Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

31 viewsAccounts CIA 3 Final

Accounts CIA 3 Final

Uploaded by

Tanmay AroraMRF, an Indian tyre manufacturer, relies on several International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS) to prepare its balance sheet. Key standards include IAS 2 for inventory accounting, IAS 7 for cash flow statements, and IAS 16 for property, plant, and equipment accounting. IFRS like IFRS 12 on disclosure of interests in other entities and IFRS 13 on fair value measurement also guide MRF's financial reporting. Adhering to global standards promotes transparency and comparability.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- International Public Sector Accounting Standards ListDocument4 pagesInternational Public Sector Accounting Standards ListYonas Taddesse100% (1)

- CH 04Document111 pagesCH 04arif nugrahaNo ratings yet

- Managerial Economics (Chapter 3)Document72 pagesManagerial Economics (Chapter 3)api-370372471% (14)

- AAUI - General Overview IFRS 17Document117 pagesAAUI - General Overview IFRS 17Tyan Retsa PutriNo ratings yet

- CFAS Qualifying Exam ReviewerDocument20 pagesCFAS Qualifying Exam ReviewerCher Na100% (5)

- Ifrs 9 ClassificationDocument11 pagesIfrs 9 ClassificationMark Vendolf KongNo ratings yet

- UAE Accounting System vs. IFRS Rules.Document6 pagesUAE Accounting System vs. IFRS Rules.Shibam JhaNo ratings yet

- FRS 13 2012jan31Document145 pagesFRS 13 2012jan31Minaw BelayNo ratings yet

- Ifrs vs. Indian GaapDocument4 pagesIfrs vs. Indian GaapPankaj100% (1)

- Gaap and IfrsDocument11 pagesGaap and IfrsTanvi JainNo ratings yet

- Indepth Ifrs7 Ifrs13 Disclosures 201405Document52 pagesIndepth Ifrs7 Ifrs13 Disclosures 201405Nuwani ManasingheNo ratings yet

- Summary of IFRSDocument5 pagesSummary of IFRSSongs WorldNo ratings yet

- IFRS 9 - Financial Instruments: Classification, Measurement and ImpairmentDocument3 pagesIFRS 9 - Financial Instruments: Classification, Measurement and ImpairmentWilfredy Medina M.No ratings yet

- Ifrs 9 & Key Changes With Ias 39: Mr. Arian Meta Ms. Arta LimaniDocument5 pagesIfrs 9 & Key Changes With Ias 39: Mr. Arian Meta Ms. Arta LimaniVan John MagallanesNo ratings yet

- IFRS 13 Brief PDFDocument4 pagesIFRS 13 Brief PDFsona abrahamyanNo ratings yet

- International Accounting StandardsDocument6 pagesInternational Accounting StandardsReza Al SaadNo ratings yet

- F7 Notes 2Document4 pagesF7 Notes 2Ahmed IqbalNo ratings yet

- Ifs Funds 2016Document91 pagesIfs Funds 2016Justine991No ratings yet

- Group 3Document17 pagesGroup 3Wambo MonsterrNo ratings yet

- Financial Instruments Accounting For Asset Management PDFDocument39 pagesFinancial Instruments Accounting For Asset Management PDFNikitaNo ratings yet

- List of Indian Accounting Standards Along With Comparative Accounting Standard (AS)Document6 pagesList of Indian Accounting Standards Along With Comparative Accounting Standard (AS)Krishna PrasadNo ratings yet

- IFRS AssignmentDocument24 pagesIFRS Assignmentomijr7458No ratings yet

- SL NO Principles Name of IAS Details About IAS Principles Status of ACI With IAS Complied Not CompliedDocument6 pagesSL NO Principles Name of IAS Details About IAS Principles Status of ACI With IAS Complied Not CompliedNaimmul FahimNo ratings yet

- Topic 1.2 Financial Reporting FrameworkDocument15 pagesTopic 1.2 Financial Reporting Frameworkhgul5275No ratings yet

- International Financial Reporting Standards 9: Dynamic Forward Looking The South African Banking Credit LandscapeDocument12 pagesInternational Financial Reporting Standards 9: Dynamic Forward Looking The South African Banking Credit LandscapeGuljeeNo ratings yet

- Accounting StandardsDocument13 pagesAccounting StandardsxoxoxoNo ratings yet

- CFAS Qualifying Exam ReviewerDocument14 pagesCFAS Qualifying Exam Reviewercaryljoycemaceda3No ratings yet

- Highlight IFRSDocument16 pagesHighlight IFRSBảo Hân VũNo ratings yet

- IFRS 17 Ebook - AptitudeSoftwareDocument40 pagesIFRS 17 Ebook - AptitudeSoftwareAnton LimNo ratings yet

- Impact of VUCA On Fair Value Accounting: CA Ajit Joshi & CA Rajul MurudkarDocument8 pagesImpact of VUCA On Fair Value Accounting: CA Ajit Joshi & CA Rajul MurudkarResky Andika YuswantoNo ratings yet

- IFRS 13-Eng PDFDocument71 pagesIFRS 13-Eng PDFNhhư QuỳnhhNo ratings yet

- Unit 2 - GAAP and IFRSDocument15 pagesUnit 2 - GAAP and IFRSKanak RathoreNo ratings yet

- SBR IFRS 13 Fair ValueDocument16 pagesSBR IFRS 13 Fair ValuekawsursharifNo ratings yet

- Wolters Kluwer Onesumx Ifrs Solution PrimerDocument8 pagesWolters Kluwer Onesumx Ifrs Solution PrimeryogeshthakkerNo ratings yet

- Final Presentation IfrsDocument10 pagesFinal Presentation IfrsPankajNo ratings yet

- CFAS Qualifying Exam ReviewerDocument15 pagesCFAS Qualifying Exam ReviewerJoyceNo ratings yet

- 13-Fair Value MeasurementDocument46 pages13-Fair Value MeasurementChelsea Anne VidalloNo ratings yet

- Adoption Guide OverviewDocument10 pagesAdoption Guide OverviewemmaNo ratings yet

- Ifrs S1Document48 pagesIfrs S1ComunicarSe-ArchivoNo ratings yet

- IFRS 9 Financial InstrumentsDocument14 pagesIFRS 9 Financial InstrumentsSudershan Thaiba100% (1)

- SAICA - Comparison of GRAP and IFRSDocument6 pagesSAICA - Comparison of GRAP and IFRSKarlapotgieter20No ratings yet

- Summary On Ifrs and Ias StandardsDocument14 pagesSummary On Ifrs and Ias StandardsAlexNo ratings yet

- 5 Ifrs13Document110 pages5 Ifrs13Juzt BillyNo ratings yet

- Practical Guide To IFRS: Fair Value Measurement - Unifying The Concept of Fair Value'Document35 pagesPractical Guide To IFRS: Fair Value Measurement - Unifying The Concept of Fair Value'chetanhskNo ratings yet

- Compendium of New Standards Issued by The IASB - IfRS 15,9, 16Document14 pagesCompendium of New Standards Issued by The IASB - IfRS 15,9, 16Adegbite Olusegun JamesNo ratings yet

- IFRS PresentationDocument49 pagesIFRS Presentationunni Krishnan100% (9)

- IPSAS Accrual Standards Issued To Date Based On IFRSs - 14.03.2019Document8 pagesIPSAS Accrual Standards Issued To Date Based On IFRSs - 14.03.2019EmekaNo ratings yet

- Afm ProjectDocument36 pagesAfm ProjectSonam Mahajan100% (1)

- Ifrs StandardsDocument2 pagesIfrs StandardsKruthika KavyaNo ratings yet

- IFRS Effects AnalysisDocument72 pagesIFRS Effects AnalysisLucy PaongananNo ratings yet

- Accounting Standard PDFDocument10 pagesAccounting Standard PDFANAND T PNo ratings yet

- 201 SliteDocument35 pages201 SliteSakib AlamNo ratings yet

- Kế Toán Quốc Tế 1: Nguyễn Đình Hoàng UyênDocument56 pagesKế Toán Quốc Tế 1: Nguyễn Đình Hoàng UyênHồ Đan ThụcNo ratings yet

- Lecture 1 - Regulatory Framework Financial Reporting - 2023Document44 pagesLecture 1 - Regulatory Framework Financial Reporting - 2023Suwani HettiarachchiNo ratings yet

- Solution 1.1: Solutions To Gripping IFRS: Graded Questions Financial Reporting FrameworkDocument893 pagesSolution 1.1: Solutions To Gripping IFRS: Graded Questions Financial Reporting Frameworksarvesh guness100% (1)

- E-Technical Update Nov2009Document14 pagesE-Technical Update Nov2009Atif RehmanNo ratings yet

- Convergence With International Financial Reporting Standards ('IFRS') - Impact On Fundamental Accounting Practices and Regulatory Framework in IndiaDocument4 pagesConvergence With International Financial Reporting Standards ('IFRS') - Impact On Fundamental Accounting Practices and Regulatory Framework in IndiaVinodh RathnamNo ratings yet

- New Zealand Equivalent To International Financial Reporting Standard 13 Fair Value Measurement (NZ IFRS 13)Document34 pagesNew Zealand Equivalent To International Financial Reporting Standard 13 Fair Value Measurement (NZ IFRS 13)Nam PhamNo ratings yet

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSFrom EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSNo ratings yet

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- UK GAAP 2017: Generally Accepted Accounting Practice under UK and Irish GAAPFrom EverandUK GAAP 2017: Generally Accepted Accounting Practice under UK and Irish GAAPNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- ReportDocument4 pagesReportBakayoko VaflalyNo ratings yet

- CASE 1 Premier CementDocument3 pagesCASE 1 Premier CementMarness Stacey Llorente Boyles100% (1)

- Service Marketing: Session: 9 & 10 Prof: Yasmin SDocument41 pagesService Marketing: Session: 9 & 10 Prof: Yasmin SmayurgharatNo ratings yet

- Second Year 3rd SemDocument21 pagesSecond Year 3rd SemZreh TreasurywalaNo ratings yet

- Off-Balance Sheet - Risk ManagementDocument18 pagesOff-Balance Sheet - Risk ManagementjoanabudNo ratings yet

- I. Manufacturing Costs ( Direct Production Cost + Fixed Charges + Plant Overhead CostDocument8 pagesI. Manufacturing Costs ( Direct Production Cost + Fixed Charges + Plant Overhead CostDEMI PADILLANo ratings yet

- Easy Jet AnalysisDocument23 pagesEasy Jet AnalysisToyosi OlugbenleNo ratings yet

- Solution Chapter 2Document3 pagesSolution Chapter 2arha_86867820100% (1)

- Trade Binary OptionsDocument52 pagesTrade Binary OptionsMarc Ashwin100% (1)

- Chapter 4 and 5: Responsibility CentersDocument30 pagesChapter 4 and 5: Responsibility CentersRajat SharmaNo ratings yet

- Fariha Sheikhs Resume 1Document2 pagesFariha Sheikhs Resume 1api-537112938No ratings yet

- Bfc34502 s11 Business PlanDocument34 pagesBfc34502 s11 Business PlanZahirah SaffriNo ratings yet

- Liquidity Ratio Current RatioDocument15 pagesLiquidity Ratio Current RatioRaj K GahlotNo ratings yet

- Financial Ratios and Analysis Glossary (CVR) PDFDocument4 pagesFinancial Ratios and Analysis Glossary (CVR) PDFDrashti ChoudharyNo ratings yet

- Annual ReportDocument154 pagesAnnual Reportp15bipinbNo ratings yet

- Equity Financing - ExerciseDocument2 pagesEquity Financing - Exerciselovingbooks1No ratings yet

- Internship Report Format and InstructionsDocument54 pagesInternship Report Format and Instructionsnavya19ashokNo ratings yet

- Titan vs. TimexDocument50 pagesTitan vs. Timexparulkansotia100% (1)

- Irpes Final PMC Pre Bid Minutes of MeetingDocument13 pagesIrpes Final PMC Pre Bid Minutes of MeetingIES-GATEWizNo ratings yet

- Private, Public and Global EnterprisesDocument16 pagesPrivate, Public and Global EnterprisesNishtha GuptaNo ratings yet

- PTPP Uob 15 Mar 2022Document5 pagesPTPP Uob 15 Mar 2022Githa Adhi Pramana I GDNo ratings yet

- Initiating Coverage Report PB FintechDocument30 pagesInitiating Coverage Report PB FintechSantosh RoutNo ratings yet

- IEB PresentationDocument11 pagesIEB PresentationKanika MaheshwariNo ratings yet

- Unit 2Document16 pagesUnit 2sheetal gudseNo ratings yet

- Chapter 7 - Activity-Based Costing and Management: ANSWER: FalseDocument42 pagesChapter 7 - Activity-Based Costing and Management: ANSWER: FalseBhumika PatelNo ratings yet

- Closing Entries, Worksheet, Post Closing Trial BalanceDocument12 pagesClosing Entries, Worksheet, Post Closing Trial BalanceHendra SetiyawanNo ratings yet

- Chapter 3 Performance Management and Strategic PlanningDocument3 pagesChapter 3 Performance Management and Strategic PlanningDeviane CalabriaNo ratings yet

Accounts CIA 3 Final

Accounts CIA 3 Final

Uploaded by

Tanmay Arora0 ratings0% found this document useful (0 votes)

31 views6 pagesMRF, an Indian tyre manufacturer, relies on several International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS) to prepare its balance sheet. Key standards include IAS 2 for inventory accounting, IAS 7 for cash flow statements, and IAS 16 for property, plant, and equipment accounting. IFRS like IFRS 12 on disclosure of interests in other entities and IFRS 13 on fair value measurement also guide MRF's financial reporting. Adhering to global standards promotes transparency and comparability.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMRF, an Indian tyre manufacturer, relies on several International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS) to prepare its balance sheet. Key standards include IAS 2 for inventory accounting, IAS 7 for cash flow statements, and IAS 16 for property, plant, and equipment accounting. IFRS like IFRS 12 on disclosure of interests in other entities and IFRS 13 on fair value measurement also guide MRF's financial reporting. Adhering to global standards promotes transparency and comparability.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

31 views6 pagesAccounts CIA 3 Final

Accounts CIA 3 Final

Uploaded by

Tanmay AroraMRF, an Indian tyre manufacturer, relies on several International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS) to prepare its balance sheet. Key standards include IAS 2 for inventory accounting, IAS 7 for cash flow statements, and IAS 16 for property, plant, and equipment accounting. IFRS like IFRS 12 on disclosure of interests in other entities and IFRS 13 on fair value measurement also guide MRF's financial reporting. Adhering to global standards promotes transparency and comparability.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 6

FINANCIAL ACCOUNTING

CIA – 3

Submitted By- SUBMITTED

To-

Tanmay Arora (2324364) Dr. Pradeep Kumar

Aron Paul (2324316)

MRF

ABOUT THE COMPANY

Madras Rubber Factory, MRF Limited, is an Indian multinational tyre manufacturing

company. It was founded in 1946 by K.M. Mammen Mappillai. It is headquartered in

Chennai, Tamil Nadu. MRF Primarily manufactures rubber products like tyres, treads, tubes

and conveyor belts

BALANCE SHEET OF MRF

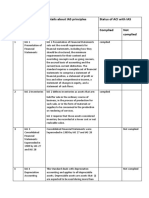

International Accounting Standards –

used by MRF

MRF relies on IAS 2 to ensure uniform

inventory accounting, provide accurate

information to stakeholders, and align its

IAS 2 INVENTORIES financial statements with global accounting

standards, promoting transparency and ease

of comparison in financial reporting.

IAS 7 assists MRF in crafting a precise and

uniform cash flow statement, promoting

transparency, facilitating comparisons, and

IAS 7 STATEMENT OF CASH FLOWS instilling trust among stakeholders,

ultimately guiding well-informed financial

choices.

IAS 12 enables MRF to account for income

taxes precisely, transparently report them,

adhere to global standards, employ tax

IAS 12 INCOME TAXES planning strategies for effective tax

management, and foster trust among

stakeholders.

IAS 16 assists MRF in accurately managing

and disclosing its property, plant, and

equipment, including depreciation practices,

IAS 16 PROPERTY, PLANT, potential revaluations, and the transparent

EQUIPMENT presentation of information, ensuring

international compliance and fostering

stakeholder confidence.

IAS 19 assists MRF in accurately managing

and disclosing employee benefits, making

informed actuarial assumptions, fulfilling

IAS 19 EMPLOYEE BENEFITS disclosure requirements, maintaining

consistency, and adhering to international

standards. This contributes to increased

transparency and trust among stakeholders

MRF assesses its assets for impairment at

the end of each reporting period. If an asset

is impaired, MRF recognises an impairment

IAS 36 IMPAIRMENT OF ASSETS loss equal to the difference between its

carrying value and its recoverable amount.

MRF recognises provisions when it has a

legal or constructive obligation to transfer

an economic benefit as a result of a past

IAS 37 PROVISION, CONTINGENT event and when it can make a reliable

LIABILITY AND CONTINGENT ASSET estimate of the amount of the obligation.

MRF discloses contingent liabilities and

contingent assets

IAS 38 is relevant for intangible assets such

as brand names, patents, and trademarks,

which MRF may possess.

IAS 38 – INTANGIBLE ASSETS

International Financial Reporting System

– used by MRF

IFRS is a set of accounting standards developed by the International Accounting Standards

Board (IASB). IFRS standards are designed to provide a common global language for

business, making it easier for investors and other stakeholders to compare the financial

performance of companies from different countries.

The following are some of the fundamental IFRS accounting principles that MRF Ltd.

follows in preparing its balance sheet:

IFRS 12 requires extensive disclosures

about MRF's interests in subsidiaries, joint

IFRS 12 - DISCLOSURE OF INTERESTS

ventures, and associates, providing

IN OTHER ENTITIES

transparency about the company's

involvement with other entities.

IFRS 13 sets out its measurement and

disclosure requirements when assets or

FRS 13 - FAIR VALUE MEASUREMENT

liabilities are measured at fair value. This

standard is relevant for assets and liabilities

on MRF's balance sheet that are measured at

fair value.

This standard is relevant if MRF has

subsidiaries. It outlines the requirements for

IFRS 10 - CONSOLIDATED FINANCIAL

consolidating the financial statements of

STATEMENTS

subsidiaries and guides how to present

investments in subsidiaries on the balance

sheet.

IFRS 16 introduces a single lessee

accounting model, which is relevant if MRF

IFRS 16 - LEASES

has lease agreements for properties,

equipment, or vehicles.

You might also like

- International Public Sector Accounting Standards ListDocument4 pagesInternational Public Sector Accounting Standards ListYonas Taddesse100% (1)

- CH 04Document111 pagesCH 04arif nugrahaNo ratings yet

- Managerial Economics (Chapter 3)Document72 pagesManagerial Economics (Chapter 3)api-370372471% (14)

- AAUI - General Overview IFRS 17Document117 pagesAAUI - General Overview IFRS 17Tyan Retsa PutriNo ratings yet

- CFAS Qualifying Exam ReviewerDocument20 pagesCFAS Qualifying Exam ReviewerCher Na100% (5)

- Ifrs 9 ClassificationDocument11 pagesIfrs 9 ClassificationMark Vendolf KongNo ratings yet

- UAE Accounting System vs. IFRS Rules.Document6 pagesUAE Accounting System vs. IFRS Rules.Shibam JhaNo ratings yet

- FRS 13 2012jan31Document145 pagesFRS 13 2012jan31Minaw BelayNo ratings yet

- Ifrs vs. Indian GaapDocument4 pagesIfrs vs. Indian GaapPankaj100% (1)

- Gaap and IfrsDocument11 pagesGaap and IfrsTanvi JainNo ratings yet

- Indepth Ifrs7 Ifrs13 Disclosures 201405Document52 pagesIndepth Ifrs7 Ifrs13 Disclosures 201405Nuwani ManasingheNo ratings yet

- Summary of IFRSDocument5 pagesSummary of IFRSSongs WorldNo ratings yet

- IFRS 9 - Financial Instruments: Classification, Measurement and ImpairmentDocument3 pagesIFRS 9 - Financial Instruments: Classification, Measurement and ImpairmentWilfredy Medina M.No ratings yet

- Ifrs 9 & Key Changes With Ias 39: Mr. Arian Meta Ms. Arta LimaniDocument5 pagesIfrs 9 & Key Changes With Ias 39: Mr. Arian Meta Ms. Arta LimaniVan John MagallanesNo ratings yet

- IFRS 13 Brief PDFDocument4 pagesIFRS 13 Brief PDFsona abrahamyanNo ratings yet

- International Accounting StandardsDocument6 pagesInternational Accounting StandardsReza Al SaadNo ratings yet

- F7 Notes 2Document4 pagesF7 Notes 2Ahmed IqbalNo ratings yet

- Ifs Funds 2016Document91 pagesIfs Funds 2016Justine991No ratings yet

- Group 3Document17 pagesGroup 3Wambo MonsterrNo ratings yet

- Financial Instruments Accounting For Asset Management PDFDocument39 pagesFinancial Instruments Accounting For Asset Management PDFNikitaNo ratings yet

- List of Indian Accounting Standards Along With Comparative Accounting Standard (AS)Document6 pagesList of Indian Accounting Standards Along With Comparative Accounting Standard (AS)Krishna PrasadNo ratings yet

- IFRS AssignmentDocument24 pagesIFRS Assignmentomijr7458No ratings yet

- SL NO Principles Name of IAS Details About IAS Principles Status of ACI With IAS Complied Not CompliedDocument6 pagesSL NO Principles Name of IAS Details About IAS Principles Status of ACI With IAS Complied Not CompliedNaimmul FahimNo ratings yet

- Topic 1.2 Financial Reporting FrameworkDocument15 pagesTopic 1.2 Financial Reporting Frameworkhgul5275No ratings yet

- International Financial Reporting Standards 9: Dynamic Forward Looking The South African Banking Credit LandscapeDocument12 pagesInternational Financial Reporting Standards 9: Dynamic Forward Looking The South African Banking Credit LandscapeGuljeeNo ratings yet

- Accounting StandardsDocument13 pagesAccounting StandardsxoxoxoNo ratings yet

- CFAS Qualifying Exam ReviewerDocument14 pagesCFAS Qualifying Exam Reviewercaryljoycemaceda3No ratings yet

- Highlight IFRSDocument16 pagesHighlight IFRSBảo Hân VũNo ratings yet

- IFRS 17 Ebook - AptitudeSoftwareDocument40 pagesIFRS 17 Ebook - AptitudeSoftwareAnton LimNo ratings yet

- Impact of VUCA On Fair Value Accounting: CA Ajit Joshi & CA Rajul MurudkarDocument8 pagesImpact of VUCA On Fair Value Accounting: CA Ajit Joshi & CA Rajul MurudkarResky Andika YuswantoNo ratings yet

- IFRS 13-Eng PDFDocument71 pagesIFRS 13-Eng PDFNhhư QuỳnhhNo ratings yet

- Unit 2 - GAAP and IFRSDocument15 pagesUnit 2 - GAAP and IFRSKanak RathoreNo ratings yet

- SBR IFRS 13 Fair ValueDocument16 pagesSBR IFRS 13 Fair ValuekawsursharifNo ratings yet

- Wolters Kluwer Onesumx Ifrs Solution PrimerDocument8 pagesWolters Kluwer Onesumx Ifrs Solution PrimeryogeshthakkerNo ratings yet

- Final Presentation IfrsDocument10 pagesFinal Presentation IfrsPankajNo ratings yet

- CFAS Qualifying Exam ReviewerDocument15 pagesCFAS Qualifying Exam ReviewerJoyceNo ratings yet

- 13-Fair Value MeasurementDocument46 pages13-Fair Value MeasurementChelsea Anne VidalloNo ratings yet

- Adoption Guide OverviewDocument10 pagesAdoption Guide OverviewemmaNo ratings yet

- Ifrs S1Document48 pagesIfrs S1ComunicarSe-ArchivoNo ratings yet

- IFRS 9 Financial InstrumentsDocument14 pagesIFRS 9 Financial InstrumentsSudershan Thaiba100% (1)

- SAICA - Comparison of GRAP and IFRSDocument6 pagesSAICA - Comparison of GRAP and IFRSKarlapotgieter20No ratings yet

- Summary On Ifrs and Ias StandardsDocument14 pagesSummary On Ifrs and Ias StandardsAlexNo ratings yet

- 5 Ifrs13Document110 pages5 Ifrs13Juzt BillyNo ratings yet

- Practical Guide To IFRS: Fair Value Measurement - Unifying The Concept of Fair Value'Document35 pagesPractical Guide To IFRS: Fair Value Measurement - Unifying The Concept of Fair Value'chetanhskNo ratings yet

- Compendium of New Standards Issued by The IASB - IfRS 15,9, 16Document14 pagesCompendium of New Standards Issued by The IASB - IfRS 15,9, 16Adegbite Olusegun JamesNo ratings yet

- IFRS PresentationDocument49 pagesIFRS Presentationunni Krishnan100% (9)

- IPSAS Accrual Standards Issued To Date Based On IFRSs - 14.03.2019Document8 pagesIPSAS Accrual Standards Issued To Date Based On IFRSs - 14.03.2019EmekaNo ratings yet

- Afm ProjectDocument36 pagesAfm ProjectSonam Mahajan100% (1)

- Ifrs StandardsDocument2 pagesIfrs StandardsKruthika KavyaNo ratings yet

- IFRS Effects AnalysisDocument72 pagesIFRS Effects AnalysisLucy PaongananNo ratings yet

- Accounting Standard PDFDocument10 pagesAccounting Standard PDFANAND T PNo ratings yet

- 201 SliteDocument35 pages201 SliteSakib AlamNo ratings yet

- Kế Toán Quốc Tế 1: Nguyễn Đình Hoàng UyênDocument56 pagesKế Toán Quốc Tế 1: Nguyễn Đình Hoàng UyênHồ Đan ThụcNo ratings yet

- Lecture 1 - Regulatory Framework Financial Reporting - 2023Document44 pagesLecture 1 - Regulatory Framework Financial Reporting - 2023Suwani HettiarachchiNo ratings yet

- Solution 1.1: Solutions To Gripping IFRS: Graded Questions Financial Reporting FrameworkDocument893 pagesSolution 1.1: Solutions To Gripping IFRS: Graded Questions Financial Reporting Frameworksarvesh guness100% (1)

- E-Technical Update Nov2009Document14 pagesE-Technical Update Nov2009Atif RehmanNo ratings yet

- Convergence With International Financial Reporting Standards ('IFRS') - Impact On Fundamental Accounting Practices and Regulatory Framework in IndiaDocument4 pagesConvergence With International Financial Reporting Standards ('IFRS') - Impact On Fundamental Accounting Practices and Regulatory Framework in IndiaVinodh RathnamNo ratings yet

- New Zealand Equivalent To International Financial Reporting Standard 13 Fair Value Measurement (NZ IFRS 13)Document34 pagesNew Zealand Equivalent To International Financial Reporting Standard 13 Fair Value Measurement (NZ IFRS 13)Nam PhamNo ratings yet

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSFrom EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSNo ratings yet

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- UK GAAP 2017: Generally Accepted Accounting Practice under UK and Irish GAAPFrom EverandUK GAAP 2017: Generally Accepted Accounting Practice under UK and Irish GAAPNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- ReportDocument4 pagesReportBakayoko VaflalyNo ratings yet

- CASE 1 Premier CementDocument3 pagesCASE 1 Premier CementMarness Stacey Llorente Boyles100% (1)

- Service Marketing: Session: 9 & 10 Prof: Yasmin SDocument41 pagesService Marketing: Session: 9 & 10 Prof: Yasmin SmayurgharatNo ratings yet

- Second Year 3rd SemDocument21 pagesSecond Year 3rd SemZreh TreasurywalaNo ratings yet

- Off-Balance Sheet - Risk ManagementDocument18 pagesOff-Balance Sheet - Risk ManagementjoanabudNo ratings yet

- I. Manufacturing Costs ( Direct Production Cost + Fixed Charges + Plant Overhead CostDocument8 pagesI. Manufacturing Costs ( Direct Production Cost + Fixed Charges + Plant Overhead CostDEMI PADILLANo ratings yet

- Easy Jet AnalysisDocument23 pagesEasy Jet AnalysisToyosi OlugbenleNo ratings yet

- Solution Chapter 2Document3 pagesSolution Chapter 2arha_86867820100% (1)

- Trade Binary OptionsDocument52 pagesTrade Binary OptionsMarc Ashwin100% (1)

- Chapter 4 and 5: Responsibility CentersDocument30 pagesChapter 4 and 5: Responsibility CentersRajat SharmaNo ratings yet

- Fariha Sheikhs Resume 1Document2 pagesFariha Sheikhs Resume 1api-537112938No ratings yet

- Bfc34502 s11 Business PlanDocument34 pagesBfc34502 s11 Business PlanZahirah SaffriNo ratings yet

- Liquidity Ratio Current RatioDocument15 pagesLiquidity Ratio Current RatioRaj K GahlotNo ratings yet

- Financial Ratios and Analysis Glossary (CVR) PDFDocument4 pagesFinancial Ratios and Analysis Glossary (CVR) PDFDrashti ChoudharyNo ratings yet

- Annual ReportDocument154 pagesAnnual Reportp15bipinbNo ratings yet

- Equity Financing - ExerciseDocument2 pagesEquity Financing - Exerciselovingbooks1No ratings yet

- Internship Report Format and InstructionsDocument54 pagesInternship Report Format and Instructionsnavya19ashokNo ratings yet

- Titan vs. TimexDocument50 pagesTitan vs. Timexparulkansotia100% (1)

- Irpes Final PMC Pre Bid Minutes of MeetingDocument13 pagesIrpes Final PMC Pre Bid Minutes of MeetingIES-GATEWizNo ratings yet

- Private, Public and Global EnterprisesDocument16 pagesPrivate, Public and Global EnterprisesNishtha GuptaNo ratings yet

- PTPP Uob 15 Mar 2022Document5 pagesPTPP Uob 15 Mar 2022Githa Adhi Pramana I GDNo ratings yet

- Initiating Coverage Report PB FintechDocument30 pagesInitiating Coverage Report PB FintechSantosh RoutNo ratings yet

- IEB PresentationDocument11 pagesIEB PresentationKanika MaheshwariNo ratings yet

- Unit 2Document16 pagesUnit 2sheetal gudseNo ratings yet

- Chapter 7 - Activity-Based Costing and Management: ANSWER: FalseDocument42 pagesChapter 7 - Activity-Based Costing and Management: ANSWER: FalseBhumika PatelNo ratings yet

- Closing Entries, Worksheet, Post Closing Trial BalanceDocument12 pagesClosing Entries, Worksheet, Post Closing Trial BalanceHendra SetiyawanNo ratings yet

- Chapter 3 Performance Management and Strategic PlanningDocument3 pagesChapter 3 Performance Management and Strategic PlanningDeviane CalabriaNo ratings yet