Professional Documents

Culture Documents

The Grape Group (Acquisition) : Cfap 1: A A F R

The Grape Group (Acquisition) : Cfap 1: A A F R

Uploaded by

.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Grape Group (Acquisition) : Cfap 1: A A F R

The Grape Group (Acquisition) : Cfap 1: A A F R

Uploaded by

.Copyright:

Available Formats

PRACTICE KIT

CFAP 1: ADVANCED ACCOUNTING AND FINANCIAL REPORTING

CHAPTER 20: CONSOLIDATION CASH FLOWS

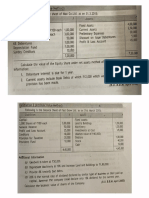

(3) Taxation on profits on ordinary activities Rs.000 Rs.000

Tax on income at 30% 600 90

Deferred tax 150 35

Under provision in respect of previous years 50 -

800 125

(4) Foreign exchange differences Rs.000 Rs.000

Gains arising on re- 700 400

translation

The exchange rate gain relates to the translation of an 80% owned overseas

subsidiary, Louise, under the closing rate method. The gain comprises:

Non-current assets 424

Inventories 117

Receivables 339

Cash 53

Trade payables (58)

875

Attributable to NCI (175)

Attributable to owners of parent company 700

(5) During the year non-current assets additions of Rs. 700,000 were acquired under finance

leases. Payments on finance leases are made in arrears. The net book value of noncurrent

assets disposed of was Rs. 720,000, With sale proceeds of Rs.810,000.

Required

(a) Prepare the group statement of cash flows of Bishop in accordance with IAS 7 together with any required

notes for the year ended 31 December 20X2.

(b) Explain why external users of financial statements benefit from receiving a statement of cash flows.

[ICAP CFAP-01 Practice Kit]

6. The Grape Group (Acquisition)

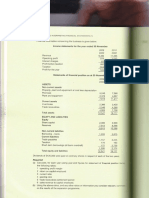

The draft statements of financial position and statement of profit or loss of the Grape Group at 31 March

Year 4 and 31 March Year 3 are as follows:

Notes Year 4 Year 3

Rs.000 Rs.000

Non-current assets

Intangible assets 24 -

Property, plant and equipment (1) 13,515 12,990

Investments – associated undertakings 1,966 1,920

15,505 14,910

Current assets

Inventory 11,657 10,530

Receivables 7,209 6,936

From the desk of Hassnain R. Badami, ACA

TSB Education-Premium Accountancy Courses P a g e 65 of 318

You might also like

- Cfi Fmva Exam Questions and AnswersDocument77 pagesCfi Fmva Exam Questions and AnswerssalaanNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Prelim Quiz Preparation of Balance Sheet and Income StatementDocument8 pagesPrelim Quiz Preparation of Balance Sheet and Income StatementCHARRYSAH TABAOSARES100% (2)

- Boutique Hotel Financial ModelDocument15 pagesBoutique Hotel Financial ModelNgọcThủy0% (1)

- Cash Flow Statement - QuestionDocument27 pagesCash Flow Statement - Questionhamza khanNo ratings yet

- SOALDocument2 pagesSOALjwtrmdhnNo ratings yet

- Ch10 ProblemDocument2 pagesCh10 ProblempalashndcNo ratings yet

- ACC501 - Practice Question (Lesson 1-18)Document8 pagesACC501 - Practice Question (Lesson 1-18)freebutterfly121No ratings yet

- Rs.000 Rs.000: Vitz Limited (Disposal + Acquisition of Foreign Operation)Document1 pageRs.000 Rs.000: Vitz Limited (Disposal + Acquisition of Foreign Operation).No ratings yet

- CA FINAL (May 2019 - New Course) Paper - 1 (Financial Reporting)Document32 pagesCA FINAL (May 2019 - New Course) Paper - 1 (Financial Reporting)Upasana NimjeNo ratings yet

- Notes - Cash Flow Statement and ProblemsDocument4 pagesNotes - Cash Flow Statement and ProblemsDhruv MalhotraNo ratings yet

- Statement of Financial Position As at 31st March 2015Document52 pagesStatement of Financial Position As at 31st March 2015Shameel IrshadNo ratings yet

- Income Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsDocument1 pageIncome Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsAik Luen LimNo ratings yet

- Consolidated Statement of Financial Position As at 31 December 20X2 20X2 20X1 Rs.000 Rs.000Document1 pageConsolidated Statement of Financial Position As at 31 December 20X2 20X2 20X1 Rs.000 Rs.000.No ratings yet

- Caf 5 Far1 Spring 2019xsxDocument5 pagesCaf 5 Far1 Spring 2019xsxMustafa ZaheerNo ratings yet

- Chapter: Common Size, Comparative and Trend AnalysisDocument6 pagesChapter: Common Size, Comparative and Trend Analysiseldridatech pvt ltdNo ratings yet

- Act 3602. Chapter 3. Prob.3-39 HomeworkDocument3 pagesAct 3602. Chapter 3. Prob.3-39 HomeworkphanupongnineNo ratings yet

- TPP PP 2024Document225 pagesTPP PP 2024AminaNo ratings yet

- CA Final - FR Faster Batch - Consolidation Additional QuestionsDocument8 pagesCA Final - FR Faster Batch - Consolidation Additional QuestionsRonaldo GOmesNo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document14 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- Term-End Examination June, 2010 Mcs-035: Accounting and Financial ManagementDocument4 pagesTerm-End Examination June, 2010 Mcs-035: Accounting and Financial ManagementAnishia KuriakoseNo ratings yet

- Test Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- Lecture No. 2 - Financial Statements & Illustrative ProblemDocument6 pagesLecture No. 2 - Financial Statements & Illustrative ProblemJA LAYUG100% (1)

- FR AS ScannerDocument144 pagesFR AS ScannerPooja GuptaNo ratings yet

- Spring 2024 - ACC501 - 1Document3 pagesSpring 2024 - ACC501 - 1freebutterfly121No ratings yet

- Far320 Capital Reduction ExercisesDocument7 pagesFar320 Capital Reduction ExercisesALIA MAISARA MD AKHIRNo ratings yet

- FR Suggested Answers CompilerDocument150 pagesFR Suggested Answers CompilerSach SahuNo ratings yet

- CORPORATE REPORTING Icag PDFDocument31 pagesCORPORATE REPORTING Icag PDFmohedNo ratings yet

- ACCT 302 Financial Reporting II Tutorial Set 4-1Document8 pagesACCT 302 Financial Reporting II Tutorial Set 4-1Ohenewaa AppiahNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Workings Rs.000Document1 pageWorkings Rs.000.No ratings yet

- Workings Rs.000Document1 pageWorkings Rs.000.No ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Competency Exam Practice-211Document5 pagesCompetency Exam Practice-211marites yuNo ratings yet

- Examination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Document8 pagesExamination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Boago PhatshwaneNo ratings yet

- Accounts Home Test 2Document7 pagesAccounts Home Test 2Ashish RaiNo ratings yet

- Management Programme: Assignment First Semester 2009Document4 pagesManagement Programme: Assignment First Semester 2009gkmishra2001 at gmail.com100% (2)

- Hyper Star Traders Income Statement As of Dec 31, 2009: Net SalesDocument6 pagesHyper Star Traders Income Statement As of Dec 31, 2009: Net SalesomairpkNo ratings yet

- OSA Jan23 BCOM ACC MAF3B7 Final PDFDocument8 pagesOSA Jan23 BCOM ACC MAF3B7 Final PDFAmithNo ratings yet

- Suggested Solution To Tutorial On SOCFDocument5 pagesSuggested Solution To Tutorial On SOCFLiyendra FernandoNo ratings yet

- Company Acc PracticeDocument9 pagesCompany Acc PracticeRaffayNo ratings yet

- Financial Accounting PDFDocument27 pagesFinancial Accounting PDFAnna MwitaNo ratings yet

- June 2009 Fa4a1Document9 pagesJune 2009 Fa4a1ksakala58No ratings yet

- C 20: C C F: Hapter Onsolidation ASH LowsDocument1 pageC 20: C C F: Hapter Onsolidation ASH Lows.No ratings yet

- Statement of Cashflow: Tutor Class - 101 HUDA AULIA ARIFIN - 1406533781Document13 pagesStatement of Cashflow: Tutor Class - 101 HUDA AULIA ARIFIN - 1406533781Fiza Xiena100% (1)

- Valuation: © The Institute of Chartered Accountants of IndiaDocument72 pagesValuation: © The Institute of Chartered Accountants of IndiaNmNo ratings yet

- Solution Test 2 (1) June 19Document5 pagesSolution Test 2 (1) June 19Nur Dina AbsbNo ratings yet

- Jawapan Chapter 3Document7 pagesJawapan Chapter 3wawan0% (2)

- Class Day Test BSC Finance Year 2Document5 pagesClass Day Test BSC Finance Year 2Revatee HurilNo ratings yet

- PracticeDocument1 pagePracticeNana CatNo ratings yet

- FRS 107 Ie 2016BBDocument10 pagesFRS 107 Ie 2016BBAmelia RahmawatiNo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document15 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- P5 MTP 1 For Nov 23 Answers @CAInterLegendsDocument20 pagesP5 MTP 1 For Nov 23 Answers @CAInterLegendsraghavagarwal2252No ratings yet

- Review Questions Ias 1 & Ias 7Document7 pagesReview Questions Ias 1 & Ias 7hajiraj504No ratings yet

- Module 5Document3 pagesModule 5Vikki ElNo ratings yet

- AOP Sales - 23.12.2017Document12 pagesAOP Sales - 23.12.2017Rubayat MatinNo ratings yet

- Management Development Institute, GurgaonDocument7 pagesManagement Development Institute, Gurgaonrishav jhaNo ratings yet

- CR Inter QuestionsDocument22 pagesCR Inter QuestionsRichie BoomaNo ratings yet

- Balance Sheet SampleDocument1 pageBalance Sheet Samplewaqas akramNo ratings yet

- Intermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreDocument2 pagesIntermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreGrezel NiceNo ratings yet

- Assets: © The Institute of Chartered Accountants of IndiaDocument16 pagesAssets: © The Institute of Chartered Accountants of IndiaMarvel KadaNo ratings yet

- FR (New) A MTP Final Mar 2021Document17 pagesFR (New) A MTP Final Mar 2021ritz meshNo ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Dear Shareholders,: Future OutlookDocument1 pageDear Shareholders,: Future Outlook.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Financial Capital: Analysis of Non-Financial Key Performance IndicatorsDocument1 pageFinancial Capital: Analysis of Non-Financial Key Performance Indicators.No ratings yet

- Major Gen Naseer Ali Khan: ST SC HR EC SIC ACDocument1 pageMajor Gen Naseer Ali Khan: ST SC HR EC SIC AC.No ratings yet

- KFGJHDocument1 pageKFGJH.No ratings yet

- 2022 Performance Highlights: People Planet ProsperityDocument1 page2022 Performance Highlights: People Planet Prosperity.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Policy For Security Clearance of Foreign Directors Policy On Non-Executive and Independent Directors' RemunerationDocument1 pagePolicy For Security Clearance of Foreign Directors Policy On Non-Executive and Independent Directors' Remuneration.No ratings yet

- Syed Atif Ali: ST HR SIC AC SC ECDocument1 pageSyed Atif Ali: ST HR SIC AC SC EC.No ratings yet

- Profile of The Board: Syed Bakhtiyar KazmiDocument1 pageProfile of The Board: Syed Bakhtiyar Kazmi.No ratings yet

- DsasDocument1 pageDsas.No ratings yet

- Value Creation Business ModelDocument1 pageValue Creation Business Model.No ratings yet

- DFSDDocument1 pageDFSD.No ratings yet

- Financial CapitalDocument1 pageFinancial Capital.No ratings yet

- Anual - 63Document1 pageAnual - 63.No ratings yet

- Corporate Governance: Executive and Non - Executive DirectorsDocument1 pageCorporate Governance: Executive and Non - Executive Directors.No ratings yet

- Company Directors' SustainabilityDocument1 pageCompany Directors' Sustainability.No ratings yet

- Workings Rs.000Document1 pageWorkings Rs.000.No ratings yet

- C 11: B C C G S: (W4) Non-Controlling InterestDocument1 pageC 11: B C C G S: (W4) Non-Controlling Interest.No ratings yet

- Al - 62Document1 pageAl - 62.No ratings yet

- CAA CH 2 Questions Pt.1Document4 pagesCAA CH 2 Questions Pt.1JohnNo ratings yet

- Jawaban KK Pengantar Akuntansi 2 After MidtermDocument8 pagesJawaban KK Pengantar Akuntansi 2 After Midtermdinda ardiyaniNo ratings yet

- BCG Q2FY22 ResultsDocument12 pagesBCG Q2FY22 ResultsSandyNo ratings yet

- Balance Sheet: Sources of FundsDocument4 pagesBalance Sheet: Sources of Fundssumit_pNo ratings yet

- Chapter 03 - AnswerDocument10 pagesChapter 03 - AnswerGeomari D. BigalbalNo ratings yet

- FABM1 11 Quarter 4 Week 6 Las 3Document4 pagesFABM1 11 Quarter 4 Week 6 Las 3Janna PleteNo ratings yet

- Akuntansi KeuanganDocument8 pagesAkuntansi KeuanganFredi Dwi SusantoNo ratings yet

- Balance Sheet Unilever ProjectionDocument1 pageBalance Sheet Unilever ProjectionGusti Angrumsari Mustikawati 1206285775No ratings yet

- Final Accounts With Case Solution & Dindorf SolutionDocument39 pagesFinal Accounts With Case Solution & Dindorf SolutionAnkit kumarNo ratings yet

- Periodic Answer Key (Editable)Document44 pagesPeriodic Answer Key (Editable)coleenmaem.04No ratings yet

- Components of Financial StatementsDocument3 pagesComponents of Financial StatementsRufus MillmanNo ratings yet

- Lupin FinalDocument37 pagesLupin FinalShruti Mathur100% (1)

- Balance Sheet IOCLDocument1 pageBalance Sheet IOCLNishant YadavNo ratings yet

- Banking Account and Ratio DefinitionsDocument8 pagesBanking Account and Ratio DefinitionsRakesh PaswaanNo ratings yet

- 11 Accountancy English 2020 21Document376 pages11 Accountancy English 2020 21Tanishq Bindal100% (1)

- Laporan Keuangan PT Madusari Murni Indah TBK 31 Mar 2019 Finall PDFDocument78 pagesLaporan Keuangan PT Madusari Murni Indah TBK 31 Mar 2019 Finall PDFChicy AprilianyNo ratings yet

- Cost - Direct Costing, CVP AnalysisDocument7 pagesCost - Direct Costing, CVP AnalysisAriMurdiyantoNo ratings yet

- Fixed Asstes R12 V 1.0 1 1Document91 pagesFixed Asstes R12 V 1.0 1 1ramialNo ratings yet

- English Q3 2018 Financials For Galfar WebsiteDocument24 pagesEnglish Q3 2018 Financials For Galfar WebsiteMOORTHYNo ratings yet

- BA 118.3 Module 2 - Lesson 2 and 3 - Consolidating Financial StatementsDocument23 pagesBA 118.3 Module 2 - Lesson 2 and 3 - Consolidating Financial StatementsRed Ashley De LeonNo ratings yet

- Auditing Concepts and Application SolManDocument20 pagesAuditing Concepts and Application SolManPenryu LeeNo ratings yet

- Financial AnalysisDocument37 pagesFinancial AnalysisAlliah Kaye De ChavezNo ratings yet

- XYZ Corp PresentationDocument4 pagesXYZ Corp PresentationIna Patricia ErjasNo ratings yet

- Reliance Industries Limited AnalysisDocument111 pagesReliance Industries Limited AnalysisAparna KumariNo ratings yet

- Chapter 2 Financial Statements and Accounting Concepts and PrinciplesDocument57 pagesChapter 2 Financial Statements and Accounting Concepts and Principlesbrendon laverNo ratings yet

- Management Accounting Bms-Iii: Manjiri DigheDocument67 pagesManagement Accounting Bms-Iii: Manjiri Dighebhavivyas71No ratings yet

- Adobe Scan 08-Oct-2022Document13 pagesAdobe Scan 08-Oct-2022Abhishek SinghNo ratings yet