Professional Documents

Culture Documents

Activity 2 - Emily Cruz

Activity 2 - Emily Cruz

Uploaded by

elriatagat850 ratings0% found this document useful (0 votes)

38 views1 pageEmily Cruz started an accounting practice in December and completed various transactions including investing cash, paying expenses, purchasing assets, providing services to clients, and collecting cash from clients. She also withdrew cash for personal use. The accounting transactions need to be recorded, adjustments made for accruals and depreciation, and financial statements prepared.

Original Description:

Original Title

Activity 2_Emily Cruz

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEmily Cruz started an accounting practice in December and completed various transactions including investing cash, paying expenses, purchasing assets, providing services to clients, and collecting cash from clients. She also withdrew cash for personal use. The accounting transactions need to be recorded, adjustments made for accruals and depreciation, and financial statements prepared.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

38 views1 pageActivity 2 - Emily Cruz

Activity 2 - Emily Cruz

Uploaded by

elriatagat85Emily Cruz started an accounting practice in December and completed various transactions including investing cash, paying expenses, purchasing assets, providing services to clients, and collecting cash from clients. She also withdrew cash for personal use. The accounting transactions need to be recorded, adjustments made for accruals and depreciation, and financial statements prepared.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

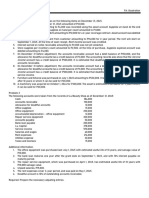

Emily Cruz, completed the transactions below for the month of December, 2022.

The company uses the

following chart of accounts:

Cash Emily Cruz, Capital

Accounts Receivable Emily Cruz, Withdrawals

Supplies Service Revenue

Equipment Rent Expense

Furniture Utilities Expense

Accumulated Depreciation- Equipment Salary Expense

Accumulated Depreciation- Furniture Depreciation Expense- Equipment

Accounts Payable Depreciation Expense- Furniture

Salary Payable Supplies Expense

Unearned Service Revenue

Dec 2 Invested 120,000 to start an accounting practice, Emily Cruz, Accountant.

2 Paid monthly office rent, 5,000.

3 Paid cash for an Apple computer, 30,000. The computer is expected to remain in service

for 5 years.

4 Purchased office furniture on account, 36,000. The furniture should last for five years.

5 Purchased supplies on account, 3,000.

9 Performed tax service for a client and received cash for the full amount of 8,000.

12 Paid utility expenses, 2,000.

18 Performed consulting service for a client on account, 17,000.

21 Received 9,000 in advance tax work to be performed evenly over the next 30 days.

21 Hired a secretary to be paid 15,000 on the 20th day of each month.

26 Paid for the supplies purchased on December 5.

28 Collected 6,000 from the consulting client on December 18.

30 Withdrew 16,000 for personal use.

Additional information:

a. Accrued service revenue, 4,000.

b. Earned a portion of the service revenue collected in advance on December 21.

c. Supplies on hand, 1,000.

d. Depreciation expense- equipment, 500; furniture, 600.

e. Accrued expense for secretary salary.

Required:

Complete the steps in the Accounting Cycle.

You might also like

- ST Mary's University School of Graduate Studies, MBA Group Assignment (20%)Document2 pagesST Mary's University School of Graduate Studies, MBA Group Assignment (20%)feisel100% (2)

- Acc 211 MidtermDocument8 pagesAcc 211 MidtermRinaldi Sinaga100% (2)

- Comprehensive Accounting Cycle Review Problem Copy 2Document12 pagesComprehensive Accounting Cycle Review Problem Copy 2api-252183085No ratings yet

- Accounting For Sole Proprietorship Problem1-5Document8 pagesAccounting For Sole Proprietorship Problem1-5Rocel Domingo100% (1)

- Final Examination 1St Sem 2019-2020Document2 pagesFinal Examination 1St Sem 2019-2020Franco James SanpedroNo ratings yet

- Activity Jenny Light Accountant Problem 1.1Document2 pagesActivity Jenny Light Accountant Problem 1.1Atasha Xd670No ratings yet

- Assignment I Comprehensive Accounting CycleDocument2 pagesAssignment I Comprehensive Accounting Cycleyikebermihreu2008No ratings yet

- FINAL Exam BACC 1 Answer SheetDocument1 pageFINAL Exam BACC 1 Answer Sheetivyortizdalida2004No ratings yet

- AccountingDocument2 pagesAccountingretchiel love calinogNo ratings yet

- Assignment I Comprehensive Accounting Cycle-1Document2 pagesAssignment I Comprehensive Accounting Cycle-1Alemayehu DegifNo ratings yet

- Assignment 1 For Fundamental of Acc-IDocument1 pageAssignment 1 For Fundamental of Acc-INoumanNo ratings yet

- Prelim and MidtermDocument4 pagesPrelim and Midtermdanica gomezNo ratings yet

- Assume No Other Adjusting Entries Are Made During The YearDocument16 pagesAssume No Other Adjusting Entries Are Made During The YearAnnie RapanutNo ratings yet

- COMPREHENSIVE ACCOUNTING CYCLE PROBLEMgroup Assignemnt IDocument3 pagesCOMPREHENSIVE ACCOUNTING CYCLE PROBLEMgroup Assignemnt ITereda100% (1)

- For The Past Several Years Dawn Lytle Has Operated ADocument1 pageFor The Past Several Years Dawn Lytle Has Operated AM Bilal SaleemNo ratings yet

- Lecture-6 Adjusted Trial BalanceDocument22 pagesLecture-6 Adjusted Trial BalanceWajiha NadeemNo ratings yet

- Question Bank (Accounting Problems)Document11 pagesQuestion Bank (Accounting Problems)Abhishek MohantyNo ratings yet

- FMA Assignment OneDocument3 pagesFMA Assignment OneKaleab83% (6)

- Accounting With SolutionsDocument8 pagesAccounting With Solutions26 Athira S Nair CS1No ratings yet

- Accounting For non-CPADocument7 pagesAccounting For non-CPAJim OctavoNo ratings yet

- Owner, Organized Hearts Inc. Two Month Ago To Practice Cardiology. During Dec 2019, Hearts Inc. Completed The Following TransactionsDocument7 pagesOwner, Organized Hearts Inc. Two Month Ago To Practice Cardiology. During Dec 2019, Hearts Inc. Completed The Following TransactionsAshe Bek100% (1)

- ITDocument4 pagesITNamnam PacheNo ratings yet

- Comprehensive Accounting Cycle ProblemDocument2 pagesComprehensive Accounting Cycle ProblemYidnekachew DerbewNo ratings yet

- Performance TasksDocument3 pagesPerformance TasksJebEscuetaAriolaNo ratings yet

- Exercises For Midterm PDFDocument10 pagesExercises For Midterm PDFThanh HằngNo ratings yet

- Tutorial Week 5Document7 pagesTutorial Week 5Mai HoàngNo ratings yet

- ACCT - Ch2 Accounting ProblemsDocument3 pagesACCT - Ch2 Accounting ProblemsshigekaNo ratings yet

- Fdocuments - in Test BbaDocument5 pagesFdocuments - in Test Bbatop 10 infoNo ratings yet

- Accounting Yr 11 Chapter 11-13 QuizDocument9 pagesAccounting Yr 11 Chapter 11-13 QuizThin Zar Tin WinNo ratings yet

- Jawaban SendiriDocument9 pagesJawaban Sendiribulan maretNo ratings yet

- Topic 6 Sample ProblemsDocument1 pageTopic 6 Sample ProblemsMary Jane Pedere VeranoNo ratings yet

- Individual Assignment 1 ACTDocument4 pagesIndividual Assignment 1 ACTKalkidanNo ratings yet

- ADJUSTING Activities With AnswersDocument5 pagesADJUSTING Activities With AnswersRenz RaphNo ratings yet

- Trixie Maye Startes Her Own Consulting FirmDocument1 pageTrixie Maye Startes Her Own Consulting FirmAnggaNo ratings yet

- ACCO 20033 - Quiz 2Document2 pagesACCO 20033 - Quiz 2DRUMMER DROIDNo ratings yet

- T AccountsDocument3 pagesT AccountsEdizon De Andres JaoNo ratings yet

- MT FreshDocument5 pagesMT FreshMechergui RamiNo ratings yet

- For Bookkeeping ProblemDocument2 pagesFor Bookkeeping ProblemDanica TomasNo ratings yet

- Case Study SheetDocument5 pagesCase Study Sheetvictorianguyen961No ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- Peta Accounting 4thDocument5 pagesPeta Accounting 4thmmstalaveraNo ratings yet

- Accounting MathDocument4 pagesAccounting Mathhabib50% (2)

- Arid Agriculture University, Rawalpindi: Final Exam / FALL-2020 (Paper Duration 24 Hours) To Be Filled by TeacherDocument6 pagesArid Agriculture University, Rawalpindi: Final Exam / FALL-2020 (Paper Duration 24 Hours) To Be Filled by TeachernabeelNo ratings yet

- Prepare Adjusting Entries For DeferralsDocument15 pagesPrepare Adjusting Entries For DeferralsKirammin Bararrah100% (1)

- Adjusting Entries Until Adjusted Trial Balance - EditedDocument2 pagesAdjusting Entries Until Adjusted Trial Balance - EditedCINDY LIAN CABILLON100% (2)

- Fundamental of Accounting I Assigment IIDocument6 pagesFundamental of Accounting I Assigment IIadinannejash146No ratings yet

- Assignment 1 Solution Mech 313Document2 pagesAssignment 1 Solution Mech 313Parv SinghNo ratings yet

- Chapter 3 Exercises SolutionDocument5 pagesChapter 3 Exercises SolutionNguyen Huong Huyen (K15 HL)No ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- ACCT 1005 - Worksheet - 2Document12 pagesACCT 1005 - Worksheet - 2Rick SimmsNo ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesChu Thị ThủyNo ratings yet

- For The Past Several Years Derrick Epstein Has Operated ADocument1 pageFor The Past Several Years Derrick Epstein Has Operated AM Bilal SaleemNo ratings yet

- Week5 Stepbytep Je Postng TBDocument22 pagesWeek5 Stepbytep Je Postng TBAngel BambaNo ratings yet

- Chapter 3 ExercisesDocument11 pagesChapter 3 ExercisesPhạm Hồng Trang Alice -No ratings yet

- PDF DocumentDocument4 pagesPDF DocumentYarka Buuqa Neceb MuuseNo ratings yet

- I. Problem Solving. Journal, Ledger & Trial BalanceDocument1 pageI. Problem Solving. Journal, Ledger & Trial BalanceMarcel VelascoNo ratings yet

- Asignment Sec 2Document2 pagesAsignment Sec 2suhayb abdiNo ratings yet

- Abmss 4Document3 pagesAbmss 4Archie EspiloyNo ratings yet

- 2023 10 04 - 03 25 47Document2 pages2023 10 04 - 03 25 47elriatagat85No ratings yet

- 2023 10 04 - 03 19 56Document2 pages2023 10 04 - 03 19 56elriatagat85No ratings yet

- Major Steps in Accounting Cycle1Document15 pagesMajor Steps in Accounting Cycle1elriatagat85No ratings yet

- Answer Key - Emily CruzDocument7 pagesAnswer Key - Emily Cruzelriatagat850% (1)

- Accoutning For Merchandising ActivitiesDocument44 pagesAccoutning For Merchandising Activitieselriatagat85100% (1)

- 3 - Statement of Cash FlowsDocument29 pages3 - Statement of Cash Flowselriatagat85No ratings yet

- Izzy WorksheetDocument30 pagesIzzy Worksheetelriatagat85No ratings yet