Professional Documents

Culture Documents

Lakewood ZDS Labor Rate Computation (September 2023)

Lakewood ZDS Labor Rate Computation (September 2023)

Uploaded by

ErwinBasconOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lakewood ZDS Labor Rate Computation (September 2023)

Lakewood ZDS Labor Rate Computation (September 2023)

Uploaded by

ErwinBasconCopyright:

Available Formats

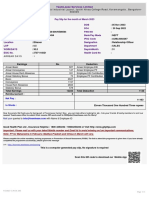

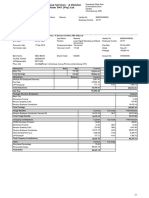

Republic of the Philippines

Province of Zamboanga del Sur

Municipality of Lakewood

OFFICE OF THE MUNICIPAL ENGINEER

LABOR RATE COMPUTATION

For the Municipality of Lakewood, Zamboanga del Sur

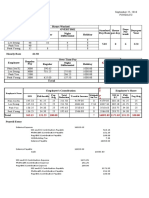

Resource Labor Cost Basic Wage 13th Month Social Benefits

Description Leaves

Code No. Index Daily Monthly Pay SSS/EC PhilHealth

1 Foreman 1.80 78.98 631.80 15,795.00 631.80 1,316.25

2 Leadman 1.65 72.39 579.15 14,478.75 579.15 1,206.56

3 HE Operator 1.50 65.81 526.50 13,162.50 526.50 1,096.88

4 Highly Skilled Labor 1.50 65.81 526.50 13,162.50 526.50 1,096.88

5 Light Equipment Operator 1.40 61.43 491.40 12,285.00 491.40 1,023.75

6 Driver 1.30 57.04 456.30 11,407.50 456.30 950.63

7 Skilled Labor 1.30 57.04 456.30 11,407.50 456.30 950.63

8 Semi-Skilled Labor 1.20 52.65 421.20 10,530.00 421.20 877.50

9 Unskilled Labor 1.00 43.88 351.00 8,775.00 351.00 731.25

Note:

Minimum Wage Rate = ₱ 351.00 Pursuant to Wage Order No. RBIX-21, Eff. June 25, 2022.

Basic Daily Compensation = Minimum Wage x Labor Cost Index of Each Category

Leaves (Service Incentive Leave/ = Basic Daily Wage x 25 days per month x 12/300 days

Maternity/Paternal) =

Bonus, 13th Month Pay = Basic Monthly Wage / 12

SSS Contribution = Graduated Amount Representing Employee's Contribution

PhilHealth = Graduated Amount Representing Employee's Contribution

Pag-Ibig = 2% of Basic Monthly Compensation below P5,000.00 and P100.00 above P5,000.00

Employer's Compensation Contribution = ₱ 10.00

Monthly Rate = Basic Monthly Wage + Leaves + 13th Month Pay + Social Benefits

Daily Rate = Monthly Rate / 25 days per month

Hourly Rate = Daily Rate / 8h per day

PREPARED/SUBMITTED BY: NOTED BY:

ERWIN M. BASCON DOMINGO V. MIRRAR

Municipal Engineer Municipal Mayor

public of the Philippines

nce of Zamboanga del Sur

unicipality of Lakewood

F THE MUNICIPAL ENGINEER

RATE COMPUTATION

pality of Lakewood, Zamboanga del Sur

Social Benefits Rate Per Rate Per

Rate Per Day

Pag-Ibig Month Hour

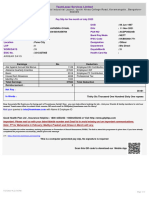

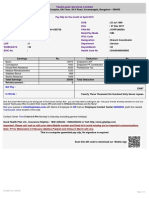

Republic of the Philippines

Province of Zamboanga del Sur

Municipality of Lakewood

OFFICE OF THE MUNICIPAL ENGINEER

LABOR RATE COMPUTATION

For the Municipality of Lakewood, Zamboanga del Sur

Resource Labor Cost Basic Wage 13th Month Social Benefits Rate Per Rate Per Rate Per

Description Leaves

Code No. Index Daily Monthly Pay SSS/EC PhilHealth Pag-Ibig Month Day Hour

1 Foreman 1.80 ₱ 556.00 ₱ 13,900.00 556.00 1,158.33

2 HE Operator 1.50 ₱ 502.00 ₱ 12,550.00 502.00 1,045.83

3 Skilled Labor 1.30 ₱ 405.20 ₱ 10,130.00 405.20 844.17

4 Unskilled Labor 1.00 ₱ 316.00 ₱ 7,900.00 316.00 658.33

Note: LAKEWOOD:

Inhirited from previous

Minimum Wage Rate = -----------------------------------------------------------------------------------------------------> actual administration/s:

min. wage

Basic Daily Compensation = Minimum Wage x Labor Cost Index of Each Category wages

Varying minimum wage

Leaves (Service Incentive Leave/ = Basic Daily Wage x 25 days per month x 12/300 days 69.50 308.89

rates, derived from

Maternity/Paternal) = 62.75 334.67 current/adopted rates

Bonus, 13th Month Pay = Basic Monthly Wage / 12 50.65 311.69

SSS Contribution = Graduated Amount Representing Employee's Contribution 39.50 316.00

PhilHealth = Graduated Amount Representing Employee's Contribution

Pag-Ibig = 2% of Basic Monthly Compensation below P5,000.00 and P100.00 above P5,000.00

Employer's Compensation Contribution = ₱ 10.00

Monthly Rate = Basic Monthly Wage + Leaves + 13th Month Pay + Social Benefits

Daily Rate = Monthly Rate / 25 days per month

Hourly Rate = Daily Rate / 8h per day

PREPARED/SUBMITTED BY:

ERWIN M. BASCON

Municipal Engineer

NOTED BY:

DOMINGO V. MIRRAR

Municipal Mayor

You might also like

- Dpwh-Cost Estimate GuidelinesDocument20 pagesDpwh-Cost Estimate Guidelinesnagtipunan85% (94)

- Astm D979-12 PDFDocument3 pagesAstm D979-12 PDFErwinBascon100% (1)

- Economic Laws Compiler (Updated) @mission - CA - FinalDocument628 pagesEconomic Laws Compiler (Updated) @mission - CA - FinalShaik MastanvaliNo ratings yet

- Medical Device Factory in China Business PlanDocument5 pagesMedical Device Factory in China Business PlanAbhishek YadavNo ratings yet

- Payroll-Calculator FDocument22 pagesPayroll-Calculator FRavi Kumar ManraNo ratings yet

- Payslip June 2019Document1 pagePayslip June 2019shee is silly100% (1)

- Private Villa B+G+1+P+PoolDocument2 pagesPrivate Villa B+G+1+P+PoolErwinBascon100% (1)

- (Research Work) BS4S14-V1-21411 - O21411G20671 - Research Methods - R1704D2623249 - Osagie ObazeeDocument21 pages(Research Work) BS4S14-V1-21411 - O21411G20671 - Research Methods - R1704D2623249 - Osagie ObazeeKing KosherNo ratings yet

- 5-Payroll Records Class (Solved Exercise)Document7 pages5-Payroll Records Class (Solved Exercise)ScribdTranslationsNo ratings yet

- Paystub, SeptemberDocument1 pagePaystub, SeptemberBhavani Prasad Sanapala100% (1)

- 54GDL 2413177 Payslip 07 2022Document1 page54GDL 2413177 Payslip 07 2022samdaniNo ratings yet

- US Custom PayslipDocument2 pagesUS Custom PayslipAlex MartinezNo ratings yet

- BADPU 1666641 Payslip 01 2020Document1 pageBADPU 1666641 Payslip 01 2020Suman DasNo ratings yet

- Paystubs March 2018Document4 pagesPaystubs March 2018Luis MartinezNo ratings yet

- VIKRANT Slip SepDocument2 pagesVIKRANT Slip SepVivek Kumar RajNo ratings yet

- Sura VoluDocument6 pagesSura VoluBhargavi BhumaNo ratings yet

- Sales ProjectionDocument20 pagesSales ProjectionjenissegemcamangonNo ratings yet

- Sheet1: Date of Birth Designatio N Designation Code/ Grade As in Government OrderDocument5 pagesSheet1: Date of Birth Designatio N Designation Code/ Grade As in Government Orderneethu lakshmiNo ratings yet

- Dhaval 0306Document1 pageDhaval 0306zadafiyadeep10No ratings yet

- Manning Burden - Assumption-Jan2020Document14 pagesManning Burden - Assumption-Jan2020shaifullahNo ratings yet

- Scenario 1 Part A: Calculating Gross Pay (2 Marks) : TH THDocument12 pagesScenario 1 Part A: Calculating Gross Pay (2 Marks) : TH THapi-607421876No ratings yet

- Wa0006.Document1 pageWa0006.Digvijay tembhareNo ratings yet

- Payslip 2023 MARDocument1 pagePayslip 2023 MARjai shree krishna 001No ratings yet

- Payslip for 59822 (1)Document1 pagePayslip for 59822 (1)merwynsequeira51No ratings yet

- 04 Nov 2010Document1 page04 Nov 2010phildoradoNo ratings yet

- Payslip TemplateDocument1 pagePayslip TemplateIsswaryahNo ratings yet

- MR Sachin Rewale: No.153/2 M.R.B. Arcade Bagalur Main Road Dwarakanagar IAF Post Yelahanka - Bangalore-53Document1 pageMR Sachin Rewale: No.153/2 M.R.B. Arcade Bagalur Main Road Dwarakanagar IAF Post Yelahanka - Bangalore-53Sachin RNo ratings yet

- PaySlip of 31223 For February 2021Document1 pagePaySlip of 31223 For February 20215k5stfythcNo ratings yet

- PaySlip July 2023Document1 pagePaySlip July 2023rushikeshovhal9697No ratings yet

- Armar Princess SA PDFDocument2 pagesArmar Princess SA PDFRotsen Marc CanibanNo ratings yet

- 04 Jan 2018 PDFDocument1 page04 Jan 2018 PDFpeteNo ratings yet

- Ee Payroll Pay Check DetailDocument1 pageEe Payroll Pay Check DetailLuis MartinezNo ratings yet

- Memo 097.7 - 070219 - Standard Labor Rates Regional District Engineering OfficesDocument126 pagesMemo 097.7 - 070219 - Standard Labor Rates Regional District Engineering OfficesRai RiveraNo ratings yet

- Staff Payroll May 2023Document6 pagesStaff Payroll May 2023OALICAN, JOHN NEIL E. 11-COOKERY1No ratings yet

- PAYROLLDocument14 pagesPAYROLLJay DeeNo ratings yet

- Pay Slip 8Document1 pagePay Slip 8kmpzdwm8ssNo ratings yet

- Summary Report Prep.Document2 pagesSummary Report Prep.Babylyn RomeroNo ratings yet

- 13th Month Pay Summary Report For CY 2015Document16 pages13th Month Pay Summary Report For CY 2015DOLE West Leyte Field OfficeNo ratings yet

- Annual 2022Document9 pagesAnnual 2022ruelan carnajeNo ratings yet

- SKMT Training DesignDocument4 pagesSKMT Training DesignDina Isanan100% (1)

- University of Caloocan City Payroll AccountingDocument4 pagesUniversity of Caloocan City Payroll AccountingJHUSTINE MHAY LEDESMANo ratings yet

- FogartybrochuresdusdDocument2 pagesFogartybrochuresdusdapi-468868635No ratings yet

- Quiz in Payroll (Lileth Anne Viduya)Document1 pageQuiz in Payroll (Lileth Anne Viduya)Lileth ViduyaNo ratings yet

- Swatantra High School Lucknow: Total Salary (Amount in Word) :-Rs. One Lakh Eight Thousand One Hundred Fifty Four OnlyDocument1 pageSwatantra High School Lucknow: Total Salary (Amount in Word) :-Rs. One Lakh Eight Thousand One Hundred Fifty Four Onlyashu singhNo ratings yet

- Revised JL Waiver Format 14.08.2021Document3 pagesRevised JL Waiver Format 14.08.2021Dhineshkumar SNo ratings yet

- Twenty-Three Thousand, Seven Hundred: TeamleaseserviceslimitedDocument2 pagesTwenty-Three Thousand, Seven Hundred: TeamleaseserviceslimitedSudhanshu SharmaNo ratings yet

- April 2019 PaySlipDocument1 pageApril 2019 PaySliparchit chopraNo ratings yet

- Ari GigiDocument1 pageAri GigiBaiq Lela NurkartikaNo ratings yet

- Screenshot 2023-04-03 at 11.14.38 PMDocument1 pageScreenshot 2023-04-03 at 11.14.38 PM2023-25 SOURABH PANDEYNo ratings yet

- Payslip Apr 2018Document1 pagePayslip Apr 2018itsmesriniNo ratings yet

- PayslipDocument1 pagePayslipOnayimisNo ratings yet

- December 2021 - PaySlipDocument1 pageDecember 2021 - PaySlipMahendra kumarNo ratings yet

- Canara Bank Deposit RatesDocument3 pagesCanara Bank Deposit RatesvigyaniNo ratings yet

- PaySlip - June 2023-1Document1 pagePaySlip - June 2023-1Ms khan KirdoliNo ratings yet

- TEACHERS CLEARANCE New-Form New Form Cagas Administration Ms. Minerva P. Alberca, Master Tea 1 Padada District Eff Date of Retirement Dec. 31, 2018Document5 pagesTEACHERS CLEARANCE New-Form New Form Cagas Administration Ms. Minerva P. Alberca, Master Tea 1 Padada District Eff Date of Retirement Dec. 31, 2018janet lou igutNo ratings yet

- PAYSLIP Aug 201926552204559Document1 pagePAYSLIP Aug 201926552204559Akshay ShindeNo ratings yet

- Statement 052321Document3 pagesStatement 052321Prince NakulNo ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsN Quinton SinghNo ratings yet

- RO-Chennai Dec2023 PayslipRegisterDocument1 pageRO-Chennai Dec2023 PayslipRegisterKrishnaNo ratings yet

- 930 PayslipDocument1 page930 Payslipevanatasha34ymail.comNo ratings yet

- Summary of Annual Expenses: Materials and Supplies 15% Professional Services 29%Document4 pagesSummary of Annual Expenses: Materials and Supplies 15% Professional Services 29%Fuad SyedNo ratings yet

- Salaries and Wages (Updated)Document3 pagesSalaries and Wages (Updated)Arvin Abena CahanapNo ratings yet

- Activity Level: Delete Duplicate EditDocument2 pagesActivity Level: Delete Duplicate EditSAI SARANNo ratings yet

- 2 Ozi Feb 2020Document2 pages2 Ozi Feb 2020aaabbbcccrrrhhhsssNo ratings yet

- Payroll Summary For The Month of AugustDocument46 pagesPayroll Summary For The Month of AugustAida MohammedNo ratings yet

- Improvement Upgrading of Coco Fiber Processing FacilityDocument103 pagesImprovement Upgrading of Coco Fiber Processing FacilityErwinBasconNo ratings yet

- High-Efficiency Laundry Centers: FFLE4033Q T / WDocument3 pagesHigh-Efficiency Laundry Centers: FFLE4033Q T / WErwinBasconNo ratings yet

- Installation: All About The of YourDocument20 pagesInstallation: All About The of YourErwinBasconNo ratings yet

- Mohd Khalifa Al Jalahma - CercisDocument2 pagesMohd Khalifa Al Jalahma - CercisErwinBasconNo ratings yet

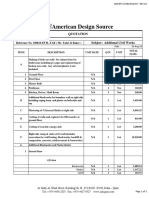

- American Design Source: QuotationDocument2 pagesAmerican Design Source: QuotationErwinBasconNo ratings yet

- Forefront Parex Usa EifsDocument9 pagesForefront Parex Usa EifsErwinBasconNo ratings yet

- Accounting Paper 1Document24 pagesAccounting Paper 1snowFlakes ANo ratings yet

- Agriculture Sorghum MarketDocument10 pagesAgriculture Sorghum MarketRubiotorRabatarNo ratings yet

- MILLICHEM FormatDocument2 pagesMILLICHEM FormatMuhammad JunaidNo ratings yet

- CustomInvoice 7670709745Document1 pageCustomInvoice 7670709745budi irawanNo ratings yet

- EthiopiaSolarEnergyTargetMarketAnalysis YoyoDocument37 pagesEthiopiaSolarEnergyTargetMarketAnalysis YoyoYonatan YohannesNo ratings yet

- HDFC Life Smart Pension Plan BrochureDocument17 pagesHDFC Life Smart Pension Plan BrochureSatyajeet AnandNo ratings yet

- Reshmi BakeryDocument14 pagesReshmi BakeryAbhishek A PNo ratings yet

- Valmin Seminar SeriesDocument12 pagesValmin Seminar SeriesmzulfikarmuslimNo ratings yet

- Marwingnavarrete: Page1of3 134magsaysaystbrgyquirino 8 5 7 9 - 0 7 4 9 - 3 1 Solanonuevavizcaya Nuevavizcayacpo 3 7 0 0Document4 pagesMarwingnavarrete: Page1of3 134magsaysaystbrgyquirino 8 5 7 9 - 0 7 4 9 - 3 1 Solanonuevavizcaya Nuevavizcayacpo 3 7 0 0Marwin NavarreteNo ratings yet

- Allowable Deductions Part 1Document3 pagesAllowable Deductions Part 1John Rich GamasNo ratings yet

- UntitledDocument2 pagesUntitledRuss FajardoNo ratings yet

- Theory of Consumer Behaviour - Demand 2020-2021Document2 pagesTheory of Consumer Behaviour - Demand 2020-2021Shivam MutkuleNo ratings yet

- 20 IE Formulas by Textile and RMG SolutionDocument8 pages20 IE Formulas by Textile and RMG Solutionsumon almamunNo ratings yet

- Supply Network DesignDocument13 pagesSupply Network DesignNehari Senanayake0% (1)

- Control AccountDocument6 pagesControl AccountPranitha RaviNo ratings yet

- Determinants of Dividend Policy in Saudi Listed CompaniesDocument10 pagesDeterminants of Dividend Policy in Saudi Listed CompaniesChickenrock TangerangNo ratings yet

- Previous L&M MockexamsDocument10 pagesPrevious L&M MockexamsGlaiza Fe GomezNo ratings yet

- Temporary Carport: Assembly InstructionsDocument4 pagesTemporary Carport: Assembly Instructionskimba worthNo ratings yet

- Dunzo - Analysis of Business ModelDocument5 pagesDunzo - Analysis of Business ModelAditya KumarNo ratings yet

- IMB685 Vinyas - To Be A Contract Manufacturer or Sell Through Own ChannelDocument6 pagesIMB685 Vinyas - To Be A Contract Manufacturer or Sell Through Own ChannelMaria Auxiliadora Nuñez RomeroNo ratings yet

- Unit 1 Lesson 1Document19 pagesUnit 1 Lesson 1Suan , Troy Justine , R.No ratings yet

- QuotationDocument1 pageQuotationASA PolyPlastNo ratings yet

- PointsDocument4 pagesPointsshadanjamia96No ratings yet

- Vitting - Format.Document12 pagesVitting - Format.rbn_7225No ratings yet

- F9 June 2010 Q-4Document1 pageF9 June 2010 Q-4rbaambaNo ratings yet

- UntitledDocument420 pagesUntitledCristian MarinNo ratings yet

- MVL0004BDocument1 pageMVL0004BnobuhleNo ratings yet