Professional Documents

Culture Documents

Pre-Market Pulse 19th December

Pre-Market Pulse 19th December

Uploaded by

sumit_mukundOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pre-Market Pulse 19th December

Pre-Market Pulse 19th December

Uploaded by

sumit_mukundCopyright:

Available Formats

Pre-Market Pulse

Tue, 19 Dec 2023

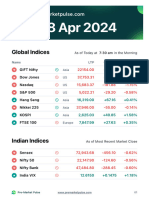

Global Indices As of Today at 8:11 am in the Morning

Name LTP Change Change %

GIFT Nifty 21,478.0 -6.0 -0.03%

Dow Jones 37,306.02 +0.86 +0.00%

Nasdaq 14,905.19 +91.27 +0.62%

S&P 500 4,740.56 +21.37 +0.45%

Hang Seng 16,581.00 -54.00 -0.32%

Nikkei 225 32,790.50 +31.52 +0.10%

KOSPI 2,565.83 -1.03 -0.04%

FTSE 100 7,614.48 +38.12 +0.50%

Indian Indices As of Most Recent Market Close

Sensex 71,315.09 -168.66 -0.24%

Nifty 50 21,418.65 -38.00 -0.18%

Nifty Bank 47,867.70 -275.85 -0.57%

India VIX 13.9000 +0.7725 +5.88%

Pre-Market Pulse www.premarketpulse.com 01

Market Bulletin

GIFT Nifty is down by -6.00 (-0.03%

The India VIX, the fear index, jumped to the highest level in the

current financial year, indicating increased market uncertainty

US stocks gained, with the S&P 500 and Nasdaq climbing,

while the Dow Jones remained steady. This movement reflects

market reactions to anticipated interest rate cuts in 2024

Asian shares and the yen held steady, with a focus on Japan's

central bank and its monetary policy. The prospect of US rate

cuts continues to influence global equity markets

India's net direct tax collections for fiscal year 2023-24 saw a

notable increase, driven by both corporate and personal

income taxes

The Indian government plans to auction 26 coal mines across

various states in its ninth round of commercial coal mine

auctions

Sun Pharmaceuticals is set to invest in Lyndra Therapeutics to

develop long-acting oral therapies, marking a strategic

expansion in pharmaceutical technology

Nestle India has announced January 5 as the record date for

its planned stock split, aiming to increase the liquidity of its

shares

The Indian government adjusted the windfall profit tax rates on

domestically produced crude oil and diesel exports

Oil prices rose following concerns about disruptions in

maritime trade after a Houthi militant group attacked ships in

the Red Sea.

Pre-Market Pulse www.premarketpulse.com 02

Technical Analysis

50 Nifty

The market displayed a lacklustre trade on December 18 with a

Doji candlestick pattern, indicating indecision among traders

The Nifty50 index slightly fell, hinting at consolidation near

record highs with support at 21,200 levels and resistance at

21,500

The overall market tone remains bullish, but it's approaching

key resistance zones marked by high overbought indicators

Traders are advised to exercise caution and consider timely

profit-taking at higher levels, with strong support around

21,200 to 21,300 levels.

Bank Nifty

The Bank Nifty also saw a pullback, forming a bearish

candlestick pattern on the daily charts

Key support is expected at 47,500 zones, with potential

upward movement towards 48,250 and 48,500 levels.

Resistance is seen at 48,020 followed by 48,084 and 48,187.

Pre-Market Pulse www.premarketpulse.com 03

Nifty Call Options Data

The maximum Call open interest was observed at the 21,500

strike, acting as a key resistance level

Significant Call writing activity was at the 21,500 strike, adding

44.85 lakh contracts, followed by 21,600 and 21,400 strikes

Notable Call unwinding was at the 21,100 strike, indicating

potential resistance weakening.

Nifty Put Options Data

The 21,300 strike held the maximum open interest, suggesting

it as a key support area

Notable Put writing was at the 21,400 strike, adding 12.78 lakh

contracts, indicating strengthening support

Put unwinding was observed at the 20,300 strike, indicating

weakening support at lower levels.

Technical Analysis Source:

https://www.moneycontrol.com/news/business/markets/trade-setup-for-

tuesday-15-things-to-know-before-opening-bell-10-11922821.html

Pre-Market Pulse www.premarketpulse.com 04

Today's Nifty Golden Levels

What is this?

These are the 8 levels of the Nifty for today, where the price will

experience support and resistance with high accuracy. These

levels are calculated based on the Golden Ratio formula (1.618).

Level 1 21262.29

Level 2 21336.12

Level 3 21381.74

Level 4 21427.36

Level 5 21455.56

Level 6 21501.18

Level 7 21529.38

Level 8 21575.01

Pre-Market Pulse www.premarketpulse.com 04

Key Stocks to Watch

Vedanta: Announces ₹11 per share dividend totaling ₹4,089 crore;

Vedanta Plc to receive ₹2,065 crore. Board meeting planned for

fundraising discussion

Apollo Tyres: White Iris Investment considering selling 3% equity to

raise $100 million, with a floor price of ₹440 per share

Sun Pharma: Aiming to acquire a 16.7% stake in Lyndra

Therapeutics for $30 million

Devyani International: Set to acquire 274 KFC restaurants in

Thailand, entering the Thai QSR market

KPI Green Energy: Initiates QIP with a floor price of ₹1,245 per

share to raise funds

Kaynes Technology: Launches QIP at ₹2,449 per share; plans to

acquire Digicom Electronics Inc. for $2.5 million

JTL Industries: Board approves issuing 3 crore shares at ₹270

each, totaling ₹810 crore, and plans a ₹500 crore QIP for

subsidiary investment

Allcargo-GATI: Schedules board meeting to discuss fundraising

IDFC First Bank: Receives RBI nod for merger with IDFC

Biocon: Completes global integration of Biocon Biologics' acquired

biosimilars business

PNC Infratech: Secures a ₹1,174 crore Hybrid Annuity Highway

Project from MPRDC

Dish TV: Evaluating new director appointments including Sanjay

Banerjee.

Pre-Market Pulse www.premarketpulse.com 05

FII were net sellers of ₹-33.5 Cr in the cash segment

FII

on 18 Dec 2023

DII were net buyers of ₹413.9 Cr in the cash segment

DII

on 18 Dec 2023

Pre-Market Pulse www.premarketpulse.com 05

Feedback

Do you have any feedback or suggestions? We'd love

to hear from you. Please feel free to send an email to

premarketpulse@gmail.com.

Contact Us

envelope premarketpulse@gmail.com

whatsapp +91 8618318166

globe www.premarketpulse.com

Privacy:

Disclaimer:

Terms:

Source:

Pre-Market Pulse

You might also like

- An Open Letter To Every Athlete On Their Senior NightDocument4 pagesAn Open Letter To Every Athlete On Their Senior NightWillieNo ratings yet

- Pre-Market Pulse 18th DecemberDocument8 pagesPre-Market Pulse 18th Decembersumit_mukundNo ratings yet

- Pre-Market Pulse 20 DecemberDocument8 pagesPre-Market Pulse 20 Decembersumit_mukundNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulseytmandar29No ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulseayush7376307320No ratings yet

- Pre-Market PulseDocument9 pagesPre-Market PulserohitcmauryaNo ratings yet

- Pre-Market Pulse-63Document7 pagesPre-Market Pulse-63dhruvika guptaNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulsejoew71437No ratings yet

- Pre Market PulseDocument9 pagesPre Market Pulsenoobmasterpro007No ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulsedeondalmeida17No ratings yet

- Pre-Market Report 07-05Document7 pagesPre-Market Report 07-05biplabmajumderNo ratings yet

- Wed, 5 Jun 2024: Global IndicesDocument7 pagesWed, 5 Jun 2024: Global IndicesKetan ShahNo ratings yet

- Tue, 4 Jun 2024: Global IndicesDocument7 pagesTue, 4 Jun 2024: Global IndicesKetan ShahNo ratings yet

- Pre-Market Report 15-04Document7 pagesPre-Market Report 15-04atharv302005No ratings yet

- Pre-Market Report 06-05Document7 pagesPre-Market Report 06-05biplabmajumderNo ratings yet

- Pre-Market Report 05-04-2Document7 pagesPre-Market Report 05-04-2Avi BansalNo ratings yet

- Pre - Market Report 11-06Document7 pagesPre - Market Report 11-06Movies Dfdtqtt1tNo ratings yet

- Most Market Outlook: Morning UpdateDocument5 pagesMost Market Outlook: Morning UpdateVinayak ChennuriNo ratings yet

- MOSt Market Outlook 13 TH May 2024Document10 pagesMOSt Market Outlook 13 TH May 2024sandeepfafsNo ratings yet

- Daily Newsletter Feb2Document10 pagesDaily Newsletter Feb2amjadyusuf118No ratings yet

- MOSt Market Outlook 20 TH March 2024Document10 pagesMOSt Market Outlook 20 TH March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 1 ST April 2024Document10 pagesMOSt Market Outlook 1 ST April 2024Sandeep JaiswalNo ratings yet

- Nifty 50 - Google SearchDocument1 pageNifty 50 - Google Searchvqsykdb8mvNo ratings yet

- DailymarketOutlook 1january2013Document3 pagesDailymarketOutlook 1january2013Darshan MaldeNo ratings yet

- MOSt Market Outlook 19 TH March 2024Document10 pagesMOSt Market Outlook 19 TH March 2024Sandeep JaiswalNo ratings yet

- Weekly Equity Market Report of Indian MarketDocument5 pagesWeekly Equity Market Report of Indian MarketRahul SolankiNo ratings yet

- MOSt Market Outlook 26 TH March 2024Document10 pagesMOSt Market Outlook 26 TH March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 2 ND April 2024Document10 pagesMOSt Market Outlook 2 ND April 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 27 TH March 2024Document10 pagesMOSt Market Outlook 27 TH March 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 28 June 2012Document10 pagesDaily Equty Report by Epic Research - 28 June 2012Pamela McknightNo ratings yet

- Daily Updates - March 28Document2 pagesDaily Updates - March 28rksapsecgrc010No ratings yet

- Sharekhan Pre Market Presentation 6th July 2020 Monday FinalDocument25 pagesSharekhan Pre Market Presentation 6th July 2020 Monday FinalOqtec Engg Acerris TeksolNo ratings yet

- MOSt Market Outlook 21 ST March 2024Document10 pagesMOSt Market Outlook 21 ST March 2024Sandeep JaiswalNo ratings yet

- Daily Updates - March 27Document2 pagesDaily Updates - March 27rksapsecgrc010No ratings yet

- K 1 M 04 Z 0 W 7 e 3 K 1 J 0Document4 pagesK 1 M 04 Z 0 W 7 e 3 K 1 J 0RamCharyNo ratings yet

- MOSt Market Outlook 4 TH April 2024Document10 pagesMOSt Market Outlook 4 TH April 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 9 TH May 2024Document10 pagesMOSt Market Outlook 9 TH May 2024sandeepfafsNo ratings yet

- MOSt Market Outlook 16 TH February 2024Document10 pagesMOSt Market Outlook 16 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 28 TH March 2024Document10 pagesMOSt Market Outlook 28 TH March 2024Sandeep JaiswalNo ratings yet

- Equity Premium Daily Journal-16th November 2017, ThursdayDocument14 pagesEquity Premium Daily Journal-16th November 2017, Thursdayyuvani vermaNo ratings yet

- FourDocument43 pagesFourHiralal patilNo ratings yet

- Morning Report EquityDocument4 pagesMorning Report EquitySathyamNo ratings yet

- INOX India and HFCL Remain Mehta Equities' Top Stock Recommendations For The Week - CaFE Invest News The Financial ExpressDocument1 pageINOX India and HFCL Remain Mehta Equities' Top Stock Recommendations For The Week - CaFE Invest News The Financial Expressravi kumarNo ratings yet

- MOSt Market Outlook 12 TH February 2024Document10 pagesMOSt Market Outlook 12 TH February 2024Sandeep JaiswalNo ratings yet

- Most Market Out Look 27 TH February 24Document12 pagesMost Market Out Look 27 TH February 24Realm PhangchoNo ratings yet

- Derivative Report 02 May UpdateDocument6 pagesDerivative Report 02 May UpdateDEEPAK MISHRANo ratings yet

- MOSt Market Outlook 20 TH February 2024Document10 pagesMOSt Market Outlook 20 TH February 2024Sandeep JaiswalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Stock Tips For The WeekDocument9 pagesStock Tips For The WeekDasher_No_1No ratings yet

- Daily Wrap-Up: Research Desk - Stock Broking 11 January, 2018Document3 pagesDaily Wrap-Up: Research Desk - Stock Broking 11 January, 2018Kobita DasNo ratings yet

- Daily Updates - May 23Document2 pagesDaily Updates - May 23Abbas IbrahimNo ratings yet

- Metropolis Share Price - Google SearchDocument1 pageMetropolis Share Price - Google SearchVikram Kumar JapaNo ratings yet

- Derivative Premium Daily Journal-25th Oct 2017, WednesdayDocument13 pagesDerivative Premium Daily Journal-25th Oct 2017, WednesdaySiddharth PatelNo ratings yet

- Market Outlook 13 September 2010Document5 pagesMarket Outlook 13 September 2010Mansukh Investment & Trading SolutionsNo ratings yet

- Equity Analysis - DailyDocument7 pagesEquity Analysis - Dailyapi-198466611No ratings yet

- Equity Premium Daily Journal-1st November 2017, WednesdayDocument13 pagesEquity Premium Daily Journal-1st November 2017, WednesdaySiddharth PatelNo ratings yet

- Market Prediction - EquityPanditDocument1 pageMarket Prediction - EquityPanditYathiraj C GowdaNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- MOSt Market Outlook 7 TH February 2024Document10 pagesMOSt Market Outlook 7 TH February 2024Sandeep JaiswalNo ratings yet

- Trade Nivesh 26.09.2016Document8 pagesTrade Nivesh 26.09.2016Sayli SayliNo ratings yet

- Pre-Market Pulse 15th DecemberDocument7 pagesPre-Market Pulse 15th Decembersumit_mukundNo ratings yet

- Pre-Market Pulse 18th DecemberDocument8 pagesPre-Market Pulse 18th Decembersumit_mukundNo ratings yet

- Developer's Guide For Creating Scales and TransformationsDocument5 pagesDeveloper's Guide For Creating Scales and Transformationssumit_mukundNo ratings yet

- Python LearnDocument1 pagePython Learnsumit_mukundNo ratings yet

- Sales and LeaseDocument12 pagesSales and LeaseJemNo ratings yet

- Mix Case LawsDocument6 pagesMix Case LawsAdv Sohail BhattiNo ratings yet

- Sampling Conditioning SystemDocument24 pagesSampling Conditioning System王祚No ratings yet

- The Vertues and Vertuous Actions of The Scared Month of Rajab by Ataul Mustafa AmjadiDocument4 pagesThe Vertues and Vertuous Actions of The Scared Month of Rajab by Ataul Mustafa AmjadiMohammad Izharun Nabi HussainiNo ratings yet

- Nbi 1ST Time Jobseeker FormDocument3 pagesNbi 1ST Time Jobseeker FormCressa JakosalemNo ratings yet

- Tubektomi VasektomiDocument60 pagesTubektomi Vasektomibayu indrayana irsyadNo ratings yet

- VTOL - WikipediaDocument46 pagesVTOL - WikipediaLeng ChaiNo ratings yet

- Hungarian SelftaughtDocument136 pagesHungarian Selftaughtbearinghu100% (11)

- Hueysuwan-Florido V FloridoDocument2 pagesHueysuwan-Florido V Floridoejusdem generisNo ratings yet

- Embrace Gas Services PVT LTD: ReadingDocument1 pageEmbrace Gas Services PVT LTD: ReadingVivek TripathiNo ratings yet

- 2058 Copyright Acknowledgement Booklet 2019 03 March SeriesDocument10 pages2058 Copyright Acknowledgement Booklet 2019 03 March SeriesTeacher HaqqiNo ratings yet

- AHW3e L3 Skills Test 4Document4 pagesAHW3e L3 Skills Test 4Lucero TapiaNo ratings yet

- Advanced Phrases For English ConversationsDocument6 pagesAdvanced Phrases For English Conversationsannakolesnik00No ratings yet

- Notas King ArthurDocument6 pagesNotas King ArthurNayeli EncaladaNo ratings yet

- Belief in Divine Decree in IslamDocument2 pagesBelief in Divine Decree in IslamahmadnaiemNo ratings yet

- Republic Acts For Urban DevelopmentDocument92 pagesRepublic Acts For Urban DevelopmentAnamarie C. CamasinNo ratings yet

- The Bible Guide - by Vance FerrellDocument246 pagesThe Bible Guide - by Vance FerrellAdventist_Truth100% (7)

- The Tail Wags The Dog Jason RobertsonDocument3 pagesThe Tail Wags The Dog Jason RobertsonIvonne Flores FernándezNo ratings yet

- Bible QuizDocument2 pagesBible QuizPrudence Chigozie Smart100% (1)

- Belgrade Retail Market Report Q2 2013Document3 pagesBelgrade Retail Market Report Q2 2013Author LesNo ratings yet

- Portfolio Educational PhilosophyDocument3 pagesPortfolio Educational Philosophyapi-507434783No ratings yet

- 12814/STEEL EXP Second Sitting (2S)Document2 pages12814/STEEL EXP Second Sitting (2S)AYUSH SINGHNo ratings yet

- Affidavit of Khristina McLaughlinDocument9 pagesAffidavit of Khristina McLaughlinRachel OldingNo ratings yet

- Shubham: Admit Card Online Written Test For JUNIOR ENGINEER TRAINEE (JET) - 2020Document2 pagesShubham: Admit Card Online Written Test For JUNIOR ENGINEER TRAINEE (JET) - 2020SHUBHAM YadavNo ratings yet

- Hcs 608 Assignment 2 - Purvasha SharanDocument13 pagesHcs 608 Assignment 2 - Purvasha Sharanpurvashasharan16No ratings yet

- Excerpt of "Identity: The Demand For Dignity and The Politics of Resentment"Document5 pagesExcerpt of "Identity: The Demand For Dignity and The Politics of Resentment"wamu885100% (1)

- Structure of Araby by MandelDocument8 pagesStructure of Araby by MandelevansNo ratings yet

- Nama: Muhammad Cincin Rakhmadila Kelas: Vii-I No. Absen: 17 ANKATAN: 2019/2020 Lawang SewuDocument2 pagesNama: Muhammad Cincin Rakhmadila Kelas: Vii-I No. Absen: 17 ANKATAN: 2019/2020 Lawang SewuIXC-19-Muhammad Cincin RakhmadilaNo ratings yet

- RK13AR12ING01PTS 5904717eDocument2 pagesRK13AR12ING01PTS 5904717epatma siswantiNo ratings yet