Professional Documents

Culture Documents

A222 Tutorial 1Q

A222 Tutorial 1Q

Uploaded by

chong huisinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A222 Tutorial 1Q

A222 Tutorial 1Q

Uploaded by

chong huisinCopyright:

Available Formats

(a) Prepaid journal entries for the year ended 31 December 2015

Date Details Debit (RM) Credit (RM)

Dec 31 Depreciation Expenses – Office Equipment 18,000

Accumulated Depreciation – Office Equipment 18,000

Insurance Expenses 2,240

Prepaid Insurance 2,240

Supplies Expenses 2,000

Supplies 2,000

Wages Expenses 1,000

Accrued Wages 1,000

Account Receivable 3,100

Revenue 3,100

(b) Prepaid adjusted Trial Balance as at 31 December 2015

Details Debit (RM) Credit (RM)

Cash 74,330

Account Receivable (8,700 + 3,100) 11,800

Office Supplies (3,550 – 2,000) 1,550

Prepaid Insurance (6,720 – 2,240) 4,480

Office Equipment 120,000

Accumulated Depreciation – Office Equipment (54,000 +18,000) 72,000

Account Payable 9,800

Capital 110,000

Revenue (118,900 + 3,100) 122,000

Wages Expense (47,700 + 1,000) 48,700

Other Operating Expenses 31,700

Depreciation Expenses – Office Equipment 18,000

Insurance Expenses 2,240

Office Supplies Expenses 2,000

Wages Accrued 1,000

Total 314,800 314,800

© Prepare an Income Statement for the year ended 31 December 2015

Details Debit (RM) Credit (RM)

Revenue 122,000

(-) Operating Expenses

Wages Expense 48,700

Other Operating Expenses 31,700

Depreciation Expenses – Office Equipment 18,000

Insurance Expenses 2,240

Office Supplies Expenses 2,000

(102,640)

Net Profit 19,360

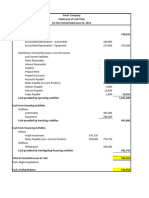

(d) Prepare a Balance Sheet for the business as at 31 December 2015

Details

Non-Current-Asset

Office Equipment 120,000

Accumulated Depreciation – Office Equipment (54,000 +18,000) (72,000)

48,000

Current Asset

Cash 74,330

Account Receivable (8,700 + 3,100) 11,800

Office Supplies (3,550 – 2,000) 1,550

Prepaid Insurance (6,720 – 2,240) 4,480

92,160

Total Asset 140,160

Equity

Capital 110,000

+ Net Profit 19,360

Total Capital 129,360

Current Liabilities

Account Payable 9,800

Wages Accrued 1,000

10,800

Total Equity and Liabilities 140,160

You might also like

- Lazar Blue Book Chapter 4 Solution (1 To 14 Only)Document27 pagesLazar Blue Book Chapter 4 Solution (1 To 14 Only)Shuhada Shamsuddin75% (4)

- Chapter-04 Completing The Accounting Cycle (Maths)Document9 pagesChapter-04 Completing The Accounting Cycle (Maths)ShifatNo ratings yet

- Tutorial Test 3Document2 pagesTutorial Test 3Hải NhưNo ratings yet

- Answer 1Document7 pagesAnswer 1Mylene HeragaNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Case 26 An Introduction To Debt Policy ADocument5 pagesCase 26 An Introduction To Debt Policy Amy VinayNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- Description Income Expenses Assets LiabilitiesDocument12 pagesDescription Income Expenses Assets LiabilitiesNipuna Perera100% (1)

- Financial Accounting - Assignment #1#Document5 pagesFinancial Accounting - Assignment #1#Hasan NajiNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- QUICKDocument8 pagesQUICKnissaNo ratings yet

- Powerjob Inc CaseDocument6 pagesPowerjob Inc CaseGloryNo ratings yet

- AccountingDocument8 pagesAccountingfarhan anwarNo ratings yet

- (ASSIGNMENT 3) Eslam Mahmoud MohamedDocument4 pages(ASSIGNMENT 3) Eslam Mahmoud MohamedAmira OkashaNo ratings yet

- Individual AssignmentDocument22 pagesIndividual AssignmentEda LimNo ratings yet

- AC3202 WK2 Exercises (22:23A)Document9 pagesAC3202 WK2 Exercises (22:23A)Long LongNo ratings yet

- AC3202 WK2 Exercises SolutionsDocument11 pagesAC3202 WK2 Exercises SolutionsLong LongNo ratings yet

- Task 3 AccDocument4 pagesTask 3 Accbbang bbyNo ratings yet

- Exercise 2.1B: PA12 - GROUP 3 - PE - CH2Document5 pagesExercise 2.1B: PA12 - GROUP 3 - PE - CH2AN HỒ QUÝNo ratings yet

- Refered To Retained Earning Deducted by Income Taxes PayableDocument1 pageRefered To Retained Earning Deducted by Income Taxes PayableWaritsa KupraditNo ratings yet

- Empire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMDocument3 pagesEmpire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMJasmin JimmyNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- Cash Flow Indirect and DirectDocument2 pagesCash Flow Indirect and DirectKatherine Borja0% (1)

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Gmernacej W5C5 AssigmentOLDDocument6 pagesGmernacej W5C5 AssigmentOLDalmaNo ratings yet

- Jawaban Soal UTS Akuntansi Keu - MenengahDocument4 pagesJawaban Soal UTS Akuntansi Keu - MenengahJessinthaNo ratings yet

- SOlution File For FRDocument38 pagesSOlution File For FRMonirul Islam MoniirrNo ratings yet

- A211 MC 2 - StudentDocument6 pagesA211 MC 2 - StudentWon HaNo ratings yet

- ACCT2015 Marathon - SOLUTION - April 2014Document5 pagesACCT2015 Marathon - SOLUTION - April 2014Tan TaylorNo ratings yet

- Answer Scheme Tutorial Questions - Accounting Non-Profit OrganizationDocument7 pagesAnswer Scheme Tutorial Questions - Accounting Non-Profit OrganizationMoriatyNo ratings yet

- Tutorial 14 Introductory Accounting Teaching Assistant TeamDocument2 pagesTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- Business Accounting Quiz 2 (Answers) Updated.Document7 pagesBusiness Accounting Quiz 2 (Answers) Updated.Hareen JuniorNo ratings yet

- ACCT 3061 Asignación Cap 4 y 5Document4 pagesACCT 3061 Asignación Cap 4 y 5gpm-81No ratings yet

- Assignment AnsDocument6 pagesAssignment AnsVAIGESWARI A/P MANIAM STUDENTNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- BHMH2101 2023 Sem 2 Assignment 1 - Suggested AnswersDocument4 pagesBHMH2101 2023 Sem 2 Assignment 1 - Suggested Answerstsoi lam chanNo ratings yet

- OCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesOCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Interest Expense Interest PayableDocument23 pagesInterest Expense Interest PayableBM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- ACT320 Assignment ProjectDocument11 pagesACT320 Assignment ProjectMd. Shakil Ahmed 1620890630No ratings yet

- Financial Accounting Assignment 2Document6 pagesFinancial Accounting Assignment 2kirubelNo ratings yet

- Tum CompanyDocument4 pagesTum CompanyNguyen My Khanh (K18 HCM)No ratings yet

- Abdirahman Assign 1Document8 pagesAbdirahman Assign 1Mazlax YareNo ratings yet

- Nguyen My Khanh - 25 - Mc1802Document6 pagesNguyen My Khanh - 25 - Mc1802Biên KimNo ratings yet

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- MARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesMARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Assignment 1 - Financial AccountingDocument3 pagesAssignment 1 - Financial AccountingHasan NajiNo ratings yet

- CashFlow Smart CompanyDocument1 pageCashFlow Smart CompanyCheyenne CariasNo ratings yet

- Tutorial On AdjustmentsDocument8 pagesTutorial On AdjustmentsPushpa ValliNo ratings yet

- Review Accounting 1Document9 pagesReview Accounting 1jhouvanNo ratings yet

- Ans Jan 2018 Far410Document8 pagesAns Jan 2018 Far4102022478048No ratings yet

- Chapter 5 Quiz-AnswerDocument4 pagesChapter 5 Quiz-AnswerkakaoNo ratings yet

- Group 5Document8 pagesGroup 5Doreen OngNo ratings yet

- g1 Final Written Answers Bkal1013Document13 pagesg1 Final Written Answers Bkal1013tasya zakariaNo ratings yet

- PYQ June 2018Document4 pagesPYQ June 2018Nur Amira NadiaNo ratings yet

- TP1-W2-S3-R0 Sri Annisa KatariDocument3 pagesTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariNo ratings yet

- Acc140 PresentationDocument8 pagesAcc140 PresentationnyararaitatendaNo ratings yet

- Accounts SOL 2022Document12 pagesAccounts SOL 2022akshitapaul19No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A222 Tutorial 2QDocument5 pagesA222 Tutorial 2Qchong huisinNo ratings yet

- 2 - Formation of Insurance ContractDocument21 pages2 - Formation of Insurance Contractchong huisinNo ratings yet

- KHOO TIAN HOCK & ANOR V OVERSEA-CHINESE BANKING CORPORATION LIMITED (KHOO SIONG HUI, THIRD PARTY)Document60 pagesKHOO TIAN HOCK & ANOR V OVERSEA-CHINESE BANKING CORPORATION LIMITED (KHOO SIONG HUI, THIRD PARTY)chong huisinNo ratings yet

- FORMOSA RESORT PROPERTIES SDN BHD V BANK BUMIPUTRA MALAYSIA CLJ - 2010 - 6 - 530 - PSBDocument12 pagesFORMOSA RESORT PROPERTIES SDN BHD V BANK BUMIPUTRA MALAYSIA CLJ - 2010 - 6 - 530 - PSBchong huisinNo ratings yet

- Ch14 - Audit ReportsDocument25 pagesCh14 - Audit ReportsShinny Lee G. UlaNo ratings yet

- Deduction PDFDocument207 pagesDeduction PDFdeepluthra6No ratings yet

- Solved Exercises - The Capital Asset Pricing Model Part IIDocument6 pagesSolved Exercises - The Capital Asset Pricing Model Part IIana lisa melanoNo ratings yet

- Ultratech JaypeeDocument8 pagesUltratech JaypeeDeepak Badlani0% (1)

- DVLA Billingual 31 Des 2018Document102 pagesDVLA Billingual 31 Des 2018ArsyitaNo ratings yet

- Test # 1 Review Material - BACC 152 16th EditionDocument14 pagesTest # 1 Review Material - BACC 152 16th EditionskswNo ratings yet

- Accounting For Non-ABM - Accounting Equation and The Double-Entry System - Module 2 AsynchronousDocument29 pagesAccounting For Non-ABM - Accounting Equation and The Double-Entry System - Module 2 AsynchronousPamela PerezNo ratings yet

- Utimco ActiveDocument20 pagesUtimco ActiveFortune100% (4)

- Valuation MultiplesDocument33 pagesValuation MultiplesGuilherme PortoNo ratings yet

- Lesson 1 Business EthicsDocument62 pagesLesson 1 Business EthicsKin LeeNo ratings yet

- 116 - English For Business - Unit 14. Banking-Text & HandoutDocument4 pages116 - English For Business - Unit 14. Banking-Text & Handoutana azarashviliNo ratings yet

- CREATE LAW - Short IntroDocument3 pagesCREATE LAW - Short IntroBenjie DavilaNo ratings yet

- A Study of Financial Performance: A Comparative Analysis of Axis and ICICI BankDocument9 pagesA Study of Financial Performance: A Comparative Analysis of Axis and ICICI BankUsman KulkarniNo ratings yet

- Top 30 Philippine Companies in The Stock MarketDocument76 pagesTop 30 Philippine Companies in The Stock MarketElizabeth Tecson100% (1)

- Icmap Newsletter Aug-Sept 2017Document20 pagesIcmap Newsletter Aug-Sept 2017GoopNo ratings yet

- 2-1-Maynard-Company-A Compress - Prepare BalanceDocument1 page2-1-Maynard-Company-A Compress - Prepare Balancesparsh.official.limited23No ratings yet

- Financial ReportingDocument156 pagesFinancial ReportingAkanksha singhNo ratings yet

- Nicolas Jack Rikhotso Anthony: Career Summary: 9 YrsDocument6 pagesNicolas Jack Rikhotso Anthony: Career Summary: 9 YrsNicolasNo ratings yet

- Explanation For This Change Is:: Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Document3 pagesExplanation For This Change Is:: Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Makan TidorNo ratings yet

- Chapter Summaries (Inv, Intangible Asset, Bio Asset)Document4 pagesChapter Summaries (Inv, Intangible Asset, Bio Asset)Kiana FernandezNo ratings yet

- IAS 34 Summary PDFDocument1 pageIAS 34 Summary PDFHaezel Santos VillanuevaNo ratings yet

- Imp As Questions From RPT MTP Past PapersDocument23 pagesImp As Questions From RPT MTP Past PapersSheenaNo ratings yet

- Home Office and Branch Accounting: Vincent - Ramiso@ue - Edu.phDocument3 pagesHome Office and Branch Accounting: Vincent - Ramiso@ue - Edu.phZihr EllerycNo ratings yet

- Pricing Contingent Convertible BondsDocument3 pagesPricing Contingent Convertible BondsJeff McGinnNo ratings yet

- ACTBC Illustrative Problems - Full Goodwill Approach and Partial Goodwill ApproachDocument46 pagesACTBC Illustrative Problems - Full Goodwill Approach and Partial Goodwill ApproachJoebet DebuyanNo ratings yet

- CH 01Document64 pagesCH 01Safiq AlhaddadNo ratings yet

- TU BBS 2nd YearDocument25 pagesTU BBS 2nd Yearsayang11590100% (1)

- Auditing and Assurance Exam MidtermDocument4 pagesAuditing and Assurance Exam MidtermMica Ella San DiegoNo ratings yet

- Annual Report GP 2015 PDFDocument120 pagesAnnual Report GP 2015 PDFFitri MegasariNo ratings yet