Professional Documents

Culture Documents

2023 Tax Declaration

2023 Tax Declaration

Uploaded by

manikandan BalasubramaniyanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2023 Tax Declaration

2023 Tax Declaration

Uploaded by

manikandan BalasubramaniyanCopyright:

Available Formats

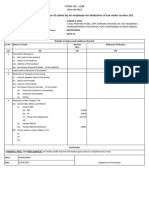

FORM NO.

12BB

(See rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

1. Name and address of the employee : MANIKANDAN BALASUBRAMANIYAN

2. Permanent Account Number of the employee : BLFPM7636B

3. Financial year : 2023-2024

Details of claims and evidence thereof

Sl. No. Nature of claim Amount(Rs.) Evidence / particulars

(1) (2) (3) (4)

House Rent Allowance:

Property No : 1

(i) Rent paid to the landlord Rs.480000

(ii) Name of the landlord ABINAYA

1. (iii) Address of the landlord 2/170-4, ACT NAGAR-1, aniyapuram Rs.480000 Original House Rent Receipts

Near chef bakers factory

(iv) Permanent Account Number of the BLAPA0353C

landlord

Note: Permanent Account Number shall be furnished if the aggregate rent paid

during the previous year exceeds one lakh rupees

Original Travel

2. Leave travel concessions or assistance Rs.0

Receipts/Tickets

Deduction of interest on borrowing:

(i) Interest payable/paid to the lender

Self Occupied Interest of :Rs.-200000

Property 1

Self Occupied Interest of :Rs.

Property 2

Let-OutInterest :Rs.0.0

(ii) Name of the lender

Self Occupied of Property 1 : sbi

Self Occupied of Property 2 :

Let-Out :

(iii) Address of the lender Provisional Certificate from

3. Rs.-200000.0 Bank/Financial

Self Occupied of : sbi bank, karur Institution/Lender

Property 1

Self Occupied of :

Property 2

Let-Out :

(iv) Permanent Account Number of the lender

Self Occupied of Property 1 : AAACS8577K

Self Occupied of Property 2 :

Let-Out :

(a) Financial Institutions(if available)

(b) Employer(if available)

(c) Others

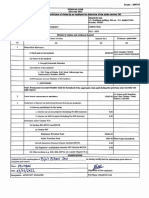

Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

(a) Housing Loan - Principal Re-payment : Rs.465968

(ii) Section 80CCC :

(iii) Section 80CCD :

Rs. 863476.0 Photocopy of the investment

4.

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A. proofs

(a) 80E - Interest on Educational Loan : Rs.130000

(b) 80DPSCI - Medical Insurance for Parents (>=60yrs) - : Rs.52392

With Insurance

(c) 80EEB - Elec Vehicle Loan Interest Benefit Apr19-Mar23 : Rs.150000

(d) SEC80DDB - Medical Treatment for Specific Disease : Rs.40000

(e) 80DSI - Medical Insurance - Self / Spouse / Children (<60 : Rs.25116

yrs) - With Insurance

Verification

I, MANIKANDAN BALASUBRAMANIYAN, son/daughter of . do hereby certify that the information given above is complete and correct.

Place : Bangalore

Date: 20/04/2023

(Signature of the employee)

Designation : Software Engineer Staff Full Name: MANIKANDAN BALASUBRAMANIYAN

Note: The information/details above, as required for deduction of tax u/s 192 of the Income Tax Act, has been entered by the employee through an

authorized login on the portal. The information submitted above is deemed to be e-signed by the employee.

You might also like

- 8.2.ironclad Contract Template - FoundrDocument8 pages8.2.ironclad Contract Template - FoundramNo ratings yet

- Abi Premium 1Document1 pageAbi Premium 1manikandan BalasubramaniyanNo ratings yet

- 2.offer and Acceptance (Business Law) Chapter 2Document19 pages2.offer and Acceptance (Business Law) Chapter 2natsu lol100% (1)

- Alvarez v. IACDocument2 pagesAlvarez v. IACYsabelleNo ratings yet

- Tutorial 2: Auditors Legal Liabilities MCQDocument7 pagesTutorial 2: Auditors Legal Liabilities MCQcynthiama7777No ratings yet

- Serv Let ControllerDocument2 pagesServ Let ControllerAbhishekShuklaNo ratings yet

- Form12bb Aug 22Document2 pagesForm12bb Aug 22Gokul KrishNo ratings yet

- LetterDocument2 pagesLettervgNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- Form 12BBDocument1 pageForm 12BBshaileshNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Epsf Form12bb 10006980Document2 pagesEpsf Form12bb 10006980Vikas SoniNo ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- EPSF FORM12BB 10006980 SignedDocument2 pagesEPSF FORM12BB 10006980 SignedVikas SoniNo ratings yet

- ONGC Road, Patharkandi. Dist. Karimganj.: Form No.12 BB (See Rule 26C)Document1 pageONGC Road, Patharkandi. Dist. Karimganj.: Form No.12 BB (See Rule 26C)Mriganko DharNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Form12-PQB0286280-C19088-Karthi Subramanian-2021-2022Document1 pageForm12-PQB0286280-C19088-Karthi Subramanian-2021-2022Karthi SubramanianNo ratings yet

- 02 Form-12BBDocument2 pages02 Form-12BByalla1No ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- FORM12BBDocument1 pageFORM12BBBotla RajaNo ratings yet

- Form-12BBDocument2 pagesForm-12BBarvindNo ratings yet

- Form 12 BBSampleDocument2 pagesForm 12 BBSampleAbhishekChauhanNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportAnkit RajNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Mayank JainNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Henna KadyanNo ratings yet

- ReportPrintDlg PageDocument2 pagesReportPrintDlg Pagealok yadavNo ratings yet

- Form-No 12BDocument4 pagesForm-No 12BtechbhaskarNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- Form12bb 5663202Document2 pagesForm12bb 5663202uttamraochopade52No ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportMulpuri Vijaya KumarNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAmitNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationKranthi kakumanuNo ratings yet

- 12BBDocument3 pages12BBcont2chanduNo ratings yet

- Form 12BBDocument2 pagesForm 12BBBasavaraj NNo ratings yet

- HH 1Document1 pageHH 1theartcave03No ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- Form-12BB FY 2021-22Document2 pagesForm-12BB FY 2021-22Vinay JadhavNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportKabir's World dinoloverNo ratings yet

- 002WZ3744Document3 pages002WZ3744DrVarsha Priya SinghNo ratings yet

- Epsf Form12bb 903949Document2 pagesEpsf Form12bb 903949MALLA SAI YASWANTH REDDYNo ratings yet

- Form 12BBDocument2 pagesForm 12BBNithin B HNo ratings yet

- IT Declaration-1555459035665Document1 pageIT Declaration-1555459035665Pooja ParabNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAshokdheena 619No ratings yet

- File 20042020153269734Document1 pageFile 20042020153269734Skill IndiaNo ratings yet

- Form 12BBDocument1 pageForm 12BBBiranchi DasNo ratings yet

- Income Tax Declaration Form - FORM-NO. 12BBDocument10 pagesIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Rental AggrementDocument3 pagesRental Aggrementmanikandan BalasubramaniyanNo ratings yet

- Rent Receipt-1Document1 pageRent Receipt-1manikandan BalasubramaniyanNo ratings yet

- App Premium-1Document1 pageApp Premium-1manikandan BalasubramaniyanNo ratings yet

- Cognizant Ifrs17 Whitepaper WebviewDocument35 pagesCognizant Ifrs17 Whitepaper WebviewVinay JainNo ratings yet

- Agreement of Easement of Right of WayDocument3 pagesAgreement of Easement of Right of WayPrince Rayner RoblesNo ratings yet

- Tender For Road Transportation of Bulk Petroleum Products: Technical BidDocument53 pagesTender For Road Transportation of Bulk Petroleum Products: Technical BidvivekshawNo ratings yet

- Luber v. VagrantDocument9 pagesLuber v. VagrantTHROnlineNo ratings yet

- This Study Resource Was: Page 1 of 5Document6 pagesThis Study Resource Was: Page 1 of 5LJBernardoNo ratings yet

- Persons and Family Relations by Monteclar (2015-2016 Transcript)Document121 pagesPersons and Family Relations by Monteclar (2015-2016 Transcript)Ma Alyssa Rea Nuñez100% (8)

- Secured Credit Book OutlineDocument39 pagesSecured Credit Book Outlineryanbco100% (2)

- Sub Zero NDADocument3 pagesSub Zero NDAAndrewNo ratings yet

- NCNDADocument8 pagesNCNDAMd Delowar Hossain Mithu100% (2)

- Kinds of ObligationsDocument5 pagesKinds of ObligationsSheen Hezel MagbanuaNo ratings yet

- Order Cert ClassDocument12 pagesOrder Cert Classjmaglich1No ratings yet

- Non-Comformity of GoodsDocument203 pagesNon-Comformity of GoodsKhaing Nyein ZinNo ratings yet

- A Primer On The Insolvency and Bankruptcy Code PDFDocument42 pagesA Primer On The Insolvency and Bankruptcy Code PDFAnurag SharmaNo ratings yet

- 6 Lao Lim Vs CA 1990Document3 pages6 Lao Lim Vs CA 1990Shaira Mae CuevillasNo ratings yet

- Farm No.214Document7 pagesFarm No.214Anonymous MsWZBrtJNo ratings yet

- Law of Partnership PDFDocument17 pagesLaw of Partnership PDFKomal SandhuNo ratings yet

- Digest Credit Trans CasesDocument7 pagesDigest Credit Trans CasesGracelyn Enriquez Bellingan100% (1)

- Pal VS CaDocument2 pagesPal VS CaLearsi AfableNo ratings yet

- Country Bankers Insurance vs. CA, GR. 85161, Sept 9, 1991Document9 pagesCountry Bankers Insurance vs. CA, GR. 85161, Sept 9, 1991Cza PeñaNo ratings yet

- Title ViiiDocument1 pageTitle ViiiMary Fe CabusoraNo ratings yet

- Contract of EmploymentDocument3 pagesContract of EmploymentRom YapNo ratings yet

- Intellectual Property RightsDocument13 pagesIntellectual Property RightsRohit OberaiNo ratings yet

- Taxes and LicensesDocument24 pagesTaxes and Licensesmin yoongiNo ratings yet

- Title Vii - Commercial Contracts For TransportationDocument4 pagesTitle Vii - Commercial Contracts For TransportationRubz JeanNo ratings yet

- Chancadora Primaria 2013Document111 pagesChancadora Primaria 2013Eyner GonzalesNo ratings yet

- Intercontinental ExchangeDocument12 pagesIntercontinental ExchangeBOBBY212No ratings yet