1220672329No ratings yet

- Mechanics of Trading and Types of OrdersDocument21 pagesMechanics of Trading and Types of OrdersJade EdajNo ratings yet

- Makati Rev CodeDocument6 pagesMakati Rev CodeHelena HerreraNo ratings yet

- Tax Rates 2021Document6 pagesTax Rates 2021Muazam memonNo ratings yet

- SOBC - July To December 2021 - EnglishDocument26 pagesSOBC - July To December 2021 - EnglishSajid MahmoodNo ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- Mexico ReportDocument12 pagesMexico ReportErica GarridoNo ratings yet

- Allen Aiims CBT 2019 Admit Card: Name: CBT Id/Form Id: Password: CBT Centre: Exam Date: Exam Time: Reporting TimeDocument1 pageAllen Aiims CBT 2019 Admit Card: Name: CBT Id/Form Id: Password: CBT Centre: Exam Date: Exam Time: Reporting TimeShubham KumarNo ratings yet

- Form SapdDocument6 pagesForm SapdNada RamadhanNo ratings yet

- Citizenship ProjectDocument17 pagesCitizenship ProjectRomika MittalNo ratings yet

- Data 2Document22 pagesData 2Ravi RadheyNo ratings yet

- Brule 2019 ReformRepresentationResistance PDFDocument78 pagesBrule 2019 ReformRepresentationResistance PDFDeepanshu JangraNo ratings yet

- Non-Circumvention and Non-Disclosure AgreementDocument3 pagesNon-Circumvention and Non-Disclosure AgreementPaolo Bautista100% (1)

- Topic 2 Market Demand and SupplyDocument56 pagesTopic 2 Market Demand and SupplyQasim AkramNo ratings yet

- Textbook Ebook Business Accounting and Finance 5Th Edition Catherine Gowthorpe All Chapter PDFDocument43 pagesTextbook Ebook Business Accounting and Finance 5Th Edition Catherine Gowthorpe All Chapter PDFines.denman744100% (7)

- BIR Ruling 023-09Document5 pagesBIR Ruling 023-09Juno Geronimo100% (2)

- Book One Criminal Law Concepts With New InsertionsDocument296 pagesBook One Criminal Law Concepts With New InsertionsSheerlan Mark J. Quimson100% (1)

- Business Letter WritingDocument8 pagesBusiness Letter WritingMonahil FatimaNo ratings yet

- Abrenica vs. Law Firm of Abrenica, Tungol and Tibayan, 502 SCRA 614, September 22, 2006Document12 pagesAbrenica vs. Law Firm of Abrenica, Tungol and Tibayan, 502 SCRA 614, September 22, 2006j0d3No ratings yet

- Bullying As An Expression of Intolerant Schemas: Original ArticleDocument6 pagesBullying As An Expression of Intolerant Schemas: Original ArticleMahir MutluNo ratings yet

- The Silk Road WebquestDocument3 pagesThe Silk Road Webquestapi-464162453No ratings yet

- InvoiceDocument1 pageInvoicePreeti JaiswalNo ratings yet

- Absen Terbaru 1Document8 pagesAbsen Terbaru 1agprabreskrimNo ratings yet

- SGC2 - 19 ITT Covering Letter PDFDocument14 pagesSGC2 - 19 ITT Covering Letter PDFVin KenNo ratings yet

- Lives and Contributions of Kenyan LeadersDocument58 pagesLives and Contributions of Kenyan Leaderswanjirunjoroge379No ratings yet

- Infosys Limited: Murthy'S Law: Case OverviewDocument18 pagesInfosys Limited: Murthy'S Law: Case OverviewParth VijayNo ratings yet

- Far East Cellular LLCDocument1 pageFar East Cellular LLCDISARR PRODNo ratings yet

- Hamid Moslehi - Apr 12 04 SDocument25 pagesHamid Moslehi - Apr 12 04 SRagnacharNo ratings yet

- Manifesto Grupo Kone V3Document10 pagesManifesto Grupo Kone V3ismaelmendezherrera3No ratings yet

- Division of Bohol: Republic of The Philippines Department of Education Region VII, Central VisayasDocument4 pagesDivision of Bohol: Republic of The Philippines Department of Education Region VII, Central VisayasJaime Curag Jr.No ratings yet

- Eco402-Midterm Solved McqsDocument5 pagesEco402-Midterm Solved McqsNoor VirkNo ratings yet

- ST V Genens, William 09-28-21 Partial FinalDocument15 pagesST V Genens, William 09-28-21 Partial FinalBen SchachtmanNo ratings yet

- TVNHS - CPC FunctionalitySelf Assessment ToolDocument32 pagesTVNHS - CPC FunctionalitySelf Assessment ToolIrene DulayNo ratings yet

- Training Matrix INSETDocument1 pageTraining Matrix INSETKatherine AudienciaNo ratings yet

- A Nation of Moochers America's Addiction To Getting Something For NothingDocument12 pagesA Nation of Moochers America's Addiction To Getting Something For NothingMacmillan PublishersNo ratings yet

Revenue Policy

Revenue Policy

Uploaded by

Rafeek MunnolliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revenue Policy

Revenue Policy

Uploaded by

Rafeek MunnolliCopyright:

Available Formats

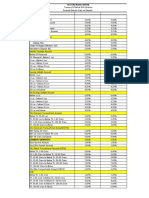

REVENUE POLICY OF GEM w.e.f 01.06.

2020

a. A one-time charge titled “Annual Milestone Charge” shall be levied @ 0.5% on all sellers

clocking a threshold Seller Merchandise Value. of Rs. 20 lacs in each financial year.

b. Seller Merchandise Value shall be reckoned as the progressive total of order values placed

upon and accepted by seller during a financial year.

c. “Annual Milestone Charge” shall be recovered from the seller simultaneous to its clocking

the threshold Seller Merchandise Value of Rs. 20 lacs.

d. For sellers who have clocked the threshold Seller Merchandise Value, Transaction Charge

at following rates shall be levied on all orders equal to or exceeding Rs. 5 lacs value in

each case: -

Product Order Value Transaction fee slab

≥5lacs <50 Cr. 0.5%

≥50cr but <100 Cr. 0.5% for 50cr (25 lacs) +

0.4% of value above 50 Cr.

≥l00cr but <200 Cr. 0.5% for 50cr (25 lacs) +

0.4% for next 50 Cr. (20 lacs) +

0.3% of value above 100 Cr.

≥200 Cr. 0.5% for 50cr (25 lacs) +

0.4% for next 50 Cr. (20 lacs) +

0.3% for next 100 Cr. (30 lacs) +

0.2% of value above 200 Cr.

e. Transaction Charge shall be paid by a seller to GeM at the time of acceptance of

concerned order.

f. Date of placement of the order shall be taken into account for the purpose of calculating

Seller Merchandise Value.

g. The proposed revenue model shall be applicable in respect of all bids published on

GeM’s portal on or after June 01, 2020. In respect of Direct Purchase/L1 buying, this

model shall be applicable on all orders placed on GeM portal on or after June 01, 2020.

h. Levy of Annual Milestone/Transaction Charges shall be subject to government levy (e.g.

GST), as applicable.

i. No Transaction charge shall be payable:

i. For orders less than Rs. 5 lacs in value.

ii. For orders which are placed and accepted by seller before the Seller Merchandise

Value (SMV) of INR 20 Lacs is reached.

j. For all purposes as mentioned above, each financial year shall be treated as a separate

and non-fungible unit.

k. In the case of cancellation of contract (as mutually agreed between buyer and seller), a

seller shall be eligible for refund of Transaction Charges in following cases:

i. Incorrect selection of goods or services by buyer;

ii. In case the related order was placed erroneously or by mistake by buyer;

iii. Product/service not required or partially required, as a result of which the buyer

refused some or full quantity of product/service or requested for discontinuation

of service(s) in the middle of contract;

iv. Consignee not available to receive the product/service;

v. Any other reason (s)to be explicitly justified by the seller.

l. However, no refund of Transaction Charges shall be made in case buyer cancels contract

due to non- fulfilment of any contractual obligations by seller or due to any omission

/misleading /false information provided by seller/service provider on GeM Portal.

You might also like

- Linear Algebra A Modern Introduction 3rd Edition Poole Solutions ManualDocument26 pagesLinear Algebra A Modern Introduction 3rd Edition Poole Solutions Manualwoollyprytheeuctw100% (30)

- Revenue Policy v1 - 1660736081Document3 pagesRevenue Policy v1 - 1660736081Essaar EnterprisesNo ratings yet

- Are You A Day Trader ?Document7 pagesAre You A Day Trader ?jayshankar yadavNo ratings yet

- Service Charges and Fees-Federal BankDocument10 pagesService Charges and Fees-Federal Bankakhil kurianNo ratings yet

- Federal Bank Service ChargesDocument11 pagesFederal Bank Service ChargesAlbin GeorgeNo ratings yet

- Kfs Sheet IDEP874184698182I8AP 925567482114388Document5 pagesKfs Sheet IDEP874184698182I8AP 925567482114388DK ForeverGaminGNo ratings yet

- Brockrage FDDocument2 pagesBrockrage FDRameshwar RathodNo ratings yet

- Service Charges and FeeDocument10 pagesService Charges and Feehgfh hgfNo ratings yet

- Rate of Interest and Charges Applicable To Micro & Small Enterprises (Mses) Covered Under Priority SectorDocument2 pagesRate of Interest and Charges Applicable To Micro & Small Enterprises (Mses) Covered Under Priority SectorAjoydeep DasNo ratings yet

- Service Charges and Fees Wef 01st Oct 2022Document12 pagesService Charges and Fees Wef 01st Oct 2022ranjith ananthNo ratings yet

- Service Charges 01st OCT 2022Document11 pagesService Charges 01st OCT 2022SpeakupNo ratings yet

- Kfs Sheet IDEP782188813627SZDW 511629824784788Document5 pagesKfs Sheet IDEP782188813627SZDW 511629824784788dhirendrapradhan372No ratings yet

- Service Charges and FeeDocument10 pagesService Charges and FeeShanNo ratings yet

- Trad Free ChargesDocument3 pagesTrad Free Chargestejasparmar12345678No ratings yet

- GFCBJJVDFBKKDocument1 pageGFCBJJVDFBKKHare KrishnaNo ratings yet

- Ev Set Aug2014Document1 pageEv Set Aug2014Anis Raihana Abdul AzizNo ratings yet

- Term SheetDocument1 pageTerm SheetSathya JaganNo ratings yet

- Threshold Limit For CasaDocument2 pagesThreshold Limit For CasaLipsa DhalNo ratings yet

- LICs New GGCA PDFDocument7 pagesLICs New GGCA PDFJemila SatchiNo ratings yet

- Idirect - Brokerage PlansDocument7 pagesIdirect - Brokerage PlansJitenNo ratings yet

- Service Charges and FeesDocument10 pagesService Charges and FeesAkhil MohanNo ratings yet

- Service Charges and FeesDocument11 pagesService Charges and FeesajmalNo ratings yet

- Revised Schedule of ChargesDocument2 pagesRevised Schedule of Chargesmayankmehta052No ratings yet

- OCBC ChargesDocument10 pagesOCBC ChargesAndrewHuiosNo ratings yet

- PlanDocument4 pagesPlanrajritesNo ratings yet

- Presentation On CGTMSE and Upcoming OpportunitiesDocument16 pagesPresentation On CGTMSE and Upcoming OpportunitiesAkshay JainNo ratings yet

- BOI MSME Loan ProductsDocument95 pagesBOI MSME Loan ProductsganpatigajanandganeshNo ratings yet

- Educative Series Green Housing LoanDocument2 pagesEducative Series Green Housing LoanRohith RaoNo ratings yet

- Amendment To Service Provider Agreement 1Document3 pagesAmendment To Service Provider Agreement 1myloan partnerNo ratings yet

- Service Charges and Fees 01-10-2020Document10 pagesService Charges and Fees 01-10-2020mshafeeqksNo ratings yet

- Investing Procedure PSEDocument11 pagesInvesting Procedure PSEGiella MagnayeNo ratings yet

- Chapter - 16 Tax Collection at Source: What Is TCS?Document7 pagesChapter - 16 Tax Collection at Source: What Is TCS?kuvira LodhaNo ratings yet

- FM2 EndtermDocument22 pagesFM2 EndtermSuraj RanaNo ratings yet

- SWATI SBI - OrganizedDocument5 pagesSWATI SBI - OrganizedVinod MNo ratings yet

- Schemes of JK BankDocument8 pagesSchemes of JK Bankigupta_4No ratings yet

- Bank Loan OffersDocument11 pagesBank Loan OffersAnandNo ratings yet

- Service Charges and Fees (With Effect From 01st June 2024)Document12 pagesService Charges and Fees (With Effect From 01st June 2024)skerketa14No ratings yet

- Most Important Terms and ConditionsDocument20 pagesMost Important Terms and Conditionsdharmendra palNo ratings yet

- Oct' 2013 DP LC Rate Card North Punjab & SouthDocument5 pagesOct' 2013 DP LC Rate Card North Punjab & SouthSahil KumarNo ratings yet

- Service Charges and Fees (With Effect From 01st April 2024)Document12 pagesService Charges and Fees (With Effect From 01st April 2024)kbrc0405No ratings yet

- Paper - 2: Strategic Financial Management Questions Future ContractDocument24 pagesPaper - 2: Strategic Financial Management Questions Future ContractRaul KarkyNo ratings yet

- TAX RATE CARD 2021-22 Income Tax Withholding Rates Sales Tax Withholding RatesDocument14 pagesTAX RATE CARD 2021-22 Income Tax Withholding Rates Sales Tax Withholding RatesTax Management ConsultingNo ratings yet

- Broking Idirect Linked Savings AccountDocument7 pagesBroking Idirect Linked Savings Accounttrue chartNo ratings yet

- Service Charges Wef 01-Oct-2023Document11 pagesService Charges Wef 01-Oct-2023Loona KKNo ratings yet

- Commission Structure - May 2019Document16 pagesCommission Structure - May 2019Sabuj MollaNo ratings yet

- Service Charges and FeesDocument12 pagesService Charges and FeestirNo ratings yet

- Treasury & Market Risk DivisionDocument3 pagesTreasury & Market Risk DivisionShahrun NaharNo ratings yet

- Financing Decisions 10-12Document48 pagesFinancing Decisions 10-12Rajat ShrinetNo ratings yet

- FM Smart WorkDocument17 pagesFM Smart WorkmaacmampadNo ratings yet

- Capital Budgeting-ClassDocument91 pagesCapital Budgeting-ClassAditi AgrawalNo ratings yet

- Crest Mitc LowDocument12 pagesCrest Mitc LowswastikNo ratings yet

- CONT .: (15 Minutes Extra Time Will Be Given Due To Slow Internet or Electricity Issues)Document2 pagesCONT .: (15 Minutes Extra Time Will Be Given Due To Slow Internet or Electricity Issues)ALEEM MANSOORNo ratings yet

- Personal Loan - Governement emDocument2 pagesPersonal Loan - Governement emrajesh.dhawan74No ratings yet

- A Project Has Initial Investment of Rs.40,000/-.It ProvidesDocument3 pagesA Project Has Initial Investment of Rs.40,000/-.It ProvidesAkshay KumarNo ratings yet

- Carry Forward & Badla TransactionDocument10 pagesCarry Forward & Badla Transaction1220672329No ratings yet

- Mechanics of Trading and Types of OrdersDocument21 pagesMechanics of Trading and Types of OrdersJade EdajNo ratings yet

- Makati Rev CodeDocument6 pagesMakati Rev CodeHelena HerreraNo ratings yet

- Tax Rates 2021Document6 pagesTax Rates 2021Muazam memonNo ratings yet

- SOBC - July To December 2021 - EnglishDocument26 pagesSOBC - July To December 2021 - EnglishSajid MahmoodNo ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- Mexico ReportDocument12 pagesMexico ReportErica GarridoNo ratings yet

- Allen Aiims CBT 2019 Admit Card: Name: CBT Id/Form Id: Password: CBT Centre: Exam Date: Exam Time: Reporting TimeDocument1 pageAllen Aiims CBT 2019 Admit Card: Name: CBT Id/Form Id: Password: CBT Centre: Exam Date: Exam Time: Reporting TimeShubham KumarNo ratings yet

- Form SapdDocument6 pagesForm SapdNada RamadhanNo ratings yet

- Citizenship ProjectDocument17 pagesCitizenship ProjectRomika MittalNo ratings yet

- Data 2Document22 pagesData 2Ravi RadheyNo ratings yet

- Brule 2019 ReformRepresentationResistance PDFDocument78 pagesBrule 2019 ReformRepresentationResistance PDFDeepanshu JangraNo ratings yet

- Non-Circumvention and Non-Disclosure AgreementDocument3 pagesNon-Circumvention and Non-Disclosure AgreementPaolo Bautista100% (1)

- Topic 2 Market Demand and SupplyDocument56 pagesTopic 2 Market Demand and SupplyQasim AkramNo ratings yet

- Textbook Ebook Business Accounting and Finance 5Th Edition Catherine Gowthorpe All Chapter PDFDocument43 pagesTextbook Ebook Business Accounting and Finance 5Th Edition Catherine Gowthorpe All Chapter PDFines.denman744100% (7)

- BIR Ruling 023-09Document5 pagesBIR Ruling 023-09Juno Geronimo100% (2)

- Book One Criminal Law Concepts With New InsertionsDocument296 pagesBook One Criminal Law Concepts With New InsertionsSheerlan Mark J. Quimson100% (1)

- Business Letter WritingDocument8 pagesBusiness Letter WritingMonahil FatimaNo ratings yet

- Abrenica vs. Law Firm of Abrenica, Tungol and Tibayan, 502 SCRA 614, September 22, 2006Document12 pagesAbrenica vs. Law Firm of Abrenica, Tungol and Tibayan, 502 SCRA 614, September 22, 2006j0d3No ratings yet

- Bullying As An Expression of Intolerant Schemas: Original ArticleDocument6 pagesBullying As An Expression of Intolerant Schemas: Original ArticleMahir MutluNo ratings yet

- The Silk Road WebquestDocument3 pagesThe Silk Road Webquestapi-464162453No ratings yet

- InvoiceDocument1 pageInvoicePreeti JaiswalNo ratings yet

- Absen Terbaru 1Document8 pagesAbsen Terbaru 1agprabreskrimNo ratings yet

- SGC2 - 19 ITT Covering Letter PDFDocument14 pagesSGC2 - 19 ITT Covering Letter PDFVin KenNo ratings yet

- Lives and Contributions of Kenyan LeadersDocument58 pagesLives and Contributions of Kenyan Leaderswanjirunjoroge379No ratings yet

- Infosys Limited: Murthy'S Law: Case OverviewDocument18 pagesInfosys Limited: Murthy'S Law: Case OverviewParth VijayNo ratings yet

- Far East Cellular LLCDocument1 pageFar East Cellular LLCDISARR PRODNo ratings yet

- Hamid Moslehi - Apr 12 04 SDocument25 pagesHamid Moslehi - Apr 12 04 SRagnacharNo ratings yet

- Manifesto Grupo Kone V3Document10 pagesManifesto Grupo Kone V3ismaelmendezherrera3No ratings yet

- Division of Bohol: Republic of The Philippines Department of Education Region VII, Central VisayasDocument4 pagesDivision of Bohol: Republic of The Philippines Department of Education Region VII, Central VisayasJaime Curag Jr.No ratings yet

- Eco402-Midterm Solved McqsDocument5 pagesEco402-Midterm Solved McqsNoor VirkNo ratings yet

- ST V Genens, William 09-28-21 Partial FinalDocument15 pagesST V Genens, William 09-28-21 Partial FinalBen SchachtmanNo ratings yet

- TVNHS - CPC FunctionalitySelf Assessment ToolDocument32 pagesTVNHS - CPC FunctionalitySelf Assessment ToolIrene DulayNo ratings yet

- Training Matrix INSETDocument1 pageTraining Matrix INSETKatherine AudienciaNo ratings yet

- A Nation of Moochers America's Addiction To Getting Something For NothingDocument12 pagesA Nation of Moochers America's Addiction To Getting Something For NothingMacmillan PublishersNo ratings yet