Professional Documents

Culture Documents

Evernew LTD (Basic) : Cfap 1: A A F R

Evernew LTD (Basic) : Cfap 1: A A F R

Uploaded by

.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Evernew LTD (Basic) : Cfap 1: A A F R

Evernew LTD (Basic) : Cfap 1: A A F R

Uploaded by

.Copyright:

Available Formats

PRACTICE KIT

CFAP 1: ADVANCED ACCOUNTING AND FINANCIAL REPORTING

CHAPTER 20: CONSOLIDATION CASH FLOWS

Current service cost 10

Past service cost (recognised immediately) 2

Net interest income on net plan assets (8)

4

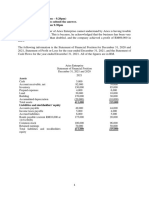

4. Evernew Ltd (Basic)

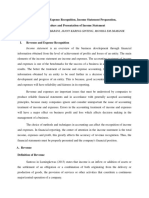

Consolidated statement of cash flows for the year ended 31 December 2016

Rs.’000 Rs.’000

Profit before taxation 138,960

Adjustment for non-cash items:

Depreciation charges 72,720

Profit on disposal of subsidiary (W.1) (5,040)

Interest expenses (payable) 10,080

Operating profit before working

Capital changes 216,720

Changes in working capital

Increase in inventory (W2) (28,800)

Increase in Receivables (W2) (32,400)

Increase in Creditors (W2) 25,200

(36,000)

Cash generated from operations 180,720

Income tax paid (W.3) (37,080)

Net cash flow from operating activities 143,640

Cash flow from investing activities:

Purchases of non-current assets (W4) (111,240)

Sales of Pastit Limited (W5) 41,040

Net cash used in investing activities (70,200)

Cash flow from financing activities:

Redemption of 10% debenture (W6) (18,000)

Dividend paid to non-controlling interest (W7) (3,600)

Interest paid (10,080)

Net cash used in financing activities (31,680)

Net increase in cash & cash equivalent 41,760

Cash & cash equivalent b/f (14,400 – 36,000) (21,600)

Cash & cash equivalent c/f 20,160

Cash & cash equivalent c/f is represented by:

Cash in hand 63,360

Bank overdraft (43,200)

20,160

Workings

(W1) Profit on disposal of subsidiary:

The entire 80% shareholding was sold.

From the desk of Hassnain R. Badami, ACA

TSB Education-Premium Accountancy Courses P a g e 80 of 318

You might also like

- Ventura, Mary Mickaella R - Cashflowp.321 - Group 3Document5 pagesVentura, Mary Mickaella R - Cashflowp.321 - Group 3Mary Ventura100% (1)

- C19a Rio's SpreadsheetDocument8 pagesC19a Rio's SpreadsheetaluiscgNo ratings yet

- 39.1 SolutionDocument5 pages39.1 SolutionJeanelle ColaireNo ratings yet

- Bernardo Corporation Statement of Financial Position As of Year 2019 AssetsDocument3 pagesBernardo Corporation Statement of Financial Position As of Year 2019 AssetsJean Marie DelgadoNo ratings yet

- Acctg. For Business Combinations - 2019 - TocDocument16 pagesAcctg. For Business Combinations - 2019 - Tocbassmastah38% (8)

- Quiz 2Document11 pagesQuiz 2Sophia Anne MonillasNo ratings yet

- AFE5008-B Exam Type Question-2-Model AnswerDocument2 pagesAFE5008-B Exam Type Question-2-Model AnswerDiana TuckerNo ratings yet

- FINANCIAL MANAGEMENT AssignmentDocument2 pagesFINANCIAL MANAGEMENT Assignmentfinn mertensNo ratings yet

- Debit Balances Increase (Decrease) Credit Balances Increase (Decrease)Document7 pagesDebit Balances Increase (Decrease) Credit Balances Increase (Decrease)Shane TabunggaoNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- CFS - 18 Oct 2022Document11 pagesCFS - 18 Oct 2022Kartik SujanNo ratings yet

- Evernew LTD (Basic) : Cfap 1: A A F RDocument1 pageEvernew LTD (Basic) : Cfap 1: A A F R.No ratings yet

- (Nikolay TSD) LCBB4001 Accounting Fundamentals-A1Document24 pages(Nikolay TSD) LCBB4001 Accounting Fundamentals-A1munnaNo ratings yet

- CH 13 Study Guide AnsDocument1 pageCH 13 Study Guide AnsLo Ka ChunNo ratings yet

- CPA 13 - Public Financial ManagementDocument15 pagesCPA 13 - Public Financial ManagementManit MehtaNo ratings yet

- Far210 - July2020 SS Q5Document2 pagesFar210 - July2020 SS Q5imn njwaaaNo ratings yet

- KZN 2020 June P1 Memo 2Document7 pagesKZN 2020 June P1 Memo 2shandren19No ratings yet

- 01 ELMS Activity 3Document2 pages01 ELMS Activity 3Gonzaga FamNo ratings yet

- Prob 8 SdftestvhsDocument1 pageProb 8 SdftestvhsAngelia TNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument14 pages© The Institute of Chartered Accountants of IndiasolomonNo ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-4Document11 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-4Pramod VasudevNo ratings yet

- Assign #03 FNNDocument11 pagesAssign #03 FNNUsman GhaniNo ratings yet

- SCF With DODocument3 pagesSCF With DOMuhammad Asif KhanNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- 1.statement of Cash Flows - MIDTERMDocument27 pages1.statement of Cash Flows - MIDTERMMaeNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- Question 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantDocument3 pagesQuestion 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantamitsinghslideshareNo ratings yet

- FAR 05 Task PerformanceDocument2 pagesFAR 05 Task PerformanceCla JoyceNo ratings yet

- HW C23 U Can Read But NoDocument2 pagesHW C23 U Can Read But NoLăng Quân VươngNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Document7 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Pramod VasudevNo ratings yet

- Statement of CashflowDocument9 pagesStatement of CashflowOwen Lustre50% (2)

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- Additional Cash Flow ProblemsDocument3 pagesAdditional Cash Flow ProblemsChelle HullezaNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- Part 2 Joint Arrangements Class Consultation PDFDocument6 pagesPart 2 Joint Arrangements Class Consultation PDFidk520055No ratings yet

- Tutorial 8Document6 pagesTutorial 8WEI QUAN LEENo ratings yet

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- Cpa 14Document17 pagesCpa 14Manit MehtaNo ratings yet

- Tugas Laporan Arus KasDocument2 pagesTugas Laporan Arus Kasnita fabilla sariNo ratings yet

- 14207Document6 pages14207genenegetachew64No ratings yet

- Josie B. Aguila, Mbmba: Financial Accounting For IeDocument6 pagesJosie B. Aguila, Mbmba: Financial Accounting For IeCATHERINE FRANCE LALUCISNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 2Document20 pages2076 - Varias, Aizel Ann B - Module 2Aizel Ann VariasNo ratings yet

- ACCT 302 Financial Reporting II Tutorial Set 4-1Document8 pagesACCT 302 Financial Reporting II Tutorial Set 4-1Ohenewaa AppiahNo ratings yet

- PYQ June 2018Document4 pagesPYQ June 2018Nur Amira NadiaNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Unit VI CashFlowStatementDocument32 pagesUnit VI CashFlowStatementSmiti RupaNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- CF Statement Solutions 1Document4 pagesCF Statement Solutions 1Joy MukhiNo ratings yet

- TP 2 Acct For BusinessDocument5 pagesTP 2 Acct For BusinessLuna AnggrainiNo ratings yet

- Cash FlowDocument13 pagesCash FlowAbdul Hadi SheikhNo ratings yet

- CHAPTER 15 17 InvestmentsDocument38 pagesCHAPTER 15 17 InvestmentsJinkyNo ratings yet

- Advanced Accounting 2BDocument4 pagesAdvanced Accounting 2BHarusiNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- OLC Chap 6Document11 pagesOLC Chap 6Isha SinghNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- Perfect Practice SolutionDocument41 pagesPerfect Practice Solutionnarutevarsha5No ratings yet

- Activity For Chapter 3 (Financial Statements, Cash Flow and Taxes)Document2 pagesActivity For Chapter 3 (Financial Statements, Cash Flow and Taxes)pamela dequillamorteNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Dear Shareholders,: Future OutlookDocument1 pageDear Shareholders,: Future Outlook.No ratings yet

- Syed Atif Ali: ST HR SIC AC SC ECDocument1 pageSyed Atif Ali: ST HR SIC AC SC EC.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Major Gen Naseer Ali Khan: ST SC HR EC SIC ACDocument1 pageMajor Gen Naseer Ali Khan: ST SC HR EC SIC AC.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Value Creation Business ModelDocument1 pageValue Creation Business Model.No ratings yet

- Profile of The Board: Syed Bakhtiyar KazmiDocument1 pageProfile of The Board: Syed Bakhtiyar Kazmi.No ratings yet

- KFGJHDocument1 pageKFGJH.No ratings yet

- ASFDDocument1 pageASFD.No ratings yet

- Financial CapitalDocument1 pageFinancial Capital.No ratings yet

- 2022 Performance Highlights: People Planet ProsperityDocument1 page2022 Performance Highlights: People Planet Prosperity.No ratings yet

- DsasDocument1 pageDsas.No ratings yet

- Policy For Security Clearance of Foreign Directors Policy On Non-Executive and Independent Directors' RemunerationDocument1 pagePolicy For Security Clearance of Foreign Directors Policy On Non-Executive and Independent Directors' Remuneration.No ratings yet

- Financial Capital: Analysis of Non-Financial Key Performance IndicatorsDocument1 pageFinancial Capital: Analysis of Non-Financial Key Performance Indicators.No ratings yet

- DFSDDocument1 pageDFSD.No ratings yet

- Company Directors' SustainabilityDocument1 pageCompany Directors' Sustainability.No ratings yet

- Corporate Governance: Executive and Non - Executive DirectorsDocument1 pageCorporate Governance: Executive and Non - Executive Directors.No ratings yet

- C 11: B C C G S: (W4) Non-Controlling InterestDocument1 pageC 11: B C C G S: (W4) Non-Controlling Interest.No ratings yet

- Al - 62Document1 pageAl - 62.No ratings yet

- Anual - 63Document1 pageAnual - 63.No ratings yet

- Workings Rs.000Document1 pageWorkings Rs.000.No ratings yet

- The Grape Group (Acquisition) : Cfap 1: A A F RDocument1 pageThe Grape Group (Acquisition) : Cfap 1: A A F R.No ratings yet

- Dividend YieldDocument5 pagesDividend YieldPoojaGuptaNo ratings yet

- A Review of The Accounting CycleDocument46 pagesA Review of The Accounting CycleRNo ratings yet

- Khulna Power Company Limited: Balnace Sheet StatementDocument9 pagesKhulna Power Company Limited: Balnace Sheet StatementTahmid ShovonNo ratings yet

- PAS and PFRS SummaryDocument17 pagesPAS and PFRS SummaryApril AguigamNo ratings yet

- Section e - AnswersDocument7 pagesSection e - AnswersAhmed Raza MirNo ratings yet

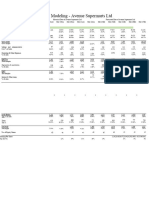

- Financial Model of Dmart - 5Document4 pagesFinancial Model of Dmart - 5Shivam DubeyNo ratings yet

- Final AccountsDocument7 pagesFinal Accountssubhasishmajumdar0% (2)

- Test Bank - Chapter14 Capital BudgetingDocument35 pagesTest Bank - Chapter14 Capital BudgetingAiko E. Lara100% (8)

- Revenue and Expense Recognition, Income Statement Preparation, Procedure and Presentation of Income StatementDocument11 pagesRevenue and Expense Recognition, Income Statement Preparation, Procedure and Presentation of Income StatementAbigail Elsa Samita Sitakar 1902113687No ratings yet

- This Study Resource Was: Partnership FormationDocument8 pagesThis Study Resource Was: Partnership FormationJanine LerumNo ratings yet

- Book Value Per ShareDocument29 pagesBook Value Per ShareKaren MagsayoNo ratings yet

- Chapter 2 Partnership OperationsDocument9 pagesChapter 2 Partnership OperationsmochiNo ratings yet

- 12ENTREP Q2 Module 8 Terminal Report of Business OperationsDocument10 pages12ENTREP Q2 Module 8 Terminal Report of Business OperationsJM Almaden AbadNo ratings yet

- Elc - Acc113 - CH 11 - SM - 2nd SemDocument19 pagesElc - Acc113 - CH 11 - SM - 2nd SemAlmaali BookshopNo ratings yet

- Accounting Paper 2 Summer School Exam PreparationDocument45 pagesAccounting Paper 2 Summer School Exam Preparationthabileshab08No ratings yet

- Yes 3Document1 pageYes 3yes yesnoNo ratings yet

- Doctora (Worksheet Evangelista) CompleteDocument3 pagesDoctora (Worksheet Evangelista) Completekianna doctoraNo ratings yet

- Problems DepletionDocument21 pagesProblems DepletionSharmin ReulaNo ratings yet

- Financial Statements Eastern Condiments PVT LTDDocument7 pagesFinancial Statements Eastern Condiments PVT LTDjjjajjaaaNo ratings yet

- Financial PlanningDocument8 pagesFinancial PlanningMohamed EzzatNo ratings yet

- Preparation of Final AccountsDocument13 pagesPreparation of Final AccountsDr Sarbesh MishraNo ratings yet

- Cash Management Project On HLLDocument74 pagesCash Management Project On HLLnational coursesNo ratings yet

- 咨询: 400-600-8011 邮箱:cfa@gaodun.cn 网站:http://finance.gaodun.cn 高顿财经Document3 pages咨询: 400-600-8011 邮箱:cfa@gaodun.cn 网站:http://finance.gaodun.cn 高顿财经wing hoi ngNo ratings yet

- Handout Bus Com 2302Document6 pagesHandout Bus Com 2302Cylevri TomimboNo ratings yet

- متطلبات القياس و الافصاح المحاسبي عن رأس المال الفكري و أثره على القوائم المالية لمنظمات الأعمالDocument24 pagesمتطلبات القياس و الافصاح المحاسبي عن رأس المال الفكري و أثره على القوائم المالية لمنظمات الأعمالNour MezianeNo ratings yet

- Acctg 102 - Cost AccountingDocument2 pagesAcctg 102 - Cost AccountingLenyBarrogaNo ratings yet

- Cost Accounting Exercise-11Document5 pagesCost Accounting Exercise-11Ki xxiNo ratings yet