Professional Documents

Culture Documents

Account Set A

Account Set A

Uploaded by

Nayan KcCopyright:

Available Formats

You might also like

- Coca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)Document7 pagesCoca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)sarthak mendiratta100% (1)

- MidTerm ExamDocument15 pagesMidTerm ExamYonatan Wadler100% (2)

- Accounts Project Isc (Mine)Document12 pagesAccounts Project Isc (Mine)Rahit Mitra100% (2)

- Chapter 3 ExercisesDocument11 pagesChapter 3 ExercisesNguyen VyNo ratings yet

- Account Set BDocument4 pagesAccount Set BNayan KcNo ratings yet

- Accountancy: Pre-Board Examinations 2078Document3 pagesAccountancy: Pre-Board Examinations 2078Herman PecassaNo ratings yet

- Account XII For Board Exam PracticeDocument18 pagesAccount XII For Board Exam PracticeBicky ShahNo ratings yet

- Rspu 8Document10 pagesRspu 8ashmit chadhaNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- DR AKL Corporate Oct21 CIA 2021Document2 pagesDR AKL Corporate Oct21 CIA 2021Saif UddeenNo ratings yet

- Ca QP ModelDocument3 pagesCa QP Modelmahabalu123456789No ratings yet

- Khwopa2080 XII Board Exam Base 5 Model Practice Sets 2080Document15 pagesKhwopa2080 XII Board Exam Base 5 Model Practice Sets 2080bikki2ehNo ratings yet

- 1e710c6f-4b3e-4b03-943f-11430d867f0e-Document30 pages1e710c6f-4b3e-4b03-943f-11430d867f0e-angela antoniaNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- Jorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Document3 pagesJorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Abin DhakalNo ratings yet

- OCTOBER 2019: Reg. No.Document6 pagesOCTOBER 2019: Reg. No.Selvi SelviNo ratings yet

- Advanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversityDocument13 pagesAdvanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversitySaif Uddin33% (3)

- Shares & Debentures TestDocument10 pagesShares & Debentures TestAthul Krishna KNo ratings yet

- Account Model QuestionsDocument41 pagesAccount Model QuestionsPrerana NepaliNo ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Shares Forfeiture & ReissueDocument5 pagesShares Forfeiture & ReissueUnknownNo ratings yet

- Corporate AccountingDocument32 pagesCorporate AccountingSaran Ranny100% (1)

- Issue of Shares Most Important Part 1Document25 pagesIssue of Shares Most Important Part 1mainikunal09No ratings yet

- CBSE Class 12 Accountancy Accounting For Share Capital and Debenture WorksheetDocument3 pagesCBSE Class 12 Accountancy Accounting For Share Capital and Debenture WorksheetJenneil CarmichaelNo ratings yet

- Company AccountsDocument3 pagesCompany AccountsYATTIN KHANNANo ratings yet

- Shares 2024 Final PDF SPCC - 98efd20d c80b 4cd4 A01b 6ce76136740cDocument106 pagesShares 2024 Final PDF SPCC - 98efd20d c80b 4cd4 A01b 6ce76136740cDaksh YadavNo ratings yet

- Abc Unit 3 PDFDocument7 pagesAbc Unit 3 PDFLuckygirl JyothiNo ratings yet

- Lecture 11-Forfeiture of SharesDocument12 pagesLecture 11-Forfeiture of SharesAwab HamidNo ratings yet

- Test 2 QPDocument8 pagesTest 2 QPDharmateja ChakriNo ratings yet

- Chapter - 7: Case/Source Based Questions:: Kvs Ziet Bhubaneswar 12/10/2021Document18 pagesChapter - 7: Case/Source Based Questions:: Kvs Ziet Bhubaneswar 12/10/2021abiNo ratings yet

- Corporate Accounting Exam Questions PaperDocument7 pagesCorporate Accounting Exam Questions PaperAmmar Bin NasirNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 21100518 Mar 2021Document5 pagesBcom 3 Sem Corporate Accounting 1 21100518 Mar 2021abin.com22No ratings yet

- Shares Class PPT Sunil PandaDocument60 pagesShares Class PPT Sunil Pandadollpees01No ratings yet

- 2019 Paper - DSE5.1A Sub - Corporate Accounting Time - 3 Hours Full Marks - 80Document4 pages2019 Paper - DSE5.1A Sub - Corporate Accounting Time - 3 Hours Full Marks - 80tanmoy sardarNo ratings yet

- Worksheet - Accounting For Share CapitalDocument6 pagesWorksheet - Accounting For Share CapitalPrisha SharmaNo ratings yet

- 5th Account Gobind Kumar Jha 9874411552Document69 pages5th Account Gobind Kumar Jha 9874411552binay chaudharyNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Class XiithDocument11 pagesClass XiithSantvana ChaturvediNo ratings yet

- Share CapitalDocument10 pagesShare CapitalShreyas PremiumNo ratings yet

- Kami Export - Issue of Shares SQPDocument8 pagesKami Export - Issue of Shares SQPtawwabsayedNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationDocument3 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationKashifNo ratings yet

- June 2019 All Paper SuggestedDocument120 pagesJune 2019 All Paper SuggestedEdtech NepalNo ratings yet

- Account Scanner by GKJDocument53 pagesAccount Scanner by GKJsintisharma67No ratings yet

- Small Sums in Issue of SharesDocument10 pagesSmall Sums in Issue of SharesHamza MudassirNo ratings yet

- Question Bank (Repaired)Document7 pagesQuestion Bank (Repaired)jayeshNo ratings yet

- Class 12 Account Set 2 Grade Increment Examination Question PaperDocument10 pagesClass 12 Account Set 2 Grade Increment Examination Question PaperPrem RajwanshiNo ratings yet

- ACCOUNTANCY - 9 - by Saravanan.bDocument13 pagesACCOUNTANCY - 9 - by Saravanan.bnirmalsaravanan916No ratings yet

- Internal ReconstructionDocument5 pagesInternal ReconstructionJoshua StarkNo ratings yet

- Admsn ShareDocument2 pagesAdmsn Shareak99archana1999No ratings yet

- Question Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowDocument16 pagesQuestion Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowRaveendra KJNo ratings yet

- Corp Accounting 9th AugustDocument53 pagesCorp Accounting 9th AugustParkavi ArunachalamNo ratings yet

- Apex College: (Pre-University Exam)Document2 pagesApex College: (Pre-University Exam)ali333444No ratings yet

- Adobe Scan 13-Jun-2023Document1 pageAdobe Scan 13-Jun-2023Himanshi BhatiaNo ratings yet

- A Ccount 12 2059 ChaitraDocument2 pagesA Ccount 12 2059 ChaitraNayan KcNo ratings yet

- 6 Winding Up of Companies61059595441467158Document11 pages6 Winding Up of Companies61059595441467158Prabin sthaNo ratings yet

- Shivaraj Corrporeting Acconting 3rd SemDocument9 pagesShivaraj Corrporeting Acconting 3rd Semshivaraj gowdaNo ratings yet

- 12 Accountancy Accounting For Share Capital and Debenture Impq 1Document8 pages12 Accountancy Accounting For Share Capital and Debenture Impq 1Aejaz MohamedNo ratings yet

- Adv. TestDocument2 pagesAdv. TestHassan Jameel SheikhNo ratings yet

- Liquidation of CompaniesDocument12 pagesLiquidation of CompaniesFaisal ManjiNo ratings yet

- Worksheet For Issue of Share and DebentureDocument2 pagesWorksheet For Issue of Share and DebentureLaxmi Kant SahaniNo ratings yet

- 12 C BK Mock Board PraveenaDocument4 pages12 C BK Mock Board PraveenaAdvanced AcademyNo ratings yet

- RTP Dec 18 QNDocument21 pagesRTP Dec 18 QNbinu100% (1)

- SET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirDocument5 pagesSET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirnisharvishwaNo ratings yet

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)

- Physics UtDocument2 pagesPhysics UtNayan KcNo ratings yet

- Suspend 2Document1 pageSuspend 2Nayan KcNo ratings yet

- Cover Letter For AssistantDocument1 pageCover Letter For AssistantNayan KcNo ratings yet

- NoticeDocument1 pageNoticeNayan KcNo ratings yet

- Chapter 1Document24 pagesChapter 1Nayan Kc100% (1)

- 1.introduction of MarketingDocument12 pages1.introduction of MarketingNayan KcNo ratings yet

- Unit 5 Social Cultural Environment - PDF 5Document6 pagesUnit 5 Social Cultural Environment - PDF 5Nayan KcNo ratings yet

- Gym: Martial Arts: Gym: Martial Arts: Gym: Martial Arts: Gym: Martial ArtsDocument1 pageGym: Martial Arts: Gym: Martial Arts: Gym: Martial Arts: Gym: Martial ArtsNayan KcNo ratings yet

- T/ XL Do XL Lg0F (O LNBF PGLX? T/ XL Do XL Lg0F (O LNBF PGLX? T/ XL Do XL Lg0F (O LNBF PGLX? T/ XL Do XL Lg0F (O LNBF PGLX?Document1 pageT/ XL Do XL Lg0F (O LNBF PGLX? T/ XL Do XL Lg0F (O LNBF PGLX? T/ XL Do XL Lg0F (O LNBF PGLX? T/ XL Do XL Lg0F (O LNBF PGLX?Nayan KcNo ratings yet

- Accounting For General Capital Assets and Capital ProjectsDocument49 pagesAccounting For General Capital Assets and Capital ProjectsMatt100% (3)

- ACC309 - Quiz 01 Intangible Assets and Current LiabilitiesDocument21 pagesACC309 - Quiz 01 Intangible Assets and Current LiabilitiesMariz RapadaNo ratings yet

- Accounting For Business Combination - Practice MaterialDocument2 pagesAccounting For Business Combination - Practice MaterialZYRENE HERNANDEZNo ratings yet

- Financial Accounting and ReportingDocument29 pagesFinancial Accounting and ReportingChjxksjsgskNo ratings yet

- Financial ManagementDocument10 pagesFinancial ManagementAli mohamedNo ratings yet

- Management Accounting: Specimen Exam Applicable From June 2014Document23 pagesManagement Accounting: Specimen Exam Applicable From June 2014Intan ParamithaNo ratings yet

- 11 - Estimation of Doubtful AccountsDocument21 pages11 - Estimation of Doubtful AccountsDidik DidiksterNo ratings yet

- Manufacturing SolutionsDocument8 pagesManufacturing SolutionsMothusi M NtsholeNo ratings yet

- Bwff1013 Foundations of Finance Quiz #3Document8 pagesBwff1013 Foundations of Finance Quiz #3tivaashiniNo ratings yet

- 2-Analysis of Financial StatementsQ&Assg.2Document4 pages2-Analysis of Financial StatementsQ&Assg.2Acha Bacha50% (2)

- Chapter 4 Production CostsDocument18 pagesChapter 4 Production Costs刘文雨杰No ratings yet

- CVP Analysis: PG D M2 0 21-23 RelevantreadingsDocument21 pagesCVP Analysis: PG D M2 0 21-23 RelevantreadingsAthi SivaNo ratings yet

- Fundamentals of AccountingDocument18 pagesFundamentals of AccountingBelle MendozaNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelZaid NaveedNo ratings yet

- Assign 6 Chapter 8 Operating and Financial Leverage Cabrera 2019-2020Document12 pagesAssign 6 Chapter 8 Operating and Financial Leverage Cabrera 2019-2020mhikeedelantar100% (1)

- FAR460 - S - June 2018 - StudentsDocument6 pagesFAR460 - S - June 2018 - StudentsRuzaikha razaliNo ratings yet

- Module 1 - Cost Concepts & Cost BehaviorDocument5 pagesModule 1 - Cost Concepts & Cost BehaviorEmma Mariz GarciaNo ratings yet

- Dividend DecisionsDocument3 pagesDividend DecisionsRatnadeep MitraNo ratings yet

- Liquidation - IllustrationDocument18 pagesLiquidation - IllustrationRizalyn Joy BoloNo ratings yet

- IntAcc 1 by Valix 2023 Edition Answer Key From Chapter 4-14Document137 pagesIntAcc 1 by Valix 2023 Edition Answer Key From Chapter 4-14Bella Flair100% (1)

- Unit 1 Exam Review - Chapters 1-3Document5 pagesUnit 1 Exam Review - Chapters 1-3Jullian LimNo ratings yet

- Uts Finance IvanDocument28 pagesUts Finance IvanIvan ZackyNo ratings yet

- Cost INSTR PPT - Chapter 1 - Overview of Cost & Mgt. AcctDocument53 pagesCost INSTR PPT - Chapter 1 - Overview of Cost & Mgt. AcctAshe BalchaNo ratings yet

- Ex. WorksheetDocument3 pagesEx. WorksheetAllysa Kim RubisNo ratings yet

- Equity Research AssignmentDocument3 pagesEquity Research Assignment201812099 imtnagNo ratings yet

- FM 1 Chapter 3 Module 3Document27 pagesFM 1 Chapter 3 Module 3Kitheia Ostrava Reisenchauer100% (1)

Account Set A

Account Set A

Uploaded by

Nayan KcOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Account Set A

Account Set A

Uploaded by

Nayan KcCopyright:

Available Formats

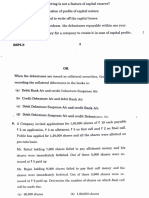

Capitol Hill College To the applicants of 5,000 shares 5,000 shares

Teku, Kathmandu To the applicants of 12,000 shares 5,000 shares

Second Term Examination-2078 To the applicants of 8,000 shares Nil

Subject: Accounting –II It is resolved that the excess amount paid on application is to be adjusted

Level: 12 Code: 1041 Full Marks: 75 against amount due on allotment and call. All the monies were duly received.

Time: 3 hours Pass Marks: 30 Required: Entries for ApplicationAllotmentFirst and final call. [3+1+1]

13. A company limited issued 5,000 shares of Rs. 100 each payable as under: On

Candidates are required to give their answers in their own words as far as

practicable. The figures in the margin indicate full marks. application Rs. 40; On allotment Rs. 30; On first and final call Rs. 30

Attempt ALL questions. Applications were received for 8,000 shares, allotment were made on the

Very Short Answer Question [11×1=11] following basis:

1. What is company? To applicants for 3,000 shares Full

To applicants for 4,000 shares 2,000 shares

2. What do you know about issued capital?

To applicants for 1,000 shares Nil

3. What is forfeiture of share? All excess amount paid on application is to be adjusted against amount due on

4. What do you mean by articles of association? allotment and subsequent calls. The shares were fully called and paid up except

5. Define preliminary expenses. one shareholder to whom 100 shares were allotted failed to pay on first an final

6. Define financial position. calls and his shares were forfeited.

7. Write any one objective of work sheet. Required: Journal entries for Allotment First and final call. [3+2=5]

8. XYZ Company issued 10,000 shares of Rs.100 each at 10% discount in 14. A. R& R Company issued 2000, 10% debentures of Rs. 100 each at a premium

of 10%, and redeemable at the end of 5 years at a premium of 5%.

lump-sum. All called up money was received and allotted.

Required: Journal entry for issue of debentures.

Required: Journal entries.

B.Differentiate between shares and debentures.

9. A limited forfeited500 shares of Rs.100 each issued at par of Mr. Shree due

15. The trial balance of CG Company limited as on Chaitra 31st ,2077

to non-payment of shares first and final calls of Rs.60 per share.

Particulars Rs. Particulars Rs.

Required: Journal entry for share forfeiture.

Purchases 100,000 Sales 200,000

10. If shares of Rs.400,000 are issued for purchase of assets Wages 40,000 Rent 10,000

Rs.500,000;Rs.100,000 will be treated as ---- Salaries 40,000 Creditors 30,000

a. Discount b. Premium c. Profit d. Loss Administrative expenses 10,000 Share capital 200,000

11. A Company issue of 2000;10% debentures ofRs.100 each at par and Machinery 50,000 Bank loan 50,000

redeemable at par value Land & building 145,000

Required: Journal entries for issue of debenture. Office expenses 30,000

Sundry debtors 25,000

Bank balance 30,000

Attempt ALL questions. Dividend paid 20,000

Short Answer Question [8 ×5=40 ] Total 490,000 Total 490,000

12. A company issued 10,000 shares of Rs. 100 each at a Premium of Rs. 10 per

Additional information:

share payable under:

a. Stock at the end value Rs.30,000

On application Rs.40

b. Depreciation on machinery @10%

On allotment Rs.50 (Including Premium)

On First and Final call Rs.20 c. Rent received included unearned rent Rs.500

Application were received for 25,000 shares.The allotment were made as d. Prepaid salary was Rs.10,000

follows: Required: prepare income statement and balance sheet [5]

16. The Trial balance of Himal Company Limited as on 31 st December is given Statement of Retained Earnings.

below: [1]

Particulars Debit(Rs.) Credit(Rs.) 18. A. Write any three features of Private Company.

Debtors and creditor 290,000 50,000 [3]

Purchases and sales revenue 105,000 300,000 B. write any two objectives of profit and loss account.

Wages 25,000 - [2]

Salaries 30,000 - 19. Explain the procedures of preparing the work sheet. [5]

Fixed assets 300,000 - Long Answer Question

Share capital - 400,000 20. The Trial Balance of SUbhaCompnay as on Chaitra 31st is given below:

Insurance 10,000 - Debit Rs. Credit Rs.

Commission paid 40,000 - Land & building 280,000 Share capital 300,000

Profit and loss account - 50,000 Equipment 340,000 P/L appropriation a/c 32,000

Total 800,000 800,000 Opening 24,000 Reserve fund 78,000

Additional information: Cash balance 16,000 Creditors 43,200

a. Depreciation on fixed assets by 10% Purchases 280,000 Sales revenue 616,000

b. Outstanding wages Rs.5,000 Debtors 32,800 Advance commission 8,000

c. Transfer to reserve Rs.10,000 Wages and Carriage 72,000 Purchase return 1,600

Required: prepare work sheet.[5] Salaries 76,000 Bank loan 100,000

17. Trial balance shown below are before adjustment for XYZ Company as on Office rent 33,600

Ashadh 31st 2077 Insurance 5,600

Particulars Dr.(Rs.) Cr.(Rs.) Closing 19,200

Cash 21,800 - Total 1,179,200 Total 1,179,200

Account receivable 6,400 - Additional information:

Office supplies expenses 5,000 - Depreciation at 10% on machinery.

Depreciation expenses 8,000 - Bad debt written off Rs.800 and make a provision for bad debts at 5%

Office equipment 32,000 - Provision for tax is to be made at Rs.8,000

Acc.depreciation- office equipment - 7,200 Dividend proposed at 10% on share capital.

Account payable - 11,600 Required: Trading account. [1]

Unreaned rent revenue - 3,600 Profit and loss account. [3]

Common stock - 20,000 Profit and loss appropriation account. [1]

Dividend 5,600 - Balance sheet. [3]

Service revenue - 68,000 21. The Trial Balance of N Company Ltd. as on Chaitra 31 is given below:

Rent revenue - 26,400 Particulars Rs. Particulars Rs.

Salaries expenses (40% of sales staffs) 34,000 - Purchase 275,000 Sales 600,000

Rent expenses (25% paid for show room 12,000 - Opening stock 30,000 Share capital 200,0010

Income tax expenses 12,000 - Building 250,000 Profit and Loss A/C 50,000

Total 136,800 136,800 Rent 5,000

Wages 30,000

Required:Multi- Step income Statement [4]

Insurance 10,000

Debtors 200,000

Salaries 50,000

Total 850,000 Total 850,000

Additional Information:

a. Outstanding salaries Rs.4,000

b.Pre-paid insurance Rs.2,500

c. Proposed dividend @ 10%

Required: Adjustment entries Work sheet [2+6=8]

[2+6=8]

22. The trial balance of a Company as on Ashadh 31st is given below:

Particulars Amount(Rs.) Amount(Rs.)

Equity share capital - 150,000

Revenue - 400,000

Long term loan - 125,000

Sundry creditors - 25,000

Cash in hand 20,000 -

Sundry debtors 30,000 -

Fixed assets 350,000 -

Rent 100,000 -

Purchases and wages 200,000 -

Total 700,000 700,000

Adjustment:

a. Depreciation on fixed assets Rs.30,000

b.Wages payable Rs.20,000

c. Closing stock Rs.35,000

d.Rent paid Rs.8,000 per month

Required: Income statement as per NFRS. [4]

Balance sheet as per NFRS. [4]

*O*

You might also like

- Coca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)Document7 pagesCoca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)sarthak mendiratta100% (1)

- MidTerm ExamDocument15 pagesMidTerm ExamYonatan Wadler100% (2)

- Accounts Project Isc (Mine)Document12 pagesAccounts Project Isc (Mine)Rahit Mitra100% (2)

- Chapter 3 ExercisesDocument11 pagesChapter 3 ExercisesNguyen VyNo ratings yet

- Account Set BDocument4 pagesAccount Set BNayan KcNo ratings yet

- Accountancy: Pre-Board Examinations 2078Document3 pagesAccountancy: Pre-Board Examinations 2078Herman PecassaNo ratings yet

- Account XII For Board Exam PracticeDocument18 pagesAccount XII For Board Exam PracticeBicky ShahNo ratings yet

- Rspu 8Document10 pagesRspu 8ashmit chadhaNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- DR AKL Corporate Oct21 CIA 2021Document2 pagesDR AKL Corporate Oct21 CIA 2021Saif UddeenNo ratings yet

- Ca QP ModelDocument3 pagesCa QP Modelmahabalu123456789No ratings yet

- Khwopa2080 XII Board Exam Base 5 Model Practice Sets 2080Document15 pagesKhwopa2080 XII Board Exam Base 5 Model Practice Sets 2080bikki2ehNo ratings yet

- 1e710c6f-4b3e-4b03-943f-11430d867f0e-Document30 pages1e710c6f-4b3e-4b03-943f-11430d867f0e-angela antoniaNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- Jorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Document3 pagesJorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Abin DhakalNo ratings yet

- OCTOBER 2019: Reg. No.Document6 pagesOCTOBER 2019: Reg. No.Selvi SelviNo ratings yet

- Advanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversityDocument13 pagesAdvanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversitySaif Uddin33% (3)

- Shares & Debentures TestDocument10 pagesShares & Debentures TestAthul Krishna KNo ratings yet

- Account Model QuestionsDocument41 pagesAccount Model QuestionsPrerana NepaliNo ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Shares Forfeiture & ReissueDocument5 pagesShares Forfeiture & ReissueUnknownNo ratings yet

- Corporate AccountingDocument32 pagesCorporate AccountingSaran Ranny100% (1)

- Issue of Shares Most Important Part 1Document25 pagesIssue of Shares Most Important Part 1mainikunal09No ratings yet

- CBSE Class 12 Accountancy Accounting For Share Capital and Debenture WorksheetDocument3 pagesCBSE Class 12 Accountancy Accounting For Share Capital and Debenture WorksheetJenneil CarmichaelNo ratings yet

- Company AccountsDocument3 pagesCompany AccountsYATTIN KHANNANo ratings yet

- Shares 2024 Final PDF SPCC - 98efd20d c80b 4cd4 A01b 6ce76136740cDocument106 pagesShares 2024 Final PDF SPCC - 98efd20d c80b 4cd4 A01b 6ce76136740cDaksh YadavNo ratings yet

- Abc Unit 3 PDFDocument7 pagesAbc Unit 3 PDFLuckygirl JyothiNo ratings yet

- Lecture 11-Forfeiture of SharesDocument12 pagesLecture 11-Forfeiture of SharesAwab HamidNo ratings yet

- Test 2 QPDocument8 pagesTest 2 QPDharmateja ChakriNo ratings yet

- Chapter - 7: Case/Source Based Questions:: Kvs Ziet Bhubaneswar 12/10/2021Document18 pagesChapter - 7: Case/Source Based Questions:: Kvs Ziet Bhubaneswar 12/10/2021abiNo ratings yet

- Corporate Accounting Exam Questions PaperDocument7 pagesCorporate Accounting Exam Questions PaperAmmar Bin NasirNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 21100518 Mar 2021Document5 pagesBcom 3 Sem Corporate Accounting 1 21100518 Mar 2021abin.com22No ratings yet

- Shares Class PPT Sunil PandaDocument60 pagesShares Class PPT Sunil Pandadollpees01No ratings yet

- 2019 Paper - DSE5.1A Sub - Corporate Accounting Time - 3 Hours Full Marks - 80Document4 pages2019 Paper - DSE5.1A Sub - Corporate Accounting Time - 3 Hours Full Marks - 80tanmoy sardarNo ratings yet

- Worksheet - Accounting For Share CapitalDocument6 pagesWorksheet - Accounting For Share CapitalPrisha SharmaNo ratings yet

- 5th Account Gobind Kumar Jha 9874411552Document69 pages5th Account Gobind Kumar Jha 9874411552binay chaudharyNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Class XiithDocument11 pagesClass XiithSantvana ChaturvediNo ratings yet

- Share CapitalDocument10 pagesShare CapitalShreyas PremiumNo ratings yet

- Kami Export - Issue of Shares SQPDocument8 pagesKami Export - Issue of Shares SQPtawwabsayedNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationDocument3 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationKashifNo ratings yet

- June 2019 All Paper SuggestedDocument120 pagesJune 2019 All Paper SuggestedEdtech NepalNo ratings yet

- Account Scanner by GKJDocument53 pagesAccount Scanner by GKJsintisharma67No ratings yet

- Small Sums in Issue of SharesDocument10 pagesSmall Sums in Issue of SharesHamza MudassirNo ratings yet

- Question Bank (Repaired)Document7 pagesQuestion Bank (Repaired)jayeshNo ratings yet

- Class 12 Account Set 2 Grade Increment Examination Question PaperDocument10 pagesClass 12 Account Set 2 Grade Increment Examination Question PaperPrem RajwanshiNo ratings yet

- ACCOUNTANCY - 9 - by Saravanan.bDocument13 pagesACCOUNTANCY - 9 - by Saravanan.bnirmalsaravanan916No ratings yet

- Internal ReconstructionDocument5 pagesInternal ReconstructionJoshua StarkNo ratings yet

- Admsn ShareDocument2 pagesAdmsn Shareak99archana1999No ratings yet

- Question Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowDocument16 pagesQuestion Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowRaveendra KJNo ratings yet

- Corp Accounting 9th AugustDocument53 pagesCorp Accounting 9th AugustParkavi ArunachalamNo ratings yet

- Apex College: (Pre-University Exam)Document2 pagesApex College: (Pre-University Exam)ali333444No ratings yet

- Adobe Scan 13-Jun-2023Document1 pageAdobe Scan 13-Jun-2023Himanshi BhatiaNo ratings yet

- A Ccount 12 2059 ChaitraDocument2 pagesA Ccount 12 2059 ChaitraNayan KcNo ratings yet

- 6 Winding Up of Companies61059595441467158Document11 pages6 Winding Up of Companies61059595441467158Prabin sthaNo ratings yet

- Shivaraj Corrporeting Acconting 3rd SemDocument9 pagesShivaraj Corrporeting Acconting 3rd Semshivaraj gowdaNo ratings yet

- 12 Accountancy Accounting For Share Capital and Debenture Impq 1Document8 pages12 Accountancy Accounting For Share Capital and Debenture Impq 1Aejaz MohamedNo ratings yet

- Adv. TestDocument2 pagesAdv. TestHassan Jameel SheikhNo ratings yet

- Liquidation of CompaniesDocument12 pagesLiquidation of CompaniesFaisal ManjiNo ratings yet

- Worksheet For Issue of Share and DebentureDocument2 pagesWorksheet For Issue of Share and DebentureLaxmi Kant SahaniNo ratings yet

- 12 C BK Mock Board PraveenaDocument4 pages12 C BK Mock Board PraveenaAdvanced AcademyNo ratings yet

- RTP Dec 18 QNDocument21 pagesRTP Dec 18 QNbinu100% (1)

- SET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirDocument5 pagesSET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirnisharvishwaNo ratings yet

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)

- Physics UtDocument2 pagesPhysics UtNayan KcNo ratings yet

- Suspend 2Document1 pageSuspend 2Nayan KcNo ratings yet

- Cover Letter For AssistantDocument1 pageCover Letter For AssistantNayan KcNo ratings yet

- NoticeDocument1 pageNoticeNayan KcNo ratings yet

- Chapter 1Document24 pagesChapter 1Nayan Kc100% (1)

- 1.introduction of MarketingDocument12 pages1.introduction of MarketingNayan KcNo ratings yet

- Unit 5 Social Cultural Environment - PDF 5Document6 pagesUnit 5 Social Cultural Environment - PDF 5Nayan KcNo ratings yet

- Gym: Martial Arts: Gym: Martial Arts: Gym: Martial Arts: Gym: Martial ArtsDocument1 pageGym: Martial Arts: Gym: Martial Arts: Gym: Martial Arts: Gym: Martial ArtsNayan KcNo ratings yet

- T/ XL Do XL Lg0F (O LNBF PGLX? T/ XL Do XL Lg0F (O LNBF PGLX? T/ XL Do XL Lg0F (O LNBF PGLX? T/ XL Do XL Lg0F (O LNBF PGLX?Document1 pageT/ XL Do XL Lg0F (O LNBF PGLX? T/ XL Do XL Lg0F (O LNBF PGLX? T/ XL Do XL Lg0F (O LNBF PGLX? T/ XL Do XL Lg0F (O LNBF PGLX?Nayan KcNo ratings yet

- Accounting For General Capital Assets and Capital ProjectsDocument49 pagesAccounting For General Capital Assets and Capital ProjectsMatt100% (3)

- ACC309 - Quiz 01 Intangible Assets and Current LiabilitiesDocument21 pagesACC309 - Quiz 01 Intangible Assets and Current LiabilitiesMariz RapadaNo ratings yet

- Accounting For Business Combination - Practice MaterialDocument2 pagesAccounting For Business Combination - Practice MaterialZYRENE HERNANDEZNo ratings yet

- Financial Accounting and ReportingDocument29 pagesFinancial Accounting and ReportingChjxksjsgskNo ratings yet

- Financial ManagementDocument10 pagesFinancial ManagementAli mohamedNo ratings yet

- Management Accounting: Specimen Exam Applicable From June 2014Document23 pagesManagement Accounting: Specimen Exam Applicable From June 2014Intan ParamithaNo ratings yet

- 11 - Estimation of Doubtful AccountsDocument21 pages11 - Estimation of Doubtful AccountsDidik DidiksterNo ratings yet

- Manufacturing SolutionsDocument8 pagesManufacturing SolutionsMothusi M NtsholeNo ratings yet

- Bwff1013 Foundations of Finance Quiz #3Document8 pagesBwff1013 Foundations of Finance Quiz #3tivaashiniNo ratings yet

- 2-Analysis of Financial StatementsQ&Assg.2Document4 pages2-Analysis of Financial StatementsQ&Assg.2Acha Bacha50% (2)

- Chapter 4 Production CostsDocument18 pagesChapter 4 Production Costs刘文雨杰No ratings yet

- CVP Analysis: PG D M2 0 21-23 RelevantreadingsDocument21 pagesCVP Analysis: PG D M2 0 21-23 RelevantreadingsAthi SivaNo ratings yet

- Fundamentals of AccountingDocument18 pagesFundamentals of AccountingBelle MendozaNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelZaid NaveedNo ratings yet

- Assign 6 Chapter 8 Operating and Financial Leverage Cabrera 2019-2020Document12 pagesAssign 6 Chapter 8 Operating and Financial Leverage Cabrera 2019-2020mhikeedelantar100% (1)

- FAR460 - S - June 2018 - StudentsDocument6 pagesFAR460 - S - June 2018 - StudentsRuzaikha razaliNo ratings yet

- Module 1 - Cost Concepts & Cost BehaviorDocument5 pagesModule 1 - Cost Concepts & Cost BehaviorEmma Mariz GarciaNo ratings yet

- Dividend DecisionsDocument3 pagesDividend DecisionsRatnadeep MitraNo ratings yet

- Liquidation - IllustrationDocument18 pagesLiquidation - IllustrationRizalyn Joy BoloNo ratings yet

- IntAcc 1 by Valix 2023 Edition Answer Key From Chapter 4-14Document137 pagesIntAcc 1 by Valix 2023 Edition Answer Key From Chapter 4-14Bella Flair100% (1)

- Unit 1 Exam Review - Chapters 1-3Document5 pagesUnit 1 Exam Review - Chapters 1-3Jullian LimNo ratings yet

- Uts Finance IvanDocument28 pagesUts Finance IvanIvan ZackyNo ratings yet

- Cost INSTR PPT - Chapter 1 - Overview of Cost & Mgt. AcctDocument53 pagesCost INSTR PPT - Chapter 1 - Overview of Cost & Mgt. AcctAshe BalchaNo ratings yet

- Ex. WorksheetDocument3 pagesEx. WorksheetAllysa Kim RubisNo ratings yet

- Equity Research AssignmentDocument3 pagesEquity Research Assignment201812099 imtnagNo ratings yet

- FM 1 Chapter 3 Module 3Document27 pagesFM 1 Chapter 3 Module 3Kitheia Ostrava Reisenchauer100% (1)