Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

59 viewsFast Credit GT All Bank PL Policy - One Pager

Fast Credit GT All Bank PL Policy - One Pager

Uploaded by

Vishal BawaneK

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AXIS Bank SM Mapping List Jan'24Document6 pagesAXIS Bank SM Mapping List Jan'24Vishal BawaneNo ratings yet

- MZ PIbyic Ob Yaj YLjDocument15 pagesMZ PIbyic Ob Yaj YLjVishal BawaneNo ratings yet

- Leave ApplicationDocument1 pageLeave ApplicationVishal BawaneNo ratings yet

- Od328521493785744100 1Document1 pageOd328521493785744100 1Vishal BawaneNo ratings yet

- List of Active Channel Partners As On June 30 2018Document56 pagesList of Active Channel Partners As On June 30 2018Vishal BawaneNo ratings yet

- TermsDocument9 pagesTermsVishal BawaneNo ratings yet

- Updated One Pager SPL - Dsa-1Document1 pageUpdated One Pager SPL - Dsa-1Vishal BawaneNo ratings yet

- ZX160083 May 2022 AsifDocument1 pageZX160083 May 2022 AsifVishal BawaneNo ratings yet

- Abante Integrated Management Services Private LimitedDocument1 pageAbante Integrated Management Services Private LimitedVishal BawaneNo ratings yet

- Borrower Eligibility Criteria Updated Oct'23 PDFDocument2 pagesBorrower Eligibility Criteria Updated Oct'23 PDFVishal BawaneNo ratings yet

- PayslipDocument1 pagePayslipVishal BawaneNo ratings yet

- Sep Se OctDocument17 pagesSep Se OctVishal BawaneNo ratings yet

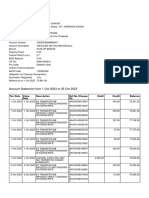

- Account Statement From 1 Oct 2023 To 25 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument12 pagesAccount Statement From 1 Oct 2023 To 25 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceVishal BawaneNo ratings yet

- Print - Udyam Registration Certificate-1-1Document5 pagesPrint - Udyam Registration Certificate-1-1Vishal BawaneNo ratings yet

- Print - Udyam Registration Certificate JankarDocument2 pagesPrint - Udyam Registration Certificate JankarVishal BawaneNo ratings yet

- Prefr Pincode ListDocument476 pagesPrefr Pincode ListVishal BawaneNo ratings yet

- Prefr Pincode ListDocument23 pagesPrefr Pincode ListVishal BawaneNo ratings yet

- StatementDocument15 pagesStatementVishal BawaneNo ratings yet

- As TRW4I3 CpyLssKGyO Bank Statement 1Document54 pagesAs TRW4I3 CpyLssKGyO Bank Statement 1Vishal BawaneNo ratings yet

- Jayanta Jana UdyamDocument4 pagesJayanta Jana UdyamVishal BawaneNo ratings yet

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration CertificateVishal BawaneNo ratings yet

- Udyam Registration Certificate: ServicesDocument2 pagesUdyam Registration Certificate: ServicesVishal BawaneNo ratings yet

- Brunda Tea Stall Udyam Registration CertificateDocument5 pagesBrunda Tea Stall Udyam Registration CertificateVishal BawaneNo ratings yet

- Ack 348372290030723Document1 pageAck 348372290030723Vishal BawaneNo ratings yet

- DGAadhaarDocument2 pagesDGAadhaarVishal BawaneNo ratings yet

- MSME CompleteDocument5 pagesMSME CompleteVishal BawaneNo ratings yet

- API PanDocument2 pagesAPI PanVishal BawaneNo ratings yet

- Null 7Document6 pagesNull 7Vishal BawaneNo ratings yet

- ENA230926100426931LUPLDIMSM85BPHDocument1 pageENA230926100426931LUPLDIMSM85BPHVishal BawaneNo ratings yet

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration CertificateVishal BawaneNo ratings yet

Fast Credit GT All Bank PL Policy - One Pager

Fast Credit GT All Bank PL Policy - One Pager

Uploaded by

Vishal Bawane0 ratings0% found this document useful (0 votes)

59 views20 pagesK

Original Title

Fast Credit Gt All Bank Pl Policy - One Pager (4)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentK

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

59 views20 pagesFast Credit GT All Bank PL Policy - One Pager

Fast Credit GT All Bank PL Policy - One Pager

Uploaded by

Vishal BawaneK

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 20

- BAJAJ

credit FINSERV

Think it. Done

|AJ FINANCE PL product policy

It offer PL to all Salaried employees Govt & Pvt

Income Norms :

Minimum : 700

Bachelor Accommodation ~

Hostel / PG

Age Norms : Minimum : 25 Yrs

Maximum : 58/ 60 as per state Govt policy.

Employment :

Minimum total Employment 6 Months required

Minimum loan amount : 1L.

Max loan amount : 25L.

Balance Transfer : NO.

Credit eard BT: NO.

MCA Registration : Minimum 2 Yrs required.

Partial payment : 2%

Preclosure charges : Allowed after | months at 4%

Tenure :

Minimum : 12 Months

Maximum : 84 Months

Co-applicant / Joint loans in CIBIL

obligation is not considered if the applicant is not the primary applicant

in the loan and the EMI is paid by co-applicant account ( with Co -applicant

pay slips and bank statements on file).

FOIR Norms:

Above 50K+HL live closed FOIR 70%

Above SOKNTH without HL FOIR 65%

Less than 50K NTH with or without HL FOIR 60%

Yearly bonus can also be added for calculation

RATE:

PI 13.50 to 14.50%, PF 1%, FFR 4999

OD/FLEXI 14.75 to 15.50%, PF 1%, FFR,Flex

No

Pensioner PL policy: Yes

Multiplier: Not applicable

NRI Loans: Not Allowed

a

/ innable

Qe seect or

FINNABLE PL product policy

It offers PL to all Salaried employees Govt & Pvt

Income Norms:

Minimum salary: 20K

CIBIL: 0/-1 YES

Minimum: 700

Bachelor accommodation ---- Yes

Hostel / PG —- No

Age Norms: Minimum: 25 Yrs

Maximum: 58/ 60 as per state Govt policy.

Employment:

Minimum total Employment 1 Yr required

Minimum loan amount: 50K

Max Joan amount :10L

Minimum locking period: 6 months.

Balance Transfer: No.

Credit eard BT : No.

MCA Registration: Only 1 Year registration required.

Partial payment: After 6 months

Preclosure charges: Allowed after 6 months at 4%

‘Tenure:

Minimum: 36 Months

Maximum: 5 Years

Co-applicant / Joint loans in CIBIL

obligation is not considered if the applicant is not the primary applicant

in the loan and the EMI is paid by co-applicant account (with Co -applicant

pay slips and bank statements on file).

FOIR Norms:

For sal pvt employees

Sal 20K - 32K : 50%

Pensioner PL policy: No

Multiplier: Not applicable

NRI Loans: Not Allowed

Complete Digital process No physical documents required

Loan Process: 1) Executive will enter all customer details online through unique Id,

upload KYC, income & photo after receiving OTP from customer

2) customer will receive the link to download finable app, to

confirm the details uploaded (can edit if there are any changes)

3) Direct disbursement post approval

4) Documents soft copies accepted

5) Banking E- statement pdf required

@ Fast Credit GT 7 RAN

AXIS PL product policy

It offer PL to all Salaried employees Govt / Pvt

Complete Manual process, physical documents required.

Income Norms:

For AXIS Salary Account:

Cat A,B & C : 20K

Cat C & Unlisted: 40K

Customer having only SB Account:

Cat A, B & C : 30K

Cat C & Unlisted: 30K

Non relationship - other Salary Account:

Cat A,B & C: 40K

Cat C &: 40K

CIBIL : 0 / -1 ---- no

Minimum : 680

Application Score :

Govt - 367, Cat A, B, & C - 330

Bachelor accommodation -—- Yes

Hostel / PG —-- Yes

Age Norms : Minimum : 21 Yrs

Maximum : 60 Yrs

Employment :

Minimum total Employment 1 Yrs required

Minimum loan amount : IL

Max loan amount : 40L (For Cat D and unlisted 10L only}

Minimum locking period : 12 month.

Balance Transfer : As per Bank Norms.

Credit card BT : yes.

MCA Registration ; Minimum 1Yr required.

Partial payment : Yes

Preclosure charges : 4

Tenure :

Minimum : 12 Months

Maximum : 72 Months

Co-applicant / Joint loans in CIBIL

obligation is not considered if the applicant is not the primary applicant

in the loan and the EMI is paid by co-applicant account ( with Co -applicant

pay slips and bank statements on file).

FOIR Norms

Sal <30K : 40%

Sal 30K - 50K : 50%

Sal above 50K : 70%

If customer having Salary Account in AXIS Bank Above 75K Sal : 70%

If customer having a Home loan Above 50 K : 70%

Pensioner PL policy : No

Multiplier : Yes

NRI Loans : Not Allowed

Fullerton

@ Fast Credit GT India

LLERTON PL product policy

It offer PL to all Salaried employees Govt & Pvt

Income Norm:

Minimum salary

CIBIL : 0/-1

Minimum : 600

Bachelor accommodation ---- No

Hostel / PG ---- No

Age Norms : Minimum : 24 Yrs

Maximum : 58/60 as per state Govt policy.

Employment

Minimum total Employment | Yr required

Minimum loan amount : 1L_

Max loan amount : Any loan amount based on eligibility

Minimum locking period : 6 months.

Balance Transfer : Maximum upto 7 BTs only.

Credit card BT : YES.

MCA Registration : Only registration required

Partial payment : No

Preclosure charges: Allowed after 6 months at 7%

‘Tenure:

Minimum : 24 Months

Maximum : 60 Months

Co-applicant / Joint loans in CIBIL

obligation is not considered if the applicant is not the primary applicant

in the loan and the EMI is paid by co-applicant account ( with Co -applicant

pay slips and bank statements on file).

FOIR Norms :

For sal pvt employees

Sal 20K - 32K : 45%

Sal 32K - 45K : 50%

Sal above 45K :55%

For Govt employees

Sal 20K - 32K : 55%

Sal 32K - 45K : 60%

Sal above 45K :65%

‘Yearly bonus can also be added for calculation

Pensioner PL policy : Yes

Multiplier : Not applicable

NRI Loans : Not Allowed

@

Fast Credit GT

Fuwavs ATH YOU: HeroFinCorp.

Finance Made Easy

HERO FINCROP PL product policy

Itoffer PL to all Salaried employees & Self employees

Income Norms :

Minimum

CIBIL

Minimum : 650

Bachelor accommodation --- Yes

Hostel / PG —- No

‘Age Norms : Minimum : 21 Yrs

Maximum : 58 as per state Govt policy.

Employment :

Minimum total Employment | Yr required

(present company 6 months )

Minimum 6 months bank statement required

Minimum loan amount : 50K

Max loan amount : SL

Minimum locking period : 6 months.

Balance Transfer : No.

Credit card BT : No.

MCA Registration : Not mandatory.

Partial payment : No

Preclosure charges : Allowed afier 6 months at 5%

Tenure:

Minimum : 12 Months

Maximum : 60 Months

Co-applicant / Joint loans in CIBIL

obligation is not considered if the applicant is not the primary applicant

in the loan and the EMI is paid by co-applicant account ( with Co -applicant

pay slips and bank statements on file).

FOIR Norms :

For sal pvt employees

Sal 15K - 20K : 40%

Sal 30K - 40K : 50%

Sal above 50K :75%

Pensioner PL policy : Not Allowed

Multi Not applicable

NRI Loans : Not Allowed

@

Fast Credit GT

IDFC PL product policy

It offer PL to all Salaried employees Govt / Pvt & Self employed

Complete Digital process No physical documents required soft copies of

documents by mail are accepted

Income Norms :

Minimum salary: 20K

CIBIL: 0/-1 -—-- NO

Minimum: 700

Bachelor accommodation ---- Yes

Hostel / PG No

Age Norms: Minimum: 23 Yrs

Maximum: 58/ 60 as per state Govt policy.

Employment:

Minimum total Employment 6 months required

Minimum loan amount : 1L.

Max loan amount: 40L

Minimum locking period : 6 months.

Balance Transfer: Maximum upto 3 BTs only.

Credit card BT : YES.

MCA Registration: Minimum 1Yr required.

Partial payment: Yes

Preclosure charges: Allowed after 6 months at 5%

‘Tenure:

Minimum: 24 Months

Maximum: 60 Months

Co-applicant / Joint loans in CIBIL

obligation is not considered if the applicant is not the primary applicant

in the loan and the EMI is paid by co-applicant account (with Co -applicant

pay slips and bank statements on file).

FOIR Norms:

Super Cat A & A,B

Sal 25K - 39K : 60%

Sal 40K - 49K : 60%

Sal 50K - 74K : 65%

Sal above 75K : 70%

Cat C/D (open market)

Sal 25K - 39K : 50%

Sal 40K - 49K : 60%

Sal 50K - 74K : 65%

Sal above 75K : 70%

Pensioner PL policy : No

Multiplier: Not applicable

NRI Loans: Not Allowed

IDFC FIRST

EET

@ Fast Credit GT InCred

= Borrow. With Confidence,

INCRED PL product poli

It offer PL to all Salaried employees

Income Norms

Minimum salary : 15K

CIBIL: 0/-1 -—- Yes

Minimum: 650

Bachelor accommodation ---- No

Hostel / PG ---- No

Age Norms: Minimum : 21 Yrs

Maximum: 55 as per state Govt policy.

Employment:

imum total Employment 1 Yr required (present company 3 months)

Minimum 3 months bank statement required

Profile: we can do propritership & partnership employees also.

Minimum loan amount: 75K

Max loan amount: 7.5L

Minimum locking period: 6 months.

Balance Transfer: No.

Credit card BT : No.

MCA Registration: Not mandatory.

Partial payment: No

Preclosure charges: Allowed after 6 months at 5%

Tenure:

Minimum: 24 Months

Maximum: 48 Months

Co-applicant / Joint loans in CIBIL

obligation is not considered if the applicant is not the primary applicant

in the loan and the EMI is paid by co-applicant account (with Co applicant

pay slips and bank statements on file).

FOIR Norm:

Sal 15K - 20K : 40%

Sal 21K - SOK : 50%

Sal above 50K :65%

Pensioner PL policy: Not Allowed

Multiplier: Not applicable

NRI Loans: Not Allowed

For sal pvt employees

Indusind,

Q™ Credit GT ind@

INDUSND PL product policy

Itoffer PL to all Salaried employees Govt & Pvt

Complete Manual process, physical documents required.

Income Norms:

Minimum salary : 35K

For Govt & Pharma 25K req & Unlisted SOK req

CIBIL: 0/-1 No

Minimum: 700

Bachelor accommodation ---- Yes (only Cat A & Cat B CIBIL 700 above req)

Hostel / PG No

Age Norms : Minimum : 21 Yrs

‘Maximum: 58/ 60 as per state Govt policy.

Employment: Minimum total Employment 3 Yrs required

Listed company 6 months

Unlisted company 1 Year

LLP & LLC companies also will do

Minimum loan amount: 1L

Credit card BT

MCA Registration: Minimum 2 Yrs required.

Partial payment: 0%

Preclosure charges: Allowed after 1 Year at 4%

Tenure:

Minimum: 12 Months

Maximum: 60 Months

Co-applicant / Joint loans in CIBIL

obligation is not considered if the applicant is not the primary applicant

in the loan and the EMI is paid by co-applicant account (with Co -applicant

pay slips and bank statements on file).

FOIR Norms:

Above 50K : 70%

Below 50K : 50%

Pensioner PL policy: No

Multiplier: Not applicable

NRI Loans: Not Allowed

@

Fast Credit GT &

Muthoot Finance

MUTHOOT FINANCEPL product policy

It offers PL to Super A, Cat A, Govt, Cat B, Cat C & Cat D

Income Norms:

Minimum salary:

Cat A & Cat B: 20K

Cat C & Cat D : 25K

Govt : 20K

CIBIL: 0/-1 — only Govt

CIBIL Policy: not more than 4 unique CIBIL enquiries in last 15 days

Bachelor accommodation --- No

Hostel / PG —- No

Age Norms: Minimum: 23 Yrs

Maximum: 58/ 60 as per state Govt policy.

Employment:

Cat-A , Band C 1 Yrs

Cat D-— 1 Yrs

Minimum total Employment 3 Yrs required

Minimum loan amount: 1L_

Max loan amount: 7.5L.

Minimum locking period: 1Year.

‘Topup & parallel: Can be done after 9 months.

Balance Transfer: Yes

Credit card BT : Yes.

MCA Registration: Only 3 Yrs registration required.

Partial payment: Allowed after 36 months upto 25% of outstanding pricipal

Preclosure charges: Allowed after 12 months at 4%

Tenure:

Minimum: 12 Months

Maximum: 60 Months

Co-applicant / Joint loans in CIBIL

Obligation is not considered if the applicant is not the primary applicant

in the loan and the EMI is paid by co-applicant account (with Co -applicant

pay slips and bank statements on file).

FOIR Norms:

Sal 20K - 29K : 40%

Sal 30K - 49K : 50% to 60%

Above 75K : 75%

‘Yearly bonus can also be added for calculation

Pensioner PL policy: Not Allowed

Multiplier: Not applicable

NRI Loans: Not Allowed

; , Standard @&

Q™ Credit GT Chartered Se

SCB PL product policy

It offers PL to all Salaried employees Govt & Pvt

Income Norms:

Minimum salary: Gross Sal SOK

Salary A/e SC!

CIBIL: 0/-1

Minimum: 740

Bachelor accommodation ---- YES

Hostel / PG ---- No

Age Norms: Minimum: 23 Yrs

Maximum: Govt 65Yrs (with retirement proof).Pvt 60Y rs (with retirement

proof).

Employment:

Minimum total Employment 2 Yr required

(Present Company 2months also accepted)

Minimum loan amount: IL

Max loan amount: SOL for listed companies

15L for Non listed companies

Minimum locking period: | Year.

Balance Transfer: Maximum upto 2 BTs only.

Credit card BT : No.

MCA Registration: 3 Years registration required,

Partial payment: YES

Preclosure charges: Allowed after | Year at 5%

Tenure:

Minimum: 24 Months

Maximum: 60 Months

Co-applicant / Joint loans in CIBIL

obligation is not considered if the applicant is not the primary applicant

in the loan and the EMI is paid by co-applicant account (with Co -applicant

pay slips and bank statements on file),

FOIR Norms:

For Listed companies: 55%

For Non-Listed companies: 40%

Director policy: Salaried director upto 20% shareholding allowed

LLP company employees can also be processed

Pensioner PL policy: NO

Multiplier: 15 times

g@ Fast Credit GT Glo lei i -E UL s

ICICI BANK PL product policy

Itoffer PL to the employees of Elite, Govt, super prime, contractual government employees

of Hospital /school / colleges &

Preferred (18000 companies)

Income Norm

Elite & Govt

Super prime

ICICI sal Ave -- 30K

Other sal A/c -- 30K

Preferred :

ICICT sal Ave - 30K

Other sal Ave ~ 35K

30K NTH

CIBIL :

0/-1--- YES

<700 ---- with mitigant (live loan more than 12 EMIs paid)

Bachelor accommodation -—- Yes

Hostel / PG ---- Yes.

Age Norms :

Minimum : 21 Yrs

Maximum : 58/ 60 as per state Govt policy.

Employment :

Minimum total Employment 2 Yrs required (in one or multiple jobs)

Minimum locking period : 12 Months.

Topup : Allowed only after 6 EMIs being paid.

Parallel loan : Allowed only after 3 EMIs being paid

Special norms for Government teachers getting irregular salaries

ICICI Bank Government teachers where salary is received inconsistently with a delay (at

least 2 of last 3 month salary not observed ) such cases can also be processed by checking at

east 10 of 12 salary credits in last 12 months.

Average of last 10/11 monthly credits may be considered for income imputation.

Latest salary credited should not be >3 months old, subject to employment confirmation.

Balance Transfer : Allowed for any number of loans based on eligibility.

Credit card BT ; Not allowed.

MCA Registration : Mandatory

Partial payment : Not allowed

Preclosure charges : allowed after 12 EMIs @ 5.00% preclosure charges.

‘Tenure:

Minimum : 12 Months

Maximum : 72 Months for Elite and Govt, sal > 50K CIBIL > 750.

Else 60 months

Co-applicant / Joint loans in CIBIL

obligation is not considered if the applicant is not the primary applicant

in the loan and the EMI is paid by co-applicant account ( with Co applicant

pay slips and bank statements on file).

Q-crett GT eee =F 11s

42

ICICI BANK

FOIR Norms :

Sal 30K - 50K :

Elite, Govt & super prime —- 55%

Preferred & open market -- 50%

Sal SOK - 70K

Elite, Govt & super prime —- 65%

Preferred & open market -- 55%

Sal 70K and above

Elite, Govt & super prime -- 70% (with HL)

Preferred & open market -- 60%

Multiplier :

Tenor upto 24 months

Sal > 50K --- 7 times for all categories

Sal < SOK --- 6 times (elite & SP) & 5 times (Govt, preferred and others)

Tenor : 36 months

Sal > 50K — 18 times (elite,Govt & SP) & 15 times (preferred & others)

Sal < 50K --- 16 times elite, 15--Govt & 13 — Sp) 7 times other

Tenor 48 months

Sal > 75K — 22 times (elite & SP) : 21 times Govt : 18 times Preferred

Sal > SOK —- 21 times (elite, Govt & SP) : 18 times preferred.

Sal > 35K —- 16 times (elite, Govt & SP) : 15 times preferred.

Tenor 60 months

Sal > 75K —- 24 times (elite & SP) : 23 times Govt : 20 times Preferred

Sal > SOK --- 23 times (elite, Govt ) : 22 times SP.

Sal > 35K —-- 20 times (elite, Govt & SP)

NRI Loans :

customer should have NRE account in ICICI bank

NRI would be co-applicant in the loan.

Income and eligibility will be calculated based in the average remittance

in ICICI NRE account.

Maximum loan amount : 20 L based on the policy and eli

Documents required as per policy :

Applicant --- KYC docs req

NRI--- income, passport, employment, contract copy & bank statements

with salary credit req.

lity.

F.

Q™ Credit GT ee Rs

‘sHraio—— We understand your world

HDFC PL product policy

It offer PL to the employees of Elite, Govt, Super A, Cat A, B,C, D & Army

Income Norms :

Super A, Cat A, Cat B

Sal account HDFC : 25K

Non HDFC sal account : 30K

Cat C/MED :

Salary above 35K req

Railways :

HDFC / Non HDFC sal ac : 30K

Cat GO (Non-Nurse)

HDFC / Non HDFC sal ac : 30K

CIBIL :

0/-1-—— YES

<700 ---- Yes

Bachelor accommodation --- Yes

Hostel / PG —- No

Age Norms

Minimum : 21 Yrs

Maximum : 58/ 60 as per state Govt policy.

Employment :

Minimum total Employment 3 months For Super A, Cat A

Cat B , Cat C & Govt Minimum employment 1 Year req

Minimum locking period : 12 Months.

Topup : Allowed only after 3 EMIs being paid.

Parallel : Allowed only after 3 EMIs being paid.

Balance Transfer : Allowed after | Year

Credit card BT : Yes

MCA Registration : Not Mandatory

Partial payment : After 1 Year

Preclosure charges : allowed after 12 EMls > 10L 0% &< 10L 4%

Tenure:

Minimum : 12 Months

Maximum : 72 Months (req sal above 50K Band A to C)

Co-applicant / Joint loans in CIBIL

obligation is not considered if the applicant is not the primary applicant

in the loan and the EMI is paid by co-applicant account ( with Co -applicant

pay slips and bank statements on file).

Pensioner PL policy :

Applicable for retired Govt and Non Govt employees.

Loan amount from 50K to Slakh.

Maximum Age : 65 Yrs

Maximum tenor 36 months

Minimum pension 20K per month

Coapllicant mandatory

Other income can be considered maximum upto 50% of pension amount based on

TTR filed.

PENSIONER POLICY IS NOT RUN!

BY BANK DUE TO COVID,

nays THOU — Kotak Mahindra Bank

@ Fast Credit GT kotak

KOTAKOVERDRAFT NOTES.

‘© CURRENT A/C (OD) TO BE OPENED FOR EXISTING BANK CUSTOMER HAVING SALARY/SAVING

A/C WITH KOTAK BANK

© CURRENT A/C (OD) & SAVING A/C TO BE OPENED WITH 10K CHEQUE FOR NEW TO BANK

CUSTOMER

REPAYMENT WILL BE FROM SAVING A/C OF KOTAK BANK ONLY

LOAN AMOUNT 1LAC TO 25LAC

COMPANY CATEGORY AA, A, B & GOVERNMENT.

SALARY SHOULD BE 50K

PLBT ALLOWED IN OD. BT OF BAJAJ & TATA OD NOT ALLOWED

‘TENURE WILL BE 5 YEARS ONLY

‘© 1 YEAR HYBRID OD & 4 YEARS DROPLINE OD.

* LIMIT DROP PER MONTH AFTER 1 YEAR: OD LIMIT AMOUNT DIVIDED BY 48 MONTHS

© 6 CHEQUE’S OF SAVING A/C REQUIRED AT THE TIME OF DISBURSEMENT

INSTEAD OF AMC CHARGE: MINIMUM UTILISATION TO BE 10% IN A QUARTER ELSE

CHARGES OF 0.50% ON OD LIMIT AMOUNT

PAYOUT WILL BE ON SLAB BASIS

LOCKING PERIOD WILL BE 1 YEAR

FORECLOSURE CHARGES NIL.

8 TO 10 DAYS FOR PROCESSING OF LOAN

© OD FACILITY AVAILABLE IN HYDERABAD, BANGALORE, CHENNAI, DELHI, MUMBAI AND PUNE

CITIES ONLY

Tenure = 60 months

Super CAT A/Kotak Govt.

Dsa/ost Group employeest | caTa/psu | cATB | ‘Companies

NTH > 75000 11.50% 11.75% 13.25% 12%

fresh | NTH? 50000-75000 11.78% 72.00% 13.74% 12.25%

Gases/BT Not to be addressed as of now

NTH Less than SOk

Optimus

‘Amount>20L 11.50% 11.50% | 125% | 11.50%

Prime

PEG

PF Grid Super CATA] CATA/PSU CATE Govt Companies

Fresh cases 150% 150% 174% 17%

Balance Transfer 174% 170% 225% 2.00%

@

Fast Credit GT

AXIS FINANCE

> Tenure=12- 84 months Pevsstinance

» Age —21 Salaried and 60 at the time me of maturity

> Tier —Rs.25K (1), RS.20K (Il), Rs.15 (ll)

» Latest 3 months’ bank st

>» Latest 3 month salary slip

© Applicant is staying in self-owned/parental owned/company provided

‘Accommodation on ( Same to be confirmed from App form & during Tele-PD with

the customer) Or

© Applicant is having a matured or Live HL/LAP (To be confirmed from Bureau) Or

0 Place of current residence matches with Bureau records (HIT Customer).

Reported residence in bureau should be >= 12 months.

S CAT A—Rs.0.50 lacs to Rs.25 lacs — 3 months current and 24 months total expi-

CAT A~Rs.0.50 lacs to Rs.20 lacs - 3 months current and 24 months total expi

CAT B - Rs.0.50 lacs to Rs.15 lacs - 3 months current and 24 months total expi

No EMI bouncs last 3 month for ISF (Moratorium availed customer need to

provide bank st to check 3 EMI debit

Bach Acco — TVR at Permanent Ri mandatory

Top up—9 months seasoning required for Parallel or Top up with no EMI bounce

Pan cards starting from D, E .... AND Age > 40 yrs. to be approved at NCM level

Recent Unsecured loan — 1 PL in last 6 months

For 6yrs tenor Super A/ cat-A no require co-applicant.

> With HL BT max loan SAlakh.

In cases where PF is not being deducted, No PF deduction to be be

mitigated by Form 16, same to be documented screened/validated by

RCU/Credit through govt. sites

NSP Profifile

Tenure 12 m to 48 months

Loan amount Rs.0.50 lacs to 10 lacs and Rs.5 lacs for New to credit

Age —21 yrs to 58 yrs or re recent age at time of maturity

Current employment stability is 2 yrs and Total is 5 yrs.

Cases with Applicant Age >= 40 years & NTH <= 30 K with rented residence are not to

be sourced

Segment with Age >= 40 years & NTH <= 30 K shall be processed with below

deviation on and supported with documented ownership proof current residence - To

be approved at NCM Level

> Resi—2 yrs stability in current resi

> ABB = 1* EMIis required CAT D or Unapproved co's

Minimum Loan amount is Rs.1 lac to 10 lacs and Rs.5 lacs for New to credit

Resi Stability - 1 yrs for rented

Office Stability 2 yrs in current job and 4 yrs in total

Minimum Income for the Tier is Rs.30000

Bach acco cases not to be funded in CAT D profile

Office Fi is mandatory

VV VV VV VV VY

vvvvy

v

Technical Profile mapping across key sectors (Skilled profiles/

employees of

focus industries/sectors) - Complete discre on of Credit hes BNANGE

BT Program

3 PLand 2 Credit card

No Minimum BT amount

Minimum Seasoning for BT is 5 months

NIL bounces in last 5 months

NIL late fees or over u6 lised fees in credit card st

EMI Obligate on Calculation on Logic

> Any Joint Loan ~ If not proved that EMI is paid by 3rd party - EMI

obligated is Half

> Gold Loan and Loan against share / OD account - 1.50 pc of the current

outstanding balance to be taken as obligated on

> Loan Expiry in 3 months - EMI not to be obligated

> Hand LAP Expiry in 6 months ~ EMI not to be obligated

g@ Fast Credit GT

ADITYA BIRLA GROUP

Aditya Birla Finance Ltd

CAT A-50 lakhs

CAT B40 lakhs

CAT C30 lakhs

CAT D~10 lakhs

Tenure Min: 12 months | Max: 60 / 84 months (In Salary 35+ FOIR Calculate 84

months)Age Norms Minimum Age ~ 23 years, Cat D- 25 age

Maximum Age ~ 60 years Work Experience Min Total Experience: 24 Months | Current

Experience: 6Months

‘ABB TO EMI-1 TIME

FOIR Grid:

‘* 35,000 -45,000- 60%

© 45,000-75,000- 65%

© 75,000-1,50,000 - 70%

‘* >=1,50,000- 75%

PL Emerging

CAT A/ B10 lakhs CAT C / D—5 lakhs Proprietorship / partnership / LLP —5 lakhs and tenor

48 MonthsFOIR Grid: CAT A, B, C & D: <=35,000- 60%

For Proprietorship / LLP / partnership: <=30,000 = $5% >30,000 = 60%

CIBIL score: =700

Top-up allow after 9 EMI's

Max FOIR should be restricted to 100%

Loan amount capping for Elite 25 Lakh and Emerging 10 Lakh

No loan last 6 Months

Min track of 12 months is applicable only in case of PL BT and CC BT not allowed

‘+ Min Tenure 1 YR and <15 Lac Tenure 60 Months >15+ CAT A CAT B CIBIL 750+ to offered 84

months

ROI Details

am Fast Credit GT

fans

30,001-35,000 | 19.99% | 20.99% | 21.99% | 22.99% | 23.99%

35,001-45,000 | 14.49% | 15.49% | 16.49% | 17.49% | 19.49%

45,001-75,000 | 13.99% | 14.99% | 15.99% | 16.99% | 18.99%

75,001 - 1,50,000 | 13.49% | 14.49% | 15.49% | 16.49% | 18.49%

>1,50,000 12.99% | 13.99% | 14.99% | 15.99% | 17.99%

TATA Personal Loan Sourcing Norms (Revised!

+ Sourcing is allowed from employees working in All company categories except

Uncategorized (Where company turnover isles than R520 crores)

* Maximum loan tenure: as per existing policy norms

Tata Group / Super Cat A / Cat A/ Cat B- upto 72 months

Cat C- upto 60 months

Cat U-upto 48 months

‘+ SPECIAL MAX LOAN TENURE FOR OD Customers

Tata Group / SUper Cat A/ Cat A/ Cat 8-84 months (2 year fixed and 5 year dropline)

Cat C~ 60 months (1 year fixed and 4 year dropline)

Please note: Above max tenure is indicative and changes based on customer's loan amount, income

and company category

Minimum Income Norms

CATE]

Salary Range CATA catc | caTD | Others

Sout org. TATA CAPITAL

=30,000 21.99% | 22.99% | 23.99% | 24.99% | 25.99% sneer

‘Company Category ALL Locations Locations other than Tier 1

Tata Group 15K 15K

Government 25K 25K

‘Super Cat A and Cat A 20K 15K

Cat B 25K 20K

Cat C 25K, 20K

Unlisted 40K 40K

Tier 1 Cities - Delhi-NCR, Mumbai-MMR, Chennai, Pune, Kolkata, Bangalore, Hyderabad Salary

Norms and Loan Amount capping rules for employees working in different categories

+ Minimum loan amount 75,000

+ Maximum loan amount 25 Lac (No capping of loan amount basis salary or

employer category)

+ For Customers with CIBIL score 0/-1:

* For TGE loan amount to be restricted to Rs.5 Lakhs

* For other employer category, amount to be restricted to Rs.3 Lakh

@ Fast Credit GT

romcup

TOTA.SALTIAL

“Salary Band Max FOIR Unsecured FOIR

SE om oR

>25K & <= 50K 60% 50%

TORE STR oR mK

TR 7 oe

+ Govt Employees with Salary >Rs.50k to be treated as per Super Cat A norms

+ Latest month salary credit to be validated in all cases.

+ Incase salary slips are not available for recent months, then case to be considered if

salary credit narration mentions company name / Form 16 validation / Appointment

letter / Form 26AS is available

Restructuring Norms

In case customer has applied / availed restructuring in any of loan in last 12 months then funding

to be avoided.

Industry Norms

+ Applicant working in a negative industry (Salaried or Self-employed) will not be funded

except in case of Government / Tata Group

List of Negative Industry: (Where Funding to be restricted)

1. Aviation including businesses dependent on aviation industry

Construction and real estate (Real Estate Developer)

3. Hospitality (casinos, amusement parks, events, cruises and other tourism-related services

including Tour & Travel operators, restaurants, hotels, Taxi / Cruise / Bus operators, forex

dealers and other businesses dependent on the industry)

4, Entertainment and Leisure (Multiplex, Resorts, SPA's and Massage Parlours, Entertainment

Parks, Banquet Halls/Lawns, Bars, Lounges, Salons, Gyms, Gaming centres, Catering & Tent

houses ete.)

5. Manpower companies’ dependent on any of the above negative indus

FLNorms

Office Fl waiver Norms

* Official email 1D validation

+ Govt employee: ID card, latest one-month salary slip and two month bank statement

+ supervisor recommendation / HR confirmation along with domain validation

+ If customer’s PF / 26AS / Perfios check is positive or Bank statement has been sampled by

RcU

Resi Fl waiver Norms

+ Address should match with CIBIL records

CREs/ on roll Tata Capital employees / Doc pick up agencies meeting applicant (s) at their

residence should fill up Fl forms along with photograph and the same shall be considered

as Fl report

Geo tagging based on video PD

Fast Credit GT

—— ALWAYS WITH YOU ———

Visit Now- www. fastcreditgt.com

Email Id- contact@fastcreditgt.com

Contact No.- 9794186833. 8948396920.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AXIS Bank SM Mapping List Jan'24Document6 pagesAXIS Bank SM Mapping List Jan'24Vishal BawaneNo ratings yet

- MZ PIbyic Ob Yaj YLjDocument15 pagesMZ PIbyic Ob Yaj YLjVishal BawaneNo ratings yet

- Leave ApplicationDocument1 pageLeave ApplicationVishal BawaneNo ratings yet

- Od328521493785744100 1Document1 pageOd328521493785744100 1Vishal BawaneNo ratings yet

- List of Active Channel Partners As On June 30 2018Document56 pagesList of Active Channel Partners As On June 30 2018Vishal BawaneNo ratings yet

- TermsDocument9 pagesTermsVishal BawaneNo ratings yet

- Updated One Pager SPL - Dsa-1Document1 pageUpdated One Pager SPL - Dsa-1Vishal BawaneNo ratings yet

- ZX160083 May 2022 AsifDocument1 pageZX160083 May 2022 AsifVishal BawaneNo ratings yet

- Abante Integrated Management Services Private LimitedDocument1 pageAbante Integrated Management Services Private LimitedVishal BawaneNo ratings yet

- Borrower Eligibility Criteria Updated Oct'23 PDFDocument2 pagesBorrower Eligibility Criteria Updated Oct'23 PDFVishal BawaneNo ratings yet

- PayslipDocument1 pagePayslipVishal BawaneNo ratings yet

- Sep Se OctDocument17 pagesSep Se OctVishal BawaneNo ratings yet

- Account Statement From 1 Oct 2023 To 25 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument12 pagesAccount Statement From 1 Oct 2023 To 25 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceVishal BawaneNo ratings yet

- Print - Udyam Registration Certificate-1-1Document5 pagesPrint - Udyam Registration Certificate-1-1Vishal BawaneNo ratings yet

- Print - Udyam Registration Certificate JankarDocument2 pagesPrint - Udyam Registration Certificate JankarVishal BawaneNo ratings yet

- Prefr Pincode ListDocument476 pagesPrefr Pincode ListVishal BawaneNo ratings yet

- Prefr Pincode ListDocument23 pagesPrefr Pincode ListVishal BawaneNo ratings yet

- StatementDocument15 pagesStatementVishal BawaneNo ratings yet

- As TRW4I3 CpyLssKGyO Bank Statement 1Document54 pagesAs TRW4I3 CpyLssKGyO Bank Statement 1Vishal BawaneNo ratings yet

- Jayanta Jana UdyamDocument4 pagesJayanta Jana UdyamVishal BawaneNo ratings yet

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration CertificateVishal BawaneNo ratings yet

- Udyam Registration Certificate: ServicesDocument2 pagesUdyam Registration Certificate: ServicesVishal BawaneNo ratings yet

- Brunda Tea Stall Udyam Registration CertificateDocument5 pagesBrunda Tea Stall Udyam Registration CertificateVishal BawaneNo ratings yet

- Ack 348372290030723Document1 pageAck 348372290030723Vishal BawaneNo ratings yet

- DGAadhaarDocument2 pagesDGAadhaarVishal BawaneNo ratings yet

- MSME CompleteDocument5 pagesMSME CompleteVishal BawaneNo ratings yet

- API PanDocument2 pagesAPI PanVishal BawaneNo ratings yet

- Null 7Document6 pagesNull 7Vishal BawaneNo ratings yet

- ENA230926100426931LUPLDIMSM85BPHDocument1 pageENA230926100426931LUPLDIMSM85BPHVishal BawaneNo ratings yet

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration CertificateVishal BawaneNo ratings yet