Professional Documents

Culture Documents

Banking & Ni

Banking & Ni

Uploaded by

bhargava mathsyarajaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking & Ni

Banking & Ni

Uploaded by

bhargava mathsyarajaCopyright:

Available Formats

BANKING – 5th Semester

Harinath Janumpally Practicing Advocate

Advocate in Civil & Criminal Matters

B.Com; MBA; LLB & Medchal & Other Courts

(Studying LLM in OU Campus) Mob: 94406 29864

Mail: Harinath0012@gmail.com

LLB 5 t h SEMESTER

LAW OF BANKING AND NEGOTIABLE INSTRUMENTS

PAPER- III: SYLLABUS

LAW OF BANKING AND NEGOTIABLE INSTRUMENTS

Unit-I: History of the Banking Regulation Act — Salient features — Banking Business and its importance in

modern times – Different kinds of Banking – impact of Information Technology on Banking.

Unit-II: Relationship between Banker and Customer — Debtor and Creditor Relationship - Fiduciary

Relationship — Trustee and Beneficiary — Principal and Agent — Bail and Bailee — Guarantor.

Unit-III: Cheques — Crossed Cheques — Account Payee — Banker's Drafts — Dividend Warrants, etc. —

Negotiable instruments and deemed negotiable instruments — Salient features of The Negotiable

Instruments Act.

Unit-IV: The Paying Banker — Statutory protection to Bankers — Collecting Banker – Statutory protection

– Rights and obligations of paying and collecting bankers.

Unit-V: Banker's lien and set off -- Advances - Pledge - Land - Stocks - Shares - Life Policies - Document of

title to Goods - Bank Guarantees - Letters of Credit – Recovery of Bank loans and position under the

SARFAESI Act, 2002 – Jurisdiction and powers of Debt Recovery Tribunal.

Suggested Readings: 1. Tannan: Banking Law & Practice in India, Orient Law House, New Delhi.

2. Avtar Singh: Negotiable Instruments, Eastern Book Company, Lucknow.

3. P.N.Varshney: Banking Law & Practice, Sultan Chand & Sons, New Delhi.

4. Taxman: Law of Banking, India Law House

5. B.R. Sharma and Dr.R.P. Nainta: Principles of Banking Law and Negotiable Instruments Act, Allahabad

Law Agency.

6. Mukherjee's Banking Law and Practice, Premier Publications Company.

7. Bashyam and Adiga: Negotiable Instruments Act, Bharat Law House.

8. S.R. Myneni, Law of Banking, Asia Law House.

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 1

BANKING – 5th Semester

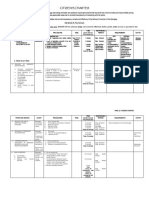

SL NO BANKING AND NEGOTIABLE INSTRUMENTS - 5th SEMESTER - IMPORTANT QUESTIONS REP

1 Explain the concept of banking and discuss the objectives and salient features of the Banking Regulation Act 3

2 Define banking and trace the history of banking system in India and its importance in modern times 5

3 Banker's obligation to maintain the secrecy of customers account is not absolute 2

Case - Can an Income Tax Officer demand the details of an account from the banker? 1

4 Who is banker? General relationship between banker and customer 6

Fiduciary Relationship 2

Banker as Trustee 2

5 Define cheque and discuss Crossed Cheque (2 times) / Account Payee (2 times) 5

6 Bill of Exchange 4

7 Describe Promissory/Pronote Notes and when it expires 3

8 What is NI and describe the main characteristics? Is a cheque a negotiable instrument? Explain 4

9 Discuss the law relating to NI and deemed NI 2

Travellers Cheques 3

Dividend Warrants 2

Circular Notes 1

Demand Draft 1

Postal Order 1

Banker's Draft 1

10 Define paying banker and discuss the statutory protection available to the paying banker 4

11 Collecting Banker 3

12 Banker's Lien 3

13 Banker's setoff 3

14 Bank Guarantees 3

15 What is letter of credit? What are the different kinds of letters of credit? 3

16 Reserve Bank of India / Bankers' Bank 2

IMPORTANT CASES

17 Is this a Negotiable Instrument?

Case - An instrument "I promise to pay B, Rs. 500/- when he delivers the goods" is it a pronote? 1

Case - 'I promise to pay B or order Rs. 500' what is this instrument? 1

Case - Bill of Exchange 1

Case - A bill without any name 1

Case - Discrepancy between figures and words on NI 1

18 Holder in due course

Case - 'A' the holder of a bill, endorses it to 'B', 'B' negotiates the bill to 'C' 1

Case - Mr. Srinu draws and handovers a cheque of Rs. 2000 as gift to Mr. Balu is Balu a holder in due course? 1

Case - 'A' on point of pistol forces 'B' to issue a bearer cheque, after collecting it hands over to 'C', is 'C' holder in due course? 1

19 Endorsing fewer amount

Case - Endorsing fewer amounts on the Promissory note, what are the consequences? 1

Case - Holder of a Promissory note for Rs. 1000 writes on it "pay B Rs. 500" and endorses the note 1

20 Forged/Stolen Negotiable Instrument

Case - A bill which was obtained by fraud was endorsed to third party 1

Case - A bill was stolen, Y forged it and endorsed to 'Z' 1

Case - Stolen cheque 1

Case - Forged cheques encashing 1

Case - Obtaining acceptance to a Bill of Exchange by fraud 1

Case - A cheque was stolen and encashed by forging the cheque. 1

21 Stolen cheque was encashed, is the paying banker responsible? 1

22 Dishonour of a cheque by the banker without any valid reasons:

When a banker refuses payment of a cheque, what is the legal position? 1

A cheque is dishonoured due to bank's fault 1

IMPORTANT SECTIONS:

NEGOTIABLE INSTRUMENTS ACT

1. Sec 4 Promissory Note,

2. Sec 5 Bill of Exchange,

3. Sec 6 Cheque,

4. Sec 9 Holder in Due Course,

5. Sec 10: Payment in Due Course.

6. Sec 13(a) Definition of NI,

7. Sec 15 Endorsement,

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 2

BANKING – 5th Semester

8. Sec 31 Liability for dishonouring a cheque.

9. Sec 56: Partial Endorsement.

10. Sec 58 Stolen/Lost/Fraud/Forgery Instruments,

11. Sec 123 General Crossing,

12. Sec 124 Special Crossing.

13. Sec 131 of Income Tax Act for obtaining bank accounts.

Answers to important questions

1. Explain the concept of banking and discuss the objectives and salient features of the Banking

Regulation Act

Answer: Definition of a Bank:

A bank is a financial institution that performs the deposit and lending function. A bank allows a person

with excess money (Saver) to deposit his money in the bank and earn an interest rate. Similarly, the bank

lends to a person who needs money (investor/borrower) at an interest rate. Thus, the banks act as an

intermediary between the saver and the borrower.

The bank usually takes a deposit from the public at a much lower rate called deposit rate and lends the

money to the borrower at a higher interest rate called lending rate.

The difference between the deposit and lending rate is called ‘net interest spread’, and the interest

spread constitutes the banks' income.

Meaning of Banking

Banking is a business activity that involves accepting money from the public in the form of deposits and

lending it as loans for earning profit. Banking institutions mainly serves the purpose of safeguarding

people’s money and fulfilling their fund requirements by providing them with loan facilities. These

institutions pay interest on deposits to savers and charge higher rates of interest from borrowers.

The difference between these two rates of interest is the bank profit. Apart from accepting and lending

money, banks also provide many other services such as lockers, ATM services, online fund transfers,

cheque payments, foreign currency exchange, issuing debit/credit cards, providing bank guarantees,

insurance services, letters of credits etc. Banks accept deposits from the public under different categories

of accounts like saving account, current account, fixed deposit and recurring deposit account.

In the same way, these institutions lend money to the public as overdraft facilities, personal loans,

business loans, vehicle loans, home loans and mortgage loans etc. Banking institutions play a key role in

the economic development of a country as it ensures liquidity of funds by the movement of funds among

people.

Objectives of Banking

1. Safeguard Deposits

Bank serves the main purpose of accepting deposits from public and safeguarding it. It guarantees the

safety of funds to customers for depositing their money in their accounts.

2. Provide Loans

It advances loans to customers at both a short-term and long-term basis as per their needs. Bank provides

loans out of the deposits that they receive and charges interest on the amount from customers.

3. Encourage Savings

Banking institutions have an efficient role in encouraging saving habits among people. It motivates people

for saving and depositing their earnings in bank accounts by paying them a fixed rate of interest on their

deposited amount regularly.

4. Capital Formation

Banking accelerates the capital formation rate within the country. It extends credit to various sectors of

the economy from time to time which helps in uninterrupted continuation of all growth and development

activities. Different industries and businesses approach banks for fulfilling their financial needs.

5. Currency Issue

Banking organizations does the purpose of issuing currency which is served as a legal tender in country.

Central bank of our country (i.e. RBI) prints and issues all currency notes for the public.

6. Enhances Living Standards

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 3

BANKING – 5th Semester

It assists the people in improving their quality of life by providing them credit. Bank enables customers in

purchasing high quality and costly goods on credit basis or hire purchase system.

7. Generates Employment

Banking organizations also helps in generating large employment opportunities within the country. It

helps companies in extending their activities by providing them credit as per their needs. This will result in

increase in human resource requirement for various positions. In addition to this, a large section of

economy is working within the banking sector and provides self-employment loans to the needy people

those who deserve it.

Importance of Banking

1. Bring Economic Stability

Banking sector plays a crucial role in attaining the economic stability. They are the one who assists in

controlling the depression and inflation phases. During depression, banks adopt cheap money policy and

increase the flow of money in economy, at the time of inflation; it follows strict money policy to decrease

the flow of money. It increases the interest rate on borrowings to control the people’s spending during

inflation.

2. Creates Money

Banks generates money in an economy by advancing loans to all those who are in need of funds. It is one

which grants credit out of the money collected by it from public. These institutions aim at maintaining

sufficient flow of funds.

3. Facilitates Trade

It helps in doing both internal and external trade. Banks enable merchants in conducting trade by provide

them proper payment facility, issuing letter of credit, discounting bill of exchange and providing them

other guarantee documents.

4. Money Transfer

It enables people to transfer their funds rapidly even to far distant places. It has facilitated the payment

system by providing various instruments such as draft, cheque and bill of exchange. Payment done via

these instruments is more safe and convenient instead of paying in cash. Nowadays banks are providing

electronic transfers through RTGS, IMPS AND NEFT for easy, speedy and efficient transfer.

5. Transfer Savings Into Investment

Banking serves as the medium of transferring money from those who have excess of it to those who are in

need of it. It collects people savings and provides loan out of these savings to entrepreneurs and

companies for their expansion programs. Bank converts the people’s ideal lying funds into productive

means.

6. Ensures Liquidity

Maintaining a proper liquidity in the economy is another important role played by banks. Banks regulate

the money flows by adopting an efficient monetary policy. During inflation it decreases the money supply

whereas at the time of deflation it increases the flow of money.

Features of banking regulation act 1949:

The main features of the banking regulation act are as follows:

1. The Banking Regulation Act was passed to consolidate and amend the law relating to banking

companies.

2. Banking Regulation Act controls the Banking institutions since their birth to death.

3. The Banking Regulation Act came into effect from 16 th March, 1949 and applies to the whole of

India.

4. The Act was further amended by Banking Laws (Amendment) Act, 1983, the Banking Public

Financial Institutions and Negotiable Instrument Laws (Amendment) Act, 1988, the banking

Regulation (Amendment) Act, 1994 and the Banking Regulation (Amendment) Bill, 2020.

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 4

BANKING – 5th Semester

5. Prohibition of trading (Section 8): According to Section 8 of the Banking Regulation Act, a bank

cannot directly or indirectly deal with buying or selling or bartering of goods. However it may

barter the transactions relating to bills of exchange received for collection or negotiation.

1. Non-banking asset (Section 9): A bank cannot hold any immovable property, howsoever acquired,

except for its own use, for any period exceeding seven years from the date of acquisition thereof.

The company is permitted, within a period of seven years, to deal or trade in any such property for

facilitating its disposal.

2. Management (Section 10): This rule states that every bank shall have one of its directors as

Chairman on its Board of Directors. It also states that not less than 51% of the total number of

members of the Board of Directors of a bank shall consist of persons who have special knowledge

or practical experience in accountancy, agriculture, banking, economics, finance, law and co-

operatives.

3. Minimum capital (Section 11): Section 11 (2) of the Banking Regulation Act, 1949, states that no

bank shall commence or carry on business in India, unless it has minimum paid-up capital and cash

reserve prescribed by the RBI.

4. Payment of commission (Section 13): According to Section 13, a bank is not permitted to pay

directly or indirectly by way of commission, brokerage, discount or remuneration on issues of its

shares in excess of 2.5% of the paid-up value of such shares.

5. Payment of dividend (Section 15): According to Section 15, no bank shall pay any dividend on its

shares until all its capital expenses(including preliminary expenses, organisation expenses, share

selling commission, brokerage, amount of losses incurred and other items of expenditure not

represented by tangible assets) have been completely written-off.

2. Define banking and trace the history of banking system in India and its importance in modern times.

Answer:

What is banking?

Banking is directly or indirectly connected with the trade of a country and the life of each and every

individual. It is an industry that manages credit, cash, and other financial transactions. In banking, the

commercial bank is the most influential institution for any country’s economy or for providing any credit

to its customers. In India, banking company is responsible for transacting all the business transactions

including withdrawal of cheques, payments, and investments, etc. In other words, the bank is involved in

the deposit and withdrawal of money, repayable on demand, savings and earning a decent amount of

profits by lending money.

Bank also helps to mobilize the savings of an individual, making funds accessible to business and help

them to start a new venture.

However, unlike the commercial bank, the private sector banks are owned, operated and regulated by

private investors and have the right to operate according to the market forces.

History of banking system in India:

Banking is considered to be the “Backbone of a Nation’s Economy”. The Indian Banking, today, is divided

into commercial banks which are Private, Public scheduled and non-scheduled banks, Regional and Rural,

and Cooperative Banks. Banking Companies Act of 1949 defined banking as accepting for the purpose of

lending or investment of depositing money from the public, repayable on demand or otherwise and

withdrawable by cheque draft or otherwise. Let us learn more about the History of Banking System in

India.

Phases of Indian Banking System

The advancement in the Indian banking system is classified into 3 distinct phases:

1. The Pre-Independence Phase i.e. before 1947

2. Second Phase from 1947 to 1991

3. Third Phase 1991 and beyond

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 5

BANKING – 5th Semester

1. The Pre-Independence Phase i.e. before 1947

This phase is characterized by the presence of a large number of banks (more than 600).

Banking system commenced in India with the foundation of Bank of Hindustan in Calcutta (now

Kolkata) in 1770 which ceased to operate in 1832.

After that many banks came but were not successful like:

(1) General Bank of India (1786-1791)

(2) Oudh Commercial Bank (1881-1958) – the first commercial bank of India.

Whereas some are successful and continue to lead even now like:

(1) Allahabad Bank (est. 1865)

(2) Punjab National Bank (est. 1894, with HQ in Lahore (that time))

(3) Bank of India (est. 1906)

(4) Bank of Baroda (est. 1908)

(5) Central Bank of India (est. 1911)

While some others like Bank of Bengal (est. 1806), Bank of Bombay (est. 1840), Bank of Madras

(est. 1843) merged into a single entity in 1921 which came to be known as Imperial Bank of India.

Imperial Bank of India was later renamed in 1955 as the State Bank of India.

In April 1935, Reserve Bank of India was formed based on the recommendation of Hilton Young

Commission (set up in 1926).

In this time period, most of the banks were small in size and suffered from a high rate of failures.

As a result, public confidence is low in these banks and deposit mobilization was also very slow.

People continued to rely on the unorganized sector (moneylenders and indigenous bankers).

2. The second phase from 1947 to 1991

Broadly the main characteristic feature of this phase is the Nationalization of the banks.

With the view of economic planning, nationalization emerged as an effective measure.

Need for nationalization in India:

(a) The banks mostly catered to the needs of large industries, big business houses.

(b) Sectors such as agriculture, small-scale industries and exports were lagging behind.

(c) The poor masses continued to be exploited by the moneylenders.

Following this, in the year 1949, 1st January the Reserve Bank of India was nationalized.

Fourteen commercial banks were nationalized on 19th July 1969. Smt. Indira Gandhi was the

Prime Minister of India, during in 1969. The following banks are nationalized:

1. Central Bank of India

2. Bank of India

3. Punjab National Bank

4. Bank of Baroda

5. United Commercial Bank

6. Canara Bank

7. Dena Bank

8. United Bank

9. Syndicate Bank

10. Allahabad Bank

11. Indian Bank

12. Union Bank of India

13. Bank of Maharashtra

14. Indian Overseas Bank

Six more commercial banks were nationalized in April 1980. These are mentioned below:

1. Andhra Bank

2. Corporation Bank

3. New Bank of India

4. Oriental Bank of Commerce

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 6

BANKING – 5th Semester

5. Punjab & Sindh Bank

6. Vijaya Bank.

Meanwhile, on the recommendation of the Narasimham Committee, Regional Rural Banks (RRBs)

were formed on Oct 2, 1975. The objective behind the formation of RRBs was to serve the large

unserved population of rural areas and promoting financial inclusion.

With a view to meet the specific requirement from the different sector (i.e. agriculture, housing,

foreign trade, industry) some apex level banking institutions were also set up like: (a) NABARD

(est. 1982), (b) EXIM (est. 1982), (c) NHB (est. 1988) and (d) SIDBI (est. 1990).

Impact of Nationalization:

Improved efficiency in the Banking system – since the public‘s confidence got boosted.

Sectors such as Agriculture, small and medium industries started getting funds which led to

economic growth.

Increased penetration of Bank branches in rural areas.

3. Third phase 1991 and beyond

This period saw remarkable growth in the process of development of banks with the liberalization

of economic policies.

Even after nationalization and the subsequent regulations that followed, a large portion of masses

is untouched by the banking services.

Considering this, in 1991, the Narasimham committee gave its recommendation i.e. to allow the

entry of private sector players into the banking system.

Following this, RBI gave license to 10 private entities, out of which few survived the market

demands, which are- ICICI, HDFC, Axis Bank, IndusInd Bank, DCB.

In 1998, the Narsimham committee again recommended the entry of more private players. As a

result, RBI gave a license to the following newbies:

(a) Kotak Mahindra Bank (2001)

(b)Yes Bank (2004)

In 2013-14, the third round of bank licensing took place and in 2015, IDFC bank and Bandhan Bank

emerged.

In order to further financial inclusion, RBI also proposed to set up 2 new kinds of banks i.e.

Payment Banks and Small Banks.

In 2015, RBI gave in-principle licence to 11 entities to launch Payments Bank and granted 'in-

principle' approval to the 10 applicants to set up Small Finance Banks.

List the Importance of Banks in Detail

Importance of Bank: Banking plays an important role in the financial life of a business, and the importance

of banks can be seen from the fact that they are considered to be the life-blood of the modern economy.

Although no wealth is created by banks, their essential activities facilitate the process of production,

exchange and distribution of wealth.

1. Collections of Savings and Advancing Loans

Acceptance of deposit and advancing the loans is the basic function of commercial banks. On this function,

all other functions depend accordingly. Bank operates different types of accounts for its customers.

2. Money Transfer

Banks have facilitated the making of payments from one place or persons to another by means of

cheques, bill of exchange and drafts, instead of cash. Payment through cheques, the draft is more safe and

convenient, especially in case of huge payments, this facility is a great help for traders and businessmen. It

really enhances the importance of banks for the business community.

3. Encourages Savings

Banks perform an invaluable service by encouraging savings among the people. They induce them to save

for profitable investment for themselves and for the national interest. These savings help in capital

formation.

4. Transfer Savings into Investment

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 7

BANKING – 5th Semester

Bank transfer the savings collected from the people into investment and thus increase the amount of

effective capital, which helps the process of economic growth.

5. Overdraft Facilities

The banks allow the overdraft facilities to their trusted customers and thus help them in overcoming

temporary financial difficulties.

6. Discounting bill of exchange

The importance of banks can be seen through the facility of discounting the bill of exchange. Banks

discount their bill of exchange of consumers and help them in financial difficulties. By discounting a bill of

exchange, they able to get the desired amount for the investment they want.

7. Financing Internal & External Trade

Banks help merchants and traders in financing internal and external trade by discounting a foreign bill of

exchange, issuing of letters of credit and other guarantees for their customers.

8. Act as an Agent

The bank act as an agent and help their customers in the purchase and sales of shares, provision of lockers

payment of monthly subscriptions, payment of rents and salaries and collection of dividends on the stock.

9. Issue of Traveller’s Cheques

For the convenience and security of money for travellers and tourists, the bank provides the facility of

traveller’s cheques. These cheques enable travellers and tourists to meet their expenses during their

journey, as these are accepted by issuing bankers, restaurants, and other businessmen both at home and

abroad. No doubt, this is also one of the great functions of banks and shows the importance of banks for

us in more precise ways.

10. General Utility Services

The existence of commercial banks is essential for contribution to general prosperity. Banks are the main

factors in raising the level of economic development of the world. In addition to the above-cited

advantages, banks also provide many services of general utilities to the customers and the general public.

For e.g. providing safe deposit lockers, ATM facility, Debit/Credit cards

3. Banker's obligation to maintain the secrecy of customers’ account is not absolute.

Case: An Income Tax Officer directly writes to a banker to disclose certain details relating to his

customers accounts. Examine whether the banker can legally disclose information. (Dec-2015).

Answer: A banker is expected to maintain secrecy of his customer’s account. The banker should not

disclose his customer’s financial position and the nature and the details of his account.

The bank owes a duty of secrecy in respect of its customer’s affairs, but there are exceptions to this

general duty.

The general rule about the secrecy of customer’s accounts may be dispensed within the following

circumstances:

(i). When the law requires such disclosure to be made; and

(ii). When the practices and usages amongst the bankers permit such disclosure.

Disclosure of Information required by Law:

A banker will be justified in disclosing information about his customer’s account on reasonable and

proper occasions and is under statutory obligations to disclose the information relating to his customer’s

account when the law specifically requires him to do so. The banker would, therefore, be justified in

disclosing information to meet the following statutory requirements:

1. Under the Income Tax Act, 1961:

According to Section 131, the Income Tax authorities possess the same powers as are vested in a court

under the Code of Civil Procedure, 1908 for enforcing the attendance of any person including any officer of

banking company and examining him on oath and compelling the production of books of accounts and

other documents and issuing commissions. Section 133 empowers the income tax authorities to require

any person, including a banking company or any officer thereof, to furnish information in relation to such

points or matter, or to furnish statements of accounts and affairs giving information in relation to such

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 8

BANKING – 5th Semester

points or matters, as in the opinion of the income tax authorities will be useful for or relevant to any

proceedings under the Act. The income tax authorities are thus authorized to call for necessary

information from the banker for the purpose of assessment of the bank’s customers.

2. Under the Companies Act, 1956:

When the Central Government appoints an inspector to investigate the affairs of any joint stock company

under Section 235 or 237 of the Companies Act, 1956, it shall be the duty of all officers and other

employees and agents (including the bankers) of the company to –

a. Produce all books and papers of, or relating to, the company, which are in their custody or power,

and

b. Otherwise to give to the inspector all assistance in connection with investigation which they are

reasonably able to give.

3. By order of the Court under the Banker’s Book Evidence Act, 1891:

When the court orders the banker to disclose information relating to a customer’s account, the banker is

bound to do so. In order to avoid the inconvenience likely to be caused to the bankers from attending the

courts and producing their account books as evidence, the Banker’s Books Evidence Act, 1891, provides

that certified copies of the entries in the banker’s books are to be treated as sufficient evidence and

production of the books in the courts cannot be forced upon the bankers.

4. Under the Reserve Bank of India Act, 1934:

The Reserve Bank of India collects credit information from the banking companies and also furnishes

consolidated credit information from the banking company. Every banking company is under a statutory

obligation under Section 45-B of the Reserve Bank of India Act, 1934, to furnish such credit information to

the Reserve Bank. The Act, however, provides that the credit information supplied to the Reserve Bank by

the banking companies shall be kept confidential.

5. Under the Banking Regulation Act, 1949:

Under Section 26 of the Banking regulation Act, every banking company is required to submit a return

annually of all such accounts in India, which have not been operated upon for 10 years. Banks are

required to give particulars of the deposits standing to the credit of each such account.

6. Under the Gift Tax Act, 1958:

Section 36 of the Gift Tax Act, 1958, confers on the Gift Tax authorities powers similar to those conferred

on income tax authorities under Section 131 of the Income Tax Act.

7. Disclosure to Police:

Under Section 94(3) of the Criminal Procedure Code, 1973, the banker is not exempted from producing the

account books before the police. The police officers conducting an investigation may also inspect the

banker’s books for the purpose of such investigations.

8. Under the Foreign Exchange Management Act, 1999:

Banking companies dealing in foreign exchange business are designated as authorized dealers in foreign

exchange. Section 43 of this Act empowers the officer of the Directorate of Enforcement and the Reserve

Bank to inspect the books and accounts and other documents of any authorized dealer and also to

examine on oath such dealer or its Director or officials in relation to its business.

9. Under the Industrial Development Bank of India Act, 1964:

After the insertion of sub-section 1A in Section 29 of this Act in 1975, the Industrial Development Bank of

India is authorized to collect from or furnish to the Central Government, the State Bank, any subsidiary

bank, nationalized bank or other scheduled bank, State Cooperative Bank, State Financial Corporation

credit information or other information as it may consider useful for the purpose of efficient discharge of

its function. The term ‘credit information’ shall have the same meaning as under the Reserve Bank of

India Act, 1934.

Disclosure Permitted by the Banker’s practices and Usages:

The practices and usages customary amongst bankers permit the disclosure of certain information under

the following circumstances:

1. With Express or Implied Consent of the Customer:

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 9

BANKING – 5th Semester

The banker will be justified in disclosing any information relating to his customer’s account with the

latter’s consent. In fact, the implied term of the contract between the banker and his customer is that the

former enters into a qualified obligation with the latter to abstain from disclosing information as to his

affairs without his consent. It is very important that the banker must be very careful in disclosing the

required information to the customer or his authorized representative. The consent of the customer may

be express or implied.

2. Banker’s Reference:

Bankers follow the practice of making necessary enquiries about the customers, their sureties or the

acceptors of the bills from other bankers. This is an established practice amongst the bankers and is

justified on the ground that an implied consent of the customer is presumed to exist. By custom and

practice necessary information or opinion about the customer is furnished by the banker confidentially.

The banker may disclose the state of his customer’s account in order to legally protect his own interest.

For example, if the banker has to recover the dues from the customer or the guarantor, disclosure of

necessary facts to the guarantor or the solicitor becomes necessary and is quite justified.

3. Duty to the Public to Disclose:

A banker may justifiably disclose any information relating to his customer’s account when it is his duty to

the public to disclose such information. When a bank is asked for information by a government official

concerning the commission of a crime and the bank has reasonable cause to believe that a crime has been

committed and that the information in the bank’s possession may lead to the apprehension of the culprit.

4. Who is banker? General relationship between banker and customer.

Fiduciary Relationship and Banker as a Trustee.

Answer: Who is banker: The term ‘banker’ refers to a person or company carrying on the business of

receiving moneys, and collecting drafts, for customers subject to the obligation of honouring cheques

drawn upon them from time to time by the customers to the extent of the amounts available on their

current accounts. Banker is one who conducts the business of banking; one who, individually, or as a

member of a company, keeps an establishment for the deposit or loan of money, or for traffic in money,

bills of exchange, etc.

Relationship between Banker and Customer:

The relationship between the banker and the customer arises out of the contract between them and

cannot be created except by mutual consent. A contract that exists between a banker and its customer is

a loan contract because if the customer’s account is in credit, the bank owes him that money and vice-

versa if the account is overdrawn. The relationship between a banker and his customer is basically the

contractual relationship of debtor and creditor and is regulated by the provisions contained in the

Negotiable Instruments Act, 1881, and the Indian Contract Act, 1872. The relationship between the banker

and the customer is vital.

The banker-customer relationship is that of a:

1. Debtor and Creditor,

2. Pledger and Pledgee,

3. Licensor and Licensee,

4. Bailor and Bailee,

5. Hypothecator and Hypothecatee,

6. Trustee and Beneficiary,

7. Agent and Principal,

8. Advisor and Client, and

9. Other miscellaneous relationships

1. Relationship of Debtor and Creditor

When a customer opens an account with a bank and if the account has a credit balance, then the

relationship is that of debtor (banker / bank) and creditor (customer).

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 10

BANKING – 5th Semester

In case of savings / fixed deposit / current account (with credit balance), the banker is the debtor, and

the customer is the creditor. This is because the banker owes money to the customer. The customer has

the right to demand back his money whenever he wants it from the banker, and the banker must repay

the balance to the customer.

In case of loan / advance accounts, banker is the creditor, and the customer is the debtor because the

customer owes money to the banker. The banker can demand the repayment of loan / advance on the

due date, and the customer has to repay the debt.

A customer remains a creditor until there is credit balance in his account with the banker. A customer

(creditor) does not get any charge over the assets of the banker (debtor). The customer's status is that of

an unsecured creditor of the banker.

The debtor-creditor relationship of banker and customer differs from other commercial debts in the

following ways:

A. The creditor (the customer) must demand payment. On his own, the debtor (banker) will not repay

the debt. However, in case of fixed deposits, the bank must inform a customer about maturity.

B. The creditor must demand the payment at the right time and place. The depositor or creditor must

demand the payment at the branch of the bank, where he has opened the account. However, today,

some banks allow payment at all their branches and ATM centres. The depositor must demand the

payment at the right time (during the working hours) and on the date of maturity in the case of

fixed deposits. Today, banks also allow pre-mature withdrawals.

C. The creditor must make the demand for payment in a proper manner. The demand must be in form

of cheques; withdrawal slips, or pay order. Now-a-days, banks allow e-banking, ATM, mobile-

banking, etc.

2. Relationship of Pledger and Pledgee

The relationship between customer and banker can be that of Pledger and Pledgee. This happens when

customer pledges (promises) certain assets or security with the bank in order to get a loan. In this case,

the customer becomes the Pledger, and the bank becomes the Pledgee. Under this agreement, the assets

or security will remain with the bank until a customer repays the loan.

3. Relationship of Licensor and Licensee

The relationship between banker and customer can be that of a Licensor and Licensee. This happens when

the banker gives a safe deposit locker to the customer. So, the banker will become the Licensor, and the

customer will become the Licensee.

4. Relationship of Bailor and Bailee

The relationship between banker and customer can be that of a Bailor and Bailee.

A. Bailment is a contract for delivering goods by one party to another to be held in trust for a specific

period and returned when the purpose is ended.

B. Bailor is the party that delivers property to another.

C. Bailee is the party to whom the property is delivered.

So, when a customer gives a sealed box to the bank for safe keeping, the customer became the bailor, and

the bank became the bailee.

5. Relationship of Hypothecator and Hypothecatee

The relationship between customer and banker can be that of Hypothecator and Hypothecatee. This

happens when the customer hypothecates (pledges) certain movable or non-movable property or assets

with the banker in order to get a loan. In this case, the customer became the Hypothecator, and the

Banker became the Hypothecatee and banks provide loans for home appliances and vehicles on hire-

purchase basis.

6. Relationship of Trustee and Beneficiary

A trustee holds property for the beneficiary, and the profit earned from this property belongs to the

beneficiary. If the customer deposits securities or valuables with the banker for safe custody, banker

becomes a trustee of his customer. The customer is the beneficiary so the ownership remains with the

customer.

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 11

BANKING – 5th Semester

7. Relationship of Agent and Principal

The banker acts as an agent of the customer (principal) by providing the following agency services:

Buying and selling securities on his behalf,

Collection of cheques, dividends, bills or promissory notes on his behalf, and

Acting as a trustee, attorney, executor, correspondent or representative of a customer.

Banker as an agent performs many other functions such as payment of insurance premium, electricity

and gas bills, handling tax problems, etc.

9. Other Relationships

Other miscellaneous banker-customer relationships are as follows:

Obligation to honour cheques: As long as there is sufficient balance in the account of the

customer, the banker must honour all his cheques. The cheques must be complete and in proper

order. They must be presented within six months from the date of issue. However, the banker can

refuse to honour the cheques only in certain cases.

Secrecy of customer's account: When a customer opens an account in a bank, the banker must not

give information about the customer's account to others.

Banker's right to claim incidental charges: A banker has a right to charge a commission, interest or

other charges for the various services given by him to the customer. For e.g. an overdraft facility.

Law of limitation on bank deposits: Under the law of limitation, generally, a customer gives up the

right to recover the amount due at a banker if he has not operated his account since last 10 years.

5. Define Cheque and discuss Crossed Cheque (2 times) / Account Payee (2 times).

Answer: Meaning of Cheque: A Cheque is a document which orders a bank to pay a particular amount of

money from a person’s account to another individual’s or company’s account in whose name the cheque

has been made or issued. The cheque is utilised to make safe, secure and convenient payments. It serves

as a secure option since hard cash is not involved during the transfer process; hence the fear of loss or

theft is minimised.

An order to a bank to pay a stated sum from the drawer's account, written on a specially printed

form.

Cheque refers to a negotiable instrument that contains an unconditional order to the bank to pay

a certain sum mentioned in the instrument, from the drawer’s account, to the person to whom it

is issued, or to the order of the specified person or the bearer.

As per the Section 13 of the Negotiable Instruments Act, 1881, a cheque is a Negotiable Instrument:

A “negotiable instrument” means a promissory note, bill of exchange or cheque payable either to order or

to bearer.

Crossing of Cheque

Definition: Crossing of a cheque is nothing but instructing the banker to pay the specified sum through the

banker only, i.e. the amount on the cheque has to be deposited directly to the bank account of the payee.

Hence, it is not instantly encashed by the holder presenting the cheque at the bank counter. If any

cheque contains such an instruction, it is called a crossed cheque.

The crossing of a cheque is done by making two transverse parallel lines at the top left corner across the

face of the cheque.

Who can cross a cheque?

Anyone with physical access to the cheque can cross the cheque. Crossing the cheque ensures that the

cheque cannot be paid out to cash.

Importance of Crossing of Cheque:

The significance of crossing of a cheque is that a crossed cheque cannot be encashed by the bearer but can

only be collected from the drawee bank in the bank account. (Sec. 123 and 126 of the Negotiable

Instruments Act) Therefore, Crossing of cheque provides protection and safeguard to the issuer of the

cheque. In case of a crossed cheque one can easily detect who encashed the said cheque, unlike the case

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 12

BANKING – 5th Semester

of non-crossed cheque. Hence, Crossing protects both payer and the payee of the cheque. Also, both

bearer and order cheques can be crossed.

Rules of Crossing of Cheque

Negotiable Cheques are generally crossed as a measure of safety.

A cheque can be crossed generally, may be crossed specially by the holder.

The Cheque holder has the right to add the words “not negotiable” to it.

When an uncrossed cheque or a crossed cheque generally is sent to a banker for the collection, the

person may cross it specially to himself. In this case, he does not enjoy the statutory protection

against being sued for conversion.

Types of Cheque Crossing:

There are two types of crossing of cheques – General and Special crossing of cheques.

General Crossing of Cheque

Section 123 of the Negotiable Instruments Act has defined General Crossing – “where a cheque bears

across its face an addition of the words ‘And Company’ or any abbreviation thereof, between two parallel

transverse lines or of two parallel transverse lines simply, and either with or without the words ‘not

negotiable’, that addition shall be deemed to be a crossing of cheque and the cheque shall be deemed to

be crossed generally”.

General Crossing involves two parallel transverse lines across the face of the cheque with or without ‘not

negotiable’ written on it. Such addition shall be considered to be a crossing.

To summaries, a cheque is considered to be generally crossed in the following cases:

When there are two transverse parallel lines marked across the face of cheque

When the cheque bears an abbreviation “& Co.” between the two transverse parallel lines

When the cheque bears the words “A/c. Payee” between the two transverse parallel lines.

When the cheque bears the words “Not Negotiable” written between the two parallel lines

Specimen of General crossing of cheque

Effect of General Crossing: Over the counter payment cannot be made in case of generally crossed

cheque, it can be made only through a bank account.

Special and Restrictive Crossing of Cheque

A cheque is said to be specially crossed when a particular bank’s name is written in between the two

transverse parallel lines on the cheque.

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 13

BANKING – 5th Semester

According to the Section 124 of the Negotiable Instruments Act, Special Crossing is defined as, the

cheque which “bears across its face an addition of the name of a banker, with or without the words “not

negotiable”, that addition shall be deemed a crossing and the cheque shall be deemed to be crossed

specially and to be crossed to that banker”.

In a special crossed cheque, the amount written in cheque is payable by the drawee only, and only to

the bank named in the crossing.

Effect of Special Crossing: The money is paid only to the bank whose name is mentioned on the cheque.

Not negotiable Crossing of Cheque:

The effect of writing ‘not negotiable’ crossing of a cheque is that the cheque can be transferred but

transferee will not be able to acquire a better title to the cheque. Thus, such a cheque is deprived of its

essential feature of negotiability.

One of the important features of a negotiable instrument is that a person, who receives it in good faith,

without negligence, for value, before maturity and without knowing the defect in the title of the

transferor, gets a good title to the instrument.

Thus, he becomes the holder in due course and acquires an indisputable title to it. Also, when the

instrument passes through a holder in due course, all the subsequent holders also receive a good title.

But, Not Negotiable Crossing takes away this important feature. In this case, the transferee does not

get the rights of the holder in due course.

6. Bill of Exchange.

Answer: Meaning of Bill of Exchange:

According to Section 5 of the Negotiable Instruments Act 1881, ‘a bill of exchange is defined as an

instrument in writing containing an unconditional order, signed by the maker, directing a certain person to

pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument.’

Features of bill of exchange:

It is important to have a bill of exchange in writing

It must contain a confirm order to make a payment and not just the request

The order should not have any condition

The bill of exchange amount should be definite

Fixed date for the amount to be paid

The bill must be signed by both the drawee and the drawer

The amount stated on the bill should be paid on-demand or on the expiry of a fixed time

The amount is paid to the beneficiary of the bill, specific person, or against a definite order

Acceptance of the drawee (debtor) on the Bill of Exchange is essential.

Advantages of bill of exchange:

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 14

BANKING – 5th Semester

Legal Document- It is a legal document, and if the drawee fails to make the payment, it will be

easier for the drawer to recover the amount legally.

Discounting Facility- In cases where the drawer is in immediate need of money, the bill can be

converted into cash by discounting it from a bank by paying some nominal charges.

Endorsement Possible- This bill of exchange can be exchanged from one individual to another for

the adjustment of the debt.

Bill of Exchange Format

In the above-mentioned bill of exchange format, Kunal Singh is the drawer as well as the payee of the bill.

Raj Kiran is the Drawee and accepter.

Parties of Bill of Exchange: A bill of exchange has three parties:

(1) Drawer:

The drawer is the maker of a bill of exchange.

The bill is signed by Drawer.

A creditor who is entitled to receive payment from the debtor can draw a bill of exchange.

(2) Drawee:

Drawee is the person upon whom the bill of exchange is drawn.

Drawee is the debtor who has to pay the money to the drawer.

He is also known as ‘Acceptor’.

(3) Payee:

The payee is the person to whom payment has to be made.

The payee may be the drawer himself or a third party.

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 15

BANKING – 5th Semester

Example of a Bill of Exchange

Let's say Company ABC purchases auto parts from Car Supply XYZ for Rs. 25,000. Car Supply XYZ draws a

bill of exchange, becoming the drawer and payee in this case. The bill of exchange stipulates that

Company ABC will pay Car Supply XYZ Rs. 25,000 in 90 days. Company ABC becomes the drawee and

accepts the bill of exchange and the goods are shipped. In 90 days, Car Supply XYZ will present the bill of

exchange to Company ABC for payment. The bill of exchange was an acknowledgment created by Car

Supply XYZ, which was also the creditor in this case, to show the indebtedness of Company ABC, the

debtor.

7. Describe Promissory/Pronote Notes and when it expires.

Answer: Definition: A Promissory Note, as the name itself gives a brief description, is a legal financial

instrument issued by one party, promising to pay the debt owed to another party.

It is a written negotiable instrument duly signed by the maker that contains an unconditional promise

to pay the stated sum of money to a particular person or to any other person, on the order of that

particular person, either on-demand or on a specified date, under given terms.

Promissory note is defined by Section 4 of the Act. It says, “A Promissory note is an instrument in

writing containing an unconditional undertaking, signed by the maker, to pay a certain sum of money only

to, or to the order of a certain person or to the bearer of the instrument”.

It is a short-term credit instrument which does not amount to a banknote or a currency note.

Characteristics of Promissory Note

It is a written document.

There must be a clear and unconditional promise to pay a certain sum to a specified person or on-

demand.

It must contain due date or payment on demand stipulation.

It must be drawn and duly signed by the maker.

It must be properly stamped.

It specifies the name of the maker and payee

The amount to be paid must be certain, given in both figures and words.

Payment is to be made in the country’s legal currency.

Payee should also be a certain person

Must contain the signature of the promisors.

Date of the transaction.

Acknowledgment of the debt.

A promissory note may consist of various terms and conditions related to indebtedness like the

principal amount, date of maturity, the rate of interest, terms of repayment, issue date, name and

signature of the drawer, name of the drawee and so forth. A promissory note needs no acceptance.

Parties to Promissory Note: All promissory notes constitute three primary parties. These include the

drawee, drawer and payee.

1. Drawer: The one who makes the promise to another, to pay the debt is the drawer of the

instrument. He/she is the debtor or borrower. A drawer is a person who agrees to pay the drawee

a certain amount of money on the maturity of the promissory note. He/she is also known as

maker.

2. Drawee: The one, in whose favour the note is drawn, is the drawee. He/she is the creditor who

provides goods on credit or lender, who lends money. She/he is an individual, in whose favour the

note is prepared. In usual cases the drawee is also the payee until and unless the promissory note

is transferred specifically in favour of the payee. For e.g. Ram is considered a drawer if he

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 16

BANKING – 5th Semester

promises to pay Shyam Rs 5000 (Shyam is the drawee). However, if the same promissory note is

transferred in favour of Rohan, then Rohan becomes the payee.

3. Payee: The one, to whom the payment is made, is the payee of the negotiable instrument. The

payee is someone to whom the payment is made; sometimes drawee and payee both are same.

The drawee and payee can be the same person when the amount is to be paid to the person in whose

favour the note is drawn. However, when the amount is to be paid to another person, on the order of the

drawee, meaning that if the drawee transfers the instrument in favour of another person then, in that

case, the payee would be different.

Further, the party that owes money to another party holds the promissory note and after discharging

the obligation completely, the drawee or payee (whatever the case may be) cancels the note and returns

to the drawer.

In Y.Veeraiah v. M/S Margadarsi Chit Fund (P) Ltd, the court held that to make a document a

“Promissory Note” within the meaning of Section 4 of the Act, it must substantially consist of a promise to

pay on demand a defined sum and must not be something else and if it is a document guaranteeing

payment of a fixed sum on a certain date after certain period, it becomes a “Promissory note payable

otherwise than on demand”, as contemplated within the meaning of Section 49 of the Stamp Act.

Important Points to Remember about Promissory Notes

A Promissory Note is issued under Section 4 of the Negotiable Instruments Act, 1881

Promissory Notes issued in one Indian state can be presented in another state provided that the

note bears the valid stamp. There is no requirement for additional stamp duty to be paid.

A Promissory Note must always be written by hand. It must include all the mandatory elements

such as the legal names of the payee and maker’s name, amount being loaned / to be repaid, full

terms of the agreement and the full amount of liability, beside other elements.

The note must clearly mention only the promise of making the repayment and no other

conditions.

After issuance, a Promissory Note must be stamped according to the regulations of the Indian

Stamp Act. The common practice is to use a revenue stamp on the note which is then signed by

the promissory and/or cross signed by the borrower.

A Promissory Note can also be issued on a Stamp paper in case revenue stamps are unavailable.

The ideal way to lend money is via issuing crossed account cheques. Details of the cheques can be

mentioned in the note.

All Promissory Notes are valid only for a period of 3 years starting from the date of execution,

after which they will be invalid, when no payment date is mentioned on the note, if any future

payment date is mentioned on note the limitation of 3 years starts from that date not from the

date of the execution of the instrument.

There is no maximum limit in terms of the amount which can be lent or borrowed.

The lender of the funds is normally the one who will hold the Promissory Note. When the loan

amount has been disbursed or repaid fully, the Promissory Note must be cancelled and marked as

“Paid in Full”, after which it can be returned to the borrower / payee.

While the signature of a witness is not a mandatory requirement, it is advisable to have a note

signed by a witness who is independent from the transaction.

The term maturity refers to the date on which a bill of exchange or promissory note becomes due

for payment. In arriving at maturity date, three days, known as days of grace, must be added to

the date on which the period of credit expires.

Acknowledgement of Debt: When payment is made with respect to a debt over a promissory note,

the repayment is considered as acknowledgment of debt and the limitation period is renewed to a

fresh three year period from the date of such partial payment. This kind of written

acknowledgement of payment is accepted as renewal of limitation.

S. 35 of Indian Stamps Act lays down that no instrument chargeable with duty is admissible as

evidence in law even if there is consent of parties. Kuruvilla Markose v. Varkey AIR 1966 Ker 315,

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 17

BANKING – 5th Semester

this case emphasizes the importance of affixing a stamp and signing across it for validity of the

promissory note.

Promissory Note Format

8. What is NI and describe the main characteristics? Is a cheque a negotiable instrument? Explain.

Answer: What is Negotiable Instrument: As per Section 13(a) of the Act, “Negotiable instrument means a

promissory note, bill of exchange or cheque payable either to order or to bearer, whether the word

“order” or “ bearer” appear on the instrument or not.”

A negotiable instrument is actually a written document. This document specifies payment to a specific

person or the bearer of the instrument at a specific date. So we can define a bill of exchange as “a

document signifying an unconditional promise signed by the person giving the promise, requiring the

person to whom it is addressed to pay on demand or at a fixed date or time”.

Important characteristics of Negotiable Instruments are:

1. Property: The possessor of negotiable instrument is acknowledged to be the owner of property

contained therein. Negotiable instrument does not simply give ownership of the instrument but

right to property as well. The property in negotiable instrument can be moved without any

formality. In the case of bearer instrument, the possessions pass by meagre delivery to the

transferee. In case of order instrument, endorsement & delivery are necessary for transfer of

property.

2. Title: The transferee of negotiable instrument is called ‘holder in due course.’ A genuine transferee

for value is not affected by any flaw of title on the part of transferor or of any of the previous

holders of instrument.

3. Rights: The transferee of negotiable instrument can take legal action in his own name, in case of

dishonour. A negotiable instrument can be reassigned any number of times till it is attains

maturity. The holder of instrument need not give notice of transfer to the party legally responsible

on the instrument to pay.

4. Prompt payment: A negotiable instrument facilitates the holder to anticipate prompt payment

because dishonour refers to the ruin of credit of all persons who are parties to the instrument.

5. Presumptions: The Certain presumption applies to all negotiable instruments unless the contrary

is provided. This presumption is dealt in Sections, 118 and 119 and are as follows:

(a) Consideration. Every negotiable is presumed to have been made drawn, accepted, indorsed,

negotiable or transferred for consideration. This would help a holder to get a decree from a court without

any difficulty.

(b) Date. Every negotiable instrument bearing a date is presumed to have been made or drawn on such

date.

(c) Time of acceptance. When a bill of exchange has been accepted, it is presumed that it was accepted

within a reasonable time of its date and before its maturity

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 18

BANKING – 5th Semester

(d) Time of transfer. Every transfer of negotiable instrument is presumed to have been made before its

maturity.

(e) Order of endorsements. The endorsement appearing upon a negotiable are presumed to have been

made in the order in which they appear thereon

(f) Stamp. When an instrument has been lost it is presumed that it duly stamped.

(g) Holder a holder in due course. Every holder of a negotiable instrument is presumed to be holder in due

course (Sec 118)

(h) Proof of protest. In a suit upon an instrument which has been dishonour, the court, on proof of the

protest presumes the fact of dishonour, unless and such fact is disproved (sec 119).

The above presumption is rebuttable by evidence. If any one challenges any of this presumption,

he has to prove his allegation again; this presumption would not arise where an instrument has been

obtained by any offense, fraud or unlawful consideration.

Types of Negotiable Instruments

Let us take a look at some of the most common types of negotiable instruments.

1. Promissory Note (Sec 4): In this case, the debtor is the one who makes the instrument. And he

promises unconditionally to the creditor (or the bearer of the document) a certain sum of money

on a specific date.

2. Bills of Exchange (Sec 5): This is an order from the creditor to the debtor. This instrument instructs

the drawee (debtor) to pay the payee a certain amount of money. The bill will be made by the

drawer (creditor)

3. Cheque (Sec 6): This is just another form of a bill of exchange. Here the drawer is a bank. And such

a cheque is only payable on demand. It is basically the depositor instructing the bank to pay a

certain amount of money to the payee or the bearer of the cheque.

4. Other/deemed Negotiable Instruments Examples: There are other instruments such as

government promissory notes, railway receipts, delivery orders, etc. These can be negotiable

instruments by custom or practice of the trade.

9. Discuss the law relating to Negotiable Instrument and deemed Negotiable Instrument.

Travellers Cheques, Dividend Warrants, Circular Notes, Demand Draft, Postal Order and Banker’s

Draft.

Answer: Refer previous question for law relating to Negotiable Instrument.

Deemed Negotiable Instrument:

As per Section 13 of Negotiable Instruments Act, 1881 “promissory note, cheque and bill of exchange are

called negotiable instruments but any other instrument which is having all the essential characteristics of

a negotiable instrument, occupied the character of negotiability as a result of usage or custom of trade, is

called deemed negotiable instrument for example:

1. Bank Drafts, 2. Dividend Warrants, 3. Postal Orders and Money Orders, 4. Traveller’s Cheque, Circular

Notes, 6. Government Promissory Notes, 7. A fixed deposit receipt, 8. Railway Receipt, 9. Life Insurance

Policies, 10. Exchequer Bills, 11. Bank Notes, 12. Share Warrants, 13. Bearer Debentures, 14. Share

certificates with transfer deeds, 15. Demand Drafts, 16. Banker’s Draft etc.

Following are the short questions which are asked frequently and while answering write the above answer

and followed by defining the given topic, Travellers Cheques, Dividend Warrants, Circular Notes, Demand

Draft, Postal Order and Banker’s Draft.

Traveller’s Cheque:

A traveller’s cheque is a once-popular but now largely outmoded medium of exchange utilized as an

alternative to hard currency. The product typically is used by people on vacation in foreign countries. It

offers a safe way to travel overseas without cash. The issuing party, usually a bank, provides security

against lost or stolen cheques. Beginning in the late 1980s, traveller’s cheques have increasingly been

supplanted by credit and debit cards.

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 19

BANKING – 5th Semester

KEY TAKEAWAYS

Traveller’s cheques are generally used by people traveling to foreign countries.

They are purchased for set amounts and can be used to buy goods or services or be exchanged for

cash.

Once widely used, traveller’s cheques have largely been supplanted today by debit cards and

credit cards, and it can be hard to find places that will accept them.

Dividend Warrants:

DIVIDEND WARRANT is an order, or warrant, issued by a company, and drawn upon its bankers, in favour

of a member of the company, for payment of the interest or dividend due to him upon his holding of

shares or stock in the company.

Section 96 of the Bills of Exchange Act, 1882, is:—" The provisions of this Act as to crossed cheques shall

apply to a warrant for payment of dividend."

A dividend warrant must be signed by the person to whom it is payable, and, unless authorised by the

company, as per procuration signature should not be accepted. If payable to John Brown or bearer, it

never the less requires John Brown's discharge.

Where a dividend warrant is payable to several persons, it is the custom to pay it on being signed by

one of them. But in the case of an interest warrant all the persons named should sign.

Many Dividend Warrants are crossed & Co. and the effect is the same as when a cheque is so crossed

(Section 95).

Circular Notes:

In banking, a circular note is a document request by a bank to its foreign correspondents to pay a

specified sum of money to a named person. The person in whose favour a circular note is issued is

furnished with a letter (containing the signature of an official of the bank and the person named) called a

letter of indication, which is usually referred to in the circular note, and must be produced on presentation

of the note. Circular notes are generally issued against a payment of cash to the amount of the notes, but

the notes need not necessarily be cashed, but may be returned to the banker in exchange for the amount

for which they were originally issued.

It is the duty of the payer to see that payment is made to the proper person and that the signature is

valid; he cannot recover the amount of a forged note from the banker who issued the note.

Demand Draft:

A demand draft or a DD is a negotiable instrument issued by the bank. The meaning of negotiable

instrument is that it guarantees a certain amount of payment mentioning the name of the payee. It cannot

be transferred to another person in any situation.

The bank issues the draft to a client (drawer) directing another bank or own branch to pay the

specific amount to the payee

Demand drafts can be compared to cheques but these are hard to counterfeit and more secure.

This is because the drawer has to pay before issuing a demand draft to the bank whereas cheque

can be issued without ensuring the sufficient funds in your bank account. Therefore, cheques can

bounce but drafts assure a safe and on-time payment

The drafts are payable on demand. It cannot be paid to the bearer but the beneficiary has to

present the instrument directly to the branch. It can also be collected by the clearing mechanism

of the bank

Mostly, demand drafts are issued in situations where the parties are unknown to each other and

lack trust. It comes handy in such situations as there are almost no chances of fraud and

counterfeiting

The draft facility is available for people regardless of them having a bank account or not. Anyone

who wants to pay a certain amount to an institution or to someone with a proof of payment can

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 20

BANKING – 5th Semester

issue a demand draft. Individuals can visit the bank and ask for a draft form or they can also fill the

form online.

Postal Order:

The Indian Postal Orders are available in all the Post Offices across India. You can buy IPO from

Head Post Office, Sub-Post Office or from the rural post office called Branch Post Office. They are not

available at other places. They are also available from any of the Army Post Offices. Postal Orders

have regained popularity, especially as a form of payment for shopping on the Internet, as they are

drawn on the Post Offices accounts so a vendor can be certain that they will not bounce.

The most popular use is to pay fees under Right to Information (RTI) and is one of the most

acceptance modes of deposition of fees. It is also useful for students to send fee required for different

competition examinations. Can also be purchased & sent as “crossed” If a Postal Order be crossed,

payment will be made only through that Bank. There are eight types of IPO denomination available in

India.

Banker’s Draft:

A bank draft, also called a bank cheque, is a method of payment that involves a document issued by a

bank guaranteeing that the amount stated on the certificate will be paid to the recipient of the

document. A bank draft is used as a type of cheque which is more reliable than a personal cheque as it

is backed by the bank itself on behalf of the payer; hence, it ensures that the person who the draft is

addressed to, will receive the money.

This kind of cheque is usually employed when the amount of money being paid is large, or when the

two parties do not know each other that well. Therefore, a secure form of payment is required to

complete the transaction. Drafts are also used when one of the parties does not accept personal

cheques in doubt that the funds may not actually be available.

A bank issues a bank draft when one of its depositors (a person who holds an account in such bank)

requests one using the following steps. First, the bank cheques to depositor’s account to make sure

the funds are available for transfer. After the funds have been validated, the bank transfers the money

from the depositor’s account to the bank. This is what makes these drafts more reliable than other

forms of payments; as the bank already has the money that will be paid and the document is backed

by a reputed financial institution. The draft is then issued and handed to the client who will afterwards

deliver it to the seller or recipient.

These drafts are commonly used as method of payment for real estate transactions or used vehicle

purchases.

10. Define paying banker and discuss the statutory protection available to the paying banker.

Answer: Banker customer relationship is a contractual relationship with a super-head obligation on the

part of the banker to honour the customer’s cheques as and when they are presented provided, of course,

certain conditions are satisfied before payment is made by a banker.

Definition of Paying Banker:

A banker on whom cheques are drawn by his customers for payment is called the “paying banker”. A

banker’s primary function and duty is to honour his customer’s cheques which is an implied term of the

contract entered into by the banker and his customer, when the account is opened. This duty is, however,

subject to the limitations imposed by Section 31 of the Negotiable Instruments Act, 1881, which provides:

“The drawee of a cheque having sufficient funds of the drawer in his hands properly applicable to the

payment of such cheque must pay the cheque when duly required so to do, and, in default of such

payments, must compensate the drawer for any loss of damage caused by such default”.

Thus, the terms of Section 31 limit the banker’s duty to pay cheques on the existence of:

1. Sufficiency of funds of the drawer in the hands of the banker, or as per agreed borrowing facilities

on the account;

2. Availability of funds, that is, the funds are properly applicable to the payment of such cheques and

there is no legal bar prohibiting payment; and

Harinath Janumpally – harinath0012@gmail.com – 94406 29864 21

BANKING – 5th Semester

3. Technical regularity of the cheque, that is, the cheques are drawn in the regular form and properly

presented for payment in the ordinary course of business.

Other terms:

4. Stop Payment of that cheque number is not requested by the customer.

5. Not a post-dated cheque.

6. The cheque has not crossed the expiry period of 3 months (not a stale cheque).

7. No corrections or modifications on the cheque.

8. It is not a mutilated cheque.

All these conditions must be satisfied for honouring a cheque. If any of these conditions is not fulfilled,

the paying banker would be within his right to return the cheque as unpaid.

Protection to Paying Banker:

For a paying banker to claim protection under the negotiable Instruments Act, one of the criteria he has

to satisfy, is that the payment should be in due course. As to what is payment in due course, has been

stated in Section 10 of the negotiable Instrument Act, which reads as follows:

“Payment in due course” means payment in accordance with the apparent tenor of the instrument in

good faith and without negligence to any person in possession thereof under circumstances which does

not afford a reasonable ground for believing that he is not entitled to receive payment of the amount

therein mentioned.

From the above definition, it can be observed that payment in due course has to qualify the payment to

be made on the basis of following principles:

1. In accordance with the apparent tenor of the instrument;

2. In good faith;

3. Without negligence;

4. To the person in possession of the instrument; and

5. While making payment the banker should not have reasons to ‘believe’ that the person in

possession of the instrument is not entitled to receive payment of the amount mentioned in the

instrument.

Further, it is also important to understand that Section 85 of the Negotiable Instrument Act, grants

protection to a banker on his making payment of a cheque.

1. Where a cheque payable to order purports to be endorsed by or on behalf of the payee, the drawee is

discharged by payment in due course.

2. Where a cheque is originally expressed to be payable to bearer, the drawee is discharged by payment in

due course to the bearer thereof, notwithstanding any endorsement whether in full or in blank appearing

thereon, and notwithstanding that any such endorsement purports to restrict its further negotiation.

Paying banker should ensure that the cheque is regular in all respects and should take the precautions

while making payment of the cheque:

1. The cheque must have been drawn properly. It is interesting to note that Negotiable Instruments Act

defines a cheque but does not prescribe it’s from. It does not even say that it should be drawn on the

printed form issued by the bank. Strictly speaking, a banker cannot refuse to honour a cheque drawn on

piece of paper provided it carries an unconditional order to the banker and fulfills other requirements of a

cheque. But by tradition and custom, banks all over recognize only the cheque drawn on the printed form

issued by the bank. Accordingly, if customer demands that the payment be made on the basis of a letter

other than by way of a cheque, the banker should permit such request. However he can demand stamped

discharge. We are aware that in the case of cheque, it need not be stamped. This exemption is accorded to

cheques; if they are in the prescribed format.

2. A cheque must bear a date because the mandate of the customer to the banker becomes legally

effective on the date mentioned therein. The date should not be incomplete. If the drawer mentions a

date earlier to the date of writing then it is called an ante-dated cheque. In India, a cheque is treated as