Professional Documents

Culture Documents

Bharat Plywood and Timber Vs Employees' Provident Fund On 4 February 1976

Bharat Plywood and Timber Vs Employees' Provident Fund On 4 February 1976

Uploaded by

Shivansh SharmaCopyright:

Available Formats

You might also like

- 13 2 Reply JalandharDocument8 pages13 2 Reply JalandharSudhir Sinha86% (35)

- Contract To Sell: Know All Men by These PresentsDocument3 pagesContract To Sell: Know All Men by These PresentsMarvel Felicity100% (3)

- Interim Application Under Section 143ADocument9 pagesInterim Application Under Section 143AKartik Sabharwal92% (13)

- Affidavit of MistakeDocument4 pagesAffidavit of MistakeRinku Kokiri67% (3)

- SMART COMMUNICATIONS, INC. ET AL. v. NTC - DigestDocument2 pagesSMART COMMUNICATIONS, INC. ET AL. v. NTC - DigestMark Genesis Rojas100% (1)

- Penalty On EPF Delay PaymentDocument8 pagesPenalty On EPF Delay PaymentAnand ChaudharyNo ratings yet

- Payment of Wages Act, 1936: FactoriesDocument46 pagesPayment of Wages Act, 1936: FactoriesViraja GuruNo ratings yet

- PAYMENT OF GRATUITY. - (1) Gratuity Shall Be Payable To An Employee On TheDocument4 pagesPAYMENT OF GRATUITY. - (1) Gratuity Shall Be Payable To An Employee On TheVenkata Rao NaiduNo ratings yet

- Banking Law Case AnalysisDocument4 pagesBanking Law Case Analysis1982024No ratings yet

- The Workmen'S Compensation Act, 1923Document4 pagesThe Workmen'S Compensation Act, 1923dplpthk1502No ratings yet

- Taxguru - In-Reversal Recovery of ITC Due To Time Limit Us 164 A Possible View in Departments Favour PDFDocument7 pagesTaxguru - In-Reversal Recovery of ITC Due To Time Limit Us 164 A Possible View in Departments Favour PDFKoushikNo ratings yet

- Liquidation of Companies PDFDocument8 pagesLiquidation of Companies PDFTippanna GodiNo ratings yet

- PF Arrest ProvisionsDocument8 pagesPF Arrest Provisionsiona_hegdeNo ratings yet

- Before The High Court of Karnataka at Bengaluru WRIT PETITION NO. 58209/2018 (L-PF) BetweenDocument8 pagesBefore The High Court of Karnataka at Bengaluru WRIT PETITION NO. 58209/2018 (L-PF) BetweenkirumcaNo ratings yet

- JMM Promotions and Management, Inc. vs. National Labor Relations Commission and Ulpiano L. Delos Santos and Radiola Toshiba Philippines, Inc. vs. The Intermediate Appellate CouDocument4 pagesJMM Promotions and Management, Inc. vs. National Labor Relations Commission and Ulpiano L. Delos Santos and Radiola Toshiba Philippines, Inc. vs. The Intermediate Appellate CouJacinth DelosSantos DelaCernaNo ratings yet

- BBA-MBA Integrated Programme Advanced Course On OB & HRM Individual Assignment Submitted byDocument19 pagesBBA-MBA Integrated Programme Advanced Course On OB & HRM Individual Assignment Submitted byAalokNo ratings yet

- Case LawDocument5 pagesCase LawRaj ChouhanNo ratings yet

- Sher Singh Rawat vs. PIO, EPFO (17.05.2017 - CIC) Section 3 RtiDocument9 pagesSher Singh Rawat vs. PIO, EPFO (17.05.2017 - CIC) Section 3 RtiAyyachamy IlangovanNo ratings yet

- Payment of Gratuity Act 1972Document4 pagesPayment of Gratuity Act 1972PraveenakishorNo ratings yet

- WcactDocument5 pagesWcactRajendra KumarNo ratings yet

- Atlantic Department Stores, Inc. v. United States, 557 F.2d 957, 2d Cir. (1977)Document8 pagesAtlantic Department Stores, Inc. v. United States, 557 F.2d 957, 2d Cir. (1977)Scribd Government DocsNo ratings yet

- Amity Law School Labour Law Project Case Study ON: Nathulal Vs M.P. State Road Transport, 1986Document5 pagesAmity Law School Labour Law Project Case Study ON: Nathulal Vs M.P. State Road Transport, 1986Kalpit SharmaNo ratings yet

- Article On Section 13 (4) of SARFAESI ActDocument7 pagesArticle On Section 13 (4) of SARFAESI ActIntern VSPNo ratings yet

- Workmen's Compensation Act Rules ThereunderDocument52 pagesWorkmen's Compensation Act Rules ThereunderJyothiPunemNo ratings yet

- Payment of Gratuity Act ProjectDocument16 pagesPayment of Gratuity Act ProjectRuben RockNo ratings yet

- Serrano V GallantDocument5 pagesSerrano V GallantGerard Relucio OroNo ratings yet

- Payment of Gratuity Punjab RulesDocument7 pagesPayment of Gratuity Punjab RulesSakshi VermaNo ratings yet

- 12 11 Workmen Compensation ActDocument6 pages12 11 Workmen Compensation ActArunima SarkarNo ratings yet

- Cases Social LegislationDocument44 pagesCases Social LegislationHuehuehueNo ratings yet

- K. Ramaswamy and D.P. Wadhwa, JJDocument2 pagesK. Ramaswamy and D.P. Wadhwa, JJHarshit ShrivastavaNo ratings yet

- Delhi Development Authority Vs Swastic ConstructioDE2023020223180731100COM11934Document7 pagesDelhi Development Authority Vs Swastic ConstructioDE2023020223180731100COM11934KANCHAN SEMWALNo ratings yet

- Royer's, Inc. v. United States, 265 F.2d 615, 3rd Cir. (1959)Document6 pagesRoyer's, Inc. v. United States, 265 F.2d 615, 3rd Cir. (1959)Scribd Government DocsNo ratings yet

- Rules 1972Document30 pagesRules 1972venkateshbedhreNo ratings yet

- Lorenzo Tangga An v. Philippine Transmarine CarriersDocument4 pagesLorenzo Tangga An v. Philippine Transmarine CarriersMike HamedNo ratings yet

- Show FileDocument22 pagesShow Filesaumya.bsphcl.prosixNo ratings yet

- Referred To The Decision of The Supreme Court in The Case ONGC v. SAW Pipes To Define As To What Comes Under The Scope of "Public Policy"Document6 pagesReferred To The Decision of The Supreme Court in The Case ONGC v. SAW Pipes To Define As To What Comes Under The Scope of "Public Policy"Ramasayi GummadiNo ratings yet

- Mendoza v. PeopleDocument6 pagesMendoza v. PeopleDanielle AngelaNo ratings yet

- FAQ S For Application For POHW 20230513Document6 pagesFAQ S For Application For POHW 20230513Ayush BhattNo ratings yet

- CD - 3. Serrano Vs Gallant Maritime Services Inc, GR No. 167614, March 24, 2009Document6 pagesCD - 3. Serrano Vs Gallant Maritime Services Inc, GR No. 167614, March 24, 2009Marianne Shen PetillaNo ratings yet

- JMM Promotions vs. NLRCDocument4 pagesJMM Promotions vs. NLRCraynald_lopezNo ratings yet

- Notice About w-4Document2 pagesNotice About w-4Apollo Myles Lafrance El100% (1)

- Term, Whichever Is Less ." Violates OFW's Constitutional Rights in That It Impairs The Terms of Contract, DeprivesDocument12 pagesTerm, Whichever Is Less ." Violates OFW's Constitutional Rights in That It Impairs The Terms of Contract, DeprivesTriccie MangueraNo ratings yet

- People v. Gatchalian, G.R. No. L-12011-14Document15 pagesPeople v. Gatchalian, G.R. No. L-12011-14Eszle Ann L. ChuaNo ratings yet

- FAQ S For Application For POHW 20230513 3Document8 pagesFAQ S For Application For POHW 20230513 3nvtp58k8gfNo ratings yet

- 37 - Philippine Integrated Labor Assistance v. NLRC G.R. No. 123354Document5 pages37 - Philippine Integrated Labor Assistance v. NLRC G.R. No. 123354Shash BernardezNo ratings yet

- 1996 Air 1214 1996 SCC (3) 45Document6 pages1996 Air 1214 1996 SCC (3) 45Abeer UlfatNo ratings yet

- The Assam Professions, Trades, Callings and Employments Taxation - Act-Chapter III - ch3Document4 pagesThe Assam Professions, Trades, Callings and Employments Taxation - Act-Chapter III - ch3barsha jalanNo ratings yet

- Labour Law Assigmnent 27-3-19Document8 pagesLabour Law Assigmnent 27-3-19shubham chauhanNo ratings yet

- Payment Return AgreementDocument6 pagesPayment Return AgreementSonica DhankharNo ratings yet

- Banking End Sem CasesDocument35 pagesBanking End Sem CasesMahathi BokkasamNo ratings yet

- NCLT Aplication For Disposal of ClaimsDocument3 pagesNCLT Aplication For Disposal of ClaimsShashikant ThakreNo ratings yet

- Employee's Contribution For PF/ESI Before Due Date of Filing Return of Income Is Allowable ExpenseDocument7 pagesEmployee's Contribution For PF/ESI Before Due Date of Filing Return of Income Is Allowable ExpenseAnil VermaNo ratings yet

- Establishment: Factory Industry Establishment Central Government EstablishmentDocument9 pagesEstablishment: Factory Industry Establishment Central Government EstablishmentPayal PurohitNo ratings yet

- Abstract of The Minimum Wages Act, 1948Document4 pagesAbstract of The Minimum Wages Act, 1948Shabir TrambooNo ratings yet

- Position Paper SampleDocument18 pagesPosition Paper SampleKenneth FrancoNo ratings yet

- Digest LaborDocument36 pagesDigest LabortearsomeNo ratings yet

- Workmen'S Compensation ActDocument19 pagesWorkmen'S Compensation ActGospelNo ratings yet

- Page 52 of 332Document7 pagesPage 52 of 332Ravinder Singh AtwalNo ratings yet

- 2024 LHC 2795Document4 pages2024 LHC 2795Cheema KhanNo ratings yet

- Power Grid Corporation of India LTD Vs Jyoti StrucDE201715121715561431COM964804Document4 pagesPower Grid Corporation of India LTD Vs Jyoti StrucDE201715121715561431COM964804Suraj AgarwalNo ratings yet

- Prathiba M. Singh, J.: Equiv Alent Citation: 2019 (177) DRJ473Document3 pagesPrathiba M. Singh, J.: Equiv Alent Citation: 2019 (177) DRJ473Siddharth BhandariNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Labor Contract Law of the People's Republic of China (2007)From EverandLabor Contract Law of the People's Republic of China (2007)No ratings yet

- Kho vs. Makalintal, 306 SCRA 70Document3 pagesKho vs. Makalintal, 306 SCRA 70BFP 12 ORD-StaffNo ratings yet

- NATIONAL HIGHWAYS AUTHORITY OF INDIA vs. SAYEDABAD TEA COMPANY LTD. AND ORS.Document5 pagesNATIONAL HIGHWAYS AUTHORITY OF INDIA vs. SAYEDABAD TEA COMPANY LTD. AND ORS.siddharthNo ratings yet

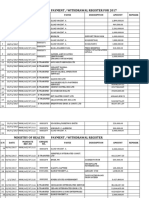

- Withdrawal Register 2020Document65 pagesWithdrawal Register 2020Ellastrous Gogo NathanNo ratings yet

- Oscar Espuelas y MendozaDocument2 pagesOscar Espuelas y MendozaAc CorpuzNo ratings yet

- Quality Criteria To Indicate Student's Level of AttainmentDocument2 pagesQuality Criteria To Indicate Student's Level of AttainmentFadwa BaasharNo ratings yet

- The Value Proposition Canvas PDFDocument1 pageThe Value Proposition Canvas PDFAristeres Carranza SánchezNo ratings yet

- Bcom Sem-6 (2019) April-2023 Auditing & Corporate Governance-2Document2 pagesBcom Sem-6 (2019) April-2023 Auditing & Corporate Governance-2Hariom ShingalaNo ratings yet

- N-AP-1 - Accrued MarkupDocument2 pagesN-AP-1 - Accrued MarkupAung Zaw HtweNo ratings yet

- Cambridge Maths 4 Work Book PDF License Mathematics 49Document1 pageCambridge Maths 4 Work Book PDF License Mathematics 49suzan.gabbarNo ratings yet

- University Institute of Legal Studies, Punjab University, Chandigarh Moot MemorialDocument14 pagesUniversity Institute of Legal Studies, Punjab University, Chandigarh Moot MemorialNimrat kaurNo ratings yet

- "A Rose For Emily" by William Faulkner Mock Trial & Textual AnalysisDocument5 pages"A Rose For Emily" by William Faulkner Mock Trial & Textual AnalysisLINA PASSIONNo ratings yet

- Terms and Conditions - For Rice GoodsDocument13 pagesTerms and Conditions - For Rice GoodsAriane AdajarNo ratings yet

- 1 1 Simple-Compound-Interest - P2Document4 pages1 1 Simple-Compound-Interest - P2Missblack XoxpNo ratings yet

- Manila Memorial Park, Inc. vs. Secretary of The Department of Social Welfare and Development 711 SCRA 302, December 03, 2013, G.R. No. 175356Document3 pagesManila Memorial Park, Inc. vs. Secretary of The Department of Social Welfare and Development 711 SCRA 302, December 03, 2013, G.R. No. 175356Almer Tinapay100% (1)

- Preamble Declares India To Be A Sovereign, Socialist, Secular and Democratic RepublicDocument8 pagesPreamble Declares India To Be A Sovereign, Socialist, Secular and Democratic RepublicPpriya PNo ratings yet

- The Ascent Adam Plantinga Full ChapterDocument67 pagesThe Ascent Adam Plantinga Full Chapterruth.bulle702100% (9)

- RRCA Bos Letter Nov 28, 2023Document4 pagesRRCA Bos Letter Nov 28, 2023newsNo ratings yet

- Terms of EngagementDocument6 pagesTerms of EngagementMyeduniya MEDNo ratings yet

- Affidavit - ERRONEOUS ENTRY - BONGCAYAODocument1 pageAffidavit - ERRONEOUS ENTRY - BONGCAYAODiaz Law OfficeNo ratings yet

- Vol-III - 05 - Attachment 22 - Certificate by Auditor PPP-MIIDocument2 pagesVol-III - 05 - Attachment 22 - Certificate by Auditor PPP-MIIsarat mishraNo ratings yet

- Francis Chawanda V. Illovo Sugar Malawi Limited - IRC Form 1 & Statement of ClaimDocument6 pagesFrancis Chawanda V. Illovo Sugar Malawi Limited - IRC Form 1 & Statement of ClaimSameer ChilumphaNo ratings yet

- Research MethodologyDocument18 pagesResearch MethodologyYogesh RathiNo ratings yet

- Engineering Mechanics Statics and Dynamics 2nd Edition Plesha Solutions Manual 1Document210 pagesEngineering Mechanics Statics and Dynamics 2nd Edition Plesha Solutions Manual 1elaine100% (42)

- Kenya Law - Civil DivisionDocument18 pagesKenya Law - Civil DivisionDestiny LearningNo ratings yet

- Press Statement - Traytes Law Signed by GovernorDocument2 pagesPress Statement - Traytes Law Signed by GovernorMurry LeeNo ratings yet

- CSC Published Resolutions and Mcs 1989 - 2014Document21 pagesCSC Published Resolutions and Mcs 1989 - 2014rickiti9No ratings yet

- 7 Functions of The Legislative BranchDocument17 pages7 Functions of The Legislative BranchJerry De Leon LptNo ratings yet

Bharat Plywood and Timber Vs Employees' Provident Fund On 4 February 1976

Bharat Plywood and Timber Vs Employees' Provident Fund On 4 February 1976

Uploaded by

Shivansh SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bharat Plywood and Timber Vs Employees' Provident Fund On 4 February 1976

Bharat Plywood and Timber Vs Employees' Provident Fund On 4 February 1976

Uploaded by

Shivansh SharmaCopyright:

Available Formats

Bharat Plywood And Timber ... vs Employees' Provident Fund ...

on 4 February, 1976

Kerala High Court

Bharat Plywood And Timber ... vs Employees' Provident Fund ... on 4 February, 1976

Equivalent citations: (1977) ILLJ 379 Ker

Author: T K Thommen

Bench: T K Thommen

JUDGMENT T. Kochu Thommen, J.

1. The petitioner-company is an establishment coming within the ambit of the Employee's Provident

Funds Act, 1952 (hereinfter called "the Act"), and the Scheme framed thereunder, Exhibits P 3 dated

March 13, 1969, P4 dated August 31, 1970, P8 dated February 27,1971 and P 9 dated June 15, 1973

relating respectively to the periods February-November, 1967; December 1967-December 1969;

January-March 1970; and April 1970-March, 1971 were issued to the petitioner under Section 14B of

the Act. The petitioner was called upon to pay damages at the rate of 25% of the amounts of arrears

alleged to be due from it. The case of the petitioner is that, at the time of the impugned orders Exts.

P3, P4, P8 and P9, no amount was due from it under the provisions of the Act or the Scheme, and

consequently the respondents have no power to recover damages from the petitioner. The petitioner

further states that in any case what is recoverable under Section 14B is only damages in reject of the

lass caused by its default in remitting the amount towards Provident Fund on the due dates.

2. I shall row read the relevant provisions concerning the petitioner's liability towards Provident

Fund, Section 6 reads as follows;

The contribution which shall be paid by the employer to the Fund shall be six and a quarter per cent

of the basic wages, dearness allowance and retaining allowance (if any) for the time being payable to

each of the employees (whether employed by him directly or by or through a contractor), and the

employee's contribution shall be equal to the contribution payable by the employer in respect of him

and may, if any employee so desires and if the Scheme makes provision therefore be an amount not

exceeding eight and one third per cent of his basic wages, dearness allowance and retaining

allowance (if any) x x x x x x Section 14(2 A) imposes a penalty upon any person who contravenes or

makes default in complying with any provision of the Act. It reads as follows:

Whoever contravenes or makes default in complying with any prevision of this Act or of any

condition subject to which exemption was granted under Section 17 shall, if no other penalty is

elsewhere provided by or under this Act for such contravention or non-compliance, be punishable

with imprisonment which may extend to three months, or with fin a which may extend to one

thousand rupees, or with both.

3. The impugned orders, as stated earlier, have been issued under Section 14B which reads a under:

Where an employer makes default in the payment of any contribution to the Fund or in the transfer

of accumulations required to be transferred by him under Sub-section (2) of Section 15 or

Sub-section (5) of Section 17 or in the payment of any charges payable under any other provision of

this Act or of any Scheme or under any of the conditions specified under Section 17, the appropriate

Government may recover from the employer such damages, not exceeding twenty-five per cent of

Indian Kanoon - http://indiankanoon.org/doc/1179487/ 1

Bharat Plywood And Timber ... vs Employees' Provident Fund ... on 4 February, 1976

the amount of arrears, as it may think fit to impose.

4. The amounts are dus for payment within-fifteen days of the close of the month as provided under

paragraph 38(2) of the Scheme. The petitioner having failed to remit the amounts within the

stipulated time was called upon to pay a fine under Section 14(2A). This fine was paid by it in full.

5. The question that arises for consideration is whether the petitioner is liable to pay damages under

Section 14B if no amount was subsisting on the date of the order passed under the section ; and if so,

whether it is liable to pay any amount in excess of the actual damages caused by its default ?

6. Section 14B clearly indicates that an employer is liable to pay damages if he has made default in

payment of the contribution. Merely because the amount had been paid earlier to the order under

Section 14B, it cannot be contended that there was no default in payment on the due date if the

amount was paid only subsequent to the due date. Any delay in paying the amount under Section 6

causes loss to the beneficiaries of the Scheme: such as loss of interest and the like. This is the loss

that is sought to be recovered from the defaulter for the purpose of indemnifying the beneficiaries of

the Schemenamely, the employeesto the extent of the loss suffered. The defaulter under S 14B is,

therefore, liable to pay damages which represent the loss; but not anything more, as such recovery

would amount to penalty, and that is not permitted under the section

7. This aspect of the question does not seem to have been considered by the respondent, although,

upon the petitioner's representation, Ext P 4 was modified by Ext. P 7 by reducing the amount from

25 per cent to 10 per cent of the arrears. I would, therefore, quash Exts. P 3, P 8 and P 9, and direct

the respondents to compute the actual loss which can be recovered from the petitioner by way of

damages within the scope of Section 14B, as indicated above, and pass appropriate orders in respect

of the periods covered by Exts. P 3, P 8 and P 9. Subject to what is stated above, the original petition

is allowed and the parties are directed to bear their respective costs.

Indian Kanoon - http://indiankanoon.org/doc/1179487/ 2

You might also like

- 13 2 Reply JalandharDocument8 pages13 2 Reply JalandharSudhir Sinha86% (35)

- Contract To Sell: Know All Men by These PresentsDocument3 pagesContract To Sell: Know All Men by These PresentsMarvel Felicity100% (3)

- Interim Application Under Section 143ADocument9 pagesInterim Application Under Section 143AKartik Sabharwal92% (13)

- Affidavit of MistakeDocument4 pagesAffidavit of MistakeRinku Kokiri67% (3)

- SMART COMMUNICATIONS, INC. ET AL. v. NTC - DigestDocument2 pagesSMART COMMUNICATIONS, INC. ET AL. v. NTC - DigestMark Genesis Rojas100% (1)

- Penalty On EPF Delay PaymentDocument8 pagesPenalty On EPF Delay PaymentAnand ChaudharyNo ratings yet

- Payment of Wages Act, 1936: FactoriesDocument46 pagesPayment of Wages Act, 1936: FactoriesViraja GuruNo ratings yet

- PAYMENT OF GRATUITY. - (1) Gratuity Shall Be Payable To An Employee On TheDocument4 pagesPAYMENT OF GRATUITY. - (1) Gratuity Shall Be Payable To An Employee On TheVenkata Rao NaiduNo ratings yet

- Banking Law Case AnalysisDocument4 pagesBanking Law Case Analysis1982024No ratings yet

- The Workmen'S Compensation Act, 1923Document4 pagesThe Workmen'S Compensation Act, 1923dplpthk1502No ratings yet

- Taxguru - In-Reversal Recovery of ITC Due To Time Limit Us 164 A Possible View in Departments Favour PDFDocument7 pagesTaxguru - In-Reversal Recovery of ITC Due To Time Limit Us 164 A Possible View in Departments Favour PDFKoushikNo ratings yet

- Liquidation of Companies PDFDocument8 pagesLiquidation of Companies PDFTippanna GodiNo ratings yet

- PF Arrest ProvisionsDocument8 pagesPF Arrest Provisionsiona_hegdeNo ratings yet

- Before The High Court of Karnataka at Bengaluru WRIT PETITION NO. 58209/2018 (L-PF) BetweenDocument8 pagesBefore The High Court of Karnataka at Bengaluru WRIT PETITION NO. 58209/2018 (L-PF) BetweenkirumcaNo ratings yet

- JMM Promotions and Management, Inc. vs. National Labor Relations Commission and Ulpiano L. Delos Santos and Radiola Toshiba Philippines, Inc. vs. The Intermediate Appellate CouDocument4 pagesJMM Promotions and Management, Inc. vs. National Labor Relations Commission and Ulpiano L. Delos Santos and Radiola Toshiba Philippines, Inc. vs. The Intermediate Appellate CouJacinth DelosSantos DelaCernaNo ratings yet

- BBA-MBA Integrated Programme Advanced Course On OB & HRM Individual Assignment Submitted byDocument19 pagesBBA-MBA Integrated Programme Advanced Course On OB & HRM Individual Assignment Submitted byAalokNo ratings yet

- Case LawDocument5 pagesCase LawRaj ChouhanNo ratings yet

- Sher Singh Rawat vs. PIO, EPFO (17.05.2017 - CIC) Section 3 RtiDocument9 pagesSher Singh Rawat vs. PIO, EPFO (17.05.2017 - CIC) Section 3 RtiAyyachamy IlangovanNo ratings yet

- Payment of Gratuity Act 1972Document4 pagesPayment of Gratuity Act 1972PraveenakishorNo ratings yet

- WcactDocument5 pagesWcactRajendra KumarNo ratings yet

- Atlantic Department Stores, Inc. v. United States, 557 F.2d 957, 2d Cir. (1977)Document8 pagesAtlantic Department Stores, Inc. v. United States, 557 F.2d 957, 2d Cir. (1977)Scribd Government DocsNo ratings yet

- Amity Law School Labour Law Project Case Study ON: Nathulal Vs M.P. State Road Transport, 1986Document5 pagesAmity Law School Labour Law Project Case Study ON: Nathulal Vs M.P. State Road Transport, 1986Kalpit SharmaNo ratings yet

- Article On Section 13 (4) of SARFAESI ActDocument7 pagesArticle On Section 13 (4) of SARFAESI ActIntern VSPNo ratings yet

- Workmen's Compensation Act Rules ThereunderDocument52 pagesWorkmen's Compensation Act Rules ThereunderJyothiPunemNo ratings yet

- Payment of Gratuity Act ProjectDocument16 pagesPayment of Gratuity Act ProjectRuben RockNo ratings yet

- Serrano V GallantDocument5 pagesSerrano V GallantGerard Relucio OroNo ratings yet

- Payment of Gratuity Punjab RulesDocument7 pagesPayment of Gratuity Punjab RulesSakshi VermaNo ratings yet

- 12 11 Workmen Compensation ActDocument6 pages12 11 Workmen Compensation ActArunima SarkarNo ratings yet

- Cases Social LegislationDocument44 pagesCases Social LegislationHuehuehueNo ratings yet

- K. Ramaswamy and D.P. Wadhwa, JJDocument2 pagesK. Ramaswamy and D.P. Wadhwa, JJHarshit ShrivastavaNo ratings yet

- Delhi Development Authority Vs Swastic ConstructioDE2023020223180731100COM11934Document7 pagesDelhi Development Authority Vs Swastic ConstructioDE2023020223180731100COM11934KANCHAN SEMWALNo ratings yet

- Royer's, Inc. v. United States, 265 F.2d 615, 3rd Cir. (1959)Document6 pagesRoyer's, Inc. v. United States, 265 F.2d 615, 3rd Cir. (1959)Scribd Government DocsNo ratings yet

- Rules 1972Document30 pagesRules 1972venkateshbedhreNo ratings yet

- Lorenzo Tangga An v. Philippine Transmarine CarriersDocument4 pagesLorenzo Tangga An v. Philippine Transmarine CarriersMike HamedNo ratings yet

- Show FileDocument22 pagesShow Filesaumya.bsphcl.prosixNo ratings yet

- Referred To The Decision of The Supreme Court in The Case ONGC v. SAW Pipes To Define As To What Comes Under The Scope of "Public Policy"Document6 pagesReferred To The Decision of The Supreme Court in The Case ONGC v. SAW Pipes To Define As To What Comes Under The Scope of "Public Policy"Ramasayi GummadiNo ratings yet

- Mendoza v. PeopleDocument6 pagesMendoza v. PeopleDanielle AngelaNo ratings yet

- FAQ S For Application For POHW 20230513Document6 pagesFAQ S For Application For POHW 20230513Ayush BhattNo ratings yet

- CD - 3. Serrano Vs Gallant Maritime Services Inc, GR No. 167614, March 24, 2009Document6 pagesCD - 3. Serrano Vs Gallant Maritime Services Inc, GR No. 167614, March 24, 2009Marianne Shen PetillaNo ratings yet

- JMM Promotions vs. NLRCDocument4 pagesJMM Promotions vs. NLRCraynald_lopezNo ratings yet

- Notice About w-4Document2 pagesNotice About w-4Apollo Myles Lafrance El100% (1)

- Term, Whichever Is Less ." Violates OFW's Constitutional Rights in That It Impairs The Terms of Contract, DeprivesDocument12 pagesTerm, Whichever Is Less ." Violates OFW's Constitutional Rights in That It Impairs The Terms of Contract, DeprivesTriccie MangueraNo ratings yet

- People v. Gatchalian, G.R. No. L-12011-14Document15 pagesPeople v. Gatchalian, G.R. No. L-12011-14Eszle Ann L. ChuaNo ratings yet

- FAQ S For Application For POHW 20230513 3Document8 pagesFAQ S For Application For POHW 20230513 3nvtp58k8gfNo ratings yet

- 37 - Philippine Integrated Labor Assistance v. NLRC G.R. No. 123354Document5 pages37 - Philippine Integrated Labor Assistance v. NLRC G.R. No. 123354Shash BernardezNo ratings yet

- 1996 Air 1214 1996 SCC (3) 45Document6 pages1996 Air 1214 1996 SCC (3) 45Abeer UlfatNo ratings yet

- The Assam Professions, Trades, Callings and Employments Taxation - Act-Chapter III - ch3Document4 pagesThe Assam Professions, Trades, Callings and Employments Taxation - Act-Chapter III - ch3barsha jalanNo ratings yet

- Labour Law Assigmnent 27-3-19Document8 pagesLabour Law Assigmnent 27-3-19shubham chauhanNo ratings yet

- Payment Return AgreementDocument6 pagesPayment Return AgreementSonica DhankharNo ratings yet

- Banking End Sem CasesDocument35 pagesBanking End Sem CasesMahathi BokkasamNo ratings yet

- NCLT Aplication For Disposal of ClaimsDocument3 pagesNCLT Aplication For Disposal of ClaimsShashikant ThakreNo ratings yet

- Employee's Contribution For PF/ESI Before Due Date of Filing Return of Income Is Allowable ExpenseDocument7 pagesEmployee's Contribution For PF/ESI Before Due Date of Filing Return of Income Is Allowable ExpenseAnil VermaNo ratings yet

- Establishment: Factory Industry Establishment Central Government EstablishmentDocument9 pagesEstablishment: Factory Industry Establishment Central Government EstablishmentPayal PurohitNo ratings yet

- Abstract of The Minimum Wages Act, 1948Document4 pagesAbstract of The Minimum Wages Act, 1948Shabir TrambooNo ratings yet

- Position Paper SampleDocument18 pagesPosition Paper SampleKenneth FrancoNo ratings yet

- Digest LaborDocument36 pagesDigest LabortearsomeNo ratings yet

- Workmen'S Compensation ActDocument19 pagesWorkmen'S Compensation ActGospelNo ratings yet

- Page 52 of 332Document7 pagesPage 52 of 332Ravinder Singh AtwalNo ratings yet

- 2024 LHC 2795Document4 pages2024 LHC 2795Cheema KhanNo ratings yet

- Power Grid Corporation of India LTD Vs Jyoti StrucDE201715121715561431COM964804Document4 pagesPower Grid Corporation of India LTD Vs Jyoti StrucDE201715121715561431COM964804Suraj AgarwalNo ratings yet

- Prathiba M. Singh, J.: Equiv Alent Citation: 2019 (177) DRJ473Document3 pagesPrathiba M. Singh, J.: Equiv Alent Citation: 2019 (177) DRJ473Siddharth BhandariNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Labor Contract Law of the People's Republic of China (2007)From EverandLabor Contract Law of the People's Republic of China (2007)No ratings yet

- Kho vs. Makalintal, 306 SCRA 70Document3 pagesKho vs. Makalintal, 306 SCRA 70BFP 12 ORD-StaffNo ratings yet

- NATIONAL HIGHWAYS AUTHORITY OF INDIA vs. SAYEDABAD TEA COMPANY LTD. AND ORS.Document5 pagesNATIONAL HIGHWAYS AUTHORITY OF INDIA vs. SAYEDABAD TEA COMPANY LTD. AND ORS.siddharthNo ratings yet

- Withdrawal Register 2020Document65 pagesWithdrawal Register 2020Ellastrous Gogo NathanNo ratings yet

- Oscar Espuelas y MendozaDocument2 pagesOscar Espuelas y MendozaAc CorpuzNo ratings yet

- Quality Criteria To Indicate Student's Level of AttainmentDocument2 pagesQuality Criteria To Indicate Student's Level of AttainmentFadwa BaasharNo ratings yet

- The Value Proposition Canvas PDFDocument1 pageThe Value Proposition Canvas PDFAristeres Carranza SánchezNo ratings yet

- Bcom Sem-6 (2019) April-2023 Auditing & Corporate Governance-2Document2 pagesBcom Sem-6 (2019) April-2023 Auditing & Corporate Governance-2Hariom ShingalaNo ratings yet

- N-AP-1 - Accrued MarkupDocument2 pagesN-AP-1 - Accrued MarkupAung Zaw HtweNo ratings yet

- Cambridge Maths 4 Work Book PDF License Mathematics 49Document1 pageCambridge Maths 4 Work Book PDF License Mathematics 49suzan.gabbarNo ratings yet

- University Institute of Legal Studies, Punjab University, Chandigarh Moot MemorialDocument14 pagesUniversity Institute of Legal Studies, Punjab University, Chandigarh Moot MemorialNimrat kaurNo ratings yet

- "A Rose For Emily" by William Faulkner Mock Trial & Textual AnalysisDocument5 pages"A Rose For Emily" by William Faulkner Mock Trial & Textual AnalysisLINA PASSIONNo ratings yet

- Terms and Conditions - For Rice GoodsDocument13 pagesTerms and Conditions - For Rice GoodsAriane AdajarNo ratings yet

- 1 1 Simple-Compound-Interest - P2Document4 pages1 1 Simple-Compound-Interest - P2Missblack XoxpNo ratings yet

- Manila Memorial Park, Inc. vs. Secretary of The Department of Social Welfare and Development 711 SCRA 302, December 03, 2013, G.R. No. 175356Document3 pagesManila Memorial Park, Inc. vs. Secretary of The Department of Social Welfare and Development 711 SCRA 302, December 03, 2013, G.R. No. 175356Almer Tinapay100% (1)

- Preamble Declares India To Be A Sovereign, Socialist, Secular and Democratic RepublicDocument8 pagesPreamble Declares India To Be A Sovereign, Socialist, Secular and Democratic RepublicPpriya PNo ratings yet

- The Ascent Adam Plantinga Full ChapterDocument67 pagesThe Ascent Adam Plantinga Full Chapterruth.bulle702100% (9)

- RRCA Bos Letter Nov 28, 2023Document4 pagesRRCA Bos Letter Nov 28, 2023newsNo ratings yet

- Terms of EngagementDocument6 pagesTerms of EngagementMyeduniya MEDNo ratings yet

- Affidavit - ERRONEOUS ENTRY - BONGCAYAODocument1 pageAffidavit - ERRONEOUS ENTRY - BONGCAYAODiaz Law OfficeNo ratings yet

- Vol-III - 05 - Attachment 22 - Certificate by Auditor PPP-MIIDocument2 pagesVol-III - 05 - Attachment 22 - Certificate by Auditor PPP-MIIsarat mishraNo ratings yet

- Francis Chawanda V. Illovo Sugar Malawi Limited - IRC Form 1 & Statement of ClaimDocument6 pagesFrancis Chawanda V. Illovo Sugar Malawi Limited - IRC Form 1 & Statement of ClaimSameer ChilumphaNo ratings yet

- Research MethodologyDocument18 pagesResearch MethodologyYogesh RathiNo ratings yet

- Engineering Mechanics Statics and Dynamics 2nd Edition Plesha Solutions Manual 1Document210 pagesEngineering Mechanics Statics and Dynamics 2nd Edition Plesha Solutions Manual 1elaine100% (42)

- Kenya Law - Civil DivisionDocument18 pagesKenya Law - Civil DivisionDestiny LearningNo ratings yet

- Press Statement - Traytes Law Signed by GovernorDocument2 pagesPress Statement - Traytes Law Signed by GovernorMurry LeeNo ratings yet

- CSC Published Resolutions and Mcs 1989 - 2014Document21 pagesCSC Published Resolutions and Mcs 1989 - 2014rickiti9No ratings yet

- 7 Functions of The Legislative BranchDocument17 pages7 Functions of The Legislative BranchJerry De Leon LptNo ratings yet