Professional Documents

Culture Documents

Ey Recai 62 Top 40 Ranking v3 Final

Ey Recai 62 Top 40 Ranking v3 Final

Uploaded by

Stathis MetsovitisOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ey Recai 62 Top 40 Ranking v3 Final

Ey Recai 62 Top 40 Ranking v3 Final

Uploaded by

Stathis MetsovitisCopyright:

Available Formats

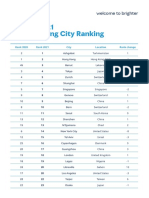

November 2023 | 62 edition

RECAI

Renewable Energy Country

US

1

Germany

2 China Mainland

3

France

Attractiveness Index 4

Australia

5

Since 2003, the biannual RECAI has India

6

ranked the world’s top 40 markets on the

UK 0 US +2 Denmark

attractiveness of their renewable energy 7

The US retains the top spot amid A policy allowing issuance of guarantees

investment and deployment opportunities. 1 2

8 Spain

3 significant solar growth driven by Inflation of origin for green hydrogen supports

The rankings reflect our assessments of market 5 Reduction Act incentives. Market players Denmark’s role in the energy transition and

7 are putting pressure on the government is a key decarbonization factor for hard-to-

attractiveness and global market trends. 6

9 Denmark regarding offshore wind requirements. abate sectors.

4

8

Saudi Arabia 40

40 10 Netherlands

11

39

Romania 39 Increased attractiveness compared

44 with previous index

9 11 Canada 0 Germany +1 Italy

Thailand 38 12 There has been significant growth in Italy aims to increase the amount of

38 Decreased attractiveness compared Germany’s onshore wind sector, with the renewables in its energy mix to 65% by

with previous index 12 Ireland

volume of new capacity installed by the end 2030. New renewable capacity in H1 2023

South Africa 37 37 13

of September exceeding the total installed of 2.5GW represents a 120% increase on

No change in attractiveness since

10 in 2022. 2022’s rate.

Kazakhstan 36 32 previous index 13 Japan

35 15

Mexico 35 14 Italy

34 Current ranking shown in circles with 17

Switzerland 34 previous ranking noted at the bottom

36 of each segment 14 15

Poland -3 UK -2 Chile

Vietnam 33 33 20

The failure of Contracts for Difference Despite lofty new battery storage

16

16 (CfD) Round 5 to attract new offshore wind targets, Chile continues to struggle with

28 Chile

Philippines 32 capacity, plus the diminishing of green intermittency issues driven by solar

27 18

17 policies, has left investors with reduced curtailment throughout the country.

Egypt 31 30 21 Sweden confidence in UK renewables.

29 24

30 25 22 18

Turkey 31 23 26 19 Greece

29 19

Argentina 28 20 Brazil

Austria 27

26 22

21 Finland -3 Japan +5 Romania

South Korea 25 24 23 Belgium

Norway Portugal

Despite significant natural resources and a Romania is set to tender 1GW of onshore

Taiwan commitment to reduce fossil fuels, Japan wind and 1GW of solar as the first steps in

is falling behind other leading economies in its multiyear plan to award 20GW of CfD-

Morocco Israel terms of solar and wind deployment. backed capacity.

The RECAI model’s energy imperative pillar has been slightly adjusted to ensure that markets with a strong and demonstrable commitment to See page 4 for RECAI methodology.

deploying green energy are scored positively.

Renewable Energy Country Attractiveness Index 62 01

RECAI 62 scores

Technology-specific scores

Ranking Market Previous Movement vs. Score Onshore Offshore Solar PV Solar CSP Biomass Geothermal Hydro Marine

ranking previous wind wind

1 US 1 73.9 58.4 59.5 58.3 46.8 40.8 47.4 39.6 20.7

2 Germany 2 71.4 53.4 52.3 56.1 32.4 50.7 38.1 41.4 20.9

3 China Mainland 3 71.4 52.5 55.7 61.5 55.0 49.3 24.8 51.0 17.9

4 France 5 70.6 56.2 52.3 54.8 23.9 46.9 39.8 42.1 38.5

5 Australia 7 70.2 53.5 42.4 57.2 47.2 41.8 15.8 27.1 25.7

6 India 6 69.2 53.7 28.7 62.7 34.3 43.6 24.8 48.9 20.0

7 UK 4 68.3 57.6 57.6 48.0 15.1 54.8 36.8 39.3 34.8

8 Spain 8 67.1 54.0 35.6 54.0 29.2 40.0 15.4 23.2 23.0

9 Denmark 11 66.3 54.1 51.5 47.0 17.4 45.4 16.4 22.3 22.1

10 Netherlands 9 66.1 53.5 48.3 48.8 16.0 51.7 24.8 27.7 16.8

11 Canada 12 65.1 55.8 39.5 48.2 19.9 36.4 26.3 47.9 26.9

12 Ireland 13 63.4 49.6 47.3 46.4 19.7 36.2 17.9 21.9 24.7

13 Japan 10 63.3 48.4 50.7 49.1 18.5 56.6 44.3 37.3 22.6

14 Italy 15 63.2 47.2 40.9 51.1 31.1 42.1 32.3 45.7 18.4

15 Poland 17 62.4 49.1 41.1 49.2 14.0 46.3 20.1 36.4 14.7

16 Chile 14 61.9 51.5 22.4 48.0 55.3 42.7 47.0 45.1 28.0

17 Sweden 20 61.4 49.0 42.6 42.6 16.3 44.3 18.8 36.6 27.8

18 Greece 16 61.1 49.0 30.9 47.9 36.0 43.6 25.5 39.0 15.1

19 Brazil 18 60.8 50.0 31.9 52.5 24.8 49.4 12.9 45.0 18.5

20 Finland 21 60.0 60.1 30.2 37.0 15.7 45.3 15.7 23.1 15.7

Renewable Energy Country Attractiveness Index 62 02

RECAI 62 scores

Technology-specific scores

Ranking Market Previous Movement vs. Score Onshore Offshore Solar PV Solar CSP Biomass Geothermal Hydro Marine

ranking previous wind wind

21 Belgium 24 59.9 51.2 39.5 42.0 18.5 41.5 22.8 25.7 18.1

22 Portugal 22 59.7 43.6 24.0 49.3 25.3 40.5 23.2 36.9 23.9

23 Israel 19 59.7 41.8 15.3 54.1 36.4 28.7 14.7 17.7 15.0

24 Taiwan 26 59.1 42.0 47.2 45.9 19.0 29.9 27.2 33.8 29.2

25 Morocco 23 58.8 45.1 17.4 51.1 50.7 25.2 13.9 34.0 13.9

26 Norway 31 58.2 46.1 43.2 39.9 15.8 33.8 18.2 46.7 33.6

27 South Korea 25 57.3 38.3 40.8 48.1 18.2 48.5 16.7 29.3 32.4

28 Austria 29 57.3 46.0 22.5 43.5 14.4 42.5 17.8 42.5 21.5

29 Argentina 30 56.9 50.4 22.1 49.0 31.6 36.7 18.1 35.5 17.7

30 Turkey 27 56.7 48.9 20.6 48.4 23.8 41.6 42.5 45.4 19.6

31 Egypt 28 56.5 47.2 15.8 53.8 36.6 24.6 11.5 23.0 11.5

32 Philippines 33 56.1 42.6 20.5 47.4 19.9 40.2 44.0 41.7 21.2

33 Vietnam 36 56.0 45.4 42.0 44.3 17.6 39.3 13.1 46.6 18.7

34 Switzerland 34 55.9 41.3 17.8 44.2 18.5 36.2 25.3 39.0 15.5

35 Mexico 35 55.5 42.1 21.3 48.0 24.5 34.9 40.2 35.1 19.1

36 Kazakhstan 32 55.4 49.8 16.2 43.2 18.1 35.0 16.3 41.4 13.8

37 South Africa 37 54.3 46.9 20.0 44.7 47.4 31.6 12.5 19.8 20.7

38 Thailand 38 54.2 42.7 16.2 44.2 21.6 41.8 16.6 31.7 18.6

39 Romania 44 53.9 41.4 17.2 43.6 13.7 34.6 16.3 34.5 13.7

40 Saudi Arabia 39 53.7 45.1 17.9 46.5 28.1 23.6 15.8 12.1 11.8

Renewable Energy Country Attractiveness Index 62 03

RECAI 62 methodology

The index rankings reflect our assessment of the factors driving

market attractiveness in a world where renewable energy has gone

beyond decarbonization and reliance on subsidies.

We have defined the questions being asked, based on what Determining the rankings

we see as global market trends affecting investment and

deployment priorities, and the challenges and success factors Each parameter within the five pillars comprises a series

impacting EY clients: of data sets that are converted into a score, from one to

five, and weighted to generate parameter scores. These

• I● s there a long-term need for additional or replacement are weighted again to produce pillar scores, then an overall

energy supply? If so, is there a strong case for energy from RECAI score and ranking. Weightings are based on the EY

renewable resources in particular? assessment of the relative importance of each data set,

• Is

● the market actively seeking to reduce reliance on fossil parameter and pillar in driving investment and deployment

fuels? decisions. Each technology is also allocated a weighting based

on its share of historical and projected investment levels.

• Is

● policy hindering or helping the ability to exploit

renewables opportunities? Separate from the main index, EY technology-specific

• Are

● essential components in place to ensure project indices rankings reflect a weighted average score across

delivery, such as long-term contracts, grid infrastructure the technology-specific parameters, and a combined score

(including storage) and availability of finance? covering our other macro and energy market parameters.

This is because some markets may be highly attractive for

• What

● does the strength of natural resource, track record specific technologies but face other major barriers to entry.

and project pipeline reveal about the outlook for particular

renewable technologies? Data sets are based on publicly available or purchased data,

EY analysis or adjustments to third-party data. We are unable

• Even

● if all other elements are in place, does the macro

to publicly disclose the underlying data sets or weightings

stability and investment climate enable or impede the ease

used to produce the indices.

of doing business?

These index pillars therefore put emphasis on fundamentals If you would like to discuss how EY RECAI analysis could help

such as energy imperative, policy stability, project delivery your business decisions or transactions, please contact the

(including capital availability) and diversity of natural RECAI advisor Phil Dominy.

resource — factors that will increasingly become key market

differentiators as markets move toward grid parity, and

“artificial” motivations, such as government targets or the

ring-fencing of technologies, become less critical.

Renewable Energy Country Attractiveness Index 62 04

EY | Building a better working world

EY exists to build a better working world, helping to create

long-term value for clients, people and society and build trust

in the capital markets.

Enabled by data and technology, diverse EY teams in over 150

countries provide trust through assurance and help clients grow,

transform and operate.

Working across assurance, consulting, law, strategy, tax and

transactions, EY teams ask better questions to find new answers

for the complex issues facing our world today.

EY refers to the global organization, and may refer to one or more, of the member

firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst &

Young Global Limited, a UK company limited by guarantee, does not provide services

to clients. Information about how EY collects and uses personal data and a description

of the rights individuals have under data protection legislation are available via ey.com/

privacy. EY member firms do not practice law where prohibited by local laws. For more

information about our organization, please visit ey.com.

© 2023 EYGM Limited.

All Rights Reserved.

EYG no. 010558-23Gbl

BMC Agency

GA 19318140

ED None

In line with EY’s commitment to minimize its impact on the environment,

this document has been printed on paper with a high recycled content.

This material has been prepared for general informational purposes only and is not intended to be relied upon as

accounting, tax, legal or other professional advice. Please refer to your advisors for specific advice.

The views of third parties set out in this publication are not necessarily the views of the global EY organization or

its member firms. Moreover, they should be seen in the context of the time they were made.

ey.com

You might also like

- Our Programs Bezos Earth FundDocument1 pageOur Programs Bezos Earth FundAgustín Alejandro Batto Carol [él-he] Eidos GlobalNo ratings yet

- The Economist Intelligence Unit Africa Outlook 2024 2023Document10 pagesThe Economist Intelligence Unit Africa Outlook 2024 2023Mzukisi MadlavuNo ratings yet

- Impact Report 2023Document16 pagesImpact Report 2023Naomi DarlingNo ratings yet

- Consulting Industry Cheat SheetDocument1 pageConsulting Industry Cheat SheetMANAV VASHISHTHANo ratings yet

- GL 2021 Cost of Living City Ranking Mercer 0622Document9 pagesGL 2021 Cost of Living City Ranking Mercer 0622Stathis MetsovitisNo ratings yet

- Jaguar Vision and MissionDocument2 pagesJaguar Vision and MissionPraveen100% (1)

- Book SummaryDocument28 pagesBook SummaryMuzahedul HaqueNo ratings yet

- 17jul019 AtosDocument4 pages17jul019 AtosmanishaNo ratings yet

- Dell Notes StrategyDocument3 pagesDell Notes Strategyjack stoNo ratings yet

- GB520 Unit 3 Case AnalysisDocument9 pagesGB520 Unit 3 Case AnalysisKatherine Moore GageNo ratings yet

- Goldman Sachs ValuesDocument2 pagesGoldman Sachs ValueschienNo ratings yet

- Powerlist Foundation Sponsorship Pack 4 PDFDocument31 pagesPowerlist Foundation Sponsorship Pack 4 PDFPowerlist FoundationNo ratings yet

- The Bangladesh Telecommunications ReportDocument4 pagesThe Bangladesh Telecommunications ReportShamim Hasan PlabonNo ratings yet

- MILLER Brand Split Type Air Conditioners SpecificationDocument8 pagesMILLER Brand Split Type Air Conditioners SpecificationBikash Chandra DasNo ratings yet

- Sustainable Energy Handbook: Grid Loss ReductionDocument32 pagesSustainable Energy Handbook: Grid Loss ReductionAlifBaNo ratings yet

- EY DeckDocument10 pagesEY Deckishan100% (1)

- Corporate Venturing: Achieving Profitable Growth Through StartupsDocument44 pagesCorporate Venturing: Achieving Profitable Growth Through StartupsAJ MerloNo ratings yet

- Bush M Oct17Document1 pageBush M Oct17api-306307287No ratings yet

- Strategic Talent Development FinalDocument32 pagesStrategic Talent Development FinalNimita B. Nair100% (1)

- NMG Life Insurance Growth Markets 2012Document12 pagesNMG Life Insurance Growth Markets 2012smarandacirlanNo ratings yet

- Ernst Young ThesisDocument8 pagesErnst Young Thesisjenniferlopezhayward100% (2)

- InnovationClubThailand Baseline-Study-Report 2021 PDFDocument52 pagesInnovationClubThailand Baseline-Study-Report 2021 PDFKaipichit RuengsrichaiyaNo ratings yet

- Empowering Women's Success in Technology: IBM's Commitment To InclusionDocument8 pagesEmpowering Women's Success in Technology: IBM's Commitment To InclusionYessica CaicedoNo ratings yet

- Water Colored Splashes PowerPoint TemplateDocument36 pagesWater Colored Splashes PowerPoint TemplateAndhika BinarNo ratings yet

- Ekahi Group - Global Independent Family OfficeDocument13 pagesEkahi Group - Global Independent Family OfficeEkahi GroupNo ratings yet

- 6 Habits of Highly Successful Managers Cioffi en 15124Document5 pages6 Habits of Highly Successful Managers Cioffi en 15124talalNo ratings yet

- A Tale of Two Entrepreneurs: Understanding Differences in The Types of Entrepreneurship in The EconomyDocument10 pagesA Tale of Two Entrepreneurs: Understanding Differences in The Types of Entrepreneurship in The EconomyThe Ewing Marion Kauffman FoundationNo ratings yet

- Business OrganizationsDocument24 pagesBusiness OrganizationsHemang LimbachiyaNo ratings yet

- Marketing AssessmentDocument29 pagesMarketing Assessmentaisirk cordero100% (4)

- Digital Start UpDocument11 pagesDigital Start Upvicky.sajnaniNo ratings yet

- Food and Agriculture IndustryDocument55 pagesFood and Agriculture IndustryChristine BarreraNo ratings yet

- GRC Governance Risk and Compliance in Oracle - OverviewDocument21 pagesGRC Governance Risk and Compliance in Oracle - OverviewVenkatesam BarigedaNo ratings yet

- Jaime Cooper Consulting (Consulting Strategy Resume)Document2 pagesJaime Cooper Consulting (Consulting Strategy Resume)jcooper_bostonNo ratings yet

- The Support by Investors of Entrepreneurial Talent With Finance and Business Skills To Exploit Market Opportunities and Thus Obtain Capital Gains.Document46 pagesThe Support by Investors of Entrepreneurial Talent With Finance and Business Skills To Exploit Market Opportunities and Thus Obtain Capital Gains.rajvindermomiNo ratings yet

- Strategic Position and Action EvaluationDocument3 pagesStrategic Position and Action EvaluationhusinorainNo ratings yet

- Chapter 9 - Understanding Groups and Managing Work Teams: Learning OutcomesDocument16 pagesChapter 9 - Understanding Groups and Managing Work Teams: Learning OutcomesSindhu Nath ChowdhuryNo ratings yet

- Capabilities Statement TemplateDocument2 pagesCapabilities Statement Template16 ProfitsNo ratings yet

- A. Value Chain Analysis of Procter and Gamble Case StudyDocument4 pagesA. Value Chain Analysis of Procter and Gamble Case StudyNav J KarNo ratings yet

- Ben and JerryDocument4 pagesBen and JerryDeji LipedeNo ratings yet

- How To Guide ReportDocument39 pagesHow To Guide ReportHangwi ManavhelaNo ratings yet

- International Management Governance and SustainabilityDocument13 pagesInternational Management Governance and SustainabilityMaryam AsadNo ratings yet

- ALOKOZAY GROUP of CompaniesDocument39 pagesALOKOZAY GROUP of Companiessajidmirshaikh33% (3)

- Inspirational Person EssayDocument8 pagesInspirational Person Essayafabioemw100% (2)

- How To Write A Business Plan in 10 Steps + Free TemplateDocument26 pagesHow To Write A Business Plan in 10 Steps + Free TemplateYan Lin KyawNo ratings yet

- Chapter 2. E Ship - PPTX 11Document32 pagesChapter 2. E Ship - PPTX 11abebeyonas88No ratings yet

- Tata Consultancy Services (TCS)Document10 pagesTata Consultancy Services (TCS)Bhuvan SemwalNo ratings yet

- Turnaround President COO CEO in USA Resume Gregory BuckleyDocument3 pagesTurnaround President COO CEO in USA Resume Gregory BuckleyGregoryBuckley100% (1)

- The Journey by ..: By: Abhay Yadav Jamshid Melvin Nitesh Nigam Rahul Jain Vinod RichardsDocument10 pagesThe Journey by ..: By: Abhay Yadav Jamshid Melvin Nitesh Nigam Rahul Jain Vinod Richardsrahul_njain100% (1)

- UKTI Social Investment Trade Mission BrochureDocument12 pagesUKTI Social Investment Trade Mission BrochurellewellyndrcNo ratings yet

- Study of Business Strategy of Novartis: OverviewDocument22 pagesStudy of Business Strategy of Novartis: OverviewAKASH SANDILYANo ratings yet

- Cover Letter For Stanford - Mutemi-1Document1 pageCover Letter For Stanford - Mutemi-1Sitche ZisoNo ratings yet

- Net Apply To INSEADDocument21 pagesNet Apply To INSEADMartin GonzalezNo ratings yet

- Leadership Styles and Qualities of Hazrat Umar (R.A) & Bill GatesDocument29 pagesLeadership Styles and Qualities of Hazrat Umar (R.A) & Bill Gatesnyousufzai_1No ratings yet

- The Structures of GlobalizationDocument28 pagesThe Structures of GlobalizationSaige KleineNo ratings yet

- BIF ChecklistDocument7 pagesBIF ChecklistMayank UpadhyayNo ratings yet

- When Talent Development Becomes A Strategic Imperative - Fe MarieRCabantacDocument40 pagesWhen Talent Development Becomes A Strategic Imperative - Fe MarieRCabantacVoltaire M. Bernal100% (1)

- Excetive SummryDocument11 pagesExcetive SummryMuhammad Hassan JavedNo ratings yet

- Project Identification PDDocument10 pagesProject Identification PDPriya ChauhanNo ratings yet

- Stages of Strategic ManagementDocument10 pagesStages of Strategic ManagementMohammad Raihanul HasanNo ratings yet

- The Importance of Corporate Social Responsibility - RegenesysDocument2 pagesThe Importance of Corporate Social Responsibility - RegenesysAlbert TanNo ratings yet

- Business ModelsDocument38 pagesBusiness ModelsHizana D.SNo ratings yet

- Networking PDFDocument21 pagesNetworking PDFAshish_Singh_5126No ratings yet

- The Art of War (Includes the Tao Te Ching): Complete and Original EditionFrom EverandThe Art of War (Includes the Tao Te Ching): Complete and Original EditionNo ratings yet

- GR Future of Shipping Sector Survey 2024Document51 pagesGR Future of Shipping Sector Survey 2024Stathis Metsovitis100% (1)

- 24th Gaes ReportDocument35 pages24th Gaes ReportStathis MetsovitisNo ratings yet

- ΣΩΜΑΤΕΙΟ ΕΡΓΑΖΟΜΕΝΩΝ ΝΑΥΠΗΓΕΙΩΝ ΕΛΕΥΣΙΝΑΣDocument3 pagesΣΩΜΑΤΕΙΟ ΕΡΓΑΖΟΜΕΝΩΝ ΝΑΥΠΗΓΕΙΩΝ ΕΛΕΥΣΙΝΑΣStathis MetsovitisNo ratings yet

- Insights Reforms Sep 2023Document34 pagesInsights Reforms Sep 2023Stathis MetsovitisNo ratings yet

- Air Safety List 2023-11-30 enDocument20 pagesAir Safety List 2023-11-30 enStathis Metsovitis100% (2)

- ΥΠΟΜΝΗΜΑ ΣΥΛ. ΕΡΓΑΖΟΜΕΝΩΝ ΣΤΟΝ ΣΥΝΗΓΟΡΟ ΤΟΥ ΠΟΛΙΤΗ ΓΙΑ ΤΗΝ ΜΙΣΘΟΛΟΓΙΚΗ ΑΝΙΣΟΤΗΤΑDocument6 pagesΥΠΟΜΝΗΜΑ ΣΥΛ. ΕΡΓΑΖΟΜΕΝΩΝ ΣΤΟΝ ΣΥΝΗΓΟΡΟ ΤΟΥ ΠΟΛΙΤΗ ΓΙΑ ΤΗΝ ΜΙΣΘΟΛΟΓΙΚΗ ΑΝΙΣΟΤΗΤΑStathis MetsovitisNo ratings yet

- Economic Freedom of The World 2023Document282 pagesEconomic Freedom of The World 2023Mmangaliso KhumaloNo ratings yet

- 2021 Antonis H Diamataris V Antonis H Diamataris EXHIBIT S 4Document2 pages2021 Antonis H Diamataris V Antonis H Diamataris EXHIBIT S 4Stathis MetsovitisNo ratings yet

- Understanding Europeans Views On Reform Needs FL 526 Factsheet EL enDocument2 pagesUnderstanding Europeans Views On Reform Needs FL 526 Factsheet EL enStathis MetsovitisNo ratings yet

- Risks of Illicit Trade in Counterfeits To SMEs FullR enDocument76 pagesRisks of Illicit Trade in Counterfeits To SMEs FullR enStathis MetsovitisNo ratings yet

- 2021 Antonis H Diamataris V Antonis H Diamataris EXHIBIT S 5Document2 pages2021 Antonis H Diamataris V Antonis H Diamataris EXHIBIT S 5Stathis MetsovitisNo ratings yet

- Ae8c39ec enDocument22 pagesAe8c39ec enStathis MetsovitisNo ratings yet

- Possibility of Recognising COVID-19 As Being of Occupational Origin at National Level in EU and EFTA CountriesDocument18 pagesPossibility of Recognising COVID-19 As Being of Occupational Origin at National Level in EU and EFTA CountriesStathis MetsovitisNo ratings yet

- Retail Financial Services Products 2022 FL 509 Report enDocument78 pagesRetail Financial Services Products 2022 FL 509 Report enStathis MetsovitisNo ratings yet

- 2021 Antonis H Diamataris V Antonis H Diamataris EXHIBIT S 7Document2 pages2021 Antonis H Diamataris V Antonis H Diamataris EXHIBIT S 7Stathis MetsovitisNo ratings yet

- Pothen EsxesDocument2 pagesPothen EsxesStathis MetsovitisNo ratings yet

- Standard Eurobaromber 97 Summer2022 Factsheet El enDocument4 pagesStandard Eurobaromber 97 Summer2022 Factsheet El enStathis MetsovitisNo ratings yet

- EICAccelerator FinalDocument1 pageEICAccelerator FinalStathis MetsovitisNo ratings yet

- EU Response To War in Ukraine FL506 Presentation enDocument86 pagesEU Response To War in Ukraine FL506 Presentation enStathis MetsovitisNo ratings yet

- Avensis Intake System PDFDocument19 pagesAvensis Intake System PDFMladen VidovićNo ratings yet

- Boiler B10 B14Document20 pagesBoiler B10 B14Nacho HernandezNo ratings yet

- FP Rev01 GB CervapXLDocument1 pageFP Rev01 GB CervapXLraduonoNo ratings yet

- Internal Flow - Heat Transfer CorelationsDocument18 pagesInternal Flow - Heat Transfer CorelationsarssNo ratings yet

- Robodon Doro I Calculation SpreadsheetDocument2 pagesRobodon Doro I Calculation SpreadsheetTg TarroNo ratings yet

- IFC Climate Investment Opportunity Report Dec FINALDocument140 pagesIFC Climate Investment Opportunity Report Dec FINALL Prakash JenaNo ratings yet

- 01 - List of Ieee StandardsDocument18 pages01 - List of Ieee StandardsAhmed Said Ghonimy0% (1)

- Distillation 1Document19 pagesDistillation 1Salman HaniffaNo ratings yet

- Dandi March MemorialDocument4 pagesDandi March MemorialMayank AjugiaNo ratings yet

- 14 PesDocument14 pages14 PessidraNo ratings yet

- SELENOIDE-Valv Solen 8210Document6 pagesSELENOIDE-Valv Solen 8210MARACO46No ratings yet

- Spiteri SpiteriDocument16 pagesSpiteri SpiteriklausNo ratings yet

- Standard Engines: The Engine For Construction EquipmentDocument2 pagesStandard Engines: The Engine For Construction EquipmentstephaneggNo ratings yet

- Axpert KS 1 5KVA - Manual - 20160301 PDFDocument35 pagesAxpert KS 1 5KVA - Manual - 20160301 PDFjasonsivertsenNo ratings yet

- Nyein Myo San R.ep-14Document73 pagesNyein Myo San R.ep-14Nyein Myo SanNo ratings yet

- Thesis Noth 2008 PDFDocument196 pagesThesis Noth 2008 PDFAPNo ratings yet

- Numerical Question Part 5 (Q61 70)Document4 pagesNumerical Question Part 5 (Q61 70)ramkrishna100% (4)

- Power ElectronicsDocument114 pagesPower ElectronicsRoyal LakhemaruNo ratings yet

- 16V4000G83 3D en ConsumptionDocument9 pages16V4000G83 3D en ConsumptionmsahbkNo ratings yet

- Microsoft Word - DC Machine Notes - SVM - AIT - Unit 01 To 04-VasudevmurthyDocument19 pagesMicrosoft Word - DC Machine Notes - SVM - AIT - Unit 01 To 04-VasudevmurthyRevati MotagiNo ratings yet

- Chemistry Paper 3 SLDocument14 pagesChemistry Paper 3 SLamrdeck1No ratings yet

- Ways To Measure The Force Acting On A Rotating Shaft: What Is Torque?Document5 pagesWays To Measure The Force Acting On A Rotating Shaft: What Is Torque?chandununnaNo ratings yet

- A New Simple Analytical Method For Calculating The Optimum Inverter Size in Grid Connected PV PlantsDocument8 pagesA New Simple Analytical Method For Calculating The Optimum Inverter Size in Grid Connected PV PlantsrcpyalcinNo ratings yet

- Ppe / Ipe: Final CoachingDocument331 pagesPpe / Ipe: Final CoachingMark Joseph Nambio NievaNo ratings yet

- Opportunities of Clean Development Mechanism Through Hydropower in NepalDocument16 pagesOpportunities of Clean Development Mechanism Through Hydropower in NepalUsha KhatiwadaNo ratings yet

- Starting System PDFDocument25 pagesStarting System PDFAnderson ToribiioNo ratings yet

- Boiler TypesDocument9 pagesBoiler TypesDevidutta PandaNo ratings yet