Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

24 viewsXi See Acc 2021 Set 2 Ms

Xi See Acc 2021 Set 2 Ms

Uploaded by

s1672snehil6353This document provides the marking scheme for the Class 11 Accountancy session ending examination for Kendriya Vidyalaya Sangathan, Chandigarh Region for the 2020-21 academic year. It lists 32 questions from the exam and provides the answers and marks allocated for each question. The exam covers two parts - Part A on Financial Accounting-I and Part B on Financial Accounting-II. The highest mark value for a single question is 8 marks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Management Accounting, 4th Edition (PG 225 253)Document29 pagesManagement Accounting, 4th Edition (PG 225 253)Uncle MattNo ratings yet

- Homemade Leverage - Levered To UnleveredDocument4 pagesHomemade Leverage - Levered To Unleveredakeila3100% (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Sadguru Construction Cma 16-17 To 2020-21Document8 pagesSadguru Construction Cma 16-17 To 2020-21vdtaudit 1No ratings yet

- PresentationDocument5 pagesPresentationJian XiangNo ratings yet

- New Heritage Doll CompanDocument9 pagesNew Heritage Doll CompanArima ChatterjeeNo ratings yet

- MS Accountancy Set 2Document9 pagesMS Accountancy Set 2Tanisha TibrewalNo ratings yet

- Accountancy - Additional Questions MARKING SCHEMEDocument15 pagesAccountancy - Additional Questions MARKING SCHEMEseema chadhaNo ratings yet

- Class 11 Accounts SP 2 Answer KeyDocument18 pagesClass 11 Accounts SP 2 Answer KeyUdyamGNo ratings yet

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- Paper2 Set1 SolutionDocument5 pagesPaper2 Set1 Solutionadityatiwari122006No ratings yet

- Paper2 SolutionDocument10 pagesPaper2 Solutionadityatiwari122006No ratings yet

- Marking Scheme 2020Document5 pagesMarking Scheme 2020Joanna GarciaNo ratings yet

- Paper2 Set2 SolutionDocument7 pagesPaper2 Set2 Solutionadityatiwari122006No ratings yet

- TS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmDocument17 pagesTS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmMayank Garange100% (2)

- BoardPaper 2019 SolutionsDocument7 pagesBoardPaper 2019 Solutionskartik 011No ratings yet

- Answer Keys & Marking Scheme Acc XiiDocument8 pagesAnswer Keys & Marking Scheme Acc XiiGHOST FFNo ratings yet

- Accountancy-MS 23-24Document10 pagesAccountancy-MS 23-24Ashutosh SinghNo ratings yet

- Accountancy MSDocument11 pagesAccountancy MSmansoorbariNo ratings yet

- Answer Key 3Document8 pagesAnswer Key 3Hari prakarsh NimiNo ratings yet

- Set 2 MS, 2ND PBDocument10 pagesSet 2 MS, 2ND PBHarini NarayananNo ratings yet

- Internal Reconstruction - HomeworkDocument25 pagesInternal Reconstruction - HomeworkYash ShewaleNo ratings yet

- XII ACCOUNTANCY SET-2 Marking Scheme Ist Pre Board 2023-24-1Document9 pagesXII ACCOUNTANCY SET-2 Marking Scheme Ist Pre Board 2023-24-1Riddhima Murarka50% (2)

- Internal Reconstruction Part-IIDocument13 pagesInternal Reconstruction Part-IIINTER SMARTIANSNo ratings yet

- ElementsBookKeepingAccountancy MSDocument6 pagesElementsBookKeepingAccountancy MSKanya PrakashNo ratings yet

- Accountancy 2023-24 MSDocument11 pagesAccountancy 2023-24 MSirfanoushad15No ratings yet

- Cbleacpu 07Document10 pagesCbleacpu 07sarathsivadamNo ratings yet

- ProblemsDocument12 pagesProblemsShereen FathimaNo ratings yet

- Marking Scheme Mock Test I 2023 24Document9 pagesMarking Scheme Mock Test I 2023 24HARSH CHAURASIYANo ratings yet

- 2020-BPS - Pre - Board II-Accountancy Answer KeyDocument16 pages2020-BPS - Pre - Board II-Accountancy Answer KeyJoshi DrcpNo ratings yet

- Kendriya Vidyalaya Sangathan, Lucknow Region TERM-II 2021-22 Marking Scheme Class - XI Subject - AccountancyDocument4 pagesKendriya Vidyalaya Sangathan, Lucknow Region TERM-II 2021-22 Marking Scheme Class - XI Subject - AccountancyThe Web RendezvousNo ratings yet

- Cbse cl12 Ead Accountancy Answers To Sample Paper 6Document15 pagesCbse cl12 Ead Accountancy Answers To Sample Paper 6amaankhan828768No ratings yet

- XI Account MSDocument6 pagesXI Account MSrohanjithesh2525No ratings yet

- XII Accountancy MorningDocument18 pagesXII Accountancy Morningarihant jainNo ratings yet

- RKG Accounts (XI) CH 9 To 16 SolDocument3 pagesRKG Accounts (XI) CH 9 To 16 SolJohn WickNo ratings yet

- Ledger Book Question SolutionDocument78 pagesLedger Book Question SolutionAKSHAY KUMAR GUPTANo ratings yet

- RKG Class 11 Accounts Mock 1 SolDocument14 pagesRKG Class 11 Accounts Mock 1 SolSangket MukherjeeNo ratings yet

- Introduction To Financial Accounting: Suggested Answers Foundation Examinations - Spring 2011Document5 pagesIntroduction To Financial Accounting: Suggested Answers Foundation Examinations - Spring 2011adnanNo ratings yet

- 5.cpbe - Xii Accts - MSDocument18 pages5.cpbe - Xii Accts - MScommerce12onlineclassesNo ratings yet

- Partnership - Admission of Partner - DPP 10 (Of Lecture 12) - (Kautilya)Document8 pagesPartnership - Admission of Partner - DPP 10 (Of Lecture 12) - (Kautilya)Shreyash JhaNo ratings yet

- Sample Paper 5 (Final Exam XI Accountancy)Document9 pagesSample Paper 5 (Final Exam XI Accountancy)pritanshutripathi84No ratings yet

- 1styr 1stMT Financial Accounting and Reporting 2324Document31 pages1styr 1stMT Financial Accounting and Reporting 2324MaryNo ratings yet

- Sample Paper AccountsDocument7 pagesSample Paper AccountsmenekyakiaNo ratings yet

- MS - Accountancy - 12-Practice Paper-1Document7 pagesMS - Accountancy - 12-Practice Paper-1Arun kumarNo ratings yet

- MS Accountancy Set 5Document9 pagesMS Accountancy Set 5Tanisha TibrewalNo ratings yet

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadNo ratings yet

- Finals 2019Document4 pagesFinals 2019GargiNo ratings yet

- CCP402Document19 pagesCCP402api-3849444No ratings yet

- 12 Accountancy sp10Document26 pages12 Accountancy sp10Akshat AgarwalNo ratings yet

- Accountancy Sample Paper Jan2021 Class 11 With Solutions Set 1 2020 2021Document21 pagesAccountancy Sample Paper Jan2021 Class 11 With Solutions Set 1 2020 2021Devang 15 XII COMMNo ratings yet

- Financial Accounting - B, Com Sem I NEP 2022 PDFDocument6 pagesFinancial Accounting - B, Com Sem I NEP 2022 PDF『SHREYAS NAIDU』No ratings yet

- FT GR12 Acak Set1 - 17832Document5 pagesFT GR12 Acak Set1 - 17832Amaan AbbasNo ratings yet

- JournalDocument5 pagesJournalGanapathi VNo ratings yet

- QUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsDocument13 pagesQUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsSiddharth VoraNo ratings yet

- 12 Accountancy sp06Document28 pages12 Accountancy sp06Jaydev JaydevNo ratings yet

- Poa Multiple Choice Questions 6-10Document11 pagesPoa Multiple Choice Questions 6-10AsishMohapatra100% (1)

- Model Test Paper-5Document26 pagesModel Test Paper-5Lavagreat The greatNo ratings yet

- MCQs On Cash Book & Ledgers PDFDocument11 pagesMCQs On Cash Book & Ledgers PDFHaroon Akhtar100% (1)

- Set - 1 Acc MS PB12023-24Document10 pagesSet - 1 Acc MS PB12023-24aamiralishiasbackup1No ratings yet

- Midterm - Business Acctg - To PrintDocument7 pagesMidterm - Business Acctg - To PrintSHENo ratings yet

- Chapter 9Document7 pagesChapter 9Saharin Islam ShakibNo ratings yet

- Answers To NavneetDocument12 pagesAnswers To NavneetPawan TalrejaNo ratings yet

- Caa Assignment SolutionsDocument39 pagesCaa Assignment Solutionschikanesakshi2001No ratings yet

- Acct Practice PaperDocument11 pagesAcct Practice PaperKrish BajajNo ratings yet

- Business Valuation MethodsDocument10 pagesBusiness Valuation Methodsraj28_999No ratings yet

- 50 Q AuditingDocument45 pages50 Q Auditingnickle kanthNo ratings yet

- Assets Would Have Increased P55,000Document4 pagesAssets Would Have Increased P55,000Louise100% (1)

- Spice Jet Data For Business Analytics'Document47 pagesSpice Jet Data For Business Analytics'Namita BhattNo ratings yet

- Individual Assignment OneDocument3 pagesIndividual Assignment OnefeyselNo ratings yet

- IAS 36 - Impairment of Non-Current AssetsDocument7 pagesIAS 36 - Impairment of Non-Current AssetsEric Agyenim-BoatengNo ratings yet

- Study Material Memorandum of Association PDFDocument3 pagesStudy Material Memorandum of Association PDFSaptarshi DasNo ratings yet

- Poppyside Designated Activity Company FSDocument17 pagesPoppyside Designated Activity Company FSsonika.anand11No ratings yet

- Gitman IM Ch09Document24 pagesGitman IM Ch09Imran FarmanNo ratings yet

- Week-2-Chapter-3-Financial-Build-A-Mode LDocument7 pagesWeek-2-Chapter-3-Financial-Build-A-Mode LCrusty GirlNo ratings yet

- 1.what Is GDR?Document2 pages1.what Is GDR?btamilarasan88No ratings yet

- Premium Advance Test Schedule Single Chapter CS Executive Dec-23Document31 pagesPremium Advance Test Schedule Single Chapter CS Executive Dec-23Puja ShawNo ratings yet

- Mba Strategic Management Unit 4 2020Document42 pagesMba Strategic Management Unit 4 2020IvannaNo ratings yet

- Jan 192014 Dos 01 eDocument11 pagesJan 192014 Dos 01 erakhalbanglaNo ratings yet

- Full Download Intermediate Accounting 2nd Edition Gordon Solutions ManualDocument35 pagesFull Download Intermediate Accounting 2nd Edition Gordon Solutions Manualashero2eford100% (51)

- MSFT Valuation 28 Sept 2019Document51 pagesMSFT Valuation 28 Sept 2019ket careNo ratings yet

- Nism Sorm NotesDocument25 pagesNism Sorm NotesdikpalakNo ratings yet

- Waterloo ACTSC372 Lec 1Document15 pagesWaterloo ACTSC372 Lec 1Claire ZhangNo ratings yet

- Accounting For Intangible Assets (PAS 38) : UE UEDocument106 pagesAccounting For Intangible Assets (PAS 38) : UE UEJay-L TanNo ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- Indian CG Scorecard PDFDocument91 pagesIndian CG Scorecard PDFJill MehtaNo ratings yet

- ROA and ROEDocument20 pagesROA and ROEPassmore DubeNo ratings yet

- ch13 CURRENT LIABILITIES AND CONTINGENCIES PDFDocument37 pagesch13 CURRENT LIABILITIES AND CONTINGENCIES PDFRenz AlconeraNo ratings yet

- Marginal Costing in PepsicoDocument38 pagesMarginal Costing in Pepsicopallavi21_1992No ratings yet

- ACCTBA2 ReviewerDocument49 pagesACCTBA2 ReviewerBiean Abao100% (2)

Xi See Acc 2021 Set 2 Ms

Xi See Acc 2021 Set 2 Ms

Uploaded by

s1672snehil63530 ratings0% found this document useful (0 votes)

24 views5 pagesThis document provides the marking scheme for the Class 11 Accountancy session ending examination for Kendriya Vidyalaya Sangathan, Chandigarh Region for the 2020-21 academic year. It lists 32 questions from the exam and provides the answers and marks allocated for each question. The exam covers two parts - Part A on Financial Accounting-I and Part B on Financial Accounting-II. The highest mark value for a single question is 8 marks.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides the marking scheme for the Class 11 Accountancy session ending examination for Kendriya Vidyalaya Sangathan, Chandigarh Region for the 2020-21 academic year. It lists 32 questions from the exam and provides the answers and marks allocated for each question. The exam covers two parts - Part A on Financial Accounting-I and Part B on Financial Accounting-II. The highest mark value for a single question is 8 marks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

24 views5 pagesXi See Acc 2021 Set 2 Ms

Xi See Acc 2021 Set 2 Ms

Uploaded by

s1672snehil6353This document provides the marking scheme for the Class 11 Accountancy session ending examination for Kendriya Vidyalaya Sangathan, Chandigarh Region for the 2020-21 academic year. It lists 32 questions from the exam and provides the answers and marks allocated for each question. The exam covers two parts - Part A on Financial Accounting-I and Part B on Financial Accounting-II. The highest mark value for a single question is 8 marks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 5

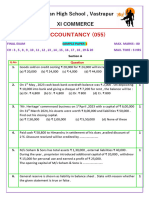

KENDRIYA VIDYALAYA SANGATHAN, CHANDIGARH REGION

SESSION ENDING EXAMINATION

CLASS - XI

ACCOUNTANCY

(2020-21)

TIME ALLOWED: 3 HOURS M.M.: 80

MARKING SCHEME

Q. NO. ANSWER MARKS

PART A : FINANCIAL ACCOUNTING-I

1. C)Banks and Financial Institutions 1

2. Journalising 1

3. B) On being incurred 1

4. Debit 1

5. Dual Aspect Concept 1

6. Voucher is an evidence of business transaction. 1

7. True 1

8. A) Internal Liability 1

9. D) Journal proper 1

10. B)Output CGST and SGST 1

11. It is a book which is maintained for recording expenses involving small 1

amounts.

12. C)Nominal accounts 1

13. It is a reserve created out of capital profits and are not normally available 1

for distribution as dividend

14. Correct meaning of Accounting. (1 mark) 3

Objectives:(Any Four)

1. Maintaining accounting records

2. Determining Profit or Loss

3. Determining Financial Position

4. Facilitating management

5. Protecting business assets

6. Providing information to users.

7. Any other suitable point (1/2 mark for each 1/2*4=2)

OR

Page PAGE 5 of NUMPAGES 5

1 mark each for one limitation (1*3=3 marks)

15. Cash Balance Rs. 23,500 4

Amount deposited in bank on 28th July Rs. 1,00,000

Bank Balance Rs. 1,43,500

16. 4

Journal

Date Particulars L. F Dr. Cr.

Amount Amount

(a) Purchases A/c ..Dr 20,000

Input CGST A/c ..Dr 1,200

Input SGST A/c ..Dr 1,200

To Cash A/c 22,400

(b) Bad Debts A/c ..Dr 3,600

Cash A/c ..Dr 2,400

To Ameesh A/c 6,000

(c ) Drawings A/c ..Dr 5,000

To Purchases A/c 5,000

(d) Salary A/c ..Dr 3,000

To Outstanding Salary A/c 3,000

17. 2 marks each for Correct explanation of concepts. 4

OR

A) Matching Concept

B) Accrual Concept

C) Business Entity Concept

D) Revenue Recognition Concept.

18. Credit balance as per Pass Book Rs.10,720 4

19. Journal 6

Date Particulars L..F Dr. Cr.

Amount Amount

(a) Suspense A/c ..Dr 1,000

To Sales Return A/c 1,000

(b) Machinery A/c ..Dr 9,600

To Kunal A/c 2,700

To Purchases A/c 6,900

Page PAGE 5 of NUMPAGES 5

(c ) Y A/c ..Dr 1,000

To X A/c 1,000

(d) Purchases A/c ..Dr 5,000

Purchase Return A/c ..Dr 5,000

To Suspense A/c 10,000

(e) Rent A/c ..Dr 12,000

To Landlord A/c 12,000

(f) Cash A/c ..Dr 3,000

To Bad Debts Recovered A/c 3,000

20. Books of A 6

Date Particulars L.F Dr. Cr.

Amount Amount

1.1.20 Bill Receivable I A/c ..Dr 5,000

Bill Receivable II A/c ..Dr 10,000

To B A/c 15,000

4.3.20 B A/c ..Dr 5,050

To Bill Receivable I A/c 5,000

To Cash A/c 50

4.3.20 Bank A/c ..Dr 9,925

Discount A/c ..Dr 75

To Bill Receivable II A/c 10,000

4.4.20 B A/c ..Dr 10,080

To Bank A/c 10,080

Books of B

Date Particulars L.F Dr. Cr.

Amount Amount

1.1.20 A A/c ..Dr 15,000

To Bill Payable I A/c 5,000

To Bill Payable II A/c 10,000

4.3.20 Bill Payable I A/c ..Dr 5,000

Noting Charges A/c ..Dr 50

To A A/c 5,050

Page PAGE 5 of NUMPAGES 5

4.4.20 Bill Payable II A/c ..Dr 10,000

Noting Charges A/c ..Dr 80

To A A/c 10,080

21. 2016-17 Depreciation Rs.4000; Balance of Machinery Rs 76,000 8

2017-18 Depreciation Rs. 9,600; Balance of Machinery Rs. 1,26,400

2018-19 Depreciation on sold machine Rs. 1,140; Loss on sale Rs. 6,660

Depreciation on remaining machines Rs. 12,610; Balance of

machinery Rs 1,20,990.

OR

2015-16 Depreciation Rs.10,000; Balance of Trucks Rs 90,000

2016-17 Depreciation on sold machine Rs. 1,500; Profit on sale Rs.

1,500; Balance of Trucks Rs. 64,000

2017-18 Depreciation on sold machine Rs.500; Loss on sale Rs. 500

Depreciation on remaining machines Rs. 6,000; Balance of

Trucks Rs. 42,000.

PART B : FINANCIAL ACCOUNTING-II

22. B) Volatile Memory 1

23. A) Readymade Software 1

24. Marshalling of assets and liabilities means arranging the assets and 1

liabilities in a particular order, i.e. in order of permanence or in order of

liquidity

25. B) Advertising Campaign to lauch a new product. 1

26. C) Monitor 1

27. Rs. 8,000 1

28. Software 1

29. Cost of goods sold= Rs. 9,50,000 2 marks 3

Gross profit = Rs. 50,000 1 mark

OR

Cost of goods sold = Cost of goods produced- closing stock

= Rs. 3,50,000- Rs. 50,000

=Rs. 3,00,000 (0.5 mark)

Cost of goods sold = Sales- Gross profit

Page PAGE 5 of NUMPAGES 5

3,00,000 =Sales- 1/5 Sales

3,00,000 =4/5 Sales

3,00,000*5/4 = Sales

3,75,000 =Sales (1.5 mark)

Gross profit= Sales - cost of goods sold

= Rs. 3,75,000- Rs. 3,00,000

= Rs. 75,000 ( 1mark)

30. Four advantages of computerised accounting system over manual 4

accounting system

OR

2 marks each for correct explanation of customised and readymade

accounting software.

31. Opening Capital Rs. 5,63,000 6

Closing Capital Rs. 6,12,000

Profit during the year Rs. 84,000

32. Gross profit Rs. 44,500 8

Net profit Rs. 24,600

Balance sheet Total Rs. 89,400

OR

Gross profit Rs. 1,79,000

Net profit Rs. 1,29,100

Balance sheet Total Rs. 3,66,000

Page PAGE 5 of NUMPAGES 5

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Management Accounting, 4th Edition (PG 225 253)Document29 pagesManagement Accounting, 4th Edition (PG 225 253)Uncle MattNo ratings yet

- Homemade Leverage - Levered To UnleveredDocument4 pagesHomemade Leverage - Levered To Unleveredakeila3100% (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Sadguru Construction Cma 16-17 To 2020-21Document8 pagesSadguru Construction Cma 16-17 To 2020-21vdtaudit 1No ratings yet

- PresentationDocument5 pagesPresentationJian XiangNo ratings yet

- New Heritage Doll CompanDocument9 pagesNew Heritage Doll CompanArima ChatterjeeNo ratings yet

- MS Accountancy Set 2Document9 pagesMS Accountancy Set 2Tanisha TibrewalNo ratings yet

- Accountancy - Additional Questions MARKING SCHEMEDocument15 pagesAccountancy - Additional Questions MARKING SCHEMEseema chadhaNo ratings yet

- Class 11 Accounts SP 2 Answer KeyDocument18 pagesClass 11 Accounts SP 2 Answer KeyUdyamGNo ratings yet

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- Paper2 Set1 SolutionDocument5 pagesPaper2 Set1 Solutionadityatiwari122006No ratings yet

- Paper2 SolutionDocument10 pagesPaper2 Solutionadityatiwari122006No ratings yet

- Marking Scheme 2020Document5 pagesMarking Scheme 2020Joanna GarciaNo ratings yet

- Paper2 Set2 SolutionDocument7 pagesPaper2 Set2 Solutionadityatiwari122006No ratings yet

- TS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmDocument17 pagesTS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmMayank Garange100% (2)

- BoardPaper 2019 SolutionsDocument7 pagesBoardPaper 2019 Solutionskartik 011No ratings yet

- Answer Keys & Marking Scheme Acc XiiDocument8 pagesAnswer Keys & Marking Scheme Acc XiiGHOST FFNo ratings yet

- Accountancy-MS 23-24Document10 pagesAccountancy-MS 23-24Ashutosh SinghNo ratings yet

- Accountancy MSDocument11 pagesAccountancy MSmansoorbariNo ratings yet

- Answer Key 3Document8 pagesAnswer Key 3Hari prakarsh NimiNo ratings yet

- Set 2 MS, 2ND PBDocument10 pagesSet 2 MS, 2ND PBHarini NarayananNo ratings yet

- Internal Reconstruction - HomeworkDocument25 pagesInternal Reconstruction - HomeworkYash ShewaleNo ratings yet

- XII ACCOUNTANCY SET-2 Marking Scheme Ist Pre Board 2023-24-1Document9 pagesXII ACCOUNTANCY SET-2 Marking Scheme Ist Pre Board 2023-24-1Riddhima Murarka50% (2)

- Internal Reconstruction Part-IIDocument13 pagesInternal Reconstruction Part-IIINTER SMARTIANSNo ratings yet

- ElementsBookKeepingAccountancy MSDocument6 pagesElementsBookKeepingAccountancy MSKanya PrakashNo ratings yet

- Accountancy 2023-24 MSDocument11 pagesAccountancy 2023-24 MSirfanoushad15No ratings yet

- Cbleacpu 07Document10 pagesCbleacpu 07sarathsivadamNo ratings yet

- ProblemsDocument12 pagesProblemsShereen FathimaNo ratings yet

- Marking Scheme Mock Test I 2023 24Document9 pagesMarking Scheme Mock Test I 2023 24HARSH CHAURASIYANo ratings yet

- 2020-BPS - Pre - Board II-Accountancy Answer KeyDocument16 pages2020-BPS - Pre - Board II-Accountancy Answer KeyJoshi DrcpNo ratings yet

- Kendriya Vidyalaya Sangathan, Lucknow Region TERM-II 2021-22 Marking Scheme Class - XI Subject - AccountancyDocument4 pagesKendriya Vidyalaya Sangathan, Lucknow Region TERM-II 2021-22 Marking Scheme Class - XI Subject - AccountancyThe Web RendezvousNo ratings yet

- Cbse cl12 Ead Accountancy Answers To Sample Paper 6Document15 pagesCbse cl12 Ead Accountancy Answers To Sample Paper 6amaankhan828768No ratings yet

- XI Account MSDocument6 pagesXI Account MSrohanjithesh2525No ratings yet

- XII Accountancy MorningDocument18 pagesXII Accountancy Morningarihant jainNo ratings yet

- RKG Accounts (XI) CH 9 To 16 SolDocument3 pagesRKG Accounts (XI) CH 9 To 16 SolJohn WickNo ratings yet

- Ledger Book Question SolutionDocument78 pagesLedger Book Question SolutionAKSHAY KUMAR GUPTANo ratings yet

- RKG Class 11 Accounts Mock 1 SolDocument14 pagesRKG Class 11 Accounts Mock 1 SolSangket MukherjeeNo ratings yet

- Introduction To Financial Accounting: Suggested Answers Foundation Examinations - Spring 2011Document5 pagesIntroduction To Financial Accounting: Suggested Answers Foundation Examinations - Spring 2011adnanNo ratings yet

- 5.cpbe - Xii Accts - MSDocument18 pages5.cpbe - Xii Accts - MScommerce12onlineclassesNo ratings yet

- Partnership - Admission of Partner - DPP 10 (Of Lecture 12) - (Kautilya)Document8 pagesPartnership - Admission of Partner - DPP 10 (Of Lecture 12) - (Kautilya)Shreyash JhaNo ratings yet

- Sample Paper 5 (Final Exam XI Accountancy)Document9 pagesSample Paper 5 (Final Exam XI Accountancy)pritanshutripathi84No ratings yet

- 1styr 1stMT Financial Accounting and Reporting 2324Document31 pages1styr 1stMT Financial Accounting and Reporting 2324MaryNo ratings yet

- Sample Paper AccountsDocument7 pagesSample Paper AccountsmenekyakiaNo ratings yet

- MS - Accountancy - 12-Practice Paper-1Document7 pagesMS - Accountancy - 12-Practice Paper-1Arun kumarNo ratings yet

- MS Accountancy Set 5Document9 pagesMS Accountancy Set 5Tanisha TibrewalNo ratings yet

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadNo ratings yet

- Finals 2019Document4 pagesFinals 2019GargiNo ratings yet

- CCP402Document19 pagesCCP402api-3849444No ratings yet

- 12 Accountancy sp10Document26 pages12 Accountancy sp10Akshat AgarwalNo ratings yet

- Accountancy Sample Paper Jan2021 Class 11 With Solutions Set 1 2020 2021Document21 pagesAccountancy Sample Paper Jan2021 Class 11 With Solutions Set 1 2020 2021Devang 15 XII COMMNo ratings yet

- Financial Accounting - B, Com Sem I NEP 2022 PDFDocument6 pagesFinancial Accounting - B, Com Sem I NEP 2022 PDF『SHREYAS NAIDU』No ratings yet

- FT GR12 Acak Set1 - 17832Document5 pagesFT GR12 Acak Set1 - 17832Amaan AbbasNo ratings yet

- JournalDocument5 pagesJournalGanapathi VNo ratings yet

- QUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsDocument13 pagesQUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsSiddharth VoraNo ratings yet

- 12 Accountancy sp06Document28 pages12 Accountancy sp06Jaydev JaydevNo ratings yet

- Poa Multiple Choice Questions 6-10Document11 pagesPoa Multiple Choice Questions 6-10AsishMohapatra100% (1)

- Model Test Paper-5Document26 pagesModel Test Paper-5Lavagreat The greatNo ratings yet

- MCQs On Cash Book & Ledgers PDFDocument11 pagesMCQs On Cash Book & Ledgers PDFHaroon Akhtar100% (1)

- Set - 1 Acc MS PB12023-24Document10 pagesSet - 1 Acc MS PB12023-24aamiralishiasbackup1No ratings yet

- Midterm - Business Acctg - To PrintDocument7 pagesMidterm - Business Acctg - To PrintSHENo ratings yet

- Chapter 9Document7 pagesChapter 9Saharin Islam ShakibNo ratings yet

- Answers To NavneetDocument12 pagesAnswers To NavneetPawan TalrejaNo ratings yet

- Caa Assignment SolutionsDocument39 pagesCaa Assignment Solutionschikanesakshi2001No ratings yet

- Acct Practice PaperDocument11 pagesAcct Practice PaperKrish BajajNo ratings yet

- Business Valuation MethodsDocument10 pagesBusiness Valuation Methodsraj28_999No ratings yet

- 50 Q AuditingDocument45 pages50 Q Auditingnickle kanthNo ratings yet

- Assets Would Have Increased P55,000Document4 pagesAssets Would Have Increased P55,000Louise100% (1)

- Spice Jet Data For Business Analytics'Document47 pagesSpice Jet Data For Business Analytics'Namita BhattNo ratings yet

- Individual Assignment OneDocument3 pagesIndividual Assignment OnefeyselNo ratings yet

- IAS 36 - Impairment of Non-Current AssetsDocument7 pagesIAS 36 - Impairment of Non-Current AssetsEric Agyenim-BoatengNo ratings yet

- Study Material Memorandum of Association PDFDocument3 pagesStudy Material Memorandum of Association PDFSaptarshi DasNo ratings yet

- Poppyside Designated Activity Company FSDocument17 pagesPoppyside Designated Activity Company FSsonika.anand11No ratings yet

- Gitman IM Ch09Document24 pagesGitman IM Ch09Imran FarmanNo ratings yet

- Week-2-Chapter-3-Financial-Build-A-Mode LDocument7 pagesWeek-2-Chapter-3-Financial-Build-A-Mode LCrusty GirlNo ratings yet

- 1.what Is GDR?Document2 pages1.what Is GDR?btamilarasan88No ratings yet

- Premium Advance Test Schedule Single Chapter CS Executive Dec-23Document31 pagesPremium Advance Test Schedule Single Chapter CS Executive Dec-23Puja ShawNo ratings yet

- Mba Strategic Management Unit 4 2020Document42 pagesMba Strategic Management Unit 4 2020IvannaNo ratings yet

- Jan 192014 Dos 01 eDocument11 pagesJan 192014 Dos 01 erakhalbanglaNo ratings yet

- Full Download Intermediate Accounting 2nd Edition Gordon Solutions ManualDocument35 pagesFull Download Intermediate Accounting 2nd Edition Gordon Solutions Manualashero2eford100% (51)

- MSFT Valuation 28 Sept 2019Document51 pagesMSFT Valuation 28 Sept 2019ket careNo ratings yet

- Nism Sorm NotesDocument25 pagesNism Sorm NotesdikpalakNo ratings yet

- Waterloo ACTSC372 Lec 1Document15 pagesWaterloo ACTSC372 Lec 1Claire ZhangNo ratings yet

- Accounting For Intangible Assets (PAS 38) : UE UEDocument106 pagesAccounting For Intangible Assets (PAS 38) : UE UEJay-L TanNo ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- Indian CG Scorecard PDFDocument91 pagesIndian CG Scorecard PDFJill MehtaNo ratings yet

- ROA and ROEDocument20 pagesROA and ROEPassmore DubeNo ratings yet

- ch13 CURRENT LIABILITIES AND CONTINGENCIES PDFDocument37 pagesch13 CURRENT LIABILITIES AND CONTINGENCIES PDFRenz AlconeraNo ratings yet

- Marginal Costing in PepsicoDocument38 pagesMarginal Costing in Pepsicopallavi21_1992No ratings yet

- ACCTBA2 ReviewerDocument49 pagesACCTBA2 ReviewerBiean Abao100% (2)