Professional Documents

Culture Documents

Kapil Assignment de

Kapil Assignment de

Uploaded by

dev737990 ratings0% found this document useful (0 votes)

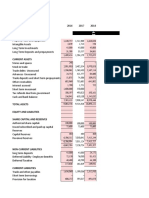

3 views7 pagesThe tables summarize Pakistan's budgeted and revised revenue receipts, non-tax revenue receipts, public account position, current expenditures, and current investments for fiscal years 2022-23 and 2023-24. Revenues are projected to increase substantially from Rs. 7.2 trillion in the revised FY2022-23 budget to Rs. 9.4 trillion in the FY2023-24 budget. Current expenditures are also projected to rise significantly, from Rs. 10.5 trillion to Rs. 13.3 trillion over the same period.

Original Description:

Original Title

Kapil Assignment De

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe tables summarize Pakistan's budgeted and revised revenue receipts, non-tax revenue receipts, public account position, current expenditures, and current investments for fiscal years 2022-23 and 2023-24. Revenues are projected to increase substantially from Rs. 7.2 trillion in the revised FY2022-23 budget to Rs. 9.4 trillion in the FY2023-24 budget. Current expenditures are also projected to rise significantly, from Rs. 10.5 trillion to Rs. 13.3 trillion over the same period.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views7 pagesKapil Assignment de

Kapil Assignment de

Uploaded by

dev73799The tables summarize Pakistan's budgeted and revised revenue receipts, non-tax revenue receipts, public account position, current expenditures, and current investments for fiscal years 2022-23 and 2023-24. Revenues are projected to increase substantially from Rs. 7.2 trillion in the revised FY2022-23 budget to Rs. 9.4 trillion in the FY2023-24 budget. Current expenditures are also projected to rise significantly, from Rs. 10.5 trillion to Rs. 13.3 trillion over the same period.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 7

TABLE - 4

REVENUE RECEIPTS

Table-4 presents the detail of Revenues collected by FBR as given in Table- 1, Part-II.

(Rs in Million)

Classification Budget Revised Budget

2022-23 2022-23 2023-24

FBR TAXES (I + II) 7,470,000 7,200,000 9,415,000

I. Direct Taxes 3,039,000 2,851,000 4,255,000

- Income Tax 3,024,076 2,816,514 4,203,531

- Capital Value Tax 515 620 925

- Workers Welfare Fund 6,947 10,497 15,666

- Workers' Profit Participation 7,462 23,369 34,878

Fund

II. Indirect Taxes 4,431,000 4,349,000 5,160,000

- Customs Duties 953,000 1,084,000 1,211,000

- Sales Tax 3,076,000 2,808,000 3,411,000

- Federal Excise 402,000 457,000 538,000

TABLE - 5

NON TAX REVENUE RECEIPTS

Table-5 shows the Non Tax Revenues details realized by the other government functionaries.

(Rs in Million)

Classification Budget Revised Budget

2022-23 2022-23 2023-24

A. LEVIES & FEES 35,151 22,457 29,433

- Mobile Handset Levy 10,000 8,000 10,000

- Fee collected by ICT Administration 25,098 14,404 19,380

- Airport Fee 53 53 53

B. INCOME FROM PROPERTY & ENTERPRISE 279,647 305,407 398,054

- Pakistan Telecom Authority (Surplus) 9,000 1,628 1,628

- PTA (4G Licences) 50,000 74,000 72,597

- Regulatory Authorities (Surplus/ 695 438 7,203

Penalties)

- Mark up (Provinces) 39,652 39,652 77,201

- Mark up (PSEs & Others) 100,000 108,000 118,000

- Dividends 80,300 81,688 121,425

C. RECEIPTS FROM CIVIL ADMINISTRATION 354,045 403,802 1,168,492

AND OTHER FUNCTIONS

- General Administration 13,621 2,605 7,613

- SBP Profit 300,000 371,186 1,113,000

- Defence 30,222 25,222 41,256

- Law and Order 3,850 1,453 2,016

- Community Services 3,847 2,160 2,629

- Social Services 2,504 1,177 1,977

D. MISCELLANEOUS RECEIPTS 1,266,053 886,491 1,367,185

- Economic Services 25,971 12,939 15,806

- Foreign Grants 25,000 25,000 25,000

- Petroleum Levy 855,000 542,000 869,000

- Natural Gas Development Surcharge 40,000 14,000 40,000

- Citizenship, Naturalization & Passport 35,000 32,003 59,004

Fee

- Royalty on Crude Oil 46,000 54,000 50,000

- Royalty on Natural Gas 70,000 65,000 75,000

- Discount Retained on Local Crude Price 20,000 20,000 20,000

- Windfall Levy against Crude Oil 10,000 30,000 35,000

- Gas Infrastructure Development Cess (GIDC) 30,000 9,000 40,000

- Petroleum Levy on LPG 8,000 3,450 12,000

- Extraordinary Receipts (UNO) 45,020 33,323 58,322

- Extraordinary Receipts (Others) 31 1,095 2,647

- Others 56,031 44,682 65,405

Total (A +B+C+D) 1,934,897 1,618,157 2,963,164

TABLE - 8

PUBLIC ACCOUNT (NET)

Table-8 indicates the position of Public Account of Federation (Net):

(Rs in Million)

Classification Budget Revised Budget

2022-23 2022-23 2023-24

1 National Savings Schemes (113,736) (408,913) (13,131)

2 G.P. Fund (15,129) (29,358) (25,265)

3 Deposits and Reserves (Net ) 3,669 48,893 45,606

TOTAL: (125,196) (389,378) 7,210

TABLE - 10

CURRENT EXPENDITURE*

Table-10 contains Current Expenditure, already given at A in Table-1, in

summarized form. (Rs in Million)

Budget Revised Budget

Classification 2022-23 2022-23 2023-24

(i) Mark-up Payment 3,950,062 5,520,456 7,302,524

- Mark-up on Domestic Debt 3,439,090 4,795,086 6,430,305

- Mark-up on Foreign Debt 510,972 725,370 872,219

(ii) Pension 609,000 609,000 801,000

- Military 395,000 446,378 563,000

- Civil 125,000 162,622 228,000

- Federal Pension Fund 10,000 - 10,000

- Increase in Pension 79,000 - -

(iii) Defence Affairs and Services 1,563,000 1,586,884 1,804,000

- Defence Services 1,563,000 1,586,884 1,804,000

(iv) Grants and Transfers 1,174,478 1,155,200 1,408,638

- Grants to Provinces 82,000 82,000 92,400

- Grants to Others 1,092,478 1,073,200 1,316,238

(v) Subsidies 664,000 1,103,077 1,064,275

(vi) Running of Civil Government 553,000 553,000 713,959

(vii) Provision for Emergency and 195,000 - 250,000

others

CURRENT EXPENDITURE (i to vii) 8,708,540 10,527,616 13,344,395

*RE 2022-23 as of 25th May 2023

TABLE - 11

FUNCTION WISE CURRENT EXPENDITURE

Table-11 shows details of Current expenditure which is divided

into Ten (10) functional items as per Charts of Accounts i.e. how much

(Rs in Million)

Classification Budget Revised Budget

2022-23 2022-23 2023-24

1) General Public Service 6,245,478 7,843,592 10,444,266

2) Defence Affairs and 1,566,698 1,591,183 1,809,467

Services

3) Public Order and 209,161 209,178 237,215

Safety Affairs 182,369 311,372

4) Economic Affairs 210,835

5) Environment Protection 749 660 1,226

6) Housing and 7,850 7,367 22,986

Community Amenities 19,582 22,459 24,210

7) Health Affairs &

Services 15,424 13,528

8) Recreation, Culture 16,782

and Religion 90,556 91,777 97,098

9) Education Affairs and

Services 370,103 436,501

10) Social Protection 480,309

TOTAL: 8,707,970 10,527,616 13,344,395

TABLE - 15

CURRENT INVESTMENTS

Table-15 shows detail of Current Investments through equity.

The Federal Government invests funds in various Companies,

(Rs in Million)

Classification Budget Revised Budget

2022-23 2022-23 2023-24

1 GoP Contribution in 10 10 100

2 Equity of Pak China 4,000 4,000 3,000

Paid up Capital for

3 the proposed Exim 1,000 1,000 9,940

Pakistan Mortgage

4 Refinance Company 6 6 12

Pakistan's Annual

5 Contribution to Inter 350 167 180

Loan to GENCO IV

6 PHL Loan as Equity 35,000 35,000 82,000

TOTAL: 40,366 40,183 95,232

You might also like

- 4133104Document1 page4133104Ann BenjaminNo ratings yet

- Final Balance Sheet As On 31.03.2021... 06.12.2021Document101 pagesFinal Balance Sheet As On 31.03.2021... 06.12.2021Naman JainNo ratings yet

- Impact of GST On Small and Medium EnterprisesDocument5 pagesImpact of GST On Small and Medium Enterprisesarcherselevators0% (2)

- Abs 2023 24Document30 pagesAbs 2023 24sports galoreNo ratings yet

- HR4213DivisionsSummary (5 28)Document2 pagesHR4213DivisionsSummary (5 28)api-27836025No ratings yet

- Annual Budget StatementDocument22 pagesAnnual Budget StatementFunkaarNo ratings yet

- Financial Statement For The FY 2023 2024 BudgetDocument5 pagesFinancial Statement For The FY 2023 2024 BudgetkarthanzewNo ratings yet

- Work Group 5Document9 pagesWork Group 5Khanh Ly TruongNo ratings yet

- Brief ST 00Document2 pagesBrief ST 00farhad.hossain.hstu43No ratings yet

- ALFA HAUL FY2021Document9 pagesALFA HAUL FY2021Nathan Fredrick OlingaNo ratings yet

- Doc-4 Budget at A GlanceDocument3 pagesDoc-4 Budget at A GlanceImran KhanNo ratings yet

- Telangana Budget at GlanceDocument3 pagesTelangana Budget at GlancepoojithaNo ratings yet

- UHBVN Executive Summary FY 2010-11Document46 pagesUHBVN Executive Summary FY 2010-11Neeraj KumarNo ratings yet

- Bangladeesh Budget Fiscal Year 2020Document2 pagesBangladeesh Budget Fiscal Year 2020Mohammad AmjadNo ratings yet

- Statement of Receipts and Expenditures CY 2020 Province, City or Municipality: KABUNTALAN, MAGUINDANAODocument1 pageStatement of Receipts and Expenditures CY 2020 Province, City or Municipality: KABUNTALAN, MAGUINDANAOkQy267BdTKNo ratings yet

- Broome Annual Financial Report 2022 002Document54 pagesBroome Annual Financial Report 2022 002manishswagNo ratings yet

- Proposed Line Item CutsDocument13 pagesProposed Line Item Cutsbmcauliffe8808No ratings yet

- Budget Expenditures and Sources of FinancingDocument5 pagesBudget Expenditures and Sources of FinancingkQy267BdTKNo ratings yet

- ArDocument1 pageArpruthvirajv150No ratings yet

- ' in LakhsDocument53 pages' in LakhsParthNo ratings yet

- 1summary 93SNA QrtlyDocument695 pages1summary 93SNA QrtlypmellaNo ratings yet

- Annual-Report-FML-30-June-2020 Vol 1Document1 pageAnnual-Report-FML-30-June-2020 Vol 1Bluish FlameNo ratings yet

- 210617-1539.1-Sindh Annual Budget Statement For 2021-22 - Volume-IDocument59 pages210617-1539.1-Sindh Annual Budget Statement For 2021-22 - Volume-Ishahid aliNo ratings yet

- Penjelasan Arus KasDocument6 pagesPenjelasan Arus KasREKA CHANNELNo ratings yet

- Budget at A Glance 2022 23Document7 pagesBudget at A Glance 2022 23Longjam RubychandNo ratings yet

- (In Crores) : Abstract of ReceiptsDocument1 page(In Crores) : Abstract of Receiptsalok kumarNo ratings yet

- Balance of Payments: Group 12 Dilip K Ahmed Mudassar P B Atul Pal Jacob GeorgeDocument16 pagesBalance of Payments: Group 12 Dilip K Ahmed Mudassar P B Atul Pal Jacob Georgeatulpal112No ratings yet

- Work Group 3Document6 pagesWork Group 3Khanh Ly TruongNo ratings yet

- 3.1 Federal Government Revenue Receipts: ReceiptDocument57 pages3.1 Federal Government Revenue Receipts: ReceiptBisma SiddiquiNo ratings yet

- NSEBSEUFRdt09112021 1Document40 pagesNSEBSEUFRdt09112021 1Prashant VaishnavNo ratings yet

- SA4567Summary (7 29)Document1 pageSA4567Summary (7 29)api-27836025No ratings yet

- Capping Circular Debt Report Sept 2015Document22 pagesCapping Circular Debt Report Sept 2015umairNo ratings yet

- 2018 Mayors Budget Release Copy 072717Document55 pages2018 Mayors Budget Release Copy 072717kristin frechetteNo ratings yet

- Elec 104 Avila, Charibelle A.Document8 pagesElec 104 Avila, Charibelle A.Charibelle AvilaNo ratings yet

- Budget Document 2022 23 NagalandDocument12 pagesBudget Document 2022 23 NagalandJoseph Lal GuiteNo ratings yet

- Banganga Upvc ProjectionDocument14 pagesBanganga Upvc ProjectionbinuNo ratings yet

- Reliance General Insurance Company Limited: Disclosures - Non-Life Insurance CompaniesDocument48 pagesReliance General Insurance Company Limited: Disclosures - Non-Life Insurance CompaniesNeha A BirajdarNo ratings yet

- Balance Sheet of RINL For The FY 2020-21: Particulars 31-Mar-21 31-Mar-20Document8 pagesBalance Sheet of RINL For The FY 2020-21: Particulars 31-Mar-21 31-Mar-20javoleNo ratings yet

- Blackstone 1 Q 20 Earnings Press ReleaseDocument40 pagesBlackstone 1 Q 20 Earnings Press ReleaseZerohedgeNo ratings yet

- Memo Projections - April 9 Meeting - Based On February 2020 Data PDFDocument16 pagesMemo Projections - April 9 Meeting - Based On February 2020 Data PDFal_crespoNo ratings yet

- 8 Computation of Total Income - AY 2019 20Document1 page8 Computation of Total Income - AY 2019 20karthikkarunanidhi180997No ratings yet

- City of Miami: Inter-Office MemorandumDocument15 pagesCity of Miami: Inter-Office Memorandumal_crespoNo ratings yet

- Annual Budget Statement 2024-25Document67 pagesAnnual Budget Statement 2024-25Khurshid SheraniNo ratings yet

- Bag 2023-24Document1 pageBag 2023-24Farhan NazirNo ratings yet

- HR4213Summary (5 20)Document1 pageHR4213Summary (5 20)api-27836025No ratings yet

- ABS 2021 22 18.06.2021 FinalDocument41 pagesABS 2021 22 18.06.2021 FinalpostthemailhereNo ratings yet

- Budget at A Glance 2024-25Document61 pagesBudget at A Glance 2024-25kinkar KbNo ratings yet

- Audited Amc 09-10Document14 pagesAudited Amc 09-10kamalkantshuklaNo ratings yet

- Report of The Auditor-General On The Accounts of Lagos Island Local Government For The Year Ended 31St December, 2020Document7 pagesReport of The Auditor-General On The Accounts of Lagos Island Local Government For The Year Ended 31St December, 2020Chinwe GloryNo ratings yet

- Disbursement December 2023Document27 pagesDisbursement December 2023gs55004No ratings yet

- Langkah Langkah Zahir OkDocument156 pagesLangkah Langkah Zahir OkekachristinerebecaNo ratings yet

- Budget at A Glance 2022-23Document55 pagesBudget at A Glance 2022-23Subham DebnathNo ratings yet

- Assignment FSADocument15 pagesAssignment FSAJaveria KhanNo ratings yet

- Panda Eco System Berhad - Prospectus Dated 8 November 2023 (Part 3)Document172 pagesPanda Eco System Berhad - Prospectus Dated 8 November 2023 (Part 3)geniuskkNo ratings yet

- BS 31.03.09Document11 pagesBS 31.03.09Leslie FlemingNo ratings yet

- City of Fort St. John - Pandemic Effect On The Operating Budget, March 2020Document4 pagesCity of Fort St. John - Pandemic Effect On The Operating Budget, March 2020AlaskaHighwayNewsNo ratings yet

- CR - MA-2023 - Suggested - AnswersDocument15 pagesCR - MA-2023 - Suggested - AnswersfahadsarkerNo ratings yet

- BSE Limited National Stock Exchange of India LimitedDocument9 pagesBSE Limited National Stock Exchange of India LimitedArvind PurohitNo ratings yet

- SenateExtendersMAT10506Summary (6 23)Document1 pageSenateExtendersMAT10506Summary (6 23)api-27836025No ratings yet

- 4-Fiscal DevelopmentDocument5 pages4-Fiscal DevelopmentAhsan Ali MemonNo ratings yet

- 2023-.-JBT-CAROANDocument13 pages2023-.-JBT-CAROANCathlyn Joy Soriano-DamasoNo ratings yet

- 2019 Ust Pre Week Taxation LawDocument36 pages2019 Ust Pre Week Taxation Lawdublin80% (20)

- 48 - Pay Slip ModelDocument1 page48 - Pay Slip Modeltapanamoria80% (5)

- Ajay Kapoor & CoDocument4 pagesAjay Kapoor & CoPratibha0% (1)

- REVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherDocument15 pagesREVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherGoogleNo ratings yet

- Income Tax Ordinance 1984 - Amended Upto July 2022Document382 pagesIncome Tax Ordinance 1984 - Amended Upto July 2022Sumit GNo ratings yet

- Affirmative: Tax Reform For Acceleration and Inclusion (Train) Law in The PhilippinesDocument10 pagesAffirmative: Tax Reform For Acceleration and Inclusion (Train) Law in The PhilippinesTherese Janine HetutuaNo ratings yet

- Statement 1567186512100 PDFDocument2 pagesStatement 1567186512100 PDFMánøjNo ratings yet

- 2nd Installment Academic Fee Demand Notice 2023-2024Document3 pages2nd Installment Academic Fee Demand Notice 2023-2024mamtakanwar.mech26No ratings yet

- Taxpayers Account Management Program (Tamp)Document8 pagesTaxpayers Account Management Program (Tamp)mark liezerNo ratings yet

- Form ST-105: Indiana Department of RevenueDocument2 pagesForm ST-105: Indiana Department of RevenueRenn DallahNo ratings yet

- CIR vs. BATANGAS TRANSPORTATION COMPANY and LAGUNA-TAYABAS BUS COMPANYDocument2 pagesCIR vs. BATANGAS TRANSPORTATION COMPANY and LAGUNA-TAYABAS BUS COMPANYVel JuneNo ratings yet

- True False False True True True False True True True True True True True True True True False False True True True False True TrueDocument5 pagesTrue False False True True True False True True True True True True True True True True False False True True True False True TrueDong RoselloNo ratings yet

- Rohit Saini Form-16Document2 pagesRohit Saini Form-16Sanjay DuaNo ratings yet

- OV ChipkaartDocument11 pagesOV ChipkaartDylan MoraisNo ratings yet

- Payroll Management SystemDocument14 pagesPayroll Management SystemShifat TalukdarNo ratings yet

- Tep's Tones Tax Notes 1 and 2Document80 pagesTep's Tones Tax Notes 1 and 2Paul Dean MarkNo ratings yet

- Section 80EEB of Income Tax Act - Electric Vehicle Tax Exemption, Benefits and DeductionDocument10 pagesSection 80EEB of Income Tax Act - Electric Vehicle Tax Exemption, Benefits and DeductionnavdeepdecentNo ratings yet

- InvoiceDocument2 pagesInvoiceVijay BasakNo ratings yet

- Notice of Objection - SDL 2017 FinalDocument2 pagesNotice of Objection - SDL 2017 FinalRichard MmbagaNo ratings yet

- An & Brothers MFG Co LTD-13 CTNSDocument5 pagesAn & Brothers MFG Co LTD-13 CTNSSoe Lin NaingNo ratings yet

- Day 3 - BTC Drawbacks and The BTCV Opportunity.Document6 pagesDay 3 - BTC Drawbacks and The BTCV Opportunity.patson sichambaNo ratings yet

- CIR Vs Bisaya TransportDocument2 pagesCIR Vs Bisaya TransportAnonymous fnlSh4KHIgNo ratings yet

- Invoice 5314971552Document2 pagesInvoice 5314971552sumankrbiswas8No ratings yet

- Life Scenarios Banzai CurriculumDocument16 pagesLife Scenarios Banzai Curriculumapi-344976556No ratings yet

- Vil Invoice 7569743999 2023-07-18Document1 pageVil Invoice 7569743999 2023-07-18Vishwa Teja PulluriNo ratings yet

- Statement Amar KoliDocument7 pagesStatement Amar KoliAmar KoliNo ratings yet

- Tax 2 Notes Midterms LamosteDocument6 pagesTax 2 Notes Midterms LamosteRoji Belizar HernandezNo ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptEr KrishnakantNo ratings yet