Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsFinal Accounts

Final Accounts

Uploaded by

Firing GuyThe document provides adjustments and accounting entries for a proprietor's trading and profit and loss statement as well as their balance sheet. Key adjustments include closing stock of ₹62,950, goods withdrawn of ₹7,000, rent outstanding of ₹200, depreciation on machinery of 10%, sales return of ₹1,400, and accrued rent of ₹50,000. The trading account shows a gross profit of ₹71,350 which is carried down to the profit and loss account where the net profit is ₹1,35,400. The balance sheet lists assets of ₹1,77,400 including closing stock, cash, and accr

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Peoria COperation - Cash Flow StatementDocument8 pagesPeoria COperation - Cash Flow StatementcbarajNo ratings yet

- Representative Offices of Foreign Banks in CanadaDocument3 pagesRepresentative Offices of Foreign Banks in CanadaDhon Llabres100% (1)

- Hybrid FinancingDocument41 pagesHybrid Financingibong tiriritNo ratings yet

- Day Trading - Systems & Methods C Le Beau & D W Lucas PDFDocument80 pagesDay Trading - Systems & Methods C Le Beau & D W Lucas PDFElizabeth Hammon100% (2)

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- 18-5-SA-V1-S1 Solved Problem Cfs PDFDocument19 pages18-5-SA-V1-S1 Solved Problem Cfs PDFSubbu ..No ratings yet

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- Quiz 1 SolutionDocument6 pagesQuiz 1 SolutionChristian AbieraNo ratings yet

- Study Hub SECTION CDocument10 pagesStudy Hub SECTION Cgetcultured69No ratings yet

- Financial Accounting - Chapter 4Document14 pagesFinancial Accounting - Chapter 4Phưn ĂnNo ratings yet

- Revision Questions - 2 Statement of Cash Flows - SolutionDocument7 pagesRevision Questions - 2 Statement of Cash Flows - SolutionNadjah JNo ratings yet

- ACCT101 9n10 SCFDocument17 pagesACCT101 9n10 SCFVedanshi BihaniNo ratings yet

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- Week11 Example QuestionDocument2 pagesWeek11 Example Questiongohhs_aaron100% (1)

- Trial BalanceDocument4 pagesTrial BalanceRonnie Lloyd JavierNo ratings yet

- Cochin Marine FoodsDocument6 pagesCochin Marine Foodsmehtatushar2296No ratings yet

- OLC Chap 5Document6 pagesOLC Chap 5Isha SinghNo ratings yet

- Cash Flows of Avon LTD C1Lf75UDUzDocument1 pageCash Flows of Avon LTD C1Lf75UDUzChickooNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- Practice Prepare FSDocument8 pagesPractice Prepare FSĐạt LêNo ratings yet

- 20201015012755Document57 pages20201015012755hasharawanNo ratings yet

- Unit 4Document34 pagesUnit 4b20cs099No ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- December 2010 TC1ADocument10 pagesDecember 2010 TC1AkalowekamoNo ratings yet

- Buenafe, Melanie Joy P. Sbac-3D: Journal EntryDocument7 pagesBuenafe, Melanie Joy P. Sbac-3D: Journal EntryMelanie BuenafeNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- Assets 2018 2019 Forecast: Balance SheetDocument12 pagesAssets 2018 2019 Forecast: Balance SheetJosephAmparoNo ratings yet

- Case - Chemlite (B)Document7 pagesCase - Chemlite (B)Vibhusha SinghNo ratings yet

- Jessbel G. Mahilum - IA3-CD1 - Assignment4Document6 pagesJessbel G. Mahilum - IA3-CD1 - Assignment4Jessbel MahilumNo ratings yet

- Issued & Paid Up Capital: 14 Schedual of Fixed AssetsDocument6 pagesIssued & Paid Up Capital: 14 Schedual of Fixed AssetsShoukat KhaliqNo ratings yet

- Acounting Revision QuestionsDocument10 pagesAcounting Revision QuestionsJoseph KabiruNo ratings yet

- CMPC 131 SolutionsDocument3 pagesCMPC 131 SolutionsNhel AlvaroNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- CHAPTER 4 (Accounts)Document14 pagesCHAPTER 4 (Accounts)lcNo ratings yet

- Cash Flows PAS7Document10 pagesCash Flows PAS7Jenyl Mae NobleNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Question Bank Chapter 12Document4 pagesQuestion Bank Chapter 12Giang Thái HươngNo ratings yet

- Pension Part 1Document14 pagesPension Part 1Mary PatalinghugNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Income & Balance SheetDocument26 pagesIncome & Balance SheetHasnain ShahidNo ratings yet

- Additional InformationDocument7 pagesAdditional InformationvasanthgurusamynsNo ratings yet

- Assignment Final AccountsDocument9 pagesAssignment Final Accountsjasmine chowdhary50% (2)

- Ap - Ap 2.1Document19 pagesAp - Ap 2.1viethoangduongkhanhNo ratings yet

- Qualifying Exam Review Financial Accounting & ReportingDocument21 pagesQualifying Exam Review Financial Accounting & ReportingClene DoconteNo ratings yet

- Cash Flow QuestionDocument3 pagesCash Flow QuestionChia Zen ChenNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- CPA 1 - Financial Accounting Dec 2021Document9 pagesCPA 1 - Financial Accounting Dec 2021Asaba GloriaNo ratings yet

- The Institute of Finance Management: AnswersDocument6 pagesThe Institute of Finance Management: AnswersAli SalehNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Financial Control-1-Master Budgeting CS-Gordon Com. - SolutionDocument3 pagesFinancial Control-1-Master Budgeting CS-Gordon Com. - SolutionQuang NhựtNo ratings yet

- 17769cash Flow Practice QuestionsDocument8 pages17769cash Flow Practice QuestionsirmaNo ratings yet

- WorkDocument4 pagesWorkhassan KyendoNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Annual Report - Titan Company Limited - 2014-15Document156 pagesAnnual Report - Titan Company Limited - 2014-15muthum44499335No ratings yet

- Pixar&Disney Team 5Document7 pagesPixar&Disney Team 5Jakkapong Tachawongsuwon100% (1)

- Ems p1 9 Marking Guidelines Paper Mid Year 2023Document6 pagesEms p1 9 Marking Guidelines Paper Mid Year 2023Lloyd LazarusNo ratings yet

- Computerized Accounting Using Tally - ERP 9 - Activity BookDocument18 pagesComputerized Accounting Using Tally - ERP 9 - Activity Bookshruti0% (1)

- Maharashtra SeamlessDocument19 pagesMaharashtra SeamlessmisfitmedicoNo ratings yet

- Can A Debit Card From A Different Bank Be Used at Another BankDocument5 pagesCan A Debit Card From A Different Bank Be Used at Another BankHabtamu AssefaNo ratings yet

- CH 9Document11 pagesCH 9nisarg_No ratings yet

- Financial Management 2 Test 2Document3 pagesFinancial Management 2 Test 2William MushongaNo ratings yet

- Report On HR PDFDocument61 pagesReport On HR PDFBhasha KoiralaNo ratings yet

- Government Accounting - Chap. 6, 7, 14, 16Document10 pagesGovernment Accounting - Chap. 6, 7, 14, 16Michael Brian TorresNo ratings yet

- Technopreneurship: - Module 5Document33 pagesTechnopreneurship: - Module 5Joseph AgcaoiliNo ratings yet

- KKR - Creating Sustainable ValueDocument54 pagesKKR - Creating Sustainable ValueMariah SharpNo ratings yet

- Borrower ChecklistDocument2 pagesBorrower ChecklistquibroNo ratings yet

- Dynamic Risk Assessment Template - SafetyCultureDocument4 pagesDynamic Risk Assessment Template - SafetyCulturebarrfranciscoNo ratings yet

- Cost Reviewer Part 1Document2 pagesCost Reviewer Part 1Sherlyn NolandNo ratings yet

- Chapter 6 BS 2 2PUCDocument20 pagesChapter 6 BS 2 2PUCVipin Mandyam KadubiNo ratings yet

- 1359 - APS Macro Solution - Money Market and Loanable Funds MarketDocument6 pages1359 - APS Macro Solution - Money Market and Loanable Funds MarketSumedha SunayaNo ratings yet

- Cce 3Document2 pagesCce 3Charish Jane Antonio CarreonNo ratings yet

- Intl LiquidityDocument3 pagesIntl LiquidityAshneet BhasinNo ratings yet

- 016 DBP v. Sima Wei (Bolinao)Document2 pages016 DBP v. Sima Wei (Bolinao)Malcolm CruzNo ratings yet

- A Comparative Study On Investment Policy of Nepalese Commercial BankDocument5 pagesA Comparative Study On Investment Policy of Nepalese Commercial Bankdevi ghimireNo ratings yet

- FUNCTIONAL ANALYSIS of Digital PaymentDocument80 pagesFUNCTIONAL ANALYSIS of Digital Paymentselvaramesh nadar100% (1)

- Definition of Joint Stock CompanyDocument2 pagesDefinition of Joint Stock CompanyGhalib HussainNo ratings yet

- Questionaire-Internal Control-1Document7 pagesQuestionaire-Internal Control-1Mirai KuriyamaNo ratings yet

- NW 18Document361 pagesNW 18vsatyanaNo ratings yet

- Deposit ProductsDocument5 pagesDeposit ProductsLycka MarceloNo ratings yet

- Isurance CarDocument506 pagesIsurance CarLatif SugandiNo ratings yet

Final Accounts

Final Accounts

Uploaded by

Firing Guy0 ratings0% found this document useful (0 votes)

3 views2 pagesThe document provides adjustments and accounting entries for a proprietor's trading and profit and loss statement as well as their balance sheet. Key adjustments include closing stock of ₹62,950, goods withdrawn of ₹7,000, rent outstanding of ₹200, depreciation on machinery of 10%, sales return of ₹1,400, and accrued rent of ₹50,000. The trading account shows a gross profit of ₹71,350 which is carried down to the profit and loss account where the net profit is ₹1,35,400. The balance sheet lists assets of ₹1,77,400 including closing stock, cash, and accr

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides adjustments and accounting entries for a proprietor's trading and profit and loss statement as well as their balance sheet. Key adjustments include closing stock of ₹62,950, goods withdrawn of ₹7,000, rent outstanding of ₹200, depreciation on machinery of 10%, sales return of ₹1,400, and accrued rent of ₹50,000. The trading account shows a gross profit of ₹71,350 which is carried down to the profit and loss account where the net profit is ₹1,35,400. The balance sheet lists assets of ₹1,77,400 including closing stock, cash, and accr

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesFinal Accounts

Final Accounts

Uploaded by

Firing GuyThe document provides adjustments and accounting entries for a proprietor's trading and profit and loss statement as well as their balance sheet. Key adjustments include closing stock of ₹62,950, goods withdrawn of ₹7,000, rent outstanding of ₹200, depreciation on machinery of 10%, sales return of ₹1,400, and accrued rent of ₹50,000. The trading account shows a gross profit of ₹71,350 which is carried down to the profit and loss account where the net profit is ₹1,35,400. The balance sheet lists assets of ₹1,77,400 including closing stock, cash, and accr

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

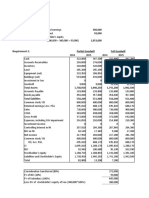

Adjustments-

i. Closing Stock is ₹62,950

ii. 7,000 goods withdrawn by proprietor

iii. Rent outstanding ₹200

iv. Depreciation charged on Machinery @10% p.a.

v. Sales return of ₹1,400

vi. Accrued rent ₹50,000

Dr. Trading A/C Cr.

Particulars Amount (₹) Particulars Amount (₹)

Purchases A/c Sales A/c

Opening balance 64,000 Opening balance 63,400

Less: purchases return 2,000 Less: sales return 1,400 62,000

Less: drawings 7,000 55,000

Closing stock 64,350

Opening balance 62,950

Add: sales return 1,400

Gross profit c/d 71,350

1,26,350 1,26,350

Dr. Profit/Loss A/c Cr.

Depreciation on machinery 400 Gross profit b/d 71,350

Discount allowed A/c 200 Discount received A/c 14,650

Rent A/c Commission received A/c 2,000

Opening balance 1,800

Add: outstanding rent 200 2,000

Net profit c/d(Balance sheet) 1,35,400 Rent A/c 50,000

1,38,000 1,38,000

Balance Sheet

Liability Amount (₹) Assets Amount (₹)

Capital A/c Machinery A/c

Opening balance 50,000 Opening balance 4,000

Less: drawings Less: depreciation 400 3,600

Cash: 6,200

Goods: 7,000

Add: Net profit 1,35,400 1,72,200

Outstanding expenses Debtor

Rent: 200 200 Opening balance 10,400 9,000

Less: sales return 1,400

Creditor 5,000 Closing stock

Opening balance 62,950

Add: sales return 1,400 64,350

Cash A/c 50,450

Accrued rent 50,000

1,77,400 1,77,400

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Peoria COperation - Cash Flow StatementDocument8 pagesPeoria COperation - Cash Flow StatementcbarajNo ratings yet

- Representative Offices of Foreign Banks in CanadaDocument3 pagesRepresentative Offices of Foreign Banks in CanadaDhon Llabres100% (1)

- Hybrid FinancingDocument41 pagesHybrid Financingibong tiriritNo ratings yet

- Day Trading - Systems & Methods C Le Beau & D W Lucas PDFDocument80 pagesDay Trading - Systems & Methods C Le Beau & D W Lucas PDFElizabeth Hammon100% (2)

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- 18-5-SA-V1-S1 Solved Problem Cfs PDFDocument19 pages18-5-SA-V1-S1 Solved Problem Cfs PDFSubbu ..No ratings yet

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- Quiz 1 SolutionDocument6 pagesQuiz 1 SolutionChristian AbieraNo ratings yet

- Study Hub SECTION CDocument10 pagesStudy Hub SECTION Cgetcultured69No ratings yet

- Financial Accounting - Chapter 4Document14 pagesFinancial Accounting - Chapter 4Phưn ĂnNo ratings yet

- Revision Questions - 2 Statement of Cash Flows - SolutionDocument7 pagesRevision Questions - 2 Statement of Cash Flows - SolutionNadjah JNo ratings yet

- ACCT101 9n10 SCFDocument17 pagesACCT101 9n10 SCFVedanshi BihaniNo ratings yet

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- Week11 Example QuestionDocument2 pagesWeek11 Example Questiongohhs_aaron100% (1)

- Trial BalanceDocument4 pagesTrial BalanceRonnie Lloyd JavierNo ratings yet

- Cochin Marine FoodsDocument6 pagesCochin Marine Foodsmehtatushar2296No ratings yet

- OLC Chap 5Document6 pagesOLC Chap 5Isha SinghNo ratings yet

- Cash Flows of Avon LTD C1Lf75UDUzDocument1 pageCash Flows of Avon LTD C1Lf75UDUzChickooNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- Practice Prepare FSDocument8 pagesPractice Prepare FSĐạt LêNo ratings yet

- 20201015012755Document57 pages20201015012755hasharawanNo ratings yet

- Unit 4Document34 pagesUnit 4b20cs099No ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- December 2010 TC1ADocument10 pagesDecember 2010 TC1AkalowekamoNo ratings yet

- Buenafe, Melanie Joy P. Sbac-3D: Journal EntryDocument7 pagesBuenafe, Melanie Joy P. Sbac-3D: Journal EntryMelanie BuenafeNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- Assets 2018 2019 Forecast: Balance SheetDocument12 pagesAssets 2018 2019 Forecast: Balance SheetJosephAmparoNo ratings yet

- Case - Chemlite (B)Document7 pagesCase - Chemlite (B)Vibhusha SinghNo ratings yet

- Jessbel G. Mahilum - IA3-CD1 - Assignment4Document6 pagesJessbel G. Mahilum - IA3-CD1 - Assignment4Jessbel MahilumNo ratings yet

- Issued & Paid Up Capital: 14 Schedual of Fixed AssetsDocument6 pagesIssued & Paid Up Capital: 14 Schedual of Fixed AssetsShoukat KhaliqNo ratings yet

- Acounting Revision QuestionsDocument10 pagesAcounting Revision QuestionsJoseph KabiruNo ratings yet

- CMPC 131 SolutionsDocument3 pagesCMPC 131 SolutionsNhel AlvaroNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- CHAPTER 4 (Accounts)Document14 pagesCHAPTER 4 (Accounts)lcNo ratings yet

- Cash Flows PAS7Document10 pagesCash Flows PAS7Jenyl Mae NobleNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Question Bank Chapter 12Document4 pagesQuestion Bank Chapter 12Giang Thái HươngNo ratings yet

- Pension Part 1Document14 pagesPension Part 1Mary PatalinghugNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Income & Balance SheetDocument26 pagesIncome & Balance SheetHasnain ShahidNo ratings yet

- Additional InformationDocument7 pagesAdditional InformationvasanthgurusamynsNo ratings yet

- Assignment Final AccountsDocument9 pagesAssignment Final Accountsjasmine chowdhary50% (2)

- Ap - Ap 2.1Document19 pagesAp - Ap 2.1viethoangduongkhanhNo ratings yet

- Qualifying Exam Review Financial Accounting & ReportingDocument21 pagesQualifying Exam Review Financial Accounting & ReportingClene DoconteNo ratings yet

- Cash Flow QuestionDocument3 pagesCash Flow QuestionChia Zen ChenNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- CPA 1 - Financial Accounting Dec 2021Document9 pagesCPA 1 - Financial Accounting Dec 2021Asaba GloriaNo ratings yet

- The Institute of Finance Management: AnswersDocument6 pagesThe Institute of Finance Management: AnswersAli SalehNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Financial Control-1-Master Budgeting CS-Gordon Com. - SolutionDocument3 pagesFinancial Control-1-Master Budgeting CS-Gordon Com. - SolutionQuang NhựtNo ratings yet

- 17769cash Flow Practice QuestionsDocument8 pages17769cash Flow Practice QuestionsirmaNo ratings yet

- WorkDocument4 pagesWorkhassan KyendoNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Annual Report - Titan Company Limited - 2014-15Document156 pagesAnnual Report - Titan Company Limited - 2014-15muthum44499335No ratings yet

- Pixar&Disney Team 5Document7 pagesPixar&Disney Team 5Jakkapong Tachawongsuwon100% (1)

- Ems p1 9 Marking Guidelines Paper Mid Year 2023Document6 pagesEms p1 9 Marking Guidelines Paper Mid Year 2023Lloyd LazarusNo ratings yet

- Computerized Accounting Using Tally - ERP 9 - Activity BookDocument18 pagesComputerized Accounting Using Tally - ERP 9 - Activity Bookshruti0% (1)

- Maharashtra SeamlessDocument19 pagesMaharashtra SeamlessmisfitmedicoNo ratings yet

- Can A Debit Card From A Different Bank Be Used at Another BankDocument5 pagesCan A Debit Card From A Different Bank Be Used at Another BankHabtamu AssefaNo ratings yet

- CH 9Document11 pagesCH 9nisarg_No ratings yet

- Financial Management 2 Test 2Document3 pagesFinancial Management 2 Test 2William MushongaNo ratings yet

- Report On HR PDFDocument61 pagesReport On HR PDFBhasha KoiralaNo ratings yet

- Government Accounting - Chap. 6, 7, 14, 16Document10 pagesGovernment Accounting - Chap. 6, 7, 14, 16Michael Brian TorresNo ratings yet

- Technopreneurship: - Module 5Document33 pagesTechnopreneurship: - Module 5Joseph AgcaoiliNo ratings yet

- KKR - Creating Sustainable ValueDocument54 pagesKKR - Creating Sustainable ValueMariah SharpNo ratings yet

- Borrower ChecklistDocument2 pagesBorrower ChecklistquibroNo ratings yet

- Dynamic Risk Assessment Template - SafetyCultureDocument4 pagesDynamic Risk Assessment Template - SafetyCulturebarrfranciscoNo ratings yet

- Cost Reviewer Part 1Document2 pagesCost Reviewer Part 1Sherlyn NolandNo ratings yet

- Chapter 6 BS 2 2PUCDocument20 pagesChapter 6 BS 2 2PUCVipin Mandyam KadubiNo ratings yet

- 1359 - APS Macro Solution - Money Market and Loanable Funds MarketDocument6 pages1359 - APS Macro Solution - Money Market and Loanable Funds MarketSumedha SunayaNo ratings yet

- Cce 3Document2 pagesCce 3Charish Jane Antonio CarreonNo ratings yet

- Intl LiquidityDocument3 pagesIntl LiquidityAshneet BhasinNo ratings yet

- 016 DBP v. Sima Wei (Bolinao)Document2 pages016 DBP v. Sima Wei (Bolinao)Malcolm CruzNo ratings yet

- A Comparative Study On Investment Policy of Nepalese Commercial BankDocument5 pagesA Comparative Study On Investment Policy of Nepalese Commercial Bankdevi ghimireNo ratings yet

- FUNCTIONAL ANALYSIS of Digital PaymentDocument80 pagesFUNCTIONAL ANALYSIS of Digital Paymentselvaramesh nadar100% (1)

- Definition of Joint Stock CompanyDocument2 pagesDefinition of Joint Stock CompanyGhalib HussainNo ratings yet

- Questionaire-Internal Control-1Document7 pagesQuestionaire-Internal Control-1Mirai KuriyamaNo ratings yet

- NW 18Document361 pagesNW 18vsatyanaNo ratings yet

- Deposit ProductsDocument5 pagesDeposit ProductsLycka MarceloNo ratings yet

- Isurance CarDocument506 pagesIsurance CarLatif SugandiNo ratings yet