Professional Documents

Culture Documents

Tata Multi Cap Fund

Tata Multi Cap Fund

Uploaded by

Harsh SrivastavaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tata Multi Cap Fund

Tata Multi Cap Fund

Uploaded by

Harsh SrivastavaCopyright:

Available Formats

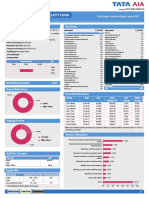

MULTI CAP FUND Fund Assure, Investment Report, October 2023

ULIF 060 15/07/14 MCF 110

Fund Details Portfolio

Investment Objective: The primary investment objective of the Fund is to Instrument % Of NAV Instrument % Of NAV

generate capital appreciation in the long term by investing in a diversified portfolio Equity 94.74 Rural Electrification Corporation Ltd. 1.79

Reliance Industries Ltd. 5.98 Shyam Metalics and Energy Ltd 1.77

of Large Cap and Mid Cap companies. The allocation between Large Cap and Mid

Infosys Ltd. 5.41 Tata Motors Ltd. 1.77

Cap companies will be largely a function of the relative valuations of Large Cap HDFC Bank Ltd 3.79 Navin Fluorine International Ltd 1.76

IndusInd Bank Ltd. 3.32 Zomato Ltd 1.73

companies as against Mid Cap companies.

Power Finance Corporation Ltd. 3.10 Voltas Ltd. 1.72

NAV as on 31 October, 23: `45.6215

ICICI Bank Ltd. 3.05 Global Health Ltd 1.68

Benchmark: S&P BSE 200 – 100% BSE Ltd 2.97 Bharti Airtel Ltd. 1.65

Corpus as on 31 October, 23: `3,706.68 Crs. MCX of India Ltd. 2.84 Krishna Institute of Medical Sciences Ltd 1.61

APL Apollo Tubes Ltd. 2.59 Suven Pharmaceuticals Ltd 1.60

Fund Manager: Mr. Nitin Bansal

Mphasis Ltd. 2.56 Ajanta Pharma Ltd 1.56

Co-Fund Manager: - Balkrishna Industries Ltd. 2.45 L&T Technology Services Ltd 1.52

Investment Style Larsen and Toubro Ltd. 2.32 Radico Khaitan Ltd. 1.51

Oil and Natural Gas Corpn Ltd. 2.11 Other Equity 24.65

Investment Style Size

Bharat Forge Ltd. 2.04 MMI & Others 5.26

Value Blend Growth Avenue Supermarts Ltd. 1.99 Total 100.00

Large Laurus Labs Ltd 1.89

Mid

Small

Fund Performance

Period Date NAV S&P BSE 200 NAV INDEX

Change Change

Last 1 Month 30-Sep-23 46.0940 8613.00 -1.03% -2.99%

Asset Allocation Last 3 Months 31-Jul-23 44.2279 8556.65 3.15% -2.35%

Last 6 Months 28-Apr-23 38.4335 7709.45 18.70% 8.38%

Last 1 Year 31-Oct-22 38.1187 7851.20 19.68% 6.42%

5.26%

Last 2 Years 29-Oct-21 34.7665 7638.90 14.55% 4.58%

Last 3 Years 30-Oct-20 20.4211 4910.04 30.73% 19.39%

Last 4 Years 31-Oct-19 18.0907 4983.57 26.02% 13.79%

Last 5 Years 31-Oct-18 15.2828 4440.16 24.45% 13.48%

Equity Since Inception 05-Oct-15 9.9996 3426.34 20.67% 11.67%

94.74%

MMI & Others Note: The investment income and prices may go down as well as up.“Since Inception” and returns above “1 Year” are

calculated as per CAGR.

AUM (in Crores) Sector Allocation

Instrument Hybrid Fund AUM

Financial service activities, except insurance and

Equity 3,511.80 20.56%

pension funding

Debt - Computer programming, consultancy and related

10.28%

MMI & Others 194.87 activities

Manufacture of coke and refined petroleum products 5.98%

Asset Mix Other financial activities 5.82%

Instrument Asset Mix as per F&U Actual Asset Mix Manufacture of electrical equipment 4.96%

Equity 60% - 100% 95% Retail trade, except of motor vehicles and motorcycles 4.74%

Debt 0% - 40% -

Manufacture of pharmaceuticals,medicinal chemical

Money Market & Others * 0% - 40% 5% 4.46%

and botanical products

* Money Market & Others includes current assets Manufacture of Basic Metals 4.37%

Human health activities 3.29%

Manufacture of machinery and equipment n.e.c. 2.90%

Others 32.64%

0% 5% 10% 15% 20% 25% 30% 35%

Equity Fund Debt Fund Hybrid Fund 16

You might also like

- Tata Multi Cap FundDocument1 pageTata Multi Cap FundJeremiah SolomonNo ratings yet

- Tata Whole Life Mid Cap Equity FundDocument1 pageTata Whole Life Mid Cap Equity FundK Dviya VennelaNo ratings yet

- Tata India Consumption FundDocument1 pageTata India Consumption FundJeremiah SolomonNo ratings yet

- Multi Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110Document1 pageMulti Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110editor's cornerNo ratings yet

- UTIFLEXICAPFUNDDocument2 pagesUTIFLEXICAPFUNDmeghaNo ratings yet

- Tata Emerging Opportunities FundDocument1 pageTata Emerging Opportunities FundJeremiah SolomonNo ratings yet

- Top 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110Document1 pageTop 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110editor's cornerNo ratings yet

- Top 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110Document1 pageTop 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110Prafful TriPathiNo ratings yet

- Tata Super Select Equity FundDocument1 pageTata Super Select Equity FundAbdulazeezNo ratings yet

- Uti Children'S Career Fund - Investment Plan: JANUARY 2023Document3 pagesUti Children'S Career Fund - Investment Plan: JANUARY 2023rout.sonali20No ratings yet

- Utimidcapfund 16020220823 053119Document2 pagesUtimidcapfund 16020220823 053119meghaNo ratings yet

- Tata Super Select Equity FundDocument1 pageTata Super Select Equity FundsanoobkarimNo ratings yet

- Whole Life Mid Cap Equity Fund: ULIF 009 04/01/07 WLE 110 Fund Assure, Investment Report, January 2021Document1 pageWhole Life Mid Cap Equity Fund: ULIF 009 04/01/07 WLE 110 Fund Assure, Investment Report, January 2021Abhishek BadalNo ratings yet

- Canara Robeco Emerging Equities PDFDocument1 pageCanara Robeco Emerging Equities PDFJasmeet Singh NagpalNo ratings yet

- Utivalueopportunitiesfund 193Document2 pagesUtivalueopportunitiesfund 193201 TVNo ratings yet

- Equity Elite OpportunitiesDocument1 pageEquity Elite OpportunitiesdibuayroorNo ratings yet

- SBI Multi Asset Allocation Fund FactsheetDocument1 pageSBI Multi Asset Allocation Fund FactsheetamanNo ratings yet

- Tata Mid Cap Growth Fund December 2019Document2 pagesTata Mid Cap Growth Fund December 2019ChromoNo ratings yet

- BOP One Pager Jan 2019Document1 pageBOP One Pager Jan 2019Ashwin HasyagarNo ratings yet

- Utiniftyindexfund 12820200210 213216Document2 pagesUtiniftyindexfund 12820200210 213216VarathavasuNo ratings yet

- Tata Quant PortfolioDocument1 pageTata Quant PortfolioDeepanshu SatijaNo ratings yet

- Sbi Life Balanced Fund PerformanceDocument1 pageSbi Life Balanced Fund PerformanceVishal Vijay SoniNo ratings yet

- Axis Growth Opportunities FundDocument1 pageAxis Growth Opportunities FundManoj JainNo ratings yet

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDocument1 pageSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNo ratings yet

- UlipDocument1 pageUlipsanu091No ratings yet

- Midcap FundDocument1 pageMidcap FundAman KumarNo ratings yet

- SBI Small Cap PDFDocument1 pageSBI Small Cap PDFJasmeet Singh NagpalNo ratings yet

- 8ccff Pms Communique August 22Document13 pages8ccff Pms Communique August 22pradeep kumarNo ratings yet

- LST ProtfolioDocument14 pagesLST ProtfolioPranjay ChauhanNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- 578380618monthly Communique May, 2022Document12 pages578380618monthly Communique May, 2022Dhairya BuchNo ratings yet

- Report On Demerger - Tube Investment India LimitedDocument8 pagesReport On Demerger - Tube Investment India LimitedMithil DoshiNo ratings yet

- Ppfas MF Factsheet October 2019Document8 pagesPpfas MF Factsheet October 2019Shyam GuptaNo ratings yet

- Sbi Nifty Index Fund Factsheet (December-2020!13!11) PDFDocument1 pageSbi Nifty Index Fund Factsheet (December-2020!13!11) PDFSubscriptionNo ratings yet

- Sbi Large and Midcap Fund Factsheet (June-2021!2!1)Document1 pageSbi Large and Midcap Fund Factsheet (June-2021!2!1)Gaurav NagpalNo ratings yet

- Sbi Life Bond Optimiser Fund PerformanceDocument1 pageSbi Life Bond Optimiser Fund PerformanceVishal Vijay SoniNo ratings yet

- Mid Cap Growth FundDocument1 pageMid Cap Growth FundChromoNo ratings yet

- 590784414monthly Communique March, 2022Document12 pages590784414monthly Communique March, 2022Dhairya BuchNo ratings yet

- Solutions Oriented Scheme-Children'S Fund: Investment ObjectiveDocument1 pageSolutions Oriented Scheme-Children'S Fund: Investment Objectiveparvinder.singh02No ratings yet

- ABSL Equity Hybrid '95 Fund Factsheet PDFDocument1 pageABSL Equity Hybrid '95 Fund Factsheet PDFKiranmayi UppalaNo ratings yet

- Mirae Asset India Opportunities Fund - Regular Plan: As On % Net AssetsDocument31 pagesMirae Asset India Opportunities Fund - Regular Plan: As On % Net AssetsNamrata ShettiNo ratings yet

- Equity FundDocument1 pageEquity Fundnitin choudharyNo ratings yet

- 2020756102monthly Communique June, 2022Document13 pages2020756102monthly Communique June, 2022Dhairya BuchNo ratings yet

- Value Investing: Managing Your Money Using Principles!Document8 pagesValue Investing: Managing Your Money Using Principles!Parthiv JethiNo ratings yet

- Sbi Life Top 300 Fund PerformanceDocument1 pageSbi Life Top 300 Fund PerformanceVishal Vijay SoniNo ratings yet

- Sbi Life Midcap Fund Latest Fund Performance (Jan 2024)Document1 pageSbi Life Midcap Fund Latest Fund Performance (Jan 2024)Vishal Vijay SoniNo ratings yet

- Midcap FundDocument1 pageMidcap Fundnitin choudharyNo ratings yet

- SBI Bluechip Fund - One PagerDocument1 pageSBI Bluechip Fund - One PagerjoycoolNo ratings yet

- UTI Multi Asset Allocation Fund Fact Sheet Feb 2024Document3 pagesUTI Multi Asset Allocation Fund Fact Sheet Feb 2024Lancelot DCunhaNo ratings yet

- SBI Consumption Opportunities Fund Factsheet April 2024Document1 pageSBI Consumption Opportunities Fund Factsheet April 2024Hitesh MiskinNo ratings yet

- Kotak Equity OpportunitiesDocument8 pagesKotak Equity OpportunitiesKiran VidhaniNo ratings yet

- Rawat Bhaskar SinghDocument13 pagesRawat Bhaskar SinghBhaskar RawatNo ratings yet

- HDFC MF Factsheet April 2023-1Document1 pageHDFC MF Factsheet April 2023-1Jayashree PawarNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- Offer Period - 12th Dec, 2019 - 20th Dec, 2019Document5 pagesOffer Period - 12th Dec, 2019 - 20th Dec, 2019JYOTHI D100% (1)

- Value Product Note October-20Document2 pagesValue Product Note October-20Swades DNo ratings yet

- Capital First's Boss Makes His Maids, Drivers and Former Colleagues Rich - The Economic TimesDocument2 pagesCapital First's Boss Makes His Maids, Drivers and Former Colleagues Rich - The Economic TimesAnupNo ratings yet

- DSP Dec 2021Document97 pagesDSP Dec 2021RUDRAKSH KARNIKNo ratings yet

- 4614 A Fact SheetDocument1 page4614 A Fact SheetAatish TNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet