Professional Documents

Culture Documents

Dep Scuf 50881902 Ledger

Dep Scuf 50881902 Ledger

Uploaded by

Manu PratapOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dep Scuf 50881902 Ledger

Dep Scuf 50881902 Ledger

Uploaded by

Manu PratapCopyright:

Available Formats

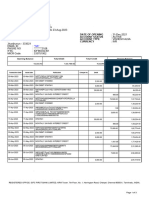

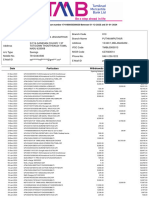

SHRIRAM CITY UNION FINANCE LTD.

MS SHILPA GOUR

RZ 117 /9H, KISHAN GARH, VASANT KUNJ,

VASANT KUNJ, SOUTH WEST DELHI, DELHI -

110070

9560575444

Certificate No : Deposit / 50881902

Servicing Branch : MSCDR - DIRECT MSC

Broker : DIR2222 / DIRECT

Certificate No.** Deposit / 50881902 Int.Rate 7.49% p.a.

Acknowledgement No. C220026657 Date of Deposit 28/03/2022

Customer ID S0795315 Date of Maturity 28/03/2027

PAN AKDPG6495Q Type of Deposit NON-CUMULATIVE

Amount 630000.00 Int. Pay Frequency Monthly

Period 60.0 Months Int. Pay Mode NEFT

Senior Citizen Scheme No Maturity Instruction Refund On Maturity

Beneficiary Name SHILPA GOUR Tax Status Type Resident Individual

Customer ID Tax Non Taxable (21-22) Certificate Tax Status Non Taxable (21-22)

Status

Beneficiary Bank THE RATNAKAR BANK LTD, MANUPRATAPSINGH83@GMAIL.C

Detail GURGAON, ********0788, IFSCCODE: Email ID OM

RATN0000116, ECSMICRCODE: NA

Interest Accruing / Payable Details:

SCUF/DEP/50881902 Printed On: 28/03/2022 16:43:18 Page 1 / 2

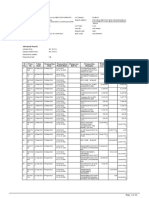

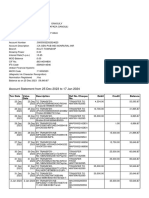

Sl Interest Interest Gross Tax Net Sl Interest Interest Gross Tax Net Interest

No From Date To Date Interest Interest No From To Date Interest

1 # 28/03/2022 30/04/2022 4451.00 *445.00 4006.00 Date

2 01/05/2022 31/05/2022 3933.00 *393.00 3540.00 31 01/10/2024 31/10/2024 3933.00 *393.00 3540.00

3 01/06/2022 30/06/2022 3933.00 *393.00 3540.00 32 01/11/2024 30/11/2024 3933.00 *393.00 3540.00

4 01/07/2022 31/07/2022 3933.00 *393.00 3540.00 33 01/12/2024 31/12/2024 3933.00 *393.00 3540.00

5 01/08/2022 31/08/2022 3933.00 *393.00 3540.00 34 01/01/2025 31/01/2025 3933.00 *393.00 3540.00

6 01/09/2022 30/09/2022 3933.00 *393.00 3540.00 35 01/02/2025 28/02/2025 3933.00 *393.00 3540.00

7 01/10/2022 31/10/2022 3933.00 *393.00 3540.00 36 01/03/2025 31/03/2025 3933.00 *393.00 3540.00

8 01/11/2022 30/11/2022 3933.00 *393.00 3540.00 37 01/04/2025 30/04/2025 3933.00 *393.00 3540.00

9 01/12/2022 31/12/2022 3933.00 *393.00 3540.00 38 01/05/2025 31/05/2025 3933.00 *393.00 3540.00

10 01/01/2023 31/01/2023 3933.00 *393.00 3540.00 39 01/06/2025 30/06/2025 3933.00 *393.00 3540.00

11 01/02/2023 28/02/2023 3933.00 *393.00 3540.00 40 01/07/2025 31/07/2025 3933.00 *393.00 3540.00

12 01/03/2023 31/03/2023 3933.00 *393.00 3540.00 41 01/08/2025 31/08/2025 3933.00 *393.00 3540.00

13 01/04/2023 30/04/2023 3933.00 *393.00 3540.00 42 01/09/2025 30/09/2025 3933.00 *393.00 3540.00

14 01/05/2023 31/05/2023 3933.00 *393.00 3540.00 43 01/10/2025 31/10/2025 3933.00 *393.00 3540.00

15 01/06/2023 30/06/2023 3933.00 *393.00 3540.00 44 01/11/2025 30/11/2025 3933.00 *393.00 3540.00

16 01/07/2023 31/07/2023 3933.00 *393.00 3540.00 45 01/12/2025 31/12/2025 3933.00 *393.00 3540.00

17 01/08/2023 31/08/2023 3933.00 *393.00 3540.00 46 01/01/2026 31/01/2026 3933.00 *393.00 3540.00

18 01/09/2023 30/09/2023 3933.00 *393.00 3540.00 47 01/02/2026 28/02/2026 3933.00 *393.00 3540.00

19 01/10/2023 31/10/2023 3933.00 *393.00 3540.00 48 01/03/2026 31/03/2026 3933.00 *393.00 3540.00

20 01/11/2023 30/11/2023 3933.00 *393.00 3540.00 49 01/04/2026 30/04/2026 3933.00 *393.00 3540.00

21 01/12/2023 31/12/2023 3933.00 *393.00 3540.00 50 01/05/2026 31/05/2026 3933.00 *393.00 3540.00

22 01/01/2024 31/01/2024 3933.00 *393.00 3540.00 51 01/06/2026 30/06/2026 3933.00 *393.00 3540.00

23 01/02/2024 29/02/2024 3933.00 *393.00 3540.00 52 01/07/2026 31/07/2026 3933.00 *393.00 3540.00

24 01/03/2024 31/03/2024 3933.00 *393.00 3540.00 53 01/08/2026 31/08/2026 3933.00 *393.00 3540.00

25 01/04/2024 30/04/2024 3933.00 *393.00 3540.00 54 01/09/2026 30/09/2026 3933.00 *393.00 3540.00

26 01/05/2024 31/05/2024 3933.00 *393.00 3540.00 55 01/10/2026 31/10/2026 3933.00 *393.00 3540.00

27 01/06/2024 30/06/2024 3933.00 *393.00 3540.00 56 01/11/2026 30/11/2026 3933.00 *393.00 3540.00

28 01/07/2024 31/07/2024 3933.00 *393.00 3540.00 57 01/12/2026 31/12/2026 3933.00 *393.00 3540.00

29 01/08/2024 31/08/2024 3933.00 *393.00 3540.00 58 01/01/2027 31/01/2027 3933.00 *393.00 3540.00

30 01/09/2024 30/09/2024 3933.00 *393.00 3540.00 59 01/02/2027 28/02/2027 3933.00 *393.00 3540.00

60 01/03/2027 28/03/2027 3415.00 *342.00 3073.00

Total interest = 235535.00

Interest will be paid on the last day of the month/quarter/half year/year as per interest payment frequency.

* Tax Amount is based on the current tax rate and current threshold value specified by the Govt. Tax rates are subject to

change.

Tax status and tax amount may change subject to:

• Any change in tax rate.The present rate at which tax is deducted is 10%.

• The total interest in the folio crossing the threshold limit for tax exemption and 15G submission.

• Submission of PAN details for the folio. Non submission of PAN would attract a penalty TDS @20%.

• Amount printed on ledger sheet will vary from time to time based on change in customer ID tax status.

• Interest exceeding the exemption limit.15G cannot be submitted by the deductee if the total interest on deposits

exceeds the exemption limit of 250000/-

**The deposit receipt issued is subject to cheque realisation/ receipt of funds in company's account. In case of cheque

dishonour/non receipt of funds, the deposit receipt stands cancelled automatically.

# The first Interest payment will be clubbed with the next interest payment in case of delay in Cheque clearance.

Note: If the interest amount is not sufficient to recover the TDS amount, the same may be recovered from the principal amount

of the fixed deposit.

This being a computer generated statement, does not require signature.

SCUF/DEP/50881902 Printed On: 28/03/2022 16:43:18 Page 2 / 2

You might also like

- Fund ProofDocument30 pagesFund Prooftubamanpower2018No ratings yet

- DOH Administrative Order No 2020 0060Document10 pagesDOH Administrative Order No 2020 0060Liza AysonNo ratings yet

- Client Agreement DraftDocument5 pagesClient Agreement DraftPandu TiruveedhulaNo ratings yet

- StatementMon Dec 18 14:49:51 GMT+05:30 2023Document5 pagesStatementMon Dec 18 14:49:51 GMT+05:30 2023Sangeeta SarawadeNo ratings yet

- XXXXXXX3849 - Account StatementDocument3 pagesXXXXXXX3849 - Account StatementPraveen SainiNo ratings yet

- Rek. UswatunDocument1 pageRek. Uswatundefha jordhyNo ratings yet

- Current & Saving Account StatementDocument4 pagesCurrent & Saving Account Statementsonu saxenaNo ratings yet

- IDFCFIRSTBankstatement 10088009654 113443099Document4 pagesIDFCFIRSTBankstatement 10088009654 113443099shubham purohitNo ratings yet

- StatementDocument32 pagesStatementAnanya ANo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument2 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceManish ChandoreNo ratings yet

- IDFCFIRSTBankstatement 10094802422 121843230Document3 pagesIDFCFIRSTBankstatement 10094802422 121843230vikas jainNo ratings yet

- 2024 05 3 15 37 30 Statement - 1709633250962Document4 pages2024 05 3 15 37 30 Statement - 1709633250962mateenfarooqieNo ratings yet

- IDFCFIRSTBankstatement 10089821044 154101058Document3 pagesIDFCFIRSTBankstatement 10089821044 154101058dabu choudharyNo ratings yet

- Property DetailsDocument1 pageProperty DetailsNew Arunodaya High schoolNo ratings yet

- UntitledDocument2 pagesUntitledRoshan singh 9229No ratings yet

- AccountStatement 5284367650 Nov20 213826Document1 pageAccountStatement 5284367650 Nov20 213826Ashutosh GuptaNo ratings yet

- Account Statement1675960719649Document2 pagesAccount Statement1675960719649Dibyendu D BhattacharyaNo ratings yet

- YLz CQXAGoexlu C1 EDocument2 pagesYLz CQXAGoexlu C1 ESüŕéSh ÃchäńťäNo ratings yet

- WB 3078 TW 0117779Document2 pagesWB 3078 TW 0117779saheb aliNo ratings yet

- Rtyt 676Document3 pagesRtyt 676tecnalite expertsNo ratings yet

- Installment Schedule Document 0009891 2 17 09 2021Document2 pagesInstallment Schedule Document 0009891 2 17 09 2021sorowako46No ratings yet

- IDFCFIRSTBankstatement 10050847623 220713515Document4 pagesIDFCFIRSTBankstatement 10050847623 220713515spu9480No ratings yet

- Bank StatementDocument3 pagesBank Statementmwauemmanuel5No ratings yet

- Statement of AccountDocument2 pagesStatement of AccountReshma ModhiaNo ratings yet

- Mac I Cici 10323 To 300923Document22 pagesMac I Cici 10323 To 300923kundanraiadlakhaNo ratings yet

- AccountStatement 27 JUL 2023 To 27 JAN 2024Document24 pagesAccountStatement 27 JUL 2023 To 27 JAN 2024sarang chawareNo ratings yet

- ADUKULEDocument2 pagesADUKULEedemaronNo ratings yet

- Latest Salary SlipsDocument8 pagesLatest Salary SlipsFarhan HaqueNo ratings yet

- Account Statement From 1 Apr 2023 To 30 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument1 pageAccount Statement From 1 Apr 2023 To 30 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRavi MeenaNo ratings yet

- 2024 13 1 22 05 16 Statement - 1705163716154Document2 pages2024 13 1 22 05 16 Statement - 1705163716154eniyaconstructionsNo ratings yet

- OpTransactionHistory08 07 2023Document6 pagesOpTransactionHistory08 07 2023Pritesh ShahNo ratings yet

- IDFCFIRSTBankstatement 10163242633 023757645Document4 pagesIDFCFIRSTBankstatement 10163242633 023757645amansingh21031992No ratings yet

- T MB Mobile 1706691185024Document2 pagesT MB Mobile 1706691185024sundarNo ratings yet

- AccountStatement 5463060206 May01 165205Document2 pagesAccountStatement 5463060206 May01 165205bhaiya jiNo ratings yet

- AccountStatement 1920334917 Jul11 225251Document2 pagesAccountStatement 1920334917 Jul11 225251ilostsomethinginmindNo ratings yet

- IDFCFIRSTBankstatement 10137207542Document11 pagesIDFCFIRSTBankstatement 10137207542tobu843501No ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument5 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceRahul JhaNo ratings yet

- Statement 349001000000078Document1 pageStatement 349001000000078Arun Nahendran SNo ratings yet

- Statement 349001000000078Document1 pageStatement 349001000000078Arun Nahendran SNo ratings yet

- 2024 23 3 14 15 53 Statement - 1711183553250Document6 pages2024 23 3 14 15 53 Statement - 1711183553250midfielde111No ratings yet

- FTDocumentDocument2 pagesFTDocumentGustavo UribeNo ratings yet

- Z 7 VPif ZXR XKMP GM EDocument4 pagesZ 7 VPif ZXR XKMP GM Epankajsuthar2709No ratings yet

- CASA Statement 3541 006720103008616 01 Nov 2023 26 Dec 20232075699346Document2 pagesCASA Statement 3541 006720103008616 01 Nov 2023 26 Dec 20232075699346MAHENDRA RATHODNo ratings yet

- Wa0020.Document12 pagesWa0020.revathirajakrishnanNo ratings yet

- IDFCFIRSTBankstatement 10076322890Document3 pagesIDFCFIRSTBankstatement 10076322890bhojwanispNo ratings yet

- Enbd Statement 230705 134013Document2 pagesEnbd Statement 230705 134013satnamNo ratings yet

- OpTransactionHistoryUX3 - PDF04 05 2024Document4 pagesOpTransactionHistoryUX3 - PDF04 05 2024optimus sales distributionNo ratings yet

- IDFCFIRSTBankstatement 10083889101 220222910Document5 pagesIDFCFIRSTBankstatement 10083889101 220222910NavinNo ratings yet

- SAMPLEN - For MergeDocument3 pagesSAMPLEN - For MergeSETUPNo ratings yet

- AccountStatement - 23 JUL 2023 - To - 23 JAN 2024Document30 pagesAccountStatement - 23 JUL 2023 - To - 23 JAN 2024humeaapsemohabbathaiNo ratings yet

- ANDRIANSYAHDocument2 pagesANDRIANSYAHEko VanderNo ratings yet

- CombinepdfDocument21 pagesCombinepdfSpotifyuserNo ratings yet

- Armstrong Payment DetailsDocument2 pagesArmstrong Payment DetailsdhanajiraoNo ratings yet

- XXXXXXXXXX0900 21240128150640302187 2 Locked 4 1 1 Protected 1 ProtectedDocument6 pagesXXXXXXXXXX0900 21240128150640302187 2 Locked 4 1 1 Protected 1 Protectedssrajaput345No ratings yet

- Summary of MJ Manila Petty Cash Fund 2024Document4 pagesSummary of MJ Manila Petty Cash Fund 2024MJ AccountantNo ratings yet

- 2024 23 3 20 08 19 Statement - 1711204699187Document3 pages2024 23 3 20 08 19 Statement - 1711204699187midfielde111No ratings yet

- Rita MurmuDocument2 pagesRita MurmuBhavika VasvaniNo ratings yet

- 005 XXXXXXXXX 50941Document2 pages005 XXXXXXXXX 50941swapnil kusalkarNo ratings yet

- Account Statement From 25 Dec 2023 To 17 Jan 2024Document3 pagesAccount Statement From 25 Dec 2023 To 17 Jan 2024saikat gangulyNo ratings yet

- Statement PDFDocument4 pagesStatement PDFCindy AtsiayaNo ratings yet

- Apauline IciciDocument41 pagesApauline Icicihalotog831No ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- API 6D Valves - Types, vs. API 598 - QRC ValvesDocument9 pagesAPI 6D Valves - Types, vs. API 598 - QRC ValvesMAHESH CHANDNo ratings yet

- Quiz 3 Fin II - Parte 2Document3 pagesQuiz 3 Fin II - Parte 2RicardoNo ratings yet

- Chemseal - 109 SDocument3 pagesChemseal - 109 SghazanfarNo ratings yet

- Osiloskop Analog PDFDocument4 pagesOsiloskop Analog PDFSauqia MufidamuyassarNo ratings yet

- Moly-D Technical HandbookDocument16 pagesMoly-D Technical HandbookJessAlcaláNo ratings yet

- Soundproof GeneratorDocument1 pageSoundproof Generatorprasadi.ariyadasaNo ratings yet

- Question 1. Calculate Covariance and Correlation Between Below Two Columns A and B?Document5 pagesQuestion 1. Calculate Covariance and Correlation Between Below Two Columns A and B?navdeepNo ratings yet

- Chapter 1 - Fundamental To Microlectronic FabricationDocument26 pagesChapter 1 - Fundamental To Microlectronic FabricationAmriNo ratings yet

- Changes To WebsiteDocument4 pagesChanges To Websitegacha sad lordNo ratings yet

- Title Facts Issue/S Ruling Doctrine GR No. 79777: PD 27, Eos 228Document26 pagesTitle Facts Issue/S Ruling Doctrine GR No. 79777: PD 27, Eos 228Carla VirtucioNo ratings yet

- Kashmir Moeed PirzadaDocument13 pagesKashmir Moeed Pirzadamanojkp33No ratings yet

- Gemi - N - Ada Kullan - Lan Metalik Malzemeler - Retim Teknikleri, Klaslama Ve Sertifikaland - Rma (#877972) - 1568759Document9 pagesGemi - N - Ada Kullan - Lan Metalik Malzemeler - Retim Teknikleri, Klaslama Ve Sertifikaland - Rma (#877972) - 1568759Mario Enrique RojasNo ratings yet

- HealthCare Management SystemDocument95 pagesHealthCare Management SystemBanagiri AkhilNo ratings yet

- Global Management ChallengeDocument13 pagesGlobal Management ChallengeannadeviNo ratings yet

- The Importance of Engineering To SocietyDocument29 pagesThe Importance of Engineering To Societybarat378680% (10)

- FlightbookingconfirmationDocument3 pagesFlightbookingconfirmationhassan1989No ratings yet

- REVIEWERDocument3 pagesREVIEWERRuvy Jean Codilla-FerrerNo ratings yet

- Projects Synopsis: 1. Surendra Singh (08esmec104) 2. Surender Singh (08esmec102)Document7 pagesProjects Synopsis: 1. Surendra Singh (08esmec104) 2. Surender Singh (08esmec102)Hamza HebNo ratings yet

- Arci Ele Final Boq, Specs and Data's 11.10.2014Document230 pagesArci Ele Final Boq, Specs and Data's 11.10.2014madhav0303No ratings yet

- Siasat V IACDocument14 pagesSiasat V IACCathy BelgiraNo ratings yet

- Regional Rural BanksDocument6 pagesRegional Rural Banksdranita@yahoo.comNo ratings yet

- Assignment# 4Document2 pagesAssignment# 4Danveer SinghNo ratings yet

- Marketing of PencilDocument11 pagesMarketing of PencilMokshika KocharNo ratings yet

- 8.building Analysis ModelDocument64 pages8.building Analysis ModeltierSargeNo ratings yet

- Habit Tracker + CalendarDocument2 pagesHabit Tracker + Calendarmaha.ashraf5145No ratings yet

- LEgal Ethical and Societal Issues OLDocument18 pagesLEgal Ethical and Societal Issues OLJeah Mae CastroNo ratings yet

- PGDM Admissions Brochure Chennai 2021 23Document32 pagesPGDM Admissions Brochure Chennai 2021 23shahulNo ratings yet

- Globalisation and Its Impact On Financial ServicesDocument30 pagesGlobalisation and Its Impact On Financial ServicesLairenlakpam Mangal100% (3)